Global Cocoa Nibs Market Size, Share, And Business Benefits By Type (Raw Cocoa Nibs, Roasted Cocoa Nibs, Flavored Cocoa Nibs), By Product (Conventional, Organic), By Application (Commercial, Household) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150958

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

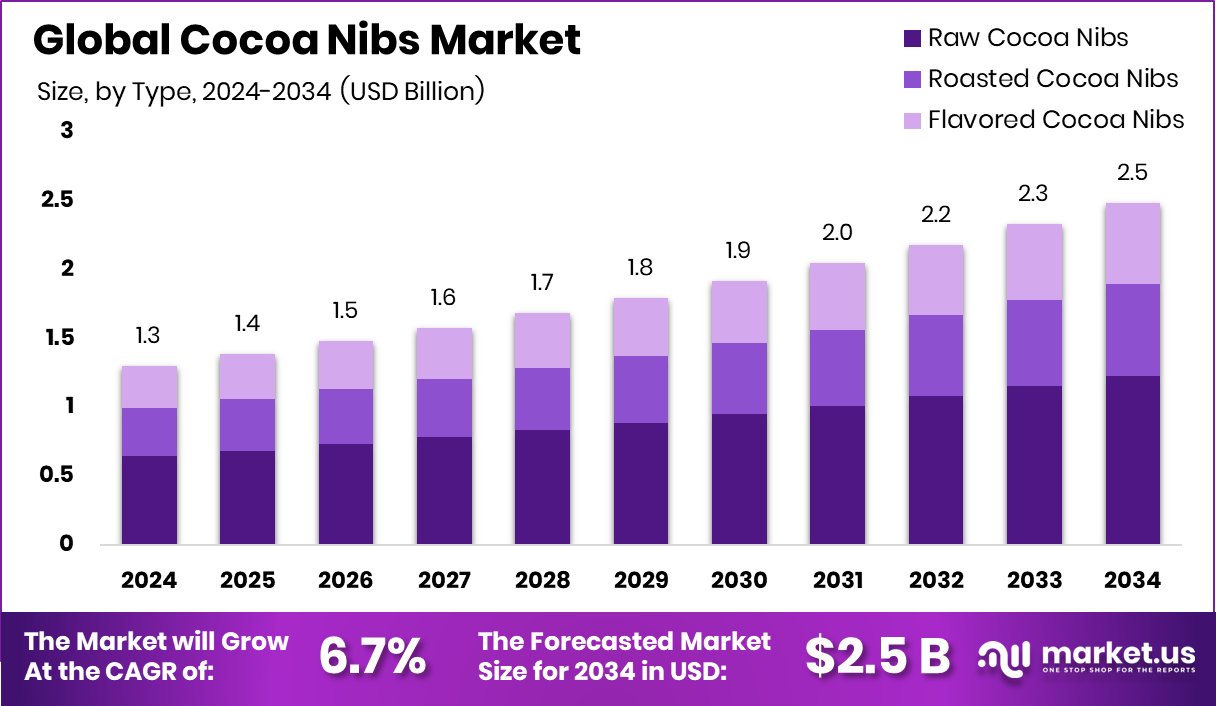

Global Cocoa Nibs Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and grow at a CAGR of 6.7% from 2025 to 2034. Rising health trends in North America, 45.2% boosted cocoa nibs demand and sales.

Cocoa nibs are small pieces of crushed cocoa beans that have been fermented, dried, roasted, and then cracked open. They are essentially raw chocolate and contain no added sugar or dairy, offering a pure and intense chocolate flavor. Often used in baking or smoothies or eaten as a snack, cocoa nibs are packed with antioxidants, fiber, and essential minerals like magnesium and iron, making them a favorite among health-conscious consumers. According to an industry report, Guildford-based Nukoko has secured over €1.3 million to scale up production of its cocoa-free chocolate bar.

The cocoa nibs market is gaining attention as people shift towards cleaner, less processed food options. With a rise in awareness around the health benefits of dark chocolate and plant-based diets, cocoa nibs are being increasingly incorporated into daily nutrition. Their versatility in food preparation also adds to their appeal, making them popular in both home kitchens and health-focused cafes. According to an industry report, Nukoko has raised $1.5 million to expand what it claims is the world’s first cocoa-free chocolate made from fava beans.

One key growth factor for the cocoa nibs market is the growing demand for natural and organic food ingredients. Consumers are moving away from overly processed products and are embracing whole, nutrient-dense foods. Cocoa nibs fit perfectly into this trend, especially among those seeking energy-boosting snacks or alternatives to sugary treats. According to an industry report, Wonka: Planet A has raised $15.4 million to support its development of a climate-friendly cocoa alternative.

Rising demand also stems from the wellness and fitness community. Athletes and fitness enthusiasts value cocoa nibs for their rich antioxidant content and ability to enhance mood and energy naturally. This demand has encouraged innovation in packaging and product combinations, making cocoa nibs more accessible and appealing. According to an industry report, Swiss-Ghanaian startup Koa has closed a $15 million Series B funding round to scale up its upcycled cacao business.

Key Takeaways

- Global Cocoa Nibs Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and grow at a CAGR of 6.7% from 2025 to 2034.

- Raw cocoa nibs hold a 49.4% share, driven by consumer preference for natural, unprocessed chocolate alternatives.

- Conventional cocoa nibs dominate with 78.3%, reflecting strong demand in mass-market food and snack applications.

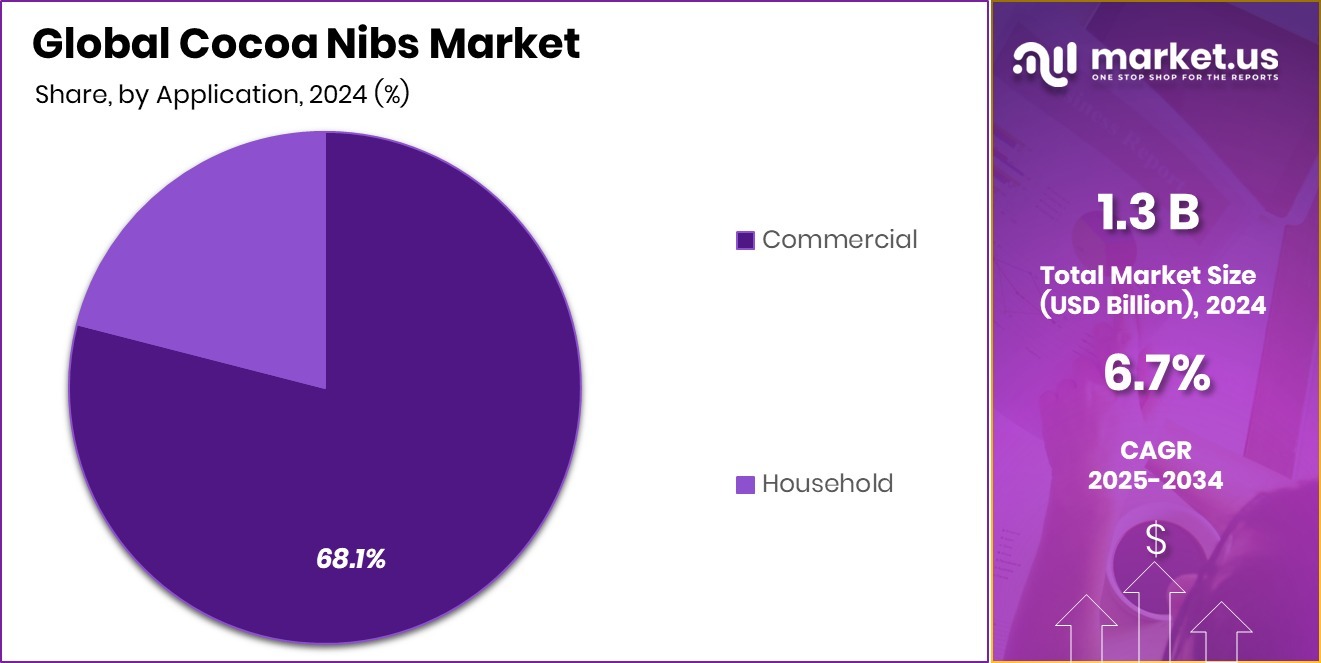

- Commercial usage leads at 68.1%, fueled by cafes, bakeries, and foodservice sectors incorporating cocoa nibs creatively.

- The market value in North America reached USD 0.5 Bn during the year.

By Type Analysis

Raw cocoa nibs hold a 49.4% share in the Cocoa Nibs Market segment.

In 2024, Raw Cocoa Nibs held a dominant market position in the By Type segment of the Cocoa Nibs Market, with a 49.4% share. This leading position is attributed to the growing consumer inclination toward minimally processed and natural food products. Raw cocoa nibs, being unprocessed and retaining most of their nutritional properties, have resonated strongly with health-conscious buyers. Their high antioxidant levels, rich mineral content, and intense flavor appeal to those seeking clean-label and nutrient-dense food options.

The demand for raw cocoa nibs is also driven by the increasing adoption of plant-based diets and the rise of wellness-focused lifestyles. Consumers are opting for raw forms of superfoods to maximize health benefits, and cocoa nibs fit this trend seamlessly. Their application in vegan recipes, natural energy snacks, and premium baking products further strengthens their market share.

Additionally, the preference for transparency and ethical sourcing in the food supply chain supports the popularity of raw cocoa nibs. As awareness of food origins grows, consumers are favoring products with minimal processing and clear sourcing.

By Product Analysis

Conventional cocoa nibs dominate with 78.3% of the total cocoa nibs market products.

In 2024, Conventional held a dominant market position in the By Product segment of the Cocoa Nibs Market, with a 78.3% share. This significant share reflects the wide availability and established consumer preference for conventional cocoa nibs across various distribution channels. The lower cost of production and easier sourcing of conventionally grown cocoa beans have made these products more accessible and affordable to a broader consumer base, particularly in emerging and price-sensitive markets.

The dominance of the conventional segment is further supported by its extensive use in commercial food manufacturing and large-scale culinary applications. Many bakeries, snack producers, and confectionery brands continue to rely on conventional cocoa nibs due to their consistent supply and stable pricing. These products also meet the growing demand for cocoa-based ingredients without the premium pricing often associated with alternative or specialty categories.

Moreover, conventional cocoa nibs benefit from stronger distribution networks, including supermarkets, bulk suppliers, and food service providers, which enhances their reach and volume sales. The familiarity and trust consumers place in conventional food formats also contribute to the segment’s robust market presence.

By Application Analysis

Commercial use accounts for 68.1% of the global Cocoa Nibs Market applications.

In 2024, Commercial held a dominant market position in the By Application segment of the Cocoa Nibs Market, with a 68.1% share. This leading position highlights the widespread adoption of cocoa nibs across commercial sectors such as bakeries, restaurants, cafés, and food manufacturers. Commercial buyers often seek bulk quantities of cocoa nibs to meet consistent product demand, making this segment a key driver of overall market volume.

The commercial segment benefits from the growing consumer interest in premium and health-oriented food options, prompting businesses to incorporate cocoa nibs into a variety of offerings, including desserts, snacks, and beverages. Their rich flavor and nutritional appeal allow food service providers to innovate and differentiate their products in competitive markets.

Moreover, commercial usage is supported by well-established procurement channels and supply chain reliability, ensuring steady access to cocoa nibs at scale. The versatility of cocoa nibs in recipe formulation—combined with their ability to enhance texture, flavor, and perceived health value—has made them a staple ingredient in professional kitchens and production lines.

Key Market Segments

By Type

- Raw Cocoa Nibs

- Roasted Cocoa Nibs

- Flavored Cocoa Nibs

By Product

- Conventional

- Organic

By Application

- Commercial

- Household

Driving Factors

Growing Focus on Healthy Eating and Nutrition

One of the main reasons behind the rising demand for cocoa nibs is the growing awareness about healthy eating and better nutrition. People today are more careful about what they eat, choosing foods that are natural, less processed, and full of health benefits. Cocoa nibs are rich in antioxidants, fiber, magnesium, and iron, making them a popular choice among health-conscious consumers.

They are also free from added sugars and additives, which appeals to those avoiding processed snacks. As plant-based and clean-label diets continue to grow, cocoa nibs fit in perfectly. More people are using them in smoothies, snacks, or baking to enjoy both taste and health benefits, making this a strong driving factor for market growth.

Restraining Factors

High Product Cost Limits Wider Consumer Reach

One major challenge for the cocoa nibs market is their relatively high cost compared to other snack or chocolate alternatives. Since cocoa nibs are often sourced from specific regions and go through detailed processing like fermentation and roasting, their production cost can be high. This makes the final product more expensive for consumers.

In many markets, especially price-sensitive ones, this limits regular purchases and keeps cocoa nibs in the premium or niche category. While health-conscious consumers may be willing to pay more, average buyers may choose cheaper chocolate or snacks instead.

Growth Opportunity

Expanding Into Ready-to-Eat Snack Mixes

The cocoa nibs market has a promising opportunity in ready-to-eat snack mixes. Consumers are increasingly looking for convenient, healthy, and flavorful snack options they can grab on the go. Cocoa nibs are a tasty and nutritious addition to trail mixes, granola blends, and protein-packed snack packs.

By partnering with existing snack brands or creating new mixes that feature cocoa nibs alongside nuts, seeds, dried fruits, or whole grains, producers can reach a wider audience. This approach appeals not only to health-focused individuals but also to busy professionals, students, and families seeking quick energy boosts. With smart packaging and clear health messaging, these snack mixes can tap into both the wellness and convenience trends, fueling growth in the cocoa nibs market.

Latest Trends

Rise of Cocoa Nibs in Vegan Desserts

One of the latest trends in the cocoa nibs market is their growing use in vegan desserts. As more people choose plant-based diets, chefs and home bakers are experimenting with creative ways to add flavor and texture to vegan treats without relying on dairy or refined ingredients. Cocoa nibs, with their intense chocolate crunch and natural bitterness, work especially well in this space.

They bring a rich, satisfying chocolate kick to vegan brownies, ice creams, mousse, and energy balls. When paired with ingredients like almond butter, coconut milk, or oat-based creams, cocoa nibs elevate both taste and nutrition. This trend reflects a broader shift toward indulgent yet health-conscious desserts in the plant-based world.

Regional Analysis

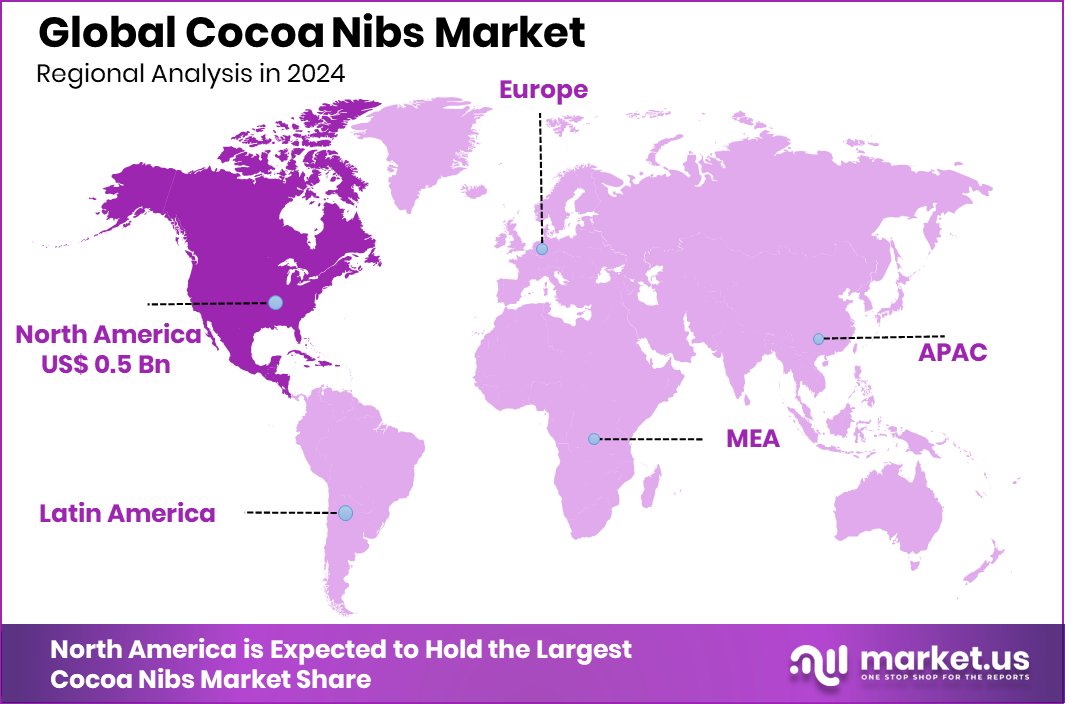

North America held a 45.2% share in the Cocoa Nibs Market in 2024.

In 2024, North America emerged as the dominating region in the Cocoa Nibs Market, accounting for 45.2% of the global share and reaching a market value of USD 0.5 Bn. This strong position is supported by rising consumer awareness of healthy eating habits and the popularity of plant-based diets across the United States and Canada.

Consumers in this region are increasingly integrating nutrient-rich ingredients like cocoa nibs into their daily routines, driving both retail and commercial demand. Europe also shows stable demand, driven by a mature health food market and increasing use of cocoa nibs in gourmet and organic food sectors.

In Asia Pacific, the market is gradually expanding, supported by growing interest in Western food trends and rising disposable income in countries like Japan and Australia. Meanwhile, the Middle East & Africa region is witnessing early-stage adoption, with cocoa nibs gaining traction among niche health-conscious groups. Latin America, being a key cocoa-producing region, holds potential for domestic market growth, although much of its cocoa output is still export-focused.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global cocoa nibs market continues to evolve, shaped by a growing consumer preference for natural and minimally processed ingredients. Within this landscape, three companies—BMV Cocoa, Cargill, and Chocovivo—represent distinct strategic positions that highlight the market’s diversity.

BMV Cocoa, with its roots in cocoa processing, maintains strength through its integration with origin sourcing, particularly from Indonesia and West Africa. The company’s focus on consistent quality and volume supply positions it as a dependable player for industrial buyers. BMV’s ability to offer customized cocoa products, including nibs, appeals to both large-scale manufacturers and specialty brands seeking traceability.

Cargill, a global agribusiness heavyweight, leverages its expansive supply chain, processing capabilities, and sustainability initiatives to influence the cocoa nibs segment. In 2024, Cargill’s emphasis on transparency and digital traceability through platforms like CocoaWise continues to build credibility among ethically driven customers. Its scale enables reliable delivery and cost efficiencies, critical for food and beverage manufacturers looking to secure a large-volume nib supply.

Chocovivo, in contrast, operates with an artisanal philosophy, crafting stone-ground chocolate products directly from whole cocoa nibs. The company’s niche appeal lies in its direct trade model and commitment to maintaining the natural integrity of cacao. In 2024, Chocovivo gains visibility among health-conscious consumers and boutique retailers, reflecting the growing premium and craft segment within the nibs market.

Top Key Players in the Market

- Alter Eco

- Barry Callebaut

- BMV Cocoa

- Cargill

- Chocovivo

- Cocoa Family

- CocoaSupply (Fine Cocoa Products Corp)

- Ghirardelli

- Green and Black’s

- Navitas Organics

- NOW Foods

- Olam International

- Sunfood

- United Cocoa Processor, Inc.

- Valrhona

- Viva Naturals

Recent Developments

- In April 2025, the European Patent Office (EPO) released a decision concerning Olam’s patented process. This method outlines how to produce dark, natural cocoa by mixing cocoa nibs (or beans) with water, heating, drying, and grinding—without alkalization.

- In September 2024, Cargill invested €35 million to expand its Deventer facility in the Netherlands. The upgrade increased coatings and fillings output by 60%, supporting multi-ingredient lines—including nibs-based and vegan options—under stricter nut-free conditions.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Raw Cocoa Nibs, Roasted Cocoa Nibs, Flavored Cocoa Nibs), By Product (Conventional, Organic), By Application (Commercial, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alter Eco, Barry Callebaut, BMV Cocoa, Cargill, Chocovivo, Cocoa Family, CocoaSupply (Fine Cocoa Products Corp), Ghirardelli, Green and Black’s, Navitas Organics, NOW Foods, Olam International, Sunfood, United Cocoa Processor, Inc., Valrhona, Viva Naturals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alter Eco

- Barry Callebaut

- BMV Cocoa

- Cargill

- Chocovivo

- Cocoa Family

- CocoaSupply (Fine Cocoa Products Corp)

- Ghirardelli

- Green and Black's

- Navitas Organics

- NOW Foods

- Olam International

- Sunfood

- United Cocoa Processor, Inc.

- Valrhona

- Viva Naturals