Global Composite Insulators Market Size, Share, And Business Benefits By Product (Pin Insulators, Suspension Insulators, Shackle Insulators, Others), By Voltage (High Voltage, Medium Voltage, Low Voltage), By Installation (Distribution, Transmission, Substation, Railways, Others), By Application (Cables and transmission Lines, Switchgears, Transformer, Bus Bars, Others), By End use (Utilities,Residential, Commercial and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160811

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

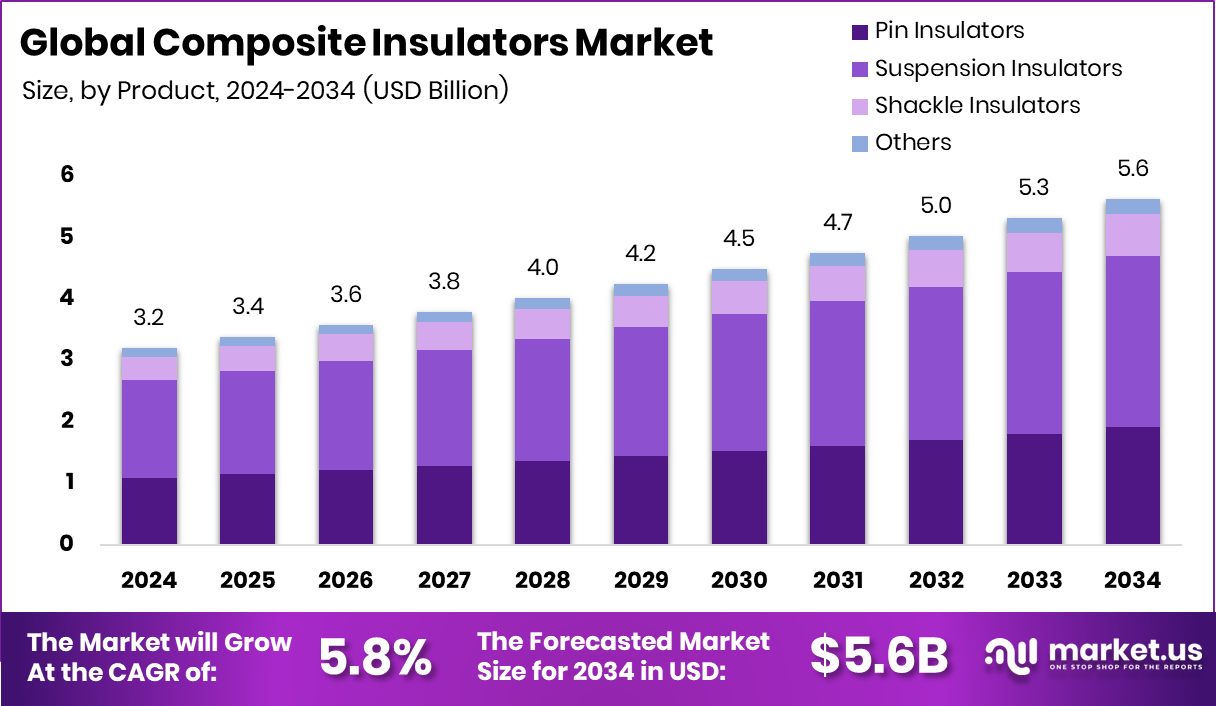

The Global Composite Insulators Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.2 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Asia-Pacific’s 41.80% growth is driven by rising transmission projects and expanding power infrastructure.

A composite insulator is an electrical insulator constructed by combining different materials—typically a central core made of fiber-reinforced resin or fiberglass, and an outer polymeric (rubber or silicone) housing. This hybrid structure aims to deliver both mechanical strength and electrical insulation in demanding service conditions. Compared to traditional porcelain or glass insulators, composite insulators are lighter, more resistant to environmental stress, and less prone to fracturing under mechanical loads or vibration.

The composite insulators market encompasses the design, manufacture, distribution, and use of these hybrid insulators in power transmission, distribution, substations, and rail applications. It represents the commercial ecosystem around these components—covering raw materials, component suppliers, manufacturers, utilities, and end-users who install and maintain power infrastructure using composite insulators.

One strong growth driver is the global effort to modernize aging power grids: utilities are replacing old ceramic or glass insulators with composites that offer lower maintenance costs and improved resilience under harsh weather. Another factor is the rising integration of renewable energy (wind, solar) and the expansion of long-distance, high-voltage transmission lines, pushing demand for lighter, higher-performance insulating materials. Also, stricter regulatory requirements for grid reliability and insulation quality are encouraging the adoption of advanced composite solutions.

Opportunities exist in smart grid integration, where insulators may be embedded with sensors for real-time diagnostics. Further advances in polymer and composite materials may reduce cost or improve life cycles. Also, large infrastructure funding initiatives renew the appetite for grid upgrades. For example, Entergy Texas secured approval for a major transmission investment and $200 M grant funding to strengthen the grid; Xbattery raised $2.3 M seed funding to build high-voltage BMS for EVs and energy storage; an $8 million investment targets high-voltage direct current grid modernization; NV5 obtained $5 m to fund design of high voltage substations for data centers; though conversely the U.S. energy department cancelled $7.6 billion in funding for certain projects. These funding shifts will reshape which technologies and regions see accelerated composite insulator uptake.

Key Takeaways

- The Global Composite Insulators Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.2 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, suspension insulators dominated the Composite Insulators Market, holding a 49.6% share.

- High voltage applications captured a 54.8% share of the global Composite Insulators Market in 2024.

- Transmission installations accounted for a 43.9% share in the Composite Insulators Market during 2024.

- Cables and transmission lines dominated the Composite Insulators Market with a 49.5% share in 2024.

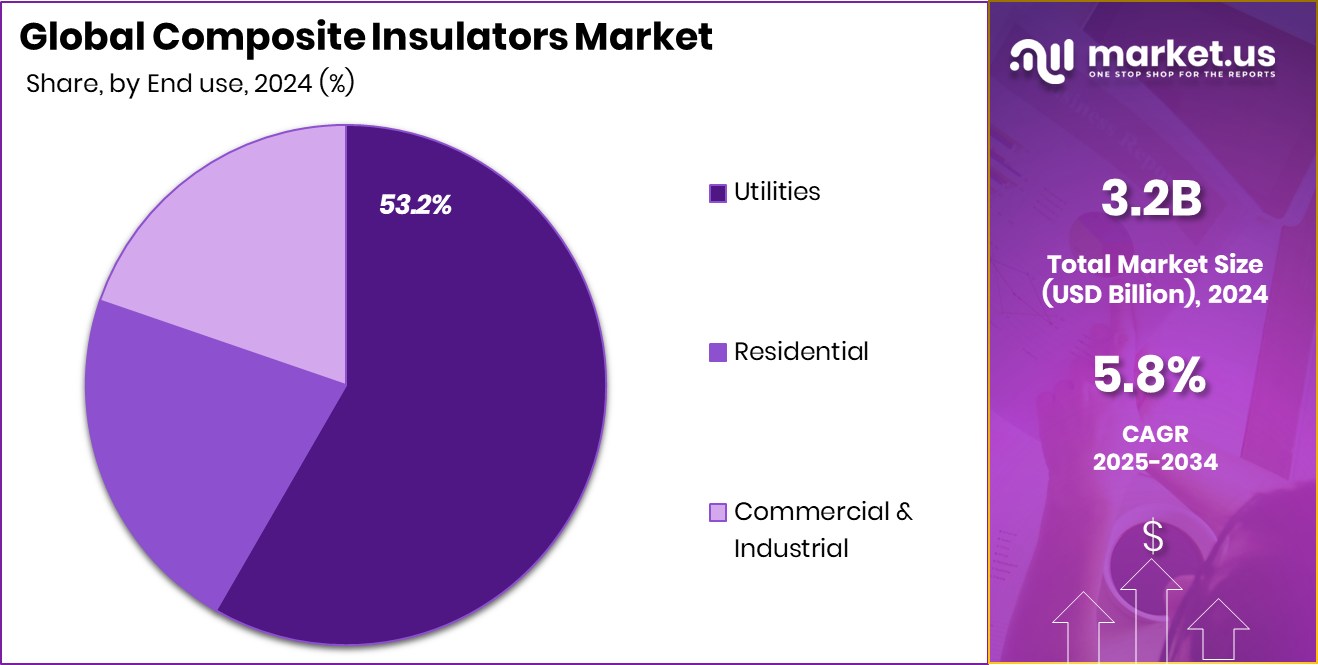

- Utilities segment led the Composite Insulators Market with a 53.2% share in 2024.

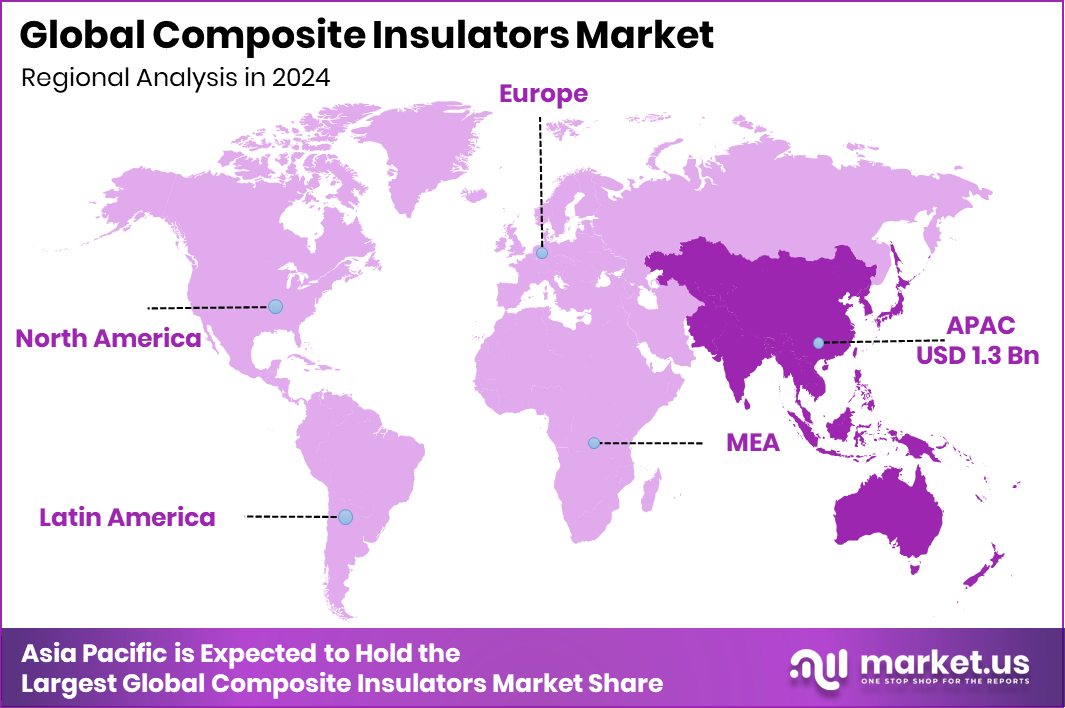

- The Asia-Pacific accounted for around USD 1.3 billion in market value in 2024.

By Product Analysis

In 2024, Suspension Insulators held a 49.6% share in the Composite Insulators Market.

In 2024, Suspension Insulators held a dominant market position in the By Product segment of the Composite Insulators Market, with a 49.6% share. These insulators are widely used in high-voltage transmission and distribution networks due to their superior mechanical strength, lightweight structure, and resistance to contamination and moisture. Their flexible design allows efficient performance under varying load conditions, making them suitable for long-span transmission lines and harsh environmental areas.

The growing need for stable power transmission, modernization of grid infrastructure, and preference for durable materials over traditional porcelain insulators have strengthened the use of suspension insulators. Their reliability and cost-effectiveness continue to drive adoption across power utilities and large-scale transmission projects globally.

By Voltage Analysis

In 2024, the High Voltage segment dominated with a 54.8% share in the Composite Insulators Market.

In 2024, High Voltage held a dominant market position in the By Voltage segment of the Composite Insulators Market, with a 54.8% share. This dominance is attributed to the growing expansion of long-distance transmission networks and the increasing need for reliable insulation systems in high-voltage applications. Composite insulators used in these systems offer high mechanical strength, reduced weight, and excellent resistance to pollution and weathering.

Their superior performance in maintaining electrical stability under high tension and adverse environmental conditions makes them ideal for modern power grids. The ongoing replacement of traditional materials with advanced polymer composites continues to support the strong market share of high-voltage composite insulators in global transmission infrastructure.

By Installation Analysis

In 2024, Transmission installation accounted for a 43.9% share in the Composite Insulators Market.

In 2024, Transmission held a dominant market position in the By Installation segment of the Composite Insulators Market, with a 43.9% share. This dominance is driven by the extensive use of composite insulators in high-voltage transmission lines to ensure efficient and reliable power flow over long distances. These insulators provide superior mechanical and electrical performance, making them well-suited for harsh environments and high mechanical stress conditions.

Their lightweight design, resistance to pollution, and low maintenance needs have enhanced their preference in modern transmission infrastructure. The steady growth of grid expansion projects and the replacement of conventional insulators with advanced composite materials continue to support the strong presence of transmission installations in the global market.

By Application Analysis

In 2024, Cables and Transmission Lines captured a 49.5% share in the Composite Insulators Market.

In 2024, Cables and Transmission Lines held a dominant market position in the By Application segment of the Composite Insulators Market, with a 49.5% share. This strong position is due to the rising demand for durable and efficient insulation materials in high-voltage transmission and distribution networks. Composite insulators used in cables and transmission lines provide excellent electrical insulation, mechanical strength, and resistance to extreme weather conditions.

Their lightweight and maintenance-free design makes them ideal for modern grid systems, reducing energy losses and improving reliability. As utilities focus on grid modernization and expanding transmission capacity, the use of composite insulators in cables and transmission lines continues to play a critical role in ensuring stable and efficient power delivery.

By End Use Analysis

In 2024, the Utilities end-use segment led with a 53.2% share in the Composite Insulators Market.

In 2024, Utilities held a dominant market position in the By End Use segment of the Composite Insulators Market, with a 53.2% share. This leadership is driven by the extensive adoption of composite insulators across power transmission and distribution networks managed by utility companies. These insulators provide reliable electrical performance, high mechanical strength, and resistance to pollution and weathering, ensuring long-term operational stability in diverse environments.

Utility operators prefer composite materials due to their lightweight design and low maintenance needs, which help reduce operational costs and enhance grid efficiency. The growing focus on modernizing power infrastructure and improving transmission reliability continues to reinforce the strong demand for composite insulators among utilities worldwide.

Key Market Segments

By Product

- Pin Insulators

- Suspension Insulators

- Shackle Insulators

- Others

By Voltage

- High Voltage

- Medium Voltage

- Low Voltage

By Installation

- Distribution

- Transmission

- Substation

- Railways

- Others

By Application

- Cables and Transmission Lines

- Switchgears

- Transformer

- Bus Bars

- Others

By End use

- Utilities

- Residential

- Commercial and Industrial

Driving Factors

Growing Grid Modernization and Transmission Expansion Projects

A key driving factor for the Composite Insulators Market is the rapid modernization of power grids and expansion of high-voltage transmission networks worldwide. As electricity demand continues to rise, utilities are investing in advanced infrastructure to improve efficiency, safety, and reliability. Composite insulators play a vital role in these upgrades due to their lightweight design, resistance to weather and pollution, and long operational life.

Governments and private firms are also investing in smart grid technologies that require durable insulating materials. Supporting this trend, Smart Wires raised $65 million to scale grid solutions for the growing data center market, reflecting strong momentum toward advanced and flexible power transmission systems that rely on composite insulation components.

Restraining Factors

High Initial Costs and Technical Installation Challenges

One major restraining factor for the Composite Insulators Market is the high initial cost and technical complexity involved in installation and maintenance. Although composite insulators offer long-term advantages such as lightweight design and better durability, their production and material costs are higher compared to traditional porcelain types. Additionally, specialized handling and training are required for installation, which increases project expenses.

In regions with limited technical expertise, this becomes a key hurdle for large-scale adoption. Moreover, emerging technologies in power transmission are gaining attention. For instance, Veir raised $75 million to pilot a superconducting transmission solution for data centers, which could slow short-term demand for conventional composite insulator-based grid systems in advanced markets.

Growth Opportunity

Rising Investments in High-Voltage Transmission Infrastructure

A major growth opportunity for the Composite Insulators Market lies in the increasing investments toward expanding and upgrading high-voltage transmission infrastructure. As electricity demand grows with industrialization, renewable integration, and urban expansion, many countries are strengthening their grid networks to handle higher loads efficiently. Composite insulators are preferred in these projects for their strength, lightweight design, and excellent performance under extreme environmental conditions.

Governments and private utilities are allocating significant budgets to enhance grid stability and reduce power losses. However, large-scale projects also highlight financial pressures; for example, a key transmission project’s $1.5 billion blowout points to bill shock pain, emphasizing the need for cost-effective and durable composite solutions to ensure long-term grid sustainability.

Latest Trends

Adoption of Advanced Polymer Materials in Insulators

A leading trend in the Composite Insulators Market is the growing adoption of advanced polymer materials to improve durability and performance. Modern polymer-based insulators offer superior resistance to ultraviolet radiation, moisture, and pollution, making them ideal for harsh outdoor conditions. These materials also provide flexibility and reduced weight, simplifying installation and lowering maintenance costs.

The shift toward such high-performance polymers supports the global drive for efficient and reliable power transmission. Additionally, rising investments in grid development are fueling this trend. For instance, Sterlite Power secured ₹3 billion in funding for a major transmission project in Jammu & Kashmir, reflecting increasing confidence in advanced materials and technologies that enhance long-term grid reliability and sustainability.

Regional Analysis

In 2024, the Asia-Pacific dominated the Composite Insulators Market with a 41.80% share.

In 2024, Asia-Pacific held a dominant position in the global Composite Insulators Market, accounting for 41.80% of the total share, valued at around USD 1.3 billion. The region’s leadership is driven by rapid grid expansion, strong investments in high-voltage transmission networks, and government-backed programs supporting power infrastructure upgrades across major economies such as China, India, and Japan.

North America follows closely, supported by modernization of existing grid systems, increasing renewable energy integration, and the replacement of aging ceramic insulators with advanced composite types. Europe continues to show steady adoption, focusing on sustainable energy transmission solutions and stringent environmental standards.

Meanwhile, the Middle East & Africa region is witnessing gradual growth due to infrastructure development and cross-border transmission projects, while Latin America is progressing with rural electrification and industrial power connectivity initiatives. The rising demand for reliable, lightweight, and weather-resistant insulators across all regions highlights a shared global shift toward efficient energy delivery systems.

However, Asia-Pacific remains the most influential region, with expanding power distribution networks and large-scale transmission projects positioning it as the central hub for composite insulator manufacturing and deployment in the global energy infrastructure landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Bonomi continued to strengthen its presence in the global Composite Insulators Market through innovation and quality-driven production. The company focuses on manufacturing high-performance insulators that meet the demands of modern transmission and distribution networks. Its products are known for excellent resistance to environmental stress, ensuring long service life in diverse operating conditions. Bonomi’s consistent investment in research and product reliability has helped it maintain a trusted reputation among utility and infrastructure developers worldwide.

CYG Insulator demonstrated steady growth by emphasizing advanced polymer technologies and expanding its global supply network. The company’s expertise in silicone rubber and composite materials has positioned it as a key player in high-voltage applications. CYG Insulator’s strategic initiatives include product optimization for harsh climate performance and improved mechanical strength, addressing the industry’s evolving reliability standards. Its continued investment in production capacity supports the rising global demand for lightweight and durable insulators used in grid modernization projects.

CTC Insulator focused on enhancing its manufacturing precision and material innovation to deliver efficient and cost-effective solutions. The company’s portfolio of composite insulators caters to both transmission and distribution sectors, ensuring strong mechanical stability and superior electrical insulation. In 2024, CTC Insulator concentrated on strengthening customer partnerships and expanding its reach in emerging markets. Its commitment to technological refinement and quality assurance reinforces its position as a reliable supplier within the global composite insulators industry, contributing to the continuous evolution of modern power infrastructure systems.

Top Key Players in the Market

- Bonomi

- CYG Insulator

- CTC Insulator

- Deccan Enterprises

- ENSTO

- Gipro

- Hitachi Energy

- Hubbell

- Izoelektro

- Kuvag

Recent Developments

- In March 2025, the Bonomi Group announced the acquisition of Conflow S.p.A., a firm specializing in control valves, pressure reducers, and heat exchangers. This move expands Bonomi’s equipment portfolio and strengthens its industrial product offering.

- In November 2024, CYG Insulator was awarded the “Guangdong Green Factory” honor and passed a review as a National Specialized and New “Little Giant” Enterprise.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pin Insulators, Suspension Insulators, Shackle Insulators, Others), By Voltage (High Voltage, Medium Voltage, Low Voltage), By Installation (Distribution, Transmission, Substation, Railways, Others), By Application (Cables and transmission Lines, Switchgears, Transformer, Bus Bars, Others), By End use (Utilities, Residential, Commercial and Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bonomi, CYG Insulator, CTC Insulator, Deccan Enterprises, ENSTO, Gipro, Hitachi Energy, Hubbell, Izoelektro, Kuvag Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Composite Insulators MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Composite Insulators MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bonomi

- CYG Insulator

- CTC Insulator

- Deccan Enterprises

- ENSTO

- Gipro

- Hitachi Energy

- Hubbell

- Izoelektro

- Kuvag