Global Brushless DC Motor Market Size, Share, And Enhanced Productivity By Rotor (Inner Rotor, Outer Rotor), By Power Output (Less than 750 Watts, 750 Watts to 2.99 kW, 3 kW - 75 kW, Above 75 kW), By Speed (Less than 500 RPM, 501-2,000 RPM, 2,001-10,000 RPM, More than 10,000 RPM),By End use (Industrial Machinery, Motor Vehicles, HVAC Equipment, Aerospace and Transportation, Household Appliances, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174428

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

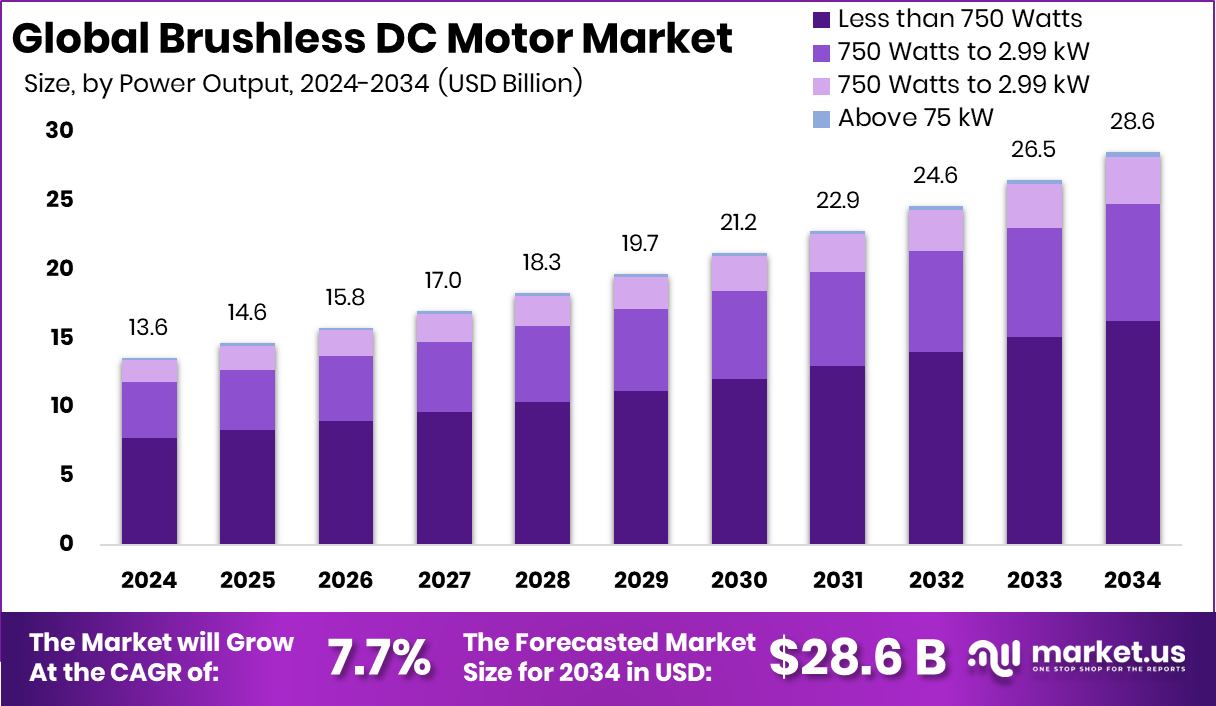

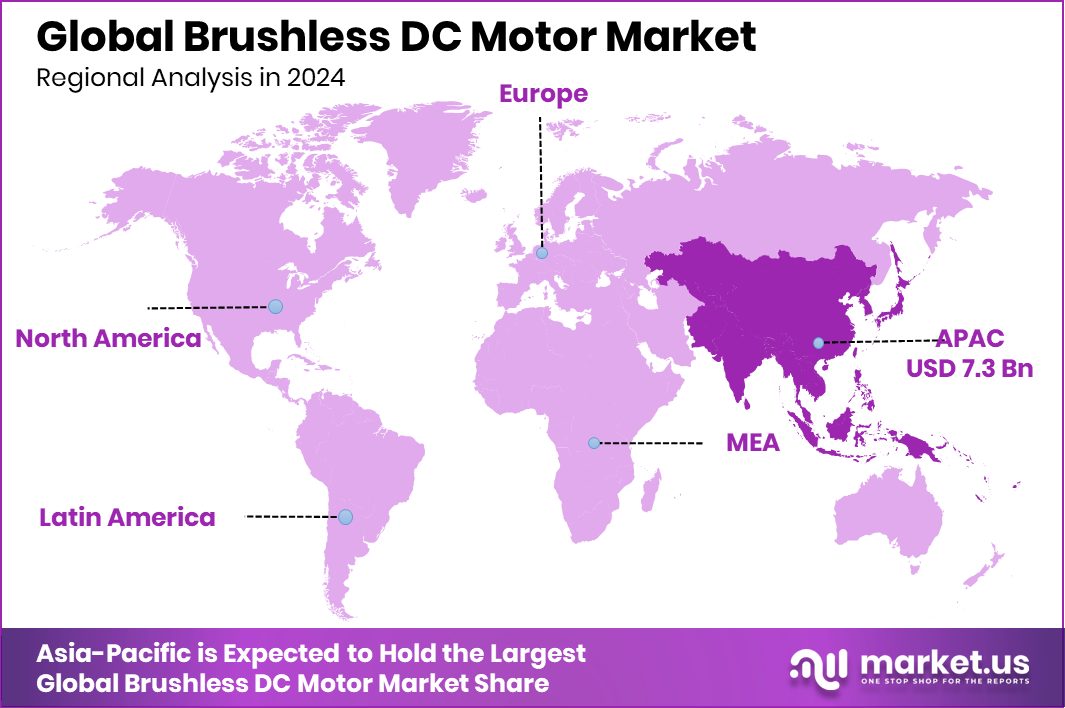

The Global Brushless DC Motor Market is expected to be worth around USD 28.6 billion by 2034, up from USD 13.6 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034. With USD 7.3 Bn, the Asia Pacific accounted for 54.4% of the DC Motor Market.

A Brushless DC (BLDC) motor is an electric motor that operates without physical brushes, using electronic controllers to switch current within the motor. This design reduces friction, heat, and wear, resulting in higher efficiency, quieter operation, and longer service life. BLDC motors are widely used where precise speed control, reliability, and energy savings are important, such as in appliances, HVAC systems, vehicles, and industrial equipment.

The Brushless DC Motor Market refers to the global ecosystem involved in designing, manufacturing, and deploying these motors across different end-use sectors. The market has expanded as industries move away from traditional brushed motors toward solutions that offer better performance, lower maintenance, and reduced electricity consumption. Regulatory pressure for energy efficiency and operational reliability continues to shape adoption across both public and private infrastructure.

One major growth factor is rising investment in building upgrades and energy-efficient infrastructure. For example, Springfield schools committed USD 18.5 million to system upgrades, including HVAC replacement, highlighting strong demand for efficient motor-driven systems. Similarly, USD 1.2 million in ARPA funds approved for the Folsom Senior Center HVAC system reflects public-sector support for modern motor technologies.

Demand is increasing as innovative cooling and climate solutions gain traction. Gradient’s AC unit securing USD 18 million in funding signals market confidence in advanced HVAC designs that rely on efficient motors. At the same time, Athol’s USD 50,000 grant for HVAC system design shows how even smaller communities are prioritizing modern, motor-driven climate systems.

Looking ahead, opportunities are expanding through digital maintenance and operational optimization. NodaFi’s USD 3.5 million seed funding to grow its CMMS platform supports smarter monitoring of motor-driven assets. As facility managers focus on uptime, efficiency, and lifecycle performance, brushless DC motors remain central to future-ready infrastructure systems.

Key Takeaways

- The Global Brushless DC Motor Market is expected to be worth around USD 28.6 billion by 2034, up from USD 13.6 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034.

- Brushless DC Motor Market inner rotor designs dominate due to compactness, efficiency, and capturing a 63.8% share.

- The Brushless DC Motor Market is driven by less than 750 watts, leading to increased efficiency, affordability, and adoption, at 56.9%.

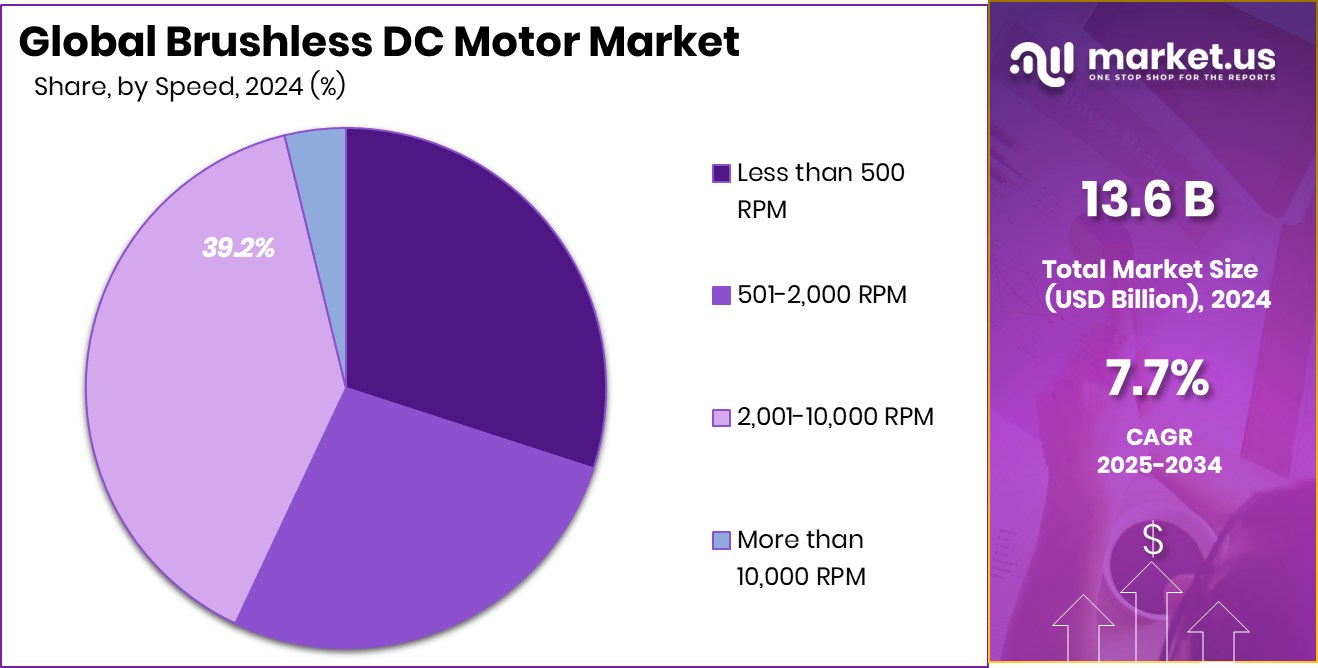

- The brushless DC Motor Market favors the 2,001-10,000 RPM range, balancing performance, control, and durability, holding a 39.2% share.

- The brushless DC motor market demand rises in motor vehicles due to efficiency, electrification, and reliability, accounting for 31.7%.

- Asia Pacific dominated the Brushless DC Motor Market at 54.4%, reaching USD 7.3 Bn.

By Rotor Analysis

In the Brushless DC Motor Market, inner rotor leads with 63.8% share.

In 2024, the Brushless DC Motor Market saw Inner Rotor designs hold a dominant 63.8% share, driven by their compact structure, high efficiency, and superior torque control. Inner rotor motors place the rotor at the center, allowing better heat dissipation and faster acceleration, which is critical for applications requiring precise speed control. These motors are widely used in automotive components, industrial automation, HVAC systems, and consumer electronics. Their ability to deliver high power density in a smaller footprint makes them ideal for space-constrained designs.

Manufacturers also favor inner rotor configurations due to lower noise levels and improved durability, supporting long operational life and reduced maintenance needs across demanding end-use environments.

By Power Output Analysis

Within the Brushless DC Motor Market, below 750-watt motors dominate at 56.9%.

In 2024, the Brushless DC Motor Market was largely driven by motors rated less than 750 watts, accounting for 56.9% of total demand. This segment benefits from strong adoption in household appliances, medical devices, small industrial equipment, and portable electronics.

Low-power BLDC motors offer high energy efficiency, precise control, and reduced electricity consumption, aligning well with global energy-efficiency standards. Their lightweight design and lower heat generation improve product safety and reliability. As manufacturers focus on compact and cost-effective solutions, sub-750-watt motors continue to replace traditional brushed motors, especially in applications where consistent performance, quiet operation, and long service life are essential for daily use.

By Speed Analysis

The Brushless DC Motor Market favors 2,001-10,000 RPM speeds, holding 39.2% share.

In 2024, the Brushless DC Motor Market experienced strong traction in the 2,001–10,000 RPM speed range, which captured 39.2% of the market. Motors in this speed category balance power, efficiency, and controllability, making them suitable for a wide range of applications, including automotive subsystems, industrial tools, cooling fans, and power equipment. This speed range supports smooth operation while minimizing vibration and mechanical stress, which enhances system reliability.

Manufacturers prefer this segment because it meets diverse performance requirements without excessive energy loss. The growing need for adaptable motors capable of handling variable loads continues to reinforce demand within this mid-to-high speed category.

By End Use Analysis

Motor vehicles drive the Brushless DC Motor Market, accounting for 31.7% demand.

In 2024, the Brushless DC Motor Market was strongly influenced by the motor vehicles segment, which accounted for 31.7% of overall consumption. BLDC motors are increasingly used in electric power steering, fuel pumps, cooling systems, seat adjusters, and electric drivetrain components. Their high efficiency, precise speed control, and low maintenance requirements make them well-suited for modern vehicles focused on performance and energy savings.

The shift toward electric and hybrid vehicles further accelerates adoption, as automakers seek motors that extend battery life and improve system reliability. Continuous innovation in automotive electronics ensures sustained demand for BLDC motors across vehicle platforms.

Key Market Segments

By Rotor

- Inner Rotor

- Outer Rotor

By Power Output

- Less than 750 Watts

- 750 Watts to 2.99 kW

- 3 kW – 75 kW

- Above 75 kW

By Speed

- Less than 500 RPM

- 501-2,000 RPM

- 2,001-10,000 RPM

- More than 10,000 RPM

By End use

- Industrial Machinery

- Motor Vehicles

- HVAC Equipment

- Aerospace and Transportation

- Household Appliances

- Others

Driving Factors

Infrastructure Modernization Drives Efficient Motor Adoption Worldwide

The Brushless DC Motor Market is strongly driven by large-scale transportation and infrastructure programs that rely on efficient electric systems. Modern vehicles, logistics fleets, and public transport increasingly depend on electric components, where BLDC motors improve efficiency and reliability. However, funding stability plays a critical role. California’s facing a loss of USD 158 million in funding over CDL issues highlights how workforce and regulatory gaps can directly affect transportation projects and fleet upgrades.

When such funding is delayed or withdrawn, electrification timelines slow, impacting demand for efficient motors used in vehicle subsystems, charging infrastructure, and auxiliary equipment. This situation reinforces the importance of skilled labor, policy alignment, and sustained investment to fully realize efficiency-driven growth across transportation-linked motor applications.

Restraining Factors

Funding Gaps and Compliance Slow Market Momentum

A key restraining factor for the Brushless DC Motor Market is uneven funding distribution and compliance-related delays in transport and infrastructure programs. While electrification goals are clear, execution depends on stable financial support and regulatory coordination. The USD 118 million awarded by the DOT for Commercial Vehicle Transportation Grants supports cleaner and more efficient vehicle systems, yet access to such funding is often complex and time-consuming.

Smaller operators and local authorities may struggle to meet compliance requirements, slowing the adoption of advanced motor technologies. These challenges create uncertainty for manufacturers and buyers alike, limiting short-term deployment despite long-term efficiency benefits. Addressing administrative barriers remains essential for smoother market expansion.

Growth Opportunity

Electric Vehicle Incentives Create Strong Expansion Opportunities

The Brushless DC Motor Market is seeing strong growth opportunities from rising electric vehicle affordability and consumer incentives. Policy support directly encourages the adoption of electric cars, increasing demand for efficient motors across drivetrain and auxiliary systems. The inclusion of another Toyota model under the £1,500 electric car grant expands the consumer base for EVs, while £700 payouts per claim following the car finance scandal improve buyer confidence and purchasing power. These measures collectively support higher vehicle sales volumes, indirectly driving demand for BLDC motors. As incentives reduce ownership barriers, manufacturers benefit from rising production needs tied to electric mobility platforms.

Latest Trends

Commercial Electric Mobility Accelerates Technology Adoption

One of the latest trends shaping the Brushless DC Motor Market is rapid investment in commercial electric mobility. Fleet operators increasingly adopt electric buses and delivery vehicles to reduce operating costs and emissions. This shift is reinforced by EKA Mobility securing INR 200 crore from Enam Holdings, supporting the expansion of electric commercial vehicle manufacturing. ‘

Such investments accelerate the deployment of BLDC motors in traction systems, cooling units, and power electronics. The trend reflects growing confidence in electric mobility at scale, particularly for public transport and logistics, positioning brushless DC motors as a core component of next-generation commercial vehicle platforms.

Regional Analysis

In 2024, the Asia Pacific led the DC Motor Market with 54.4%, USD 7.3 Bn.

The Brushless DC Motor Market shows clear regional variation, with Asia Pacific emerging as the dominating region, holding 54.4% of the market and valued at USD 7.3 Bn. This leadership is supported by strong manufacturing ecosystems, large-scale electronics production, and extensive adoption of electric motors across automotive, industrial, and consumer appliance sectors in countries across the region. High-volume production capabilities and continuous integration of energy-efficient motor technologies further strengthen Asia Pacific’s position.

North America represents a mature and technology-driven market, supported by demand from automotive systems, industrial automation, and HVAC applications, where efficiency and precision control remain key priorities. Europe follows closely, benefiting from strict efficiency standards and widespread use of brushless motors in electric mobility, factory automation, and renewable-energy-related equipment.

The Middle East & Africa region shows steady growth, primarily driven by infrastructure development, industrial expansion, and rising adoption of automated equipment. Latin America demonstrates gradual progress, supported by improving industrial output and increasing use of efficient motor solutions across manufacturing and transport-related applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB continues to play a strategic role in the global Brushless DC Motor Market in 2024 through its strong focus on electrification, automation, and energy-efficient motor technologies. ABB’s broad industrial presence allows it to integrate BLDC motors into robotics, motion control, HVAC, and electric mobility systems. The company’s emphasis on digital control, reliability, and lifecycle efficiency positions it well for customers seeking long-term operational performance rather than short-term cost savings. Its global manufacturing footprint and engineering depth support consistent quality across regions.

Ametek Inc. brings a differentiated approach to the BLDC motor space by combining precision engineering with application-specific customization. Ametek’s strength lies in serving niche, high-performance segments such as aerospace, medical devices, analytical instruments, and industrial equipment. Its brushless motor solutions are valued for accuracy, durability, and stable performance under demanding conditions. This focus on specialized end uses allows Ametek to maintain strong customer relationships and defend margins through technical differentiation.

Johnson Electric Holdings Limited remains a key volume player, particularly in automotive and consumer applications. The company benefits from deep expertise in motion systems, large-scale manufacturing, and close collaboration with OEMs. Its ability to supply compact, efficient BLDC motors at scale supports growing demand from vehicle electrification and smart appliance platforms worldwide.

Top Key Players in the Market

- ABB

- Ametek Inc.

- Johnson Electric Holdings Limited.

- NIDEC CORPORATION

- Allied Motion Technologies, Inc.

- WorldWide Electric

- Schneider Electric

- Regal Rexnord Corporation

- Siemens

- TECO Corporation

Recent Developments

- In June 2024, ABB showcased several new high-performance motor solutions, including advanced NEMA motors and liquid-cooled synchronous reluctance (SynRM) options with efficiency levels up to IE6 at the EASA 2024 event in the U.S. These product launches broaden ABB’s offerings for demanding motor applications.

- In January 2024, Allied Motion Technologies (rebranded as Allient Inc.) acquired SNC Manufacturing Co., Inc., a company that designs and makes electrical transformers. This move expanded Allient’s capabilities in industrial automation and power quality systems and added manufacturing capacity that could support broader motor and control product supply.

Report Scope

Report Features Description Market Value (2024) USD 13.6 Billion Forecast Revenue (2034) USD 28.6 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rotor (Inner Rotor, Outer Rotor), By Power Output (Less than 750 Watts, 750 Watts to 2.99 kW, 3 kW – 75 kW, Above 75 kW), By Speed (Less than 500 RPM, 501-2,000 RPM, 2,001-10,000 RPM, More than 10,000 RPM),By End use (Industrial Machinery, Motor Vehicles, HVAC Equipment, Aerospace and Transportation, Household Appliances, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Ametek Inc., Johnson Electric Holdings Limited., NIDEC CORPORATION, Allied Motion Technologies, Inc., WorldWide Electric, Schneider Electric, Regal Rexnord Corporation, Siemens, TECO Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Brushless DC Motor MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Brushless DC Motor MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Ametek Inc.

- Johnson Electric Holdings Limited.

- NIDEC CORPORATION

- Allied Motion Technologies, Inc.

- WorldWide Electric

- Schneider Electric

- Regal Rexnord Corporation

- Siemens

- TECO Corporation