Global Cone Crusher Market Size, Share, Growth Analysis By Type (Standard Cone Crusher, Short Head Cone Crusher, Compound Cone Crusher, Hydraulic Cone Crusher), By Offering (Mobile Crushers, Portable Crushers, Stationary Crushers), By Capacity (50 to 100 TPH, Less than 50 TPH, 100 to 150 TPH, More than 150 TPH), By Application (Mining, Construction, Aggregate Production, Chemical Industry, Others), By Sales Type (New Equipment Sales, Aftermarket Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177127

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

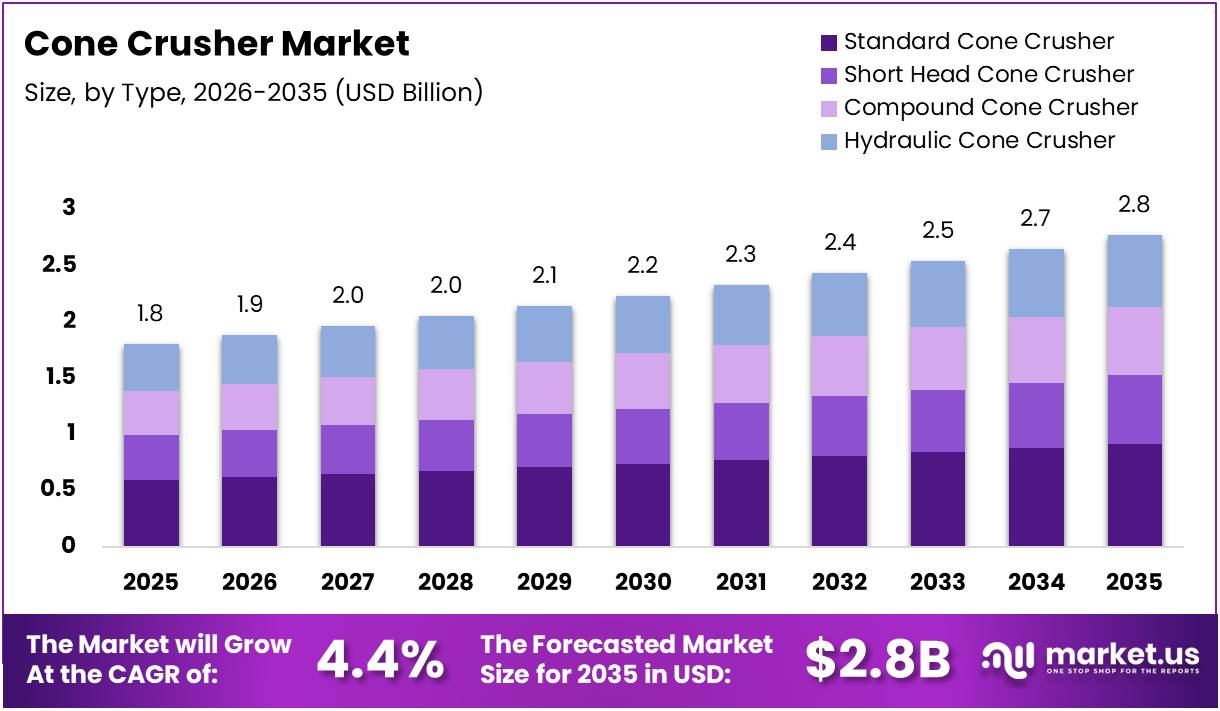

The Global Cone Crusher Market size is expected to be worth around USD 2.8 Billion by 2035 from USD 1.8 Billion in 2025, growing at a CAGR of 4.4% during the forecast period 2026 to 2035.

Cone crushers are essential crushing equipment used in mining, construction, and aggregate production industries. These machines compress material between a rotating mantle and stationary bowl liner to achieve reduction in particle size. They operate as secondary, tertiary, or quaternary crushing stages in material processing operations.

The market demonstrates robust expansion driven by accelerating infrastructure development worldwide. Moreover, rising urbanization in emerging economies creates sustained demand for construction aggregates and processed materials. Consequently, cone crusher adoption increases across quarrying, mining, and recycling applications globally.

Growing mining activities focused on hard rock and metal ore extraction significantly boost market growth. Additionally, technological advancements enhance crusher performance through automation and smart monitoring systems. Therefore, operators achieve improved energy efficiency, throughput optimization, and reduced operational downtime in crushing operations.

Government infrastructure investments and road construction projects drive aggregate production demand substantially. Furthermore, environmental compliance requirements encourage adoption of low-emission and energy-efficient crushing equipment. However, operational complexity and skilled workforce requirements present ongoing challenges for market participants seeking optimal performance outcomes.

According to Metso, optimizing the chamber profile has increased the production of a cone crusher by up to 20% or more, and this level of improvement has been achieved in more cases than one might expect. Additionally, idle energy losses in hydraulic cone crushers can be reduced to less than 5% of operational energy use.

According wear parts suppliers, field data demonstrates service life extensions of approximately 35-45% for advanced wear parts compared with conventional alternatives under similar materials and operating conditions. Moreover, a mining operation extended wear part replacement intervals from 8 weeks to 12 weeks, significantly reducing maintenance costs.

Key Takeaways

- Global Cone Crusher Market is valued at USD 1.8 Billion in 2025 and projected to reach USD 2.8 Billion by 2035.

- Market exhibits a CAGR of 4.4% during the forecast period from 2026 to 2035.

- Mobile Crushers

- lead the offering segment with 63.6% market share in 2025.

- Mining application holds the largest share at 51.3% of total market revenue.

- New Equipment Sales dominate with 74.9% share in the sales type segment.

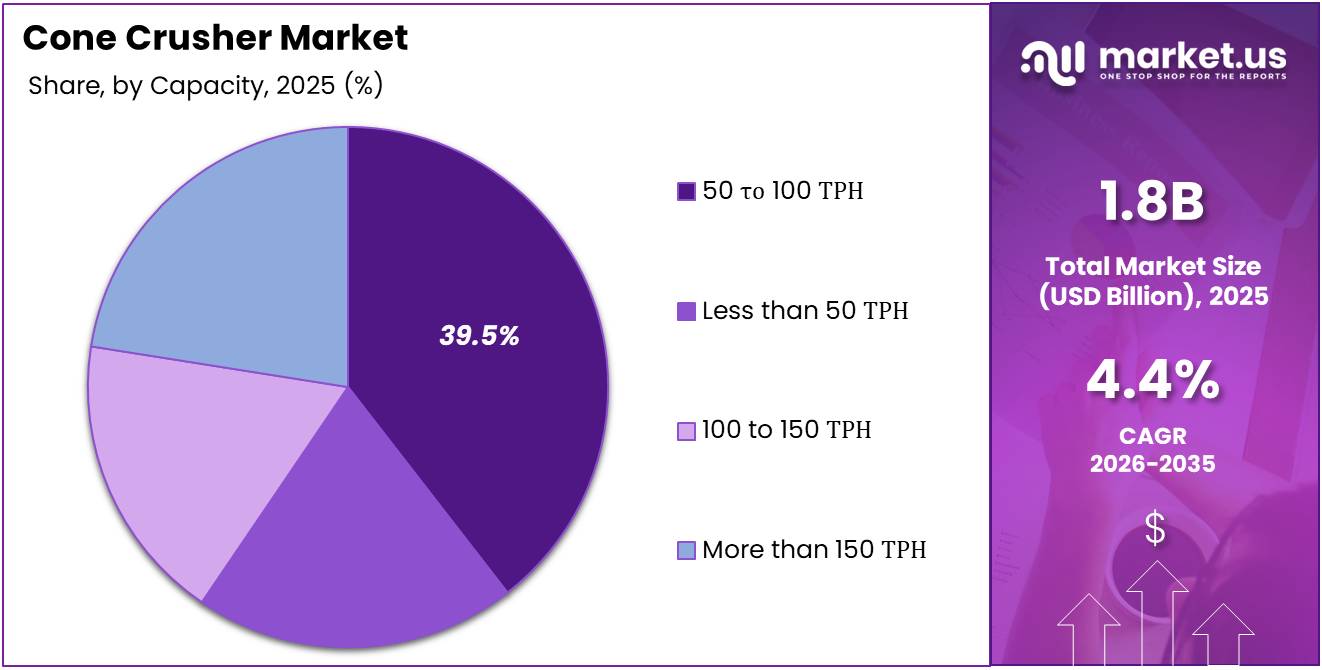

- 50 to 100 TPH capacity segment commands 39.5% market share.

- Standard Cone Crusher captures 26.8% share in the type segment.

- North America dominates the market with 47.90% share, valued at USD 0.8 Billion.

Type Analysis

Standard Cone Crusher dominates with 26.8% due to versatile crushing capabilities and widespread industrial adoption.

In 2025, Standard Cone Crusher held a dominant market position in the By Type segment of Cone Crusher Market, with a 26.8% share. This crusher type delivers reliable performance across diverse crushing applications with proven mechanical simplicity. Moreover, its robust design ensures consistent particle size reduction in secondary crushing operations throughout mining and aggregate sectors.

Short Head Cone Crusher serves specialized applications requiring finer product output and higher reduction ratios. This variant features a shorter crushing chamber configuration optimized for tertiary and quaternary crushing stages. Additionally, it produces uniform fine aggregates essential for concrete production and high-specification construction projects demanding precise gradation control.

Compound Cone Crusher combines multiple crushing functions within integrated design configurations for enhanced operational efficiency. These systems reduce equipment footprint while maintaining high throughput capacity in space-constrained operations. Furthermore, compound designs minimize material handling requirements between crushing stages, lowering operational costs and simplifying plant layouts significantly.

Hydraulic Cone Crusher represents advanced technology incorporating automated adjustment systems for optimal performance management. Hydraulic mechanisms enable rapid setting changes, overload protection, and efficient chamber clearing during operational cycles. Consequently, these crushers deliver superior energy efficiency with idle energy losses reduced to less than 5% compared to traditional designs.

Offering Analysis

Mobile Crushers dominate with 63.6% due to superior operational flexibility and rapid deployment capabilities.

In 2025, Mobile Crushers held a dominant market position in the By Offering segment of Cone Crusher Market, with a 63.6% share. These self-propelled units provide exceptional mobility for on-site crushing operations across diverse geographical locations. Moreover, integrated design eliminates complex installation requirements, enabling operators to commence production rapidly and relocate equipment efficiently between project sites.

Portable Crushers offer semi-mobile solutions mounted on wheeled chassis for convenient transportation between operational locations. These units balance mobility with processing capacity, suitable for medium-duration projects requiring periodic relocation. Additionally, portable configurations reduce infrastructure investment while maintaining robust crushing performance for contractors managing multiple simultaneous project sites.

Stationary Crushers provide fixed installation solutions for high-capacity operations demanding maximum throughput and continuous processing capabilities. These permanent installations deliver optimal stability, reliability, and production consistency in large-scale mining and quarrying applications. Furthermore, stationary plants accommodate extensive automation integration and sophisticated material handling systems, maximizing operational efficiency in centralized processing facilities.

Capacity Analysis

50 to 100 TPH segment dominates with 39.5% due to optimal balance between productivity and operational flexibility.

In 2025, 50 to 100 TPH held a dominant market position in the By Capacity segment of Cone Crusher Market, with a 39.5% share. This capacity range addresses requirements of medium-scale operations across construction, quarrying, and regional mining projects effectively. Moreover, equipment in this segment offers favorable capital-to-output ratios, making cone crushers accessible to diverse operator profiles.

Less than 50 TPH capacity crushers serve small-scale operations, specialty applications, and localized material processing requirements efficiently. These compact units suit contractors handling limited volumes or producing specialized aggregates for niche market segments. Additionally, lower capacity equipment requires reduced capital investment and operational infrastructure, appealing to emerging market participants and small enterprises.

100 to 150 TPH capacity range addresses growing operations requiring enhanced throughput without transitioning to large-scale industrial equipment configurations. These crushers balance production volume with manageable operational complexity and maintenance requirements. Furthermore, mid-range capacity units provide scalability pathways for expanding businesses increasing production gradually to meet evolving market demands.

More than 150 TPH capacity crushers cater to large-scale mining operations, major quarries, and high-volume aggregate production facilities. These heavy-duty systems maximize productivity through continuous high-throughput processing of hard rock materials. Consequently, major industrial operators achieve economies of scale while meeting substantial material supply commitments for infrastructure and construction projects.

Application Analysis

Mining dominates with 51.3% due to extensive hard rock extraction and metal ore processing requirements.

In 2025, Mining held a dominant market position in the By Application segment of Cone Crusher Market, with a 51.3% share. Mining operations require robust mining equipment such as cone crushers for processing hard rock, metal ores, and mineral-bearing materials extracted from underground and surface mines. Moreover, cone crushers deliver essential secondary and tertiary crushing functions, producing sized material for downstream beneficiation and mineral processing operations.

Construction applications utilize cone crushers for producing aggregates essential in concrete production, asphalt manufacturing, and infrastructure development projects. These crushing operations generate precisely graded materials meeting stringent construction specifications and quality standards. Additionally, construction sector growth driven by urbanization and infrastructure investment sustains steady demand for reliable crushing equipment across regional and global markets.

Aggregate Production represents specialized operations focused exclusively on producing construction-grade stone, sand, and gravel materials for commercial distribution. These facilities operate dedicated crushing circuits optimized for high-volume output and consistent product quality. Furthermore, aggregate producers rely on cone crushers to achieve required gradations efficiently while maintaining competitive production costs.

Chemical Industry applications employ cone crushers for processing raw materials, reducing particle sizes of chemical compounds, and preparing feedstock for industrial processes. These specialized applications demand equipment capable of handling diverse material characteristics while maintaining product purity and consistent gradation specifications essential for chemical manufacturing operations.

Others category encompasses recycling operations, waste processing, and emerging applications expanding cone crusher utilization across industrial sectors. This segment includes demolition waste processing, concrete recycling, and specialty material reduction applications. Additionally, innovative applications continue emerging as industries discover new uses for cone crushing technology in material processing workflows.

Sales Type Analysis

New Equipment Sales dominate with 74.9% due to expanding operations and technological advancement adoption.

In 2025, New Equipment Sales held a dominant market position in the By Sales Type segment of Cone Crusher Market, with a 74.9% share. Growing infrastructure projects and mining expansion activities drive primary demand for modern crushing equipment featuring advanced technologies. Moreover, operators invest in new machinery to access improved energy efficiency, automation capabilities, and enhanced productivity.

Aftermarket Sales encompass replacement parts, wear components, maintenance services, and equipment upgrades supporting installed crusher base globally. This segment provides essential revenue streams through consumable wear parts requiring periodic replacement during operational cycles. According to industry data, advanced wear parts demonstrate service life extensions of approximately 35-45% compared with conventional alternatives.

Key Market Segments

By Type

- Standard Cone Crusher

- Short Head Cone Crusher

- Compound Cone Crusher

- Hydraulic Cone Crusher

By Offering

- Mobile Crushers

- Portable Crushers

- Stationary Crushers

By Capacity

- 50 to 100 TPH

- Less than 50 TPH

- 100 to 150 TPH

- More than 150 TPH

By Application

- Mining

- Construction

- Aggregate Production

- Chemical Industry

- Others

By Sales Type

- New Equipment Sales

- Aftermarket Sales

Drivers

Accelerated Infrastructure Development and Mining Expansion Drive Cone Crusher Market Growth

Accelerated infrastructure and road construction activities significantly increase aggregate demand across global markets. Governments worldwide invest heavily in transportation networks, urban development, and public infrastructure projects requiring substantial crushed stone and processed aggregates. Consequently, cone crusher deployment expands rapidly to meet growing material production requirements throughout construction supply chains.

Rising mining operations focused on hard rock and metal ore extraction boost cone crusher adoption substantially. Mining companies expand production capacity to satisfy global demand for copper, gold, iron ore, and industrial minerals. Moreover, hard rock processing requires robust secondary and tertiary crushing equipment capable of handling abrasive materials efficiently while maintaining consistent product quality.

Growing adoption of secondary and tertiary crushing in quarrying operations enhances product quality and operational efficiency. Quarry operators implement multi-stage crushing circuits to achieve precise gradation control and maximize saleable product yield. Additionally, cone crushers deliver superior reduction ratios and cubical product shapes essential for premium aggregate specifications demanded by construction markets.

Restraints

Operational Complexity and Workforce Requirements Challenge Market Growth

Operational complexity and downtime risks in continuous crushing applications limit equipment utilization and productivity potential. Cone crushers require careful material feed control, consistent liner wear monitoring, and precise operational parameter management to maintain optimal performance. Moreover, unplanned downtime resulting from mechanical failures, improper settings, or material blockages significantly impacts production schedules and operational profitability.

Dependence on skilled technical workforce for efficient crusher operation constrains market expansion in regions experiencing labor shortages. Operating personnel must understand crusher mechanics, troubleshooting procedures, and performance optimization techniques to maximize equipment effectiveness. Additionally, training requirements and workforce development investments increase operational costs for mining and aggregate production companies.

Equipment maintenance complexity demands specialized knowledge and technical expertise to perform liner replacements, mechanical adjustments, and preventive maintenance procedures correctly. Furthermore, inadequate maintenance practices accelerate component wear, reduce equipment lifespan, and increase total cost of ownership significantly. These factors challenge operators managing multiple crushing installations across distributed operational sites.

Growth Factors

Urbanization and Technological Innovation Create Substantial Market Opportunities

Expansion of urbanization projects in emerging economies drives crushing equipment needs across Asia Pacific, Latin America, and Middle Eastern markets. Rapid urban population growth necessitates extensive residential construction, commercial development, and infrastructure expansion requiring massive aggregate volumes. Consequently, cone crusher demand accelerates as developing nations invest in modernizing crushing operations and increasing domestic material production capacity.

Increasing demand for cone crushers in recycling and construction waste processing opens new market segments and application opportunities. Environmental regulations and sustainability initiatives encourage concrete recycling, asphalt reclamation, and demolition waste reprocessing operations. Moreover, cone crushers efficiently reduce recycled materials to specification-grade aggregates, supporting circular economy principles while reducing primary aggregate extraction requirements.

Technological upgrades enhancing energy efficiency and throughput performance attract operators seeking competitive advantages and operational cost reduction. Advanced automation systems, optimized chamber geometries, and hydraulic adjustment mechanisms improve crusher productivity substantially. Additionally, smart monitoring systems enable predictive maintenance, real-time performance optimization, and remote equipment management capabilities that minimize downtime and maximize production consistency.

Emerging Trends

Digital Transformation and Sustainability Shape Future Market Development

Integration of automation and smart monitoring systems in cone crushers revolutionizes operational management and performance optimization capabilities. Modern crushers incorporate sensors, data analytics platforms, and automated control systems that continuously monitor crushing parameters and equipment condition. Consequently, operators achieve improved process control, reduced energy consumption, and enhanced production consistency through real-time performance adjustments and predictive maintenance scheduling.

Growing preference for modular and portable cone crushing solutions addresses market demand for flexible, rapidly deployable processing equipment. Contractors and mining companies increasingly favor mobile crushing plants that relocate easily between project sites without extensive dismantling procedures. Moreover, modular designs simplify transportation logistics, reduce installation timeframes, and enable operators to respond quickly to changing project requirements and market opportunities.

Shift toward environmentally compliant and low-emission crushing equipment reflects industry commitment to sustainability and regulatory compliance. Manufacturers develop crushers featuring improved fuel efficiency, reduced noise emissions, and dust suppression systems meeting stringent environmental standards. Additionally, electric and hybrid power options emerge as viable alternatives to traditional diesel-powered equipment, particularly in urban construction applications where emission regulations intensify progressively.

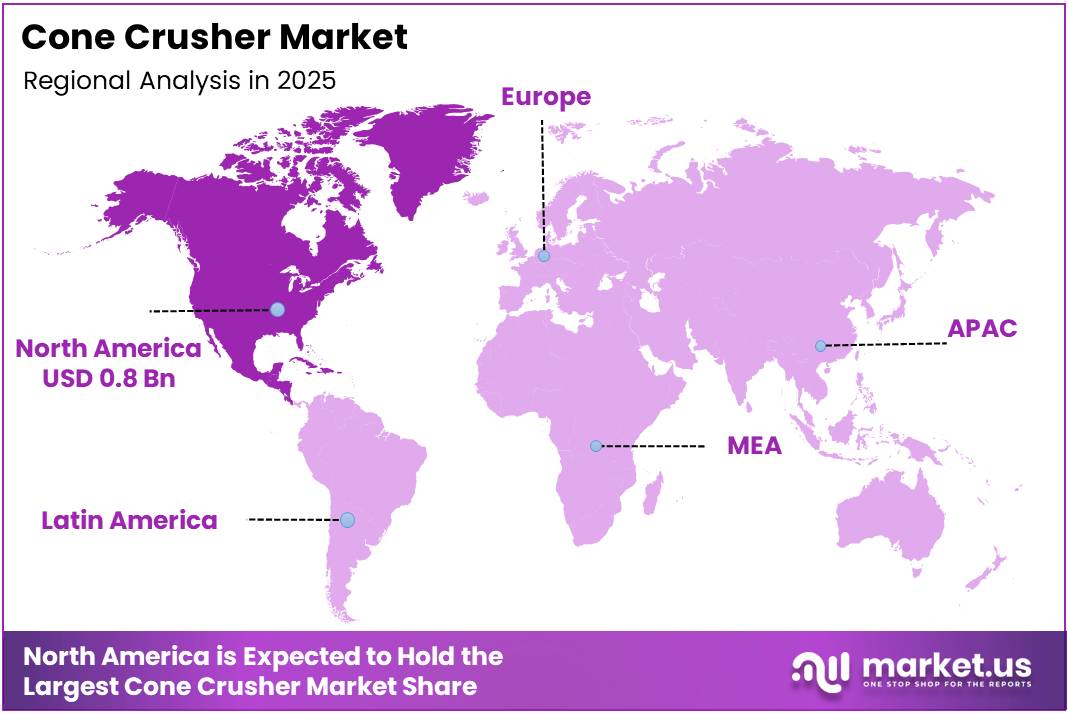

Regional Analysis

North America Dominates the Cone Crusher Market with a Market Share of 47.90%, Valued at USD 0.8 Billion

North America commands the largest cone crusher market share, driven by extensive mining operations, robust construction activity, and well-established aggregate production infrastructure. The region benefits from technological leadership in crushing equipment innovation and strong replacement demand from aging installed equipment base. Moreover, ongoing infrastructure modernization initiatives and mining sector investments sustain equipment demand. The market holds 47.90% share valued at USD 0.8 Billion in 2025.

Europe Cone Crusher Market Trends

Europe demonstrates steady cone crusher demand supported by construction activity, quarrying operations, and stringent aggregate quality requirements across member nations. The region emphasizes environmental compliance, energy efficiency, and emission reduction in crushing operations. Additionally, equipment modernization and replacement cycles drive continued market growth throughout established European aggregate and mining industries.

Asia Pacific Cone Crusher Market Trends

Asia Pacific exhibits rapid market expansion fueled by accelerating urbanization, infrastructure development, and mining sector growth across emerging economies. Countries invest heavily in transportation networks, residential construction, and industrial facilities requiring substantial aggregate volumes. Furthermore, expanding domestic mining operations and increasing construction equipment adoption drive robust cone crusher demand throughout the region.

Middle East & Africa Cone Crusher Market Trends

Middle East and Africa experience growing cone crusher adoption driven by infrastructure mega-projects, mining development, and construction sector expansion. Regional governments prioritize economic diversification through infrastructure investment and resource extraction activities. Moreover, aggregate production capacity expansion supports ambitious development programs and construction market growth across Gulf Cooperation Council nations.

Latin America Cone Crusher Market Trends

Latin America demonstrates increasing cone crusher demand supported by mining industry expansion, infrastructure development, and construction sector recovery. The region possesses significant mineral resources driving continued mining investment and crushing equipment procurement. Additionally, urbanization trends and infrastructure modernization initiatives create sustained demand for aggregate production equipment throughout major Latin American markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Terex Corporation maintains significant market presence through comprehensive crushing equipment portfolios serving mining, construction, and aggregate production sectors globally. The company delivers innovative mobile and stationary cone crusher solutions featuring advanced automation and performance optimization technologies. Moreover, Terex provides integrated aftermarket support services ensuring equipment reliability and maximizing customer operational uptime across diverse applications.

Metso Corporation leads cone crusher innovation through continuous technological advancement and industry-leading product development initiatives. The company introduced the Nordberg HPe Series cone crushers featuring enhanced energy efficiency and automated performance management capabilities. Additionally, Metso’s extensive global service network delivers comprehensive parts supply, maintenance support, and technical expertise to mining and aggregate customers worldwide.

McCloskey Equipment specializes in mobile and portable crushing solutions addressing contractor and aggregate producer requirements for flexible processing equipment. The company designs compact, high-performance cone crushers integrated into track-mounted and wheeled chassis configurations for rapid deployment. Furthermore, McCloskey emphasizes user-friendly operation, simplified maintenance procedures, and robust construction quality throughout its crushing equipment product range.

ThyssenKrupp AG leverages engineering expertise and industrial manufacturing capabilities to produce high-capacity cone crushers for demanding mining and quarrying applications. The company focuses on heavy-duty equipment designs capable of processing abrasive materials under continuous operational conditions. Moreover, ThyssenKrupp integrates advanced automation technologies and remote monitoring systems enhancing operational efficiency and predictive maintenance capabilities for large-scale industrial customers.

Key players

- Terex Corporation

- Metso Corporation

- McCloskey Equipment

- ThyssenKrupp AG

- Sandvik AB

- Astec Industries Inc.

- Puzzolana Machinery Fabricators LLP

- Keestrack NV

- FLSmidth & Co. A/S

- Tesad Engineering Ltd

Recent Developments

- July 2025 – Astec Industries entered into a definitive agreement to acquire TerraSource Holdings, LLC for approximately USD $245 million in cash. This strategic acquisition expands Astec’s crushing and screening equipment portfolio while strengthening its market position across aggregate processing and material handling segments.

- May 2025 – Metso introduced the Nordberg HPe Series cone crushers (HP600e, HP800e and HP900e) in official product launch materials. These advanced models feature enhanced energy efficiency, automated control systems, and improved throughput performance designed to optimize operational productivity in mining and aggregate applications.

- January 2025 – Heidelberg Materials UK acquires new B3 B-Series Cone Crusher from QMS to enhance its aggregate production capabilities. The equipment installation supports operational expansion and modernization initiatives aimed at improving processing efficiency and meeting growing regional construction material demand.

Report Scope

Report Features Description Market Value (2025) USD 1.8 Billion Forecast Revenue (2035) USD 2.8 Billion CAGR (2026-2035) 4.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standard Cone Crusher, Short Head Cone Crusher, Compound Cone Crusher, Hydraulic Cone Crusher), By Offering (Mobile Crushers, Portable Crushers, Stationary Crushers), By Capacity (50 to 100 TPH, Less than 50 TPH, 100 to 150 TPH, More than 150 TPH), By Application (Mining, Construction, Aggregate Production, Chemical Industry, Others), By Sales Type (New Equipment Sales, Aftermarket Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Terex Corporation, Metso Corporation, McCloskey Equipment, ThyssenKrupp AG, Sandvik AB, Astec Industries Inc., Puzzolana Machinery Fabricators LLP, Keestrack NV, FLSmidth & Co. A/S, Tesad Engineering Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Terex Corporation

- Metso Corporation

- McCloskey Equipment

- ThyssenKrupp AG

- Sandvik AB

- Astec Industries Inc.

- Puzzolana Machinery Fabricators LLP

- Keestrack NV

- FLSmidth & Co. A/S

- Tesad Engineering Ltd