Global Brain Health Supplements Market By Product Type (Natural Molecules, Herbal Extract, Vitamins And Minerals, and Others), By Product form (Capsules/Tablets, Powders, Gummies, and Others), Age Group (Up to 25 Years, 26-35 Years, 36-45 Years, and Above 46 Years), By Distribution Channel (Offline and Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171359

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

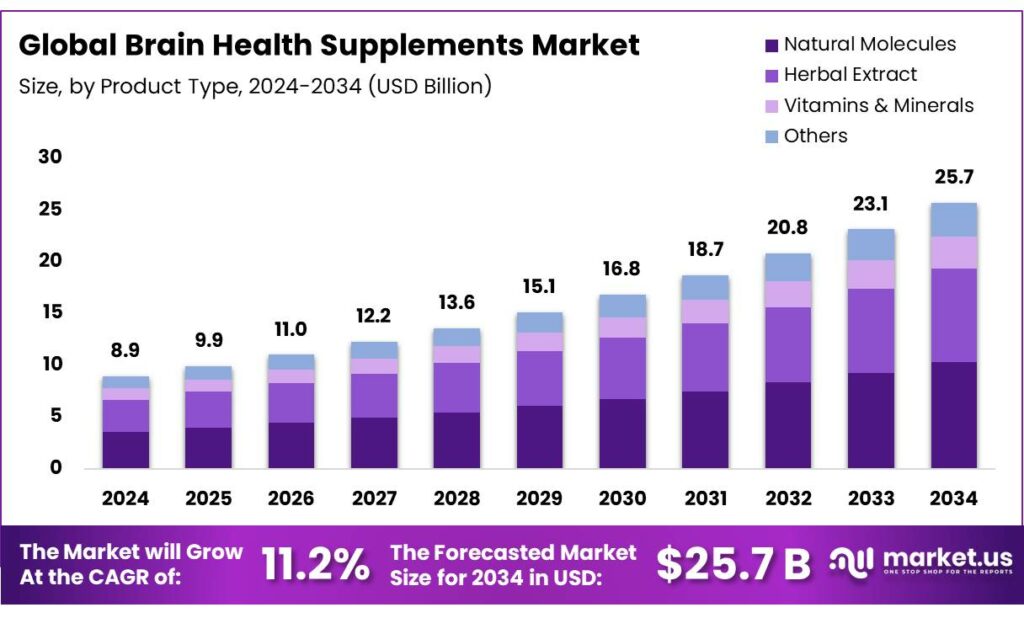

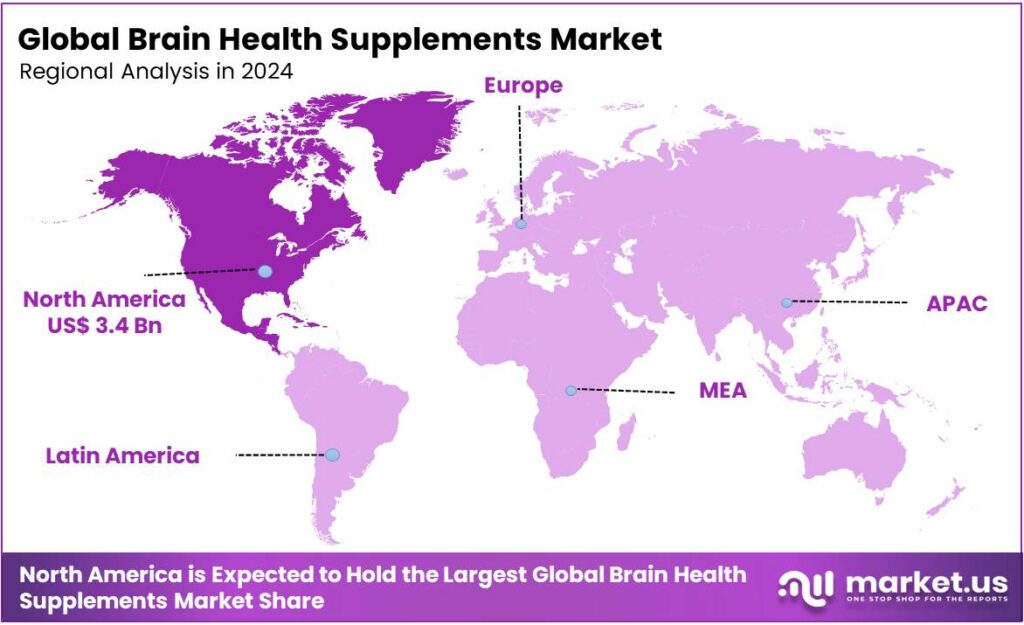

The Global Brain Health Supplements Market size is expected to be worth around USD 29.2 Billion by 2034, from USD 8.9 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.8% share, holding USD 24.3 Billion in revenue.

Brain health supplements, often known as brain boosters, are products designed to support cognitive functions such as memory, focus, and mental clarity. The brain health supplements market is experiencing steady growth, driven by an increasing awareness of cognitive health and a rising demand for preventive wellness solutions. As consumers, particularly in the 26 to 35 age group, are seeking natural ways to enhance memory, focus, and mental clarity, it creates opportunities in the market. Ingredients such as omega-3 fatty acids, ginkgo biloba, and turmeric are highly popular due to their proven benefits and natural origins in the market.

Despite a growing trend toward online shopping, a significant portion of brain health supplements is sold through offline stores, where consumers can directly engage with knowledgeable staff and inspect products. However, the market faces challenges, including regulatory gaps that may lead to product adulteration and mislabeling. The focus on mental well-being, particularly among millennials and Generation Z, continues to create opportunities for innovation in this expanding market.

- According to the World Health Organization, around 1 in 8 individuals, approximately 970 million, have a mental illness or substance use disorder. As the global prevalence of mental health issues increases, it creates opportunities for products such as brain health supplements.

Key Takeaways

- The global brain health supplements market was valued at USD 8.9 billion in 2024.

- The global brain health supplements market is projected to grow at a CAGR of 11.2% and is estimated to reach USD 25.7 billion by 2034.

- On the basis of types of brain health supplements, natural molecules dominated the market, constituting 40.1% of the total market share.

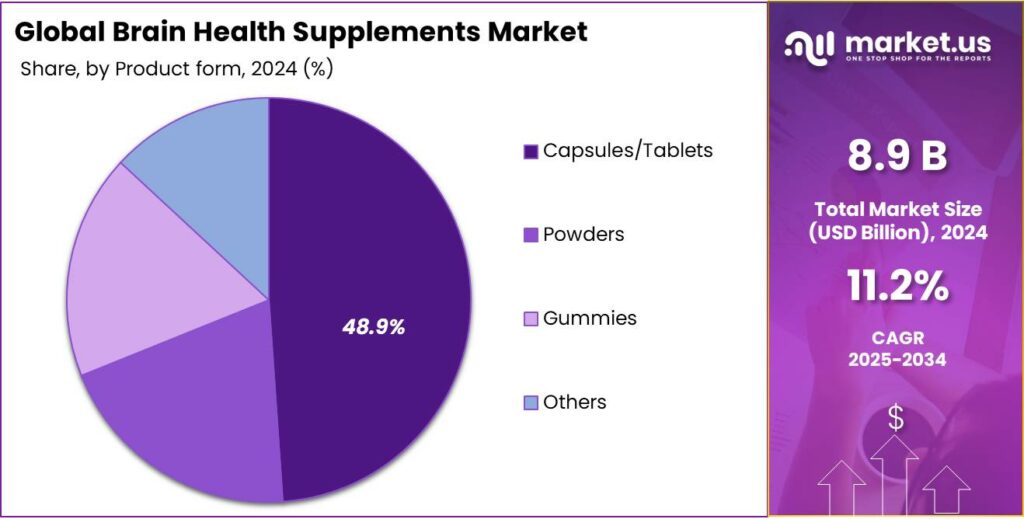

- Based on the forms of brain health supplements, capsules/tablets dominated the market, with a substantial market share of around 48.9%.

- Based on the age group, the 26-35-year-olds led the brain health supplements market, comprising 38.9% of the total market.

- Among the distribution channels, offline stores held a major share in the brain health supplements market, 68.7% of the market share.

- In 2024, North America was the most dominant region in the brain health supplements market, accounting for 38.6% of the total global consumption.

Product Type Analysis

Natural Molecules Are a Prominent Segment in the Brain Health Supplements Market.

The brain health supplements market is segmented based on product type into natural molecules, herbal extract, vitamins & minerals, and others. The natural molecules led the brain health supplements market, comprising 40.1% of the market share. Natural molecules are increasingly favored in brain health supplements due to their perceived safety, efficacy, and alignment with growing consumer demand for clean, plant-based products.

These natural compounds, such as omega-3 fatty acids, flavonoids, and antioxidants, are often considered more bioavailable and easier for the body to absorb, offering targeted benefits for cognitive function. Unlike synthetic alternatives, natural molecules tend to have no side effects, which appeals to consumers seeking holistic, long-term health solutions without the risks associated with artificial additives.

Product Form Analysis

Brain Health Supplements in the Capsules/Tablets Form Dominated the Market.

On the basis of form, the brain health supplements market is segmented into capsules/tablets, powders, gummies, and others. Brain health supplements in the capsule/tablet form dominated the market, comprising 48.9% of the market share. Brain health supplements are predominantly sold as capsules or tablets due to their convenience, precise dosing, and longer shelf life. Capsules and tablets offer a straightforward, controlled way to deliver specific doses of active ingredients, ensuring consistency and efficacy with each serving.

This is particularly important in supplements targeting brain health, where accurate dosing is crucial for achieving the desired cognitive benefits. Additionally, capsules and tablets are more easily absorbed, with some ingredients being better protected from degradation compared to powders or gummies. Additionally, capsules tend to be more cost-effective for manufacturers, as they require less complex production processes than gummies, which often involve added sugars and stabilizers.

Age Group Analysis

Brain Health Supplements Were Mostly Utilized by Individuals in the Age Group of 26-35 Years.

Based on the age group, the brain health supplements market is divided into up to 25 years, 26-35 years, 36-45 years, and above 46 years. The 26-35 years’ age group dominated the market, with a notable market share of 38.9%, due to a combination of lifestyle factors and increasing awareness of mental well-being. This age group is where individuals begin to feel the impact of stress, making cognitive health a growing concern.

Additionally, individuals in this demographic are more proactive about preventive health measures, seeking supplements to enhance focus, memory, and mental clarity before experiencing more noticeable cognitive decline. Similarly, the 26 to 35 age group tends towards natural, holistic wellness solutions, including supplements that promise improved mental performance. In contrast, younger individuals may not feel the need for cognitive support, while those in older age groups may prioritize other health concerns, such as joint or heart health, over brain function.

Distribution Channel Analysis

Offline Stores Held a Major Share of the Brain Health Supplements Market.

Among the distribution channels, 68.7% of the total global consumption of brain health supplements was sold through offline stores, due to consumer preferences for immediate product access and the demand for in-person consultations. Many individuals prefer to purchase supplements in physical stores where they can directly interact with staff responsible for receiving recommendations tailored to their specific needs.

In addition, the tactile experience of seeing and physically inspecting the product often enhances consumer confidence, particularly for those unfamiliar with brain health supplements. Similarly, consumer trust and authenticity of the products are higher when purchased from established retailers. While online sales are growing, offline retail continues to dominate due to these key factors.

Key Market Segments

By Product Type

- Natural Molecules

- Herbal Extract

- Vitamins & Minerals

- Others

By Product form

- Capsules/Tablets

- Powders

- Gummies

- Others

By Age Group

- Up to 25 Years

- 26-35 Years

- 36-45 Years

- Above 46 Years

By Distribution Channel

- Offline

- Pharmacies/Drug Stores

- Specialty Sports Stores

- Supermarkets/Hypermarkets

- Others

- Online

- E-commerce Platforms

- Brand-Owned Websites

Drivers

Increasing Prevalence of Cognitive Disorders Drives the Brain Health Supplements Market.

The rising prevalence of cognitive disorders, such as Alzheimer’s disease, dementia, and other neurodegenerative conditions, is significantly driving the demand for brain health supplements. As the global population ages, with individuals aged 60 and above expected to reach nearly 2 billion by 2050, the need for preventive and therapeutic solutions to support cognitive function is intensifying.

Similarly, according to Alzheimer’s Disease International, neurological diseases such as Alzheimer’s and Parkinson’s affect millions worldwide, with over 55 million people living with dementia, mostly Alzheimer’s, a number projected to triple by 2050. This escalating concern has led to an increased adoption of brain health supplements, particularly those containing ingredients such as omega-3 fatty acids, ginkgo biloba, and bacopa monnieri, which are observed to enhance memory, focus, and overall cognitive well-being.

Additionally, the growing awareness of the importance of maintaining brain health in early adulthood has further expanded the consumer base, influencing the market for these supplements across various demographics.

Restraints

Regulator Gaps Might Pose a Challenge to the Brain Health Supplements Market.

Regulatory gaps in the brain health supplements market present significant challenges, particularly in terms of product adulteration and mislabeling. The lack of standardized regulations across different regions allows for inconsistencies in product formulations and labeling, which can mislead consumers. For instance, certain supplements may claim to enhance cognitive function with ingredients that are either ineffective or present in insufficient quantities.

According to a report on PubMed Central by NIH, in a case study, twelve products were selected from the 650 products being marketed for brain health. Around 67% had at least one ingredient listed on the supplement facts label not detected through analysis. And compounds not reported on the label were detected in about 83% products. This has raised concerns, as some products have been found to contain hidden drugs or contaminants. These issues undermine consumer trust and hinder the growth and credibility of the brain health supplements industry.

Opportunity

Rising Awareness Regarding Mental Health Creates Opportunities in the Brain Health Supplements Market.

The growing awareness surrounding mental health has created significant opportunities for the brain health supplements market, as individuals increasingly seek proactive solutions to enhance cognitive function and overall mental well-being. With mental health conditions such as anxiety, depression, and stress on the rise, the global conversation around mental wellness has shifted towards prevention and holistic care.

According to data released by the World Health Organization (WHO) in 2025, more than 1 billion people are living with mental health disorders, with conditions such as anxiety and depression inflicting immense human tolls, with many seeking non-pharmaceutical alternatives for the conditions. This has led to a surge in demand for supplements containing ingredients such as Rhodiola rosea, ashwagandha, and L-theanine, known for their stress-relieving and cognitive-enhancing properties.

Furthermore, as millennials and Generation Z consumers prioritize self-care, their preference for natural and plant-based supplements has contributed to the market’s expansion. The increased focus on mental health in workplaces, schools, and social platforms further fuels the demand, positioning brain health supplements as a key component in maintaining cognitive function and emotional balance.

Trends

Increased Demand for Natural Ingredients.

The increased demand for natural ingredients in the brain health supplements market is a prominent ongoing trend, driven by consumers’ growing preference for plant-based and chemical-free products. As more individuals seek natural solutions to enhance cognitive function, ingredients such as ginkgo biloba, bacopa monnieri, turmeric, and lion’s mane mushroom are gaining traction.

According to a case study in the US, approximately 70% of consumers are inclined to choose supplements with natural or organic ingredients due to concerns over the side effects of synthetic compounds. This trend is particularly evident among health-conscious millennials and Generation Z, who prioritize sustainability, ethical sourcing, and holistic wellness in their purchasing decisions.

As the demand for natural products intensifies, manufacturers are increasingly focusing on clean-label formulations that align with these consumer preferences. For instance, in October 2025, Monterey Nutra launched a premium lion’s mane extract powder, which is known for potential benefits such as boosting brain memory and focus, reducing anxiety/depression, and supporting nerve repair.

Geopolitical Impact Analysis

Geopolitical Tensions Have Disrupted Supply Chains in the Brain Health Supplements Market.

The geopolitical tensions are having a notable impact on the brain health supplements market. Ongoing conflicts, trade disruptions, and economic uncertainties have led to supply chain disruptions, affecting the availability and cost of key ingredients used in cognitive health supplements.

For instance, supply shortages of raw materials such as ginkgo biloba, turmeric, and several botanicals in the US due to conflicts in China and Peru, top exporters of botanicals have resulted in price volatility as the US is the largest market for the brain health supplements. This has increased production costs and affected the affordability of supplements for consumers.

Additionally, geopolitical tensions can heighten consumer anxiety, stress, and uncertainty, which could drive demand for cognitive and mental wellness products. According to a survey by the American Psychological Association in the U.S., about 81% of adults reported heightened stress levels due to global instability, potentially increasing interest in stress-relieving and brain-enhancing supplements

. On the contrary, economic downturns associated with geopolitical crises might reduce discretionary spending, impacting the demand for non-essential health products, including brain health supplements. However, the heightened focus on mental health could prompt more investment in the market as consumers seek natural ways to cope with stress and improve cognitive function.

Regional Analysis

North America Held the Largest Share of the Global Brain Health Supplements Market.

In 2024, North America dominated the global brain health supplements market, holding about 38.6% of the total global consumption, primarily driven by high consumer awareness, a growing aging population, and increasing concerns over cognitive health. With over 54 million adults in the United States aged 65 and older, the demand for supplements aimed at improving memory, focus, and overall brain health has risen significantly. Additionally, the region benefits from a robust healthcare infrastructure, with many consumers actively seeking preventative measures for cognitive decline, such as Alzheimer’s and dementia.

According to Mental Health America, in 2024, 23.4% of adults in the U.S. experienced any mental illness (AMI) in the past year, equivalent to over 60 million people, amplifying the need for supportive supplements. The market in the region is characterized by a strong preference for natural, plant-based ingredients, with omega-3 fatty acids and ginkgo biloba among the most popular. This growing demand for cognitive health solutions has spurred innovation and expansion within the region’s supplement industry.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the brain health supplements market employ a variety of strategic activities to increase sales and meet growing consumer demand. The companies focus on product innovation, with many companies developing new formulations that incorporate trending natural ingredients such as adaptogens or nootropics to appeal to health-conscious consumers.

In addition, the players emphasize partnerships with healthcare professionals and influencers to build credibility and trust. Companies are increasingly emphasizing transparency, offering clean-label products that highlight the purity and quality of ingredients. Similarly, the major players focus on expanding distribution channels to tap into broader consumer bases. Furthermore, these companies work closely with regulatory organizations to navigate consumer trust hurdles closely.

The Major Players in The Industry

- Natural Factors Nutritional Products

- Onnit Labs, Inc.

- Purelife Bioscience Co., Ltd.

- Intelligent Labs

- Accelerated Intelligence, Inc.

- NOW Foods

- HVMN Inc.

- Reckitt Benckiser Group PLC

- Teva Pharmaceutical Industries Ltd.

- Alternascript

- Other Key Players

Key Development

- In September 2025, Neuriva, a leading brain health supplement brand by Reckitt, announced the launch of its innovation, Neuriva Memory 3D, a formula with ingredients designed to support three key dimensions of memory, including short-term, long-term, and working memory.

- In October 2025, Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceutical Industries, and Medincell announced that the U.S. Food and Drug Administration (FDA) approved UZEDY (risperidone) as a once-monthly extended-release injectable suspension as monotherapy or as adjunctive therapy to lithium or valproate for the maintenance treatment of bipolar disorder (BD-I) in adults.

Report Scope

Report Features Description Market Value (2024) USD 8.9 Bn Forecast Revenue (2034) USD 25.7 Bn CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Natural Molecules, Herbal Extract, Vitamins & Minerals, and Others), By Product form (Capsules/Tablets, Powders, Gummies, and Others), Age Group (Up to 25 Years, 26-35 Years, 36-45 Years, and Above 46 Years), By Distribution Channel (Offline and Online) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Natural Factors Nutritional Products, Onnit Labs, Inc., Purelife Bioscience Co., Ltd., Intelligent Labs, Accelerated Intelligence, Inc., NOW Foods, HVMN Inc., Reckitt Benckiser Group PLC, Teva Pharmaceutical Industries Ltd., Alternascript, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Brain Health Supplements MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Brain Health Supplements MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Natural Factors Nutritional Products

- Onnit Labs, Inc.

- Purelife Bioscience Co., Ltd.

- Intelligent Labs

- Accelerated Intelligence, Inc.

- NOW Foods

- HVMN Inc.

- Reckitt Benckiser Group PLC

- Teva Pharmaceutical Industries Ltd.

- Alternascript

- Other Key Players