Global Canned Vegetable Juice Market Size, Share, And Business Benefits By Product Type (Tomato Juice, Carrot Juice, Mixed Vegetable Juice, Others), By Nature (Conventional, Organic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150916

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

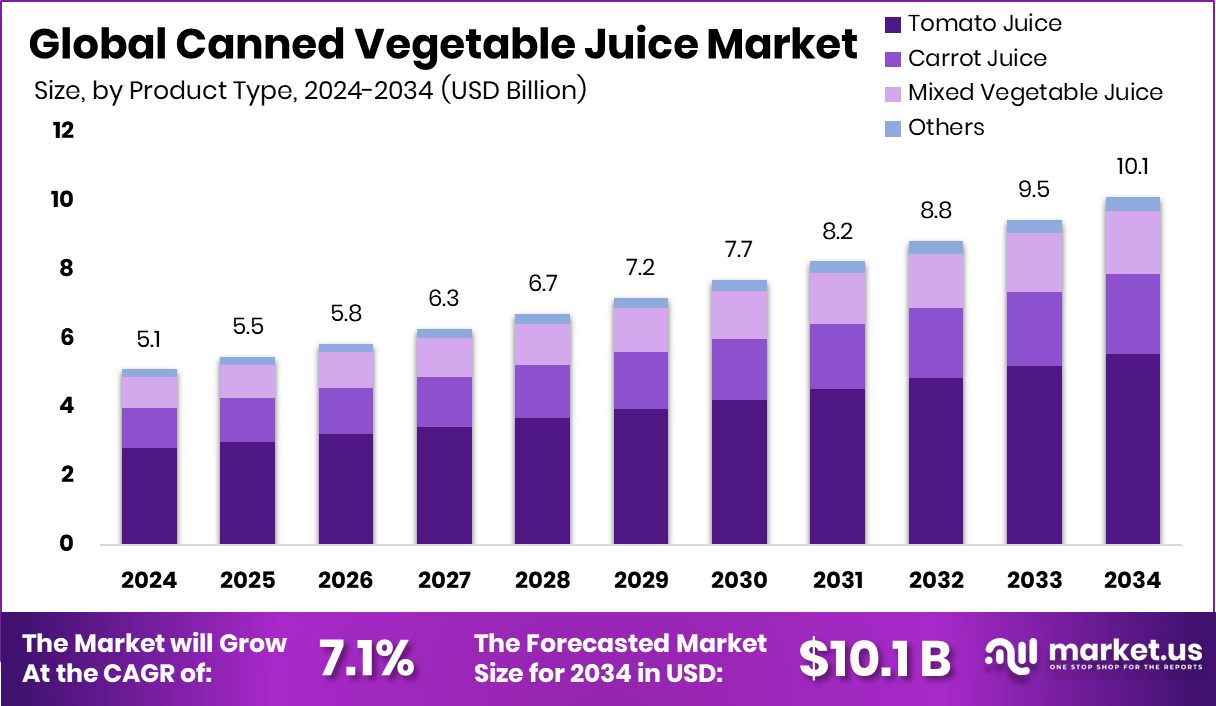

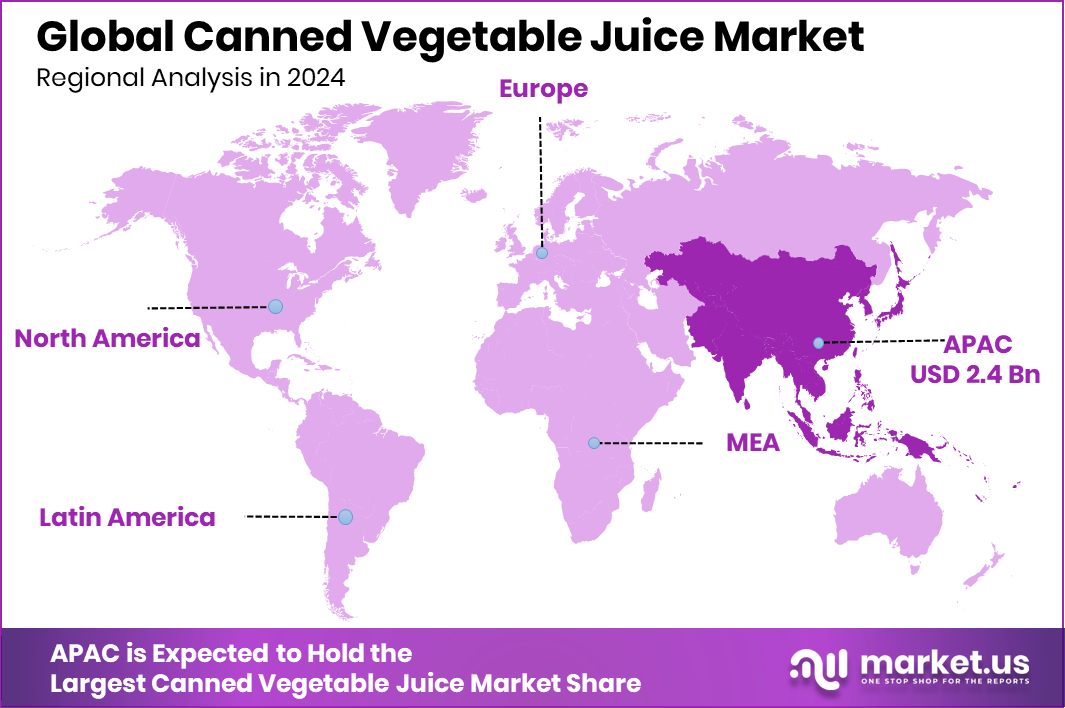

Global Canned Vegetable Juice Market is expected to be worth around USD 10.1 billion by 2034, up from USD 5.1 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034. Strong demand for healthy drinks supports Asia-Pacific’s USD 2.4 Bn market dominance.

Canned Vegetable Juice is a processed beverage made from the juice of various vegetables, typically including tomatoes, carrots, beets, celery, and spinach. It is preserved in metal cans, allowing for a longer shelf life without the need for refrigeration until opened. This type of juice is popular for its convenience and nutritional content, providing essential vitamins, minerals, and antioxidants in a ready-to-drink form.

The Canned Vegetable Juice Market includes the production, distribution, and sale of these juice products to consumers across retail stores, supermarkets, and food service channels. The market is shaped by changing dietary habits, where consumers are shifting toward healthier drink options. With urban lifestyles becoming more hectic, the demand for quick, nutritious beverages has risen, positioning canned vegetable juice as a practical solution for health-conscious individuals.

Growth factors for the market include rising health awareness, the trend of plant-based diets, and the increasing popularity of functional foods. These juices cater to consumers looking for low-calorie, nutrient-rich options. The ease of storage and use also plays a significant role in driving growth, especially in regions where refrigeration may not always be reliable. According to an industry report, Lockyer Valley Foods has raised $50 million in Series A funding aimed at revitalizing the fruit and vegetable processing sector.

Demand is driven by busy lifestyles and an increase in on-the-go consumption habits. As people look for ways to maintain nutrition despite time constraints, canned vegetable juice offers a convenient alternative. It also appeals to those who seek natural and clean-label products without added sugars or preservatives.

Key Takeaways

- Global Canned Vegetable Juice Market is expected to be worth around USD 10.1 billion by 2034, up from USD 5.1 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- Tomato juice dominates the canned vegetable juice market, accounting for 54.9% of total product share.

- Conventional variants lead the canned vegetable juice market, holding a strong 83.3% market segment dominance.

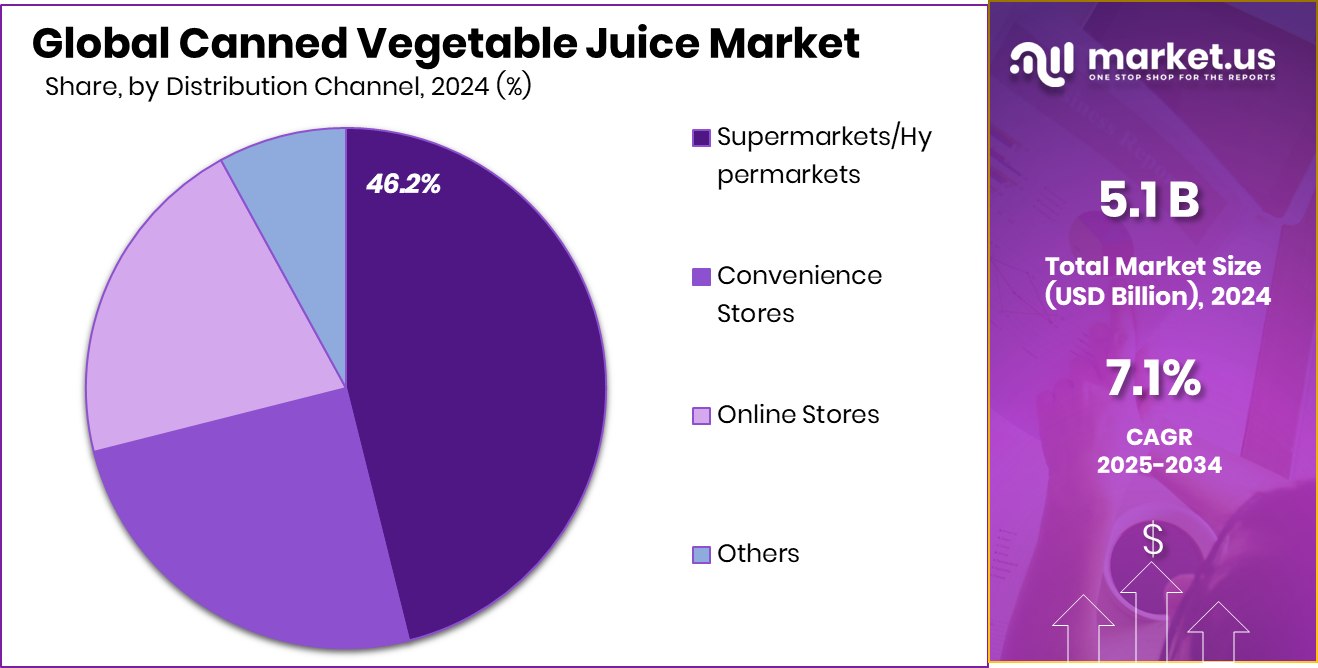

- Supermarkets and hypermarkets contribute 46.2% to canned vegetable juice sales, making them the primary distribution channel.

- The Asia-Pacific reached a market value of USD 2.4 billion this year.

By Product Type Analysis

Tomato juice dominates the canned vegetable juice market, holding a 54.9% share.

In 2024, Tomato Juice held a dominant market position in the By Product Type segment of the Canned Vegetable Juice Market, with a 54.9% share. This strong performance can be attributed to the widespread consumer preference for tomato juice as a familiar, versatile, and nutrient-rich beverage.

Its naturally high content of vitamins A and C, along with lycopene—a powerful antioxidant—has made it a favored choice among health-conscious individuals. The mild taste and compatibility with various spices and seasonings also enhance its appeal across different demographics and culinary cultures.

The popularity of tomato juice is further supported by its established use in both direct consumption and as a mixer in culinary and beverage applications. Consumers view it not only as a refreshing drink but also as a practical component in meal planning and preparation. Its shelf stability and availability in multiple packaging sizes have made it a household staple.

Additionally, tomato juice is often perceived as a functional drink, associated with heart health and detox benefits, which strengthens its market position. The convenience, health benefits, and consumer familiarity with tomato juice are key drivers behind its continued dominance in the segment.

By Nature Analysis

Conventional products lead with 83.3%, reflecting a strong preference for familiar juice options.

In 2024, Conventional held a dominant market position in the By Nature segment of the Canned Vegetable Juice Market, with an 83.3% share. This substantial market share reflects the widespread availability, affordability, and consumer accessibility of conventional canned vegetable juices. These products are mass-produced using standard agricultural practices, allowing manufacturers to maintain a consistent supply and pricing, which appeals to a broad consumer base.

The dominance of the conventional segment is further driven by its strong distribution across retail chains, supermarkets, and convenience stores. Consumers seeking a quick and budget-friendly source of nutrition often opt for conventional options, which are readily available and come in various flavor blends, particularly those featuring tomato juice. The long shelf life and ease of storage add to their practicality, especially for households and institutions that rely on bulk purchasing.

Additionally, the conventional segment benefits from well-established production and processing infrastructure, enabling manufacturers to scale operations and meet high-volume demand efficiently. While preferences for natural and nutritious beverages continue to influence purchasing behavior, the competitive pricing and familiar taste of conventional products remain key factors in their market leadership within the natural segment.

By Distribution Channel Analysis

Supermarkets remain key sales hubs, contributing 46.2% to the overall distribution channel share.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Canned Vegetable Juice Market, with a 46.2% share. This leading position is primarily attributed to the wide product assortment, strong in-store visibility, and consumer trust associated with these retail formats. Supermarkets and hypermarkets offer a convenient shopping experience where consumers can physically inspect products, compare brands, and make informed purchasing decisions—all under one roof.

The strategic shelf placement and promotional activities in these large retail outlets significantly enhance product exposure and impulse buying behavior. Moreover, the ability to offer discounts, bundle deals, and loyalty programs makes supermarkets/hypermarkets a preferred channel for regular grocery shopping, including canned vegetable juices. Consumers often favor these locations for their accessibility, especially in urban and suburban areas where such stores are commonly found.

In addition, these retail formats cater to both individual and family-sized purchases, aligning well with the consumption patterns of canned juices, which are typically bought in bulk for home use. The dominance of supermarkets and hypermarkets in this segment reflects a combination of consumer convenience, consistent product availability, and strong retailer-manufacturer partnerships that ensure steady supply and competitive pricing.

Key Market Segments

By Product Type

- Tomato Juice

- Carrot Juice

- Mixed Vegetable Juice

- Others

By Nature

- Conventional

- Organic

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Driving Factors

Rising Health Awareness Boosting Juice Consumption

One of the top driving factors for the canned vegetable juice market is the growing awareness of health and wellness among people. As more individuals become conscious about what they eat and drink, there is a strong shift toward nutritious and natural food choices. Canned vegetable juices are seen as a convenient way to consume essential vitamins, minerals, and antioxidants without spending time preparing fresh vegetables.

Many people now prefer these juices as part of a balanced diet, especially those who are managing weight, blood pressure, or cholesterol. This rising focus on healthy living is pushing both younger and older consumers to choose vegetable juices over sugary or carbonated drinks, supporting steady market growth.

Restraining Factors

High Sodium Content Limiting Consumer Acceptance

One top restraining factor in the canned vegetable juice market is the high sodium content that many products contain. To improve taste and preserve the product longer, manufacturers often add salt during processing. While this helps maintain flavor and shelf life, it raises concerns for individuals watching their sodium intake. High blood pressure or heart conditions often require reduced salt consumption, so these consumers may avoid canned juice altogether.

As more people learn about the health risks linked with excessive sodium—such as hypertension, stroke, and kidney problems—they become more cautious about including canned vegetable juices in their diets. This means that even with growing demand for convenient and nutritious drinks, the high sodium levels in many products could slow market growth unless manufacturers develop healthier, low-sodium alternatives.

Growth Opportunity

Expanding Low‑Sodium and Fortified Juice Options

A major growth opportunity in the canned vegetable juice market is the development of low‑sodium and fortified juice varieties. As health concerns like hypertension and heart disease become more common, many consumers are seeking nutritious beverages with less salt. Offering low‑sodium canned juices addresses those worries and makes the product more appealing to a wider audience.

Moreover, fortifying juices with added nutrients—such as fiber, vitamins, or probiotics—can further boost their value. These enhanced drinks can attract buyers looking for functional benefits beyond basic hydration, such as improved digestion or immune support. By delivering healthier, enriched options, manufacturers can tap into new customer segments, encourage repeat purchases, and stand out on store shelves.

Latest Trends

Natural Blends with Exotic Veggies and Spices

A leading trend in the canned vegetable juice market is the rise of natural blends featuring exotic vegetables and spices. Consumers are increasingly looking for unique taste experiences and health perks, so manufacturers are mixing in ingredients like kale, turmeric, beetroot, ginger, and even seaweed. These blends appeal to adventurous eaters and those seeking added functional benefits, such as anti-inflammatory and detoxifying properties.

The subtle heat from ginger or the earthy flavor from turmeric adds depth without artificial flavors. Plus, clean-label packaging—highlighting “no added sugar” and “all-natural ingredients”—is gaining popularity. By offering innovative, vibrant combinations, companies can excite shoppers, differentiate on store shelves, and meet the growing demand for both flavor variety and wellness-focused beverages.

Regional Analysis

In 2024, Asia-Pacific led the canned vegetable juice market with 47.9% share.

In 2024, the Asia-Pacific region emerged as the dominating market for canned vegetable juice, capturing approximately 47.9% share and generating revenues of around USD 2.4 billion. This robust performance reflects strong consumer inclination toward convenient, nutritious beverages and growing supermarket penetration across major countries in the region. The vast population base, coupled with increasing urbanization and rising health consciousness, supports sustained consumption of canned vegetable juices.

North America remains a key market thanks to its mature retail infrastructure and well-established juice consumption culture. While exact figures are not provided, the region continues to demand innovation in flavor variants and functional beverages. Similarly, Europe sustains steady growth driven by health trends and regulatory support for fortified drinks. Countries across Western and Central Europe favor tomato- and carrot-based juices, underpinning stable market expansion.

In Latin America, rising disposable incomes and shifting diets toward ready-to-drink products provide a promising growth market. Meanwhile, the Middle East & Africa region shows emerging potential, especially in urban centers where demand for processed, shelf-stable juices is rising due to convenience and storage advantages.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Campbell Soup Company, The Kraft Heinz Company, and Del Monte Foods, Inc., continue to shape the global canned vegetable juice market through established brand presence, innovation, and distribution strength.

Campbell Soup Company maintains a leading role, leveraging its longstanding expertise in tomato-based products. Its consistent product quality, strong shelf visibility, and consumer trust contribute to its stability in the market. The company’s ability to balance taste and health—particularly through low-sodium and heart-healthy options—strengthens its relevance among health-conscious consumers. Campbell’s strong logistics and retail ties ensure wide availability, keeping it competitive in high-demand markets.

The Kraft Heinz Company benefits from its extensive global footprint and deep integration across product categories. Its portfolio includes vegetable juice products that appeal to both traditional and evolving tastes. Kraft Heinz has made efforts to improve nutritional profiles, aligning with consumer trends toward clean labels and natural ingredients. This adaptability helps it retain customer loyalty across various regions.

Del Monte Foods, Inc. emphasizes fruit and vegetable-based nutrition, positioning its canned vegetable juices as convenient, wholesome options for daily consumption. Known for sourcing quality produce and offering products with minimal additives, Del Monte taps into the growing demand for natural beverages. Its marketing often centers on freshness and simplicity, resonating with modern consumers seeking transparency.

Top Key Players in the Market

- Campbell Soup Company

- The Kraft Heinz Company

- Del Monte Foods, Inc.

- PepsiCo, Inc.

- Ocean Spray Cranberries, Inc.

- Nestla

- Dole Food Company, Inc.

- Welch Foods Inc.

- Coca-Cola Company

Recent Developments

- In May 2025, Del Monte introduced nine new beverages (including canned vegetable juice) that use upcycled ingredients, successfully redirecting surplus by reclaiming 265 tons of sweetened syrup over the previous year. These products earned the Upcycled Certified® label, supporting sustainability and reducing food waste.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 10.1 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tomato Juice, Carrot Juice, Mixed Vegetable Juice, Others), By Nature (Conventional, Organic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Campbell Soup Company, The Kraft Heinz Company, Del Monte Foods, Inc., PepsiCo, Inc., Ocean Spray Cranberries, Inc., Nestla, Dole Food Company, Inc., Welch Foods Inc., Coca-Cola Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Canned Vegetable Juice MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Canned Vegetable Juice MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Campbell Soup Company

- The Kraft Heinz Company

- Del Monte Foods, Inc.

- PepsiCo, Inc.

- Ocean Spray Cranberries, Inc.

- Nestla

- Dole Food Company, Inc.

- Welch Foods Inc.

- Coca-Cola Company