Global Birch Water Market Size, Share Analysis Report By Type (Unflavored, Flavored), By Nature (Conventional, Organic), By Application (Beverages, Cosmetics And Personal Care, Pharmaceuticals, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159403

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

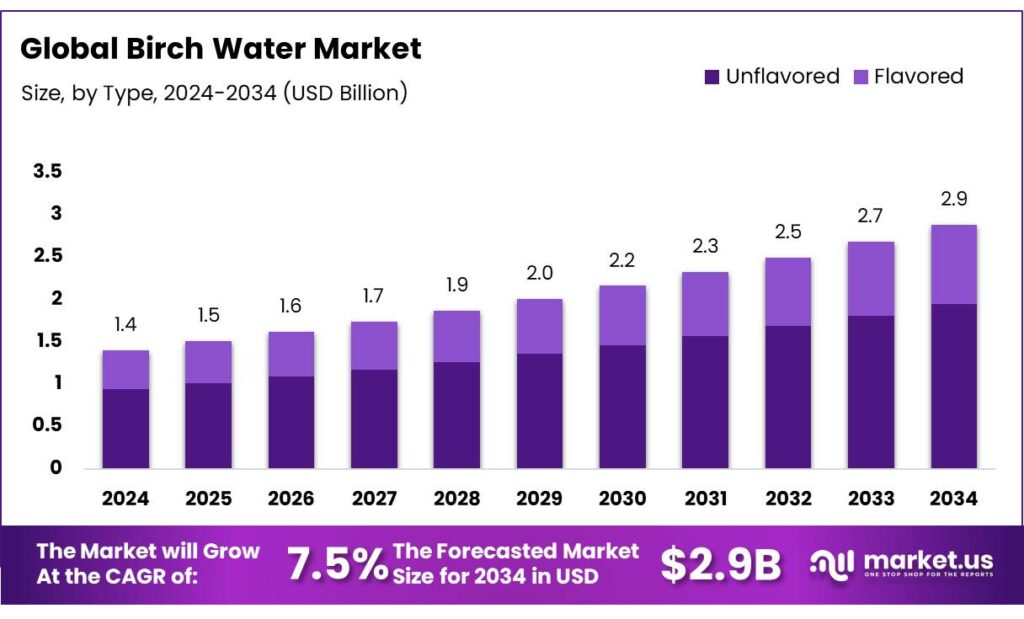

The Global Birch Water Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.4% share, holding USD 0.4 Billion in revenue.

Birch water, derived from the sap of birch trees, has emerged as a popular natural beverage and functional ingredient in the health and wellness market. Traditionally consumed in Northern Europe and parts of Asia, the global acceptance of birch water has grown due to its perceived health benefits, such as detoxifying properties, boosting hydration, and providing essential minerals. The industry has witnessed a shift toward natural and plant-based alternatives, which has helped birch water gain traction as a sustainable and health-promoting product.

In India, the government has launched several initiatives to promote water conservation and sustainable water management, which indirectly support the birch water industry. For instance, the ‘Jal Sanchay Jan Bhagidari’ initiative in Gujarat aims to conserve water through community participation, constructing approximately 24,800 rainwater harvesting structures across the state. Such programs enhance the availability of water resources, which is crucial for industries like birch water production that rely on natural water sources.

- Government initiatives in India also play a crucial role in promoting sustainable water use, indirectly benefiting industries like birch water production. For instance, the Jal Jeevan Mission aims to provide 55 liters of tap water per capita per day to every rural household by 2024, with a budget allocation of ₹3.60 lakh crore.

Several factors contribute to the expansion of the birch water industry. First, the increasing health-consciousness among consumers has led to higher demand for natural, sugar-free, and low-calorie drinks. According to the Food and Agriculture Organization (FAO), the global consumption of natural health beverages has surged by 6% year-on-year since 2019, further supporting the rise of birch water as a competitive product.

Key Takeaways

- Birch Water Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.5%.

- Unflavored birch water held a dominant market position, capturing more than a 67.4% share of the global market.

- Conventional birch water held a dominant market position, capturing more than a 79.3% share.

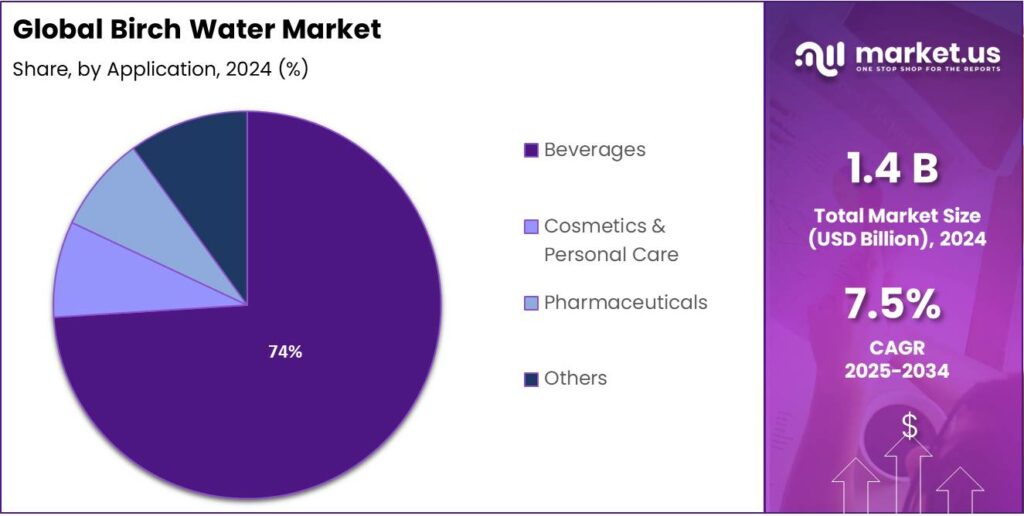

- Beverages held a dominant market position, capturing more than a 74.6% share of the global birch water market.

- Supermarkets and hypermarkets held a dominant market position, capturing more than a 39.1% share of the global birch water market.

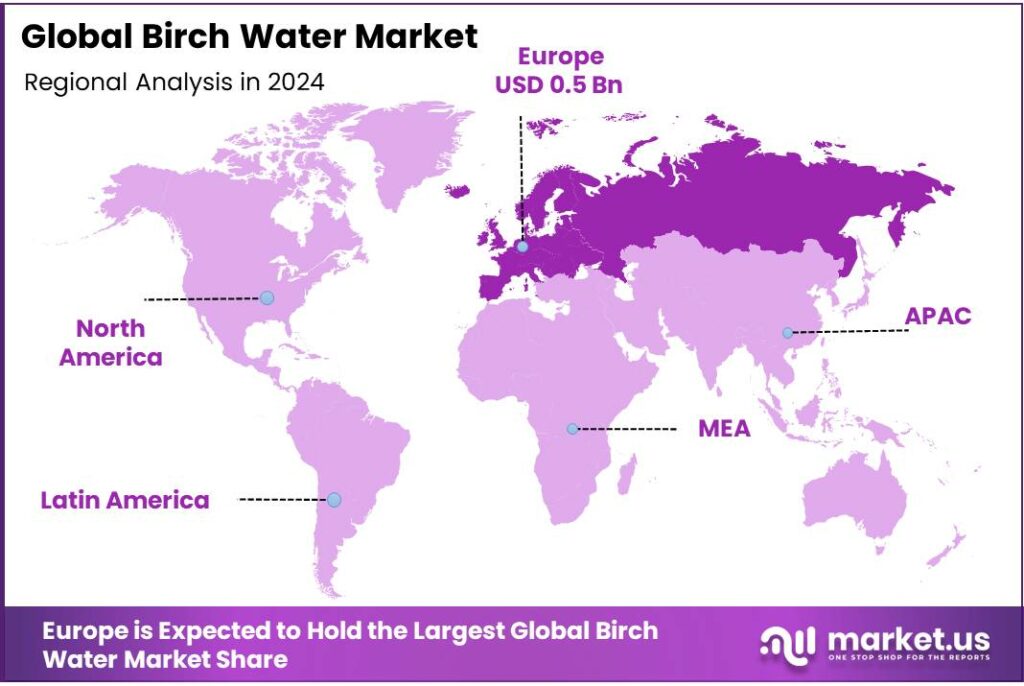

- Europe held the dominant market position in the global birch water sector, capturing more than 42.1% of the market share, valued at approximately USD 0.5 billion.

By Type Analysis

Unflavored Birch Water Dominates with 67.4% in 2024 Due to Consumer Preference for Natural Taste

In 2024, unflavored birch water held a dominant market position, capturing more than a 67.4% share of the global market. This segment’s growth can be attributed to the increasing consumer preference for natural, unadulterated beverages that offer health benefits without added sugars or artificial flavors. Unflavored birch water, with its pure and clean taste, resonates with health-conscious individuals seeking an authentic, plant-based drink.

The unflavored category’s strong market share is driven by its versatility, as it can be consumed directly or incorporated into various functional beverages, such as smoothies and energy drinks. Additionally, its appeal as a low-calorie, natural hydration solution aligns with growing trends in the health and wellness industry. The simplicity of unflavored birch water also makes it suitable for those who want to avoid artificial additives, a trend that is increasingly important among younger consumers.

By Nature Analysis

Conventional Birch Water Dominates with 79.3% in 2024 Due to Wide Availability and Familiarity

In 2024, conventional birch water held a dominant market position, capturing more than a 79.3% share of the global market. This segment’s leadership can be attributed to the widespread availability and familiarity of conventional products among consumers. Conventional birch water, typically sourced from large-scale commercial production, is more accessible and affordable compared to its organic counterparts, making it the go-to choice for a larger demographic.

The dominance of conventional birch water is also supported by its established presence in the market, where it is often preferred for its affordability and ease of access. As the global demand for functional beverages continues to rise, conventional birch water has been able to meet this demand efficiently, ensuring consistency in supply while maintaining relatively lower production costs. In addition, conventional products are generally more widely distributed, making them available in supermarkets, convenience stores, and online platforms, further strengthening their market presence.

By Application Analysis

Beverages Segment Dominates with 74.6% in 2024 Due to Rising Consumer Demand for Functional Drinks

In 2024, beverages held a dominant market position, capturing more than a 74.6% share of the global birch water market. This segment’s leadership is driven by the increasing demand for healthy, natural drinks as consumers continue to prioritize wellness and hydration. Birch water is particularly popular as a beverage due to its low-calorie, sugar-free, and naturally hydrating properties, making it a favored alternative to sugary drinks and sodas.

The growth of the beverages segment can also be attributed to the expanding functional beverage market, where birch water is being marketed as a revitalizing, nutrient-rich option. With its naturally occurring minerals, antioxidants, and electrolytes, birch water is often used as a base for health drinks, including smoothies, energy drinks, and hydration supplements. The segment’s dominance is further supported by the widespread availability of birch water in bottled and canned formats, which are gaining traction in both retail and online sales channels.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Dominate with 39.1% in 2024 Due to Accessibility and Broad Consumer Reach

In 2024, supermarkets and hypermarkets held a dominant market position, capturing more than a 39.1% share of the global birch water market. This significant market share is driven by the large-scale distribution capabilities of supermarkets and hypermarkets, which provide easy access to a wide variety of consumers. These retail channels are essential in ensuring that birch water is readily available in mainstream markets, often located in convenient, high-traffic areas, making it a go-to option for shoppers looking for functional beverages.

The widespread reach and established infrastructure of supermarkets and hypermarkets play a key role in the continued growth of birch water in the global market. As consumer demand for healthy, natural drinks rises, these retail outlets have been able to meet this demand by stocking birch water in both large-format and smaller-sized packaging. The ability to cater to different customer preferences, from premium brands to more affordable options, also enhances the appeal of birch water through these distribution channels.

Key Market Segments

By Type

- Unflavored

- Flavored

- Strawberry

- Rose Chip

- Bilberry

- Apple

- Ginger

- Others

By Nature

- Conventional

- Organic

By Application

- Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Rise of Clean-Label and Sustainable Beverage Products

One of the most significant recent trends in the birch water market is the increasing demand for clean-label and sustainable beverages. As consumers become more conscious about the ingredients in their food and drinks, there is a growing preference for beverages with simple, natural ingredients and transparent labeling. Birch water, known for its minimal processing and natural composition, aligns well with this trend.

According to the U.S. Food and Drug Administration (FDA), clean-label products are now a key consumer trend. A 2023 FDA survey found that nearly 68% of U.S. consumers check product labels to avoid artificial ingredients, additives, and preservatives, which has been a driving force behind the rise of clean-label beverages. Birch water, with its simple and natural ingredient list, fits perfectly into this market. Its appeal is particularly strong among millennials and Gen Z, who prioritize health and transparency in their food and beverage choices.

Moreover, the trend towards sustainability has also contributed to birch water’s growth. Many consumers today are concerned about the environmental footprint of the products they purchase, and as a result, they are more likely to choose beverages that are sustainably sourced and packaged. Birch water is tapped from birch trees in a process that doesn’t harm the trees, making it an eco-friendly option for those seeking natural beverages with a lower environmental impact.

In fact, the Environmental Protection Agency (EPA) reported that 66% of U.S. consumers are now willing to pay a premium for products that are certified organic or sustainably sourced. This creates an opportunity for birch water producers to emphasize their sustainable practices, which could enhance the appeal of the product among a broader base of environmentally conscious consumers.

Drivers

Rising Consumer Demand for Natural and Functional Beverages

Birch water, derived from the sap of birch trees, is celebrated for its rich composition of vitamins, minerals, and antioxidants. Notably, it contains electrolytes such as potassium and magnesium, which are essential for maintaining proper hydration and supporting metabolic functions. Its low-calorie and low-sugar profile further enhances its appeal among health-conscious individuals.

- According to the U.S. Department of Agriculture, the demand for natural and organic products has increased by 12% annually over the past five years, underscoring a significant consumer trend towards cleaner, more transparent food and beverage options. Birch water aligns seamlessly with this trend, offering a product that is both natural and functional.

The market’s expansion is also fueled by innovations in product offerings. Flavored birch water variants, such as those infused with apple ginger or bilberry, cater to diverse taste preferences, broadening the product’s appeal. These innovations not only enhance the sensory experience but also introduce additional health benefits, attracting a wider consumer base.

Furthermore, the rise of e-commerce platforms has facilitated greater accessibility to birch water products. Consumers can now conveniently purchase these beverages online, often with detailed product information and customer reviews, aiding in informed decision-making. This shift towards online retailing has been instrumental in reaching health-conscious consumers who prefer the convenience of home delivery.

Restraints

Limited Consumer Awareness and Market Education

One of the major restraining factors for the growth of the birch water market is the limited consumer awareness and lack of market education surrounding the product. Birch water, a natural sap extracted from birch trees, is still relatively unknown to a large portion of global consumers. Unlike more established beverages such as coconut water or fruit juices, birch water faces significant challenges in educating consumers about its benefits, uses, and nutritional profile. While birch water is becoming more popular in certain regions, especially in Europe and North America, it is still a niche product in many parts of the world.

- According to a 2023 report by the International Bottled Water Association (IBWA), bottled water continues to dominate the global beverage market, accounting for over 30% of the overall beverage market in the U.S. alone. This presents a significant challenge for birch water, which must compete with more established products that have larger marketing budgets and broader consumer reach.

Additionally, birch water is often marketed as a health drink, with claims of detoxification, hydration, and high mineral content. However, these claims are not always well-known or understood by the average consumer, especially in regions where birch water is not a traditional beverage. In the U.S., for instance, a survey conducted by Mintel in 2023 found that only 14% of consumers were aware of birch water as a beverage option, compared to 82% awareness for coconut water. The lack of awareness means that consumers are less likely to actively seek out birch water, making it more difficult for companies to generate strong demand.

To overcome this challenge, manufacturers of birch water must invest in consumer education and awareness campaigns. As of 2024, the U.S. Department of Agriculture (USDA), in collaboration with various beverage industry associations, launched a new initiative to support the education of consumers about the health benefits of natural, plant-based beverages. These efforts are expected to help raise awareness and drive interest in products like birch water, particularly among health-conscious consumers who are looking for new functional beverages that provide hydration and essential nutrients without added sugars or artificial ingredients.

Opportunity

Increasing Demand for Natural and Functional Beverages

One of the most significant growth opportunities for the birch water market lies in the increasing global demand for natural and functional beverages. Consumers are becoming more health-conscious and are actively seeking drinks that provide not only hydration but also additional health benefits. Birch water, which is known for its natural mineral content, low-calorie profile, and detoxifying properties, aligns well with these consumer trends. As people increasingly turn away from sugary, carbonated beverages and look for healthier alternatives, birch water is well-positioned to capture a growing segment of the functional beverage market.

According to the International Food Information Council (IFIC), 63% of U.S. consumers in 2023 stated that they were actively reducing their sugar intake, and 54% said they preferred beverages that provided added health benefits. This is particularly important as health trends such as detoxification, hydration, and immune support continue to shape consumer purchasing decisions. Birch water, which is often marketed as a hydrating and detoxifying beverage, taps into these health trends, making it a potential alternative to sugary soft drinks and even sports drinks, which many consumers associate with high sugar content and artificial additives.

In addition, the increasing interest in plant-based diets and eco-friendly products is another growth opportunity for birch water. As more people adopt plant-based diets, they are looking for plant-based beverages that offer hydration and nutritional benefits. Birch water, which is naturally sourced from birch trees and requires minimal processing, fits perfectly into this trend.

It is a plant-based product that can be marketed as sustainable and eco-friendly, especially if the production process prioritizes environmental conservation. The Plant-Based Foods Association reported in 2023 that the plant-based food and beverage market in the U.S. grew by 27% over the past two years, signaling strong consumer interest in plant-based alternatives. Birch water, with its natural, clean-label appeal, is well-positioned to benefit from this growing segment.

Regional Insights

Europe Dominates the Birch Water Market with 42.1% Share in 2024, Valued at USD 0.5 Billion

In 2024, Europe held the dominant market position in the global birch water sector, capturing more than 42.1% of the market share, valued at approximately USD 0.5 billion. This strong market presence is largely due to the region’s long-standing tradition of birch water consumption, particularly in countries like Finland, Russia, and Sweden, where birch sap has been harvested for centuries. Europe’s established market for natural and organic beverages, combined with rising consumer demand for functional drinks, has played a significant role in the growth of birch water within the region.

The European market benefits from advanced production technologies and an extensive distribution network, making birch water readily available across a variety of retail outlets, from supermarkets to specialized health food stores. Additionally, the growing trend towards sustainability and eco-friendly products has positively influenced the demand for birch water, which is seen as a more environmentally conscious alternative to traditional sugary beverages. The European Union’s emphasis on promoting natural, health-focused, and plant-based products through various regulatory measures has also contributed to the market’s expansion.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BelSeva is a French company specializing in organic birch water. They are recognized for pioneering the commercialization of birch tree water in eco-friendly packaging. Their products are marketed as natural health elixirs, offering benefits like detoxification and antioxidant properties. BelSeva emphasizes sustainability and innovation in its product offerings.

Sapp is a New York-based startup that produces organic birch water sourced from birch trees. Their products are marketed as a lower-sugar alternative to coconut water, rich in antioxidants and minerals. Sapp aims to introduce birch water to a broader audience, emphasizing its health benefits and natural origins.

Nature on Tap is a company that offers birch water sourced from Finland. They focus on providing a natural, low-calorie beverage with a subtle sweetness. The company highlights the purity and health benefits of birch water, aiming to cater to health-conscious consumers seeking alternative hydration options.

Top Key Players Outlook

- BelSeva

- Sapp

- Nature on Tap

- TreeVitalise

- Byarozavik

- Wild West

- Nordic Koivu

- Alaska Wild Harvest

- Wild & Pure

- Biotona Bio

Recent Industry Developments

In 2024, Belarusian forestry enterprises collected over 2,000 tons of birch sap in the Grodno region alone, with a portion processed into products like Byarozavik and sold domestically and abroad.

In 2024, BelSeva’s birch water was available in various flavors, including natural birch sap and infused versions with matcha, ginger, apple, and lime.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Unflavored, Flavored), By Nature (Conventional, Organic), By Application (Beverages, Cosmetics And Personal Care, Pharmaceuticals, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BelSeva, Sapp, Nature on Tap, TreeVitalise, Byarozavik, Wild West, Nordic Koivu, Alaska Wild Harvest, Wild & Pure, Biotona Bio Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BelSeva

- Sapp

- Nature on Tap

- TreeVitalise

- Byarozavik

- Wild West

- Nordic Koivu

- Alaska Wild Harvest

- Wild & Pure

- Biotona Bio