Global Connected Homes Market Size, Share, Industry Analysis Report By Product Type (Smart Appliances, Security Systems, Entertainment Systems, Energy Management Systems, Others), By Technology (Wi-Fi, Bluetooth, Zigbee, Z-Wave, Others), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161855

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- Investment opportunities

- China Market Size

- By Product Type: Smart Appliances

- By Technology: Wi-Fi

- By Application: Residential

- By Distribution Channel: Offline

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

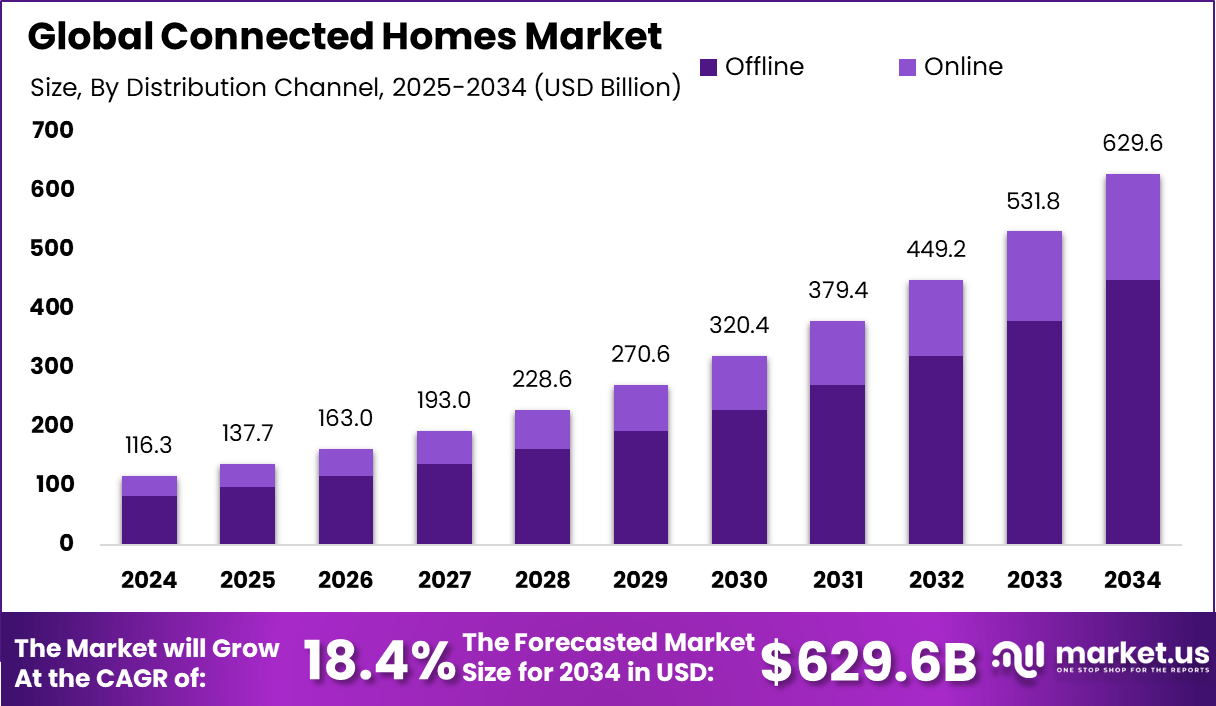

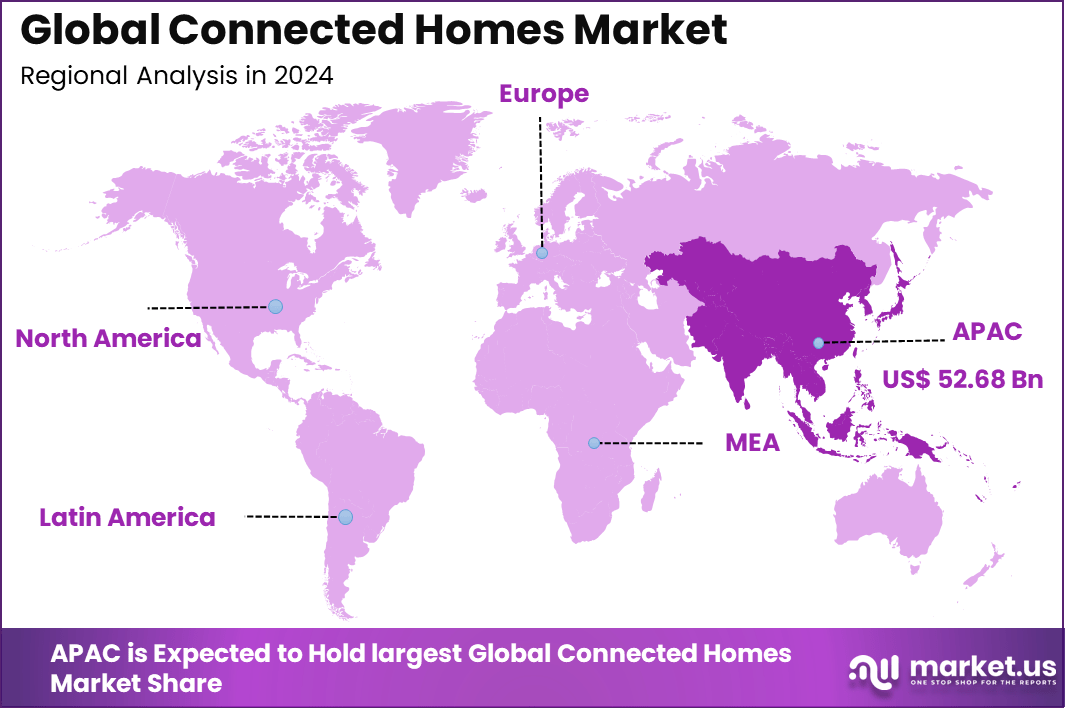

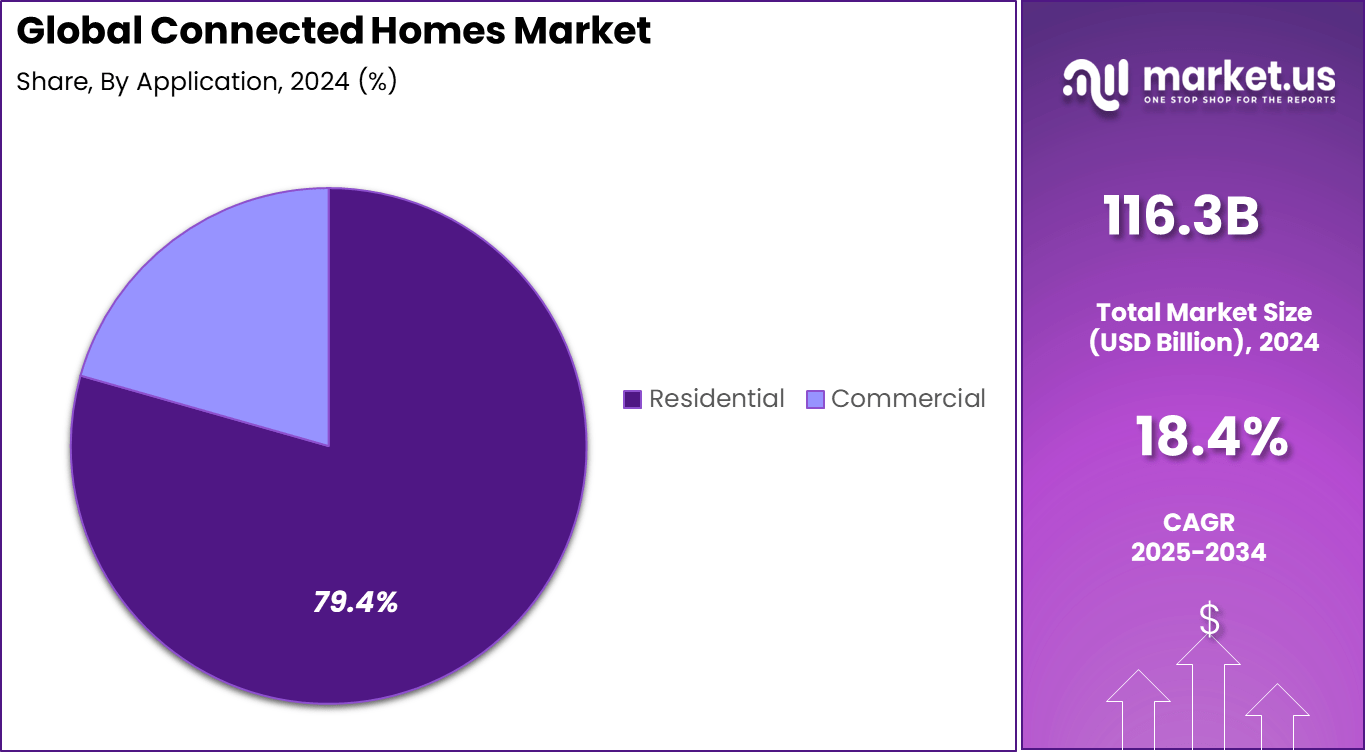

The Global Connected Homes Market generated USD 116.3 billion in 2024 and is predicted to register growth from USD 137.7 billion in 2025 to about USD 629.6 billion by 2034, recording a CAGR of 18.4% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 45.3% share, holding USD 52.6 Billion revenue.

The connected homes market involves residential environments equipped with devices and systems that communicate through wired or wireless networks. These include smart lighting, climate control, security cameras, voice assistants, entertainment systems, connected appliances, and energy management tools. Devices are managed through apps, hubs, or automated routines to improve comfort, control, and efficiency.

Top driving factors behind the growth of connected homes include rising consumer demand for automation and energy efficiency, advancements in IoT technology, and increasing awareness of home security. Consumers are actively seeking solutions that offer remote monitoring and control over lighting, security systems, heating, ventilation, and HVAC, which significantly enhance comfort and safety.

Demand analysis shows that adoption is intensified by urbanization, rising disposable incomes, and expanding broadband and 5G infrastructure, which enable more reliable and faster connectivity for IoT devices. The trend is particularly noticeable in regions with supportive government initiatives promoting smart city frameworks and digital infrastructure.

The ongoing pandemic heightened interest in connected homes for remote work, wellness monitoring, and contactless control, demonstrating sustained consumer engagement beyond initial health concerns. Increasing adoption of technologies such as AI-powered cameras, voice-command devices, smart lighting, and energy-efficient appliances reflects the market’s response to consumer preferences for personalized and convenient living spaces.

According to Exploding Topics, 78% of potential home buyers are willing to pay extra for a smart home, reflecting strong perceived value. Around 75% of current smart home users are under the age of 55, showing higher adoption among younger demographics. Satisfaction levels are notably high, with 97% of smart device owners reporting at least some level of satisfaction. However, nearly two-thirds of consumers still express concern about data security.

Top Market Takeaways

- Smart appliances hold 45.2%, showing that consumers prioritize connected devices for everyday household use.

- Wi-Fi leads with 41.8%, as it remains the most accessible and compatible technology for home integration.

- Residential usage dominates at 74.9%, driven by lifestyle upgrades and rising smart home adoption in urban areas.

- Offline channels account for 71.4%, indicating that many buyers still prefer in-store purchases for high-value home devices.

- Asia Pacific leads the market with 45.3%, supported by rapid urban development and government-backed digital infrastructure.

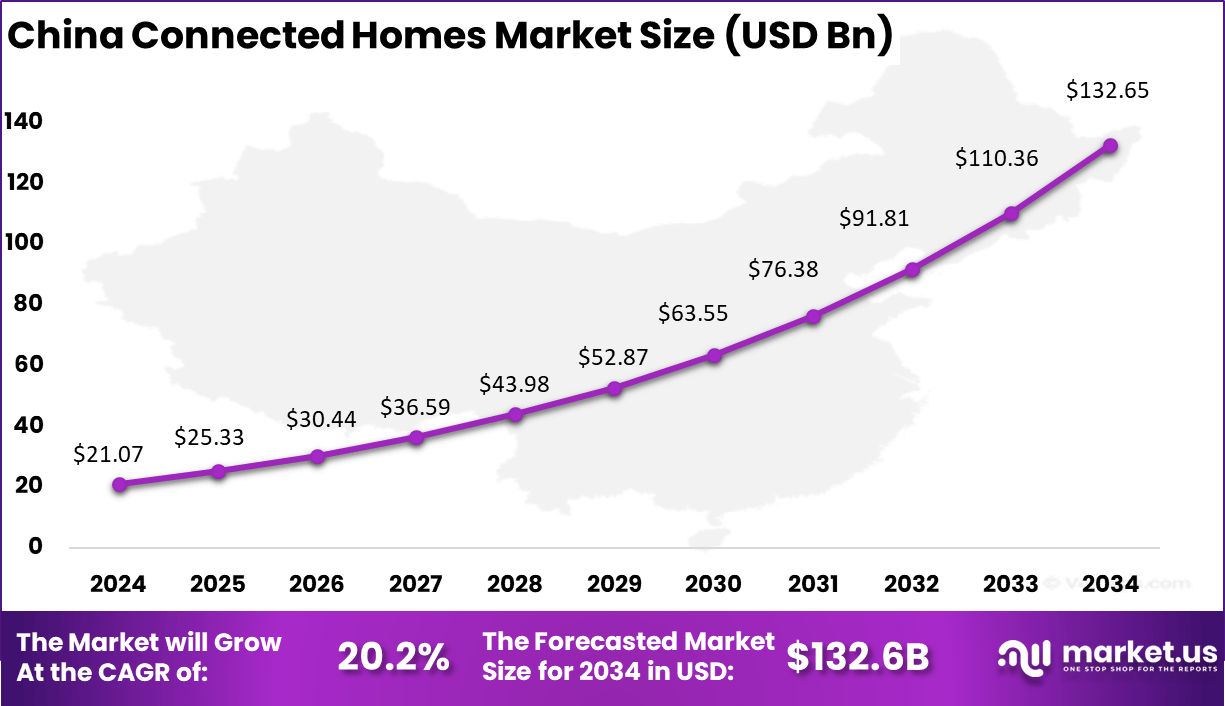

- China contributes USD 21.07 billion, reflecting strong consumer demand and large-scale manufacturing capacity.

- A CAGR of 20.2% signals expanding adoption and increasing affordability in connected home solutions.

Role of Generative AI

Connected homes are evolving rapidly, with generative AI playing a key role in making these homes more intelligent and adaptive. Generative AI is helping connected homes move from simple automated systems to proactive environments that anticipate residents’ needs. For example, generative models like GANs and transformers optimize energy use by simulating different scenarios for HVAC and lighting, reducing waste significantly.

Around 43% of smart home users reported improved energy efficiency thanks to AI-powered adjustments in 2025. This technology also enhances home security by enabling smarter surveillance systems that learn and predict unusual activities, increasing safety without constant human intervention. Moreover, generative AI contributes to personalized living by creating customized routines based on user behavior patterns. This means connected homes can tailor temperature, lighting, and entertainment settings dynamically, improving comfort.

About 38% of connected home devices now incorporate some form of generative AI to offer this level of personalization, a steep increase from just a few years ago. These AI systems also help with predictive maintenance, notifying homeowners of potential appliance failures before they occur, reducing repair costs and downtime. Such advances are transforming connected homes into intelligent living spaces that blend convenience, energy savings, and security in a seamless way.

Investment opportunities

Investment opportunities arise from the growing market demand and technological innovations such as home robots designed to automate tasks on simple commands. Real estate developers and service providers find value in incorporating connected home features to increase property attractiveness and resale value, as tech-savvy buyers prioritize homes with integrated smart technologies.

Government incentives and subsidy programs also create favorable conditions for investment in connected home infrastructure and solutions. Business benefits from connected home adoption span operational efficiency, customer engagement, and new revenue streams from data-driven services.

The data generated by smart home devices offers insights into energy consumption, usage patterns, and maintenance needs, which can be monetized or used to enhance product offerings. Providers gain competitive advantage by delivering seamless, secure, and integrated services that improve user experience, while homeowners enjoy cost savings and enhanced quality of life.

China Market Size

China is a key contributor within Asia Pacific, showing strong growth supported by a vibrant technology ecosystem and high consumer demand. The market growth aligns with a 20.2% CAGR, driven by widespread 5G deployment and government digitization programs. Smart home adoption is highlighted by increased use of AI-powered appliances, voice assistants, and IoT-enabled security devices.

The Chinese market is also propelled by major technology companies innovating smart home products that suit local consumer preferences. Urbanization and rising disposable incomes further support the demand for connected homes, making China one of the most dynamic markets in this sector today.

The Asia Pacific region leads with a 45.3% share of the connected homes market, driven by rapid urbanization, a growing middle class, and significant investments in smart infrastructure. Technological advancements and government initiatives promoting smart city projects have accelerated the adoption of connected home technologies across major economies like China, India, South Korea, and Japan.

The region benefits from increasing smartphone penetration and expanding 5G networks, which enhance connectivity options for smart devices. These factors combine to make Asia Pacific the fastest-growing and largest market, with consumers eager to adopt products that improve convenience, security, and energy management at home.

By Product Type: Smart Appliances

In 2024, Smart appliances are the leading product type in the connected homes market, capturing 45.2% of the share. These devices include smart refrigerators, washing machines, ovens, and air conditioners that feature IoT connectivity, enabling remote control, energy efficiency, and automation.

The popularity of smart appliances is driven by their ability to offer convenience and energy savings to consumers, with smart refrigerators being particularly favored for features like inventory management and temperature control through smartphone apps. Growing urban populations and rising disposable incomes further support this trend towards connected kitchen and home appliances.

The integration of AI technologies in these devices enhances the user experience by enabling predictive maintenance and personalized settings. As more consumers value convenience and sustainability, smart appliances continue to be at the forefront, transforming traditional household equipment into intelligent systems that optimize resource use and improve lifestyle quality. This segment is expected to maintain its leadership due to continued innovation and the expanding ecosystem of connected home products.

By Technology: Wi-Fi

In 2024, Wi-Fi technology accounts for 41.8% of the connectivity methods used in connected homes. Its widespread adoption results from its ease of installation, compatibility with multiple devices, and reliable performance in home networks. Wi-Fi serves as the backbone for various smart home systems, including security cameras, lighting, thermostats, and appliances, enabling seamless communication across devices and user interfaces like smartphones or voice assistants.

The expansion of high-speed internet access and the rollout of 5G networks enhance Wi-Fi’s reach and capabilities, supporting the increased data traffic generated by connected devices. Wi-Fi modules are dominant in smart home ecosystems across regions, especially in Asia Pacific and North America, where technological infrastructure and consumer acceptance are high. This preference for Wi-Fi over other technologies such as Zigbee or Z-Wave stems from its universal compatibility and convenience.

By Application: Residential

In 2024, The residential segment overwhelmingly dominates the connected homes market with a 74.9% share, reflecting the rising demand for smart solutions in households. Connected devices in residential settings improve energy management, security, and comfort. Smart thermostats, lighting systems, and security cameras provide homeowners control, often from remote locations, enhancing convenience and peace of mind.

This growth is fueled by increasing consumer awareness about smart home benefits and the affordability of smart devices. Government incentives and energy-efficiency programs in various countries further drive adoption. Residential applications lead the market as they extend beyond basic automation to include advanced AI-powered systems that learn user preferences and optimize home environments automatically.

By Distribution Channel: Offline

Despite the rise of e-commerce, the offline distribution channel holds a significant 71.4% market share for connected homes products. This preference is due in part to consumers’ desire to physically inspect devices before purchase, access installation and after-sales support, and benefit from personalized service at brick-and-mortar retail stores.

Retail outlets and specialty stores remain crucial especially in regions where internet penetration varies or where customers prefer in-person consultations. Offline channels also play an important role in educating consumers about new technologies through demonstrations and direct interactions with sales staff. However, online channels are growing fast due to convenience and availability of broader product selections.

Emerging Trends

Emerging trends in connected homes are centered around deeper AI integration and enhanced automation. Voice and gesture controls are becoming more natural and intuitive, with over 50% of smart home users adopting voice assistants that can understand complex commands and emotional contexts. This trend highlights the shift toward smart homes that respond like human partners, making daily interactions effortless.

Subscription-based smart home services are also gaining traction, providing ongoing software updates and remote monitoring features to ensure systems remain secure and efficient. At the same time, sustainable living is influencing product development, with 47% of new connected home devices focusing on energy efficiency or eco-friendly materials. The deployment of 5G and edge computing is another critical trend, enhancing real-time device communication and reducing latency.

Growth Factors

Growth in the connected homes market is fueled by several factors, with rising consumer awareness of convenience and energy savings being paramount. Nearly 55% of homeowners expressed interest in upgrading to smart home systems due to potential energy cost reductions, while another 40% were motivated mainly by enhanced security features.

These factors are driving steady adoption of smart devices like cameras, locks, and thermostats. Wider internet penetration and improved wireless infrastructure also support growth. The expansion of 5G networks has led to a 23% increase in connected device usage in residential settings in 2025.

This improved connectivity allows for more reliable and responsive smart home solutions, enhancing user experiences by reducing technical hitches. Moreover, as disposable incomes rise in developing regions, there is greater willingness to invest in smart home upgrades, making connected homes a standard feature in both urban and semi-urban environments.

Key Market Segments

By Product Type

- Smart Appliances

- Security Systems

- Entertainment Systems

- Energy Management Systems

- Others

By Technology

- Wi-Fi

- Bluetooth

- Zigbee

- Z-Wave

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Internet Penetration and AI Adoption

The expansion of internet connectivity, especially broadband and 5G networks, is a key driver for the connected homes market. As more households gain reliable high-speed internet access, they can support an increasing number of smart devices and systems. This connectivity enables seamless control of home devices such as lighting, security cameras, and energy management systems through smartphones and voice commands.

Additionally, the adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies has made homes smarter, allowing for automation that improves convenience and efficiency. This trend is supported by increasing consumer awareness and rising disposable incomes in urban and semi-urban areas, helping expand the connected homes ecosystem rapidly.

Restraint

High Setup Costs and Technical Complexity

Despite the promising growth, the high initial cost of setting up connected home systems stands as a significant restraint. Installing a complete connected home setup involves investment in sophisticated technology, smart devices, and networking infrastructure, which may be prohibitive for many consumers.

Moreover, the technical complexity involved in installation and management, including compatibility issues among devices, network stability, and the need for expert help, poses a barrier to widespread adoption. Users without sufficient technical expertise may find the setup and operation frustrating, limiting market growth, especially in less developed or rural areas where infrastructure may also be deficient.

Opportunity

Energy Efficiency and Smart City Integration

Connected homes present a huge opportunity for enhancing energy efficiency in residential buildings, aligning with increasing global focus on sustainability and cost savings. Smart home devices can optimize energy use through intelligent heating, ventilation, air conditioning, and lighting controls, reducing unnecessary consumption.

Governments and private sectors are promoting smart city initiatives, which include connected homes as a core component for creating energy-conscious urban environments. This integration helps drive adoption, as consumers seek eco-friendly living solutions supported by incentives and policy frameworks. The growing market demand for energy-efficient, AI-powered home automation systems opens a strategic opportunity for industry players to innovate and scale their offerings.

Challenge

Privacy Concerns and Cybersecurity Risks

One of the biggest challenges facing connected homes is protecting user privacy and securing the increasing amount of personal data generated and shared by smart devices. Connected home systems are vulnerable to cyberattacks that could exploit weaknesses in IoT devices, putting household security and sensitive information at risk.

As these systems depend heavily on internet connectivity, any breach or unauthorized access can have significant consequences. Consumers often lack trust due to the perceived risk of hacking, data misuse, or inadequate security measures by vendors. Addressing these privacy and security concerns is critical to building user confidence and sustaining long-term market growth.

Competitive Analysis

The Connected Homes Market is led by major consumer technology companies such as Amazon.com, Inc., Google LLC, Apple Inc., and Samsung Electronics Co., Ltd. These firms dominate smart home ecosystems through AI-enabled voice assistants, IoT-enabled hubs, and device interoperability. Their platforms support home automation, entertainment, energy monitoring, and security solutions with seamless integration across mobile and cloud environments.

Electronics and appliance manufacturers including Sony Corporation, Panasonic Corporation, LG Electronics Inc., and General Electric Company contribute with smart TVs, connected appliances, and intelligent home devices. These companies enable remote monitoring, predictive maintenance, and energy-efficient operations, expanding adoption among residential users and premium home automation markets.

Home security and infrastructure-focused companies such as ADT Inc., Vivint Smart Home, Inc., Bosch Security Systems GmbH, Johnson Controls International plc, Honeywell International Inc., Schneider Electric SE, and Siemens AG deliver smart surveillance, climate control, lighting automation, and power management systems. A broad group of other key players continues to drive innovation through partnerships, Matter protocol adoption, and scalable IoT platforms.

Top Key Players in the Market

- Sony Corporation

- Panasonic Corporation

- ADT Inc.

- Vivint Smart Home, Inc.

- Comcast Corporation

- Johnson Controls International plc

- Bosch Security Systems GmbH

- Samsung Electronics Co., Ltd.

- Google LLC

- Amazon.com, Inc.

- Apple Inc.

- LG Electronics Inc.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Others

Recent Developments

- April 2025: Panasonic launched a state-of-the-art Smart Home Experience Centre in India centered on Miraie, an IoT-enabled platform integrating wellness, security, and convenience solutions including HVAC, smart lighting, and security devices. This initiative targets India’s growing middle class and urbanization, reflecting the company’s holistic smart living vision.

- July 2025: Bosch Smart Home released a mandatory security update enhancing key controls for light and shutter automation, reflecting ongoing improvements in user safety and system reliability.

- September 2025: Sony showcased next-generation connected experiences integrating AI and cloud-native workflows at IBC 2025, reinforcing its role in immersive media ecosystems. In India, Sony expanded its BRAVIA Theatre portfolio with new immersive soundbars enhancing home entertainment.

Report Scope

Report Features Description Market Value (2024) USD 116.3 Bn Forecast Revenue (2034) USD 629.3 Bn CAGR(2025-2034) 18.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Smart Appliances, Security Systems, Entertainment Systems, Energy Management Systems, Others), By Technology (Wi-Fi, Bluetooth, Zigbee, Z-Wave, Others), By Application (Residential, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sony Corporation, Panasonic Corporation, ADT Inc., Vivint Smart Home, Inc., Comcast Corporation, Johnson Controls International plc, Bosch Security Systems GmbH, Samsung Electronics Co., Ltd., Google LLC, Amazon.com, Inc., Apple Inc., LG Electronics Inc., Honeywell International Inc., Siemens AG, Schneider Electric SE, General Electric Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sony Corporation

- Panasonic Corporation

- ADT Inc.

- Vivint Smart Home, Inc.

- Comcast Corporation

- Johnson Controls International plc

- Bosch Security Systems GmbH

- Samsung Electronics Co., Ltd.

- Google LLC

- Amazon.com, Inc.

- Apple Inc.

- LG Electronics Inc.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Others