Global Citrus Oils Market By Material (Orange Oil, Lime Oil, Grapefruit Oil, Others), By Purity (Conventional, Organic), By Application (Food and Beverages, Personal Care, Pharmaceuticals, Aromatheraphy, Others), By Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, E-commerce Platform, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150923

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

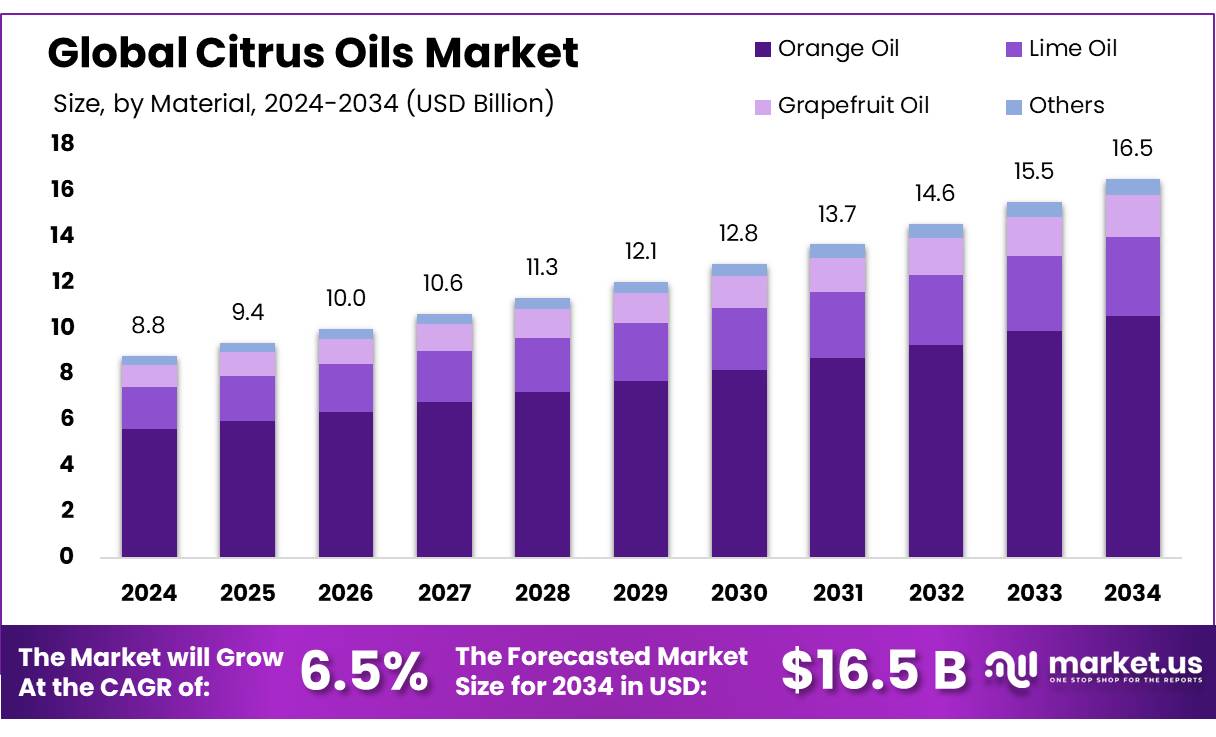

The Global Citrus Oils Market size is expected to be worth around USD 16.5 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Citrus oil concentrates, derived primarily from orange, lemon, lime, and mandarin peels, serve as essential ingredients in the food and beverage industry, particularly in flavoring, fragrance, and nutraceutical applications. The global citrus fruit production in 2020 was approximately 144 million metric tons, with oranges constituting about half of this volume. A significant portion of citrus production is processed into juice concentrates, with orange juice being the most prevalent. The United States and Brazil are the leading producers of orange juice, collectively accounting for approximately 85% of global production .

Globally, citrus fruits are among the most widely cultivated crops, with production reaching approximately 144 million metric tons in 2020. Oranges constitute about 62% of this total, followed by mandarins and tangerines at 17%, and lemons and limes at 11%. A significant portion of this production is processed into juice and oil concentrates.

The citrus oil concentrate industry is characterized by its integration with the broader citrus production sector. Countries like Brazil, the United States, and China are leading producers of citrus fruits, thereby influencing the availability and pricing of citrus oil concentrates. The industry is also impacted by climatic conditions, as citrus trees require specific temperature ranges to thrive. For instance, citrus cultivation is optimal between latitudes 40°N and 40°S, with elevations up to 1,800 meters in tropical regions and 750 meters in subtropical areas.

According to the Food and Agriculture Organization (FAO), the world production of citrus fruits in 2020 was approximately 144 million metric tons, with oranges accounting for about half of this total. A significant portion of this production is processed into juice and oil concentrates. For instance, in the United States, particularly in Florida, a major producer of orange juice, over 80% of the orange crop is utilized for juice production.

Key Takeaways

- Citrus Oils Market size is expected to be worth around USD 16.5 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 6.5%.

- Orange Oil held a dominant market position, capturing more than a 63.8% share of the citrus oils market.

- Conventional purity held a dominant market position, capturing more than a 73.8% share of the citrus oils market.

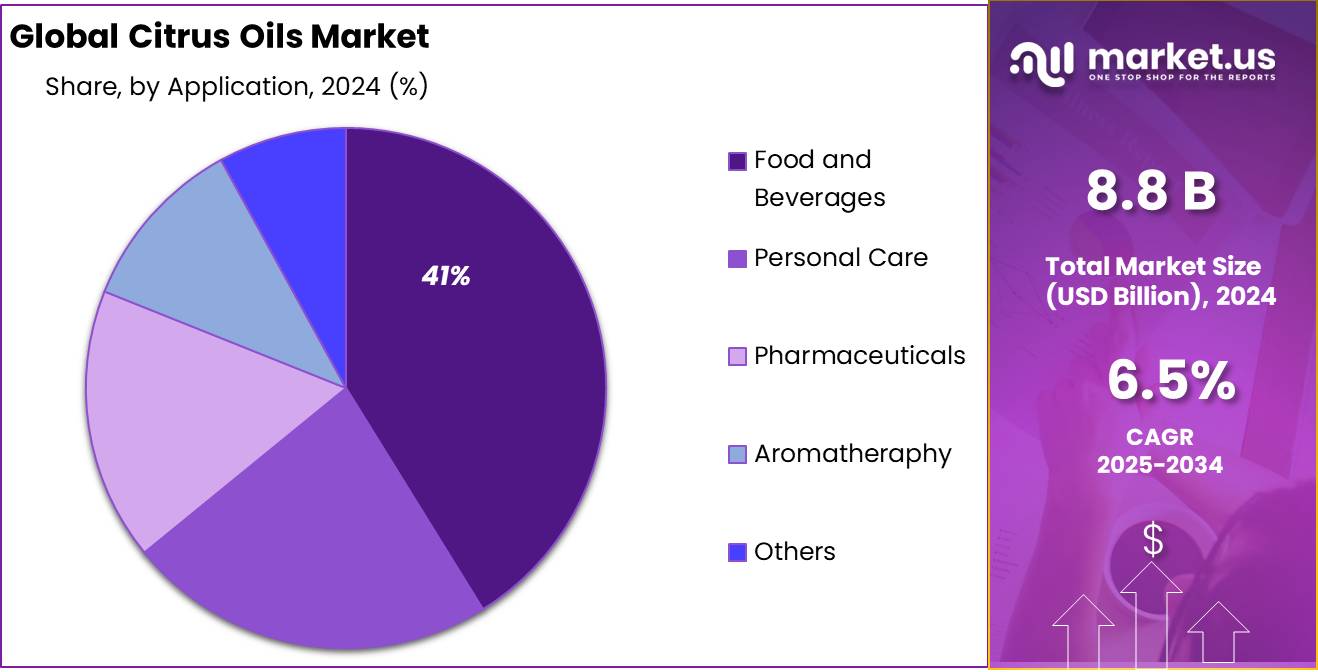

- Food and Beverages held a dominant market position, capturing more than a 41.3% share of the citrus oils market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 29.9% share of the citrus oils market.

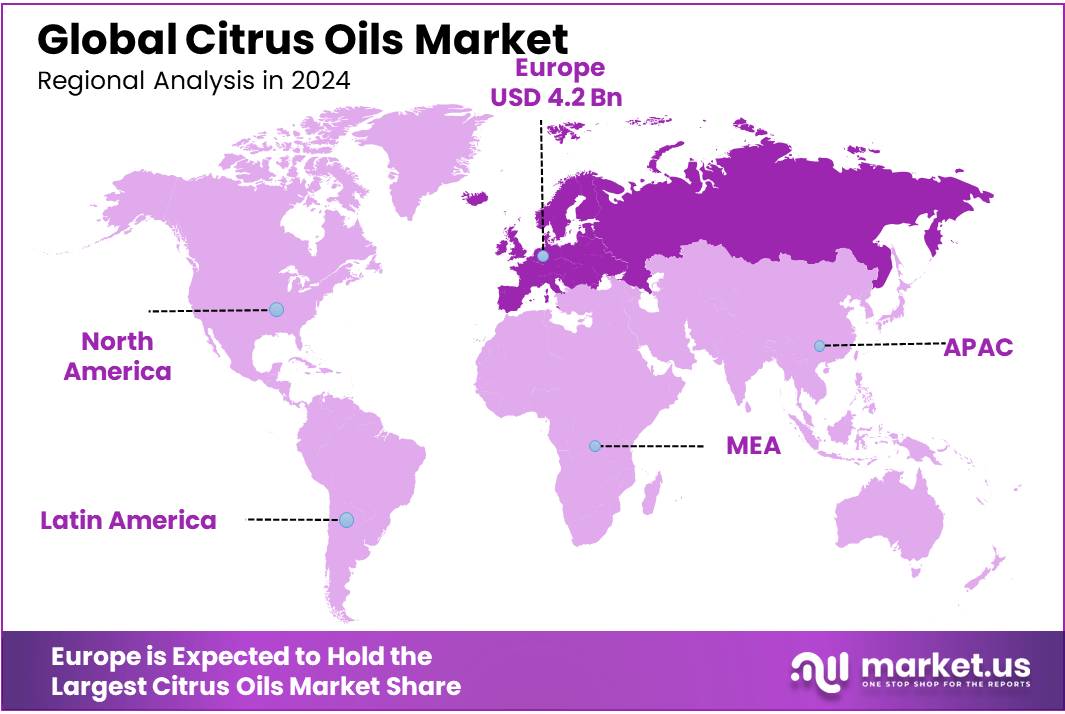

- Europe held a dominant position in the citrus oils market, capturing more than 48.3% of the market share, valued at USD 4.2 billion.

By Material

Orange Oil Dominates with 63.8% Share in 2024

In 2024, Orange Oil held a dominant market position, capturing more than a 63.8% share of the citrus oils market. This strong market presence can be attributed to the widespread application of orange oil across various industries, including food and beverages, cosmetics, and cleaning products. Orange oil is the most commonly used citrus oil due to its versatility and broad consumer acceptance. It is often used in flavoring, fragrance formulations, and as a natural cleaning agent. The substantial share of orange oil is driven by its ability to provide natural flavoring solutions and its cost-effectiveness compared to other citrus oils.

In the food and beverage industry, orange oil is particularly favored for its fresh, tangy flavor, which is commonly used in soft drinks, candies, and baked goods. Its natural origin aligns with the growing consumer preference for clean-label and organic ingredients. Additionally, orange oil’s antioxidant properties enhance its appeal in the health and wellness sector, contributing to its dominance in the market.

By Purity

Conventional Purity Dominates with 73.8% Share in 2024

In 2024, Conventional purity held a dominant market position, capturing more than a 73.8% share of the citrus oils market. This significant share is largely due to the widespread availability and cost-effectiveness of conventional citrus oils, which are typically produced through traditional extraction methods such as cold-pressing and steam distillation. These methods, while less complex and more affordable than newer extraction techniques, continue to meet the demands of industries such as food and beverage, cleaning, and personal care.

The popularity of conventional citrus oils is driven by their established production processes and their broad acceptance in mainstream applications. They are commonly used for flavoring and fragrance in food products, as well as in cleaning agents due to their natural, fresh scent and effective degreasing properties. The affordability of conventional oils compared to more refined or specialized alternatives makes them a go-to option for many industries, especially in price-sensitive markets.

By Application

Food and Beverages Lead with 41.3% Market Share in 2024

In 2024, Food and Beverages held a dominant market position, capturing more than a 41.3% share of the citrus oils market. The significant market share of this application can be attributed to the widespread use of citrus oils in flavoring and fragrance within food and beverage products. Citrus oils, especially those from oranges, lemons, and limes, are integral in producing fresh, natural flavors for a wide range of products, including soft drinks, candies, bakery goods, and sauces.

The growth in demand for clean-label products and natural ingredients in the food and beverage sector has significantly contributed to the increasing use of citrus oils. Consumers’ growing preference for products made from natural, plant-based ingredients has driven manufacturers to incorporate citrus oils as a key component in various formulations. Additionally, the health benefits associated with citrus oils, such as their antioxidant and anti-inflammatory properties, have boosted their use in beverages, functional foods, and nutritional supplements.

By Sales Channel

Supermarkets/Hypermarkets Capture 29.9% Share in 2024

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 29.9% share of the citrus oils market. This strong presence is largely due to the widespread consumer access and convenience offered by these retail channels. Supermarkets and hypermarkets are the primary distribution points for citrus oils, particularly for end-consumers purchasing products like essential oils, flavored beverages, and cleaning supplies. These outlets benefit from high foot traffic and the ability to offer a wide range of products under one roof, which positions them as a preferred shopping destination for consumers looking for citrus oil-based products.

Supermarkets and hypermarkets also play a significant role in promoting consumer awareness of citrus oils, offering various product categories, such as natural oils, flavorings, and cleaning agents, alongside other mainstream products. The growing trend of health-conscious consumers who seek natural and organic ingredients is also contributing to the increased demand for citrus oils in these stores. The availability of both small and bulk quantities in supermarkets makes citrus oils accessible to a wide demographic, further solidifying this sales channel’s dominant market share.

Key Market Segments

By Material

- Orange Oil

- Lime Oil

- Grapefruit Oil

- Others

By Purity

- Conventional

- Organic

By Application

- Food and Beverages

- Personal Care

- Pharmaceuticals

- Aromatheraphy

- Others

By Sales Channel

- Supermarkets/Hypermarkets

- Departmental Stores

- Convenience Store

- E-commerce Platform

- Others

Drivers

Government Support for Citrus Oil Concentrates

Government initiatives play a crucial role in bolstering the citrus oil concentrates industry by promoting sustainable agricultural practices, enhancing processing technologies, and supporting market expansion.

In the United States, the Department of Agriculture (USDA) has been instrumental in supporting citrus production and processing. For instance, the USDA’s Foreign Agricultural Service reports that U.S. citrus production is forecast to increase by 8% to 1.0 million tons in 2025, attributed to favorable weather conditions and improved yields in California. This boost in production is expected to enhance the availability of raw materials for citrus oil extraction, thereby supporting the growth of the citrus oil concentrate market.

Similarly, in India, the government has implemented various schemes to promote horticulture, including citrus cultivation. The Ministry of Agriculture and Farmers Welfare’s Annual Report highlights initiatives aimed at increasing the area under citrus cultivation, improving productivity, and enhancing post-harvest management. These efforts are designed to boost the production of citrus fruits, thereby providing a steady supply of raw materials for the citrus oil concentrate industry.

Furthermore, the European Union has been actively involved in supporting the citrus sector through its Common Agricultural Policy (CAP). The CAP provides financial assistance to farmers and cooperatives for the adoption of sustainable farming practices and the modernization of processing facilities. Such support is crucial for enhancing the efficiency and competitiveness of the citrus oil concentrate industry in Europe.

Restraints

Climate Change and Disease: Major Constraints on Citrus Oil Production

The citrus oil market faces significant challenges stemming from climate change and plant diseases, which impact both the availability and quality of raw materials.

In the United States, particularly Florida, citrus production has been severely affected by the bacterium Candidatus Liberibacter asiaticus, the causative agent of citrus greening disease. This disease has led to a dramatic decline in orange yields, with Florida’s orange production dropping by over 30% in recent years.

The USDA projects that Florida’s orange crop will reach levels not seen since before World War II, with just over 11.5 million boxes expected during the 2024-2025 growing cycle. This decline is attributed to factors such as hurricanes, trade wars, and the persistent spread of citrus greening disease.

Similarly, Brazil, the world’s largest exporter of orange juice, has experienced a severe drought—the worst in 50 years—coupled with the spread of citrus greening disease. These combined factors have resulted in a projected 25% reduction in orange yields, leading to a significant rise in orange juice prices. Concentrated orange juice futures surged to $4.92 per pound, nearly triple the price from two years ago.

Opportunity

Government Initiatives Boosting Citrus Oil Market Growth

The Indian government’s strategic initiatives are significantly enhancing the growth prospects of the citrus oil market by focusing on quality improvement, infrastructure development, and export promotion.

A notable example is the Clean Plant Programme (CPP), approved in August 2024 with an investment of ₹1,765.67 crore. This initiative aims to provide disease-free planting material to farmers, thereby improving the quality and yield of citrus crops. The programme is being implemented by the National Horticulture Board in collaboration with the Indian Council of Agricultural Research (ICAR) and other research institutes. It is expected to enhance the competitiveness of Indian citrus products in the global market.

Additionally, the Agriculture Infrastructure Fund (AIF) Scheme, launched in July 2020 with a corpus of ₹1,00,000 crore, supports the development of post-harvest infrastructure. In Punjab, for instance, the state has been allotted ₹7,050 crore under this scheme as of February 2025. This funding is being utilized to establish facilities such as pack houses, cold storage units, and processing plants, which are crucial for reducing post-harvest losses and enhancing the shelf life of citrus products.

The Agricultural and Processed Food Products Export Development Authority (APEDA) has been actively promoting citrus exports. In the fiscal year 2023-24, India exported fresh fruits and vegetables worth USD 1,814.58 million, with oranges being a significant contributor. APEDA’s efforts include facilitating registrations, certifications, and providing market linkages to exporters, thereby expanding the reach of Indian citrus products in international markets.

Trends

Government Initiatives Fueling Growth in the Citrus Oil Market

Government initiatives play a pivotal role in driving the growth of the citrus oil market by promoting sustainable agriculture, enhancing processing infrastructure, and expanding export opportunities.

In India, the government’s focus on horticulture has led to the implementation of various schemes aimed at boosting citrus production. The National Horticulture Board (NHB) has been actively involved in providing financial assistance for the development of post-harvest infrastructure, including pack houses and cold storage facilities. These initiatives are designed to reduce post-harvest losses and ensure a steady supply of high-quality citrus fruits for oil extraction.

Additionally, the Agricultural and Processed Food Products Export Development Authority (APEDA) has been instrumental in promoting the export of citrus products. In the fiscal year 2023-24, India exported fresh fruits and vegetables worth USD 1,814.58 million, with oranges being a significant contributor. APEDA’s efforts include facilitating registrations, certifications, and providing market linkages to exporters, thereby expanding the reach of Indian citrus products in international markets.

Regional Analysis

Europe Dominates with 48.3% Share, Valued at 4.2 Billion in 2024

In 2024, Europe held a dominant position in the citrus oils market, capturing more than 48.3% of the market share, valued at USD 4.2 billion. This strong market presence can be attributed to the high demand for citrus oils across various industries, including food and beverages, cosmetics, and cleaning products, which are well-established in the region.

The European market benefits from a significant consumer base that favors natural and clean-label products, driving the consumption of citrus oils in both mainstream and niche applications.

The food and beverage sector in Europe plays a critical role in the demand for citrus oils, with countries like the United Kingdom, Germany, and France being key markets for citrus-based flavoring and fragrances.

Additionally, Europe’s well-developed personal care industry utilizes citrus oils for their refreshing, aromatic, and therapeutic properties, particularly in essential oils, skincare, and perfumes. Furthermore, the rising trend of sustainability and organic products in Europe has further accelerated the demand for natural citrus oil-based ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Young Living Essential Oils is a leading company in the citrus oils market, known for its premium essential oils derived from natural sources. The company offers a variety of citrus oils, including lemon, orange, and lime oils, which are widely used in aromatherapy, personal care, and wellness products. Young Living is recognized for its commitment to quality and sustainability, operating its own farms and employing stringent quality control measures to ensure purity and potency.

Plant Therapy is a prominent supplier of essential oils, including a wide range of citrus oils. The company focuses on providing high-quality, pure essential oils at affordable prices. Plant Therapy’s citrus oils, such as grapefruit, lemon, and orange, are used in various applications, including aromatherapy, cleaning products, and personal care. Plant Therapy is known for its transparency, offering customers access to third-party test results to ensure the quality and authenticity of its oils.

Moksha Lifestyle Products is a key player in the citrus oils market, offering a range of essential oils, including orange, lemon, and lime. The company specializes in natural and organic oils sourced from sustainable farming practices. Moksha Lifestyle Products is recognized for its commitment to purity and providing high-quality essential oils to both the wellness and cosmetic industries. The company also focuses on ensuring the ethical sourcing and production of its citrus oils.

Top Key Players in the Market

- Young Living Essential Oils

- Plant Therapy

- Moksha Lifestyle Products Farotti Essenze

- Mountain Rose Herbs

- Symrise

- Citrosuco

- Firmenich SA

- Biolandes

- Citrus and Allied Essences Ltd.

- Lebermuth, Inc.

- DoTERRA International LLC

- Lionel Hitchen Essential Oils Ltd

- Givaudan SA

Recent Developments

In 2024, Young Living Essential Oils generated approximately $2 billion in revenue, maintaining a steady performance compared to the previous year.

In 2024 Plant Therapy, based in Twin Falls, Idaho, is a prominent player in the essential oils market, specializing in high-quality, affordable products. The company reported an annual revenue of approximately $20 million and employed around 290 individuals.

Report Scope

Report Features Description Market Value (2024) USD 8.8 Bn Forecast Revenue (2034) USD 16.5 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Orange Oil, Lime Oil, Grapefruit Oil, Others), By Purity (Conventional, Organic), By Application (Food and Beverages, Personal Care, Pharmaceuticals, Aromatheraphy, Others), By Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, E-commerce Platform, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Young Living Essential Oils, Plant Therapy, Moksha Lifestyle Products Farotti Essenze, Mountain Rose Herbs, Symrise, Citrosuco, Firmenich SA, Biolandes, Citrus and Allied Essences Ltd., Lebermuth, Inc., DoTERRA International LLC, Lionel Hitchen Essential Oils Ltd, Givaudan SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Young Living Essential Oils

- Plant Therapy

- Moksha Lifestyle Products Farotti Essenze

- Mountain Rose Herbs

- Symrise

- Citrosuco

- Firmenich SA

- Biolandes

- Citrus and Allied Essences Ltd.

- Lebermuth, Inc.

- DoTERRA International LLC

- Lionel Hitchen Essential Oils Ltd

- Givaudan SA