Global Bleaching Agents Market Size, Share, And Enhanced Productivity By Product Type (Azodicarbonamide, Hydrogen Peroxide, Ascorbic Acid, Acetone Peroxide, Chlorine Dioxide, Others), By Form (Powder, Liquid), By End-User (Pulp and Paper, Textile, Construction, Electrical and Electronics, Water Treatment, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171935

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

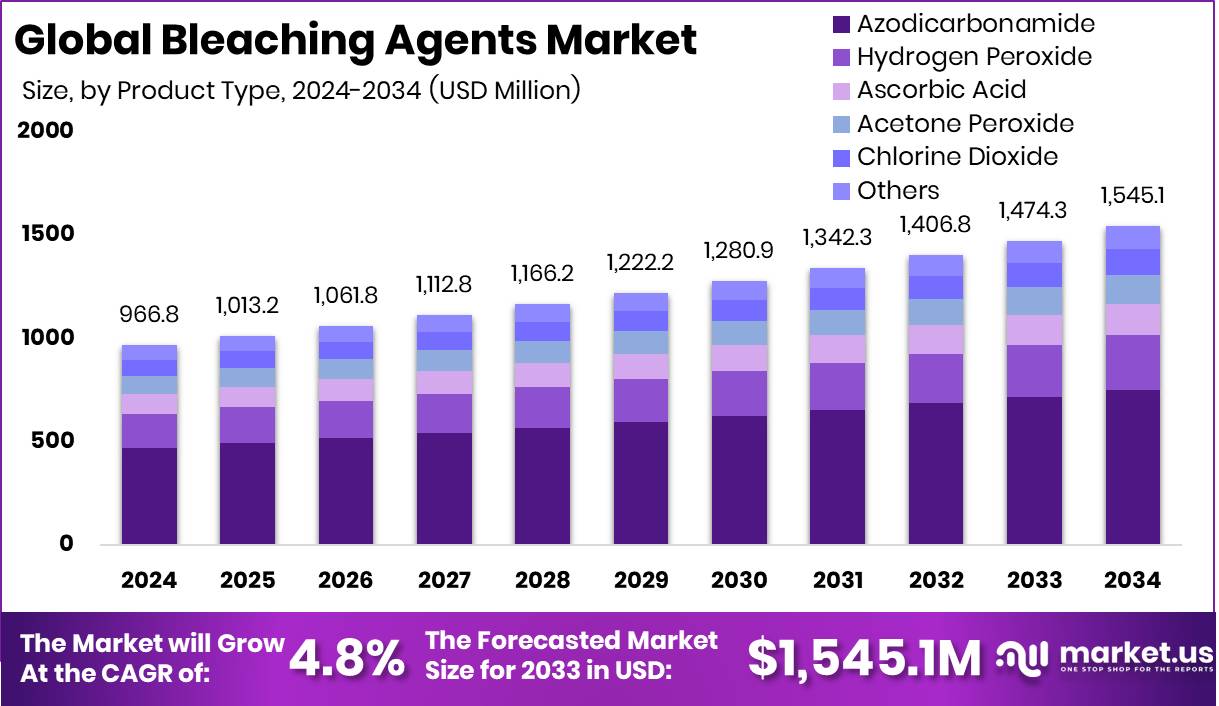

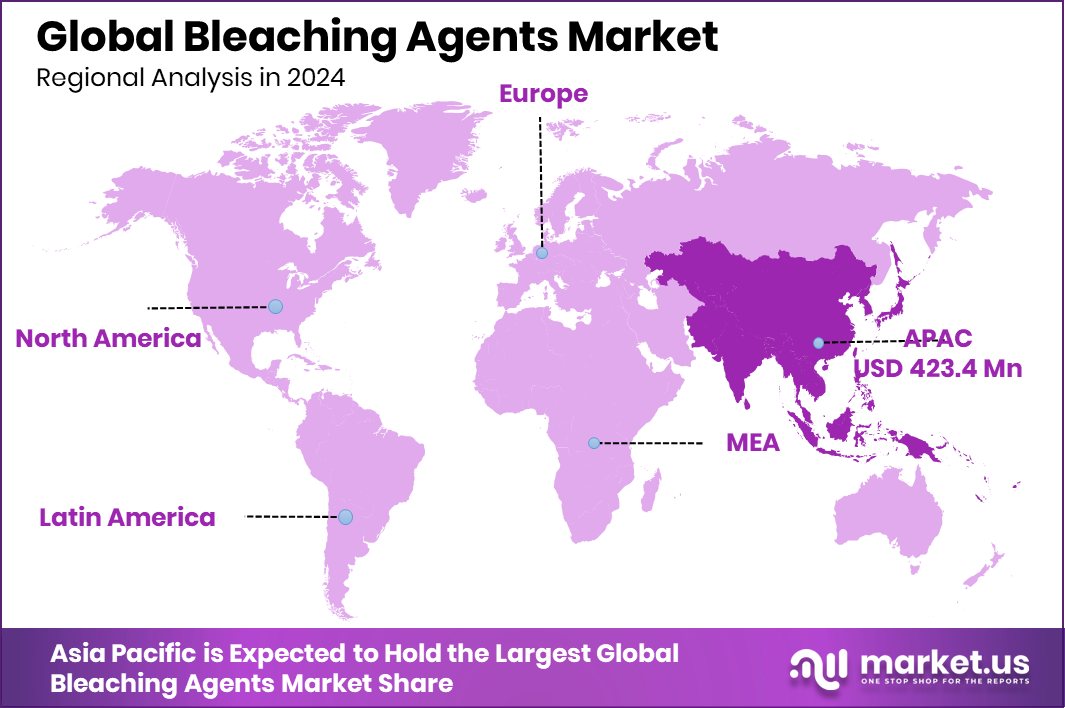

The Global Bleaching Agents Market is expected to be worth around USD 1,545.1 million by 2034, up from USD 966.8 million in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. Growing applications helped the Asia Pacific maintain 43.80% and a USD 423.4 Mn value.

Bleaching agents are chemical substances used to remove color, whiten materials, or disinfect surfaces. They work by breaking down color-forming molecules through oxidation or reduction, making them essential in pulp and paper processing, textiles, household cleaning, water treatment, and food applications. Their role is to improve brightness, hygiene, and product purity across several industries where consistent quality is necessary.

The Bleaching Agents Market represents the global demand for these whitening and oxidation chemicals used in industrial and commercial processes. Growth in this market is shaped by rising production needs in paper mills, expanding textile operations, and the increasing requirement for efficient disinfectants. The market continues to evolve as industries prefer higher-performance and cleaner chemical solutions that blend reliability with safer handling.

Growth is strongly supported by new capacities such as EPCL’s subsidiary commissioning its Rs11.7 billion hydrogen peroxide plant, adding supply and reinforcing industrial confidence. This expansion helps meet rising demand for reliable bleaching inputs in paper, textiles, and sanitation. As more manufacturing units scale production, the need for steady chemical availability becomes even more important.

Demand also increases as companies explore cleaner alternatives. A key example is the rise of plant-based molecules, highlighted by Solugen’s $4.4 million seed round from Y Combinator and others, showing investor interest in new peroxide pathways. This trend is further boosted by a Houston startup securing $30 million to develop plant-based chemical solutions, widening the opportunity for sustainable bleaching technologies in the future.

Opportunity expands as new investments enter hydrogen-based and low-carbon chemical production. Engro Polymer & Chemicals’ $23 million entry into the hydrogen peroxide business strengthens regional supply, while €4.8 billion in EU Innovation Fund grants for clean hydrogen projects support future oxygen-based chemistries. These developments create space for improved, cleaner, and more efficient bleaching agents across global industries.

Key Takeaways

- The Global Bleaching Agents Market is expected to be worth around USD 1,545.1 million by 2034, up from USD 966.8 million in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- Hydrogen peroxide holds a strong 48.7% share, driving major demand in bleaching agent markets.

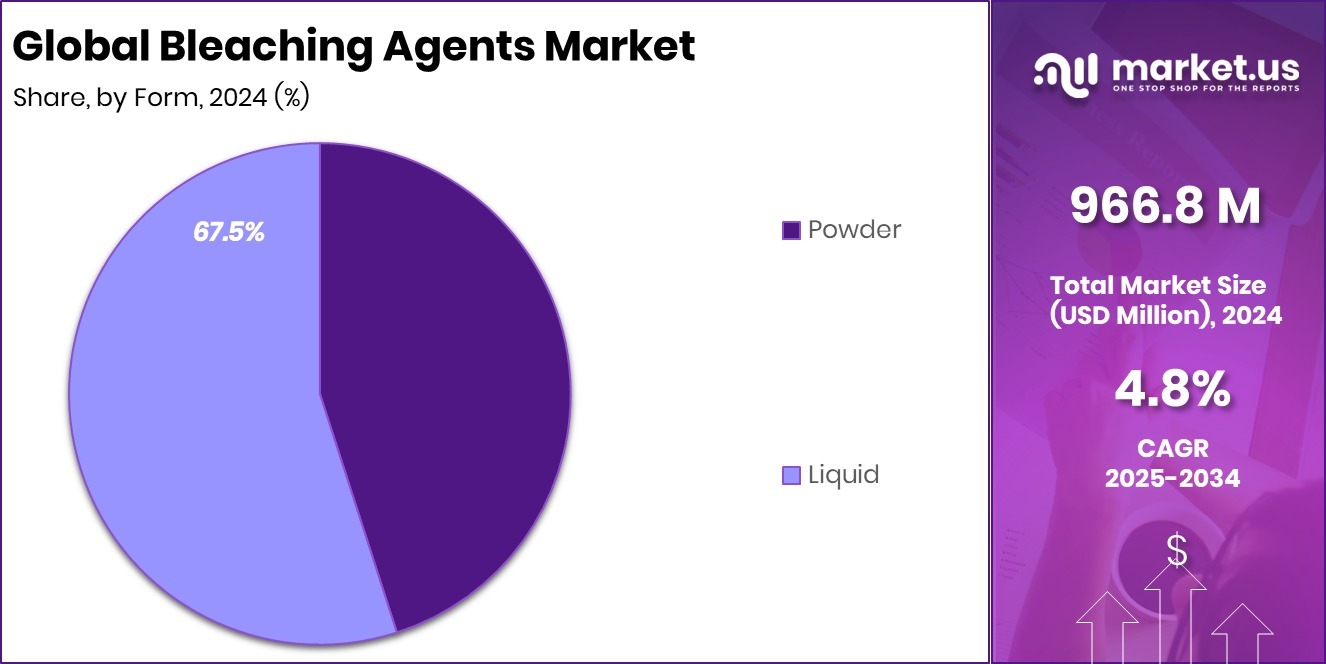

- The liquid form dominates with a 67.5% share due to easy handling in bleaching industries.

- The pulp and paper industry leads with a 37.9% share within the bleaching agents market.

- Strong industrial demand kept Asia Pacific at 43.80% and USD 423.4 Mn.\

By Product Type Analysis

Hydrogen peroxide holds 48.7%, strengthening its dominance in bleaching agent applications.

In 2024, Hydrogen Peroxide held a dominant market position in the By Product Type segment of the Bleaching Agents Market, with a 48.7% share. This strong lead reflects its consistent acceptance as a reliable and efficient bleaching solution across industrial settings. Its stability and compatibility with large-scale operations allow manufacturers to maintain uniform whitening performance without changing core processes.

Hydrogen Peroxide’s dominance also comes from its ability to deliver strong oxidative action while supporting cleaner production methods preferred by processors. Over the year, many producers continued relying on it because it fits well into existing treatment systems. This helped Hydrogen Peroxide preserve its leading position and remain the most widely used product type in the segment.

By Form Analysis

Liquid bleaching agents lead with 67.5%, driven by simplified industrial handling.

In 2024, Liquid held a dominant market position in the By Form segment of the Bleaching Agents Market, with a 67.5% share. Its high share comes from the convenience and consistency it brings to commercial and industrial operations. Users prefer liquid formats because they disperse easily, create uniform mixtures, and reduce handling challenges during batch processing.

Throughout the year, industries valued liquid bleaching agents for their smooth integration into automated systems, minimizing downtime and improving dosing accuracy. These advantages strengthened trust among processors who need predictable bleaching results. As a result, the liquid form sustained strong demand and continued to outperform other formats, making it the most widely adopted option in this segment.

By End-User Analysis

Pulp and paper dominate at 37.9%, reflecting the industry’s heavy bleaching requirements.

In 2024, Pulp and Paper held a dominant market position in the By End-User segment of the Bleaching Agents Market, with a 37.9% share. Its leading role reflects the sector’s constant need for effective whitening and fiber-brightening solutions. Bleaching agents support the industry by improving sheet brightness and ensuring uniform visual quality across large production lines.

Throughout the year, the pulp and paper segment relied heavily on stable bleaching performance to meet printing, packaging, and tissue-grade requirements. This sustained usage allowed the segment to maintain the highest share among all end-users. Its steady operational requirements and ongoing demand for high-quality output cemented its position at the top of the market.

Key Market Segments

By Product Type

- Azodicarbonamide

- Hydrogen Peroxide

- Ascorbic Acid

- Acetone Peroxide

- Chlorine Dioxide

- Others

By Form

- Powder

- Liquid

By End-User

- Pulp and Paper

- Textile

- Construction

- Electrical and Electronics

- Water Treatment

- Healthcare

- Others

Driving Factors

Growing Demand for Advanced Water Treatment Solutions

The Bleaching Agents Market is strongly driven by the growing need for cleaner and safer water treatment solutions across industries and cities. Bleaching agents such as hydrogen peroxide and related oxidizers play an important role in removing impurities, disinfecting water, and improving clarity in treatment systems. This demand rises even faster when governments support local water infrastructure.

A clear example is New Mexico awarding $26 million in grants for brackish water treatment projects, which directly increases the requirement for dependable bleaching and purification chemicals. As more regions invest in modern water systems, the use of bleaching agents naturally expands to maintain high-quality treatment output.

This driving factor becomes even stronger with large-scale funding focused on improving water infrastructure and reducing pipeline losses. New York’s allocation of more than $450 million in water infrastructure grants pushes utilities to upgrade treatment facilities, leading to higher demand for bleaching agents used in purification steps.

Innovation is also shaping the market as digital tools help manage water networks better. HULO’s €2.3 million raise for AI-powered leak detection supports improved water efficiency, which indirectly boosts chemical usage as utilities modernize operations. Together, these efforts show how water-focused investments continuously push the Bleaching Agents Market forward.

Restraining Factors

High Compliance Costs Slow Market Expansion

One major restraining factor for the Bleaching Agents Market is the rising cost of meeting stricter environmental and water-safety rules. Industries that use bleaching agents must upgrade systems, improve handling standards, and invest in safer disposal practices, which increases operating costs.

Even though governments are supporting water-related projects, compliance requirements still make it harder for smaller facilities to adopt or expand bleaching chemical usage. For example, DND’s $120 million funding for remediation and water treatment in North Bay highlights how heavily regulated these projects have become, reflecting the growing financial burden on operators.

The pressure increases as more states invest in cleaner water systems. Arkansas is advancing $154 million in water and wastewater projects, and New York is unveiling $78 million for water quality improvements, both of which show stricter expectations for chemical usage and treatment standards. These upgrades often require facilities to limit or control bleaching chemicals more carefully, making expansion slower.

Even in supportive cases, such as Florida’s $54 million forgivable loan program, the focus remains on long-term compliance, pushing cities to modernize systems earlier than planned. While these programs improve water infrastructure, they also raise regulatory demands, which can restrict the wider adoption of bleaching agents across industries.

Growth Opportunity

Expanding Pulp Production Unlocks Major Growth Potential

A key growth opportunity for the Bleaching Agents Market comes from the rising investments in the pulp and paper sector, where bleaching chemicals are essential for improving fiber brightness and product quality. The industry is witnessing multiple funding moves that signal larger production capacities ahead.

For example, Kap Paper receiving a $28.8 million government lifeline helps stabilize operations and supports continued demand for bleaching inputs used in paper processing. Such support ensures mills maintain or increase their chemical consumption as they operate more efficiently.

This opportunity grows even further as companies plan new or upgraded mills that will require significant volumes of bleaching agents. Northern Pulp seeking $2.5 billion in funding to build a new pulp mill shows how large-scale projects can reshape long-term chemical demand.

Similarly, Irving Pulp & Paper announcing a $1.1 billion upgrade for its Saint John facility indicates a major boost in processing capacity, which increases the use of bleaching chemicals across production lines. While concerns exist about forest financing—highlighted by banks supplying $26 billion to deforesting companies over a decade—the overall expansion of pulp infrastructure still points toward strong demand for reliable bleaching solutions in the coming years.

Latest Trends

Innovative Water Treatment Boosts Market Trends

A major trend shaping the Bleaching Agents Market is the strong shift toward advanced and more efficient water treatment technologies. Utilities and industries are upgrading their systems, which increases interest in modern bleaching solutions that work safely and effectively in large treatment plants. This shift is visible as Central Arkansas Water receives an $80 million state loan to improve its treatment facilities, creating room for newer oxidation and disinfection methods. These upgrades encourage wider adoption of refined bleaching agents that fit well with modern purification systems.

Innovation is also accelerating through private investments. Scotmas securing £2.2 million in funding, backed by Maven, highlights the rising demand for smarter and cleaner water disinfection technologies. Their focus on cutting-edge solutions signals how bleaching chemistry is becoming more technology-driven. At the same time, large-scale infrastructure commitments such as Beaumont’s $387 million investment planned over the next five years create steady demand for advanced treatment materials.

As cities and industries modernize operations, they increasingly prefer bleaching agents that support efficiency, cleaner processes, and stronger safety standards. This growing alignment between infrastructure upgrades and innovative disinfection technology defines the latest trend in the market.

Regional Analysis

Asia Pacific led the Bleaching Agents Market with 43.80%, reaching USD 423.4 Mn.

In 2024, Asia Pacific emerged as the dominant region in the Bleaching Agents Market with a strong 43.80% share valued at USD 423.4 Mn. This leadership reflects the region’s expanding industrial base and rising consumption across pulp and paper, textiles, and water treatment facilities. Steady manufacturing output and higher adoption of chemical bleaching solutions helped the Asia Pacific maintain its clear lead over other global regions.

North America followed with stable usage across established processing industries, supported by consistent demand for whitening and purification applications. Europe showed balanced growth driven by industrial cleaning and paper-grade requirements.

Meanwhile, Latin America and the Middle East & Africa recorded steady but smaller contributions, reflecting emerging adoption patterns as localized industries gradually expand their operational capacity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF continued to shape the market through its strong focus on high-efficiency chemical solutions that support large-scale industrial processing. The company’s long-standing expertise in oxidation and specialty chemical formulations allowed it to cater to diverse end-use sectors that rely on consistent bleaching outcomes, particularly in material treatment and purification applications.

Aditya Birla Chemicals maintained a significant presence by leveraging its integrated production capabilities and established supply networks across key Asian markets. Its portfolio alignment with pulp, textile, and water-treatment applications positioned the company as a dependable supplier for customers seeking both quality and operational reliability. The company’s regional strength helped support the steady adoption of bleaching products across developing industrial hubs.

Evonik contributed to the market with its strong emphasis on specialty additives and process-enhancing chemical ingredients that improve bleaching efficiency and stability. Its formulation expertise helped end-users achieve controlled performance in demanding production environments. Together, these companies reinforced the market’s competitive foundation, supporting dependable supply, product consistency, and application-focused innovation across global industries in 2024.

Top Key Players in the Market

- BASF

- Aditya Birla Chemicals

- Evonik

- Solvay

- Akzonobel

- Hawkins, Inc.

- Siemer Milling

- Peroxychem

- Supraveni Chemicals

- Spectrum Chemicals

Recent Developments

- In November 2025, AkzoNobel and U.S. coatings firm Axalta Coating Systems announced an all-stock merger of equals to form a larger global coatings company. The combined business is expected to strengthen geographic reach and product portfolios in performance chemical coatings. This development positions AkzoNobel within a broader global coatings network.

- In November 2024, Siemer Milling and partner Brighton Mills added a new 2,500-cwt-per-day B-mill at their Whitewater Mill in West Harrison, Indiana, raising the site’s processing capacity by 25%. This expansion helped the company produce more flour to meet growing customer demand.

- In February 2020, Evonik completed the acquisition of PeroxyChem, a major producer of hydrogen peroxide (H₂O₂), peracetic acid (PAA), and other peroxygen chemicals used as bleaching agents in pulp, paper, and water treatment industries. This deal brought PeroxyChem into Evonik’s Resource Efficiency segment, expanding Evonik’s specialty chemical portfolio focused on environmentally friendly oxidizers. The acquisition strengthened global production and distribution reach for bleaching-related chemicals.

Report Scope

Report Features Description Market Value (2024) USD 966.8 Million Forecast Revenue (2034) USD 1,545.1 Million CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Azodicarbonamide, Hydrogen Peroxide, Ascorbic Acid, Acetone Peroxide, Chlorine Dioxide, Others), By Form (Powder, Liquid), By End-User (Pulp and Paper, Textile, Construction, Electrical and Electronics, Water Treatment, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Aditya Birla Chemicals, Evonik, Solvay, Akzonobel, Hawkins, Inc., Siemer Milling, Peroxychem, Supraveni Chemicals, Spectrum Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bleaching Agents MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Bleaching Agents MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Aditya Birla Chemicals

- Evonik

- Solvay

- Akzonobel

- Hawkins, Inc.

- Siemer Milling

- Peroxychem

- Supraveni Chemicals

- Spectrum Chemicals