Global Cocamidopropyl Betaine Market Size, Share, And Business Benefits By Product Type (CAB-30, CAB-35, Others), By Physical Form (Liquid, Powder), By Application (Shampoos, Body Wash and Shower Gels, Facial Cleanser, Liquid Soaps, Other), By End-use (Personal Care and Cosmetics, Home Care, Industrial (Textile, Agriculture, Oilfield Chemicals, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149927

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

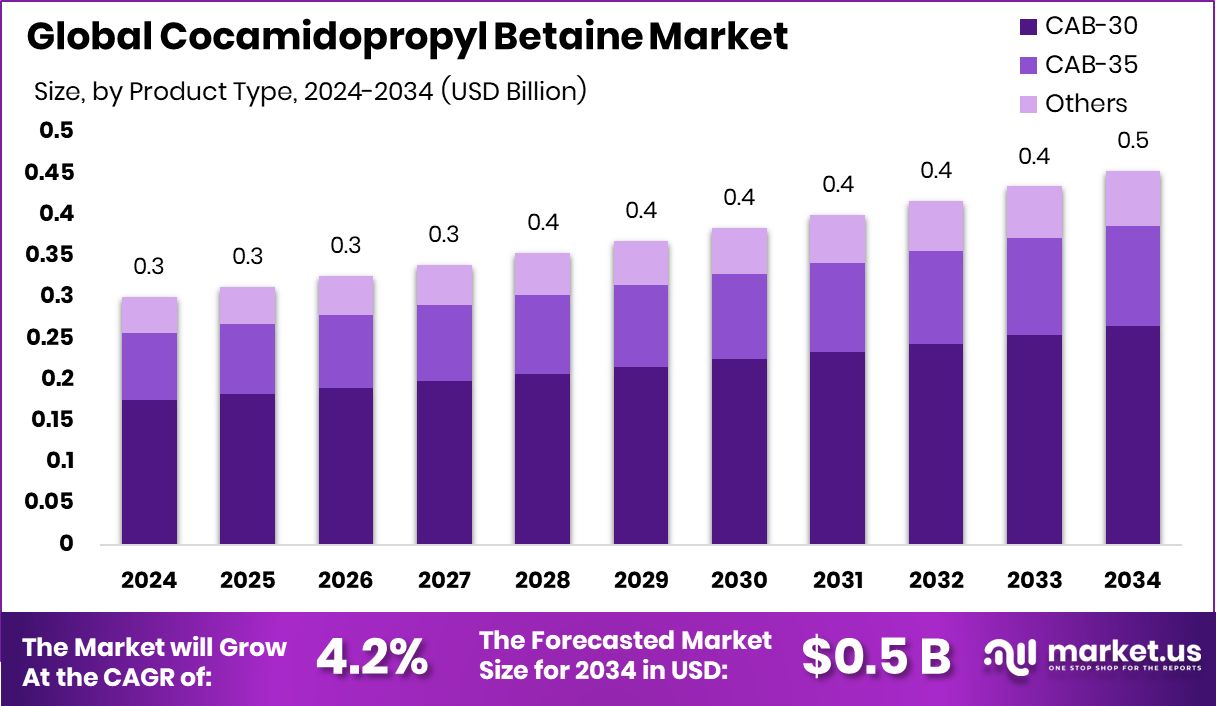

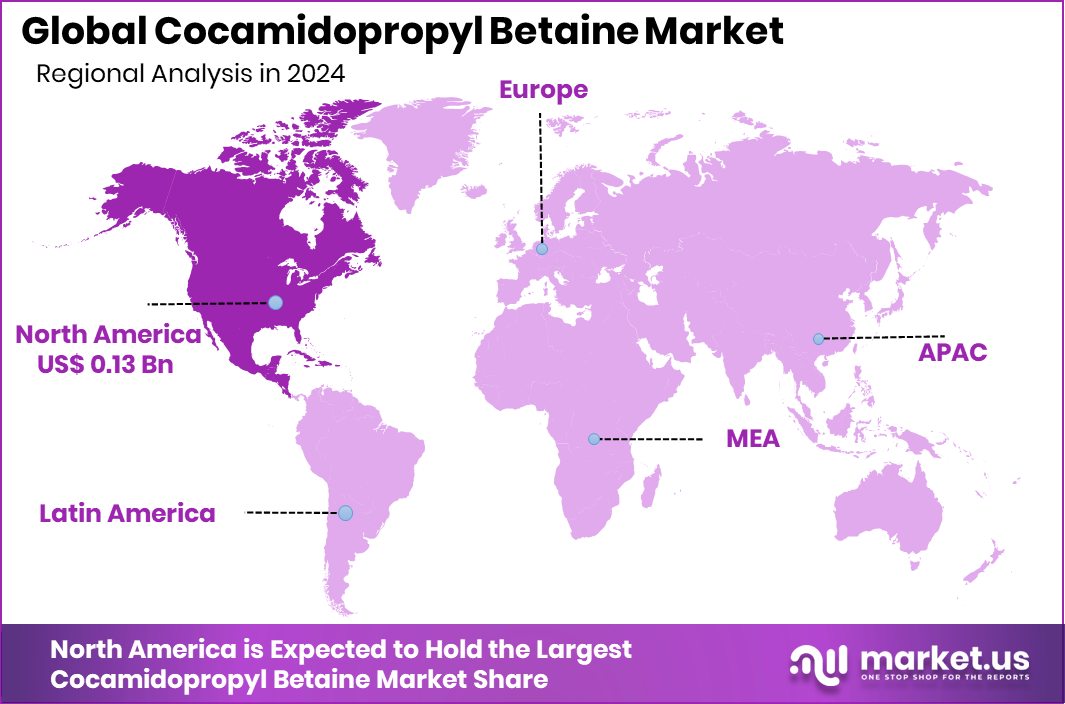

Global Cocamidopropyl Betaine Market is expected to be worth around USD 0.5 billion by 2034, up from USD 0.3 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034. Rising demand for mild cleansers boosted Cocamidopropyl Betaine sales across North America to USD 0.13 billion.

Cocamidopropyl Betaine is a mild surfactant derived from coconut oil and dimethylaminopropylamine. It appears as a clear to pale yellow liquid and is widely used in personal care products like shampoos, body washes, and facial cleansers. It helps create foam, enhances the viscosity of products, and reduces skin irritation caused by harsher ingredients. Due to its natural origin and gentle cleansing properties, Cocamidopropyl Betaine is a preferred choice for formulations targeting sensitive skin and baby care products.

The Cocamidopropyl Betaine market includes the global production, distribution, and consumption of this surfactant across industries such as personal care, household cleaning, and industrial cleaners. Growth in the market is driven by increasing awareness of biodegradable and skin-friendly ingredients. As demand for natural and sustainable formulations rises, manufacturers are shifting toward plant-based surfactants like Cocamidopropyl Betaine. It holds a strong position due to its balance of performance, mildness, and compatibility with other ingredients.

Growing preference for sulfate-free and gentle cleansing products is fueling demand for Cocamidopropyl Betaine. Its multifunctional role in enhancing foam quality, reducing skin irritation, and being derived from coconut oil makes it a preferred surfactant. The shift toward clean-label beauty products with recognizable and plant-based ingredients is further accelerating its adoption.

Consumer awareness around ingredient safety has led to a rise in demand for naturally derived and eco-friendly personal care products. Cocamidopropyl Betaine fits well into this trend, especially as more people avoid products with synthetic chemicals. The rising population and growing personal hygiene habits in emerging economies are also contributing to higher consumption rates.

Key Takeaways

- Global Cocamidopropyl Betaine Market is expected to be worth around USD 0.5 billion by 2034, up from USD 0.3 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034.

- In 2024, CAB-30 dominated the Cocamidopropyl Betaine Market by Product Type with 58.5% share.

- Liquid form held the leading position in the market’s Physical Form segment, capturing 85% share.

- Shampoos accounted for the largest Application share in 2024, contributing 41.9% to total demand.

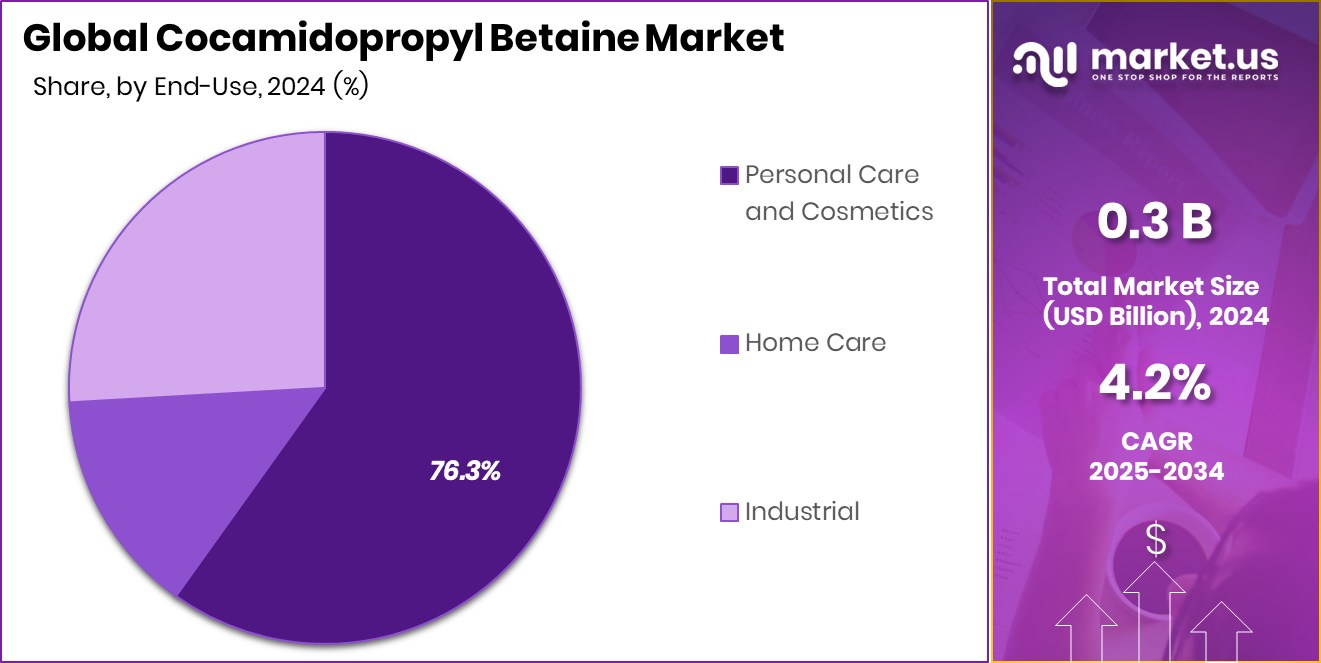

- Personal Care and Cosmetics led the End-use segment with a strong 76.3% share in 2024.

- The North American market reached a value of USD 0.13 billion in 2024.

By Product Type Analysis

In 2024, CAB-30 was dominated by product type with a 58.5% market share.

In 2024, CAB-30 held a dominant market position in the By Product Type segment of Cocamidopropyl Betaine Market, with a 58.5% share. This leadership can be attributed to its widespread application across personal care and home care formulations, particularly in shampoos, liquid soaps, facial cleansers, and body washes.

CAB-30 offers enhanced foaming, mild cleansing, and excellent skin compatibility, which makes it a preferred choice for manufacturers targeting sensitive-skin products and sulfate-free formulations. Its liquid consistency and compatibility with a wide range of surfactants further drive its dominance, enabling easy blending in different product types.

The growing demand for gentler and more sustainable surfactants, especially in North America and Europe, has also contributed to the rising adoption of CAB-30. As consumers increasingly look for skin-friendly and environmentally safer alternatives, CAB-30 remains a reliable solution derived from coconut-based raw materials.

Additionally, regulatory pressure to reduce the use of harsh ingredients in cosmetic and personal care products has shifted manufacturers toward incorporating milder components like CAB-30. With its superior performance and versatility, CAB-30 is expected to retain its strong position in the market.

By Physical Form Analysis

Liquid form led the physical form segment, accounting for 85% market presence.

In 2024, Liquid held a dominant market position in By Physical Form segment of the Cocamidopropyl Betaine Market, with an 85% share. The high share is primarily due to its ease of handling, solubility, and compatibility in large-scale manufacturing processes for personal care and home care products. Liquid form is widely preferred by formulators as it integrates smoothly into water-based formulations without requiring additional processing steps.

Liquid Cocamidopropyl Betaine is commonly used in shampoos, body washes, and facial cleansers, where its fluid nature supports quick mixing and consistent quality. The high adoption rate is also linked to its ready-to-use nature, eliminating the need for dilution or solubilizing agents during formulation. Manufacturers benefit from lower storage and transportation challenges due to the standardization of liquid-grade packaging.

Its high share reflects the industry’s ongoing shift toward scalable, cost-effective ingredients that offer flexibility without compromising product performance. Given its practical advantages and formulation versatility, the liquid form continues to be the preferred choice for both established brands and contract manufacturers, cementing its dominant role in the Cocamidopropyl Betaine market in 2024.

By Application Analysis

Shampoos held the largest application share, covering 41.9% of the market demand.

In 2024, Shampoos held a dominant market position in the By Application segment of the Cocamidopropyl Betaine Market, with a 41.9% share. This strong position is largely due to Cocamidopropyl Betaine’s exceptional foaming, cleansing, and conditioning properties, which make it a key ingredient in most commercial and salon-grade shampoo formulations.

The rising consumer shift toward sulfate-free and pH-balanced shampoos has further driven the demand for Cocamidopropyl Betaine in this category. It provides the ideal balance of lather and mildness that brands aim for in clean-label and premium haircare offerings. Additionally, its compatibility with a wide range of ingredients makes it suitable for all types of shampoos—moisturizing, volumizing, anti-dandruff, and color-safe variants.

With consumers increasingly opting for haircare products that are both effective and gentle, the reliance on Cocamidopropyl Betaine in shampoo manufacturing continues to grow. The 41.9% share highlights its critical role in supporting both product performance and the evolving expectations of modern haircare formulations, ensuring its continued dominance in the application segment.

By End-use Analysis

The personal care and cosmetics sector contributed 76.3% to overall end-use consumption.

In 2024, Personal Care and Cosmetics held a dominant market position in the by-end-use segment of the Cocamidopropyl Betaine Market, with a 76.3% share. This dominance stems from the ingredient’s widespread use in products like shampoos, facial cleansers, body washes, liquid soaps, and baby care items. Cocamidopropyl Betaine is favored for its gentle cleansing, foaming ability, and skin-conditioning properties, making it ideal for daily-use personal care formulations.

The ingredient’s ability to reduce irritation while enhancing product texture has made it essential in a wide range of cosmetic and personal hygiene products. Additionally, the rising awareness around ingredient safety and the growing popularity of clean beauty trends have further supported its application in natural and organic formulations. Its coconut-derived origin appeals to consumers looking for naturally sourced components in their skincare and haircare routines.

With the personal care industry witnessing strong growth across both developed and emerging regions, the high reliance on Cocamidopropyl Betaine across these formulations reinforces its 76.3% share in 2024. Its functional versatility and consumer-aligned safety profile continue to drive its leading role in this end-use segment.

Key Market Segments

By Product Type

- CAB-30

- CAB-35

- Others

By Physical Form

- Liquid

- Powder

By Application

- Shampoos

- Body Wash and Shower Gels

- Facial Cleanser

- Liquid Soaps

- Other

By End-use

- Personal Care and Cosmetics

- Home Care

- Industrial

- Textile

- Agriculture

- Oilfield Chemicals

- Others

Driving Factors

Rising Demand for Mild and Safe Cleansers

One of the main reasons the Cocamidopropyl Betaine market is growing fast is because people want gentler and safer ingredients in their daily products. Many consumers now check labels and choose items that are kind to the skin and hair. Cocamidopropyl Betaine is a mild cleanser that comes from coconut oil, making it a popular choice in shampoos, soaps, and facial washes.

It helps clean effectively without causing dryness or irritation. As more people become aware of the harmful effects of strong chemicals like sulfates, companies are switching to ingredients like Cocamidopropyl Betaine. This shift in customer preference is encouraging more brands to include it in their products, leading to steady growth in its global demand.

Restraining Factors

Skin Sensitivities and Allergic Reaction Risk Concerns

A key factor that may hold back the growth of the Cocamidopropyl Betaine market is the concern over allergic reactions and skin sensitivities in some people. Even though it is considered mild and is used widely in personal care products, some individuals with very sensitive skin have reported irritation or allergic responses. These issues are often linked to impurities formed during the manufacturing process.

As a result, certain consumers avoid products containing this ingredient, especially in baby care and sensitive-skin items. Growing awareness through online reviews and social media can influence public perception. This concern, even if rare, has made some companies more cautious, slowing down the full acceptance of Cocamidopropyl Betaine in all product ranges.

Growth Opportunity

Expansion in Natural and Organic Product Lines

A major growth opportunity for the Cocamidopropyl Betaine market lies in its use in natural and organic personal care products. As more people choose clean beauty and eco-friendly options, brands are looking for ingredients that are plant-based, biodegradable, and gentle on the skin. Cocamidopropyl Betaine, made from coconut oil, fits well into this trend.

It helps products foam well and feel pleasant while still being mild. With growing demand for organic shampoos, body washes, and face cleansers, this ingredient can play a key role in new formulations. Brands focusing on sustainable and “green” beauty have a strong chance to boost sales using Cocamidopropyl Betaine, making this a promising area for future market expansion.

Latest Trends

Shift Toward Sulfate-Free and Clean Formulations

One of the latest trends in the Cocamidopropyl Betaine market is the growing shift toward sulfate-free and clean-label personal care products. Many consumers now prefer shampoos, soaps, and facial cleansers that avoid harsh chemicals and instead use gentler alternatives. Cocamidopropyl Betaine is becoming a popular replacement for sulfates like SLS and SLES because it offers foaming and cleansing without irritation.

Brands are reformulating their products to meet the demand for skin-friendly and eco-conscious ingredients. This trend is especially strong in premium skincare and baby care lines, where mildness is a top priority. As the clean beauty movement continues to grow, this shift is creating more opportunities for Cocamidopropyl Betaine to become a key formulation ingredient.

Regional Analysis

In 2024, North America held a 44.90% share of the Cocamidopropyl Betaine market.

In 2024, North America held a dominant position in the global Cocamidopropyl Betaine Market, accounting for 44.90% of the total share, with a market value of USD 0.13 billion. The region’s dominance is driven by increased consumer preference for sulfate-free, skin-friendly personal care products. The strong presence of premium cosmetic and personal hygiene brands, along with rising awareness about ingredient safety, has significantly influenced product formulations that include Cocamidopropyl Betaine.

In Europe, the market witnessed stable growth, supported by the region’s focus on regulatory compliance and eco-friendly ingredients. Consumers across Germany, France, and Nordic countries are increasingly adopting natural-origin ingredients in shampoos, facial cleansers, and liquid soaps. Asia Pacific showed notable expansion, primarily driven by urbanization and the growth of the personal care sector in countries like China, India, and Japan.

Meanwhile, Latin America and the Middle East & Africa regions experienced moderate growth, led by improving lifestyle standards and gradual consumer shift toward branded and dermatologically safe hygiene products. Although these regions account for a smaller share, they present untapped opportunities for market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Solvay continued to be a prominent supplier in the CAPB market, focusing on delivering high-quality surfactants for personal care applications. Their commitment to innovation and sustainability has reinforced their position in the industry, catering to the increasing consumer preference for gentle and eco-friendly products.

Clariant emphasized the development of mild surfactants, addressing the shift away from traditional sulfates due to concerns over skin irritation. Their Genagen® CAB WF, a Cocamidopropyl Betaine variant, offers enhanced foam stability, aligning with the demand for effective yet gentle cleansing agents in personal care formulations.

BASF expanded its portfolio with the introduction of Dehyton® PK45 GA/RA, a CAPB derived from sustainably sourced coconut oil and certified by the Rainforest Alliance. This product is readily biodegradable and suitable for various applications, including shampoos and skin cleansers, reflecting BASF’s commitment to sustainability and performance.

Top Key Players in the Market

- Solvay

- Clariant

- BASF

- Lubrizol

- Evonik

- KAO Chem

- Inolex

- Stepan

- Croda

- Oxiteno

- Lonza

- Innospec

- Galaxy Sur.

- Miwon

- Colonial Chem

- Taiwan NJC

- Pilot Chem

- Enaspol

- Tinci

- Roker Chem

- DX Chem

- Hangzhou Top Chem

- Zanyu Tech

- Rugao Wanli Chemical

Recent Developments

- In April 2025, BASF introduced Dehyton® PK45 GA/RA, a new Cocamidopropyl Betaine (CAPB) surfactant derived from Rainforest Alliance-certified coconut oil. This product is readily biodegradable and designed for use in shampoos, body washes, and skin cleansers, offering excellent foaming properties while supporting sustainable sourcing practices.

- In June 2024, Kao Chemicals, in collaboration with Kao Group companies from Thailand, Indonesia, and Singapore, showcased their surfactant technologies at the Cosmohome Tech Expo in New Delhi, India. This event highlighted Kao’s commitment to sustainable and innovative solutions in the personal care industry, including advancements related to Cocamidopropyl Betaine (CAPB).

- In April 2024, Clariant completed the acquisition of Lucas Meyer Cosmetics, a strategic move aimed at enhancing its portfolio of high-value personal care ingredients. This acquisition has bolstered Clariant’s capabilities in developing innovative and sustainable solutions for the personal care industry.

Report Scope

Report Features Description Market Value (2024) USD 0.3 Billion Forecast Revenue (2034) USD 0.5 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (CAB-30, CAB-35, Others), By Physical Form (Liquid, Powder), By Application (Shampoos, Body Wash and Shower Gels, Facial Cleanser, Liquid Soaps, Other), By End-use (Personal Care and Cosmetics, Home Care, Industrial (Textile, Agriculture, Oilfield Chemicals, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Solvay, Clariant, BASF, Lubrizol, Evonik, KAO Chem, Inolex, Stepan, Croda, Oxiteno, Lonza, Innospec, Galaxy Sur., Miwon, Colonial Chem, Taiwan NJC, Pilot Chem, Enaspol, Tinci, Roker Chem, DX Chem, Hangzhou Top Chem, Zanyu Tech, Rugao Wanli Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cocamidopropyl Betaine MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Cocamidopropyl Betaine MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Solvay

- Clariant

- BASF

- Lubrizol

- Evonik

- KAO Chem

- Inolex

- Stepan

- Croda

- Oxiteno

- Lonza

- Innospec

- Galaxy Sur.

- Miwon

- Colonial Chem

- Taiwan NJC

- Pilot Chem

- Enaspol

- Tinci

- Roker Chem

- DX Chem

- Hangzhou Top Chem

- Zanyu Tech

- Rugao Wanli Chemical