Global Calcium Supplement Market Size, Share, And Business Benefits By Product Type (Calcium Carbonate, Calcium Citrate, Calcium Lactate, Calcium Gluconate, Buffered Calcium), By Formulation Type (Tablets, Powders, Syrup), By Distribution Channel (Pharmacies, Online Retail, Supermarkets and Hypermarkets, Health and Wellness Store, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156825

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

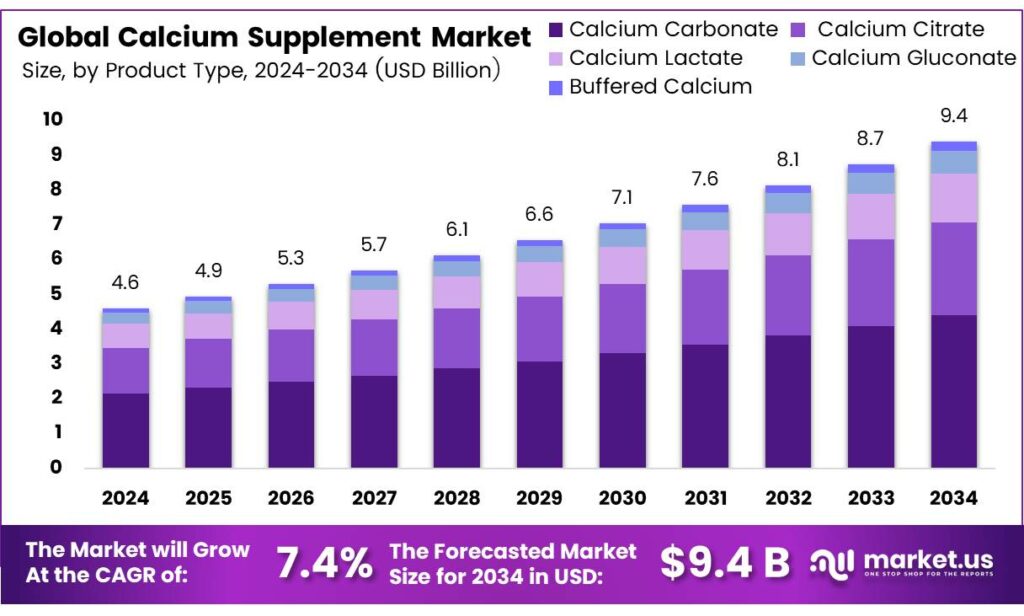

The Global Calcium Supplement Market size is expected to be worth around USD 9.4 billion by 2034, from USD 4.6 billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

Calcium plays a vital role in maintaining bone health throughout life. While a balanced diet is the best source of calcium, supplements can serve as an alternative when dietary intake is insufficient. Understanding your body’s calcium needs, the potential advantages and drawbacks of supplements, and the different types available is essential before deciding to use them.

Calcium requirements vary depending on age and sex. For men between 19 and 70 years, the recommended daily intake is 1,000 mg, while men aged 71 and older need 1,200 mg. Women between 19 and 50 years also require 1,000 mg daily, but for those aged 51 and above, the recommended intake increases to 1,200 mg. The upper daily limit for calcium is set at 2,500 mg for adults aged 19 to 50, and 2,000 mg for those 51 and older.

Calcium supplements are available in different compounds, each containing varying levels of elemental calcium, which is the actual usable calcium absorbed by the body. Common forms include calcium carbonate (40% elemental calcium), calcium citrate (21%), calcium gluconate (9%), and calcium lactate (13%). Among these, calcium carbonate is the most cost-effective and often the first choice for supplementation, while calcium citrate is also widely used for its good absorption profile.

Some supplements combine calcium with additional nutrients such as vitamin D or magnesium, which enhance absorption and provide extra health benefits. Checking the ingredient list is essential, as it reveals not only the type of calcium used but also any additional vitamins or minerals included an important consideration for individuals with specific health or dietary needs.

Understanding elemental calcium content is crucial, as it determines how much calcium your body actually absorbs. For example, 1,250 mg of calcium carbonate contains 500 mg of elemental calcium, which represents the usable portion. Reading the Supplement Facts label carefully helps in calculating the exact intake per serving, especially since the serving size may vary based on the number of tablets. This ensures accurate dosing and helps avoid deficiencies or excessive intake.

Key Takeaways

- The Global Calcium Supplement Market is expected to reach USD 9.4 billion by 2034 from USD 4.6 billion in 2024, growing at a 7.4% CAGR.

- Calcium Carbonate held a 46.9% market share in 2024 due to high elemental calcium and cost-effectiveness.

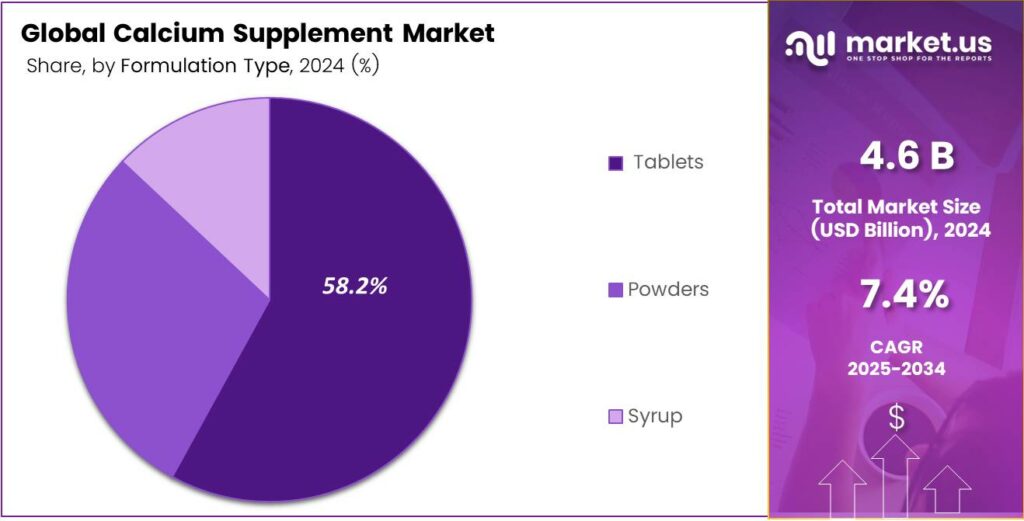

- Tablets dominated with a 58.2% share in 2024, favored for ease of use and accurate dosing.

- Pharmacies led distribution with a 39.4% share in 2024, trusted for reliable supplement guidance.

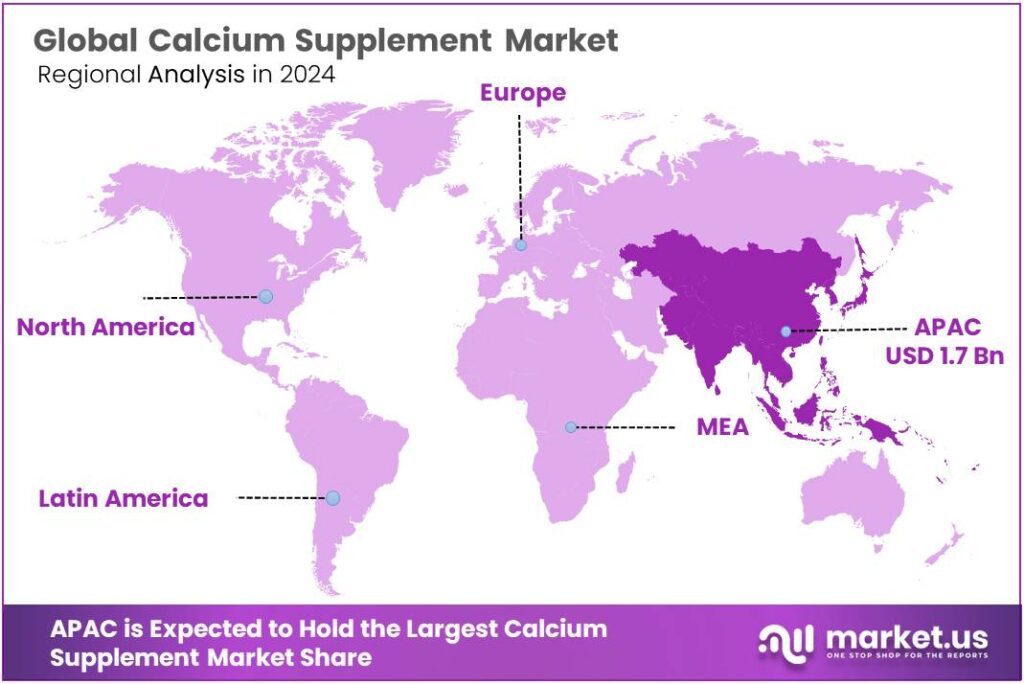

- Asia-Pacific accounted for 38.8% of market revenue (USD 1.7 billion) in 2024, driven by health awareness and demographics.

Analyst Viewpoint

The calcium supplement market presents a compelling case for investors, driven by growing consumer awareness of bone health and an aging global population. Demand for calcium supplements is surging, particularly among older adults and women. The rise of plant-based and vegan supplements also opens new avenues, as health-conscious consumers, especially younger ones, seek natural alternatives.

E-commerce is another bright spot, with online sales growing due to convenience and subscription models, especially in regions like Asia-Pacific, where health awareness is climbing alongside disposable incomes. Investors can find opportunities in innovative formulations like calcium citrate paired with vitamin D3 or magnesium and eco-friendly packaging, which resonates with environmentally conscious buyers.

Misinformation on social media about supplement safety further complicates consumer trust, requiring companies to invest heavily in transparent marketing and scientific backing. Despite these hurdles, the market’s growth potential remains strong, but investors must prioritize companies with robust quality control and a knack for navigating complex regulations to mitigate risks and build consumer confidence.

By Product Type

Calcium Carbonate Leads with 46.9% Share

In 2024, Calcium Carbonate held a dominant market position, capturing more than a 46.9% share in the global calcium supplement market. Its strong position is mainly due to its high elemental calcium content, which makes it a cost-effective choice for both manufacturers and consumers. Calcium carbonate supplements are widely available in tablet, chewable, and powder forms, making them accessible across diverse age groups.

In addition, their affordability compared to other calcium compounds continues to drive preference in developing as well as developed regions. The year 2024 has seen growing awareness about bone health and the prevention of osteoporosis, particularly among aging populations.

Calcium carbonate is often recommended because it is best absorbed when taken with food, aligning with the dietary habits of most consumers. This compatibility has supported its widespread adoption. The demand is expected to remain steady as more people adopt preventive healthcare routines, while governments and health organizations emphasize daily calcium intake to curb deficiencies.

By Formulation Type

Tablets Lead with 58.2% Share

In 2024, Tablets held a dominant market position, capturing more than a 58.2% share in the calcium supplement market. Their leadership stems from ease of use, accurate dosage, and wide consumer familiarity, making them the preferred choice among various age groups. Tablets are also cost-efficient to produce and distribute, which has ensured their strong presence in pharmacies, supermarkets, and online platforms.

Consumers often rely on tablets because they are convenient for daily intake and offer consistent calcium levels that support bone and joint health. The year 2024 has witnessed rising awareness about osteoporosis and age-related bone weakness, particularly in women above 50 years. Tablets, being compact and travel-friendly, align with the needs of this growing consumer base.

In addition, healthcare professionals frequently prescribe calcium in tablet form due to its standardized formulation, further strengthening its dominance. Looking ahead to 2025, the preference for tablets is expected to continue as they remain affordable and trusted, especially in regions where dietary calcium intake is still below recommended levels.

By Distribution Channel

Pharmacies Dominate with 39.4% Share

In 2024, Pharmacies held a dominant market position, capturing more than a 39.4% share in the calcium supplement market. Their strong performance is linked to the trust consumers place in pharmacists for guidance on dosage, product selection, and safe use of supplements. Pharmacies remain a primary point of purchase for individuals seeking reliable and medically recommended options, especially for older adults and patients with bone health concerns.

The availability of both branded and generic calcium supplements further strengthens their role as the most preferred distribution channel. During 2024, the rising prevalence of osteoporosis and calcium deficiencies has encouraged people to seek professional advice before choosing supplements.

Pharmacies offer not only accessibility but also credibility, which is a key factor in driving sales. This dominance is likely to continue as consumers increasingly prioritize safety, authenticity, and pharmacist recommendations when purchasing health-related products. Pharmacies also play a vital role in rural and semi-urban markets, where other distribution channels like online platforms are less established.

Key Market Segments

By Product Type

- Calcium Carbonate

- Calcium Citrate

- Calcium Lactate

- Calcium Gluconate

- Buffered Calcium

By Formulation Type

- Tablets

- Powders

- Syrup

By Distribution Channel

- Pharmacies

- Online Retail

- Supermarkets and Hypermarkets

- Health and Wellness Store

- Others

Drivers

Rising Burden of Osteoporosis and Bone Health Concerns

One of the major driving factors for the calcium supplement market is the growing burden of osteoporosis and other bone-related disorders across the world. Osteoporosis is often called the silent disease because bone loss occurs without symptoms until a fracture happens.

According to the International Osteoporosis Foundation (IOF), more than 200 million people worldwide are affected by osteoporosis, and every year, around 8.9 million fractures are linked to this condition, which equals one fracture every three seconds.

The World Health Organization (WHO) recommends a daily calcium intake of 1,000 to 1,200 mg for adults, depending on age and gender, to maintain healthy bones and prevent long-term complications. In parts of Asia and Africa, average daily intake is often below 500 mg per day, far short of recommended levels.

Restraints

Safety Limits and Health Risks from Excessive Calcium Intake

One major restraint when it comes to calcium supplements is the Tolerable Upper Intake Level (UL), the maximum daily amount that’s unlikely to cause harm. For most adults aged 19–50, this UL is 2,500 mg per day, and for those aged 51 and older, it drops to 2,000 mg per day. Knowing these numbers matters because it helps people and policymakers understand the boundary between helpful and harmful intake.

When you take more calcium than your body needs, especially from supplements, it doesn’t always stay harmless. The NIH points out that excessive calcium can increase the risk of kidney stones, and possibly cardiovascular issues, and prostate cancer. Similarly, dietary advisers caution that there’s no added benefit in exceeding your calcium need and doing so may even invite risks like constipation, heart calcification, and kidney stones

Opportunity

Rising Awareness of Bone Health Among Aging Populations

One of the clearest reasons calcium supplements are on the rise is the growing number of older adults who want to keep their bones strong and healthy. As countries around the world age, more people, especially women past menopause, are looking for ways to slow bone loss and lower the risk of osteoporosis.

That’s why calcium, sometimes paired with vitamin D, is becoming a more regular part of daily health routines. That means calcium alone is driving nearly USD 7.36 billion within the mineral segment. Behind these numbers are families, caregivers, and countless individuals choosing prevention and strength.

This growth is more than awareness; it’s supported by a public health initiative. For example, in the United States, the government’s Healthy People goals aim to increase average daily calcium intake for everyone aged two and above. Most recently, total intake clocks in at 1,047 mg per day, but the target is 1,184 mg. That 137 mg gap highlights a real opportunity and need for more accessible calcium sources, including supplements.

Trends

The Rise of Clean-Label and Food-Based Calcium Innovations

One truly exciting trend shaping the calcium supplement world is the move toward clean-label, food-derived sources of calcium. People are becoming more thoughtful about what goes into their bodies, and instead of swallowing synthetic tablets, many are turning toward options that feel more natural and kinder, like calcium made from real foods.

In fact, a growing number of companies are exploring calcium chews and supplements made from food sources, aiming to reduce side effects often tied to synthetic forms like stomach upset or constipation. New research discussions, highlight these emerging food-based calcium options as a way to improve tolerability and acceptance, giving people a gentler, more trustworthy way to care for their bones.

This shift isn’t just a marketing trend; it’s rooted in how people actually feel taking their vitamins. Think about it, when someone eats a supplement that feels closer to nature, maybe with a fruity chew or a plant-based origin, there’s a sense of comfort. It’s not just science. It’s human. And it matters.

Regional Analysis

Asia‑Pacific (APAC) Dominates with 38.8%, USD 1.7 Billion Market Share

The Asia‑Pacific (APAC) region holds a commanding position in the global calcium supplement market, accounting for approximately 38.8% of total industry revenue, equivalent to around USD 1.7 billion. This dominance reflects both growing consumer health awareness and evolving demographic dynamics across diverse economies.

APAC’s prominence stems from several converging market dynamics. A rapidly aging population, especially in countries like China, Japan, and India, is driving increased demand for bone‑health products such as calcium supplements. Rising disposable incomes in emerging economies across Southeast Asia and South Asia are further fueling consumer spending on preventive nutrition.

A massive and rapidly aging population, particularly in countries like Japan and China, is increasingly proactive about managing bone health issues like osteoporosis, creating a vast and expanding consumer base. Concurrently, rising disposable incomes across emerging economies, including India, Indonesia, and Vietnam, are enabling consumers to invest more in preventive healthcare and wellness products.

Furthermore, growing health awareness, spurred by government initiatives and educational campaigns on nutritional deficiencies, is significantly driving demand. The market is also characterized by a strong cultural affinity for dietary supplements and a robust distribution network encompassing pharmacies, e-commerce platforms, and direct-selling channels, making these products highly accessible.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Pfizer (Caltrate) leverages its immense brand trust and scientific reputation to dominate the calcium supplement sector with Caltrate. Its strategy focuses on clinically backed formulations, often combined with Vitamin D for enhanced absorption. Extensive distribution through major retail pharmacies and healthcare professional endorsements solidify its market-leading position.

- AandZ Pharmaceutical carves its niche as a key supplier of private-label and contract-manufactured calcium supplements. Rather than building a consumer brand, its strength lies in B2B relationships, providing cost-effective, high-volume calcium ingredients and finished products for other retailers and brands. This strategy allows them to serve a vast, price-sensitive segment of the market indirectly.

- Amway’s Nutrilite brand differentiates itself through a farm-to-supplement philosophy, emphasizing traceability and natural sourcing from its owned organic farms. This unique selling proposition appeals to health-conscious consumers seeking premium, whole-food-based nutrition. Marketed exclusively through Amway’s global network of independent business owners, Nutrilite calcium products benefit from personalized, direct-selling relationships.

Top Key Players in the Market

- Pfizer (Caltrate)

- AandZ Pharmaceutical

- Amway (Nutrilite)

- Nature Made

- GSK

- GNC Holdings Inc

- Bio Island

- Nature’s Bounty

Recent Developments

- In 2024, A&Z Pharmaceutical, a private company based in Hauppauge, New York, focuses on developing and manufacturing dietary supplements, including calcium products. However, specific recent developments related to their calcium supplement portfolio are scarce on government or company websites.

- In 2024, Amway’s Nutrilite brand is a prominent player in the global dietary supplement market, offering calcium supplements like Nutrilite Cal Mag D, which combines calcium, magnesium, and vitamin D to support bone health. Recent efforts focus on catering to health-conscious consumers, with formulations emphasizing natural ingredients and bioavailability.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 9.4 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Calcium Carbonate, Calcium Citrate, Calcium Lactate, Calcium Gluconate, Buffered Calcium), By Formulation Type (Tablets, Powders, Syrup), By Distribution Channel (Pharmacies, Online Retail, Supermarkets and Hypermarkets, Health and Wellness Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Pfizer (Caltrate), AandZ Pharmaceutical, Amway (Nutrilite), Nature Made, GSK, GNC Holdings Inc, Bio Island, Nature’s Bounty Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Calcium Supplement MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Calcium Supplement MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer (Caltrate)

- AandZ Pharmaceutical

- Amway (Nutrilite)

- Nature Made

- GSK

- GNC Holdings Inc

- Bio Island

- Nature's Bounty