Global Cellulose Ether Market Size, Share, And Business Benefits By Product Type (Cellulose Acetate, Cellulose Nitrate, Carboxymethyl Cellulose, Methyl Cellulose, Ethyl Cellulose, Hydroxyethyl Cellulose, Others), By Physical Form (Flake (Coarse Flake, Fine Flake), Granule, Powder), By Process (Kraft, Sulfite), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149876

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

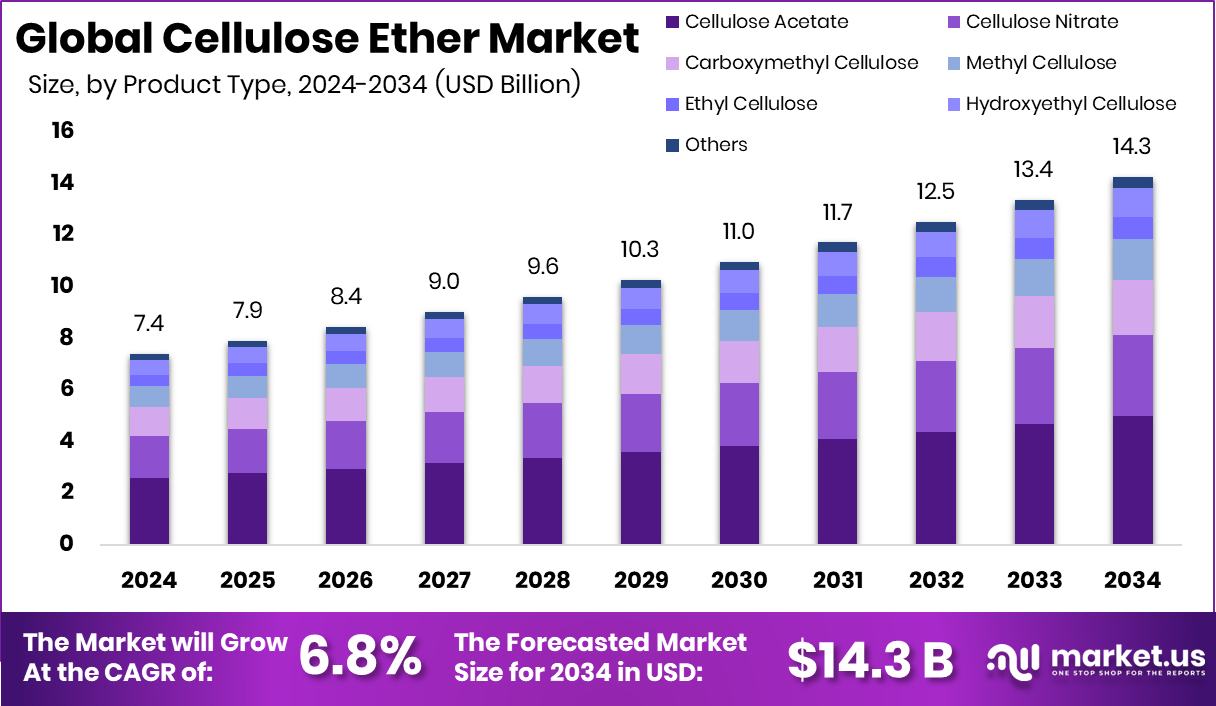

Global Cellulose Ether Market is expected to be worth around USD 14.3 billion by 2034, up from USD 7.4 billion in 2024, and grow at a CAGR of 6.8% from 2025 to 2034. High construction and pharma demand boosted Asia-Pacific’s cellulose ether share to 43.3%.

Cellulose ether is a water-soluble polymer derived from natural cellulose. It is chemically modified to enhance its solubility, viscosity, and binding properties. These changes make it suitable for a wide range of industrial uses, including as a thickener, stabilizer, film-former, and water-retention agent. It is commonly used in construction materials, food products, personal care, and pharmaceuticals due to its non-toxic and biodegradable nature.

The cellulose ether market refers to the global trade and production of cellulose ether-based products across various sectors. This market is driven by demand from the construction, pharmaceutical, food, paint, and personal care industries. The market size is influenced by trends in urbanization, health awareness, and sustainable materials. Regional demand varies, with developing economies seeing a rise in construction and healthcare sectors, which directly boosts cellulose ether consumption.

Urbanization and a construction boom in emerging economies are driving the need for efficient building materials. Cellulose ether is widely used in dry-mix mortars, plasters, and tile adhesives due to its water retention and binding abilities. As infrastructure projects increase, so does the demand for performance-enhancing additives, placing cellulose ether in a strong growth position.

The increasing use of cellulose ethers in pharmaceutical formulations and personal care products is a key demand factor. It acts as a thickener in creams, lotions, and ointments, and as a binding agent in tablets. With rising healthcare needs and self-care trends, especially post-pandemic, the demand for these applications continues to climb steadily.

Key Takeaways

- Global Cellulose Ether Market is expected to be worth around USD 14.3 billion by 2034, up from USD 7.4 billion in 2024, and grow at a CAGR of 6.8% from 2025 to 2034.

- In 2024, Cellulose Acetate led the Cellulose Ether Market by Product Type with 39.3% share.

- Powder form dominated the Physical Form segment of the Cellulose Ether Market, accounting for 76.1% in 2024.

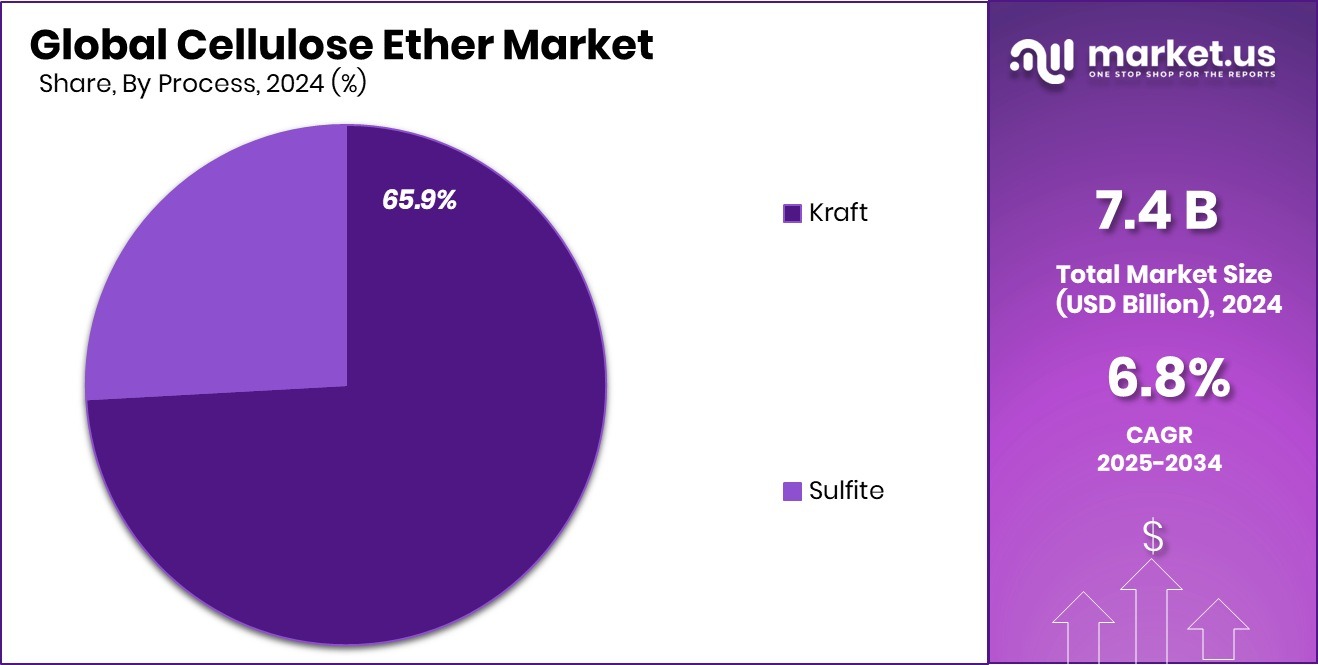

- The Kraft process held a strong 65.9% share in the Cellulose Ether Market by Process in 2024.

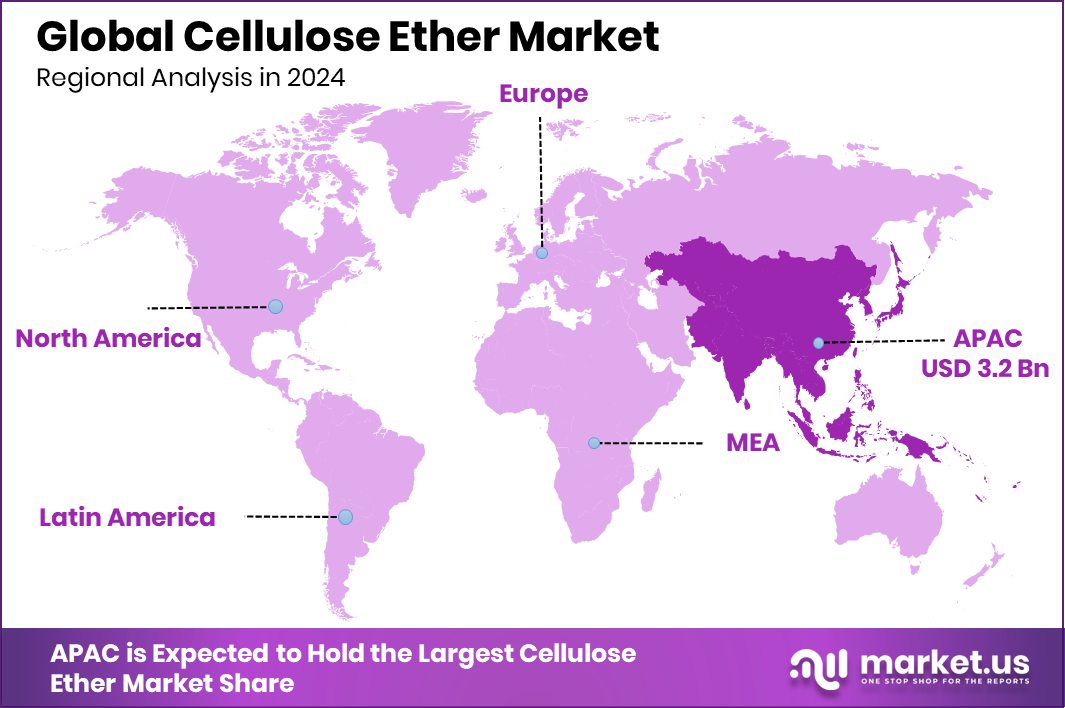

- The Asia-Pacific cellulose ether industry reached a market value of USD 3.2 billion.

By Product Type Analysis

In 2024, Cellulose Acetate held a 39.3% share in the product type segment.

In 2024, Cellulose Acetate held a dominant market position in By Product Type segment of the cellulose ether market, with a 39.3% share. This dominance is primarily driven by its widespread application across the construction, pharmaceutical, and personal care industries.

Cellulose Acetate offers excellent film-forming, thickening, and stabilizing properties, which make it a preferred choice in water-based formulations, such as wall putties, paints, and drug delivery systems. Its superior performance in moisture retention and improved workability in cement and gypsum-based products further boosted its demand in the construction sector, especially in developing economies witnessing rapid urban expansion.

The pharmaceutical sector also played a vital role in supporting market dominance. Cellulose Acetate is used in sustained-release drug formulations due to its controlled solubility, enhancing drug stability and patient compliance. Additionally, rising consumer focus on hygiene and skincare has expanded the product’s footprint in cosmetics and personal care products, where it serves as a safe and skin-friendly thickener.

The bio-based origin and biodegradable nature of Cellulose Acetate aligned well with the growing environmental consciousness among manufacturers and end-users alike. As sustainability goals grow stronger globally, this segment’s leadership in the cellulose ether market is expected to remain firm, supported by product reliability and regulatory acceptance.

By Physical Form Analysis

Powder form dominated the Cellulose Ether Market with a 76.1% market share.

In 2024, Powder held a dominant market position in By Physical Form segment of the Cellulose Ether Market, with a 76.1% share. The widespread preference for powdered cellulose ether stems from its ease of handling, stable shelf life, and better compatibility with dry formulations.

This form is especially favored in construction applications such as dry-mix mortars, tile adhesives, wall putties, and plasters, where uniform dispersion and controlled hydration are critical for performance. Powdered cellulose ether blends quickly with other materials and enables precise dosing, making it highly suitable for industrial-scale formulations.

The pharmaceutical and food industries also contributed to the segment’s leading position. In tablet production, powdered cellulose ether serves as an effective binder and disintegrant, ensuring consistent quality and improved shelf stability. In food processing, it acts as a thickener and stabilizer in ready-mix products. The high adoption rate in multiple industries reflects the functional versatility of powder form, especially in moisture-sensitive and high-volume applications.

Moreover, powder-based formats are easier to package, store, and transport, reducing overall operational costs for manufacturers. This strong utility across end-use sectors kept the powder form well ahead of other physical formats in the cellulose ether market throughout the year.

By Process Analysis

Kraft process accounted for a 65.9% share in manufacturing cellulose ether globally.

In 2024, Kraft held a dominant market position in the By Process segment of the Cellulose Ether Market, with a 65.9% share. The Kraft process is widely recognized for producing high-purity cellulose with fewer impurities, making it the preferred method for cellulose ether production.

Its efficiency in extracting long cellulose fibers from wood pulp results in superior-quality raw material, which is essential for high-performance applications in construction, pharmaceuticals, food, and cosmetics. The dominance of this segment is closely linked to the reliability, consistency, and large-scale suitability offered by the Kraft process.

The process supports bulk production while maintaining stringent quality standards, meeting the technical needs of industrial users. In construction, cellulose ether derived from Kraft pulp offers improved viscosity and water retention, enhancing the workability of mortars and adhesives. Pharmaceutical applications also benefit from the low contaminant levels achieved through this method, ensuring compliance with drug formulation standards.

Moreover, the Kraft process aligns well with sustainability goals, as it allows for efficient chemical recovery and reduces overall waste. Its established infrastructure, along with a well-developed global supply chain, further solidified its position as the leading process type in the cellulose ether market during 2024.

Key Market Segments

By Product Type

- Cellulose Acetate

- Cellulose Nitrate

- Carboxymethyl Cellulose

- Methyl Cellulose

- Ethyl Cellulose

- Hydroxyethyl Cellulose

- Others

By Physical Form

- Flake

- Coarse Flake

- Fine Flake

- Granule

- Powder

By Process

- Kraft

- Sulfite

Driving Factors

Rising Construction Activities Fueling Product Demand

One of the main driving factors for the cellulose ether market is the growing demand from the construction industry. Cellulose ether is widely used in building materials such as cement plaster, tile adhesives, wall putties, and joint fillers. It helps in water retention, improves workability, and provides better binding in dry-mix formulations.

With more housing projects, urban infrastructure, and commercial buildings being developed, especially in emerging countries, the need for such additives is increasing. Governments are also investing in road networks, affordable housing, and smart cities, which boosts demand. The reliable performance and eco-friendly nature of cellulose ether make it a preferred choice in modern construction practices, helping this segment grow steadily year by year.

Restraining Factors

High Production Costs Limit Market Growth Potential

A major restraining factor in the cellulose ether market is the high cost of production. Manufacturing cellulose ether involves several complex chemical processes, including purification, etherification, and drying, which require significant energy and specialized equipment. Additionally, the cost of raw materials like wood pulp or cotton linters can vary depending on supply availability and global demand.

These costs directly affect the final product price, making cellulose ether more expensive than some synthetic alternatives. For small-scale manufacturers or price-sensitive end-users, this can be a barrier to adoption. The challenge becomes more noticeable in developing regions where cost efficiency is crucial. As a result, high production costs slow down the wider use of cellulose ether in some applications.

Growth Opportunity

Growing Demand for Eco-Friendly Additive Solutions

A key growth opportunity in the cellulose ether market lies in the rising demand for eco-friendly and biodegradable materials. As industries move away from harmful synthetic chemicals, cellulose ether—derived from natural plant-based sources—offers a safe and sustainable alternative. It is non-toxic, biodegradable, and works well in a variety of applications like construction, food, personal care, and pharmaceuticals.

Many companies and governments are now focusing on reducing their carbon footprint and promoting green products. This shift creates strong potential for cellulose ether, especially in regions with strict environmental rules. With increasing consumer awareness and support for eco-conscious solutions, manufacturers using cellulose ether can tap into new markets and expand their product reach globally.

Latest Trends

Innovation in Modified Grades for Targeted Applications

One of the latest trends in the cellulose ether market is the development of modified grades tailored for specific uses. Manufacturers are now customizing cellulose ether products to meet the performance needs of different industries like pharmaceuticals, construction, food, and cosmetics. For example, in construction, new grades are designed to improve water retention and workability in dry-mix mortars.

In the pharmaceutical sector, modified cellulose ethers help control the release of drugs. This trend allows companies to offer more effective, application-specific products rather than a one-size-fits-all solution. It also helps end-users achieve better results while using less material, reducing costs and waste.

Regional Analysis

In 2024, Asia-Pacific led the Cellulose Ether Market with 43.3% regional share.

In 2024, Asia-Pacific dominated the Cellulose Ether Market, accounting for 43.3% of the global share with a market value of USD 3.2 billion. The region’s stronghold is supported by rapid growth in the construction and pharmaceutical sectors, particularly in China, India, and Southeast Asia, where infrastructure development and generic drug production are on the rise.

This surge in demand for construction chemicals, personal care items, and food additives has significantly boosted cellulose ether consumption. Meanwhile, North America and Europe maintained steady positions in the market, driven by consistent usage in pharmaceutical formulations, processed food, and high-end cosmetic products. These regions benefit from established regulatory frameworks and a shift toward sustainable, bio-based materials.

Latin America and the Middle East & Africa recorded comparatively lower market shares but showed gradual growth as industrial development and urbanization continued in key countries like Brazil, UAE, and South Africa. While regional dynamics varied, Asia-Pacific’s manufacturing capacity, raw material availability, and growing end-user industries firmly positioned it as the market leader.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ashland maintained a steady presence in the global cellulose ether market by focusing on specialty solutions that cater to pharmaceutical, personal care, and construction applications. The company’s cellulose ether products are known for their high purity and functional performance, which makes them suitable for controlled-release drug formulations and skin-friendly cosmetic products. Ashland’s strength lies in its formulation expertise and established customer relationships in North America and Europe.

DKS Co. Ltd., a Japanese-based manufacturer, continued to enhance its cellulose ether offerings by leveraging advanced production technology and efficient resource use. The company focused on supplying industries such as food and construction with reliable grades of cellulose ether that meet strict safety and quality standards. Its regional market influence remained strong within Asia, where demand from local infrastructure and food processing sectors supported volume growth.

Daicel Corporation further strengthened its cellulose ether portfolio through consistent manufacturing quality and a disciplined focus on performance optimization. Its cellulose derivatives are used across multiple verticals, with a noticeable rise in pharmaceutical and personal care usage. As a technology-driven company, Daicel invested in refining processing techniques to offer more precise material characteristics tailored to customer needs. The company’s focus on sustainability and bio-based raw materials positioned it well in a market increasingly shifting toward greener solutions.

Top Key Players in the Market

- The Dow Chemical Company

- Shin-Etsu Chemical Co., Ltd.

- DKS Co. Ltd.

- Daicel Corporation

- Ashland

- AkzoNobel N.V.

Recent Developments

- In March 2025, Daicel launched BELLOCEA® BS7, an eco-friendly cosmetic texture improver made from cellulose acetate. This biodegradable product offers a soft feel and aims to replace microplastic beads in cosmetics, aligning with global sustainability trends. BELLOCEA® BS7 meets European biodegradation standards and is designed to provide a delicate texture comparable to traditional microbeads.

- In December 2024, Ashland divested its Avoca business to Mane, a company specializing in fragrances and flavors. The Avoca business supplied sclareolide, a fragrance fixative, and offered contract manufacturing services.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Billion Forecast Revenue (2034) USD 14.3 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cellulose Acetate, Cellulose Nitrate, Carboxymethyl Cellulose, Methyl Cellulose, Ethyl Cellulose, Hydroxyethyl Cellulose, Others), By Physical Form (Flake (Coarse Flake, Fine Flake), Granule, Powder), By Process (Kraft, Sulfite) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Dow Chemical Company, Shin-Etsu Chemical Co., Ltd., DKS Co. Ltd., Daicel Corporation, Ashland, AkzoNobel N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Dow Chemical Company

- Shin-Etsu Chemical Co., Ltd.

- DKS Co. Ltd.

- Daicel Corporation

- Ashland

- AkzoNobel N.V.