Global Chamomile Extract Market Size, Share, And Enhanced Productivity By Source Type (Organic, Conventional), By Application (Food and Beverages, Pharmaceuticals, Dietary Supplements, Personal Care/Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177416

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

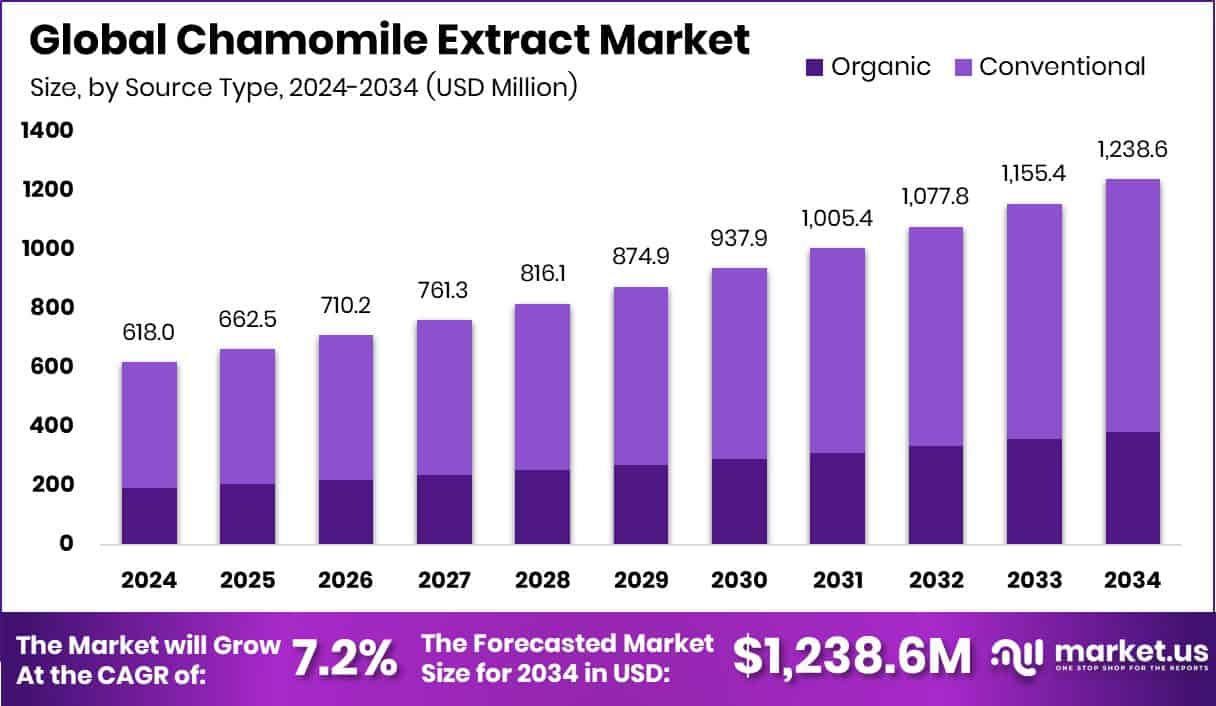

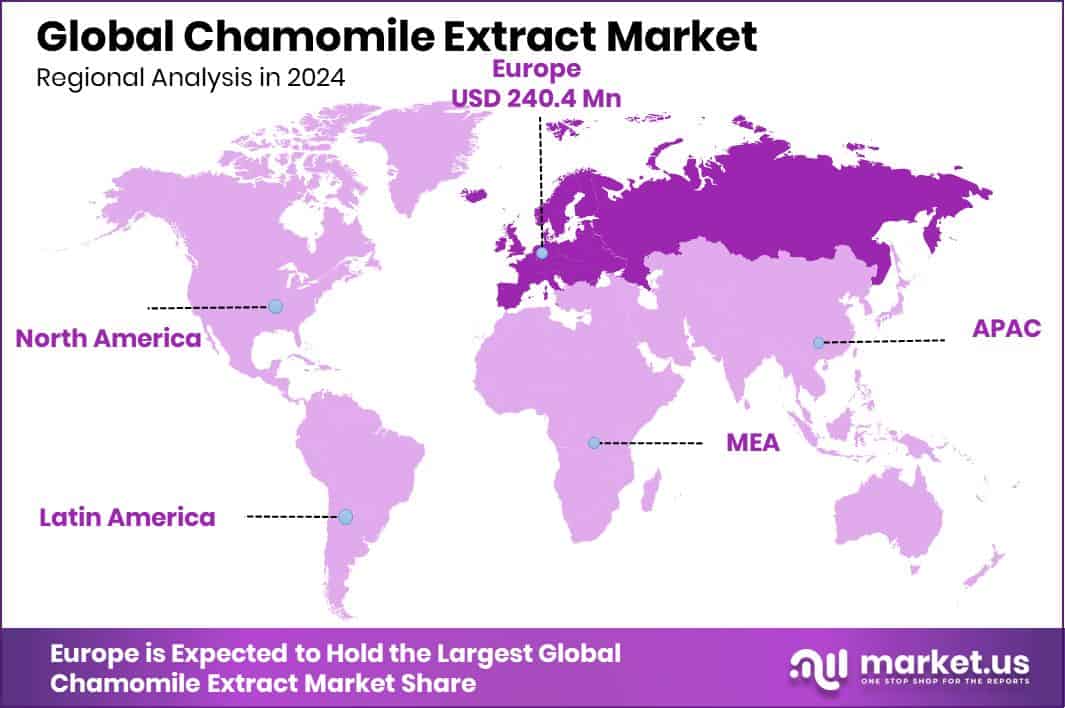

The Global Chamomile Extract Market is expected to be worth around USD 1,238.6 million by 2034, up from USD 618.0 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. The Europe segment posted 38.9% share and USD 240.4 Mn revenue growth overall.

Chamomile extract is a natural concentrate made from chamomile flowers, valued for its calming, anti-inflammatory, and soothing properties. It is widely used in teas, wellness drinks, supplements, skincare, and gentle therapeutic products. The Chamomile Extract Market represents the commercial demand, production, and global trade of these extracts, covering both organic and conventional sourcing, as well as applications across food and beverages, pharmaceuticals, dietary supplements, personal care/cosmetics, and other functional uses.

Growing interest in stress-relief ingredients remains a major factor pushing demand. Functional drink brands continue attracting strong investor backing—recently, the calming beverage brand Trip raised $40M, showing how relaxation-focused formulations are gaining commercial traction. This broader shift benefits chamomile, a core ingredient in calming blends.

Demand also rises from health-focused consumers seeking plant-based therapeutic options. New investments, such as the National Psoriasis Foundation awarding $450,000 in research grants, highlight expanding medical curiosity around natural anti-inflammatory ingredients, indirectly supporting chamomile’s relevance in soothing and dermatology-linked formulations.

Opportunity continues to widen across beverage innovation. Startups developing alcohol-free or low-alcohol drinks—such as Zero-ABV brand Feragaia, securing £1.5m, and K-Zen Beverage raising $5M—reflect an industry exploring calming botanicals in modern drink formats where chamomile fits naturally.

Overall, diverse funding—from Acid League’s $6M, Bloomscape’s $15M, and edibles companies raising $6.7M—shows growing investor confidence in wellness-driven consumer products, supporting future expansion for chamomile extract applications.

Key Takeaways

- The Global Chamomile Extract Market is expected to be worth around USD 1,238.6 million by 2034, up from USD 618.0 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- In the Chamomile Extract Market, conventional sources dominate with 69.2%, driven by large-scale cultivation.

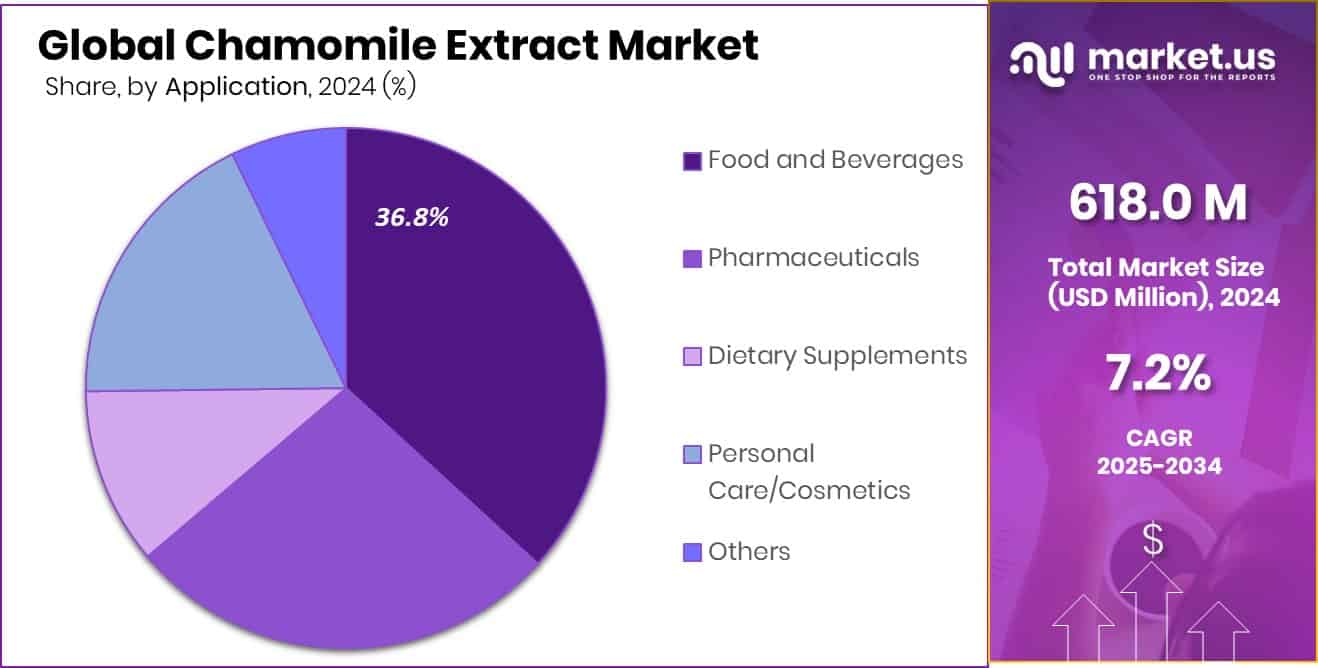

- The Chamomile Extract Market sees food and beverages holding 36.8%, fueled by wellness-focused consumption.

- Europe held a 38.9% share, generating USD 240.4 Mn within regional chamomile trade markets.

By Source Type Analysis

Conventional chamomile extract holds a 69.2% share, strengthening its dominance in global demand.

In 2024, the Chamomile Extract Market continued to see strong reliance on conventional sources, which held a dominant 69.2% share due to their wider availability, lower production cost, and consistent supply chain visibility. Many manufacturers preferred conventional chamomile because it allows stable bulk procurement, supporting high-volume applications in teas, supplements, and personal-care formulations.

Companies also benefited from established farming contracts across Europe and Asia, ensuring predictable pricing even when botanical ingredient demand fluctuated. While premium consumers increasingly show interest in organic extracts, conventional chamomile remains the backbone for mainstream brands that prioritize affordability and scalability. This dominance is expected to continue as global demand for calming, plant-based wellness products rises across retail channels.

By Application Analysis

Food and beverages account for 36.8%, driving consistent chamomile extract market expansion.

In 2024, the food and beverages segment accounted for 36.8% of the Chamomile Extract Market, driven by the growing use of chamomile as a natural flavor enhancer and functional ingredient. Beverage makers expanded chamomile-infused teas, sparkling botanicals, and relaxation drinks to meet rising consumer interest in stress-relief and sleep-support products. Food brands also incorporated chamomile into baked goods, confectionery, and wellness-focused recipes as part of the broader shift toward plant-derived ingredients.

With consumers seeking cleaner labels and gentle botanical formulations, chamomile gained traction for its soothing profile and mild floral taste. This segment’s growth remains steady as manufacturers continue innovating with calming blends and healthier beverage alternatives.

Key Market Segments

By Source Type

- Organic

- Conventional

By Application

- Food and Beverages

- Pharmaceuticals

- Dietary Supplements

- Personal Care/Cosmetics

- Others

Driving Factors

Rising demand for natural calming extracts

Rising demand for natural calming extracts continues to push the Chamomile Extract Market forward as consumers shift toward soothing botanicals in beverages, supplements, and personal-care products. This demand strengthens further as wellness brands pursue expansion supported by new investments, such as Coco5 planning channel expansion after its $10M funding round, showing that calming and hydration-focused drinks are gaining retail traction.

Chamomile fits naturally into this momentum because its gentle relaxation properties align with modern functional drink preferences. As more beverage creators use chamomile to add a calming edge to their formulations, interest rises across mainstream and specialty markets. The blend of wellness appeal and industry investment keeps this segment steadily moving upward.

Restraining Factors

Limited raw material availability impacts production

Limited raw material availability impacts production, and this remains a key restraint for chamomile extract manufacturers who depend on consistent harvest quality and stable supply networks. Market challenges expand as competing beverage categories grow rapidly, supported by strong funding.

For example, Revere launched with $2M in funding to promote plant-based workout drinks, while Uncle Arnie’s secured $7.5M in Series A funding for THC beverage expansion across the U.S. These fast-moving categories increase pressure on herb cultivators and extract suppliers, making it harder to maintain predictable chamomile sourcing. As new, well-funded brands accelerate demand for natural ingredients, supply variability becomes more noticeable, influencing production planning and limiting broader market scalability.

Growth Opportunity

Expanding applications in premium personal care

Expanding applications in premium personal care present a strong opportunity for the Chamomile Extract Market, especially as consumers seek soothing, plant-based skincare and gentle topical products. Chamomile’s calming and anti-inflammatory properties fit perfectly within this shift toward clean beauty. Future innovation may grow further as regulatory and safety initiatives strengthen, supported by major public funding.

The FDA’s request for $7.2 billion to enhance food safety, nutrition oversight, and medical product safety signals an increasing focus on cleaner, trustworthy ingredients. As personal-care brands aim to meet these rising safety expectations, they tend to adopt botanical actives with well-known benefits, creating more room for chamomile extracts in formulations ranging from creams to sensitive-skin treatments.

Latest Trends

Rapid shift toward zero-alcohol calming beverages

A rapid shift toward zero-alcohol calming beverages is shaping the latest trends in the Chamomile Extract Market. Consumers looking for relaxing, alcohol-free options are gravitating to drinks infused with botanicals like chamomile, which naturally support stress relief and mild relaxation. This trend gains more strength as the wellness beverage industry secures significant capital.

A recent example comes from a Long Island City-based nutrition startup raising $20M in Series A funding, highlighting investor confidence in functional, non-alcoholic drink innovation. With more brands exploring botanical blends that deliver mood balance without alcohol, chamomile emerges as a preferred ingredient. Its gentle flavor and established calming reputation make it an ideal fit for evolving beverage trends.

Regional Analysis

In Europe, the market reached 38.9% and USD 240.4 Mn value during 2024.

In 2024, the Chamomile Extract Market showed clear regional variations, with Europe emerging as the leading region by securing a 38.9% share valued at USD 240.4 Mn, supported by strong herbal product adoption across major economies.

In North America, demand continued to rise due to expanding use of chamomile in wellness supplements and ready-to-drink calming beverages, reflecting a steady preference for botanical formulations. Meanwhile, the Asia-Pacific experienced growth driven by increasing consumer interest in herbal extracts within traditional and modern food applications, strengthening the region’s long-term potential.

In the Middle East and Africa, the market benefited from gradual expansion in natural personal-care products, where chamomile is frequently used for its soothing properties. Lastly, Latin America witnessed stable demand supported by the rising incorporation of chamomile extract in teas and household remedies, maintaining a consistent role in the region’s botanical ingredient landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arjuna Natural Extracts Ltd strengthened its position by expanding its botanical expertise, leveraging its long-standing capabilities in plant-derived actives to meet rising requirements for purity, consistency, and traceability. The company’s ability to maintain standardized extract quality positioned it well with global food, beverage, and supplement manufacturers that increasingly seek reliable supply partnerships.

New Zealand Extracts Ltd contributed to market growth by focusing on controlled-environment cultivation and clean extraction approaches that align with the region’s reputation for high-quality natural ingredients. Its portfolio appealed to brands emphasizing premium chamomile formulations, especially in teas and wellness blends.

Meanwhile, the Pharmaceutical Plant Company maintained relevance through its heritage in herbal preparations, supporting demand for chamomile ingredients used in traditional remedies and personal-care applications. The company’s focus on consumer-friendly formulations helped it remain competitive as end users gravitated toward gentle, plant-based solutions. Collectively, these players shaped the market’s direction through specialization, quality-driven production, and reliable global supply.

Top Key Players in the Market

- Arjuna Natural Extracts Ltd

- New Zealand Extracts Ltd

- The Pharmaceutical Plant Company

- Afriplex

- Changsha Vigorous-Tech Co., Ltd.

- Gehrliche

- Nutra

- Martin Bauer Group

Recent Developments

- In May 2025, Arjuna Natural was honored with the Export Excellence Award for the sixth time, recognizing its strong performance exporting vegetable saps and herb extracts worldwide. This award highlights the company’s consistent global reach and quality in botanical ingredients.

- In February 2025, Afriplex announced it would showcase its range of botanical and plant-based products at two major international exhibitions. The company participated in the UIC 2025 Australian Medical Cannabis Symposium and the Natural Products Expo West in the USA (4–7 March), presenting its capabilities and expanding its global presence. This step highlights Afriplex’s efforts to raise awareness of its functional wellness ingredients and extracts in global markets.

Report Scope

Report Features Description Market Value (2024) USD 618.0 Million Forecast Revenue (2034) USD 1,238.6 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source Type (Organic, Conventional), By Application (Food and Beverages, Pharmaceuticals, Dietary Supplements, Personal Care/Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arjuna Natural Extracts Ltd, New Zealand Extracts Ltd, The Pharmaceutical Plant Company, Afriplex, Changsha Vigorous-Tech Co., Ltd., Gehrliche, Nutra, Martin Bauer Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chamomile Extract MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Chamomile Extract MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Arjuna Natural Extracts Ltd

- New Zealand Extracts Ltd

- The Pharmaceutical Plant Company

- Afriplex

- Changsha Vigorous-Tech Co., Ltd.

- Gehrliche

- Nutra

- Martin Bauer Group