Global Commercial Insulation Market Size, Share, And Business Benefits By Product Type (Fiberglass Insulation, Foam Insulation), By Form (Blankets, Rolls, Boards), By Thickness (Thin (up to 1 inch), Medium (1-2 inches)), By End-User (Commercial Buildings, Healthcare Facilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160398

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

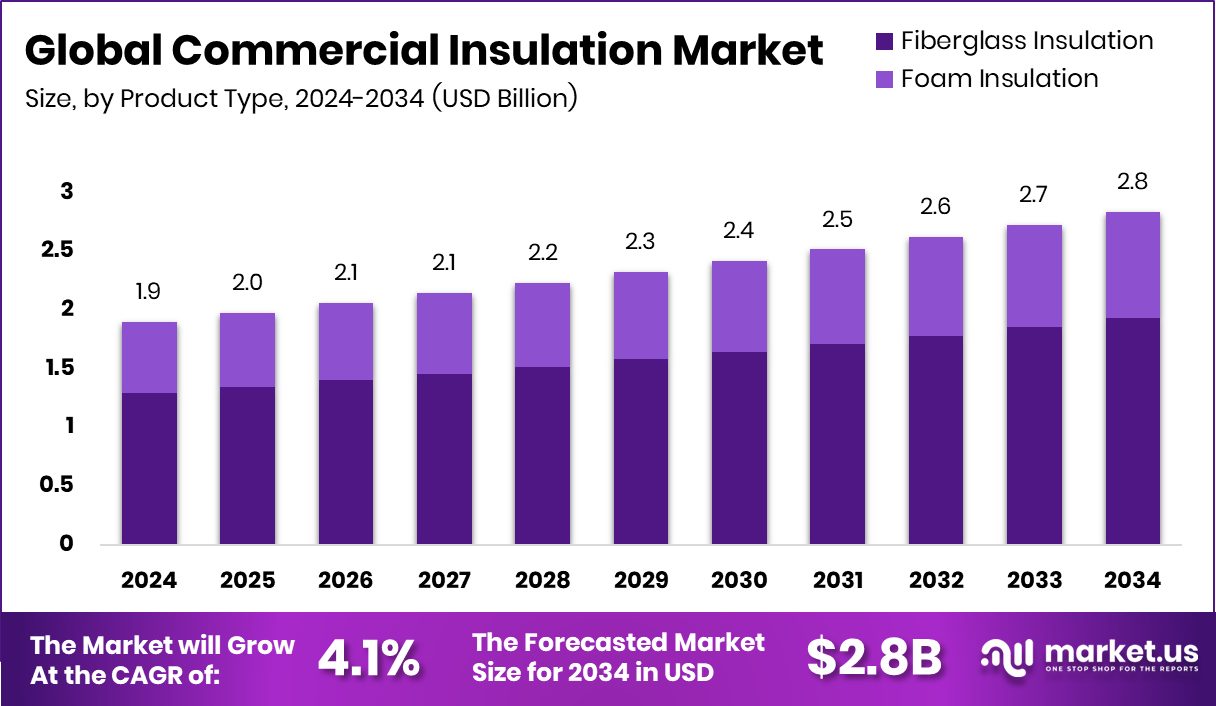

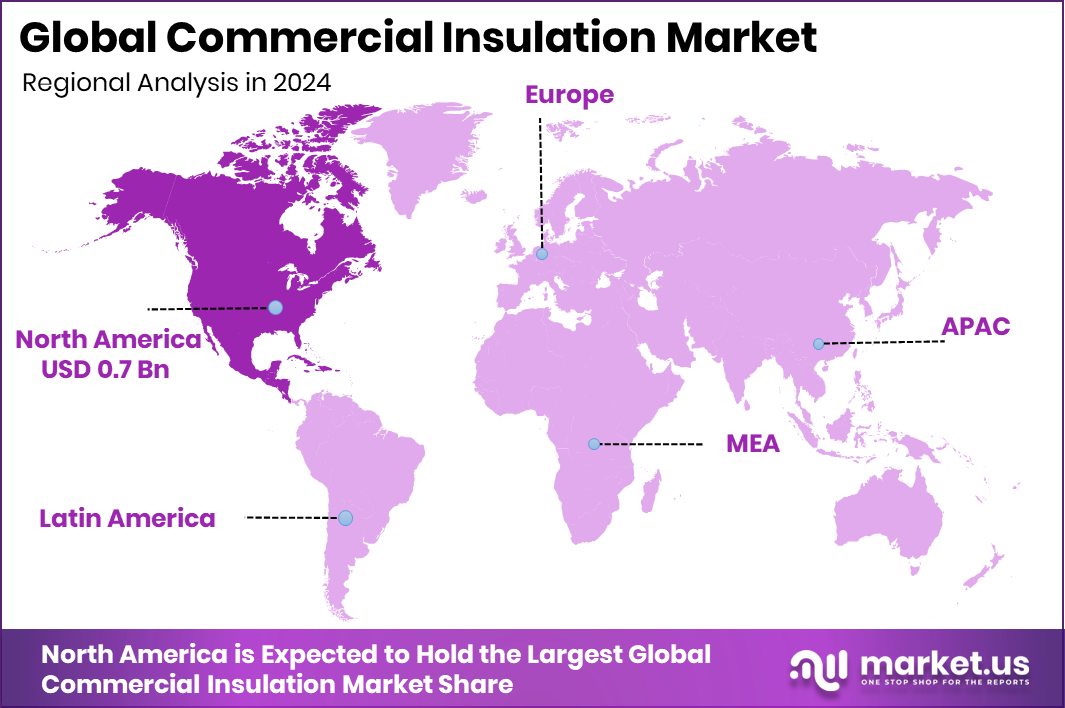

The Global Commercial Insulation Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Energy efficiency programs and green building policies continue to boost North America’s USD 0.7 Bn insulation demand.

Commercial insulation refers to the materials and systems used to reduce heat transfer, noise, and energy loss in non-residential buildings such as offices, warehouses, hospitals, and retail centers. These systems include rigid foam boards, spray foams, fibreglass, mineral wool, and reflective barriers, often installed within walls, roofs, floors, and mechanical ducts. The goal is to maintain interior comfort, boost energy efficiency, manage acoustics, and meet regulatory standards.

The commercial insulation market encompasses the industry that designs, manufactures, distributes, and installs these insulation solutions for the non-residential sector. It spans raw material suppliers, insulation product manufacturers, installation contractors, and maintenance service providers. Demand in this market is influenced by construction activity, energy codes, retrofit projects, and sustainability trends in urban and industrial development.

Growth factors include increasing regulatory pressure on energy efficiency and carbon emissions, rising energy costs that push building owners to invest in thermal performance, and urban expansion of commercial real estate. For example, the Mayor of London opens the £43m Warmer Homes energy efficiency scheme, which signals public interest in upgrading existing building stock.

Also, the government could save £55bn over the next five years by limiting the Bank of England’s interest payments to commercial banks. The Treasury will pay out over £150bn from now until 2028 to fund the Bank of England’s interest payments to commercial banks—policy landscapes can further shift incentives toward energy-saving investments.

Demand is driven by retrofits of aging commercial buildings, new construction projects in developing urban areas, and stricter building codes that mandate higher insulation standards. There is an opportunity to integrate smart insulation systems, coupling insulation with renewable heating or HVAC controls, and leverage public funding to accelerate upgrades. For instance, £557 million for public buildings to switch to cleaner heating and save on energy bills presents a strong opportunity for insulation projects. Another signal of capital flow is TopBuild’s acquisition of Specialty Products & Insulation in an All-Cash Transaction Valued at $960 million, demonstrating interest and investment in the insulation space.

Key Takeaways

- The Global Commercial Insulation Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- In 2024, fiberglass insulation dominated the commercial insulation market with a 56.9% share.

- Blankets held a 38.5% share in the Commercial Insulation Market, leading due to installation flexibility.

- Medium thickness (1–2 inches) accounted for a 65.3% share in the Commercial Insulation Market.

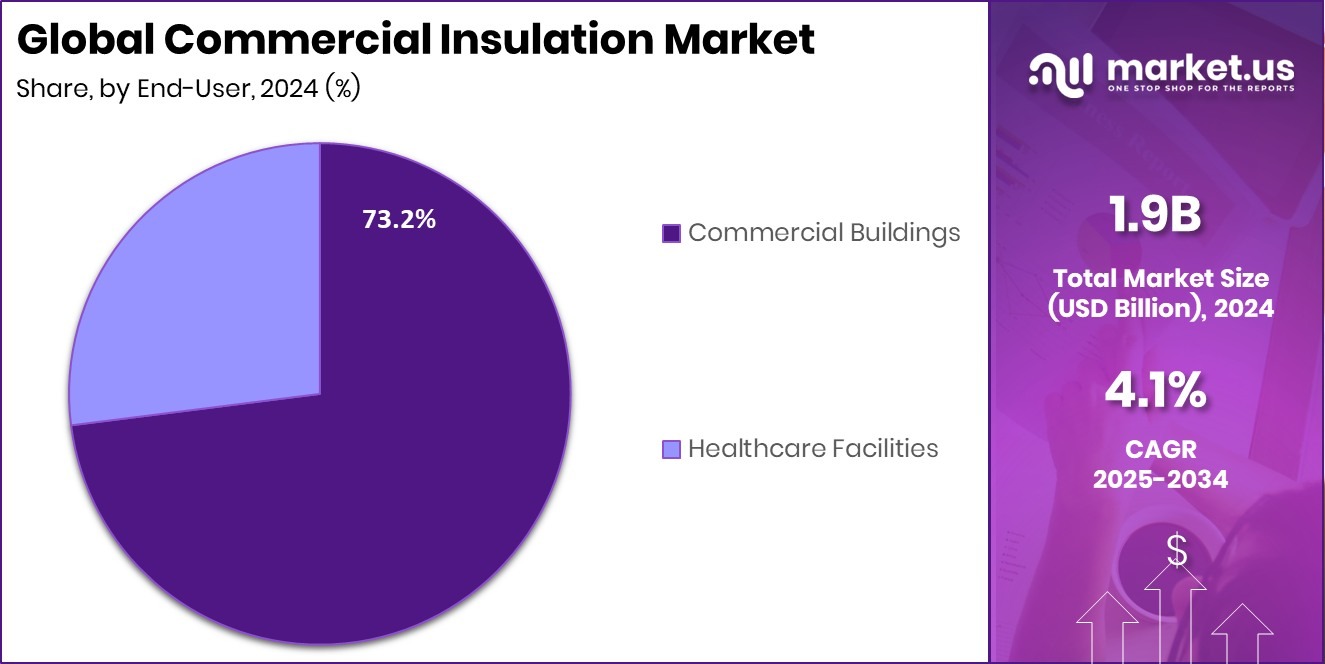

- Commercial buildings dominated the commercial insulation market with a 73.2% share in 2024.

- The North American market value reached around USD 0.7 billion, driven by strong construction activity.

By Product Type Analysis

In 2024, fiberglass insulation dominated the commercial insulation market, capturing 56.9%.

In 2024, fiberglass insulation held a dominant market position in the by-product type segment of the commercial insulation market, with a 56.9% share. This material remained the preferred choice for commercial buildings due to its excellent thermal resistance, cost efficiency, and easy installation across walls, ceilings, and mechanical systems.

Its non-combustible nature and ability to enhance acoustic comfort further strengthen its application in offices, hospitals, and educational facilities. The material’s compatibility with modern energy codes and sustainable building practices made it a consistent favorite among contractors and designers. As construction activity and retrofitting projects expanded globally, fiberglass insulation maintained its lead as a reliable and high-performance solution in commercial infrastructure.

By Form Analysis

Blankets held a 38.5% share in the commercial insulation market.

In 2024, Blankets held a dominant market position in the By Form segment of the Commercial Insulation Market, with a 38.5% share. Their flexibility, ease of installation, and cost-effectiveness made them a preferred insulation solution across commercial buildings. Blanket insulation, typically made from fiberglass or mineral wool, offered excellent thermal and acoustic performance, making it suitable for walls, roofs, and large mechanical systems.

Its adaptability to different structural designs and compatibility with sustainable construction standards supported its growing adoption. Moreover, the material’s ability to minimize energy loss while maintaining indoor comfort positioned blanket insulation as a practical and efficient choice for both new commercial developments and renovation projects worldwide.

By Thickness Analysis

Medium (1–2 inches) insulation captured 65.3% in the commercial insulation market.

In 2024, Medium (1–2 inches) held a dominant market position in the By Thickness segment of the Commercial Insulation Market, with a 65.3% share. This thickness range provided an optimal balance between thermal efficiency, material cost, and installation ease, making it the most widely used option across commercial structures.

Medium insulation effectively reduced heat transfer while maintaining structural integrity and minimizing space consumption, which is crucial in modern building designs. Its suitability for walls, ceilings, and HVAC systems contributed to its broad application in office complexes, retail spaces, and institutional buildings. The segment’s dominance reflected growing preferences for insulation materials that ensure energy savings without compromising construction flexibility or budget efficiency.

By End-User Analysis

Commercial buildings dominated the commercial insulation market with a 73.2% share.

In 2024, commercial buildings held a dominant market position in the end-user segment of the commercial insulation market, with a 73.2% share. The dominance was driven by rising construction and renovation of offices, shopping centers, hospitals, and educational facilities focused on energy efficiency and occupant comfort. Insulation in commercial buildings played a vital role in reducing energy costs, improving indoor temperature control, and ensuring compliance with modern building regulations.

The growing emphasis on sustainable architecture and green certifications further supported its extensive use. Additionally, the need for thermal and acoustic control in high-traffic urban structures reinforced the widespread adoption of insulation solutions across large-scale commercial properties worldwide.

Key Market Segments

By Product Type

- Fiberglass Insulation

- Foam Insulation

By Form

- Blankets

- Rolls

- Boards

By Thickness

- Thin (up to 1 inch)

- Medium (1-2 inches)

By End-User

- Commercial Buildings

- Healthcare Facilities

Driving Factors

Rising Energy Efficiency Needs Drive Market Expansion

A key driving factor for the Commercial Insulation Market is the growing need for energy-efficient buildings. Businesses are focusing on reducing operational costs and meeting environmental standards by using high-performance insulation materials. These solutions help maintain temperature balance, reduce energy waste, and enhance overall comfort in commercial spaces. Rising global awareness about carbon emissions and stricter building energy codes are accelerating adoption across new constructions and retrofit projects.

However, the financial sector’s increasing caution adds a layer of complexity—HSBC flags 73% of Hong Kong commercial property loans as risky, and regulators warn of hidden vulnerabilities in the $12tn commercial property market. These concerns highlight the importance of resilient, energy-saving insulation investments that secure long-term building value.

Restraining Factors

High Installation Costs Limit Market Growth Potential

A major restraining factor for the Commercial Insulation Market is the high installation and maintenance costs of insulation systems. Many commercial buildings require specialized materials, skilled labor, and complex installation processes, which significantly increase project expenses. Small and medium-sized businesses often delay insulation upgrades due to these upfront costs, even though they offer long-term savings. The challenge becomes greater in older buildings where retrofitting involves structural adjustments.

Despite financial barriers, technology investments are helping address this issue. For instance, EPRI gains $2M funding for Commercial Building VPP Demonstration Project, showing growing support for energy-efficient technologies. Yet, the initial financial burden continues to restrict faster adoption, especially in cost-sensitive commercial property markets.

Growth Opportunity

Expanding Green Construction Creates Strong Market Opportunity

A key growth opportunity for the Commercial Insulation Market lies in the global shift toward green and energy-efficient construction. Governments and organizations are promoting sustainable building practices that demand better insulation performance to reduce carbon footprints and energy costs. Builders and property owners are increasingly choosing eco-friendly materials that meet modern energy standards. Public funding and private investments are also encouraging innovation in insulation technologies.

For instance, Spaceflux raises £5.4 million in seed funding, showing confidence in sustainable infrastructure solutions, while Governor Evers and WEDC announce more than $1.5 million in grants to support small businesses across Wisconsin, further stimulating regional construction activities. These initiatives create favorable conditions for the insulation market expansion worldwide.

Latest Trends

Rising Retrofits and Renovations Boost Market Demand

One of the latest trends in the Commercial Insulation Market is the growing focus on retrofitting and renovating existing buildings to meet new energy standards. Many older commercial properties are being upgraded with advanced insulation materials to improve energy efficiency and indoor comfort. This trend is driven by environmental goals, stricter regulations, and the need to cut operational costs.

Building owners are realizing that proper insulation not only reduces energy use but also increases property value. Government support is further strengthening this shift—Gov. Evers and WEDC announce $3.2 million in grants to support small businesses statewide, encouraging upgrades and energy-efficient improvements across commercial buildings, which continues to shape the market’s positive growth outlook.

Regional Analysis

In 2024, North America dominated the Commercial Insulation Market with a 38.90% share.

In 2024, North America dominated the Commercial Insulation Market, accounting for 38.90% share with a market value of USD 0.7 billion. The region’s growth was supported by advanced construction practices, strict building energy codes, and ongoing demand for retrofitting older structures to meet sustainability standards. Commercial developers in the U.S. and Canada are increasingly adopting high-performance insulation to lower energy costs and comply with green certification programs.

Europe followed closely, driven by regulatory initiatives promoting energy efficiency and carbon-neutral buildings. Asia Pacific experienced steady expansion, led by rapid urbanization, industrial growth, and infrastructure development across China, India, and Southeast Asia.

Meanwhile, the Middle East & Africa showed gradual growth due to ongoing commercial projects in urban centers, while Latin America witnessed stable demand supported by modern construction activities in Brazil and Mexico.

North America remained the clear leader in market contribution, highlighting its early adoption of energy-efficient construction materials and strong policy frameworks encouraging sustainable building design.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Owens Corning continued to strengthen its position by focusing on energy-efficient and eco-friendly insulation solutions. The company emphasized product innovations that enhance thermal performance and acoustic comfort while reducing environmental impact. Its consistent investment in research and development demonstrated a clear commitment to sustainable construction materials, aligning with global building efficiency standards.

Rockwool International A/S maintained its leadership through its specialization in stone wool insulation products designed for high performance in commercial and industrial buildings. The company’s focus on fire resistance, sound absorption, and energy efficiency positioned it as a preferred choice in large-scale projects. Rockwool’s efforts toward circular production processes and the use of natural raw materials reflected its long-term vision of sustainability and resource optimization in construction practices.

Saint-Gobain ISOVER advanced its global footprint by offering a comprehensive portfolio of insulation materials that promote comfort, energy savings, and environmental responsibility. The company’s continuous improvement in lightweight, high-efficiency materials and digital construction solutions helped it maintain a strong presence in global markets. Its integration of sustainable manufacturing practices and focus on recyclable materials reinforced its position as a responsible industry leader.

Top Key Players in the Market

- Owens Corning

- Rockwool International A/S

- Saint-Gobain ISOVER

- Knauf Insulation

- BASF SE

- Kingspan Group plc

- Johns Manville

- Armacell International S.A.

- Insul Techs

- USA Spray Me

- Anderson Insulation, Inc.

- Texas Insulation

Recent Developments

- In February 2025, Rockwool expanded operations in Marshall County, Mississippi, investing over USD 100 million and adding a production line using their WR-Tech™ (water repellency) and CR-Tech™ (corrosion resistance) technologies to boost capacity.

- In May 2024, Owens Corning completed the acquisition of Masonite International Corporation, a major provider of interior and exterior doors and door systems. This broadened its product offerings beyond insulation and strengthened its building-materials portfolio

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fiberglass Insulation, Foam Insulation), By Form (Blankets, Rolls, Boards), By Thickness (Thin (up to 1 inch), Medium (1-2 inches)), By End-User (Commercial Buildings, Healthcare Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Owens Corning, Rockwool International A/S, Saint-Gobain ISOVER, Knauf Insulation, BASF SE, Kingspan Group plc, Johns Manville, Armacell International S.A., Insul Techs, USA Spray Me, Anderson Insulation, Inc., Texas Insulation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Insulation MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Insulation MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Owens Corning

- Rockwool International A/S

- Saint-Gobain ISOVER

- Knauf Insulation

- BASF SE

- Kingspan Group plc

- Johns Manville

- Armacell International S.A.

- Insul Techs

- USA Spray Me

- Anderson Insulation, Inc.

- Texas Insulation