Global Bus Seat Market Size, Share, Growth Analysis By Components (Frame, Upholstery, Others), By Comfort Type (Low Comfort Seat, High Comfort Seat), By Seat Type (Regular Passenger Seat, Recliner Seat, Folding Seat, Bus Driver Seat, Integrated Child Seat), By Bus Type (Transit Bus, Coach Bus, School Bus, Transfer Bus, Others), By End-Use (OEM Fitment, Aftermarket/Retro-fit), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176988

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

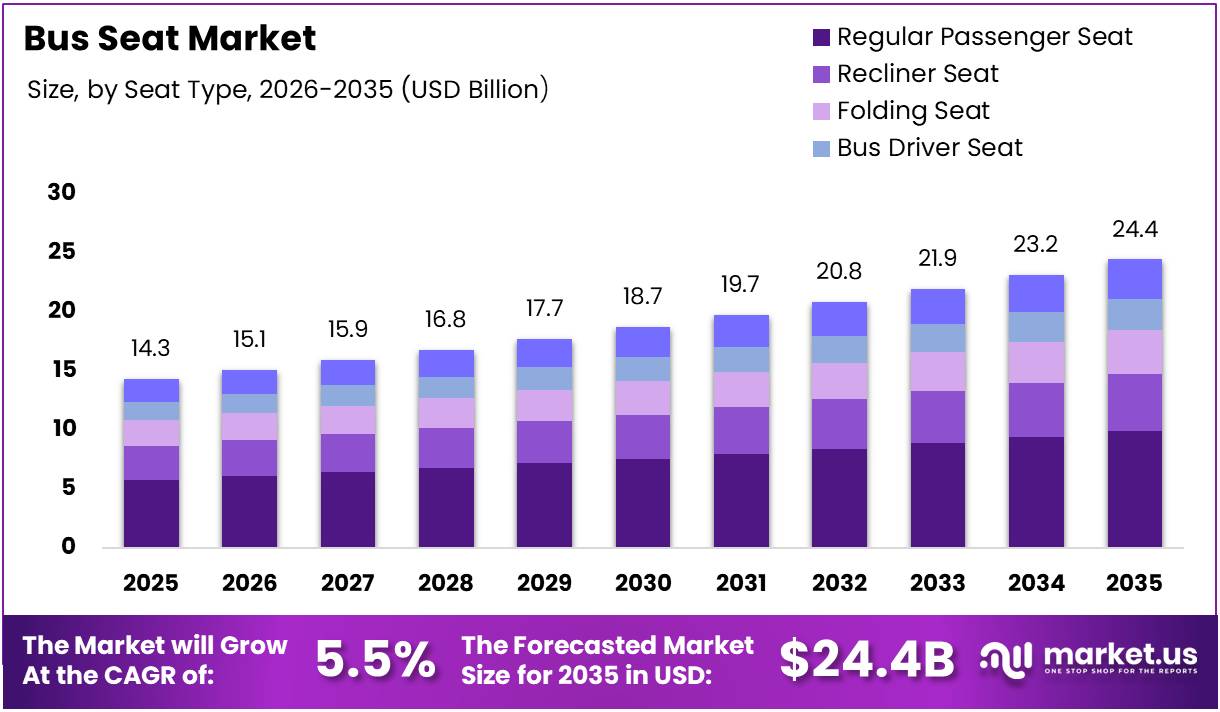

The Global Bus Seat Market size is expected to be worth around USD 24.4 Billion by 2035 from USD 14.3 Billion in 2025, growing at a CAGR of 5.5% during the forecast period 2026 to 2035.

The bus seat market encompasses the manufacturing and supply of seating systems designed for various bus types. These seats serve transit buses, coaches, school buses, and specialized transport vehicles. The market includes frames, upholstery, and integrated safety components tailored to passenger comfort and regulatory compliance.

Market growth is primarily driven by expanding public transportation networks worldwide. Urbanization continues to fuel demand for mass transit solutions, requiring frequent fleet modernization. Moreover, governments increasingly invest in sustainable mobility infrastructure, creating sustained demand for quality bus seating systems across developed and emerging economies.

Passenger comfort has become a critical differentiator in modern bus operations. Manufacturers now prioritize ergonomic designs, lightweight materials, and modular configurations. Additionally, the integration of safety features and durability standards drives innovation. Consequently, OEM fitment dominates the market as operators prefer factory-installed solutions over aftermarket modifications.

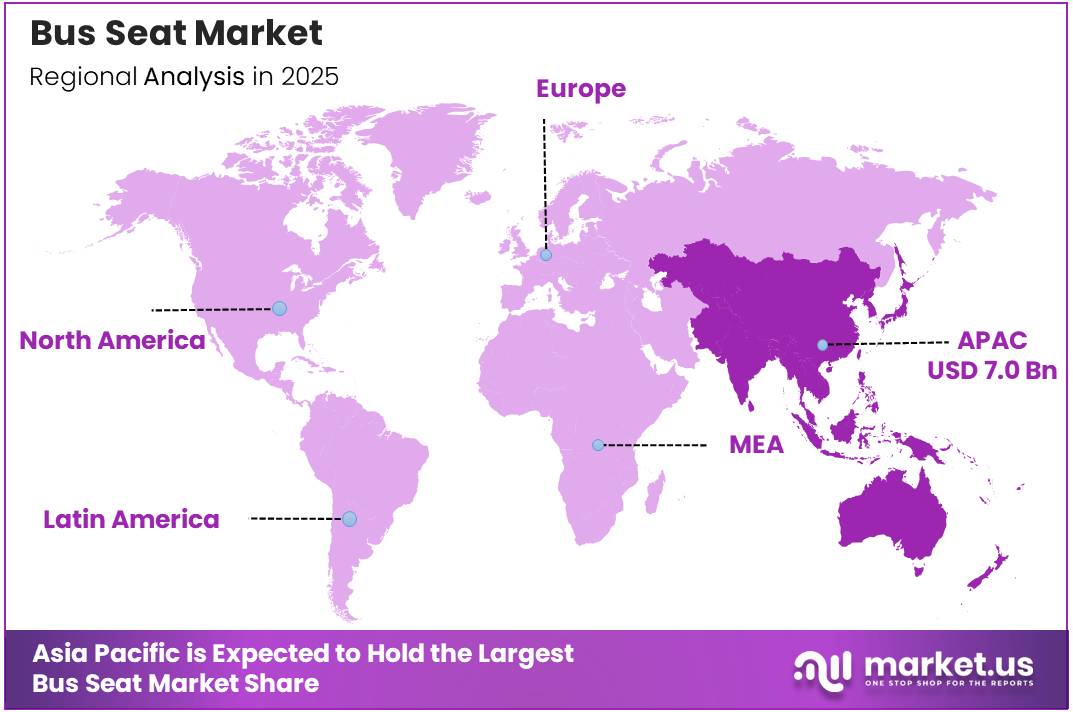

Regional expansion patterns reveal significant opportunities in developing markets. Asia-Pacific leads with robust urbanization rates and expanding public transport systems. Furthermore, emerging economies continue investing in fleet upgrades and new bus acquisitions. Therefore, manufacturers strategically position themselves to capture growing demand in high-potential markets globally.

According to research published in Transportation Ergonomics and Safety, approximately 36.1% of passengers prefer seats behind the driver, while 25% favor front seats. This seating preference data influences design priorities and layout optimization strategies. However, passenger satisfaction varies significantly across different aspects of bus travel experience.

According to a passenger survey study, 62.6% of passengers expressed dissatisfaction with cost-effectiveness and tariff affordability, while only 26% were satisfied. Additionally, according to Volvo Buses, approximately 50% of passengers prioritize legroom when selecting seats. These insights drive manufacturers to balance comfort features with economic considerations effectively.

The aftermarket segment presents distinct opportunities despite OEM dominance. Retrofit solutions enable fleet operators to upgrade aging vehicles economically. Meanwhile, technological advancements in materials and manufacturing processes reduce production costs. Consequently, the market demonstrates resilience through diverse revenue streams and expanding application segments across global transportation networks.

Key Takeaways

- Global Bus Seat Market projected to reach USD 24.4 Billion by 2035, growing at 5.5% CAGR from 2025 to 2035

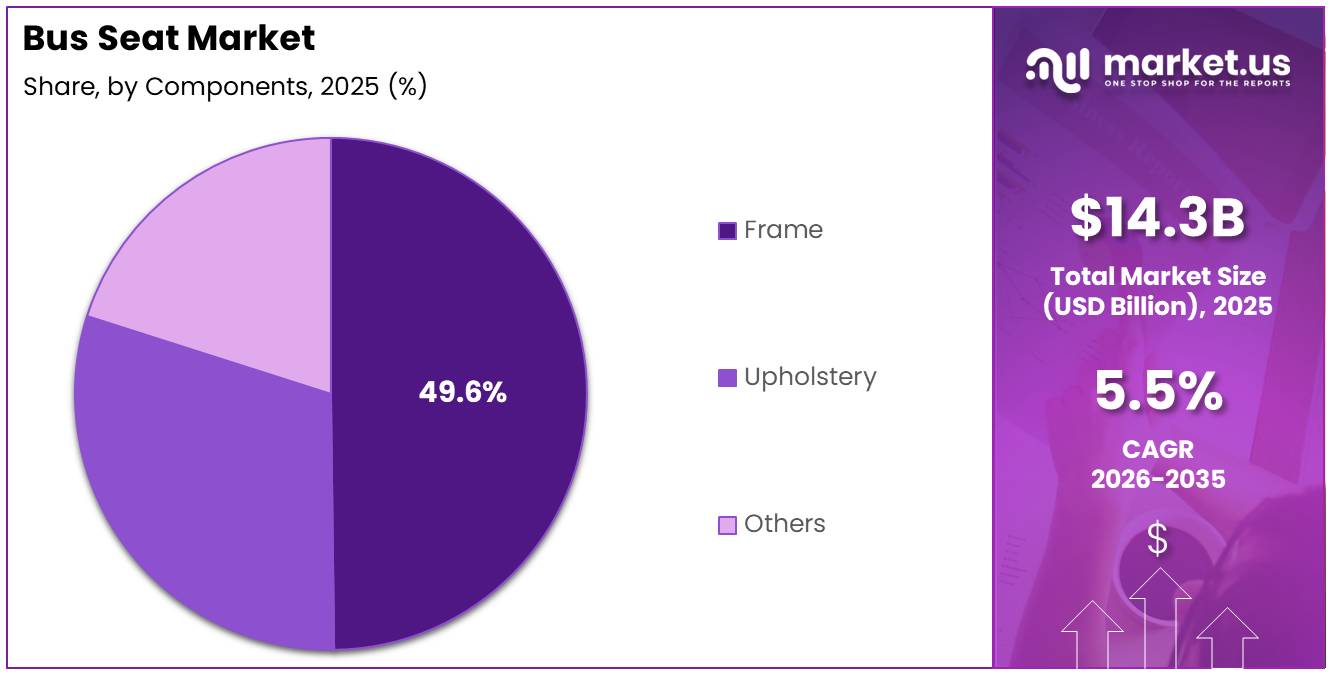

- Frame segment dominates By Components category with 49.6% market share in 2025

- Low Comfort Seat holds 67.1% share in By Comfort Type segment

- Regular Passenger Seat leads By Seat Type segment with 40.4% market share

- Transit Bus segment captures 49.7% share in By Bus Type category

- OEM Fitment dominates By End-Use segment with 71.3% market share

- Asia-Pacific region leads with 49.20% market share, valued at USD 7.0 Billion

By Components Analysis

Frame dominates with 49.6% due to structural importance and engineering requirements.

In 2025, Frame held a dominant market position in the By Components segment of Bus Seat Market, with a 49.6% share. Frames represent the foundational structural element providing strength, safety, and durability. Moreover, advanced materials like high-strength steel and aluminum alloys drive innovation. Consequently, manufacturers invest heavily in frame engineering to meet stringent safety standards.

Upholstery serves as the second major component category in bus seating systems. This segment includes fabrics, cushioning materials, and protective covers enhancing passenger comfort. Additionally, antimicrobial and fire-resistant materials gain preference among fleet operators. Therefore, upholstery innovation continues driving differentiation strategies across manufacturers globally.

Others encompasses ancillary components including armrests, headrests, and integrated safety mechanisms. These elements enhance overall seating functionality and passenger experience. Furthermore, manufacturers incorporate USB charging ports and storage solutions into modern designs. Consequently, this category demonstrates steady growth through feature-rich product development initiatives.

By Comfort Type Analysis

Low Comfort Seat dominates with 67.1% due to cost-effectiveness and standard transit applications.

In 2025, Low Comfort Seat held a dominant market position in the By Comfort Type segment of Bus Seat Market, with a 67.1% share. These seats prioritize affordability and basic functionality for short-distance travel. Moreover, transit buses and urban transport systems predominantly utilize this category. Consequently, volume demand from public transportation networks sustains market leadership significantly.

High Comfort Seat caters to premium applications including coach buses and long-distance travel. This segment features enhanced cushioning, adjustable features, and superior ergonomic design. Additionally, increasing passenger expectations drive adoption in intercity and tourism transport. Therefore, this category demonstrates higher growth potential despite smaller current market share.

By Seat Type Analysis

Regular Passenger Seat dominates with 40.4% due to universal application across bus categories.

In 2025, Regular Passenger Seat held a dominant market position in the By Seat Type segment of Bus Seat Market, with a 40.4% share. These seats represent standard configurations suitable for various bus applications. Moreover, economies of scale enable competitive pricing and widespread adoption. Consequently, this category maintains leadership through versatility and cost advantages.

Recliner Seat targets premium coach and long-distance bus applications requiring enhanced passenger comfort. This segment incorporates adjustable backrests and footrests for extended travel convenience. Additionally, luxury intercity transport services increasingly specify recliner configurations. Therefore, this category demonstrates steady growth aligned with premium service expansion.

Folding Seat provides space optimization solutions for multi-purpose and flexible bus configurations. These seats enable operators to maximize capacity during peak hours while maintaining comfort. Furthermore, school buses and shuttle services utilize folding mechanisms effectively. Consequently, this segment addresses specific operational requirements across diverse applications.

Bus Driver Seat emphasizes ergonomics, adjustability, and long-duration comfort for professional operators. This specialized category incorporates advanced lumbar support and vibration dampening technologies. Additionally, regulatory focus on driver safety and wellness drives innovation. Therefore, manufacturers develop sophisticated solutions addressing occupational health considerations specifically.

Integrated Child Seat serves school buses and family-oriented transport services requiring specialized safety features. This segment incorporates proper restraint systems and age-appropriate sizing for young passengers. Moreover, safety regulations increasingly mandate dedicated child seating solutions. Consequently, this category grows through compliance requirements and safety awareness.

By Bus Type Analysis

Transit Bus dominates with 49.7% due to extensive urban public transportation networks.

In 2025, Transit Bus held a dominant market position in the By Bus Type segment of Bus Seat Market, with a 49.7% share. Urban transit systems represent the largest volume application for bus seating globally. Moreover, government investments in public transportation infrastructure sustain consistent demand. Consequently, this segment maintains leadership through sustained urbanization and mobility expansion.

Coach Bus serves intercity, tourism, and premium transportation applications requiring enhanced comfort specifications. This segment prioritizes passenger amenities and long-distance travel suitability. Additionally, growing tourism industries across emerging markets drive adoption. Therefore, coach bus seating demonstrates robust growth potential through leisure travel expansion.

School Bus represents a specialized segment emphasizing safety, durability, and child-appropriate design features. This category maintains steady demand through educational institution requirements and regulatory mandates. Furthermore, fleet replacement cycles ensure consistent market activity. Consequently, school bus seating sustains stable demand patterns across developed markets.

Transfer Bus serves airport shuttles, hotel transport, and dedicated transfer services requiring moderate comfort levels. This segment balances passenger experience with operational efficiency considerations. Additionally, expanding hospitality and aviation sectors drive growth. Therefore, transfer bus seating benefits from tourism and business travel recovery.

Others encompasses specialized applications including corporate shuttles, healthcare transport, and custom configurations. This category addresses niche requirements beyond standard bus classifications. Moreover, private operators seek tailored solutions for specific operational needs. Consequently, this segment demonstrates diversity through customization and specialized applications.

By End-Use Analysis

OEM Fitment dominates with 71.3% due to factory integration and quality assurance preferences.

In 2025, OEM Fitment held a dominant market position in the By End-Use segment of Bus Seat Market, with a 71.3% share. Original equipment manufacturer installations ensure optimal integration and compliance with vehicle specifications. Moreover, bus manufacturers prefer coordinated supply chains and quality control processes. Consequently, this channel maintains dominance through new vehicle production volumes globally.

Aftermarket/Retro-fit serves fleet operators seeking to upgrade or replace existing seating systems economically. This segment enables life extension of aging bus fleets through targeted improvements. Additionally, operators customize configurations based on evolving passenger preferences and operational requirements. Therefore, aftermarket solutions provide flexibility and cost-effective modernization alternatives.

Key Market Segments

By Components

- Frame

- Upholstery

- Others

By Comfort Type

- Low Comfort Seat

- High Comfort Seat

By Seat Type

- Regular Passenger Seat

- Recliner Seat

- Folding Seat

- Bus Driver Seat

- Integrated Child Seat

By Bus Type

- Transit Bus

- Coach Bus

- School Bus

- Transfer Bus

- Others

By End-Use

- OEM Fitment

- Aftermarket/Retro-fit

Drivers

Rising Demand for Bus Seats Driven by Expansion of Public Transportation Systems

Global urbanization accelerates public transportation infrastructure development across major cities worldwide. Governments prioritize mass transit solutions to address congestion and environmental concerns. Moreover, expanding metro and bus rapid transit systems require substantial seating procurement. Consequently, this drives sustained demand growth for quality bus seating systems.

Emerging economies demonstrate particularly strong growth in public transportation investments. Infrastructure development programs allocate significant budgets toward fleet modernization and expansion. Additionally, smart city initiatives integrate advanced public transport networks. Therefore, manufacturers benefit from large-scale procurement opportunities in high-growth regions globally.

Passenger comfort expectations continuously evolve, influencing seating specifications and design priorities. Operators recognize enhanced comfort as competitive differentiation in service quality. Furthermore, ergonomic features improve passenger satisfaction and ridership rates. Consequently, demand shifts toward innovative seating solutions offering superior comfort and functionality.

Restraints

Strict Safety Regulations Impacting Bus Seat Design and Approval

Regulatory compliance requirements impose significant development costs and extended approval timelines. Manufacturers must navigate complex safety standards varying across different markets globally. Moreover, crash testing and certification procedures demand substantial investment. Consequently, smaller manufacturers face barriers entering regulated markets effectively.

Safety standards continuously evolve, requiring ongoing product redesign and revalidation efforts. Regulatory changes necessitate modifications to existing product lines and manufacturing processes. Additionally, compliance documentation and testing protocols extend product development cycles. Therefore, manufacturers experience increased operational complexity and time-to-market challenges.

Longer replacement cycles characteristic of bus seating limit frequent upgrade opportunities. Operators typically maintain seats throughout vehicle operational lifespans extending multiple years. Furthermore, economic constraints encourage extending replacement intervals beyond optimal timelines. Consequently, aftermarket revenue opportunities remain constrained by extended product durability and budget limitations.

Growth Factors

Expanding Bus Fleets in Emerging and Developing Economies

Developing nations demonstrate rapid motorization and public transportation infrastructure expansion. Rising middle-class populations increase demand for reliable and comfortable mass transit options. Moreover, government initiatives promote sustainable urban mobility solutions. Consequently, bus fleet procurement accelerates across Asia-Pacific, Latin America, and African markets.

Economic development drives increased investment in transportation infrastructure and fleet modernization programs. International funding organizations support public transport projects in developing regions. Additionally, urbanization rates significantly exceed developed market averages. Therefore, emerging economies present substantial growth opportunities for bus seating manufacturers.

Comfort-focused seating solutions gain market acceptance as passenger expectations rise globally. Operators recognize premium seating as value differentiation in competitive transportation markets. Furthermore, standardization initiatives improve quality consistency and cost efficiency. Consequently, manufacturers develop scalable solutions addressing diverse market requirements effectively.

Emerging Trends

Growing Preference for Ergonomic and Standardized Bus Seat Designs

Ergonomic design principles increasingly influence bus seating specifications and procurement decisions. Manufacturers incorporate advanced biomechanical research into product development processes. Moreover, passenger wellness considerations drive enhanced lumbar support and posture optimization features. Consequently, ergonomic seating becomes standard expectation rather than premium differentiation.

Lightweight materials including advanced composites and aluminum alloys gain widespread adoption. These materials reduce vehicle weight, improving fuel efficiency and environmental performance. Additionally, durability characteristics match or exceed traditional materials. Therefore, manufacturers transition toward sustainable and performance-optimized material specifications.

Modular seating systems enable flexible configurations addressing diverse operational requirements efficiently. Operators customize layouts based on route characteristics and passenger demographics. Furthermore, quick-change mechanisms reduce maintenance downtime and operational disruptions. Consequently, modular solutions demonstrate growing market acceptance through operational flexibility advantages.

Regional Analysis

Asia-Pacific Dominates the Bus Seat Market with a Market Share of 49.20%, Valued at USD 7.0 Billion

Asia-Pacific commands the largest regional market share at 49.20%, valued at USD 7.0 Billion, driven by rapid urbanization and extensive public transportation networks. China and India lead infrastructure investments, procuring substantial bus fleets annually. Moreover, government initiatives promote clean energy transit systems. Consequently, the region sustains robust growth through demographic and economic expansion.

North America Bus Seat Market Trends

North America demonstrates stable demand driven by fleet replacement cycles and regulatory compliance upgrades. The region emphasizes safety standards and accessibility features in public transportation. Additionally, school bus modernization programs sustain consistent procurement activity. Therefore, manufacturers focus on quality and compliance in this mature market.

Europe Bus Seat Market Trends

Europe prioritizes sustainability and passenger comfort in public transportation development. Stringent environmental regulations drive adoption of lightweight seating solutions. Moreover, premium coach services maintain strong demand for high-comfort configurations. Consequently, innovation and quality differentiation characterize European market dynamics.

Latin America Bus Seat Market Trends

Latin America experiences growth through urban transit expansion and fleet modernization initiatives. Brazil and Mexico lead regional demand with substantial public transportation investments. Additionally, bus rapid transit systems expand across major metropolitan areas. Therefore, the region presents emerging opportunities for cost-effective seating solutions.

Middle East & Africa Bus Seat Market Trends

Middle East and Africa demonstrate growing demand driven by infrastructure development and tourism expansion. Gulf Cooperation Council nations invest heavily in public transportation and hospitality sectors. Moreover, African nations develop urban transit networks addressing population growth. Consequently, this region shows promising long-term growth potential.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

GRAMMER AG maintains a leading position through comprehensive seating solutions for commercial vehicles globally. The company emphasizes ergonomic innovation and safety compliance across diverse bus applications. Moreover, strategic partnerships with major bus manufacturers strengthen market presence. Additionally, investment in lightweight materials and modular designs enhances competitive positioning substantially.

Faurecia leverages automotive seating expertise to deliver advanced bus seating systems worldwide. The company focuses on comfort optimization and sustainable material integration. Furthermore, technological capabilities in smart seating and connectivity features differentiate product offerings. Consequently, Faurecia captures premium segment opportunities through innovation-driven strategies.

Magna International Inc. provides integrated seating solutions emphasizing manufacturing excellence and global supply chain capabilities. The company serves OEM customers with comprehensive engineering and production support. Moreover, diversified automotive component expertise enables synergistic technology development. Therefore, Magna maintains competitive advantages through operational scale and technical capabilities.

Freedman Seating Company specializes in transit and school bus seating with strong North American market presence. The company prioritizes safety, durability, and regulatory compliance in product development. Additionally, recent acquisition by Lippert strengthens market position and expansion capabilities significantly. Consequently, Freedman demonstrates sustained leadership in specialized bus seating applications.

Key Players

- GRAMMER AG

- Faurecia

- Magna International Inc.

- Freedman Seating Company

- Franz Keil GmbH

- Adient

- ISRINGHAUSEN GmbH

- Lear Corporation

- NHK Springs

- Toyota Boshoku

Recent Developments

- October 2025 – NFI Group and GILLIG formed a 50/50 joint venture to acquire American Seating assets, strengthening North American seat supply through strategic industry partnership. This collaboration enhances manufacturing capabilities and market coverage across the region significantly.

- April 2025 – Lippert acquired Freedman, a leading transportation seating supplier, expanding its portfolio in specialized bus seating solutions. This acquisition strengthens Lippert’s position in transit and school bus markets while enhancing product development and distribution capabilities substantially.

Report Scope

Report Features Description Market Value (2025) USD 14.3 Billion Forecast Revenue (2035) USD 24.4 Billion CAGR (2026-2035) 5.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Components (Frame, Upholstery, Others), By Comfort Type (Low Comfort Seat, High Comfort Seat), By Seat Type (Regular Passenger Seat, Recliner Seat, Folding Seat, Bus Driver Seat, Integrated Child Seat), By Bus Type (Transit Bus, Coach Bus, School Bus, Transfer Bus, Others), By End-Use (OEM Fitment, Aftermarket/Retro-fit) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape GRAMMER AG, Faurecia, Magna International Inc., Freedman Seating Company, Franz Keil GmbH, Adient, ISRINGHAUSEN GmbH, Lear Corporation, NHK Springs, Toyota Boshoku Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GRAMMER AG

- Faurecia

- Magna International Inc.

- Freedman Seating Company

- Franz Keil GmbH

- Adient

- ISRINGHAUSEN GmbH

- Lear Corporation

- NHK Springs

- Toyota Boshoku