Global Bioinsecticides Market Size, Share, Analysis Report By Source (Macrobia, Plants, Others), By Formulation (Dry, Liquid), By Mode of Application (Foliar Spray, Soil Treatment, Seed Treatment, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Other) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155903

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

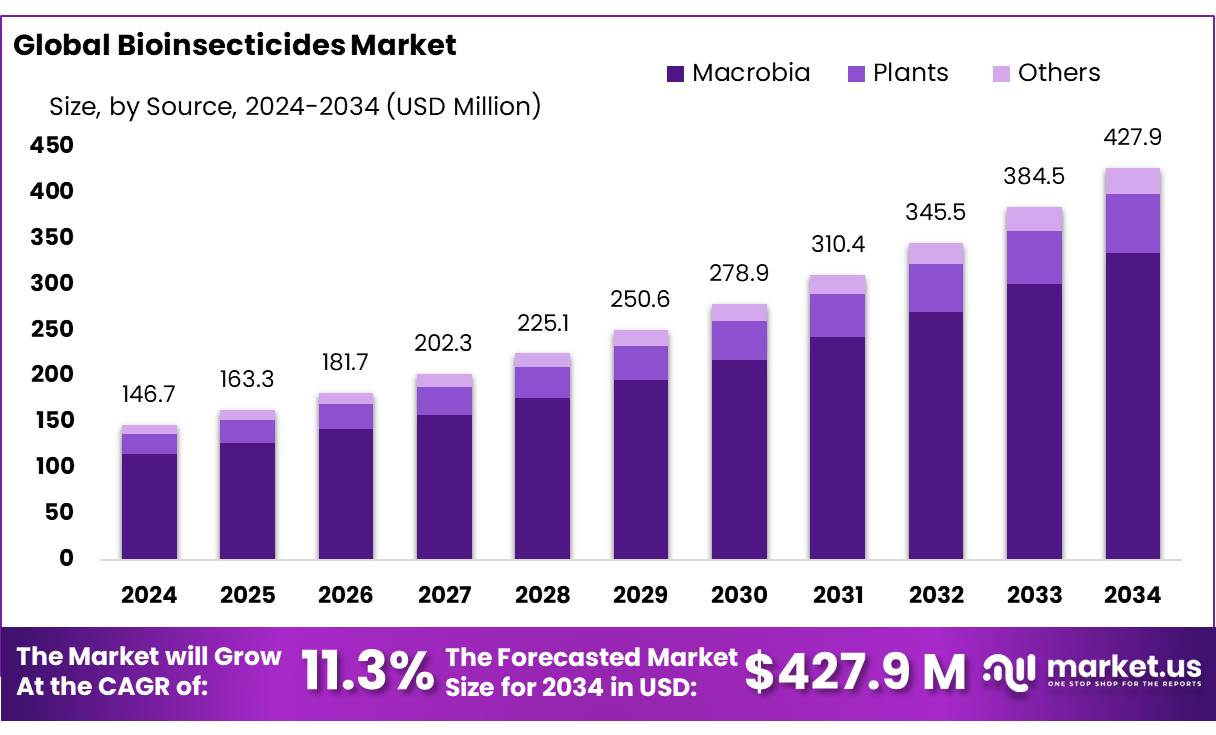

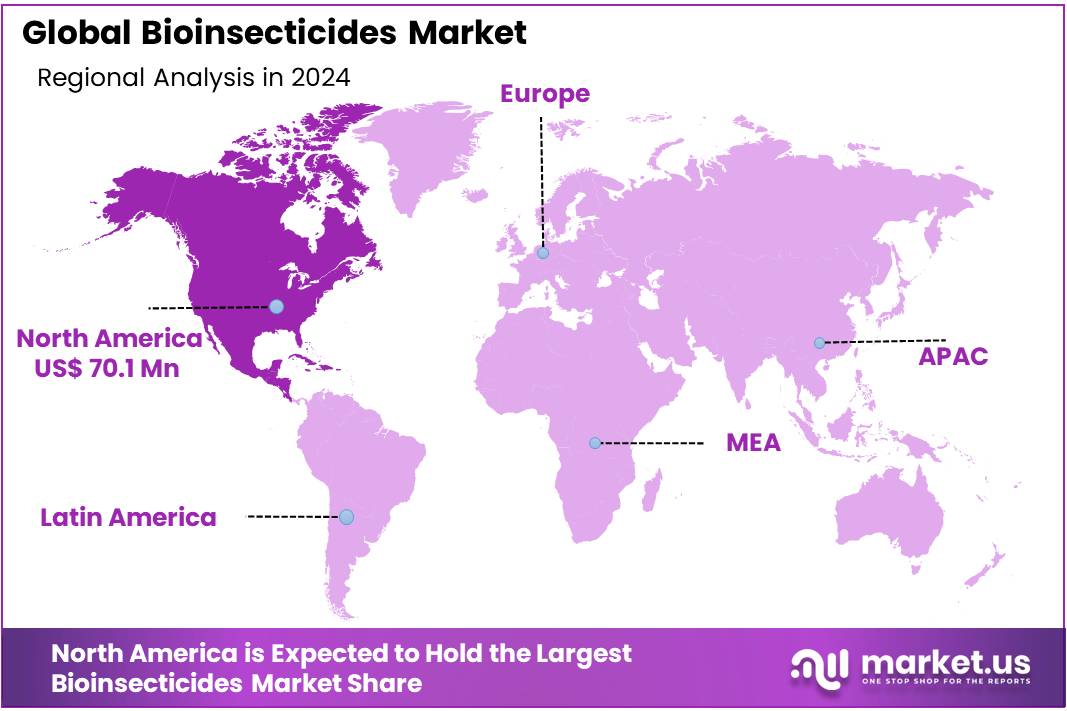

The Global Bioinsecticides Market size is expected to be worth around USD 427.9 Million by 2034, from USD 146.7 Million in 2024, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.8% share, holding USD 70.1 Billion revenue.

Bioinsecticide concentrates represent a vital subset within the broader biopesticides category—pesticides derived from natural materials such as bacteria, fungi, and botanical extracts. These concentrated formulations are increasingly deployed in integrated pest management (IPM) to provide effective insect control with reduced environmental and health risks compared to conventional synthetics.

Several factors are driving this growth. Firstly, the increasing awareness among farmers and consumers about the harmful effects of chemical pesticides on health and the environment is prompting a shift towards biopesticides. Secondly, government initiatives like the National Mission on Natural Farming, with a budget of Rs. 2481 crore, and the Paramparagat Krishi Vikas Yojana (PKVY) are promoting organic farming practices and the use of biopesticides. Additionally, the Soil Health Card Scheme is providing farmers with tailored recommendations for biopesticide usage based on soil health assessments.

Despite these advancements, challenges remain. Biopesticides currently account for only about 4.2% of India’s total pesticide market. However, this share is expected to grow significantly, with projections indicating that biopesticides could represent up to 50% of the pesticide market by 2050. The adoption of biopesticides is also supported by the government’s efforts to phase out harmful chemical pesticides. For instance, in 2023, the Ministry of Agriculture and Farmers Welfare banned or phased out 46 pesticides and four pesticide formulations due to safety and efficacy concerns.

Key Takeaways

- Bioinsecticides Market size is expected to be worth around USD 427.9 Million by 2034, from USD 146.7 Million in 2024, growing at a CAGR of 11.3%.

- Macrobia held a dominant market position, capturing more than a 78.3% share in the bioinsecticides market.

- Dry held a dominant market position, capturing more than a 69.1% share in the bioinsecticides market.

- Foliar Spray held a dominant market position, capturing more than a 49.7% share in the bioinsecticides market.

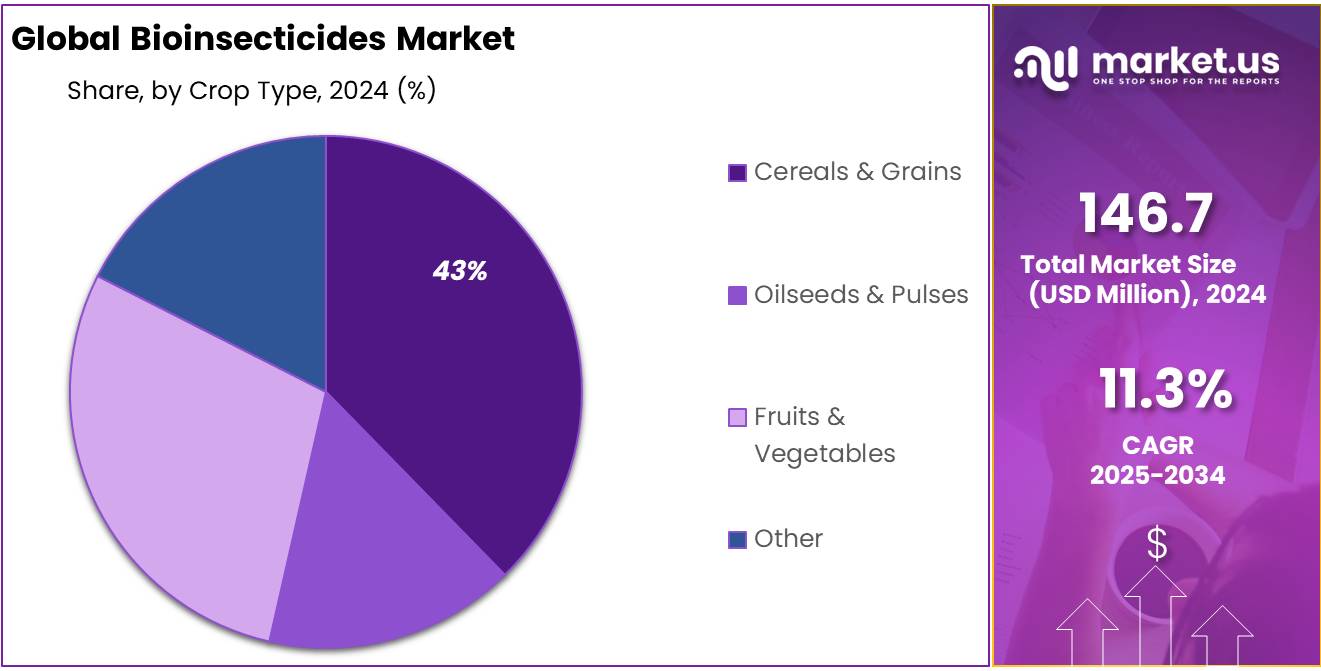

- Cereals & Grains held a dominant market position, capturing more than a 43.5% share in the bioinsecticides market.

- North America clearly leads the global bioinsecticides segment, holding a commanding 47.8% share, which equates to approximately USD 70.1 million.

By Source Analysis

Macrobia leads the bioinsecticides market with 78.3% share thanks to its natural efficiency and broad pest control range.

In 2024, Macrobia held a dominant market position, capturing more than a 78.3% share in the bioinsecticides market by source. This strong lead is mainly because macrobial bioinsecticides—derived from beneficial insects like parasitic wasps, predatory mites, and entomopathogenic nematodes—have proven to be highly effective in managing a wide range of crop pests naturally. Their ability to target specific pest species without harming beneficial organisms or the environment has made them a preferred choice among farmers adopting integrated pest management (IPM) techniques.

Moreover, Macrobia-based products are widely supported by organic farming guidelines and are gaining traction across regions with stringent chemical pesticide restrictions. Looking ahead to 2025, the demand is expected to stay strong, especially in high-value crops like vegetables, fruits, and greenhouse plants where natural pest control methods are increasingly prioritized. The segment’s continued dominance is also supported by government incentives promoting biological inputs and ongoing advancements in breeding and rearing these organisms at commercial scale.

By Formulation Analysis

Dry formulation dominates with 69.1% in 2024 due to its longer shelf life and ease of handling in storage and transport.

In 2024, Dry held a dominant market position, capturing more than a 69.1% share in the bioinsecticides market by formulation. This significant lead is largely driven by the practical advantages dry formulations offer to both manufacturers and end-users. These include improved shelf stability, reduced transportation costs, and better handling during application, especially in remote and rural farming regions. Dry bioinsecticides, such as powders, granules, and dusts, are particularly popular for their ease of use and compatibility with traditional farming tools and seed treatments.

Their extended storage life without the need for refrigeration also adds to their market appeal, especially in developing agricultural economies. By 2025, the segment is expected to maintain its lead as more bioinsecticide producers invest in improving the dispersion and solubility characteristics of dry forms, making them even more efficient in field applications. Farmers favor these formats for their convenience and reliability, especially in large-scale and outdoor crop systems.

By Mode of Application Analysis

Foliar Spray dominates with 49.7% in 2024 owing to its quick action and direct pest targeting on crop leaves.

In 2024, Foliar Spray held a dominant market position, capturing more than a 49.7% share in the bioinsecticides market by mode of application. This lead is mainly because foliar spraying allows for direct contact of the bioinsecticide with pests on plant surfaces, ensuring faster and more visible results. Farmers widely prefer this method for its quick response during pest outbreaks and its ability to uniformly cover large field areas using common spray equipment.

The approach also minimizes wastage, as the bioinsecticide reaches the exact part of the plant where pests usually attack. As more biological products are being formulated for compatibility with foliar methods, the convenience of this mode continues to drive its popularity. Looking ahead to 2025, foliar spray is likely to retain its top position, particularly in fruit, vegetable, and ornamental crop segments where fast-acting and eco-safe pest control is critical for both yield and market quality.

By Crop Type Analysis

Cereals & Grains lead with 43.5% share in 2024 as farmers turn to bioinsecticides for safer pest control in staple crops.

In 2024, Cereals & Grains held a dominant market position, capturing more than a 43.5% share in the bioinsecticides market by crop type. This strong position is mainly due to the vast cultivation area of staple crops like wheat, rice, and maize, which are often prone to pest attacks during both growing and storage stages. Farmers are increasingly using bioinsecticides in these crops to reduce dependence on chemical pesticides, especially with rising concerns over pesticide residues and pest resistance. Bioinsecticides offer a safer and sustainable solution that helps maintain soil health while effectively managing pests such as borers, aphids, and beetles common in cereal fields.

Key Market Segments

By Source

- Macrobia

- Plants

- Others

By Formulation

- Dry

- Liquid

By Mode of Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other

Emerging Trends

Surge in Organic Farming and Government Support

In recent years, India has witnessed a significant shift towards organic farming, driven by both consumer demand for residue-free produce and government initiatives promoting sustainable agricultural practices. This transition has led to an increased adoption of bioinsecticides, as farmers seek effective and environmentally friendly alternatives to chemical pesticides.

The government’s support plays a crucial role in this transformation. Initiatives such as the National Mission on Natural Farming, launched in November 2024 with a budget of ₹2,481 crore, aim to promote chemical-free farming across 15,000 clusters, reaching 1 crore farmers and covering 7.5 lakh hectares. Additionally, programs like the Paramparagat Krishi Vikas Yojana (PKVY) and the National Mission on Sustainable Agriculture (NMSA) offer subsidies and training to farmers, facilitating the adoption of organic farming practices and, by extension, the use of bioinsecticides.

This shift towards organic farming is not only benefiting the environment but also opening new markets for Indian farmers. Exporters are increasingly seeking organic produce to meet global demand, particularly in regions with stringent residue standards. States like Sikkim, which has been declared India’s first fully organic state, serve as models for integrating bioinsecticides into mainstream agriculture.

However, challenges remain in the widespread adoption of bioinsecticides. Issues such as formulation stability, farmer awareness, and supply chain complexities need to be addressed to fully realize the potential of bioinsecticides. Nevertheless, with continued government support and growing consumer awareness, the future of bioinsecticides in India looks promising, contributing to a more sustainable and resilient agricultural landscape.

Drivers

Increasing Demand for Organic Farming Drives the Bioinsecticides Market

The growing global demand for organic farming is one of the key driving factors for the bioinsecticides market. As consumers become more health-conscious and environmentally aware, the shift toward organic food products has intensified. Organic farming emphasizes the use of natural methods to control pests and diseases, and bioinsecticides are a core solution for maintaining pest control in such systems.

- According to the International Federation of Organic Agriculture Movements (IFOAM), organic farming now accounts for over 2.8% of the world’s total agricultural land, a trend that is expected to continue growing as consumer preferences lean toward sustainably produced food.

Bioinsecticides offer an eco-friendly alternative to conventional chemical pesticides, which are increasingly scrutinized for their negative impact on human health, wildlife, and the environment. The global pesticide industry has been facing increased regulatory pressure, with agencies like the U.S. Environmental Protection Agency (EPA) actively working to reduce the use of harmful chemicals in food production. In response, the bioinsecticides market is witnessing rapid growth as farmers and producers adopt greener solutions to align with organic farming principles.

The increasing awareness of the health risks posed by synthetic pesticides has contributed significantly to the rising popularity of bioinsecticides. In particular, bioinsecticides are seen as safer for both humans and beneficial insects, making them an ideal choice for organic farming. In a report by the Food and Agriculture Organization (FAO), it is highlighted that bioinsecticides are also crucial in maintaining biodiversity in agricultural landscapes. They have a targeted mode of action, which helps preserve pollinators, such as bees, that are essential for crop pollination.

Government initiatives also play a vital role in supporting the adoption of bioinsecticides. For instance, in the European Union, the Farm to Fork Strategy aims to increase the share of organic farming to 25% of total agricultural land by 2030. The strategy encourages the use of sustainable practices and reduces the dependency on chemical pesticides. Similarly, in the United States, the Department of Agriculture (USDA) has launched the National Organic Program to promote the growth of organic farming, which includes funding for research on organic pest control methods like bioinsecticides.

Restraints

Regulatory Hurdles and Slow Adoption of Biopesticides

One of the significant challenges hindering the widespread adoption of biopesticides in agriculture is the complex and often slow regulatory approval process. In India, the registration of biopesticides is managed by the Central Insecticides Board and Registration Committee (CIBRC), which operates under the Ministry of Agriculture and Farmers Welfare. The process involves rigorous evaluations, including bio-efficacy trials, safety assessments, and formulation analyses, which can be time-consuming and resource-intensive.

According to the Food and Agriculture Organization (FAO), harmonizing pesticide regulations across Southeast Asia is crucial for enhancing the efficiency of pesticide registration processes. The FAO’s guidelines emphasize the need for standardized data requirements and evaluation procedures to facilitate smoother registration of biopesticides. However, the implementation of these guidelines has been uneven, leading to delays and inconsistencies in the approval process.

This regulatory bottleneck not only affects the timely availability of biopesticides in the market but also discourages manufacturers from investing in the development of new biopesticide products. The lengthy approval timelines can result in increased costs and reduced market competitiveness, further slowing the adoption of biopesticides among farmers.

To address these issues, the Government of India has initiated several measures aimed at streamlining the regulatory process. For instance, the Department of Biotechnology’s Annual Report 2022-23 highlights the growth of India’s bio-economy, noting that the number of biotech startups has increased from 50 to 5,300 over the past eight years. This growth indicates a burgeoning interest in biotechnology, including biopesticides. However, the regulatory framework must evolve to keep pace with this growth to ensure that innovative biopesticide products reach the market efficiently.

Opportunity

Government Support and Policy Initiatives

The Indian government has been instrumental in promoting the adoption of bioinsecticides through various policies and schemes aimed at sustainable agriculture. Initiatives like the Paramparagat Krishi Vikas Yojana (PKVY) and the National Mission on Sustainable Agriculture (NMSA) have been pivotal in encouraging organic farming practices, which are inherently aligned with the use of bioinsecticides. These programs offer financial assistance, training, and certification support to farmers transitioning to organic methods, thereby fostering a conducive environment for the growth of bioinsecticide usage.

Additionally, the government’s focus on enhancing agricultural productivity and sustainability has led to increased investments in research and development (R&D) for bioinsecticides. Collaborations between public and private sectors have been encouraged to innovate and develop effective bioinsecticide solutions tailored to India’s diverse agro-climatic conditions. This collaborative approach aims to address the challenges faced by farmers, such as pest resistance and environmental concerns, by providing safer and more sustainable pest management options.

These government-led initiatives not only support the adoption of bioinsecticides but also contribute to the broader goal of sustainable agricultural development in India. By aligning policy frameworks with the needs of farmers and the environment, the government plays a crucial role in facilitating the transition towards more sustainable and eco-friendly agricultural practices.

Regional Insights

North America Commands the Bioinsecticides Market with ~$70.1 Million (47.8%)

North America clearly leads the global bioinsecticides segment, holding a commanding 47.8% share, which equates to approximately USD 70.1 million in market value. This dominance reflects the region’s strong emphasis on eco-friendly pest management and rising adoption of biocontrol solutions. Farmers and agri-businesses in the U.S. and Canada are increasingly opting for naturally derived insect control methods to meet consumer demand for sustainable and residue-free produce.

Beyond just adoption, this region benefits from active regulatory encouragement and research support. For instance, the U.S. Environmental Protection Agency (EPA) approved a record number of biopesticide active ingredients in recent years, signaling policy-level confidence in such products.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biobest Group NV, a specialist in biological crop protection, combines beneficial insects with microbial bioinsecticides to offer integrated pest management (IPM) solutions. While detailed 2024 financials are scarce, Biobest’s strength lies in its hands-on support to growers—training them in applying bio-controls effectively. As a market analyst, I see Biobest’s commitment to education and practical deployment as its standout trait, helping bioinsecticides become reliable tools on the field rather than niche experiments.

Marrone Bio Innovations is known for its bioinsecticide MBI‑306, submitted for U.S. regulatory approval and aiming for peak annual revenue of around USD 100 million upon successful launch. The company’s focus on practical, high-impact products makes it a rising star in the bioinsecticides sector—driven by innovation that partners real-world crop needs with sound biological science.

Novozymes A/S contributes to the bioinsecticides space through its microbial enzyme and microbial-based bioinsecticide offerings, supporting eco-friendly pest control. Though specific 2024 agribiotech revenue figures aren’t available, the company’s broader fermentation and biotechnology expertise underpins its strength in producing effective, scalable bio-solutions. For farmers and researchers, Novozymes represents both scientific depth and a commitment to sustainable agriculture—with tools that feel approachable and robust.

Top Key Players Outlook

- BASF SE

- Biobest Group NV

- Novozymes A/S

- Marrone Bio Innovations

- Syngenta AG

- Nufarm

- Som Phytopharma India Ltd

- Valent Biosciences LLC

- BioWorks Inc.

- Andermatt Biocontrol AG

Recent Industry Developments

In 2024, Marrone Bio Innovations continued its steady journey in sustainable crop protection, building on past strengths as a pure-play in agricultural biologicals. While up-to-date revenue figures for 2024 aren’t publicly available, the company previously guided that its second-generation bioinsecticide MBI‑306 alone could deliver approximately USD 100 million in peak annual revenue once fully launched—targeted around 2023/2024.

In 2024, Novozymes A/S, now integrated into the newly formed Novonesis, achieved total revenues of €3.9 billion, with a strong 55% share generated by its Planetary Health Biosolutions—which includes agricultural biologicals and related enzyme-based tools used in bioinsecticides and crop resilience applications.

Report Scope

Report Features Description Market Value (2024) USD 146.7 Mn Forecast Revenue (2034) USD 427.9 Mn CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Macrobia, Plants, Others), By Formulation (Dry, Liquid), By Mode of Application (Foliar Spray, Soil Treatment, Seed Treatment, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Biobest Group NV, Novozymes A/S, Marrone Bio Innovations, Syngenta AG, Nufarm, Som Phytopharma India Ltd, Valent Biosciences LLC, BioWorks Inc., Andermatt Biocontrol AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Biobest Group NV

- Novozymes A/S

- Marrone Bio Innovations

- Syngenta AG

- Nufarm

- Som Phytopharma India Ltd

- Valent Biosciences LLC

- BioWorks Inc.

- Andermatt Biocontrol AG