Global Cloud Microservices Market Size, Share and Analysis Report By Component (Solutions, Services), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance, Others), By Application (Web & Mobile Applications, API-based Integrations, Real-time Analytics & Data Processing, Legacy Application Modernization, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174299

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Application Analysis

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- By Application

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

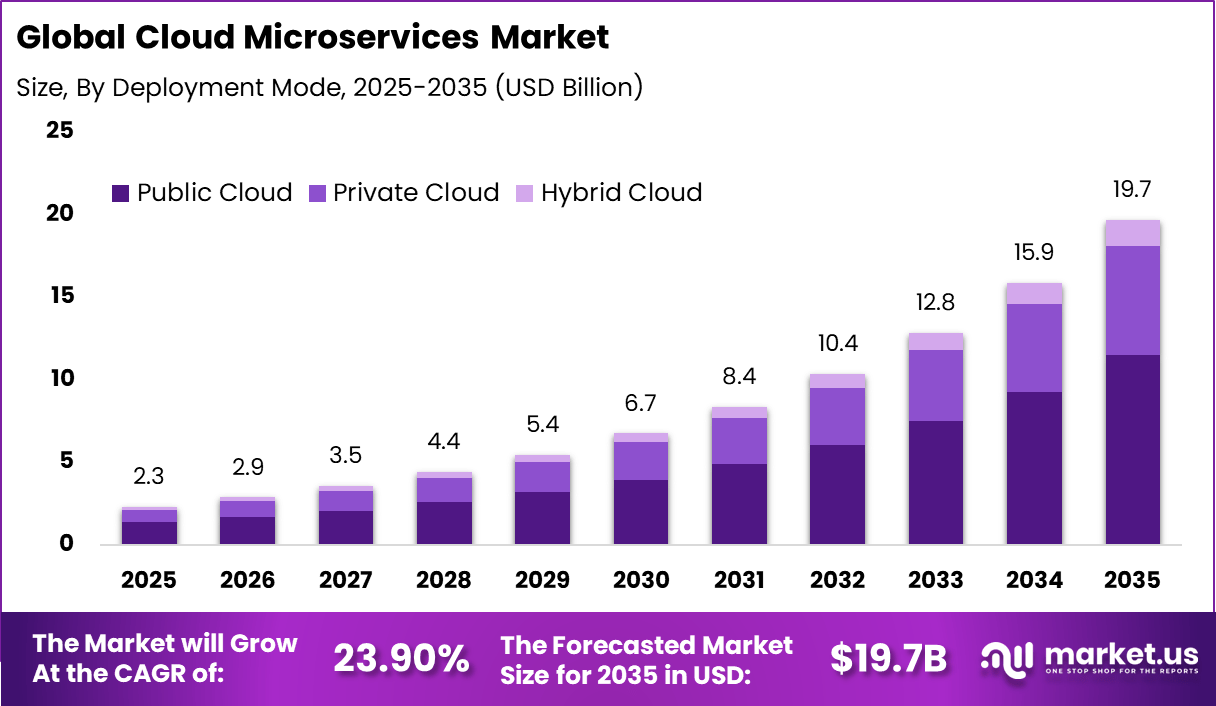

The Global Cloud Microservices Market generated USD 2.3 billion in 2025 and is predicted to register growth from USD 2.9 billion in 2026 to about USD 19.7 billion by 2035, recording a CAGR of 23.90% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 38.5% share, holding USD 0.88 Billion revenue.

The cloud microservices market refers to the use of cloud-based architectures where applications are built as a collection of small, independent services. Each microservice performs a specific function and communicates with other services through standardized interfaces. This architecture enables faster development, deployment, and scaling of applications. Cloud microservices are widely used in software development, digital platforms, and enterprise applications. Adoption supports agility and continuous innovation.

This market development has been influenced by the limitations of traditional monolithic application architectures. Large applications are difficult to update and scale efficiently. Microservices allow individual components to be modified without affecting the entire system. Cloud environments further enhance flexibility through on-demand resources. As software complexity increases, microservices become a preferred approach.

One major driving factor of the cloud microservices market is the demand for faster application development and deployment. Organizations aim to release features more frequently. Microservices enable independent development cycles. Faster updates improve responsiveness to market needs. Speed requirements drive adoption.

Demand for cloud microservices is influenced by digital transformation initiatives across industries. Organizations modernize legacy applications to improve efficiency. Microservices support gradual modernization without full system replacement. Flexible migration strategies increase adoption. Transformation goals strengthen demand.

Top Market Takeaways

- By component, solutions dominated the cloud microservices market with 72.8% share, delivering modular architectures for agile development and scaling.

- By deployment mode, public cloud captured 58.4%, offering cost-effective elasticity for dynamic workloads.

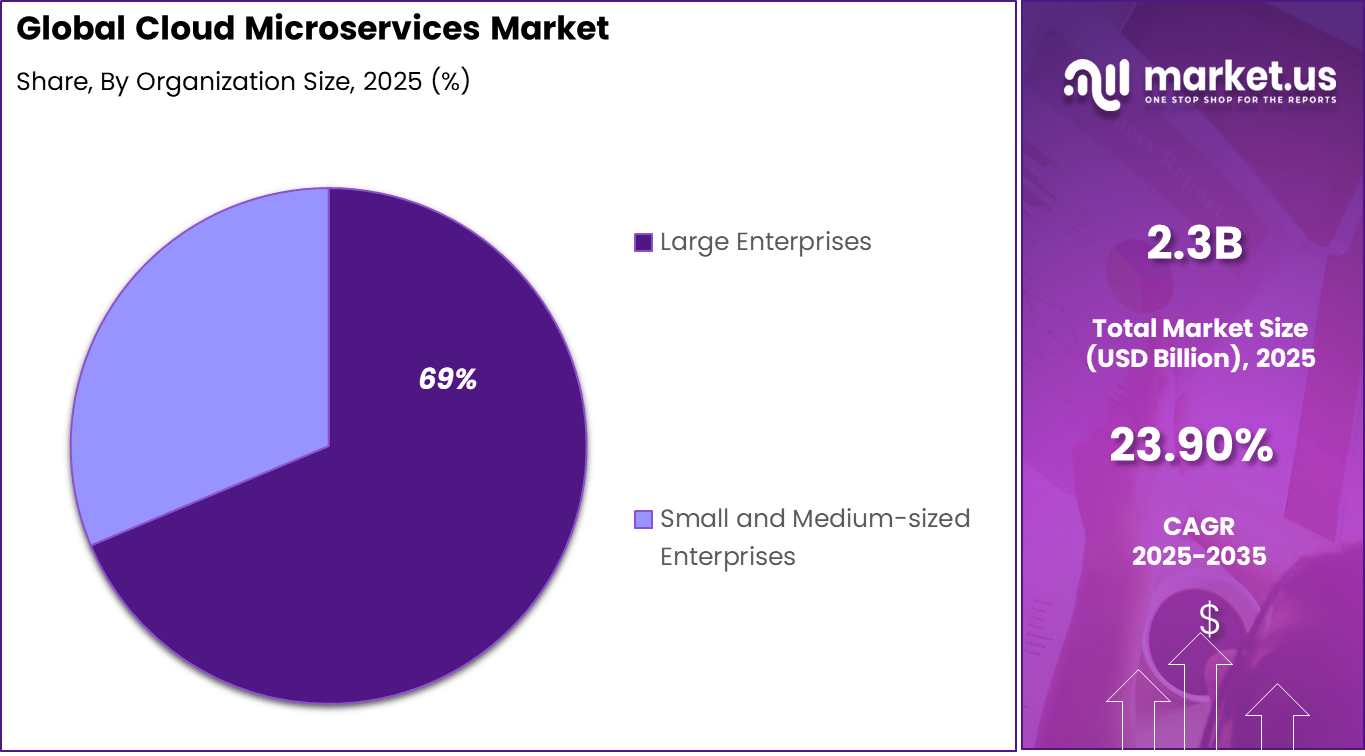

- By organization size, large enterprises held 68.7%, leveraging microservices to modernize legacy systems at scale.

- By end-user industry, IT and telecommunications led at 41.3%, using microservices for rapid network function deployment.

- By application, web and mobile applications accounted for 52.6%, enabling seamless updates and personalized user experiences.

- North America represented 38.5% of the global market, with the U.S. valued at USD 0.79 billion and growing at a CAGR of 21.52%.

Key Insights Summary

Adoption and Usage Statistics (2026)

- Over 85% of large enterprises have deployed microservices in production environments.

- Around 74% of organizations globally use microservices architecture.

- About 42% of organizations have merged selected microservices into modular monoliths to reduce complexity.

- More than 90% of new digital solutions are built using cloud-native architectures reliant on microservices and containers.

Success and Operational Metrics

- Nearly 92% of organizations report partial or full success after migrating to microservices.

- Deployment speed improved by 63% compared with monolithic architectures.

- About 49% of organizations operate fewer than 100 microservices.

- Only 3% manage very large environments with over 1,000 microservices.

- Around 84% of adopters plan to sustain or increase microservices investment through 2026.

Component Analysis

Solutions account for 72.8% of the cloud microservices market, reflecting strong demand for packaged platforms and service frameworks. Organizations adopt solution-based offerings to simplify application development and deployment. These solutions support service orchestration, API management, and container management.

The dominance of solutions is driven by the need for faster application delivery and scalability. Enterprises rely on pre-integrated tools to reduce development complexity. This improves consistency across distributed application environments.

As digital services expand, solution-based microservices platforms remain essential. Continuous enhancements in automation and monitoring strengthen adoption. Solutions continue to represent the core market offering.

Deployment Mode Analysis

Public cloud deployment holds a 58.4% share, highlighting the preference for scalable and flexible infrastructure. Public cloud environments support rapid provisioning and elastic resource allocation. This aligns well with microservices architectures.

Organizations benefit from reduced infrastructure management and faster deployment cycles. Public cloud platforms also support high availability and global access. These advantages make them suitable for modern application development. As cloud adoption increases, public deployment remains dominant. Cost efficiency and ease of integration reinforce this trend. Public cloud continues to support large-scale microservices adoption.

Organization Size Analysis

Large enterprises account for 68.7% of market demand, driven by complex application ecosystems. These organizations manage multiple applications and services across departments. Microservices architectures support modular development and scalability. Large enterprises use microservices to modernize legacy systems.

This improves agility and reduces system downtime. Centralized governance supports consistent deployment. As enterprise digital transformation accelerates, adoption remains strong. Investment capacity and technical expertise support leadership. Large enterprises remain the primary market contributors.

End-User Industry Analysis

IT and telecommunications represent 41.3% of end-user adoption, making them the leading industry segment. These industries require high system availability and performance. Microservices support dynamic scaling and service reliability.

Telecom and IT providers use microservices to deliver digital services and manage network operations. The architecture supports rapid service updates. This improves customer experience. As data traffic grows, demand for flexible systems increases. IT and telecom continue to drive market adoption. This vertical remains dominant.

Application Analysis

Web and mobile applications represent 52.6% of application demand, making them the largest use case for cloud microservices. These applications require fast response times, frequent updates, and high scalability. Microservices allow developers to update specific features without affecting the entire application.

This architecture also supports better user experience through faster deployment and improved reliability. Organizations can scale individual services based on demand. The strong presence of this application segment reflects the growing importance of agile and scalable architectures for modern digital applications.

Emerging Trends

Key Trend Description Serverless microservices Function-as-a-Service eliminates infrastructure management. AI-driven service orchestration Automation optimizes scaling and fault recovery. Service mesh advancements Enhanced observability and security for complex meshes. Edge-native microservices Deployments extend to distributed edge locations. WebAssembly integration Lightweight runtime boosts portability across clouds. Growth Factors

Key Factors Description Agile development demands Faster iterations through independent service updates. Cloud-native adoption surge Kubernetes and containers standardize architectures. Scalability requirements Handles variable workloads efficiently. Cost optimization needs Pay-per-use reduces idle resource expenses. DevOps cultural shift Enables CI/CD pipelines for continuous delivery. Driver Analysis

The cloud microservices market is being driven by the accelerating shift toward agile, scalable, and modular software architectures that support rapid development and continuous delivery. Traditional monolithic applications can be slow to update, difficult to scale, and costly to maintain, particularly in dynamic digital environments.

Cloud microservices decompose applications into independent, loosely coupled services that can be developed, deployed, and scaled separately. This approach enables organisations to respond quickly to changing business requirements, improve fault isolation, and optimise resource usage.

The growing adoption of DevOps practices, containerisation, and orchestrated cloud environments reinforces investment in microservices as a core enabler of modern software delivery and digital transformation.

Restraint Analysis

A notable restraint in the cloud microservices market relates to operational complexity and the specialised skills required to design, deploy, and manage distributed service architectures. Microservices introduce challenges such as service discovery, interservice communication, data consistency, and distributed tracing, which demand mature tooling and expertise.

Organisations operating with legacy systems may face steep learning curves and integration difficulties when transitioning to microservices, particularly if they lack cloud automation and platform engineering capabilities. These technical demands and resource constraints can slow adoption or limit microservices implementation to specific application domains.

Opportunity Analysis

Emerging opportunities in the cloud microservices market are linked to the expansion of edge computing, hybrid cloud deployment models, and application modernisation initiatives. Microservices architectures are well suited to environments where components must run across varied infrastructure layers and scale independently in response to workload peaks.

There is also opportunity in industry-specific offerings that embed microservices patterns with domain logic and compliance features tailored for regulated sectors such as financial services, healthcare, and telecommunications. Providers that offer integrated development tools, observability solutions, and automated governance frameworks can help organisations accelerate adoption and derive greater value from microservices investments.

Challenge Analysis

A central challenge confronting this market involves achieving effective orchestration and observability across distributed services. As applications consist of numerous microservices, maintaining visibility into performance, latency, and resource utilisation across service boundaries becomes operationally demanding.

Lack of comprehensive monitoring and traceability can lead to performance bottlenecks and increase mean time to recovery during incidents. Ensuring secure interservice communication, managing service versions, and implementing consistent policies across heterogeneous environments further complicate operational processes and require robust automation and governance strategies.

Key Market Segments

By Component

- Solutions

- API Management & API Gateways

- Service Mesh

- Microservices Monitoring & Observability

- Container Management & Orchestration

- Others

- Services

- Consulting & Integration

- Support & Maintenance

- Managed Services

- Others

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance

- Retail & E-commerce

- Healthcare

- Manufacturing

- Media & Entertainment

- Others

By Application

- Web & Mobile Applications

- API-based Integrations

- Real-time Analytics & Data Processing

- Legacy Application Modernization

- Others

- Regional Analysis

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading cloud providers such as Microsoft Corporation, Amazon Web Services, Inc., and Google LLC dominate the cloud microservices landscape. Their platforms offer managed Kubernetes, container orchestration, and serverless services. These capabilities support scalable and resilient application architectures. International Business Machines Corporation and Oracle Corporation strengthen adoption among large enterprises.

Enterprise software vendors such as VMware, Inc., SAP SE, and Salesforce, Inc. focus on integrating microservices with existing enterprise systems. Their solutions support hybrid and multi-cloud deployments. Red Hat, Inc. and Pivotal Software, LLC emphasize open-source frameworks and DevOps practices. These players benefit from strong enterprise trust and long-term platform adoption.

API and integration specialists such as MuleSoft, LLC, Kong Inc., and Lightbend, Inc. address service connectivity and governance. TIBCO Software Inc. and Software AG enhance orchestration and data flow management. Other vendors expand innovation and regional reach. This competitive landscape supports steady growth and wider adoption of microservices architectures.

Top Key Players in the Market

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- VMware, Inc.

- Salesforce, Inc.

- SAP SE

- Red Hat, Inc.

- Pivotal Software, LLC

- MuleSoft, LLC

- Kong Inc.

- Lightbend, Inc.

- TIBCO Software Inc.

- Software AG

- Others

Future Outlook

Growth in the Cloud Microservices market is expected to remain strong as organizations modernize applications and move away from monolithic systems. Microservices allow applications to be built as smaller, independent services that can be updated and scaled easily.

Rising use of cloud platforms, containers, and DevOps practices is supporting adoption. Over time, better service management, security tools, and observability are likely to improve reliability and simplify operations.

Recent Developments

- In June 2025, Databricks and Microsoft broadened their long standing collaboration around Azure Databricks. The updated agreement focused on deeper integration with Azure AI Foundry, Power Platform, and SAP data services. This expansion supports enterprises in developing data and AI centric microservices architectures with improved scalability and interoperability.

- In January 2025, Microsoft formed several strategic partnerships to accelerate AI driven transformation across key sectors in India. Collaborations with RailTel, Apollo Hospitals, Bajaj Finserv, Mahindra Group, and upGrad were announced, alongside a Memorandum of Understanding with India AI. The initiative aims to establish AI Centres of Excellence, expand cloud based Copilot adoption, and strengthen workforce skills in cloud and AI technologies.

- In November 2024, AWS expanded its strategic relationship with Anthropic to advance generative AI infrastructure. Anthropic was named the primary AI training partner for AWS Trainium chips, while AWS became the preferred platform for deploying Claude models through Amazon Bedrock. This collaboration reinforced AWS’s position in large scale AI training and deployment environments.

Report Scope

Report Features Description Market Value (2025) USD 2.3 Bn Forecast Revenue (2035) USD 19.7 CAGR(2025-2035) 23.40% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance, Others), By Application (Web & Mobile Applications, API-based Integrations, Real-time Analytics & Data Processing, Legacy Application Modernization, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Amazon Web Services, Inc., Google LLC, International Business Machines Corporation, Oracle Corporation, VMware, Inc., Salesforce, Inc., SAP SE, Red Hat, Inc., Pivotal Software, LLC, MuleSoft, LLC, Kong Inc., Lightbend, Inc., TIBCO Software Inc., Software AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Microservices MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Cloud Microservices MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- VMware, Inc.

- Salesforce, Inc.

- SAP SE

- Red Hat, Inc.

- Pivotal Software, LLC

- MuleSoft, LLC

- Kong Inc.

- Lightbend, Inc.

- TIBCO Software Inc.

- Software AG

- Others