Global Butane Market Size, Share, And Business Benefits By Type (Gasoline Crude Oil, Natural Gas, Isobutane, Others), By Application ((Liquid Petroleum Gases (LPG)(Residential/Commercial, Chemical/Petrochemical (Industrial, Auto Fuel, Refinery, Others))), Petrochemicals, Refineries, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151346

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

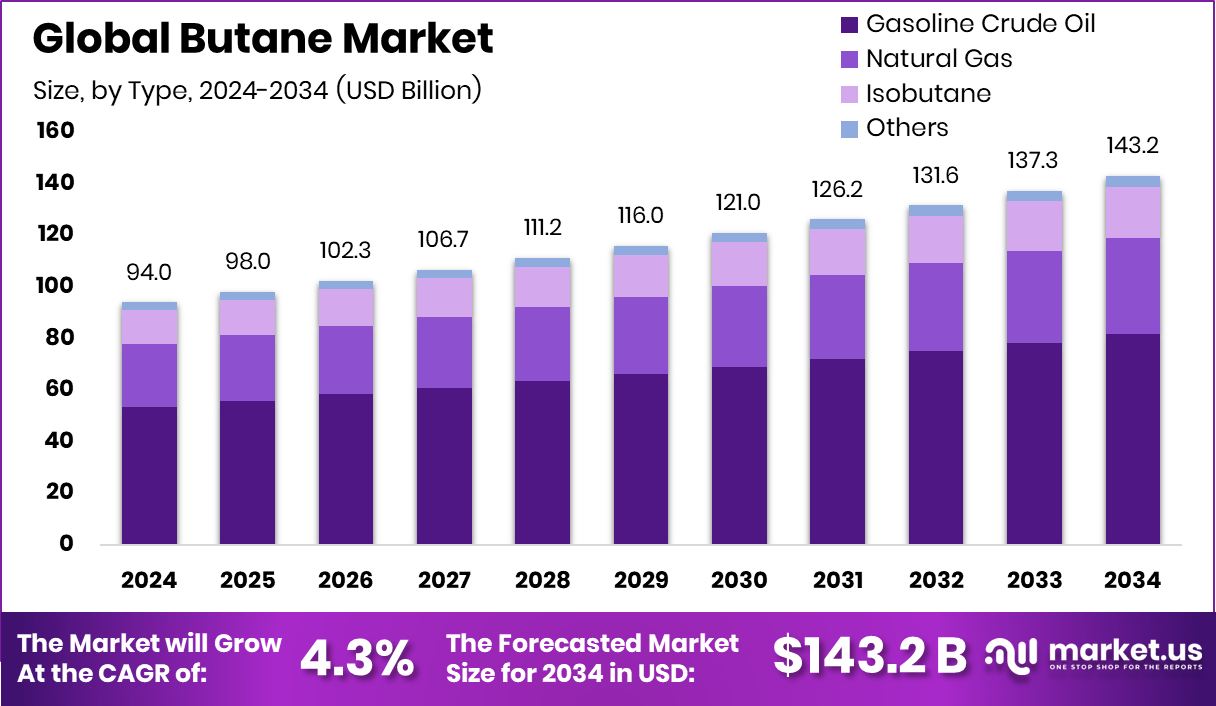

Global Butane Market is expected to be worth around USD 143.2 billion by 2034, up from USD 94.0 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. Strong demand in Asia-Pacific drove the butane market to USD 43.4 billion.

Butane is a highly flammable, colorless, and easily liquefied gas that belongs to the alkane family of hydrocarbons. It is commonly used as a fuel, refrigerant, and propellant in aerosol sprays. Found in natural gas and crude oil, butane is extracted and separated during the refining process. It is primarily available in two isomers: n-butane and isobutane, each with distinct properties and applications in the energy, industrial, and domestic sectors.

The butane market refers to the global trade, production, distribution, and consumption of butane gas across various industries. This market is influenced by energy demands, petrochemical usage, and seasonal requirements such as heating fuel in colder months. Butane is also used as a blending agent in gasoline and as a feedstock in the production of chemicals like butadiene.

Growth in the butane market is largely driven by rising urbanization and industrialization, particularly in developing regions. Increasing energy needs and a push for cleaner-burning fuels have encouraged a shift toward liquefied petroleum gases like butane. Additionally, growing infrastructure in transportation and manufacturing further boosts consumption across sectors.

Demand for butane continues to rise due to its versatility and cost-efficiency. It is widely used in households for cooking and heating, especially in areas without access to natural gas pipelines. Moreover, its role in the production of synthetic rubber and other chemicals keeps industrial demand steady and robust. Morocco has set aside MAD 16.35 billion to help cover the costs of essential goods like sugar, butane gas, and flour.

Key Takeaways

- Global Butane Market is expected to be worth around USD 143.2 billion by 2034, up from USD 94.0 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Gasoline and crude oil account for 57.1% of the butane market, reflecting refining demand trends.

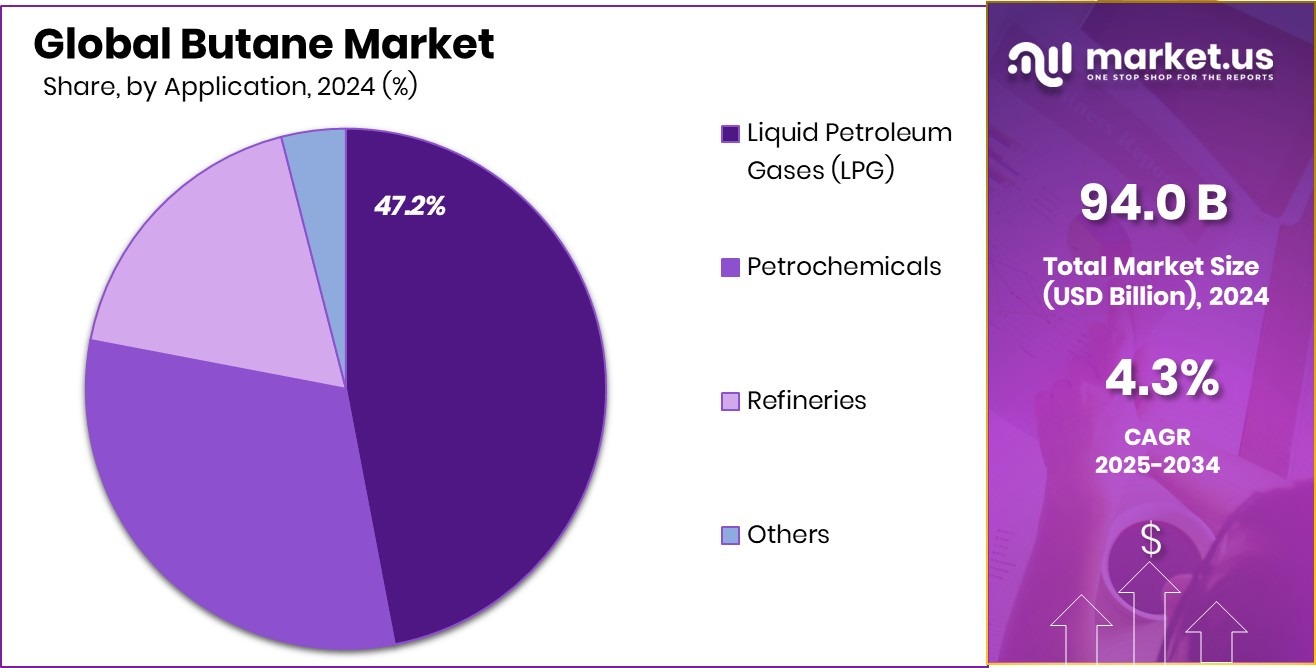

- Liquid Petroleum Gases (LPG) represent 47.2% of the butane market, driven by household and commercial usage.

- Asia-Pacific held a dominant 46.2% share in the global butane market.

By Type Analysis

Gasoline crude oil holds a 57.1% share in the butane market.

In 2024, Gasoline Crude Oil held a dominant market position in the “By Type” segment of the Butane Market, with a 57.1% share. This significant market share reflects the continued reliance on gasoline and crude oil as a primary source for butane extraction. Its dominance can be attributed to the well-established infrastructure and refining capacity dedicated to gasoline production, which naturally integrates the extraction of byproducts like butane.

The consistent demand for gasoline across transportation and industrial sectors further supports the steady output of crude oil, thereby ensuring a regular supply of butane as a secondary product.

Moreover, the efficiency and cost-effectiveness of extracting butane from crude oil make it a preferred method among producers. This process not only yields high volumes of butane but also aligns with existing refining workflows, reducing the need for additional capital investment.

In regions where gasoline consumption remains high, the availability of crude oil-based butane supports both residential and industrial fuel needs. As such, the 57.1% share held by gasoline crude oil in the butane market underlines its strategic importance and long-standing integration within the broader hydrocarbon supply chain, reinforcing its leadership within this segment in 2024.

By Application Analysis

LPG accounts for 47.2% of the total butane market usage globally.

In 2024, Liquid Petroleum Gases (LPG) held a dominant market position in the “By Application” segment of the Butane Market, with a 47.2% share. This strong foothold reflects the widespread use of butane as a key component in LPG mixtures, which are extensively utilized for domestic cooking, heating, and small-scale industrial purposes.

The convenience, portability, and relatively clean-burning nature of LPG make it a preferred energy source, especially in areas lacking direct access to natural gas infrastructure.

The 47.2% share is indicative of butane’s essential role in LPG production, where it enhances combustion efficiency and balances pressure within the gas mixture. This integration of butane into LPG has enabled consistent demand across urban and rural markets alike, supporting its dominant position in the application landscape.

Moreover, the ease of storage and transport of LPG cylinders further boosts the utility of butane in this form, making it adaptable for varied energy needs. In 2024, this application segment’s performance highlights the centrality of LPG in sustaining steady consumption patterns for butane, anchoring it as a key driver in the overall market structure.

Key Market Segments

By Type

- Gasoline Crude Oil

- Natural Gas

- Isobutane

- Others

By Application

- Liquid Petroleum Gases (LPG)

- Residential/Commercial

- Chemical/Petrochemical

- Industrial

- Auto Fuel

- Refinery

- Others

- Petrochemicals

- Refineries

- Others

Driving Factors

Rising Use of Butane in Household Energy

One of the top driving factors for the butane market is its growing use in household energy needs. Butane is widely used in homes for cooking and heating, especially in areas where access to piped natural gas is limited. Its ability to be stored and transported easily in LPG cylinders makes it very convenient for domestic use.

As more households, particularly in developing countries, move toward cleaner and efficient energy sources, the demand for butane is rising. Its affordability, clean-burning nature, and ease of use are making it a reliable choice for families. This increasing dependence on butane for everyday energy use is playing a big role in supporting the steady growth of the global butane market.

Restraining Factors

Safety Risks and Flammability Limit Widespread Usage

A key factor holding back the growth of the butane market is the safety risk linked to its high flammability. Butane is a highly combustible gas, and if not stored or handled properly, it can lead to fire hazards, explosions, or gas leaks. These risks are a major concern, especially in densely populated or poorly regulated areas.

Many consumers and businesses are cautious about using butane due to these safety issues. Strict safety regulations, installation costs for secure storage, and the need for regular maintenance can also make its use less appealing. These concerns limit butane’s adoption in some regions, slowing down market growth despite its advantages as a clean and efficient fuel source.

Growth Opportunity

Expanding Energy Access in Rural Developing Regions

A major growth opportunity for the butane market lies in expanding energy access in rural and developing areas. In many parts of the world, especially in remote villages, people still lack access to reliable and clean cooking or heating fuels. Butane, often used in the form of LPG, offers a practical and affordable solution.

It can be easily stored in cylinders and transported to off-grid locations, making it ideal for these communities. Governments and organizations promoting clean energy are also supporting such efforts through subsidies and awareness programs. As infrastructure improves and demand for safer, cleaner household energy grows, the use of butane in these underserved areas presents a strong opportunity for long-term market growth.

Latest Trends

Shift Toward Refillable and Smart Gas Cylinders Innovation

A significant recent trend in the butane market is the shift toward refillable and smart gas cylinders. These modern cylinders are designed for safety, convenience, and cost-efficiency. Instead of buying new disposable cylinders, users can refill their tanks at gas stations or specialized refill points, reducing waste and recurring cylinder expenses.

Smart versions go a step further, featuring digital sensors that monitor gas levels, usage patterns, and even provide alerts when refilling is needed or if there’s a leak. This innovation not only addresses safety concerns but also enhances user experience. With growing environmental awareness and consumer demand for smarter home appliances, these refillable and sensor-enabled cylinders are gaining traction, supporting more efficient and eco-friendly use of butane.

Regional Analysis

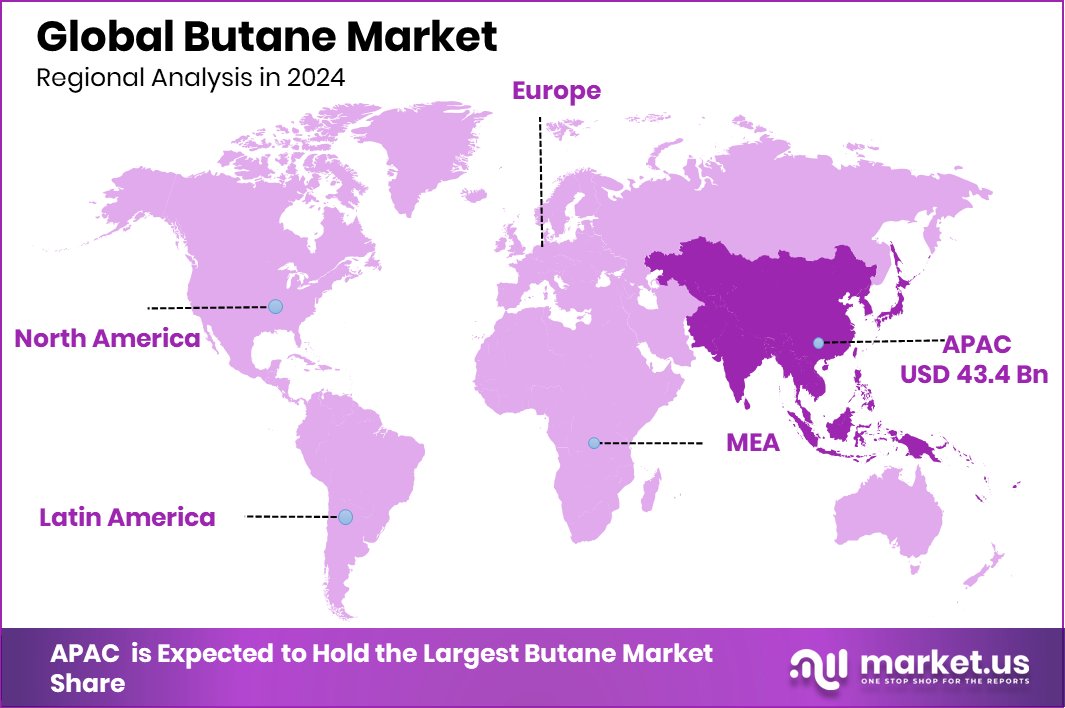

In Asia-Pacific, the butane market reached USD 43.4 billion in 2024.

In 2024, the Asia-Pacific region dominated the global butane market, capturing a leading share of 46.2% and generating a market value of USD 43.4 billion. This dominance is driven by high demand across residential, commercial, and industrial applications, particularly in emerging economies where population growth and urban expansion continue to boost energy needs. The region’s strong manufacturing base and rising consumption of LPG further contribute to its market leadership.

North America also holds a significant share, supported by established refining infrastructure and consistent demand for butane in petrochemical production and fuel blending. In Europe, the market is sustained by environmental policies promoting cleaner fuels and the widespread use of butane in household energy.

Meanwhile, the Middle East & Africa region benefits from abundant natural gas resources, supporting regional production and export potential. Latin America shows moderate growth, mainly driven by domestic energy needs and gradual infrastructure development.

Across all these regions, Asia-Pacific stands out not only in market share but also in absolute value, maintaining its position as the key contributor to global butane demand. The region’s growing consumption patterns, coupled with favorable supply-side dynamics, continue to reinforce its role as the central hub in the butane market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global butane market saw steady activity led by key players such as ConocoPhillips, Devron Energy Corporation, Ecopetrol S.A., and Exxon Mobil Corporation. These companies played significant roles in shaping supply dynamics and supporting stable market flow through their operations in upstream extraction, refining, and distribution.

ConocoPhillips continued to strengthen its position through its diversified asset base and refining efficiency. With a focus on maximizing hydrocarbon yields, the company ensured consistent butane output from its integrated facilities. Its operational presence in key production regions helped meet domestic and export demand, supporting reliability in supply chains.

Devron Energy Corporation maintained its niche standing through strategic focus on exploration and production. Its activities, while more concentrated, contributed to regional supply volumes. The company’s agility in operational scaling allowed it to respond flexibly to shifts in local demand, adding resilience to supply streams within specific markets.

Ecopetrol S.A., as a major energy firm in Latin America, contributed notably to the regional availability of butane. The company’s integrated value chain, from crude oil extraction to refining, supported consistent production levels. Ecopetrol also supported domestic LPG consumption, aligning with the rising household energy demand in South America.

Exxon Mobil Corporation remained a key global force, leveraging its vast refining capabilities and international footprint. With strong infrastructure and consistent output levels, the company ensured supply to both industrial and commercial sectors. Its large-scale operations and investment in refining efficiencies underscored its role in maintaining global butane availability in 2024.

Top Key Players in the Market

- British Petroleum

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- ConocoPhillips

- Devron Energy Corporation

- Ecopetrol S.A.

- Exxon Mobil Corporation

- Gazprom PJSC

- Indian Oil Corporation Limited

- Linde AG

- Marathon Petroleum Corporation

- Petrobras

- PetroChina Company Limited

- Phillips 66

- Repsol S.A.

- TotalEnergies SE

- Valero Energy Corporation

Recent Developments

- In October 2024, Gazprom boosted its investment plan by 4% to $16.85 billion, mainly funding gas production in Yamal and Eastern Russia, including processing capacity for NGLs like butane

- In July 2024, Devon closed a $5 billion deal to acquire Grayson Mill Energy’s Williston Basin assets, adding ~500 oil wells across 307,000 acres and boosting high‑margin natural gas liquids—like butane—production.

Report Scope

Report Features Description Market Value (2024) USD 94.0 Billion Forecast Revenue (2034) USD 143.2 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gasoline Crude Oil, Natural Gas, Isobutane, Others), By Application ((Liquid Petroleum Gases (LPG)(Residential/Commercial, Chemical/Petrochemical (Industrial, Auto Fuel, Refinery, Others))), Petrochemicals, Refineries, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape British Petroleum, Chevron Corporation, China National Petroleum Corporation (CNPC), ConocoPhillips, Devron Energy Corporation, Ecopetrol S.A., Exxon Mobil Corporation, Gazprom PJSC, Indian Oil Corporation Limited, Linde AG, Marathon Petroleum Corporation, Petrobras, PetroChina Company Limited, Phillips 66, Repsol S.A., TotalEnergies SE, Valero Energy Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- British Petroleum

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- ConocoPhillips

- Devron Energy Corporation

- Ecopetrol S.A.

- Exxon Mobil Corporation

- Gazprom PJSC

- Indian Oil Corporation Limited

- Linde AG

- Marathon Petroleum Corporation

- Petrobras

- PetroChina Company Limited

- Phillips 66

- Repsol S.A.

- TotalEnergies SE

- Valero Energy Corporation