Global (Chloro)-Dimethylsilane Market Size, Share, And Industry Analysis Report By Purity (Greater-than 80%, Greater-than 98%, Others), By Form (Liquid, Solid, Gas), By End Use (Chemical Manufacturing, Pharmaceutical Industry, Agriculture, Construction, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171859

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

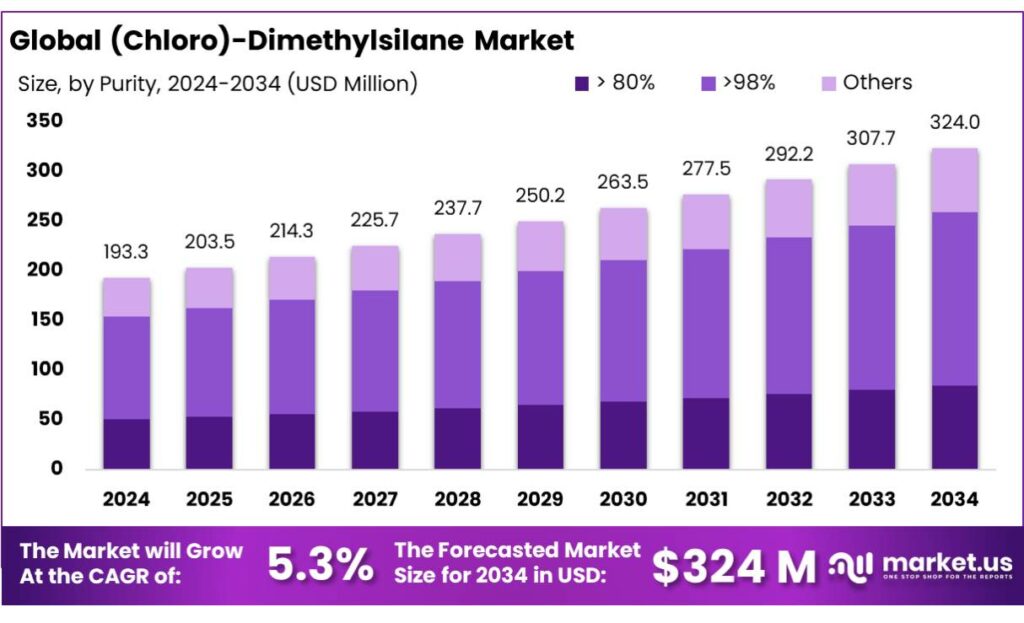

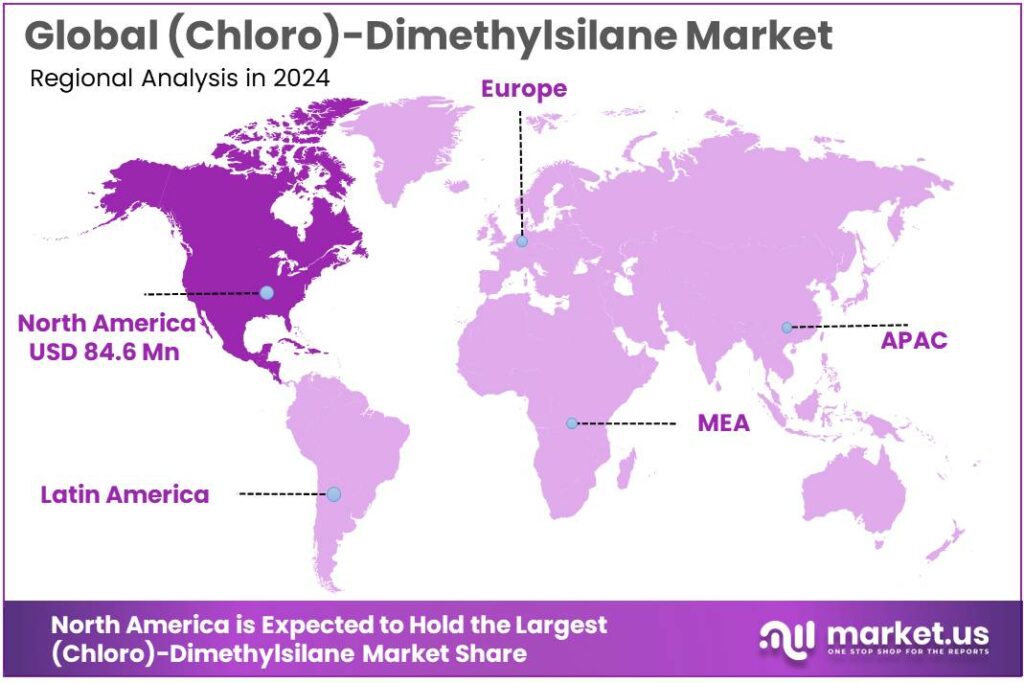

The Global (Chloro)-Dimethylsilane Market size is expected to be worth around USD 324.0 Million by 2034, from USD 193.3 Million in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.80% share, holding USD 84.6 Million in revenue.

(Chloro)-Dimethylsilane is a reactive organosilicon intermediate used to build higher-value silanes and silicone materials. Its industrial handling is shaped by its “highly volatile + moisture-sensitive” profile: it boils at about 34.7 °C and is classified with flammability/corrosivity/toxicity hazards in standard classification systems, which pushes producers toward closed systems, dry inert transfer, and tight purification control for downstream quality.

Demand drivers are increasingly downstream-led. In electronics, investment cycles matter because organosilicon intermediates ultimately support encapsulants, coatings, sealants, and process materials used in chip packaging and device protection. Global semiconductor sales reached $627.6 billion in 2024, which signals sustained pull for materials ecosystems that sit behind fabs, OSAT, and electronics manufacturing. At the same time, policy is reinforcing capacity build-outs: the U.S. CHIPS programs were funded at $50 billion to strengthen semiconductor R&D and manufacturing, the EU Chips Act targets €43 billion of policy-driven investment through 2030, and India’s Semicon India program carries an outlay of ₹76,000 crore—all of which translate into multi-year demand visibility for electronics-linked chemical supply chains.

Food-industry and “regulated use” dynamics also shape opportunity. One important downstream outlet for silicone chemistry is food processing aids such as antifoams based on dimethylpolysiloxane (E900). U.S. federal rules allow dimethylpolysiloxane as a defoaming agent at 10 parts per million in food in its ready-for-consumption state. On the safety side, the FAO/WHO JECFA database lists an acceptable daily intake (ADI) for polydimethylsiloxane of 0–1.5 mg/kg body weight. In the EU, EFSA’s re-evaluation also references the 1.5 mg/kg bw/day ADI history for E900.

Regulatory and logistics requirements also shape production and trade flows. Under EU REACH, chlorodimethylsilane’s registered “total tonnage band” is reported as ≥1,000 to <10,000 tonnes—a signal that it is handled at meaningful industrial scale in Europe and must meet registration, safety, and exposure-control expectations typical for reactive intermediates. In transport, Safety Data Sheets commonly classify it under UN 2924 with hazard class labeling that combines flammability and corrosivity (often shown as Class 3 with additional corrosive labeling), which adds packaging, storage, and carrier constraints that favor experienced, integrated chemical logistics networks.

Key Takeaways

- (Chloro)-Dimethylsilane Market size is expected to be worth around USD 324.0 Million by 2034, from USD 193.3 Million in 2024, growing at a CAGR of 5.3%.

- >98% held a dominant market position, capturing more than a 54.6% share.

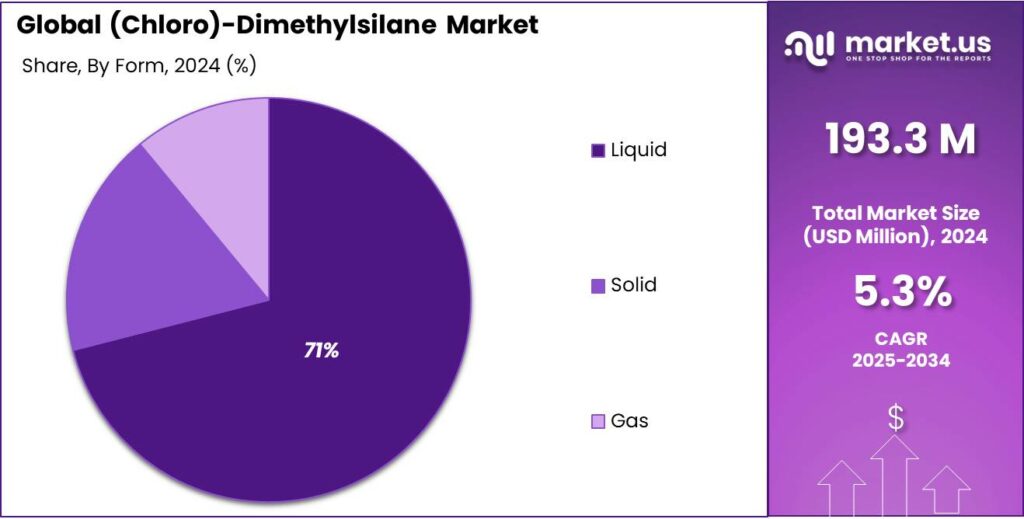

- Liquid held a dominant market position, capturing more than a 71.3% share in the (Chloro)-Dimethylsilane market.

- Chemical Manufacturing held a dominant market position, capturing more than a 44.8% share.

- North America emerged as a key regional contributor to the (Chloro)-Dimethylsilane market, securing a dominant 43.80% share with an estimated USD 84.6 million.

By Purity Analysis

High-purity >98% (Chloro)-Dimethylsilane leads with a 54.6% share due to strong quality demand

In 2024, >98% held a dominant market position, capturing more than a 54.6% share in the (Chloro)-Dimethylsilane market, driven by widespread demand for high-purity material in advanced applications such as pharmaceutical intermediates, high-precision silicone synthesis, and semiconductor fabrication. Products with purity greater than 98% were preferred by manufacturers focused on achieving consistent performance, minimal impurities, and tighter process control. During the year, industries with stringent quality standards continued to adopt this high-purity segment due to its ability to deliver stable reactivity and predictable results in sensitive chemical processes.

In 2025, demand for >98% purity (Chloro)-Dimethylsilane remained robust, supported by growth in electronics manufacturing and speciality chemicals sectors, which prioritized high-quality inputs to meet performance and regulatory requirements. Continued investments in high-tech industries and rising product acceptance in downstream applications further reinforced the leadership of the >98% segment, as producers sought reliable raw materials to enhance end-product integrity and operational efficiency across diverse industrial uses.

By Form Analysis

Liquid form dominates with a strong 71.3% share due to ease of handling and broad application use

In 2024, Liquid held a dominant market position, capturing more than a 71.3% share in the (Chloro)-Dimethylsilane market, driven by its practicality and widespread adoption across chemical synthesis, silicone production, and semiconductor processes. The liquid form was preferred for its ease of transport, dosing accuracy, and compatibility with automated handling systems in manufacturing environments where precision and efficiency are critical. During the year, industries requiring consistent quality and straightforward integration into existing workflows relied heavily on liquid formulations to ensure process stability and reduce operational complexity.

In 2025, the liquid segment maintained its leadership as production volumes continued to rise in pharmaceuticals, specialty chemicals, and electronics sectors, supported by ongoing investments in high-purity liquid feedstocks. The sustained preference for liquid (Chloro)-Dimethylsilane reflected its role in enabling smoother processing, improved yield control, and reduced need for additional formulation steps. Continued advancements in packaging and safety standards also supported increased utilization of liquid products, reinforcing their dominant position within the market as industries expanded and diversified their end-use applications.

By End Use Analysis

Chemical manufacturing leads with a 44.8% share due to broad industrial use and process integration

In 2024, Chemical Manufacturing held a dominant market position, capturing more than a 44.8% share in the (Chloro)-Dimethylsilane market as producers increasingly relied on this key intermediate for synthesizing silicones, specialty chemicals, and intermediates used across coatings, sealants, and elastomers. The segment’s prominence was supported by steady growth in downstream chemical industries that required reliable, high-quality raw materials to maintain product performance and regulatory compliance. During 2024, chemical manufacturers prioritized materials that offered consistency and ease of integration into established production lines, driving higher consumption of (Chloro)-Dimethylsilane in formulations and reactions central to industrial production.

In 2025, demand within the chemical manufacturing segment remained robust, bolstered by expanded capacity investments and increasing output in end-use applications such as advanced materials and fine chemicals. Continued focus on process efficiency and product quality reinforced this segment’s leadership, as manufacturers harnessed the versatility of (Chloro)-Dimethylsilane to support innovation and meet evolving market needs. The sustained preference for this end-use category reflected its foundational role in enabling essential chemical processes that underpin broader industrial growth.

Key Market Segments

By Purity

- > 80%

- >98%

- Others

By Form

- Liquid

- Solid

- Gas

By End Use

- Chemical Manufacturing

- Pharmaceutical Industry

- Agriculture

- Construction

- Automotive

- Others

Emerging Trends

Specialty-grade silicones are rising as food plants modernize

A clear latest trend shaping the (Chloro)-Dimethylsilane space is the move toward specialty, higher-performance silicone materials that are easier to validate for hygienic operations. Chlorodimethylsilane is not a food ingredient, but it is a key upstream building block used in producing functional silicones and silanes that end up in food processing equipment—think seals, gaskets, tubing, release surfaces, and protective coatings. In 2024–2025, more food manufacturers are upgrading lines for automation, faster changeovers, and tighter contamination control. That kind of upgrade quietly favors silicone materials because they handle heat, repeated washdowns, and strong cleaning routines better than many conventional elastomers.

What makes this trend “real” is that compliance is defined in numbers, not opinions. In the U.S., FDA regulation 21 CFR 177.2600 sets specific extractables limits for rubber articles intended for repeated food contact. For aqueous foods, total extractives must not exceed 20 milligrams per square inch in the first 7 hours and 1 milligram per square inch in the succeeding 2 hours. For fatty foods (using n-hexane), extractives must not exceed 175 milligrams per square inch in the first 7 hours and 4 milligrams per square inch in the next 2 hours. These limits are one reason buyers increasingly prefer well-documented silicone formulations and consistent supply chains—because failing a compliance test can stop a line, delay commissioning, or trigger costly rework.

You can also see the same “specialties first” trend in how major producers talk about their silicone business. WACKER reported Silicones sales of €2.81 billion in 2024 (up from €2.74 billion in 2023) and attributed the improvement mainly to a better product mix with a higher share of specialty products. A market moving toward specialties typically means more formulation work, more controlled chemistry, and higher requirements for consistency—again reinforcing the role of reactive organosilicon intermediates.

Government-led capacity building in food processing is adding fuel to this shift in 2025, because new plants and expanded lines usually adopt modern hygienic standards from day one. India’s official updates on the PLI Scheme for Food Processing state that the scheme has led to an increase in food processing capacity of 35.00 lakh MT per annum. More capacity means more equipment, more maintenance cycles, and more replacement demand for hygienic components—areas where silicone materials are often chosen when buyers want durability plus compliance comfort.

Drivers

Food-grade compliance is lifting demand for organosilicon intermediates

A major driving factor for (Chloro)-dimethylsilane is the steady “pull” from food-contact and hygienic processing applications that rely heavily on silicone elastomers, seals, hoses, and gaskets. In real plants, operators want materials that tolerate hot washdowns, steam, and repeated cleaning without leaching, cracking, or creating contamination risks. That naturally supports higher consumption of silicone intermediates because chlorodimethylsilane is a workhorse building block used to make functional silanes and silicone polymers that ultimately end up in these durable, inert components.

Regulation is a big part of why this driver stays consistent year after year. In the U.S., FDA’s 21 CFR 177.2600 sets clear extractables limits for rubber articles intended for repeated use in food contact. For aqueous foods, total extractives must not exceed 20 mg/sq in during the first 7 hours of extraction and 1 mg/sq in during the succeeding 2 hours. For fatty foods, extractives must not exceed 175 mg/sq in during the first 7 hours and 4 mg/sq in during the succeeding 2 hours. These numeric thresholds encourage processors and equipment OEMs to specify materials and formulations that can reliably pass compliance checks—one practical reason silicone-based solutions keep gaining preference in seals and flexible parts, indirectly supporting upstream organosilicon demand.

Industry performance data also points to a healthier mix shift toward specialties, which tends to favor intermediates like chlorodimethylsilane that enable tailored chemistries. WACKER reported its Silicones segment sales of €2.81 billion in 2024 versus €2.74 billion in 2023, noting that the change was driven mainly by an improved product mix with a higher proportion of specialty products. Specialty growth matters because it usually means more formulation work, more functionalization steps, and tighter quality requirements—conditions where reactive intermediates are consumed more consistently than in purely commodity cycles.

In parallel, governments are also strengthening the broader advanced-manufacturing base that consumes high-purity silicones and silanes, which helps keep capacity utilization and investment appetite firm. For instance, India’s government-approved Semicon India programme carries a total outlay of ₹76,000 crore to build semiconductor and display manufacturing ecosystems.

Restraints

Stricter safety and regulatory burdens create headwinds for (Chloro)-Dimethylsilane growth

One of the clearest restraining factors for the (Chloro)-dimethylsilane market is the growing safety scrutiny and regulatory compliance requirements placed on reactive intermediates used in chemical manufacturing, especially when such chemicals may intersect with industries that touch food systems or involve strict environmental rules. Chlorodimethylsilane is a highly reactive organosilicon intermediate, and although it is not directly used in food products, its production, storage, handling and potential trace contamination carry regulatory attention that can slow investment, complicate permitting, and increase compliance cost.

At the European level, chemical intermediates such as chlorodimethylsilane fall under the REACH Regulations, which require producers and importers to register substances made in amounts of ≥1,000 to <10,000 tonnes per year with the European Chemicals Agency (ECHA). This registration is not a simple paperwork exercise; it involves detailed hazard data, exposure scenarios, and safety assessments that can stretch over years of technical effort and cost. For mid-sized and smaller manufacturers, meeting REACH’s technical data requirements and updating safety dossiers as governance evolves can divert resources away from expansion plans and constrain operational flexibility.

These safety and reporting burdens become even more acute in jurisdictions with stringent chemical safety frameworks. Across both the EU and the U.S., regulatory authorities are tightening oversight of chemicals that interact with food processing environments, food contact surfaces, or potential environmental exposure pathways. For example, the U.S. Food and Drug Administration (FDA) has enhanced its approach to chemical safety by improving tools like the Expanded Decision Tree (EDT) for prioritizing chemicals for safety evaluation. This tool, released publicly in July 2025, is designed to screen chemicals for chronic toxic potential based on structural features and may result in more costly toxicological testing and deeper scrutiny for substances used in or around food systems.

These regulatory headwinds carry real financial implications. Complying with multidimensional safety frameworks—encompassing hazard communication, industrial hygiene measures, environmental reporting, and registration dossiers—raises entry barriers for new producers and adds ongoing costs for existing manufacturers. For chemicals like chlorodimethylsilane, which are moisture-reactive and require specialized containment and transport, regulators can mandate extra layers of engineering controls, monitoring systems, and detailed compliance reporting that smaller players in particular may struggle to absorb.

Opportunity

Food processing expansion is boosting demand for food-safe silicone materials

One of the biggest growth opportunities for (Chloro)-dimethylsilane comes from the steady expansion and modernization of the food processing and packaging ecosystem. The molecule itself is not a food ingredient, but it is an upstream building block used to make silicone elastomers and functional silanes that end up in food plants as gaskets, seals, hoses, tubing, coatings, and release surfaces. When processors add new lines, move from manual handling to automated filling, or upgrade to hygienic design, they typically replace older elastomers with more stable materials. That replacement cycle creates long-lasting pull for higher-quality silicone chemistry—and that demand flows back to intermediates like chlorodimethylsilane.

In the U.S., 21 CFR 177.2600 sets extractables limits for rubber articles intended for repeated food contact. For aqueous food contact, total extractives must not exceed 20 mg/sq in during the first 7 hours and 1 mg/sq in during the succeeding 2 hours; for fatty food contact (n-hexane), limits are 175 mg/sq in in the first 7 hours and 4 mg/sq in in the next 2 hours. These thresholds push food equipment buyers toward materials that can consistently pass testing, and silicone often benefits because it holds up well under heat, cleaning, and repeated cycles. Every time a plant standardizes on compliant silicone parts, upstream producers are encouraged to expand specialty output—where chlorodimethylsilane is used as a reactive intermediate to tune polymer properties and performance.

In 2024 and 2025, government-led growth in food processing capacity adds another strong tailwind. India’s Ministry of Food Processing Industries runs the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) with a budget outlay of ₹10,900 crore, implemented from 2021-22 to 2026-27, and official updates note 171 applicants enrolled under the scheme. A Parliament reply also states the scheme has led to an increase in food processing capacity of 35.00 lakh MT per annum. On the small-industry side, the PMFME scheme envisages an outlay of ₹10,000 crore over 2020-21 to 2024-25 and targets support for 2,00,000 micro food processing units. These programs matter because adding capacity and upgrading equipment usually increases demand for hygienic components, sealing systems, and compliant elastomers—exactly where silicone-based materials are widely specified.

Regional Insights

North America leads the (Chloro)-Dimethylsilane market with a 43.80% share, generating USD 84.6 Million amid strong industrial demand

In 2024, North America emerged as a key regional contributor to the (Chloro)-Dimethylsilane market, securing a dominant 43.80% share with an estimated USD 84.6 million in revenue, supported by a highly developed chemical manufacturing base and strong demand from specialty sectors such as pharmaceuticals, electronics, and advanced materials. The United States remained the largest national contributor within North America, driven by continued investment in high-purity chemical intermediates and sophisticated manufacturing infrastructure that supports silicone synthesis, semiconductor components, and pharmaceutical intermediates. The region’s stringent quality and regulatory standards encouraged adoption of high-grade (Chloro)-Dimethylsilane, particularly in applications where product performance and consistency are critical.

During 2024, demand was further bolstered by expansions in pharmaceutical production and advanced material development, reflecting North America’s leadership in innovation and high-value chemical sectors. In 2025, although Asia Pacific continued growth momentum globally, North America maintained its strong position as a leading regional market, reinforced by continued research and development activities and a mature supply chain capable of meeting exacting industrial requirements.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Shin-Etsu Chemical: In 2024, Shin-Etsu Chemical Co., Ltd. accounted for an estimated ~8–15% share as a key producer of high-quality (Chloro)-Dimethylsilane, particularly for electronics and healthcare sectors. Shin-Etsu’s strong integration with downstream silicone manufacturing and advanced purification capabilities supported robust demand in Asia and globally.

Evonik Industries: In 2024, Evonik Industries AG held around ~12–18% share of the (Chloro)-Dimethylsilane market, strengthened by its high-purity SilGuard product line and specialty chemical expertise. Evonik’s facilities in Europe and North America supported reliable delivery to semiconductor and precision chemical producers.

Momentive Performance Materials: In 2024, Momentive Performance Materials Inc. secured roughly ~10% share, with its Silquest DMS series widely used in adhesives, resins, and specialty silicones across North America and Asia. The company’s emphasis on tailored formulations and broad geographic reach supported stable market position.

Top Key Players Outlook

- Dow Chemical

- Wacker Chemie AG

- Shin-Etsu Chemical

- Evonik Industries

- Momentive Performance Materials

- Hubei Xingfa Chemicals Group

- Zhejiang Jianye Chemical

Recent Industry Developments

In 2024, Dow Chemical Company continued to shape the (Chloro)-Dimethylsilane sector as a key producer of chlorosilane intermediates used in silicones, coatings and specialty chemical syntheses, supported by its extensive materials science portfolio and global manufacturing reach. Dow reported total net sales of approximately USD 43 billion in 2024, with its Industrial Intermediates & Infrastructure segment, which includes silicon-based feedstocks and intermediates, contributing significantly to output volumes and customer supply reliability.

In 2024, Wacker Chemie AG maintained a notable presence in the (Chloro)-Dimethylsilane sector through its silicones and silane-based intermediates, which form essential inputs for specialty chemicals and performance materials used in coatings, sealants, electronics, and silicone synthesis. The company reported annual sales of approximately €5.72 billion in 2024, with its Silicones division generating €2.805 billion and showing a 3.8% year-on-year increase, underscoring demand for high-quality silane and silicone products that support downstream chemical manufacturing processes.

Report Scope

Report Features Description Market Value (2024) USD 193.3 Mn Forecast Revenue (2034) USD 324.0 Mn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Greater-than 80%, Greater-than 98%, Others), By Form (Liquid, Solid, Gas), By End Use (Chemical Manufacturing, Pharmaceutical Industry, Agriculture, Construction, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow Chemical, Wacker Chemie AG, Shin-Etsu Chemical, Evonik Industries, Momentive Performance Materials, Hubei Xingfa Chemicals Group, Zhejiang Jianye Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  (Chloro)-Dimethylsilane MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

(Chloro)-Dimethylsilane MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow Chemical

- Wacker Chemie AG

- Shin-Etsu Chemical

- Evonik Industries

- Momentive Performance Materials

- Hubei Xingfa Chemicals Group

- Zhejiang Jianye Chemical