Global Clinical Trial Packaging Market Size, Share, Growth Analysis By Material (Plastic, Glass, Metal, Paper & Corrugated Fiber), By Product (Syringes, Vials & Ampoules, Bottles, Bags & Pouches, Others), By End Use (Research Laboratories, Clinical Research Organizations, Drug Manufacturing Facilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170441

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

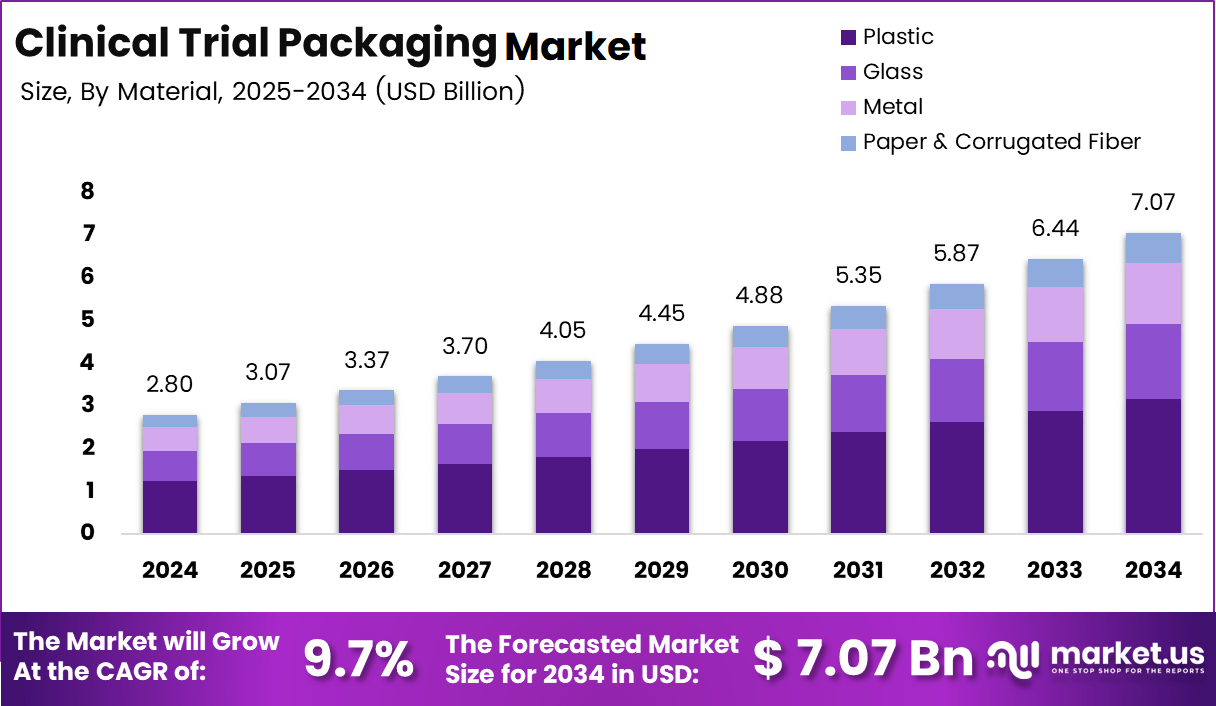

The Global Clinical Trial Packaging Market size is expected to be worth around USD 7.07 billion by 2034, from USD 2.8 billion in 2024, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034.

The clinical trial packaging market refers to specialized services that prepare, label, and distribute investigational products for clinical research programs. It covers primary, secondary, and tertiary packaging aligned with protocol requirements. From an analyst viewpoint, this market supports trial integrity, patient safety, regulatory compliance, and operational efficiency across global development pipelines.

From a growth perspective, the market is expanding alongside rising clinical trial volumes and increasing protocol complexity. Moreover, the shift toward decentralized and hybrid trials accelerates demand for flexible packaging models. Consequently, sponsors increasingly prioritize speed, accuracy, and scalability in clinical supplies management across early and late phase studies.

In terms of opportunity, outsourcing trends remain strong as pharmaceutical and biotechnology firms focus on core research activities. Furthermore, packaging partners offering agile workflows and rapid turnaround gain preference. As a result, service providers supporting both small pilot studies and large global trials are increasingly integrated into long term clinical development strategies.

Government investment and regulatory oversight also shape the clinical trial packaging market. Authorities emphasize traceability, patient protection, and product integrity throughout the clinical supply chain. Accordingly, regulations governing labeling accuracy, temperature control, and serialization continue to tighten, encouraging adoption of validated packaging systems and digitally enabled compliance processes.

Operational efficiency has become a defining expectation in this market. According to internal operational benchmarks published by clinical supply organizations, over 80% of active clinical trials are multinational, increasing logistical complexity. Therefore, packaging solutions capable of supporting multi-country labeling, distribution, and compliance are increasingly critical for trial continuity.

Waste reduction represents another key consideration. According to clinical supply chain audits, nearly 50% of packaged and labeled clinical supplies are never administered to patients. Consequently, sponsors increasingly adopt just-in-time packaging, adaptive labeling strategies, and demand-driven production models to minimize excess inventory and associated costs.

Cold chain requirements further influence market dynamics. According to regulatory and logistics guidance documents, clinical materials frequently require controlled ranges such as 2–8°C, -20°C, -70°C, and -180°C. As a result, packaging services integrating validated thermal controls, 100% glue and code detection, and rapid digital artwork processing gain stronger commercial traction within the clinical trial packaging market.

Key Takeaways

- The global Clinical Trial Packaging Market is projected to grow from USD 2.8 billion in 2024 to USD 7.07 billion by 2034, registering a CAGR of 9.7% during 2025–2034.

- By material, plastic dominates the Clinical Trial Packaging Market with a leading share of 44.8%, driven by flexibility, durability, and cold chain compatibility.

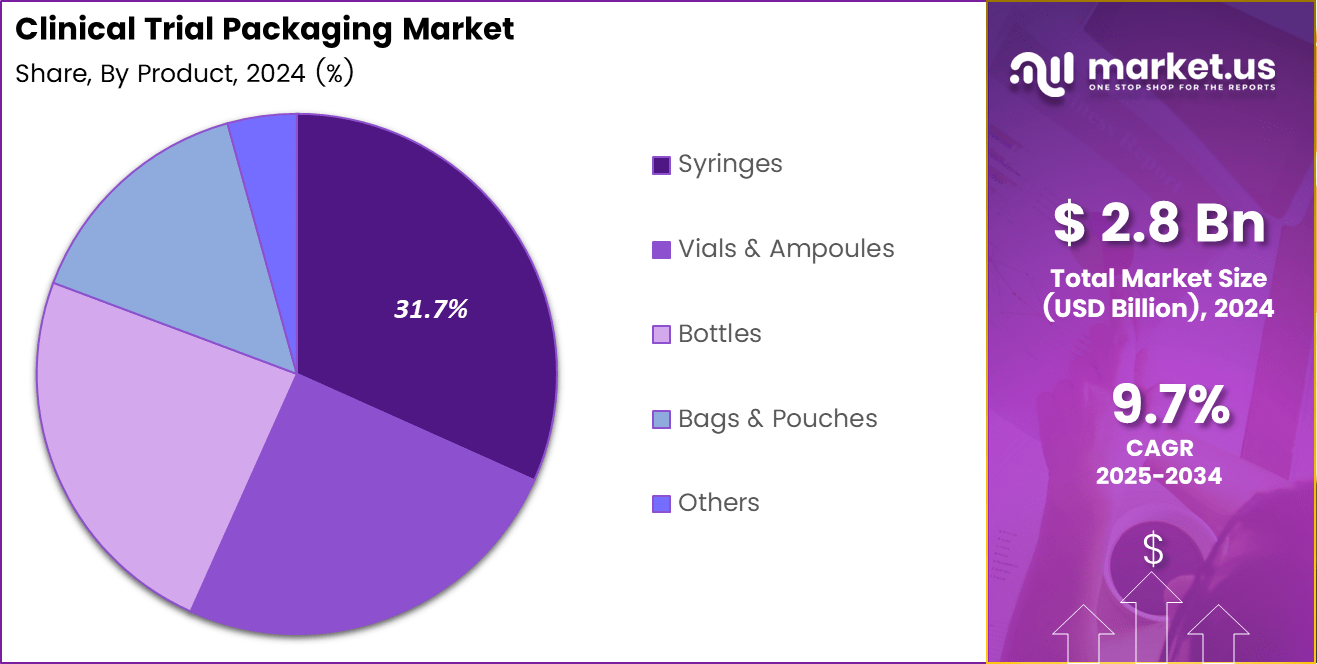

- By product, syringes hold the largest share at 31.7%, supported by rising injectable drug trials and patient-ready dosing formats.

- By end use, research laboratories account for the highest share of 39.4%, reflecting strong early-phase and preclinical trial activity.

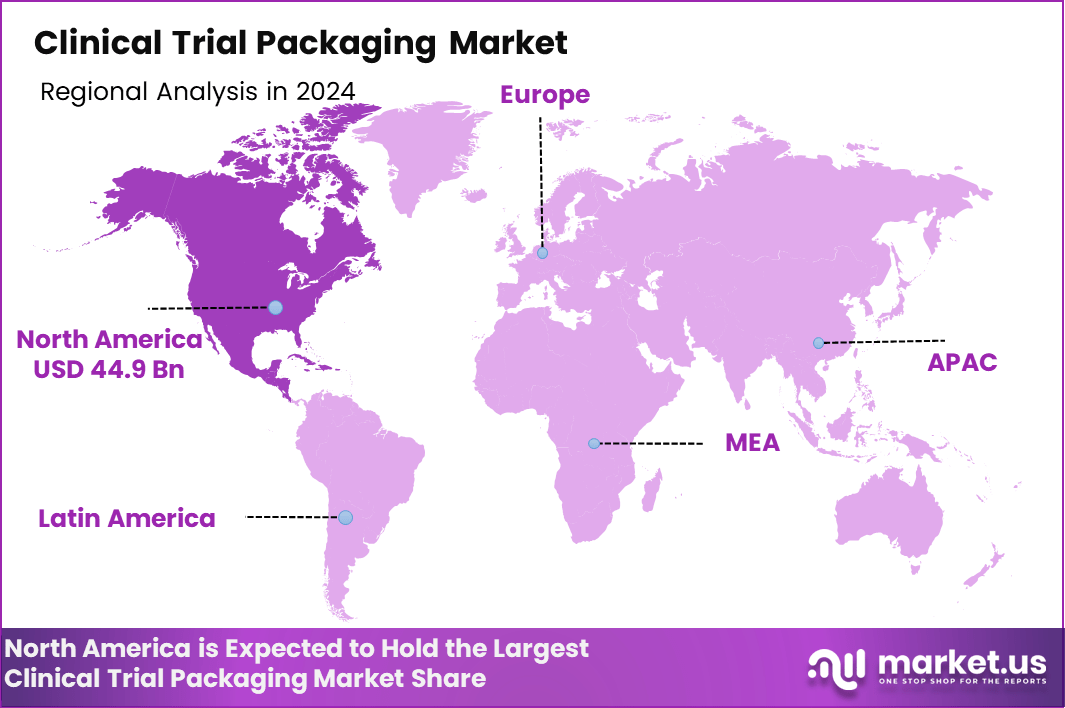

- Regionally, North America leads the Clinical Trial Packaging Market with a share of 44.9% and a market value of approximately USD 1.2 billion.

By Material Analysis

Plastic dominates with 44.8% due to its flexibility, durability, and wide suitability for diverse clinical trial packaging needs.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of the Clinical Trial Packaging Market, with a 44.8% share. Plastic packaging is widely preferred because it supports lightweight transport, compatibility with cold chain conditions, and high resistance to breakage. Moreover, it enables customized designs for labeling, blinding, and patient compliance.

Glass plays a critical role in clinical trial packaging, particularly for injectable drugs and sensitive biologics. It is valued for its chemical inertness and ability to preserve drug stability. Consequently, glass packaging is commonly used in trials requiring long-term storage, sterility assurance, and regulatory acceptance across global trial sites.

Metal packaging supports niche clinical trial applications where enhanced barrier protection is essential. It is mainly used for specialized formulations requiring protection from light, oxygen, or moisture. As a result, metal packaging finds relevance in controlled environments where product integrity and extended shelf life remain priorities.

Paper and corrugated fiber materials are primarily used for secondary and tertiary clinical trial packaging. These materials support labeling, logistics, and bulk transportation efficiency. Additionally, they contribute to sustainability goals while enabling secure distribution of primary packaged clinical trial supplies across multiple research locations.

By Product Analysis

Syringes dominate with 31.7% driven by rising injectable drug trials and growing demand for patient-ready dosing formats.

In 2024, Syringes held a dominant market position in the By Product Analysis segment of the Clinical Trial Packaging Market, with a 31.7% share. Pre-filled and safety syringes support dosing accuracy, reduce contamination risk, and improve patient adherence. These advantages make them highly suitable for decentralized and home-based clinical trials.

Vials and ampoules remain fundamental packaging formats for early-phase and hospital-based clinical trials. They are widely used for liquid and lyophilized formulations requiring precise dose withdrawal. Furthermore, their compatibility with cold storage and regulatory familiarity supports continued adoption across global trial protocols.

Bottles are commonly used in oral solid and liquid drug trials. They enable flexible dosing, easy dispensing, and efficient labeling. As trials increasingly involve chronic therapies, bottles support longer treatment durations and patient convenience, especially in multi-dose regimens managed outside clinical settings.

Bags and pouches are gaining relevance for clinical trial packaging involving IV solutions and specialty therapies. They offer space efficiency and compatibility with infusion systems. Other packaging formats address customized trial requirements, supporting innovation in trial design and adaptive packaging strategies.

By End Use Analysis

Research Laboratories dominate with 39.4% supported by high trial volumes and intensive early-phase research activities.

In 2024, Research Laboratories held a dominant market position in the By End Use Analysis segment of the Clinical Trial Packaging Market, with a 39.4% share. These laboratories require precise, small-batch packaging to support formulation testing, stability studies, and early clinical phases. Their demand emphasizes flexibility, accuracy, and regulatory compliance.

Clinical Research Organizations represent a major end-use segment due to their expanding role in managing multi-country clinical trials. They rely on advanced packaging solutions to support blinding, randomization, and efficient distribution. Consequently, CRO-driven demand encourages standardized yet adaptable packaging formats.

Drug manufacturing facilities depend on clinical trial packaging to bridge the development and commercialization stages. They focus on scalability, quality assurance, and alignment with future commercial packaging. As trials progress into late phases, manufacturers increasingly invest in packaging systems that ensure consistency, traceability, and regulatory readiness.

Key Market Segments

By Material

- Plastic

- Glass

- Metal

- Paper & Corrugated Fiber

By Product

- Syringes

- Vials & Ampoules

- Bottles

- Bags & Pouches

- Others

By End Use

- Research Laboratories

- Clinical Research Organizations

- Drug Manufacturing Facilities

Drivers

Growing Emphasis on Regulatory Compliance for Labeling Accuracy Drives Market Growth

The clinical trial packaging market is strongly driven by the rising complexity of modern clinical trial designs. Multi-arm and adaptive trials require different dosing schedules, treatment combinations, and protocol adjustments during the study. As a result, sponsors increasingly demand customized packaging configurations that support flexibility, accuracy, and patient safety across trial phases.

The expansion of decentralized and hybrid clinical trials is another key driver shaping market demand. More trials now deliver investigational products directly to patients’ homes, increasing the need for patient-centric packaging that is easy to use, clearly labeled, and tamper-resistant. Packaging solutions must also support varied shipping conditions and return logistics.

Regulatory compliance remains a central growth driver for clinical trial packaging providers. Global regulators require strict control over labeling accuracy, traceability, and investigational product integrity. Packaging plays a critical role in meeting these requirements, reducing protocol deviations, and maintaining audit readiness.

In addition, the increasing volume of biologics and cell and gene therapies is driving demand for advanced packaging solutions. These therapies are highly sensitive and require specialized cold chain and protective packaging to maintain stability and efficacy throughout storage and transportation.

Restraints

High Operational Costs Associated with Small Batch Production Restrain Market Growth

One of the major restraints in the clinical trial packaging market is the high operational cost linked to small batch production. Clinical trials often require limited quantities of packaging materials with frequent changes, increasing labor, setup time, and material waste. These factors raise overall packaging costs for sponsors.

Frequent protocol amendments further add to cost pressures. Changes in dosage, labeling, or trial design require rapid packaging modifications, leading to inefficiencies and rework. For smaller trials, these adjustments can significantly impact budgets and timelines.

Stringent global regulatory variations also create challenges for standardized packaging execution. Different countries follow distinct labeling, language, and compliance requirements. Managing multiple regulatory frameworks increases complexity and slows down packaging operations, especially for multinational trials.

Another restraint is the limited availability of validated packaging materials for novel drug delivery formats. Advanced therapies often require innovative containers and protective systems that are not widely tested or approved, creating delays in validation and regulatory acceptance.

Growth Factors

Accelerated Outsourcing of Clinical Packaging Activities Creates Growth Opportunities

The growing trend toward outsourcing clinical trial packaging activities presents strong growth opportunities for the market. Sponsors increasingly rely on specialized contract service providers to reduce internal costs, improve compliance, and gain access to advanced packaging expertise and infrastructure.

Emerging markets are also contributing to new opportunities. The rising number of early-phase clinical trials in regions such as the Asia Pacific and Latin America is driving demand for localized packaging services. Local packaging reduces lead times, logistics risks, and regulatory hurdles.

Smart packaging technologies represent another promising opportunity. Real-time monitoring tools, such as temperature sensors and tracking devices, improve supply chain visibility and patient adherence. These solutions support data-driven trial management and reduce product loss.

The growth of personalized medicine trials further expands opportunity potential. Patient-specific therapies require ultra-low volume, customized packaging solutions, creating demand for flexible, high-precision packaging capabilities.

Emerging Trends

Shift Toward Sustainable and Recyclable Materials Shapes Market Trends

Sustainability is emerging as a key trend in the clinical trial packaging market. Sponsors are increasingly adopting recyclable and eco-friendly packaging materials to reduce environmental impact while maintaining regulatory compliance and product protection.

Digital labeling and serialization systems are also gaining traction. These technologies improve trial visibility, enhance traceability, and reduce labeling errors. Digital solutions support faster updates during protocol changes and improve overall supply chain control.

Another important trend is the growing use of just-in-time packaging models. This approach minimizes inventory holding, reduces waste, and lowers the risk of product expiration. It also supports greater flexibility in managing trial changes.

Together, these trends reflect a shift toward smarter, more efficient, and sustainable clinical trial packaging operations that align with evolving trial designs and regulatory expectations.

Regional Analysis

North America Dominates the Clinical Trial Packaging Market with a Market Share of 44.9%, Valued at USD 1.2 Bn

North America held the dominant regional position in the Clinical Trial Packaging Market, accounting for a 44.9% share and reaching a value of USD 1.2 Bn. This leadership is supported by a high concentration of ongoing clinical trials, strong regulatory oversight, and widespread adoption of advanced packaging and labeling standards. The region continues to prioritize compliance, traceability, and cold-chain integrity across multinational and late-phase trials.

Europe Clinical Trial Packaging Market Trends

Europe represents a mature and regulation-driven market for clinical trial packaging, supported by harmonized clinical trial regulations and strong cross-border trial activity. The region emphasizes multilingual labeling, patient safety, and sustainability in secondary packaging formats. Increasing biologics research and adaptive trial designs are further strengthening demand for flexible and compliant packaging solutions.

Asia Pacific Clinical Trial Packaging Market Trends

Asia Pacific is emerging as a high-growth region due to the rapid expansion of clinical research activities and cost-efficient trial execution. Countries across the region are witnessing rising investments in clinical infrastructure and decentralized trial models. Demand is growing for scalable packaging solutions that support temperature-sensitive biologics and region-specific regulatory requirements.

Middle East and Africa Clinical Trial Packaging Market Trends

The Middle East and Africa market is gradually expanding, driven by improving healthcare infrastructure and increasing participation in global clinical trials. Sponsors are focusing on compliant import packaging, stability assurance, and robust labeling accuracy. Growth is supported by rising government initiatives aimed at strengthening clinical research ecosystems.

Latin America Clinical Trial Packaging Market Trends

Latin America continues to gain traction as a preferred region for patient recruitment in global trials, supporting steady demand for clinical trial packaging services. The market is shaped by regulatory alignment efforts and growing adoption of centralized and hybrid trial models. Packaging providers are increasingly addressing logistical complexity and climatic challenges across the region.

U.S. Clinical Trial Packaging Market Trends

The U.S. remains a core contributor within North America, supported by a high volume of Phase I to Phase III trials and early adoption of innovative trial designs. Strong enforcement of labeling accuracy, serialization, and cold-chain validation continues to influence packaging demand. The focus on decentralized and patient-centric trials is further shaping packaging formats and distribution strategies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Clinical Trial Packaging Company Insights

In the Global Clinical Trial Packaging Market in 2024, Clinigen Limited has reinforced its position by delivering comprehensive packaging and labeling services tailored to complex clinical protocols, enhancing sponsor confidence through reliable regulatory compliance and supply chain management.

PCI Pharma Services continues to strengthen its service portfolio with advanced serialization and temperature-controlled packaging solutions, supporting a broad range of trial phases and therapeutic formats, particularly for biologics and sensitive compounds.

Yourway has focused on scaling its clinical supplies operations by optimizing logistics and adaptive packaging workflows, enabling efficient distribution across decentralized and hybrid trial models while maintaining accuracy in labeling and traceability.

WestRock Company leverages its expertise in materials science to provide robust secondary and tertiary packaging solutions that support secure transport and sustainability goals, addressing the growing need for eco-friendly corrugated and protective packaging in global clinical trials.

Top Key Players in the Market

- Clinigen Limited

- PCI Pharma Services

- Yourway

- WestRock Company

- Oliver

- CCL Industries Inc.

- Sharp Services, LLC

- SCHOTT Pharma

- Gerresheimer AG

- Borosil Scientific

Recent Developments

- In Aug 2025, THL Partners announced the acquisition of Headlands Research, a clinical trial site company, to support its continued growth strategy. The alliance is expected to accelerate Headlands’ expansion by strengthening centralized infrastructure and enhancing operational scalability across clinical research networks.

- In Aug 2025, SGD Pharma entered into an agreement with Entangled Capital, an Italian private equity firm, to acquire Alphial, an Italy based manufacturer of tubular vials, ampoules, and ready to use glass products. The acquisition expands SGD Pharma’s pharmaceutical packaging portfolio and reinforces its manufacturing footprint in the European primary packaging market..

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 7.07 billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Glass, Metal, Paper & Corrugated Fiber), By Product (Syringes, Vials & Ampoules, Bottles, Bags & Pouches, Others), By End Use (Research Laboratories, Clinical Research Organizations, Drug Manufacturing Facilities) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Clinigen Limited, PCI Pharma Services, Yourway, WestRock Company, Oliver, CCL Industries Inc., Sharp Services, LLC, SCHOTT Pharma, Gerresheimer AG, Borosil Scientific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Trial Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Trial Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clinigen Limited

- PCI Pharma Services

- Yourway

- WestRock Company

- Oliver

- CCL Industries Inc.

- Sharp Services, LLC

- SCHOTT Pharma

- Gerresheimer AG

- Borosil Scientific