Global Chlorobutyl Rubber Market Size, Share, And Enhanced Productivity By Product Type (Regular Chlorobutyl Rubber, Brominated Chlorobutyl Rubber, Others), By Application (Tubes and Tires, Pharmaceuticals, Adhesives and Sealants, Automotive Parts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173269

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

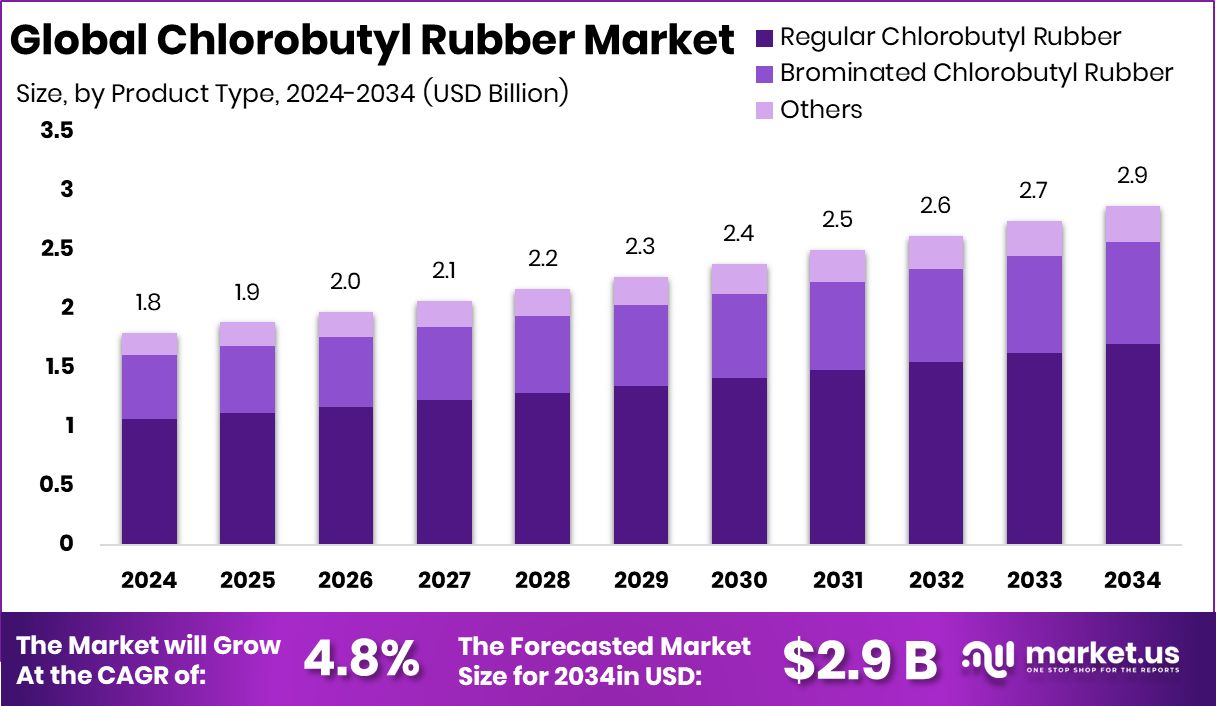

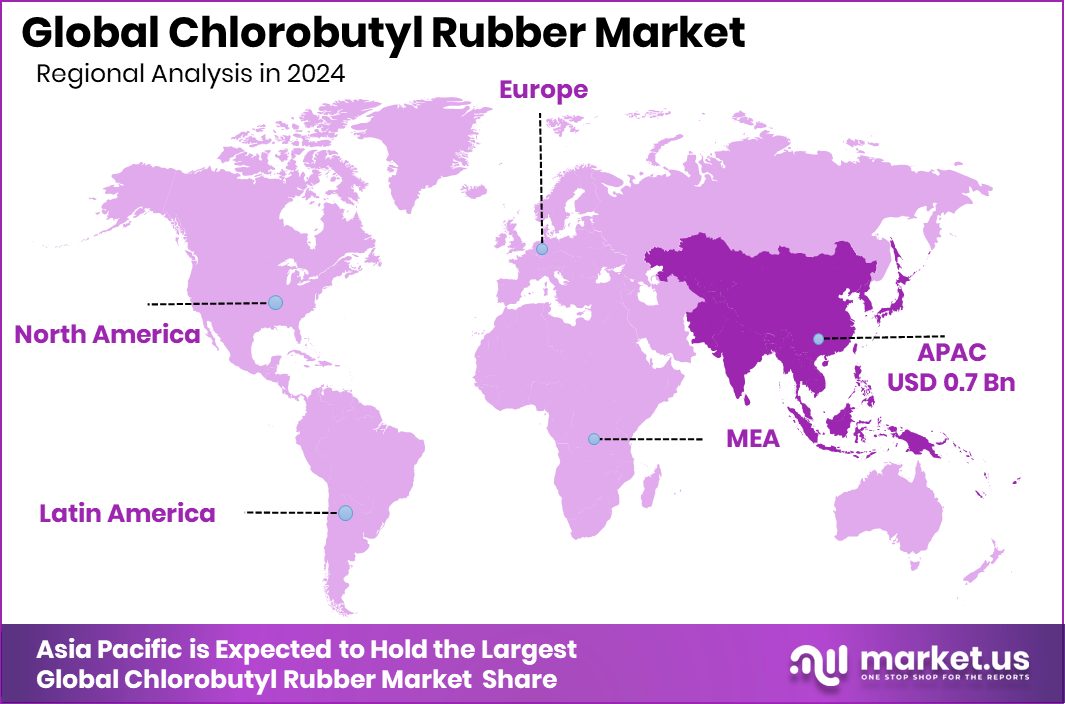

The Global Chlorobutyl Rubber Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. Asia Pacific Chlorobutyl Rubber Market reached 43.80% share, totaling USD 0.7 bn globally.

Chlorobutyl rubber is a synthetic elastomer made by modifying butyl rubber with chlorine. This change improves heat resistance, air retention, and chemical stability. Because of these properties, chlorobutyl rubber is widely used in applications that require long service life, low air permeability, and reliable performance under pressure, especially in tubes, tires, and sealing products.

The chlorobutyl rubber market represents the production, supply, and use of this material across automotive, industrial, pharmaceutical, and construction-related applications. The market connects raw material processing, rubber compounding, and downstream manufacturing. It grows steadily alongside vehicle usage, replacement cycles, and demand for durable rubber components.

Market growth is supported by rising tire replacement needs and upgrades in manufacturing infrastructure. The NCLT approval of a Rs 42.11 cr resolution plan for Innovative Tyres and Tubes highlights renewed industrial activity and capacity stabilization in rubber-based manufacturing, supporting steady material consumption across domestic supply chains.

Demand is further encouraged by regional manufacturing support and innovation-led efficiency improvements. The $25,000 state grant awarded to Des Moines’ Ruster Sports reflects localized production support, while bulk stake movements involving Sigachi Industries and HP Adhesives indicate ongoing capital reallocation within material-focused industries, sustaining operational continuity and demand.

Future opportunities are linked to technology-driven material optimization. Citrine Informatics, raising $16 million in Series C funding, supports advanced chemical design tools that can improve rubber formulations, performance consistency, and processing efficiency, creating long-term value opportunities within the chlorobutyl rubber ecosystem.

Key Takeaways

- The Global Chlorobutyl Rubber Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- Regular chlorobutyl rubber leads the chlorobutyl rubber market with 59.3% share globally across industries.

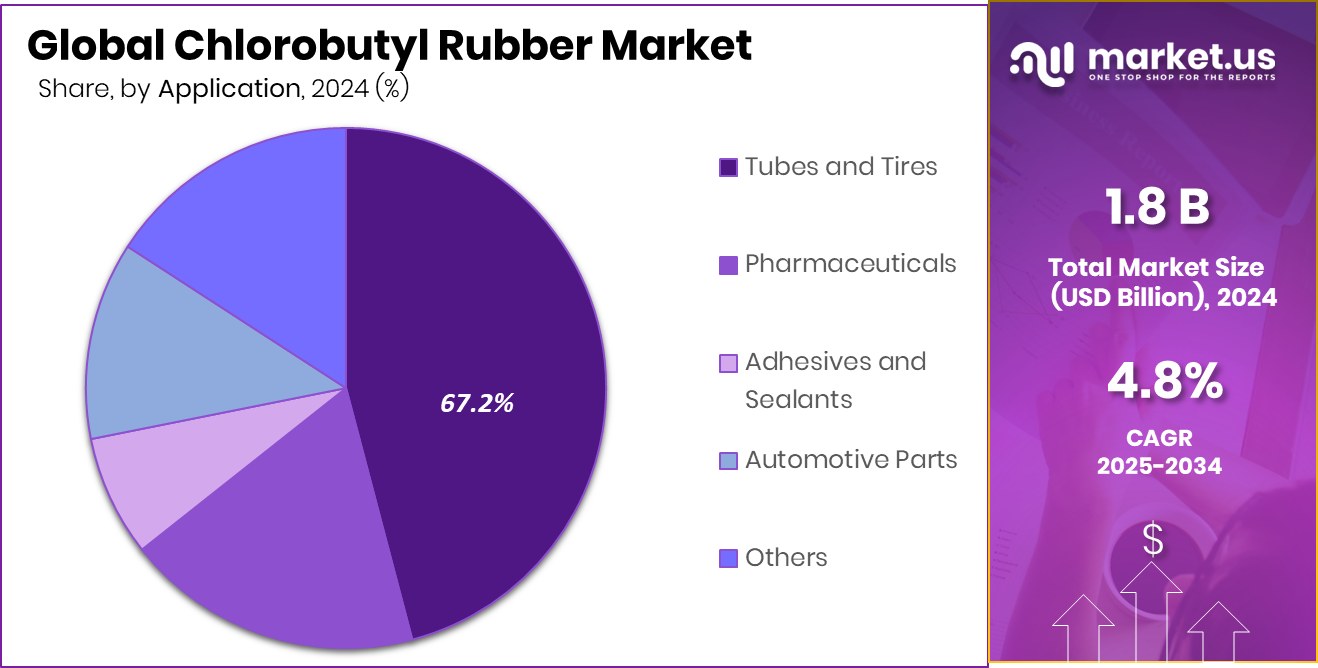

- Tubes and tires dominate the chlorobutyl rubber market by application, with 67.2% share worldwide.

- Demand placed the Asia Pacific Chlorobutyl Rubber Market at 43.80% and USD 0.7 bn.

By Product Type Analysis

Regular chlorobutyl rubber dominates the chlorobutyl rubber market with a 59.3 percent share globally.

In 2024, Regular Chlorobutyl Rubber held a dominant 59.3% share in the Chlorobutyl Rubber Market due to its balanced performance and cost efficiency. This product type is widely preferred because it offers strong air impermeability, good heat resistance, and stable aging properties, which are essential for long-life rubber goods. Manufacturers value regular chlorobutyl rubber for its ease of processing and consistent quality during large-scale production.

It blends well with other elastomers, allowing flexibility in formulation for different end uses. The material also performs reliably under varying temperature and pressure conditions, making it suitable for demanding industrial applications. As industries focus on durability and reduced maintenance, regular chlorobutyl rubber continues to be the first choice across tire, automotive, and industrial rubber segments.

By Application Analysis

Tubes and tires lead the chlorobutyl rubber market applications with a 67.2 percent share.

In 2024, Tubes and Tires accounted for a leading 67.2% share of the Chlorobutyl Rubber Market, driven by rising vehicle production and replacement demand. Chlorobutyl rubber is especially valued in this application because of its excellent air retention, which helps tires maintain pressure for longer periods. This directly improves fuel efficiency, safety, and overall tire lifespan.

The material also shows strong resistance to heat buildup and chemical exposure, which is critical for tires operating under continuous stress. Tube manufacturers rely on chlorobutyl rubber to reduce air loss and improve ride comfort. With increasing focus on performance, safety standards, and long-distance driving needs, the tubes and tires segment remains the largest consumer of chlorobutyl rubber.

Key Market Segments

By Product Type

- Regular Chlorobutyl Rubber

- Brominated Chlorobutyl Rubber

- Others

By Application

- Tubes and Tires

- Pharmaceuticals

- Adhesives and Sealants

- Automotive Parts

- Others

Driving Factors

Strong Investment Interest Supporting Rubber Manufacturing Demand

Growing investment confidence in small and mid-sized industrial companies is acting as a key driving factor for the Chlorobutyl Rubber Market. The trend highlighted by “5 Fundamentally Strong Penny Stocks Down up to 50% from Highs” shows renewed investor focus on undervalued manufacturing and materials-linked businesses. This kind of attention helps improve liquidity, balance sheets, and operational stability for rubber processors and downstream manufacturers.

When capital flows back into production-oriented firms, it supports equipment upgrades, steady raw material purchases, and improved supply reliability. Chlorobutyl rubber benefits directly because it is a core input for essential products like tubes, tires, and seals. As confidence slowly returns to industrial stocks, manufacturers are more willing to plan capacity use and maintain long-term sourcing, supporting consistent demand for chlorobutyl rubber across applications.

Restraining Factors

Capital Shifts Limit Manufacturing Investment and Expansion

Limited access to manufacturing-focused capital is a key restraining factor for the Chlorobutyl Rubber Market. When large funding flows move toward healthcare or financial investment vehicles, industrial materials often receive less attention. The $50m raised by Cohera Medical from KKR shows how investor interest is strongly directed toward medical innovation rather than core manufacturing segments.

Similarly, Pacific Avenue’s First Fund closing at $500 million highlights capital being absorbed by financial asset strategies instead of production capacity or process upgrades. This shift can slow expansion plans for rubber producers, delay modernization, and restrict working capital availability. As a result, some manufacturers remain cautious with output planning and long-term raw material sourcing. Reducing capital focus on industrial operations can limit efficiency improvements, creating cost pressure and slowing overall market momentum.

Growth Opportunity

High Dividend Returns Encourage Long-Term Industrial Expansion

Rising interest in high-return investment stories is creating a growth opportunity for the Chlorobutyl Rubber Market. The example of ₹1 lakh turning into ₹70 lakh with a 175% dividend yield reflects how long-term investors are rewarding stable, cash-generating industrial businesses. Such outcomes encourage fresh capital inflow into manufacturing-linked sectors, including rubber and specialty materials. When investors see strong dividend potential, companies gain confidence to reinvest earnings into capacity use, process improvement, and supply stability.

For chlorobutyl rubber producers, this environment supports steady demand planning and operational continuity. Long-term capital commitment also helps manufacturers focus on quality improvement rather than short-term pricing pressure. As income-focused investors look for reliable industrial performers, chlorobutyl rubber benefits from renewed financial confidence and sustainable growth planning.

Latest Trends

AI-Driven Material Design Transforming Rubber Development Processes

The Chlorobutyl Rubber Market is witnessing a clear shift toward digital and data-led material development. A key trend is the use of artificial intelligence to improve rubber formulation, testing speed, and performance consistency. The $7.5 million seed funding raised by Albert Invent highlights growing confidence in AI and machine-learning software designed specifically for material science research. Such tools help reduce trial-and-error in rubber development and shorten product optimization cycles.

For chlorobutyl rubber producers, this means faster adjustment of properties like air retention, heat resistance, and durability without increasing development costs. AI-based platforms also support better quality control and predictive performance analysis. As manufacturers seek efficiency and precision, digital R&D tools are becoming part of routine development workflows, shaping how chlorobutyl rubber grades are refined and improved.

Regional Analysis

Asia Pacific dominates the Chlorobutyl Rubber Market with 43.80% share at USD 0.7 bn.

The Chlorobutyl Rubber Market shows clear regional differences in demand patterns, industrial maturity, and end-use focus across major global regions. Asia Pacific stands as the dominating region, holding a 43.80% market share and reaching a value of USD 0.7 bn, supported by strong tire manufacturing activity, expanding automotive production, and high consumption of inner tubes across emerging and developed economies. The region benefits from large-scale manufacturing capabilities, cost-efficient processing, and consistent demand from replacement tire markets.

North America follows with stable consumption driven by established automotive and industrial rubber sectors, where product quality, performance consistency, and regulatory compliance shape purchasing decisions. Europe reflects steady demand supported by advanced tire technologies, emphasis on durability, and controlled production volumes aligned with environmental standards.

The Middle East & Africa region shows gradual growth as infrastructure development and vehicle usage increase, creating steady demand for durable rubber materials. Latin America maintains a moderate market presence, supported by regional automotive assembly and aftermarket tire demand, with consumption largely tied to economic conditions and vehicle parc stability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Exxon Mobil Corporation plays a critical role in the chlorobutyl rubber space through its strong integration across refining, petrochemicals, and specialty elastomers. In 2024, the company’s strength lies in process consistency, product reliability, and global manufacturing discipline. Its focus on operational efficiency and quality control supports long-term supply relationships with tire and industrial rubber manufacturers that demand stable performance and uniform material behavior.

LANXESS International SA remains a technology-driven participant in the chlorobutyl rubber market, emphasizing material science expertise and application-specific solutions. In 2024, the company’s positioning is shaped by its deep know-how in synthetic elastomers and its ability to tailor rubber grades for demanding tire and automotive applications. LANXESS benefits from close collaboration with downstream customers seeking improved durability and processing performance.

Reliance Sibur Elastomers Private Limited represents a strategically important producer with a strong regional manufacturing focus. In 2024, the company leverages integrated feedstock access and modern production assets to serve growing demand efficiently. Its operational model supports competitive supply within high-consumption markets, reinforcing its relevance in meeting volume-driven requirements for tubes, tires, and industrial rubber products.

Top Key Players in the Market

- Exxon Mobil Corporation

- Lanxess International SA

- Reliance Sibur Elastomers Private Limited

- Hebei Xiangyi International Trading Co., Ltd.

- POLYPLAST

- ARLANXEO

- YUSHENG ENTERPRISE LIMITED

- ENEOS Materials Corporation

- ELGI Rubber

Recent Developments

- In July 2024, ARLANXEO announced a sustainability milestone at the DKT exhibition in Nuremberg, Germany. The company achieved ISCC PLUS certifications for multiple production sites, including its butyl plant in Singapore, enabling a broader range of eco-labelled synthetic rubber products. This reflects steps toward more responsible materials that maintain performance while tracking sustainable feedstock.

- In February 2024, POLYPLAST took part in PAINTINDIA 2024 held in Mumbai, one of the world’s largest exhibitions for paints, coatings, and allied industries. This participation reflects the company’s effort to increase its international presence and visibility for chemical products, though not a direct product launch specific to chlorobutyl rubber.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 2.9 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Regular Chlorobutyl Rubber, Brominated Chlorobutyl Rubber, Others), By Application (Tubes and Tires, Pharmaceuticals, Adhesives and Sealants, Automotive Parts, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Exxon Mobil Corporation, Lanxess International SA, Reliance Sibur Elastomers Private Limited, Hebei Xiangyi International Trading Co., Ltd., POLYPLAST, ARLANXEO, YUSHENG ENTERPRISE LIMITED, ENEOS Materials Corporation, ELGI Rubber Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chlorobutyl Rubber MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Chlorobutyl Rubber MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Exxon Mobil Corporation

- Lanxess International SA

- Reliance Sibur Elastomers Private Limited

- Hebei Xiangyi International Trading Co., Ltd.

- POLYPLAST

- ARLANXEO

- YUSHENG ENTERPRISE LIMITED

- ENEOS Materials Corporation

- ELGI Rubber