Global Cheese Concentrates Market Size, Share, And Enhanced Productivity By Product (Mozzarella Cheese, Cheddar Cheese, Parmesan Cheese, Swiss Cheese, Goat Cheese, Blue Cheese, Others), By Form (Powder, Paste / Spread, Chunk, Grated, Others), By Application (Bakery and Confectionery, Processed Cheese, Sauces, Dressings, Dips and Condiments, Dairy and Desserts, Snacks and Savory Items, Ready Meal Production, Others), By Sales Channel (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Discount Stores, Food Specialty Stores, Independent Small Groceries, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170754

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

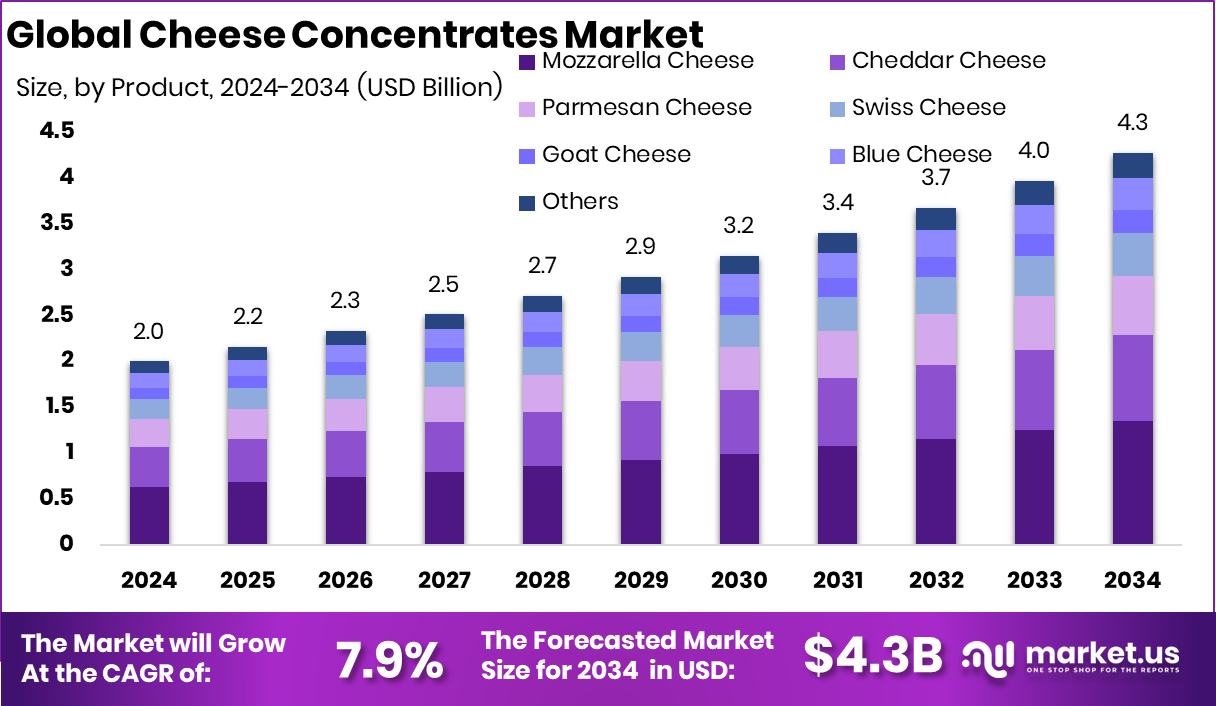

The Global Cheese Concentrates Market is expected to be worth around USD 4.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034. North America accounted for 37.2% of the Cheese Concentrates Market, valued at USD 0.7 Bn.

Cheese concentrates are condensed dairy-based or fermented ingredients made by removing excess moisture while keeping the core cheese flavor, aroma, and functional properties. They are used to add consistent cheese taste, texture, and richness in food products without relying on large quantities of natural cheese. This makes them practical for controlled formulation, longer shelf life, and uniform results across batches.

The Cheese Concentrates Market covers the production and use of these concentrated cheese ingredients across food manufacturing. It serves applications where stability, flavor consistency, and ease of handling matter. Investment in traditional and alternative cheese infrastructure continues to support this market. For example, The Orkney Cheese Company Limited secured up to £370,000 from Highlands and Islands Enterprise to upgrade its production facility, while a historic Derbyshire cheese-maker received an £8.5m bank funding boost.

Growth is supported by resilience-focused funding for protected cheese production and regional food systems. The European Commission allocated €6.8m in resilience funding for protected cheeses and vineyards, helping maintain quality standards and production continuity. Such support strengthens supply stability and encourages innovation in concentrated cheese formats.

Demand is influenced by shifts toward alternative cheese technologies and changing funding landscapes. Vienna-based Fermify raised €5 million to scale vegan cheese production, while Climax Foods, now Bettani Farms, secured $6.5m alongside leadership changes. At the same time, policy shifts like 83% of USAID contracts being canceled increase focus on private funding and efficiency-driven ingredient solutions.

Opportunities lie in brand expansion and diversified cheese formats. Parmela Creamery raised $1.25M to grow brand recognition, signaling room for concentrated cheese ingredients to support scalable, cost-efficient production.

Key Takeaways

- The Global Cheese Concentrates Market is expected to be worth around USD 4.3 billion by 2034, up from USD 2.0 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034.

- Mozzarella cheese leads the cheese concentrates market with 31.5% share, driven by pizzas, ready meals.

- Powder form dominates the cheese concentrates market at 38.2% due to longer shelf life, handling convenience.

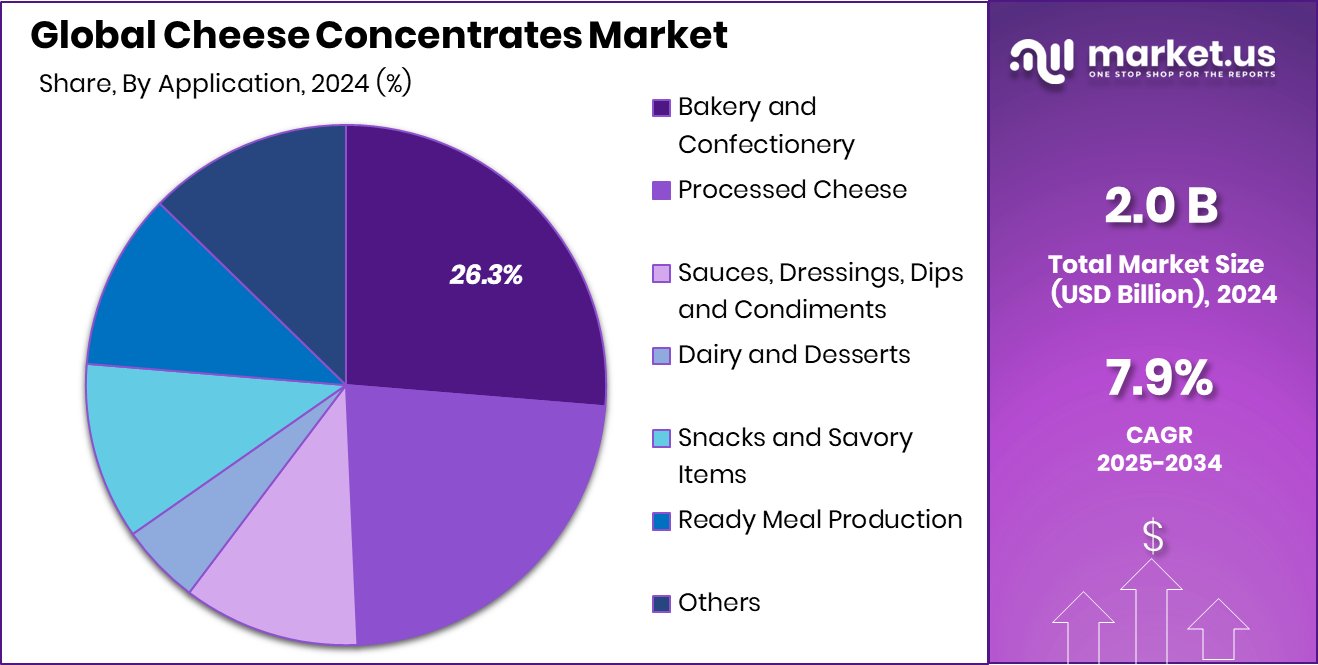

- Bakery and confectionery applications hold a 26.3% share, supported by rising cheese-flavored snacks and desserts globally.

- Hypermarkets and supermarkets account for 31.8% sales, benefiting from wide assortments and strong consumer trust.

- Cheese Concentrates Market in North America held 37.2% share, generating USD 0.7 Bn.

By Product Analysis

In the cheese concentrates market, mozzarella leads the products, holding a 31.5% share globally.

In 2024, Mozzarella Cheese held a dominant market position in the By Product segment of Cheese Concentrates Market, with a 31.5% share. This leadership reflects mozzarella’s broad acceptance across both foodservice and industrial food preparation, where consistent flavor, stretchability, and mild taste are highly valued. Cheese concentrates derived from mozzarella are widely preferred for delivering uniform sensory profiles while maintaining formulation efficiency.

The strong share also highlights mozzarella’s role as a dependable base ingredient in processed food manufacturing. Its balanced fat and protein profile allows manufacturers to achieve predictable texture and taste outcomes, supporting large-scale production. As a result, mozzarella-based cheese concentrates continue to remain central to standardized recipes and commercial food applications.

By Form Analysis

Powder form dominates the concentrates market due to convenience, accounting for 38.2% usage.

In 2024, Powder held a dominant market position in the By Form segment of Cheese Concentrates Market, with a 38.2% share. Powdered cheese concentrates are favored for their ease of handling, extended shelf stability, and compatibility with dry and blended food systems. These characteristics make them a practical option for manufacturers seeking efficiency in storage and transportation.

The dominance of powder form also reflects its versatility in formulation, allowing precise dosing and uniform dispersion in recipes. Its consistent quality and reduced moisture content help maintain product stability during processing. This reliability has positioned powdered cheese concentrates as a preferred choice for large-scale food production environments.

By Application Analysis

Bakery and confectionery applications drive cheese concentrates demand, representing 26.3% share.

In 2024, Bakery and Confectionery held a dominant market position in By Application segment of the Cheese Concentrates Market, with a 26.3% share. Cheese concentrates are increasingly used in bakery and confectionery products to enhance flavor depth while maintaining product consistency. Their concentrated nature allows bakers to achieve rich cheese notes without altering the dough structure.

This segment’s strong share indicates steady demand for value-added baked goods where taste differentiation matters. Cheese concentrates support controlled flavor release during baking, helping manufacturers deliver uniform quality across batches. Their functional performance and flavor stability make them well-suited for bakery and confectionery formulations.

By Sales Channel Analysis

Hypermarkets and supermarkets remain key sales channels, capturing 31.8% market share.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Sales Channel segment of the Cheese Concentrates Market, with a 31.8% share. These retail formats remain key distribution points due to their wide product assortment and strong consumer reach. Cheese concentrates benefit from prominent shelf placement and easy accessibility in these stores.

The leadership of this channel also reflects consumer preference for one-stop shopping environments. Hypermarkets and supermarkets support steady sales volumes by offering reliable availability and brand visibility. This channel continues to play a critical role in connecting cheese concentrate products with end users efficiently.

Key Market Segments

By Product

- Mozzarella Cheese

- Cheddar Cheese

- Parmesan Cheese

- Swiss Cheese

- Goat Cheese

- Blue Cheese

- Others

By Form

- Powder

- Paste / Spread

- Chunk

- Grated

- Others

By Application

- Bakery and Confectionery

- Processed Cheese

- Sauces, Dressings, Dips, and Condiments

- Dairy and Desserts

- Snacks and Savory Items

- Ready Meal Production

- Others

By Sales Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Mom and Pop Stores

- Discount Stores

- Food Specialty Stores

- Independent Small Groceries

- Online Retail

- Others

Driving Factors

Rising Investment in Animal-Free and Alternative Cheese Innovation

One major driving factor for the Cheese Concentrates Market is the rapid growth of animal-free and alternative cheese development, supported by strong private funding and corporate backing. Food innovators are working to replicate the taste and functionality of traditional cheese using fermentation and protein science. This progress increases demand for cheese concentrates that deliver consistent flavor and performance in new formulations.

Several funding rounds highlight this momentum. Formo secured a record USD 50 million Series A to scale animal-free mozzarella and ricotta. Climax Foods, now rebranded as Bettani Farms, raised USD 6.5 million to develop protein-rich vegan cheese. New Culture raised USD 25 million, backed by ADM, Kraft, and Dr Oetker, to commercialize bovine-free mozzarella using precision fermentation, achieving functional cheese with 50% less casein.

Restraining Factors

High Investment Pressure Slows Traditional Market Growth

A key restraining factor for the Cheese Concentrates Market is the rising investment flow toward vegan and fermented cheese alternatives, which shifts attention away from conventional dairy-based concentrates. Startups focused on plant-based and animal-free cheese are attracting strong funding, increasing competition for traditional cheese concentrate producers, and slowing adoption in some applications.

Several funding examples show this shift. Italy’s Dreamfarm raised €5 million for Mandorla Mozzarella, a fermented vegan cheese. A startup developing stretchy vegan cheese from soybeans secured USD 75 million, backed by Ironman and Bill Gates. New Culture also secured USD 5 million in early demand for animal-free mozzarella. Misha’s expanded after a USD 3 million celebrity-backed seed round, while Mr. & Mrs. Watson raised €700,000 to scale artisan vegan cheese.

Growth Opportunity

Expansion of Alternative Cheese Boosts Ingredient Demand

A major growth opportunity for the Cheese Concentrates Market comes from the rapid expansion of plant-based and animal-free cheese brands entering new regions and scaling production. As these companies grow, they increasingly rely on cheese concentrates to achieve stable taste, texture, and performance across different product formats. This creates new demand for specialized concentrates suited for modern cheese alternatives.

Recent funding activity highlights this opportunity. Armored Fresh from South Korea raised USD 23 million to fast-track its vegan cheese entry into the U.S. market. Perfect Day closed a USD 140 million funding round led by Temasek, bringing its total funding to USD 201.5 million, strengthening animal-free dairy protein production. Nobell Foods raised USD 75 million for plant-based cheese expansion, while Good Planet secured USD 12 million to grow its cheese portfolio.

Latest Trends

Fermentation-Based Vegan Cheese Shapes Market Innovation

A key latest trend in the Cheese Concentrates Market is the rise of fermentation-led vegan cheese development, where startups aim to match traditional dairy taste and texture without animal inputs. This trend increases interest in advanced cheese concentrates that can deliver authentic flavor, melt, and mouthfeel in alternative cheese products. French expertise remains influential, as two Paris-based startups together raised USD 14 million to improve cheese quality using microbial fermentation while keeping products animal-free.

Established brands are also pushing this shift. Miyoko’s Creamery raised USD 52 million to expand into foodservice and hire expert cheesemakers, signaling demand beyond retail. Kraft Heinz invested USD 3.5 million in vegan mozzarella, highlighting mainstream adoption. Meanwhile, Denmark’s FÆRM secured €1.3 million to scale vegan cheesemaking methods that closely mirror dairy processes.

Regional Analysis

North America led the Cheese Concentrates Market with a 37.2% share, a USD 0.7 Bn valuation.

North America dominated the Cheese Concentrates Market with a 37.2% share, valued at USD 0.7 Bn. The region’s leadership is supported by strong consumption of processed and convenience foods, where cheese concentrates are widely used for consistent flavor delivery. Mature food processing infrastructure and stable demand across retail and foodservice channels continue to reinforce North America’s leading market position.

Europe represents a well-established regional market for cheese concentrates, driven by long-standing cheese consumption habits and advanced food manufacturing practices. The region benefits from widespread use of cheese-based ingredients in packaged foods, bakery products, and ready meals. Consistent quality standards and established supply chains support steady adoption of cheese concentrates across applications.

Asia Pacific shows growing relevance in the Cheese Concentrates Market due to expanding processed food consumption and evolving dietary preferences. Urbanization and changing lifestyles encourage demand for convenient, flavor-enhanced food products. Cheese concentrates help manufacturers deliver standardized taste profiles, supporting broader acceptance of cheese-flavored products across regional cuisines.

The Middle East & Africa market is developing gradually, supported by the increasing availability of packaged foods and modern retail formats. Cheese concentrates are used to enhance flavor consistency in processed food products, especially where local production capabilities are expanding. The region reflects steady, application-driven demand growth.

Latin America maintains a stable presence in the Cheese Concentrates Market, supported by the rising use of cheese ingredients in processed and convenience foods. Regional food manufacturers rely on cheese concentrates to achieve consistent taste and texture. Growing retail penetration supports continued market participation across key countries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company holds a strong strategic position in the global Cheese Concentrates Market in 2024 due to its deep expertise in ingredient processing and formulation. The company’s broad capabilities across food ingredients allow it to integrate cheese concentrates into wider flavor and texture solutions. Its focus on consistent quality, scalable production, and long-term customer partnerships supports reliable supply for large food manufacturers. This positioning enables ADM to serve both standardized and customized cheese concentrate requirements efficiently.

Ingredion Incorporated continues to strengthen its role in the Cheese Concentrates Market by leveraging its specialization in food ingredient systems and functional solutions. The company emphasizes formulation support, helping manufacturers achieve desired taste, mouthfeel, and performance using cheese concentrates. Ingredion’s approach centers on application-driven development, allowing customers to optimize recipes while maintaining consistency across batches. This customer-focused strategy reinforces its relevance in processed and convenience food segments.

Adare Food Ingredients Pvt brings a focused and agile presence to the Cheese Concentrates Market, particularly through customized flavor solutions. The company is known for working closely with food producers to tailor cheese concentrate profiles to specific product needs. Its strength lies in flexibility, responsiveness, and application knowledge, enabling it to address niche requirements while maintaining quality consistency in competitive food markets.

Top Key Players in the Market

- Archer Daniels Midland Company

- Ingredion Incorporated

- Adare Food Ingredients Pvt

- Dale Farm

- C.P. Ingredients Ltd

- Land O’ Lakes Inc.

- Dairy Farmers of America, Inc.

- First Choice Ingredients (DSM)

- Butter Buds Inc.

- GoBia Ltd

- Jeneil Bioproducts GmbH

Recent Developments

- In September 2025, ADM announced a new joint venture with Alltech to create a North American animal feed business. This partnership combines ADM’s agricultural and innovation experience with Alltech’s expertise to offer customers improved feed solutions. Though this is in the animal nutrition space, it reflects ADM’s focus on expanding its ingredient and processing portfolio.

- In May 2024, Dale Farm announced a £70 million investment to expand its cheddar cheese processing facility at Dunmanbridge, County Tyrone. This project aims to boost annual cheddar output by 20,000 tonnes, add new automated lines, expand warehouse space, and increase whey protein concentrate capacity. The work will also introduce advanced energy-efficient technologies that help reduce the plant’s carbon footprint. This investment builds on Dale Farm’s role as a leading European cheddar producer.

- In February 2024, Ingredion launched NOVATION® Indulge 2940, a functional native clean-label starch designed to improve gelling and mouthfeel in dairy and alternative dairy products. This product expands the company’s ingredient solutions portfolio, helping food manufacturers achieve better texture with simpler ingredient labels.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 4.3 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Mozzarella Cheese, Cheddar Cheese, Parmesan Cheese, Swiss Cheese, Goat Cheese, Blue Cheese, Others), By Form (Powder, Paste / Spread, Chunk, Grated, Others), By Application (Bakery and Confectionery, Processed Cheese, Sauces, Dressings, Dips and Condiments, Dairy and Desserts, Snacks and Savory Items, Ready Meal Production, Others), By Sales Channel (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Discount Stores, Food Specialty Stores, Independent Small Groceries, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Ingredion Incorporated, Adare Food Ingredients Pvt, Dale Farm , C.P. Ingredients Ltd, Land O’ Lakes Inc., Dairy Farmers of America, Inc., First Choice Ingredients (DSM), Butter Buds Inc., GoBia Ltd, Jeneil Bioproducts GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cheese Concentrates MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Cheese Concentrates MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Ingredion Incorporated

- Adare Food Ingredients Pvt

- Dale Farm

- C.P. Ingredients Ltd

- Land O' Lakes Inc.

- Dairy Farmers of America, Inc.

- First Choice Ingredients (DSM)

- Butter Buds Inc.

- GoBia Ltd

- Jeneil Bioproducts GmbH