Global Cold Insulation Market By Material Type (Glass Fibre, Phenolic Foam, Polystyrene Foam, Polyurethane Foam, Poly-Isocyanurate Foam, Polyethylene Foam, and Others), By Application (HVAC Systems, Refrigeration, Pipeline Insulation, Vessels Insulation, and Others), By End-Use (Industrial and Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160342

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

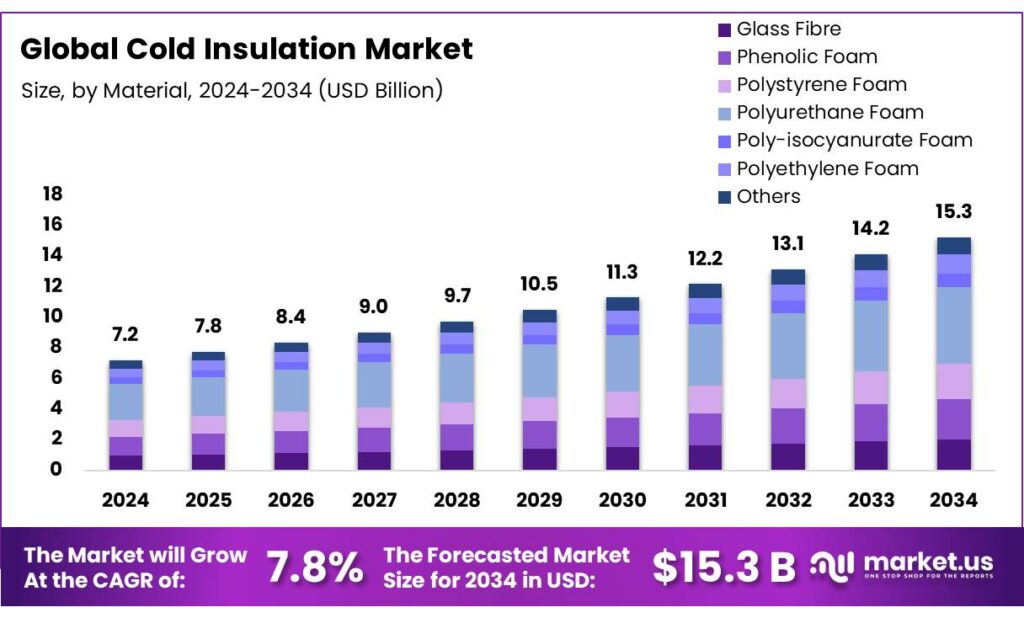

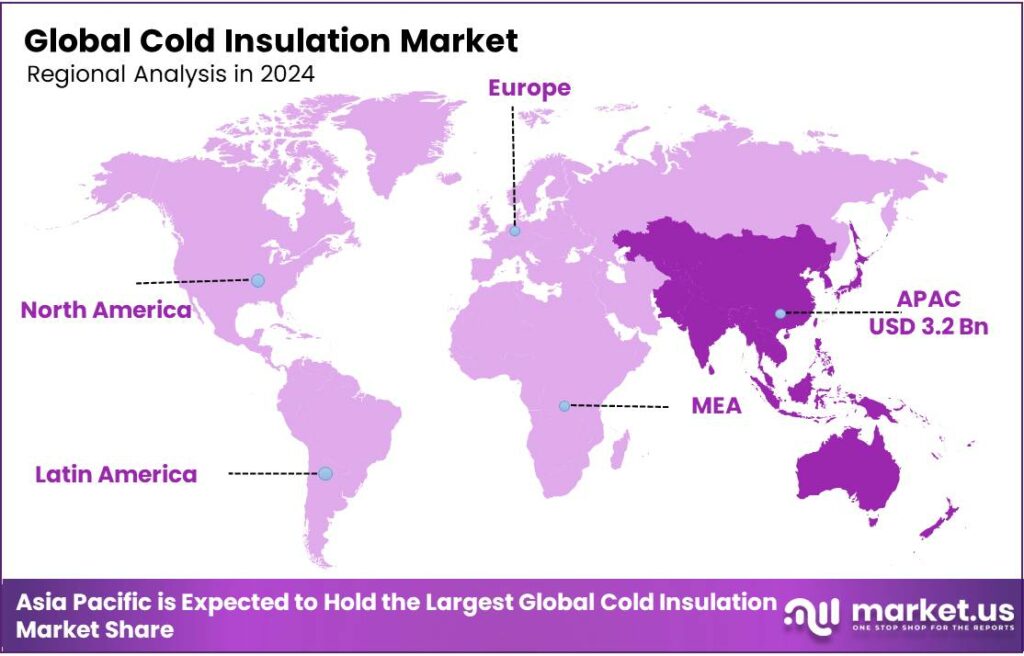

The Global Cold Insulation Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 43.9% share, holding USD 3.2 Billion in revenue.

Cold insulation prevents unwanted heat gain in low-temperature systems by using materials with low thermal conductivity, such as foam, aerogel, or perlite, to maintain stable temperatures, save energy, and stop condensation and freezing. The most used cold insulation material is polyurethane foam. It is applied to pipes, tanks, and equipment in industries like food processing, chemical manufacturing, and refrigeration to protect the system from the warmer surrounding environment and ensure its efficient, long-term operation.

As industries operate on a large scale, insulation materials are purchased in bulk, overpowering the purchases from the commercial sectors. As governments from various countries employ laws regarding energy efficiency, insulating materials gain more traction. Due to industrialization, many individuals move to urban areas, leading to an increase in residential and commercial buildings, which creates opportunities in the cold insulation market.

In recent years, consumer shift towards sustainable materials has led to innovations in material segments. Despite the advancements, the market faces several challenges, such as corrosion under insulation (CUI).

- According to a study in Minnesota, the United States, effective insulation can reduce heating and cooling costs by up to 40%, and pays for itself in 5-6 years.

Key Takeaways

- The global cold insulation market was valued at USD 7.2 billion in 2024.

- The global cold insulation market is projected to grow at a CAGR of 7.8% and is estimated to reach USD 15.3 billion by 2034.

- On the basis of materials used for cold insulation, polyurethane foam dominated the market in 2024, comprising about 32.8% share of the total global market.

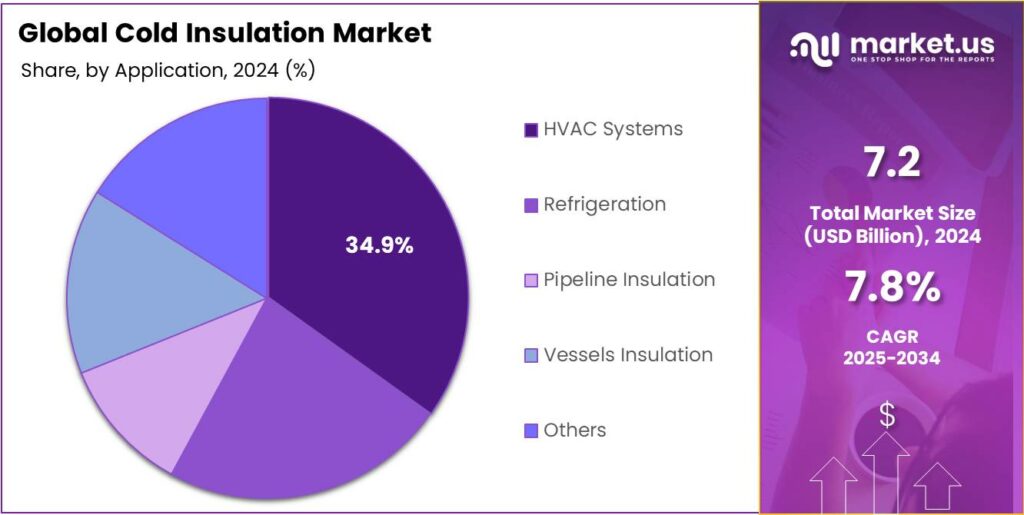

- Based on the applications of cold insulation, HVAC systems dominated the market with approximately 34.9% of the total market share.

- Among the end-uses of cold insulation, the industrial sales dominated the market in 2024, accounting for around 56.7% of the market share.

- Asia Pacific was the largest market for cold insulation in 2024, accounting for around 43.9% of the total global consumption.

Material Type Analysis

Polyurethane Foam Dominated the Cold Insulation Market in 2024.

On the basis of materials of cold insulation, the market is segmented into glass fibre, phenolic foam, polystyrene foam, polyurethane foam, poly-isocyanurate foam, polyethylene foam, and others. Polyurethane foam dominated the market in 2024 with a market share of 32.8%. Polyurethane foam is the most widely used material in the cold insulation market due to its exceptional thermal insulation properties, versatility, and ease of application. It has one of the lowest thermal conductivities among commonly used insulation materials, making it highly efficient for maintaining low temperatures in refrigeration, cryogenic storage, and cold chain logistics.

In contrast, glass fibre, which is more suited for high-temperature insulation, or polystyrene and polyethylene foams, which may absorb moisture over time, polyurethane foam offers excellent moisture resistance when properly sealed. It can be applied in both rigid panels and spray forms, allowing for a tight fit around complex shapes, which reduces thermal bridging and enhances overall system performance.

Application Analysis

HVAC Systems Emerged as a Leading Segment in the Cold Insulation Market.

Based on the applications of cold insulation, the market is divided into HVAC systems, refrigeration, pipeline insulation, vessel insulation, and others. HVAC Systems dominated the market in 2024 with a market share of 34.9%. HVAC systems represent the most dominant application of cold insulation, as they are integral to a wide range of buildings, from residential and commercial complexes to hospitals, airports, and data centers.

These systems require consistent thermal regulation to maintain indoor comfort, prevent energy loss, and reduce operational costs. Unlike refrigeration or pipeline insulation, which are more specific to industrial or logistical settings, HVAC systems are ubiquitous and used globally across climate zones. Cold insulation in HVAC ductwork and chilled water lines minimizes condensation and thermal loss, enhancing energy efficiency. The sheer volume of buildings needing HVAC systems, combined with rising energy efficiency standards, makes this application more widespread than others, such as vessels or pipelines.

End-Use Analysis

The Cold Insulation Market was Primarily Driven by Industrial Uses.

Among the end-uses of cold insulation, in 2024, the industrial uses, such as manufacturing, food processing, chemicals, and petrochemicals, were at the forefront of the market, with a total global market share of 56.7%. Industrial uses dominate the cold insulation market as they involve large-scale operations that require extensive and continuous thermal management to ensure safety, efficiency, and product integrity.

Sectors such as chemicals, petrochemicals, manufacturing, and food processing operate with processes that involve cryogenic or sub-zero temperatures, where even slight thermal losses can lead to equipment damage, product spoilage, or safety hazards. These facilities often run 24/7 and rely on vast networks of insulated pipelines, storage tanks, and process equipment. In contrast, commercial applications, such as hospitals, buildings, and supermarkets, typically use cold insulation for smaller, localized systems such as HVAC and refrigeration units. The scale, complexity, and criticality of temperature control in industrial environments make them the largest consumers of cold insulation.

Key Market Segments

By Material Type

- Glass Fibre

- Phenolic Foam

- Polystyrene Foam

- Polyurethane Foam

- Poly-Isocyanurate Foam

- Polyethylene Foam

- Others

By Application

- HVAC Systems

- Refrigeration

- Pipeline Insulation

- Vessels Insulation

- Others

By End-Use

- Commercial

- Hospital

- Buildings

- Supermarkets

- Others

- Industrial

- Manufacturing

- Food Processing

- Chemical

- Petrochemicals

- Power Plants

- Others

Drivers

Energy Efficiency Mandates Drive the Cold Insulation Market.

Energy efficiency mandates have become a major driver of the cold insulation market, as industries and governments worldwide prioritize reducing energy consumption and minimizing environmental impact. Cold insulation plays a critical role in preventing energy losses in systems that operate at low temperatures, such as refrigeration, LNG storage, and cryogenic processes.

According to the International Energy Agency (IEA), buildings and industrial processes account for over 30% of global energy use, with a significant portion lost due to inefficient thermal management. Regulatory frameworks in countries such as Germany, the U.S., and Japan enforce stringent energy codes, pushing industries to adopt advanced insulation materials like polyurethane foam, polystyrene, and fiberglass.

For instance, the U.S. Department of Energy’s Minimum Energy Performance Standards (MEPS) require industrial refrigeration systems to meet specific thermal efficiency criteria, making cold insulation indispensable. The government aims to eliminate the bottom 20% of inefficiency in the market. These mandates reduce operational costs and support carbon neutrality goals, thereby reinforcing the demand for effective insulation solutions.

Restraints

Corrosion Under Insulation (CUI) is a Significant Challenge for the Cold Insulation Market.

Corrosion Under Insulation (CUI) poses a significant challenge in the cold insulation market, particularly in industries such as oil and gas, petrochemicals, and power generation, where insulated pipes and equipment are exposed to harsh environmental conditions. CUI occurs when moisture penetrates the insulation system and accumulates on the metal surface, leading to corrosion that is often hidden until severe damage has occurred.

- The World Corrosion Organization estimates that corrosion costs the global economy US$2.2 trillion annually. According to its figures, almost 45% of the cost of this corrosion, about US$1 trillion, happens in the oil, gas, and petrochemical industries, impacting onshore and offshore operations. It is estimated that 40-60% of pipe maintenance costs are a result of CUI, and 10% of total annual maintenance costs in these industries is dedicated to repairing damage caused by CUI.

In cold insulation applications, where systems often operate below ambient temperatures, the risk is heightened due to condensation and ice formation. For instance, LNG facilities and cryogenic storage tanks are especially vulnerable, as any breach in insulation can trap moisture for long periods. Mitigating CUI requires specialized materials such as vapor barriers, non-absorbent insulation, and advanced coatings, as well as regular inspection and maintenance, adding complexity and cost to cold insulation projects.

Opportunity

Booming Urbanization Creates Opportunities in the Cold Insulation Market.

Booming urbanization is creating significant opportunities in the cold insulation market, particularly as cities expand and infrastructure demands increase. According to the United Nations, around 70% of the global population is expected to live in urban areas by 2050, up from about 58% in 2024. This rapid urban growth drives the construction of residential, commercial, and industrial facilities, several of which require efficient cold storage, air conditioning, and refrigeration systems.

For instance, urban hospitals, data centers, and supermarkets rely heavily on temperature-controlled environments that depend on effective cold insulation to maintain efficiency and reduce energy consumption.

In densely populated cities such as Shanghai, New York, and Mumbai, cold chains for food preservation and pharmaceutical logistics are expanding rapidly, demanding robust insulation solutions to prevent thermal losses. As urban centers strive to meet higher environmental standards and energy efficiency goals, the role of cold insulation becomes even more critical in supporting sustainable urban infrastructure.

Trends

A Shift Towards Sustainable and Eco-Friendly Materials in the Cold Insulation Market.

The shift toward sustainable and eco-friendly materials is an increasingly prominent trend in the cold insulation market, driven by growing environmental awareness and stricter regulations on carbon emissions and waste. Traditional insulation materials, such as polyurethane and polystyrene, are being re-evaluated due to their environmental impact, particularly concerning end-of-life disposal and chemical emissions. Manufacturers and end-users are turning to greener alternatives such as aerogels, cork, sheep wool, and recycled insulation materials, which offer effective thermal performance with a lower ecological footprint.

For instance, aerogel-based insulation, though initially expensive, is gaining traction due to its ultra-low thermal conductivity and recyclability. It is one of the lightest materials and has excellent thermal resistance. Similarly, plant-based options like cork, cotton, and sheep’s wool are renewable, biodegradable, and have good insulating properties.

Furthermore, the European Union’s push for circular economy practices and bans on certain halogenated blowing agents have accelerated the shift. Also, LEED and BREEAM green building certifications increasingly favor materials with lower embodied carbon and better life-cycle performance, encouraging industries to adopt bio-based or recyclable insulation products for cold applications.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Cold Insulation Market.

Geopolitical tensions significantly impact the cold insulation market by disrupting global supply chains, altering trade flows, and increasing uncertainty in major industrial sectors. Conflicts or strained relations between key regions, such as the trade disputes between the U.S. and China, have led to fluctuations in the availability and cost of raw materials like polyurethane, polystyrene, and other petrochemical-based insulation components.

Similarly, sanctions on Russian energy exports have forced European nations to diversify their energy sources, spurring the development of LNG terminals that rely heavily on cold insulation for cryogenic storage and transport.

In addition, trade restrictions by China and tariffs from the U.S. government have delayed the delivery of critical insulation materials and machinery, increasing project timelines and costs. China is the biggest exporter of insulation materials. Moreover, heightened geopolitical risk often discourages foreign investment in large-scale industrial or infrastructure projects where cold insulation would be essential. Companies are seeking to localize supply chains and adopt alternative materials to mitigate the risks posed by international instability.

Regional Analysis

Asia Pacific is the Largest Market for Cold Insulation.

Asia Pacific held the major share of the global cold insulation market, valued at around US$3.2 billion, commanding an estimated 43.9% of the total revenue share. The region stands as the largest market for cold insulation, driven by rapid industrialization, expanding infrastructure, and a growing demand for energy-efficient solutions across diverse sectors. Countries such as China, India, Japan, and South Korea are investing heavily in sectors such as liquefied natural gas (LNG), pharmaceuticals, food processing, and cold storage logistics. Almost all industries require reliable cold insulation to maintain low temperatures and minimize energy loss.

For instance, China is one of the world’s largest importers of LNG and continues to build new regasification terminals, each requiring advanced cryogenic insulation. Similarly, in India, government initiatives to reduce post-harvest food loss are driving the development of cold chains and refrigerated warehousing.

Additionally, the region’s growing urban population and rising middle class are increasing the demand for air conditioning and refrigeration, particularly in commercial buildings and supermarkets. Combined with supportive energy efficiency regulations, these trends position the Asia Pacific as a dominant force in shaping the future of the cold insulation market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the cold insulation market are Bayer Material Science, Huntsman Corporation, Evonik, BASF SE, Armacell International Holding GmbH, The DOW Chemical Company, Owens Corning, Aspen Aerogels, Dongsung Finetec Corporation, Certain Teed, and Kingspan Groups.

Covestro, Bayer Material Science, produces the raw materials for polyurethane rigid foams that serve as excellent thermal insulation for the cold chain. Covestro’s development of microfoam technology reduces the size of pores in the foam, increasing its insulating capability and contributing to reduced energy consumption and global efforts to minimize food loss.

Huntsman Corporation is a global manufacturer of specialty chemicals, including MDI-based rigid polyurethane foam used for cold insulation in cold chains and building applications. They operate over 60 manufacturing, R&D, and operations facilities in approximately 25 countries, employing about 6,300 associates.

BASF SE is the world’s largest chemical producer, offering various cold insulation solutions, including spray foam, rigid polyurethane foams, and thin, high-performance aerogel-based products. The company focuses on creating chemistry for a sustainable future, balancing economic success with environmental protection and social responsibility.

The major players in the industry

- Bayer Material Science

- Huntsman Corporation

- Evonik

- BASF SE

- Armacell International Holding GmbH

- The DOW Chemical Company

- Owens Corning

- Aspen aerogels

- Dongsung Finetec Corp

- Certain Teed

- Kingspan Groups PLC

- Other Players

Key Developments

- In May 2024, Huntsman Building Solutions announced the launch of the Icynene series spray polyurethane foam insulation line.

- In April 2025, Armacell, a global leader in flexible foam for the equipment insulation market and a leading provider of engineered foams, introduced ArmaGel XGC, a next-generation cryogenic and dual-temperature aerogel insulation blanket.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 15.3 Bn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Glass Fibre, Phenolic Foam, Polystyrene Foam, Polyurethane Foam, Poly-Isocyanurate Foam, Polyethylene Foam, Others), By Application (HVAC Systems, Refrigeration, Pipeline Insulation, Vessels Insulation, Others), By End-Use (Industrial, Commercial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Bayer Material Science, Huntsman Corporation, Evonik, BASF SE, Armacell International Holding GmbH, The DOW Chemical Company, Owens Corning, Aspen Aerogels, Dongsung Finetec Corp, Certain Teed, Kingspan Groups PLC, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Bayer Material Science

- Huntsman Corporation

- Evonik

- BASF SE

- Armacell International Holding GmbH

- The DOW Chemical Company

- Owens Corning

- Aspen aerogels

- Dongsung Finetec Corp

- Certain Teed

- Kingspan Groups PLC

- Other Players