Global Cleaning Services Market Size, Share, Growth Analysis By Type (Floor Care, Window Cleaning, Vacuuming, Maid Services, Carpet & Upholstery, Others),By End Use (Commercial Spaces, Residential, Institutional, Government, Healthcare Facilities, Hospitality, Aviation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174947

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

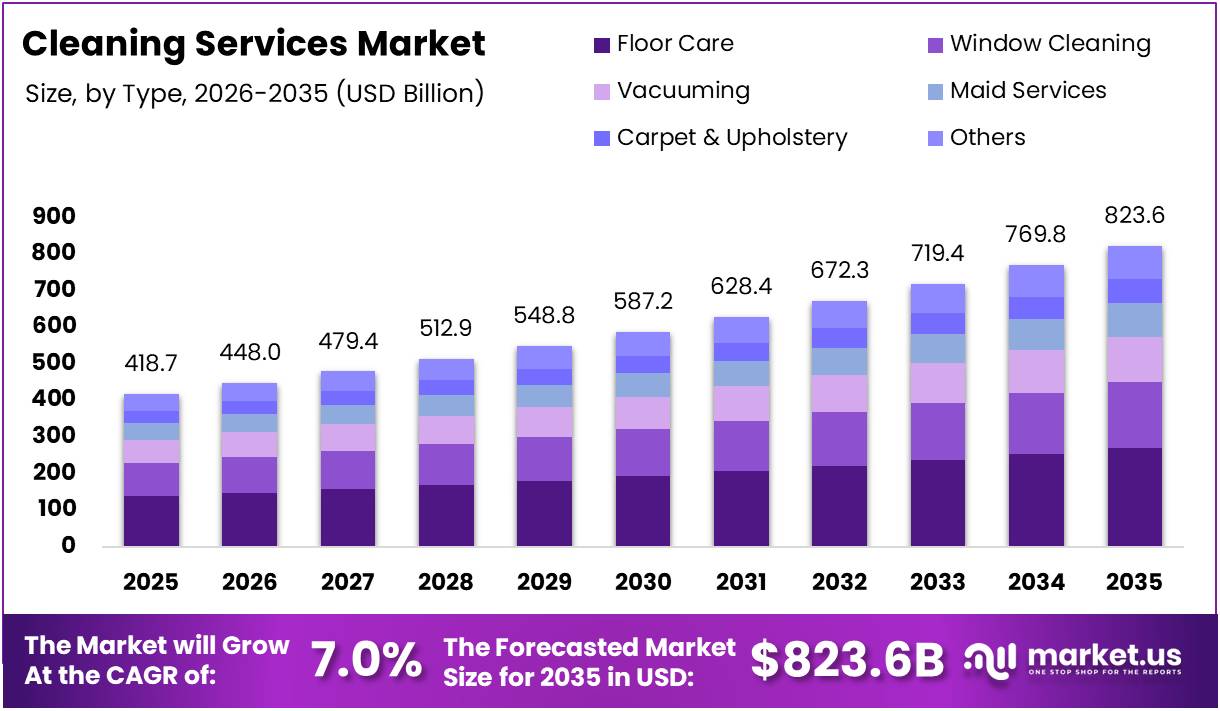

The Global Cleaning Services Market size is expected to be worth around USD 823.6 Billion by 2035, from USD 418.7 Billion in 2025, growing at a CAGR of 7% during the forecast period from 2026 to 2035.

The Cleaning Services Market encompasses professional maintenance solutions for residential, commercial, and industrial facilities. This sector delivers systematic sanitation, hygiene management, and facility upkeep through specialized workforce deployment. Services range from routine janitorial operations to deep-cleaning interventions, addressing diverse client requirements across multiple industry verticals.

Consequently, the cleaning services industry demonstrates robust expansion driven by urbanization and heightened hygiene awareness. Commercial establishments increasingly prioritize workplace sanitation standards, thereby accelerating demand for professional cleaning solutions. Moreover, residential cleaning subscriptions gain momentum as dual-income households seek convenient outsourcing options for maintaining domestic environments efficiently.

Furthermore, technological integration presents significant opportunities within this market landscape. Automation tools, eco-friendly cleaning products, and digital booking platforms revolutionize service delivery models. Additionally, specialized cleaning niches including healthcare sanitation and post-construction cleanup offer lucrative segments for providers seeking differentiated positioning and premium pricing structures.

Meanwhile, regulatory bodies enforce stringent workplace hygiene standards, particularly across healthcare and food service sectors. Governments mandate compliance with environmental protection guidelines, influencing chemical usage and waste disposal protocols. These regulations simultaneously create barriers for entry while ensuring service quality, thereby professionalizing the industry and elevating operational standards comprehensively.

Transitioning to consumer behavior patterns, mobile technology significantly influences purchasing decisions within home services. According to research, 78% of local searches on mobile devices result in service purchases or bookings within 24 hours. This statistic underscores the critical importance of digital visibility and mobile-optimized booking systems for cleaning service providers targeting residential markets.

Similarly, organizational preferences increasingly favor outsourcing arrangements over internal facility management. According to research, 60.3% of janitorial services are now outsourced rather than managed in-house. This shift reflects cost optimization strategies and allows businesses to concentrate resources on core competencies while leveraging specialized cleaning expertise externally.

Key Takeaways

- The Global Cleaning Services Market is projected to grow from USD 418.7 Billion in 2025 to USD 823.6 Billion by 2035, registering a 7% CAGR during 2026–2035.

- By type, Floor Care is the leading segment, accounting for 32.8% market share in 2025, driven by universal demand across residential, commercial, and industrial facilities.

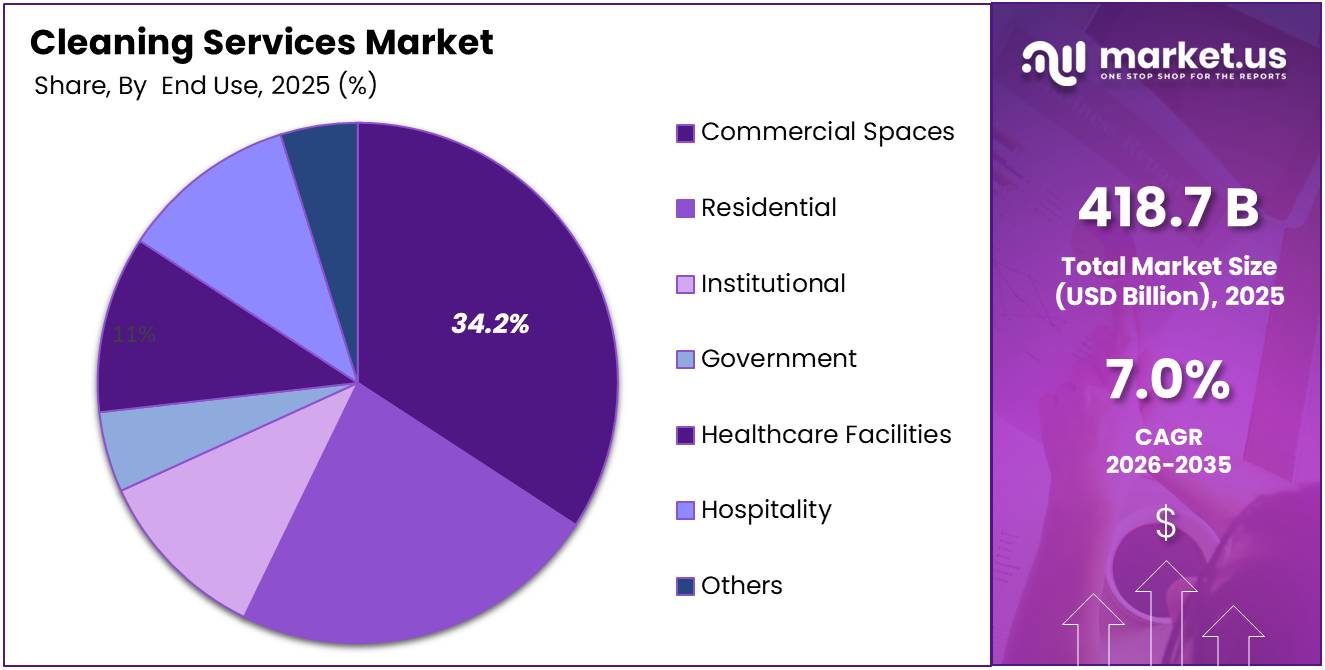

- By end use, Commercial Spaces dominate the market with a 34.2% share in 2025, supported by high footfall and stringent hygiene compliance requirements.

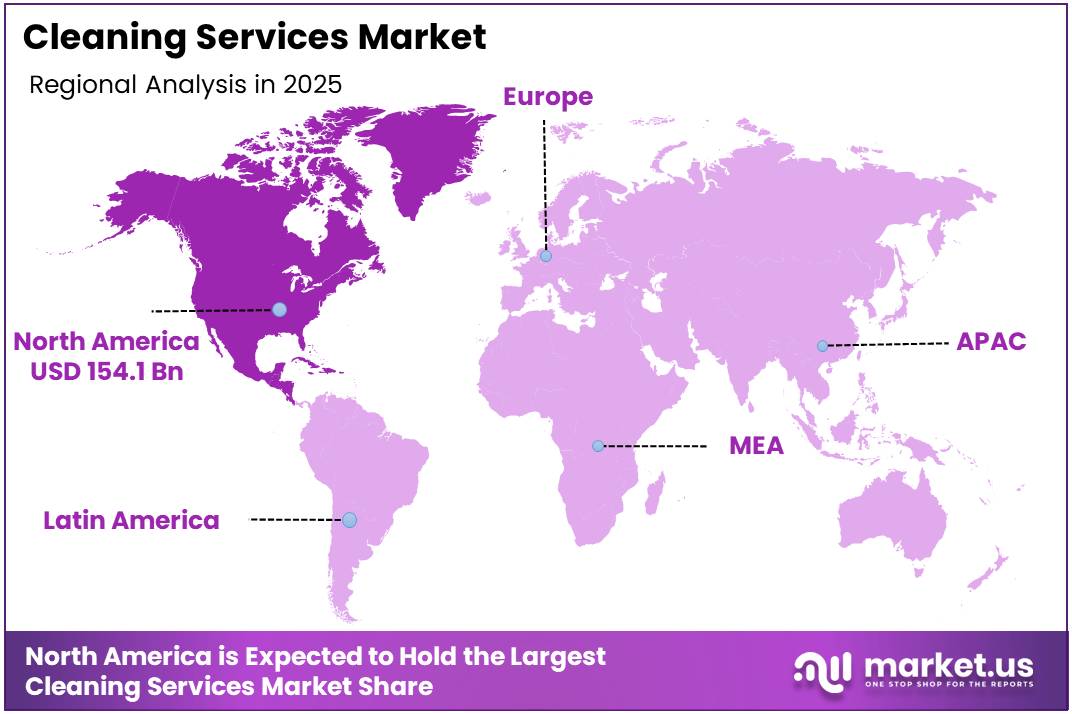

- North America leads regionally with a 36.8% market share, valued at USD 154.1 Billion, reflecting strong outsourcing adoption and regulatory standards.

By Type Analysis

Floor Care dominates with 32.8% due to its essential role in maintaining hygiene and aesthetic appeal across various facilities.

In 2025, Floor Care held a dominant market position in the By Type Analysis segment of Cleaning Services Market, with a 32.8% share. This segment’s prominence stems from universal need for floor maintenance across all settings. Regular cleaning prevents deterioration, extends surface lifespan, and ensures safety by reducing slip hazards. Advanced equipment and eco-friendly solutions have enhanced service efficiency significantly.

Window Cleaning represents a specialized service requiring skilled technicians and safety equipment, particularly for high-rise buildings. This segment experiences steady demand from corporate offices and retail spaces seeking professional appearances. Technological advancements including water-fed poles and automated systems have improved service delivery while addressing safety concerns effectively.

Vacuuming services complement floor care by addressing carpeted areas and hard-to-reach spaces where allergens accumulate. This segment benefits from growing health consciousness and indoor air quality concerns. Commercial-grade equipment and HEPA filtration systems have elevated service standards, particularly in healthcare and hospitality sectors where cleanliness impacts satisfaction.

Maid Services offer comprehensive household cleaning solutions tailored to residential clients seeking convenience and time savings. This segment encompasses general housekeeping and organization tasks performed by trained professionals. Growing dual-income households and busy lifestyles have fueled demand for recurring services with flexible scheduling options.

Carpet & Upholstery cleaning addresses deep-seated dirt and stains that regular vacuuming cannot eliminate. This specialized segment employs hot water extraction and steam cleaning methods depending on fabric types. Commercial clients regularly utilize these services to maintain appearance standards and extend furniture lifespan effectively.

Others category includes specialized services such as post-construction cleanup, industrial cleaning, and pressure washing. These niche offerings address specific requirements that standard packages cannot fulfill. Emerging demand for disinfection services has expanded this segment, particularly following heightened hygiene awareness across various industries recently.

By End Use Analysis

Commercial Spaces dominates with 34.2% due to stringent cleanliness standards and high foot traffic requiring professional maintenance.

In 2025, Commercial Spaces held a dominant market position in the By End Use Analysis segment of Cleaning Services Market, with a 34.2% share. This segment encompasses office buildings, retail stores, and shopping malls where pristine environments impact brand image and productivity. Professional services ensure compliance with workplace regulations while creating welcoming atmospheres consistently.

Residential cleaning services cater to homeowners seeking professional assistance with household maintenance tasks. This segment has experienced significant growth as consumers value work-life balance and prefer outsourcing cleaning activities. Service offerings range from basic housekeeping to deep cleaning with subscription-based models available.

Institutional facilities including schools and universities require comprehensive programs addressing high occupancy levels and diverse usage patterns. These environments demand rigorous sanitization protocols to prevent disease transmission. Cleaning services accommodate operational schedules, performing tasks during off-hours to minimize disruption while maintaining safe learning environments.

Government buildings maintain strict cleanliness standards to serve citizens and employees effectively. This segment includes administrative offices and courthouses requiring reliable services complying with governmental procurement processes. Security clearances and specialized protocols often govern service delivery in sensitive governmental areas.

Healthcare Facilities represent the most demanding segment with critical hygiene requirements preventing healthcare-associated infections. Hospitals and clinics require specialized protocols including terminal cleaning and biohazard waste handling. Cleaning staff receive specialized training on infection control procedures using medical-grade disinfectants effectively.

Hospitality sector including hotels and restaurants prioritizes exceptional cleanliness ensuring guest satisfaction and positive reviews. This segment demands rapid turnover cleaning and meticulous attention to detail across all touchpoints. Housekeeping teams maintain brand standards while accommodating varying occupancy levels consistently.

Aviation cleaning services address unique requirements of airports and aircraft cabins where cleanliness affects passenger experience. This specialized segment involves aircraft interior cleaning and terminal maintenance performed under tight turnaround schedules. Aviation cleaners navigate security protocols while ensuring thorough disinfection efficiently.

Others encompasses diverse categories including industrial facilities, warehouses, and sports venues. Each presents unique cleaning challenges requiring tailored approaches and specialized equipment. This segment continues expanding as businesses recognize professional cleaning as essential for operational efficiency and compliance.

Key Market Segments

By Type

- Floor Care

- Window Cleaning

- Vacuuming

- Maid Services

- Carpet & Upholstery

- Others

By End Use

- Commercial Spaces

- Residential

- Institutional

- Government

- Healthcare Facilities

- Hospitality

- Aviation

- Others

Drivers

Rising Urbanization Increasing Demand for Outsourced Cleaning Services Drives Market Growth

The cleaning services market is experiencing strong growth due to rapid urbanization across the globe. As more people move to cities, the number of residential apartments, office buildings, and commercial spaces continues to rise. This urban expansion creates significant demand for professional cleaning services as busy city dwellers have limited time for household maintenance tasks.

Corporate organizations are placing greater emphasis on workplace hygiene and maintaining high facility standards. Companies now recognize that clean work environments boost employee productivity and create positive impressions on clients and visitors. This awareness has led businesses to invest more in professional cleaning contracts rather than managing cleaning tasks internally.

Modern consumers increasingly prefer outsourcing their cleaning needs to professionals rather than handling these tasks themselves. Time constraints from demanding work schedules and personal commitments make professional cleaning services an attractive solution. People value the convenience and quality that trained cleaning professionals provide, making them willing to pay for these time-saving services that allow them to focus on other priorities.

Restraints

Workforce Availability Challenges Restrain Market Expansion

The cleaning services industry faces significant challenges related to workforce availability and skilled labor shortages. Finding reliable, trained cleaning staff remains difficult for service providers, particularly in competitive labor markets. This shortage affects the industry’s ability to maintain consistent service quality across all client locations.

High employee turnover rates compound these workforce problems. Cleaning jobs often involve physically demanding work with irregular hours, leading many workers to seek alternative employment. Companies must invest continuously in recruitment and training programs, which increases operational costs and affects profit margins.

Managing multi-site and large-scale cleaning contracts presents considerable operational complexity for service providers. Coordinating schedules, equipment, and staff across different locations requires sophisticated management systems and experienced supervisors. Quality control becomes challenging when operations span multiple buildings or cities.

Growth Factors

Rapid Adoption of Eco-Friendly Cleaning Solutions Creates Growth Opportunities

The cleaning services market is witnessing substantial growth opportunities through the adoption of green and environmentally friendly cleaning solutions. Consumers and businesses are becoming more environmentally conscious, actively seeking service providers who use non-toxic, biodegradable cleaning products. This shift toward sustainability allows cleaning companies to differentiate themselves and attract premium clients willing to pay more for eco-friendly services.

Healthcare facilities and industrial sectors present specialized cleaning opportunities with strong growth potential. Hospitals, clinics, and medical centers require stringent disinfection protocols and specialized cleaning techniques that command higher service fees. Industrial facilities need cleaning services that understand specific safety requirements and handling of specialized equipment, creating niche markets for qualified providers.

Subscription-based and on-demand cleaning service models are transforming the industry landscape. Digital platforms enable customers to book cleaning services instantly through mobile apps, offering flexibility and convenience. Subscription models provide predictable recurring revenue for companies while giving customers hassle-free regular cleaning schedules.

Emerging Trends

Integration of Automation and Smart Technology Shapes Market Trends

The cleaning services market is experiencing transformation through automation and smart equipment integration. Robotic vacuum cleaners, automated floor scrubbers, and UV disinfection devices are becoming standard tools for professional cleaning companies. These technologies improve efficiency, reduce labor costs, and enable cleaning staff to focus on tasks requiring human attention and detail.

Digital platforms for booking and service management are revolutionizing how customers interact with cleaning providers. Mobile applications and online portals allow clients to schedule appointments, track service progress, and make payments seamlessly. These platforms also help cleaning companies optimize route planning, manage staff schedules, and maintain customer communication efficiently.

Disinfection and deep cleaning services have seen dramatic demand increases, particularly following global health concerns. Businesses and homeowners now prioritize thorough sanitization beyond regular cleaning routines. This trend has created opportunities for companies offering specialized disinfection services using advanced techniques like electrostatic spraying and antimicrobial treatments.

Regional Analysis

North America Dominates the Cleaning Services Market with a Market Share of 36.8%, Valued at USD 154.1 Billion

North America leads the global cleaning services market with a commanding share of 36.8%, valued at USD 154.1 billion. The region’s dominance stems from stringent hygiene regulations, strong workplace safety standards, and high adoption of professional cleaning services across corporate offices, healthcare centers, and residential complexes. The United States is the primary contributor, with growing trends of outsourcing non-core activities and heightened infection control awareness driving market expansion.

Europe Cleaning Services Market Trends

Europe represents a mature market characterized by strict environmental regulations favoring eco-friendly cleaning solutions. The region’s growth is supported by comprehensive health and safety legislation, particularly in healthcare and food processing industries. Leading markets including Germany, the United Kingdom, and France demonstrate strong demand driven by large commercial sectors and increasing adoption of sustainable cleaning practices.

Asia Pacific Cleaning Services Market Trends

The Asia Pacific region is experiencing rapid growth driven by accelerating urbanization and expanding commercial infrastructure. Countries like China, India, Japan, and Australia show substantial demand as businesses increasingly outsource cleaning operations. The burgeoning healthcare sector, proliferation of office complexes, and growing middle-class population are creating extensive opportunities for professional cleaning service providers.

Middle East and Africa Cleaning Services Market Trends

The Middle East and Africa region demonstrates promising growth potential supported by infrastructure development and tourism expansion. Gulf Cooperation Council countries, particularly the UAE and Saudi Arabia, lead regional demand through extensive hospitality sectors and urban development initiatives. Increasing foreign investments and emphasis on international hygiene standards are driving demand for professional cleaning solutions.

Latin America Cleaning Services Market Trends

Latin America presents an emerging market with growth driven by increasing urbanization and expanding commercial sectors. Brazil and Mexico represent the largest markets, supported by commercial real estate developments and growing service economies. The region is witnessing a shift from informal to organized cleaning service providers, while rising investments in healthcare and manufacturing facilities create new opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cleaning Services Company Insights

The global cleaning services market in 2025 continues to be shaped by established industry leaders who have demonstrated resilience and adaptability in an evolving commercial landscape. These major players have leveraged their operational expertise, technological integration, and extensive service networks to maintain competitive advantages in both commercial and residential segments.

ABM Industries Inc. remains a dominant force in the facility services sector, distinguished by its comprehensive suite of integrated solutions that extend beyond traditional cleaning to encompass technical services and energy management. The company’s strategic focus on sustainability and smart building technologies has positioned it favorably among corporate clients seeking environmentally responsible service providers.

The ServiceMaster Company, LLC has maintained its market prominence through a well-established franchise model that combines brand recognition with localized service delivery. Its diversified portfolio spanning commercial cleaning, disaster restoration, and residential services provides multiple revenue streams and risk mitigation across different market conditions.

CleanNet has carved out a significant niche in the franchise-based commercial cleaning sector, offering entrepreneurs accessible entry points into the industry while maintaining quality standards through systematic training and support infrastructure. The company’s flexible service models cater to diverse client needs ranging from small offices to large corporate facilities.

Anago Cleaning Systems has distinguished itself through its Master Franchise business model and commitment to green cleaning practices, appealing to environmentally conscious businesses. The company’s quality assurance programs and certified cleaning protocols have enhanced customer retention and strengthened its competitive positioning in major metropolitan markets across North America.

Top Key Players in the Market

- ABM Industries Inc.

- The Service Master Company, LLC

- CleanNet

- Anago Cleaning Systems

- Aramark Corporation

- Sodexo

- Jani-King Inc.

- Stanley Steemer International, Inc.

- ChemDry

- Pritchard Industries Inc.

Recent Developments

- In December 2025, Spotless completed the acquisition of Eco-Clean to strengthen its regional footprint and enhance service coverage across the Midlands, supporting growth in commercial and industrial cleaning contracts.

- In October 2025, EZ Pizzi Cleaning expanded its service portfolio through the acquisition of The Cleaning Agency, enabling broader customer reach and added capabilities in specialized cleaning services.

- In August 2025, 4M Building Solutions acquired Miracle Clean Services and FKI Cleaning Services, significantly increasing its scale and reinforcing its position in multi-site facility and janitorial services.

- In July 2025, Truelink Capital acquired Zep, a leading cleaning products and maintenance services provider, to strengthen its portfolio with a well-established brand and diversified end-market exposure.

Report Scope

Report Features Description Market Value (2025) USD 418.7 Billion Forecast Revenue (2035) USD 823.6 Billion CAGR (2026-2035) 7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Floor Care, Window Cleaning, Vacuuming, Maid Services, Carpet & Upholstery, Others),By End Use (Commercial Spaces, Residential, Institutional, Government, Healthcare Facilities, Hospitality, Aviation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABM Industries Inc., The Service Master Company, LLC, CleanNet, Anago Cleaning Systems, Aramark Corporation, Sodexo, Jani-King Inc., Stanley Steemer International, Inc., ChemDry, Pritchard Industries Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABM Industries Inc.

- The Service Master Company, LLC

- CleanNet

- Anago Cleaning Systems

- Aramark Corporation

- Sodexo

- Jani-King Inc.

- Stanley Steemer International, Inc.

- ChemDry

- Pritchard Industries Inc.