Global Bopp Films Market Size, Share, And Business Benefit By Type (Bags and Pouches, Wraps, Tapes, Labels), By Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns, More Than 45 Microns), By Production Process (Tenter, Tubular), By Application (Food, Beverage, Personal Care, Pharmaceutical, Electrical and Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164746

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

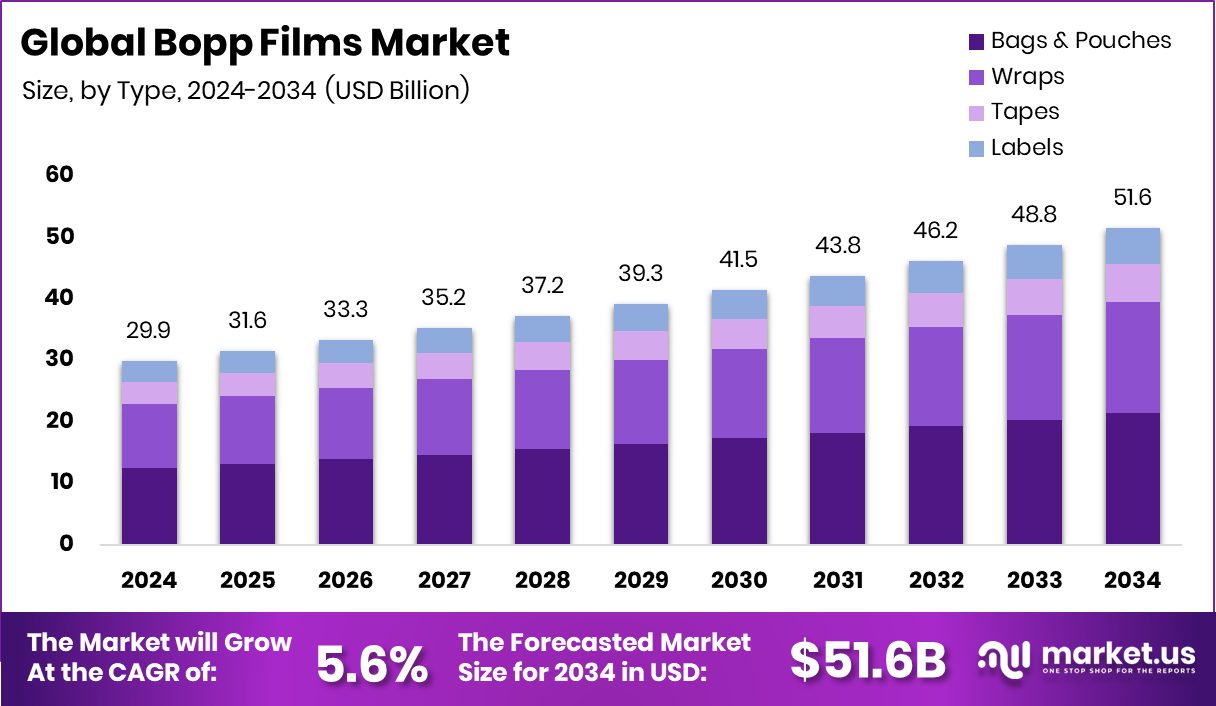

The Global Bopp Films Market is expected to be worth around USD 51.6 billion by 2034, up from USD 29.9 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. Strong packaging demand and manufacturing growth continue to strengthen Asia Pacific’s 39.60% leading position.

Biaxially Oriented Polypropylene (BOPP) films are thin, flexible plastic films made by stretching polypropylene in two directions to improve strength, clarity, and barrier performance. They are widely used in packaging, labeling, and lamination because of their high tensile strength, gloss, and recyclability. Their lightweight and moisture-resistant nature makes them ideal for protecting and displaying consumer goods attractively and sustainably.

The BOPP films market is growing as industries shift toward flexible, transparent, and recyclable packaging. Its cost-effectiveness and excellent printability make it a top choice for food, beverage, and personal care packaging. The market is also benefiting from the rising preference for lightweight materials that reduce carbon emissions and improve transport efficiency.

The major growth factor is the global surge in packaged food consumption and e-commerce. Manufacturers prefer BOPP films for their clarity and sealing properties, which maintain freshness and product appeal. Their low production cost also drives their adoption in emerging economies.

With global pressure to reduce single-use plastics, innovation in recyclable BOPP films creates new opportunities. The growing focus on sustainable packaging aligns with initiatives such as UKRI’s £3.2 million funding to manage plastic waste, Zouk’s $1.5 million raise for vegan accessories, and the €9 million phone pouch initiative—all of which indicate a broader push toward eco-friendly materials that strengthen the long-term outlook for BOPP films.

Key Takeaways

- The Global Bopp Films Market is expected to be worth around USD 51.6 billion by 2034, up from USD 29.9 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- The BOPP Films Market sees strong dominance in bags and pouches, capturing a 40.4% share.

- 15–30 micron thickness segment leads the BOPP Films Market, accounting for 49.7% of the market share.

- The tenter process drives the BOPP Films Market production, holding a commanding 89.3% share globally.

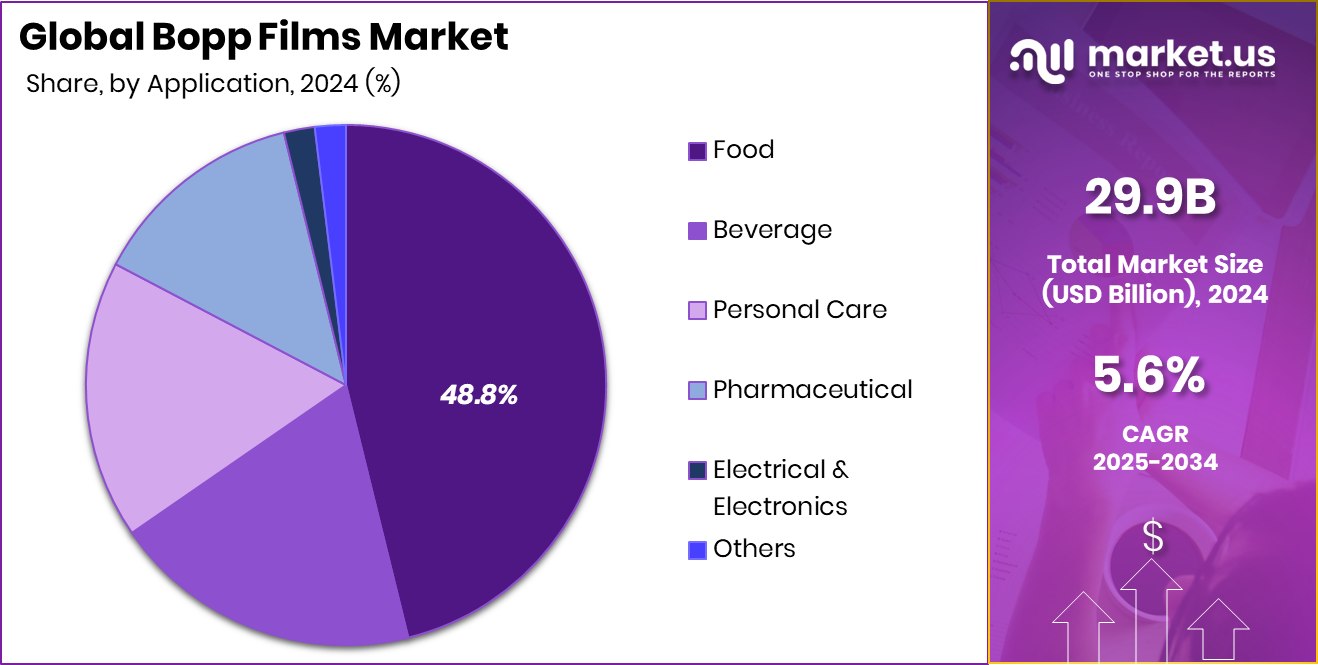

- Food packaging applications dominate the BOPP Films Market, representing a substantial 48.8% of total demand.

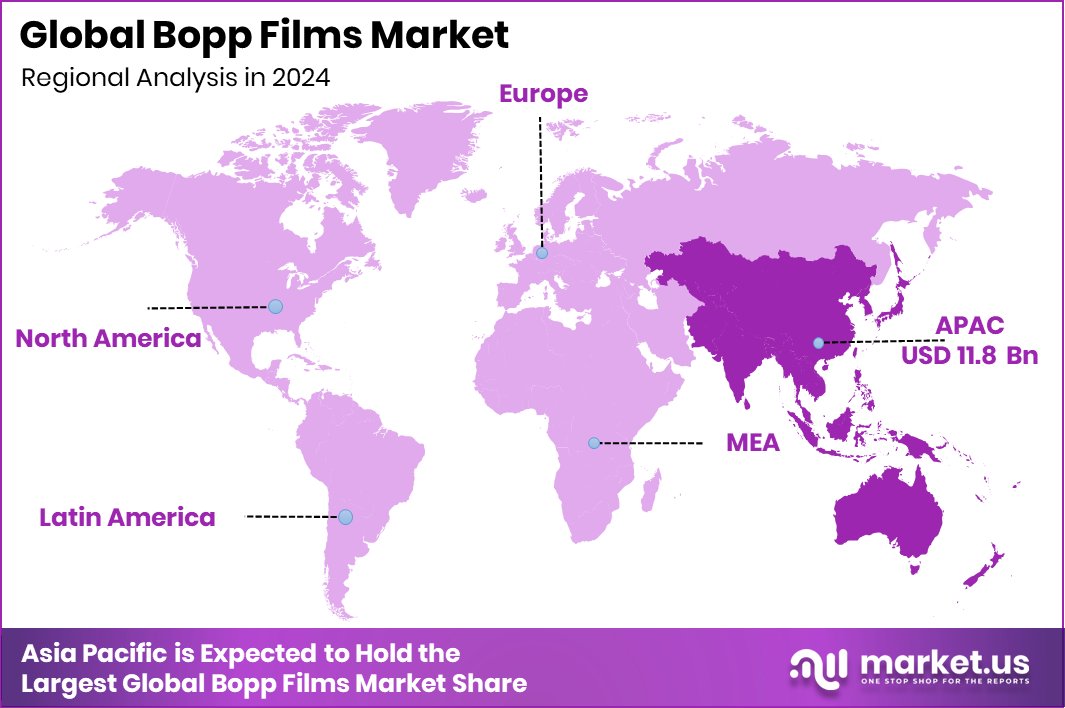

- The Asia Pacific market value reached an impressive USD 11.8 billion in 2024.

By Type Analysis

BOPP Films Market by type: Bags and Pouches held 40.4%.

In 2024, Bags and Pouches held a dominant market position in the By Type segment of the BOPP Films Market, with a 40.4% share. This strong position is driven by the rising consumption of flexible and durable packaging across the food, beverage, and personal care sectors. BOPP-based bags and pouches offer high transparency, strength, and moisture resistance, making them ideal for preserving product quality and enhancing visual appeal.

The segment also benefits from increasing consumer preference for lightweight, resealable, and recyclable packaging formats that support convenience and sustainability. As manufacturers continue to optimize packaging performance and reduce costs, BOPP bags and pouches remain a preferred choice, reinforcing their leadership in the global BOPP films market.

By Thickness Analysis

In the BOPP Films Market by thickness, the 15–30 micron segment captured 49.7%.

In 2024, 15–30 Microns held a dominant market position in the By Thickness segment of the BOPP Films Market, with a 49.7% share. This range is widely preferred due to its perfect balance between flexibility, strength, and cost-efficiency. Films within this thickness category provide excellent clarity, high tensile strength, and effective barrier properties against moisture and oxygen—making them ideal for food packaging, labels, and lamination.

Their lightweight nature supports material savings and improved production efficiency, which appeals to both manufacturers and end-users. The 15–30 micron segment continues to gain traction as industries emphasize reliable, durable, and sustainable packaging solutions suited for modern distribution and storage needs.

By Production Process Analysis

BOPP Films Market by production process: Tenter technology dominated with 89.3%.

In 2024, Tenter held a dominant market position in the By Production Process segment of the BOPP Films Market, with an 89.3% share. The Tenter process is highly favored for its ability to produce films with superior dimensional stability, uniform thickness, and excellent optical clarity. This method allows precise control over film stretching in both machine and transverse directions, enhancing mechanical strength and barrier properties.

Its efficiency in large-scale production also makes it the preferred choice for high-quality packaging, labeling, and lamination applications. The dominance of the Tenter process reflects the industry’s growing demand for consistent, durable, and cost-effective BOPP films that meet diverse performance requirements across packaging and industrial uses.

By Application Analysis

In the BOPP Films Market by application, the food sector accounted for 48.8%.

In 2024, Food held a dominant market position in the By Application segment of the BOPP Films Market, with a 48.8% share. The segment’s leadership is driven by the extensive use of BOPP films in packaging snacks, confectionery, bakery items, and ready-to-eat foods. These films offer excellent moisture resistance, high clarity, and strong sealing performance, which help preserve freshness and extend shelf life.

Their lightweight and recyclable nature also makes them a sustainable choice for manufacturers aiming to reduce packaging waste. As consumer demand for convenient and attractive packaging continues to rise, the food sector remains the largest end-user of BOPP films, reinforcing its crucial role in driving overall market growth.

Key Market Segments

By Type

- Bags and Pouches

- Wraps

- Tapes

- Labels

By Thickness

- Below 15 Microns

- 15-30 Microns

- 30-45 Microns

- More Than 45 Microns

By Production Process

- Tenter

- Tubular

By Application

- Food

- Beverage

- Personal Care

- Pharmaceutical

- Electrical and Electronics

- Others

Driving Factors

Rising Shift Toward Sustainable and Flexible Packaging

One of the strongest driving factors for the BOPP Films Market is the increasing global transition toward sustainable and flexible packaging solutions. BOPP films offer a unique combination of strength, clarity, and recyclability, making them a preferred alternative to conventional plastic films. As industries focus on reducing carbon footprints and promoting circular packaging, demand for recyclable polypropylene-based materials is steadily increasing.

Governments and companies worldwide are prioritizing green finance and sustainable investments, further boosting the sector. For instance, OCBC Bank has targeted $25 billion of sustainable financing by 2025, signaling strong financial backing for eco-friendly manufacturing initiatives. Such investments encourage producers to expand advanced, energy-efficient BOPP film production, aligning sustainability goals with long-term market growth.

Restraining Factors

Rising Environmental Concerns and Recycling Challenges

A major restraining factor for the BOPP Films Market is the growing concern about environmental pollution caused by plastic waste and the limited recycling infrastructure in many regions. Although BOPP films are technically recyclable, they often end up in mixed waste streams, making proper recovery and reuse difficult. The lack of advanced collection and sorting systems reduces recycling rates and raises sustainability issues.

Moreover, strict government regulations against single-use plastics and increasing consumer pressure for biodegradable options are pushing manufacturers to find alternatives or redesign their materials. These challenges increase production costs and complicate compliance efforts, slowing down large-scale adoption of BOPP films despite their strong performance and widespread industrial demand.

Growth Opportunity

Expanding Opportunities in Eco-Friendly Packaging Innovation

A key growth opportunity for the BOPP Films Market lies in the rapid expansion of eco-friendly and recyclable packaging materials. As consumers and regulators push for greener solutions, manufacturers are investing in advanced BOPP film technologies that reduce plastic waste and improve recyclability. These films can be easily integrated into circular packaging systems, offering both performance and sustainability.

The growing interest in material innovation is highlighted by government and corporate spending focused on responsible packaging solutions. For instance, the €9 million spent on phone pouches, described by McDonald as “unfathomable,” reflects how packaging choices are increasingly under public and political scrutiny. This trend motivates producers to develop smarter, lighter, and environmentally balanced BOPP films that meet next-generation packaging needs.

Latest Trends

Growing Adoption of High-Barrier and Specialty Films

One of the latest trends in the BOPP Films Market is the increasing use of high-barrier and specialty films designed for advanced packaging applications. These films offer superior resistance to moisture, oxygen, and light, making them ideal for preserving the freshness and quality of food and pharmaceutical products.

Manufacturers are now focusing on developing coated and metallized BOPP films that provide enhanced protection without compromising clarity or printability. This shift is also driven by the demand for longer shelf life, attractive packaging designs, and cost-efficient materials. The trend toward high-performance BOPP films demonstrates how the industry is moving beyond traditional packaging to more functional and technologically advanced solutions that meet modern consumer expectations.

Regional Analysis

In 2024, the Asia Pacific dominated the BOPP Films Market with a 39.60% share.

In 2024, the Asia Pacific held a dominant position in the global BOPP Films Market, accounting for 39.60% of the total share, valued at USD 11.8 billion. The region’s leadership is supported by strong manufacturing capabilities, expanding food and beverage industries, and rising demand for flexible packaging materials across China, India, and Southeast Asia.

Rapid urbanization and the shift toward convenient, lightweight packaging formats have further fueled consumption in the region. North America followed with steady growth, driven by technological advancements in packaging processes and a strong focus on recyclable materials in the U.S. and Canada.

Europe showed consistent demand for premium, high-clarity films supported by stringent environmental policies and a growing preference for sustainable packaging solutions. Meanwhile, the Middle East & Africa and Latin America markets are gradually expanding due to increasing retail activity and industrial packaging applications.

The overall regional dynamics highlight Asia Pacific’s continued dominance, backed by its cost-efficient production base and growing consumer goods sector, establishing it as the primary growth hub for the BOPP Films Market in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cosmo Films Limited continued to expand its product innovation and sustainability initiatives, focusing on high-barrier and recyclable films to meet the growing demand for eco-friendly packaging. Its advancements in specialty coatings and labeling solutions helped strengthen its global presence.

Taghleef Industries maintained a leading role with its extensive portfolio of packaging and labeling films, emphasizing circular economy goals and energy-efficient production processes. The company’s adaptability to regional regulations and strong technical expertise supported its market resilience.

Meanwhile, CCL Industries leveraged its leadership in packaging materials and label technologies, integrating BOPP films into premium labeling applications with superior print quality and durability. Collectively, these companies are driving the BOPP Films Market forward through continuous product innovation, sustainability investments, and a strong focus on high-performance applications tailored to global packaging trends.

Top Key Players in the Market

- Cosmo Films Limited

- Taghleef Industries

- CCL Industries

- Jindal Poly Films

- Sibur Holdings

- Zhejiang Kinlead Innovative Materials

- Inteplast Group

- Uflex Ltd.

- Polinas

- Polibak

- Toray Industries

Recent Developments

- In October 2024, JPFL Films announced it would double its capacitor film capacity with an investment of Rs 250 crore, a move that complements its BOPP film expansion strategy and aims to serve industries like electronics and energy storage.

- In June 2024, CCL Industries completed the acquisition of a 100% stake in a Middle-East venture, strengthening its regional manufacturing and distribution footprint in specialty film and packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 29.9 Billion Forecast Revenue (2034) USD 51.6 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bags and Pouches, Wraps, Tapes, Labels), By Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns, More Than 45 Microns), By Production Process (Tenter, Tubular), By Application (Food, Beverage, Personal Care, Pharmaceutical, Electrical and Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cosmo Films Limited, Taghleef Industries, CCL Industries, Jindal Poly Films, Sibur Holdings, Zhejiang Kinlead Innovative Materials, Inteplast Group, Uflex Ltd., Polinas, Polibak, Toray Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cosmo Films Limited

- Taghleef Industries

- CCL Industries

- Jindal Poly Films

- Sibur Holdings

- Zhejiang Kinlead Innovative Materials

- Inteplast Group

- Uflex Ltd.

- Polinas

- Polibak

- Toray Industries