Global Commercial and Industrial Solar Tracker Market Size, Share, And Enhanced Productivity By Type (Single Axis, Dual Axis), By Technology (Active Trackers, Passive Trackers), By Application (Utility Scale, Commercial Rooftop, Ground Mount), By End Use (Energy Generation, Grid Integration, Off-Grid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177688

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

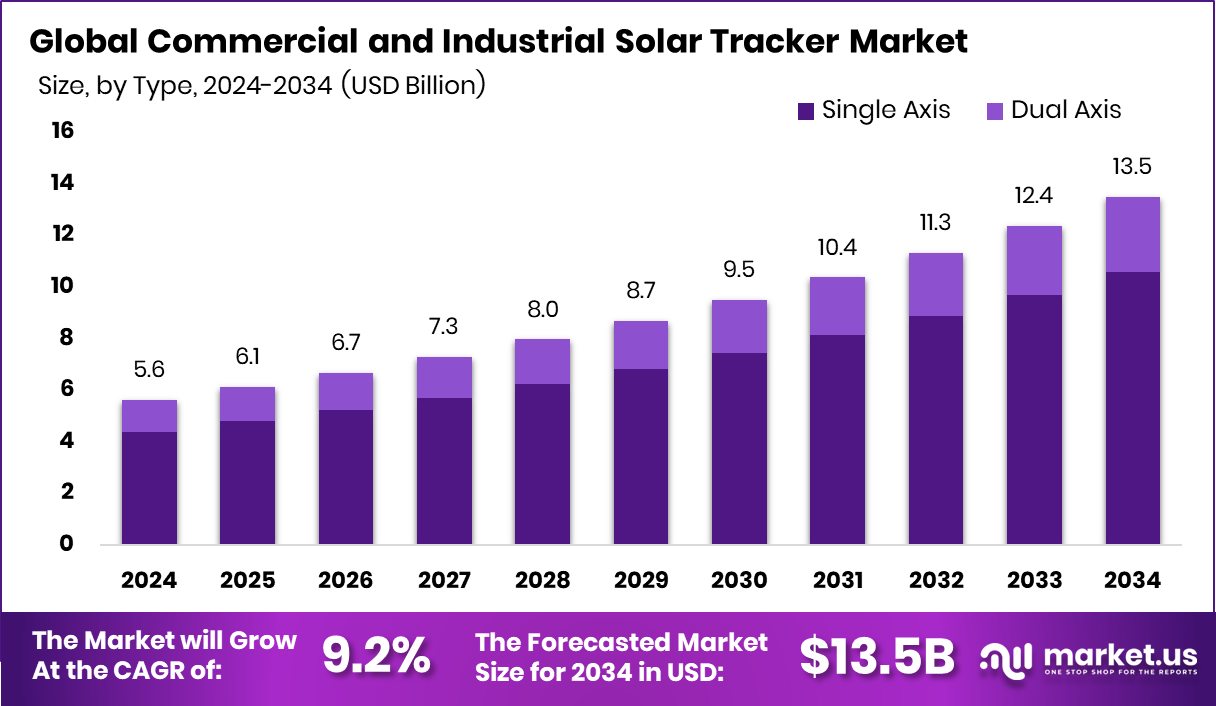

The Global Commercial and Industrial Solar Tracker Market is expected to be worth around USD 13.5 billion by 2034, up from USD 5.6 billion in 2024, and is projected to grow at a CAGR of 9.2% from 2025 to 2034. Strong industrial solar adoption supports Asia Pacific’s 41.8% market leadership.

Commercial and Industrial Solar Trackers are mechanical systems that move solar panels throughout the day to follow the sun’s path. By adjusting the angle of panels, these trackers help increase electricity output compared to fixed systems. In commercial and industrial settings, they are commonly used in utility-scale plants, large rooftops, and ground-mounted installations where energy efficiency directly impacts operating costs. Single-axis and dual-axis systems are selected depending on land availability, budget, and required performance levels.

The Commercial and Industrial Solar Tracker Market refers to the broader ecosystem of technology providers, project developers, installers, and investors involved in deploying tracking systems across business and industrial solar projects. The market covers active and passive tracker technologies, supporting applications from grid-connected power generation to off-grid industrial supply. Growth is closely linked to rising corporate sustainability commitments and the need for stable, long-term electricity costs.

One key growth factor is the steady inflow of capital into commercial solar portfolios. In recent developments, Sedgeley Solar Group raised $60 million in equity funding, while Radial Power secured US$80 million for commercial and industrial and community solar projects. Infiniti Energy also obtained $117 million to develop its U.S. solar portfolio, reflecting strong financial confidence in this segment.

Demand continues to expand as industrial customers seek a predictable energy supply and cost control. UK Solar Finance – Alight secured £34m for a 50MW C&I portfolio, and AMYPR Distributed Energy landed a £170 million debt facility, highlighting structured financing support. Meanwhile, Levanta Renewables acquired a 9.5 MW commercial and industrial solar portfolio, and TotalEnergies, Cathay, and Dajia Insurance partnered to invest and operate 1.5 GW of solar capacity for industrial customers in China. These developments underline long-term opportunity driven by scale, financing access, and industrial energy transition.

Key Takeaways

- The Global Commercial and Industrial Solar Tracker Market is expected to be worth around USD 13.5 billion by 2034, up from USD 5.6 billion in 2024, and is projected to grow at a CAGR of 9.2% from 2025 to 2034.

- Single Axis systems dominate the Commercial and Industrial Solar Tracker Market with 78.3% share.

- Active Trackers lead the Commercial and industrial solar tracker market, accounting for 69.2% share.

- Utility-scale applications capture 48.1% of the Commercial and Industrial Solar Tracker Market.

- Energy Generation end-use commands 67.5% within the Commercial and Industrial Solar Tracker Market.

- The Asia Pacific generated USD 2.3 Bn in total market revenue.

By Type Analysis

Single-axis systems dominate the Commercial and Industrial Solar Tracker Market with 78.3%.

In 2024, the Single Axis segment accounted for 78.3% of the Commercial and Industrial Solar Tracker Market, clearly leading the type category. Single-axis trackers remain the preferred choice for commercial and industrial installations due to their balanced cost-to-performance ratio. These systems rotate panels along one axis, typically east to west, increasing energy yield by 15–25% compared to fixed-tilt systems.

For commercial rooftops and ground-mounted industrial plants, this added efficiency directly improves return on investment. Their simpler structure also reduces installation complexity and maintenance costs. As businesses continue to focus on predictable payback periods and stable long-term generation, single-axis trackers are expected to maintain dominance, particularly in emerging markets where cost sensitivity remains high.

By Technology Analysis

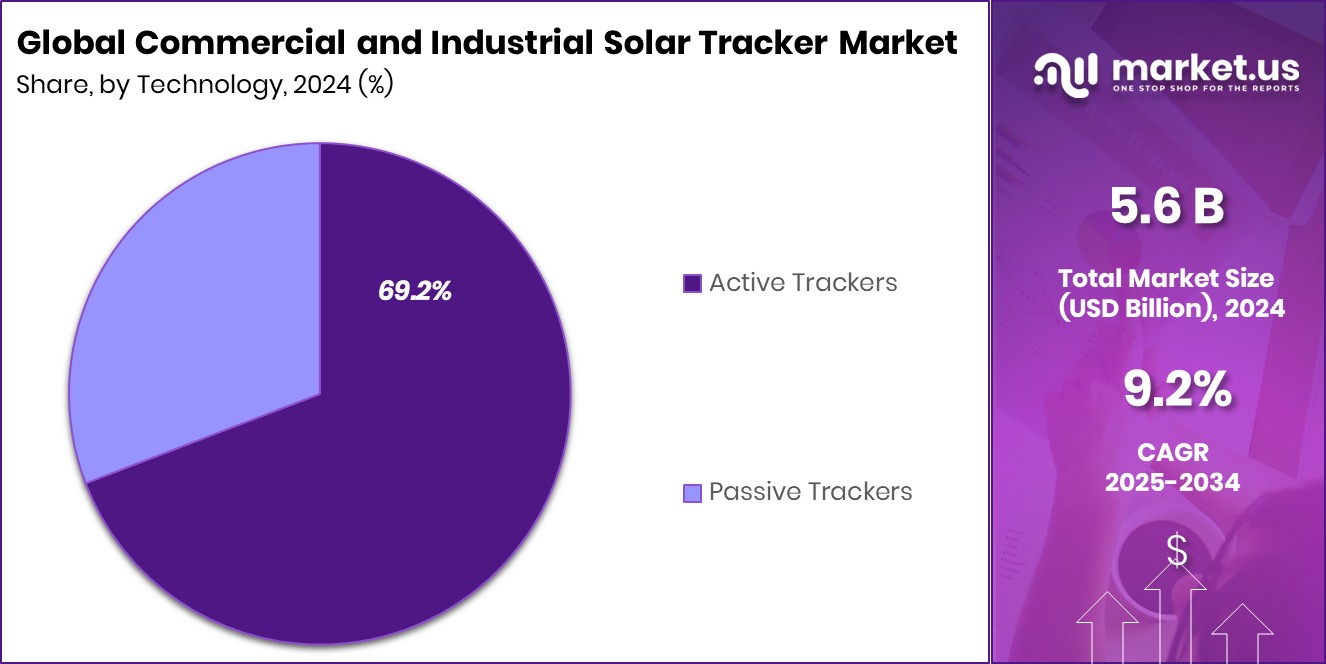

Active trackers lead the Commercial and Industrial Solar Tracker Market, holding 69.2%.

In 2024, Active Trackers held 69.2% share of the Commercial and Industrial Solar Tracker Market by technology. Active tracking systems use motors, sensors, and controllers to adjust panel positions throughout the day, ensuring maximum sunlight capture. Compared to passive systems, active trackers offer greater precision and higher energy output, making them more attractive for commercial and industrial users seeking consistent performance.

Although initial costs are slightly higher, the enhanced generation efficiency offsets capital expenditure over time. Industries operating energy-intensive facilities prefer active trackers because they help stabilize energy supply and reduce dependence on grid electricity. With ongoing improvements in automation and smart monitoring, active tracking technology continues to strengthen its market position.

By Application Analysis

Utility-scale projects capture 48.1% Commercial and Industrial Solar Tracker Market share.

In 2024, Utility Scale applications represented 48.1% of the Commercial and Industrial Solar Tracker Market. Large-scale commercial and industrial solar projects, especially those supplying power directly to factories, warehouses, and corporate campuses, are increasingly integrating tracker systems to optimize output. Utility-scale installations benefit significantly from trackers due to the vast land areas involved, where even small efficiency gains translate into substantial energy increases.

Governments and private enterprises are also entering long-term power purchase agreements to secure a stable renewable energy supply. As corporations commit to carbon neutrality targets, large installations equipped with tracking systems are becoming standard practice. This segment is expected to expand further as industrial solar capacities continue to grow globally.

By End Use Analysis

The energy generation segment commands 67.5% Commercial and Industrial Solar Tracker Market.

In 2024, Energy Generation accounted for 67.5% of the Commercial and Industrial Solar Tracker Market by end use. Most commercial and industrial buyers adopt solar trackers specifically to maximize electricity generation and improve overall plant performance. Enhanced output directly lowers the levelized cost of electricity, making solar projects financially more viable.

Industries such as manufacturing, logistics, retail chains, and data centers are prioritizing on-site power generation to reduce operating costs and meet sustainability goals. Solar trackers play a crucial role in achieving higher generation efficiency without expanding the land footprint. As energy prices fluctuate and regulatory pressure increases for cleaner operations, the focus on maximizing generation efficiency will continue to drive demand in this segment.

Key Market Segments

By Type

- Single Axis

- Dual Axis

By Technology

- Active Trackers

- Passive Trackers

By Application

- Utility Scale

- Commercial Rooftop

- Ground Mount

By End Use

- Energy Generation

- Grid Integration

- Off-Grid

Driving Factors

Rising industrial renewable energy adoption

Rising industrial renewable energy adoption continues to strengthen the Commercial and Industrial Solar Tracker Market as manufacturers, warehouses, and logistics hubs shift toward on-site solar generation. Businesses are actively investing in rooftop and ground-mounted systems to stabilize electricity costs and meet sustainability commitments. Financial backing is also reinforcing this transition.

PGIM recently provided $175M to power Solar Landscape’s rooftop expansion, reflecting growing institutional confidence in commercial solar deployment. Such capital support accelerates tracker installation across industrial rooftops where improved generation efficiency directly enhances returns. As more corporations prioritize long-term power security and decarbonization strategies, tracker systems are increasingly integrated to maximize output without expanding land use, further driving steady market momentum.

Restraining Factors

High initial capital investment requirements

High initial capital investment requirements remain a practical challenge for many commercial and industrial property owners. Although tracker systems increase energy output, upfront costs for equipment, engineering, and installation can delay decision-making, particularly for mid-sized enterprises. At the same time, financing models are evolving to address this barrier.

MetroElectro secured $5m to unlock the solar rooftop potential of industrial and commercial properties, while King Energy secured $10M for its rooftop solar financing model. These developments indicate that while funding support is emerging, access to structured capital remains uneven. Until financing becomes more standardized and accessible across markets, initial investment pressure will continue to act as a restraint on faster tracker adoption.

Growth Opportunity

Expansion in emerging industrial markets

Expansion in emerging industrial markets presents a clear growth path for tracker deployment. As cities and regional authorities face tighter public budgets, distributed solar solutions are gaining attention. Facing $32 million in federal cuts, Austin is exploring self-funded rooftop solar initiatives, signaling a stronger local-level commitment to independent energy generation.

Such developments create room for commercial and industrial facilities to integrate tracking systems that improve production efficiency and reduce long-term electricity costs. Emerging markets often experience rapid industrial expansion, where new facilities can integrate trackers from the design stage. This early adoption model strengthens long-term market penetration and opens broader opportunities for technology deployment.

Latest Trends

Adoption of AI-based tracking optimization

Adoption of AI-based tracking optimization is shaping the latest phase of development within the Commercial and Industrial Solar Tracker Market. Advanced software tools now allow systems to adjust panel positioning based on weather patterns, shading conditions, and real-time performance data. Financial activity continues to support rooftop expansion aligned with these technological upgrades

. Solar Landscape secured $175 Million financing for rooftop solar projects, reinforcing confidence in modernized, performance-driven installations. The integration of smart control systems with tracker hardware is becoming standard practice in larger commercial portfolios. This shift reflects a broader industry focus on operational efficiency, predictive maintenance, and maximizing generation yields through data-driven optimization strategies.

Regional Analysis

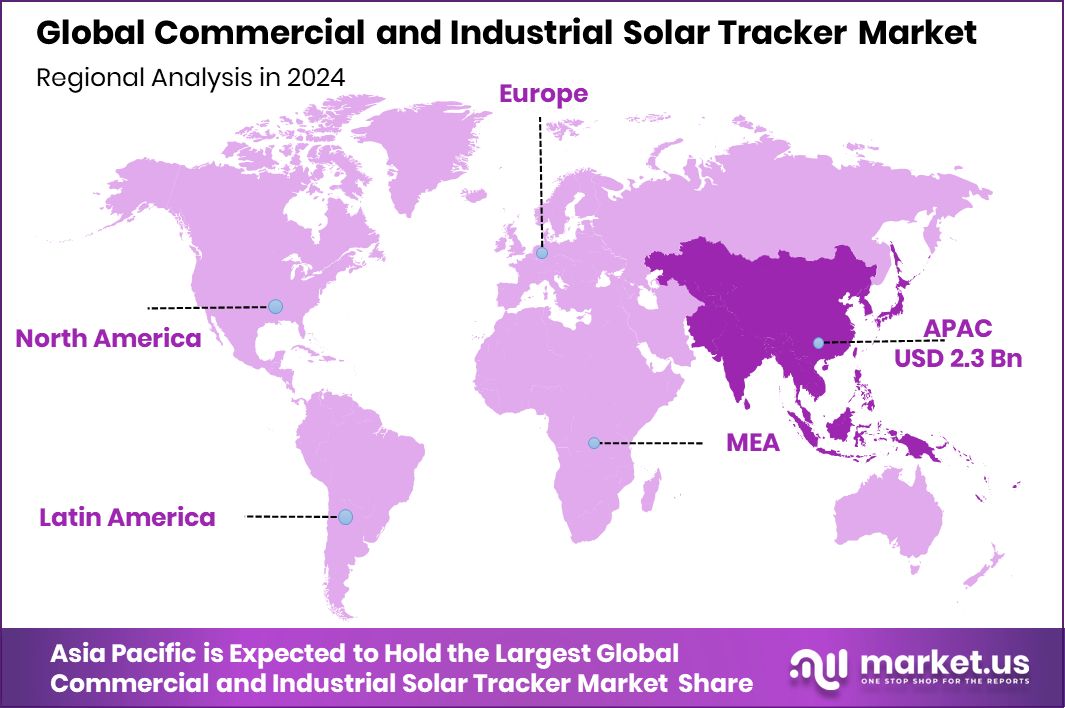

Asia Pacific dominates the Commercial and industrial solar tracker market with a 41.8% share.

The Commercial and Industrial Solar Tracker Market shows varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Among these, Asia Pacific stands as the dominating region, accounting for 41.8% of the global market and generating USD 2.3 Bn in revenue. This strong regional share reflects the large-scale deployment of commercial and industrial solar projects across major economies within the Asia Pacific, where tracker adoption continues to expand in line with rising electricity demand and industrial capacity growth.

North America and Europe represent established markets supported by structured commercial solar installations and steady tracker integration across industrial facilities. Meanwhile, the Middle East & Africa and Latin America are gradually increasing their participation, driven by growing commercial solar awareness and project-level installations.

However, Asia Pacific maintains a clear lead in both percentage share and value terms, reinforcing its position as the core revenue contributor within the global Commercial and Industrial Solar Tracker Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Trina Solar remains a strategically positioned player in the global Commercial and Industrial Solar Tracker Market in 2024. The company’s strength lies in its integrated solar ecosystem, combining modules, smart energy solutions, and tracker-compatible systems. This integration enables commercial and industrial customers to adopt optimized, performance-driven solar infrastructure under a unified technology framework. Trina Solar’s global project footprint and technical capabilities enhance its competitiveness in large commercial installations where reliability and long-term efficiency are critical.

Powerway Renewable Energy Co., Ltd continues to focus on solar mounting and tracking system engineering tailored for utility-scale and industrial applications. Its expertise in structural design and tracker system adaptability positions it well in regions demanding durable, climate-resilient solutions. The company’s emphasis on manufacturing scale and engineering customization supports commercial clients seeking cost-effective yet performance-oriented tracking systems.

Meanwhile, MECASOLAR brings specialized experience in solar tracker development, particularly within European and international commercial markets. Known for precision engineering and innovation in tracking mechanisms, MECASOLAR strengthens its presence through technologically advanced single-axis systems. Collectively, these companies shape competitive dynamics through product innovation, system reliability, and integrated commercial solar solutions.

Top Key Players in the Market

- Trina Solar

- Powerway Renewable Energy Co., L

- MECASOLAR

- Abengoa

- Array Technologies, Inc.

- ENF Ltd.

- SOLTEC

- Scorpius Trackers

- All Earth Renewables

Recent Developments

- In January 2026, Trina Solar secured new supply agreements with ACWA Power to deliver solar PV trackers for large utility and commercial PV projects (including a 1.5 GW project in Saudi Arabia). This reflects the increasing deployment of Trina’s tracking technology in major solar projects

- In January 2024, Soltec launched a new version of its SF7 solar tracker designed especially for the U.S. market, improving its adaptability, terrain performance, faster installation, and lower costs for commercial and industrial solar projects.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Billion Forecast Revenue (2034) USD 13.5 Billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Axis, Dual Axis), By Technology (Active Trackers, Passive Trackers), By Application (Utility Scale, Commercial Rooftop, Ground Mount), By End Use (Energy Generation, Grid Integration, Off-Grid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Trina Solar, Powerway Renewable Energy Co., L, MECASOLAR, Abengoa, Array Technologies, Inc., ENF Ltd., SOLTEC, Scorpius Trackers, All Earth Renewables Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial and Industrial Solar Tracker MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Commercial and Industrial Solar Tracker MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Trina Solar

- Powerway Renewable Energy Co., L

- MECASOLAR

- Abengoa

- Array Technologies, Inc.

- ENF Ltd.

- SOLTEC

- Scorpius Trackers

- All Earth Renewables