Cellulite Treatment Market By Type (Soft Cellulite, Hard Cellulite, and Edematous Cellulite), By Procedure (Non-invasive Treatment, Topical Treatment, and Minimally Invasive Treatment), By End-user (Clinics & Beauty Centers and Hospitals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153935

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

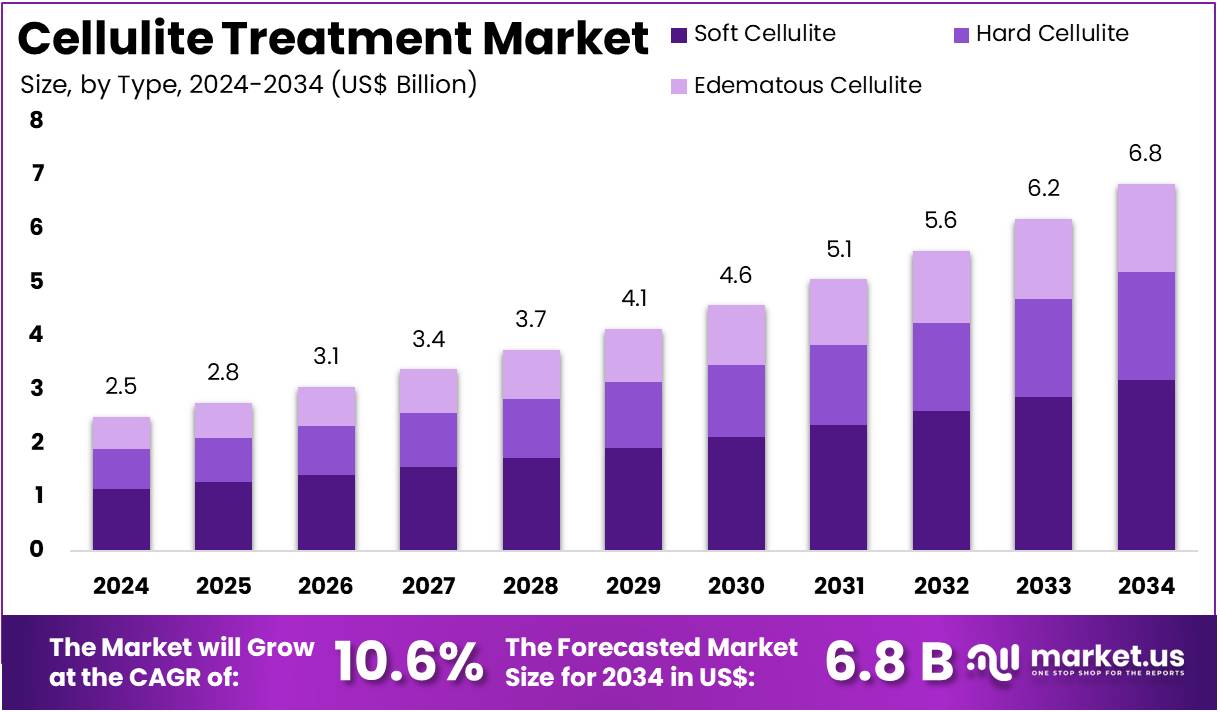

The Cellulite Treatment Market Size is expected to be worth around US$ 6.8 billion by 2034 from US$ 2.5 billion in 2024, growing at a CAGR of 10.6% during the forecast period 2025 to 2034.

Increasing consumer interest in aesthetic treatments and the growing focus on body image are driving the expansion of the cellulite treatment market. Cellulite, a condition that causes lumpy, dimpled skin, primarily affects women, leading to rising demand for effective treatments that target fat deposits and improve skin texture. The market sees significant interest in non-invasive procedures, as more individuals seek options that provide visible results with minimal recovery time.

Popular treatments include laser therapy, radiofrequency, ultrasound, and cryolipolysis, all of which aim to break down fat cells and stimulate collagen production, thus reducing the appearance of cellulite. According to the International Society of Aesthetic Plastic Surgery (ISAPS), 331,981 cellulite treatment procedures were performed in 2023, out of a total of 19,182,141 non-surgical procedures. This significant figure highlights the growing consumer demand for non-invasive aesthetic treatments.

The increasing adoption of minimally invasive procedures, coupled with advances in technology that enhance treatment outcomes, presents ample opportunities for growth in the cellulite treatment market. Recent trends show a rise in combination therapies that combine multiple treatment modalities for more effective results, offering patients a holistic approach to combating cellulite.

Additionally, the growing awareness about body positivity and self-care has led to greater demand for cosmetic procedures that help individuals feel more confident in their skin. As the market continues to evolve, innovations in treatment techniques and improved patient experiences are expected to further drive the demand for cellulite treatments.

Key Takeaways

- In 2024, the market for cellulite treatment generated a revenue of US$ 2.5 billion, with a CAGR of 10.6%, and is expected to reach US$ 6.8 billion by the year 2034.

- The type segment is divided into soft cellulite, hard cellulite, and edematous cellulite, with soft cellulite taking the lead in 2023 with a market share of 46.5%.

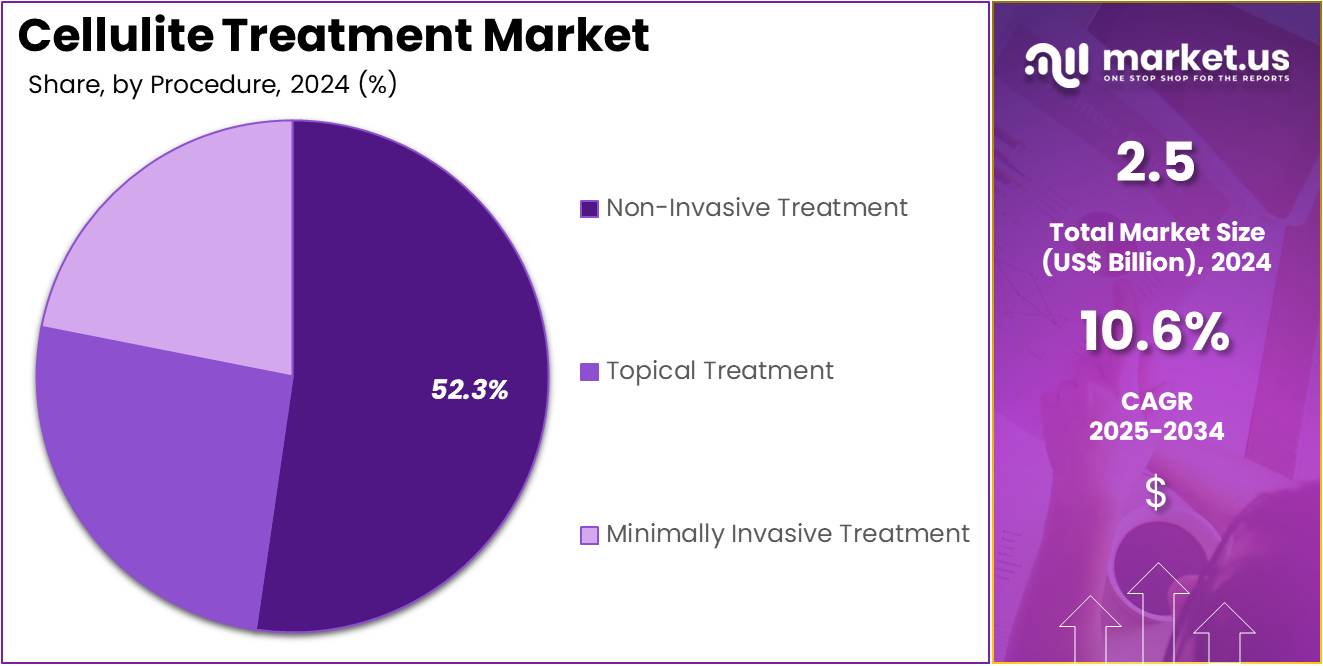

- Considering procedure, the market is divided into non-invasive treatment, topical treatment, and minimally invasive treatment. Among these, non-invasive treatment held a significant share of 52.3%.

- Furthermore, concerning the end-user segment, the market is segregated into clinics & beauty centers and hospitals. The clinics & beauty centers sector stands out as the dominant player, holding the largest revenue share of 58.1% in the cellulite treatment market.

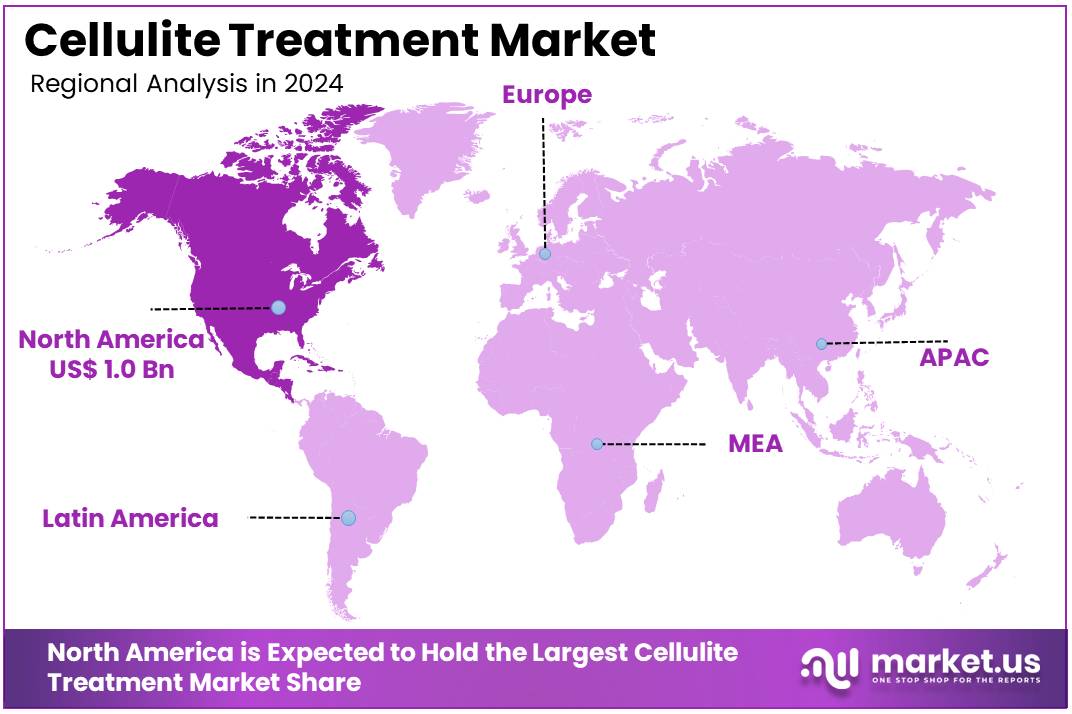

- North America led the market by securing a market share of 38.8% in 2023.

Type Analysis

Soft cellulite holds the largest share of 46.5% in the cellulite treatment market. This growth is expected to continue as soft cellulite, which is characterized by a spongy texture and appears mostly in areas like thighs and buttocks, is the most common type treated through cosmetic procedures. The rising awareness about body image and the increasing number of individuals seeking aesthetic treatments are projected to fuel demand for treatments targeting soft cellulite.

Additionally, the availability of non-invasive procedures that offer effective results with minimal downtime is anticipated to contribute to the segment’s growth. As more people look for ways to improve skin appearance and reduce the visibility of cellulite, treatments for soft cellulite, including advanced laser and radiofrequency technologies, are expected to remain in high demand. Moreover, as the focus on self-care and wellness continues to rise, the adoption of treatments for soft cellulite is likely to expand, especially among younger demographics.

Procedure Analysis

Non-invasive treatments dominate the procedure segment with 52.3% of the market share. This segment’s growth is projected to continue as non-invasive procedures become the preferred option for individuals seeking cellulite treatments with minimal risk and recovery time. These treatments, such as laser therapy, radiofrequency, and ultrasound, are expected to see higher adoption due to their ability to target cellulite without the need for surgery or incisions.

The demand for non-invasive options is driven by the increasing consumer preference for quick, painless, and affordable treatments, as well as the growing awareness of the risks associated with more invasive cosmetic procedures. As advancements in technology make non-invasive treatments more effective and accessible, the market for these procedures is likely to expand further. Additionally, the increasing number of aesthetic clinics offering non-invasive cellulite treatments is expected to contribute to the continued dominance of this segment.

End-User Analysis

Clinics & beauty centers represent the largest end-user segment, holding 58.1% of the market share. This growth is expected to continue as these centers provide convenient, specialized services for individuals seeking non-surgical treatments for cosmetic concerns such as cellulite. Clinics and beauty centers are likely to benefit from the rising demand for aesthetic procedures, particularly those that focus on body contouring and skin rejuvenation.

The increasing focus on personal appearance and wellness, alongside the growing availability of advanced treatments in beauty centers, is driving the growth of this segment. Moreover, these centers typically offer a wide range of affordable treatments, making them more accessible to a broader demographic. As more people seek out non-invasive cellulite treatments for faster recovery times and minimal discomfort, clinics and beauty centers are expected to remain at the forefront of the market. Their role in providing effective and personalized care will likely drive the continued growth of this segment in the coming years.

Key Market Segments

By Type

- Soft Cellulite

- Hard Cellulite

- Edematous Cellulite

By Procedure

- Non-invasive Treatment

- Topical Treatment

- Minimally Invasive Treatment

By End-user

- Clinics & Beauty Centers

- Hospitals

Drivers

Increasing Aesthetic Awareness and Desire for Body Contouring is Driving the Market

The heightened global aesthetic awareness, coupled with a growing desire among individuals to achieve specific body contouring and appearance goals, is a significant driver propelling the cellulite treatment market. As societal perceptions of beauty continue to evolve, many individuals seek solutions to address cosmetic concerns like dimpled skin, leading to increased demand for various non-invasive and minimally invasive aesthetic procedures.

The widespread influence of social media and visual platforms further amplifies these aesthetic aspirations, making body imperfections more noticeable and encouraging people to seek remedial actions. The International Society of Aesthetic Plastic Surgery (ISAPS) reported in its Global Survey 2023 that non-surgical procedures accounted for 19.1 million of the total 34.9 million aesthetic procedures performed globally in 2023, marking a 3.4% increase from the previous year.

While this figure encompasses all non-surgical aesthetics, it reflects the immense and growing consumer willingness to undergo non-invasive treatments. The demand for solutions that improve skin texture and address localized fat deposits continues to rise, pushing innovation and adoption in the aesthetic industry. This persistent consumer focus on physical appearance and self-confidence directly fuels the expansion of the market, as more individuals explore options to enhance their body aesthetics.

Restraints

Limited Long-Term Efficacy and Need for Multiple Sessions are Restraining the Market

The challenge of achieving consistent, long-term efficacy with many existing methods, coupled with the frequent requirement for multiple treatment sessions to see noticeable results, represents a considerable restraint on the market. Many individuals find that while initial improvements might be observed, maintaining these results often necessitates ongoing treatments or adherence to specific lifestyle changes, which can be burdensome and costly.

The temporary nature of some solutions can lead to patient dissatisfaction and a reluctance to invest further in prolonged treatment plans. The American Society for Aesthetic Plastic Surgery (ASAPS) annually collects data on aesthetic procedures. While ASAPS does not provide direct efficacy statistics, their 2023 statistics report indicated that non-surgical fat reduction was among the top non-surgical procedures, but specific patient retention for long-term cellulite reduction is a known clinical challenge.

Additionally, the US Food and Drug Administration (FDA) requires rigorous clinical data for device approvals, and post-market surveillance sometimes reveals variability in real-world results. For example, clinical studies for devices often demonstrate efficacy over a defined period, but ensuring sustained outcomes beyond that period remains a consistent hurdle for both practitioners and patients. These factors contribute to a perception of limited permanence, making it harder for the market to achieve widespread, sustained patient engagement and adoption.

Opportunities

Advancements in Non-Invasive Technologies and Combination Therapies are Creating Growth Opportunities

Ongoing technological advancements in non-invasive energy-based devices and the increasing trend towards combining different therapeutic modalities are creating significant growth opportunities in the market. Innovations in radiofrequency, ultrasound, cryolipolysis, and laser technologies offer improved precision, reduced discomfort, and enhanced effectiveness in targeting the underlying causes of cellulite, such as septae and fat lobules.

The development of multi-modal platforms allows practitioners to tailor treatment plans, often combining various technologies for synergistic effects and more comprehensive results. The US Food and Drug Administration (FDA) continues to grant clearances for devices specifically for non-invasive aesthetic procedures. For example, in 2023, the FDA granted 510(k) clearance to the “Sofwave Synchronous Ultrasound Parallel Beam (SUPERB) technology” for the non-invasive treatment of cellulite, expanding the range of approved non-surgical options.

Furthermore, companies are continually releasing new iterations of their devices; for instance, Solta Medical (a Bausch Health company), known for its body contouring devices, launched new features for its Clear + Brilliant Touch laser in 2024, emphasizing enhanced patient comfort and customization. These advancements provide practitioners with more effective tools and allow for personalized treatment strategies, broadening the appeal and efficacy of aesthetic solutions for individuals seeking improvements in skin texture.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and consumer confidence, significantly influence the cellulite treatment market by affecting discretionary income and individuals’ willingness to spend on elective aesthetic procedures. When economies face inflationary pressures or uncertainty, consumers often prioritize essential goods and services, leading to a potential decrease in spending on non-essential treatments. However, a stable global economy with rising disposable incomes can boost consumer confidence and increase spending on personal care and aesthetic enhancements.

The US Bureau of Labor Statistics (BLS) reported in September 2024 that average annual expenditures for all consumer units in the US increased by 5.9% in 2023, with personal care products and services spending seeing a significant increase of 9.7%. This indicates a positive trend in consumer willingness to invest in personal appearance even amidst broader economic shifts.

Geopolitical stability also plays a role by ensuring predictable supply chains for aesthetic devices and products, which can be sensitive to trade disruptions. Despite potential economic fluctuations, the persistent consumer desire for improved appearance, coupled with increasing disposable incomes in key regions, ensures continued investment in and demand for aesthetic solutions, fostering resilience and sustained growth in the market.

Evolving U.S. trade policies are affecting the cellulite treatment market. Tariffs have been imposed on imported aesthetic devices, laser systems, and related electronic parts. These changes are increasing equipment costs for providers. Many aesthetic device manufacturers depend on global supply chains for parts like high-power diodes and optical components. When these are taxed, costs rise. This affects both U.S.-based manufacturers and those importing finished devices. As a result, dermatologists and medspas may face higher purchase prices, which could impact consumer pricing.

In fiscal year 2023, U.S. Customs and Border Protection collected about US$38 billion in Section 301 duties from China. These duties applied to many manufactured goods, including electronics and machinery. These items are often essential in aesthetic and medical devices. The tariffs are part of a larger trade strategy. They aim to reduce trade deficits and boost domestic manufacturing. However, these policies add complexity and raise input costs for companies. The aesthetic device sector is particularly vulnerable to such global pricing shifts.

Despite these cost pressures, consumer demand remains strong. People continue to seek effective and advanced cellulite treatments. This drives manufacturers to adjust and innovate. Many are redesigning supply chains or exploring alternative sourcing. Others absorb part of the cost to remain competitive. These efforts help maintain access to modern, high-tech treatment options in the U.S. market.

Latest Trends

Increasing Focus on Patient Education and Realistic Expectations is a Recent Trend

A prominent recent trend shaping the cellulite treatment market in 2024 and continuing into 2025 is the escalating focus on comprehensive patient education and the management of realistic expectations regarding treatment outcomes. As the market matures and new technologies emerge, practitioners and professional organizations are emphasizing the importance of informed consent, clearly communicating what can and cannot be achieved with current treatments. This proactive approach aims to improve patient satisfaction by ensuring individuals understand the limitations, the number of sessions required, and the need for potential maintenance.

The American Academy of Dermatology Association (AAD), a leading professional organization, frequently publishes patient education materials and advises its members to thoroughly discuss treatment goals and potential results with patients seeking aesthetic procedures. In a press release from February 2025, the AAD reiterated its commitment to empowering patients with accurate information about dermatological conditions and treatments, including cosmetic concerns.

This emphasis helps combat misinformation and manages patient expectations more effectively, fostering trust and long-term engagement with aesthetic practices. The industry is moving towards a more ethical and transparent approach, recognizing that well-informed patients with realistic expectations are more likely to be satisfied with their results, ultimately contributing to the market’s sustainable growth.

Regional Analysis

North America is leading the Cellulite Treatment Market

The cellulite treatment market in North America, holding a significant 38.8% share, experienced notable growth in 2024. This expansion was primarily driven by rising consumer demand for non-invasive aesthetic procedures, increasing awareness of available treatments, and continuous technological advancements offering more effective solutions. The American Society of Plastic Surgeons (ASPS) reported in June 2025 that the total number of minimally invasive cosmetic treatments in the US showed a 1.5% year-over-year increase in 2024, reflecting sustained interest in aesthetic enhancements that require less downtime.

Specifically, non-surgical fat reduction procedures remained among the most popular non-surgical treatments globally in 2023, according to the International Society of Aesthetic Plastic Surgery (ISAPS) Global Survey published in June 2024. This trend highlights a growing preference for solutions that address body contouring concerns, including the appearance of cellulite. Furthermore, key players in the aesthetic device market have contributed to this growth through product innovation and expanded offerings. Bausch Health’s Solta Medical segment, which includes aesthetic devices, reported revenues of US\$440 million for the full year 2024, an increase of 27% compared to 2023, indicating strong performance in the aesthetic sector.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The cellulite treatment market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is fueled by rapidly increasing disposable income, a growing influence of social media on beauty standards, and an expanding network of aesthetic clinics and medical spas. The China Medical Aesthetics Market, for instance, witnessed nearly 15 million cosmetic procedures performed in 2022, marking a 20% increase from the previous year, according to the National Health Commission of China, demonstrating a significant and growing consumer base for aesthetic treatments.

The Asia-Pacific medical aesthetic market is experiencing a significant trend toward non-surgical cosmetic procedures, driven by technological advancements and minimal recovery times, as highlighted in a report on industry trends in January 2025. This indicates a strong inclination toward less invasive options for body contouring and skin tightening.

Moreover, the increasing availability of innovative, personalized treatments and the growing acceptance of aesthetic procedures in mainstream society are likely to accelerate market penetration. Companies offering aesthetic devices and solutions are actively expanding their presence in the region, recognizing the substantial market potential. These factors collectively indicate a robust and expanding market for such treatments across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the cellulite treatment market are prioritizing innovation, strategic partnerships, and expanding their product lines to foster growth. They are investing in research and development to create advanced, non-invasive solutions like radiofrequency and laser therapies. Digital marketing and social media are key to boosting brand visibility and engaging directly with consumers, while mergers and acquisitions allow companies to expand their product offerings and enter new markets, especially in the fast-growing Asia-Pacific region. Additionally, personalized treatments are becoming a critical differentiator, helping brands build stronger customer loyalty.

Revance Therapeutics, Inc. stands out in the market with its FDA-approved injectable treatment, Qwo, which targets the fibrous bands responsible for the appearance of cellulite. As a non-invasive option, Qwo has gained popularity due to its effectiveness and minimal recovery time. Revance continues to strengthen its leadership in the aesthetic treatment space by focusing on strategic collaborations, ongoing research, and expanding its market presence both domestically and internationally.

Recent Developments

- In September 2024, Kosmoderma Clinic launched the LPG Endermologie Cellu M6 Alliance in India, marking a significant step in advanced body and face contouring, cellulite reduction, and post-exercise recovery. This innovative technique combines mechanical stimulation with vacuum-assisted cellulitis treatment to target cellulite and promote skin tightening. With this new offering, Kosmoderma enhances its portfolio of advanced aesthetic treatments to meet the rising demand for non-invasive solutions among Indian consumers.

- In January 2024, China’s National Medical Products Administration (NMPA) approved Thermage FLX and the TR-4 Return Pad from Bausch Health Companies and Solta Medical. Thermage, a non-invasive treatment using radiofrequency technology, helps tighten and smooth the skin, temporarily improving the appearance of cellulite. This approval marked a significant advancement in the medical aesthetics market.

Top Key Players in the Cellulite Treatment Market

- Zimmer Aesthetics

- Syneron Medical

- Sisram Medical

- Sciton

- Nubway

- Merz Pharma

- Lumenis

- Hologic, Inc

- Cymedics

- BTL

- Alma Lasers

Report Scope

Report Features Description Market Value (2024) US$ 2.5 billion Forecast Revenue (2034) US$ 6.8 billion CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Soft Cellulite, Hard Cellulite, and Edematous Cellulite), By Procedure (Non-invasive Treatment, Topical Treatment, and Minimally Invasive Treatment), By End-user (Clinics & Beauty Centers and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Aesthetics, Syneron Medical, Sisram Medical, Sciton, Nubway, Merz Pharma, Lumenis, Hologic, Inc, Cymedics, BTL, Alma Lasers. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cellulite Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cellulite Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zimmer Aesthetics

- Syneron Medical

- Sisram Medical

- Sciton

- Nubway

- Merz Pharma

- Lumenis

- Hologic, Inc

- Cymedics

- BTL

- Alma Lasers