Global Biliary Stents Market By Product Type (Metal, Plastic, and Polymer), By Application (Bilio-pancreatic Leakages, Pancreatic Cancer, Gallstones, Benign Biliary Structures, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149979

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

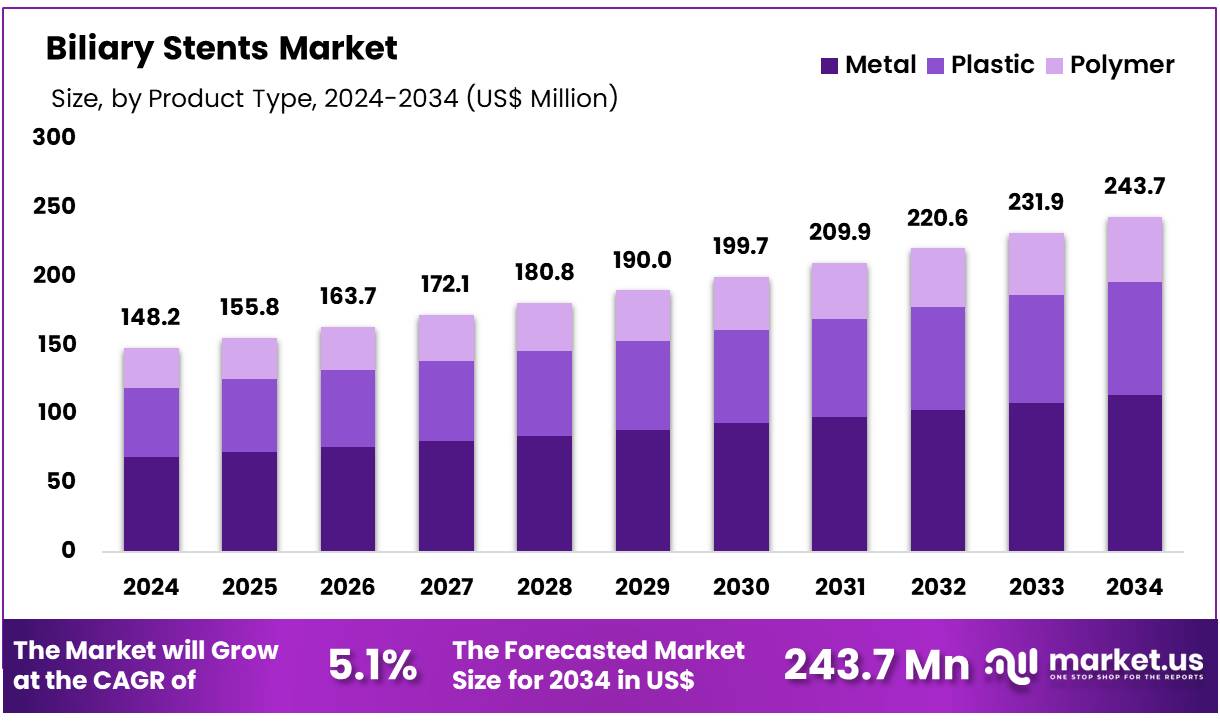

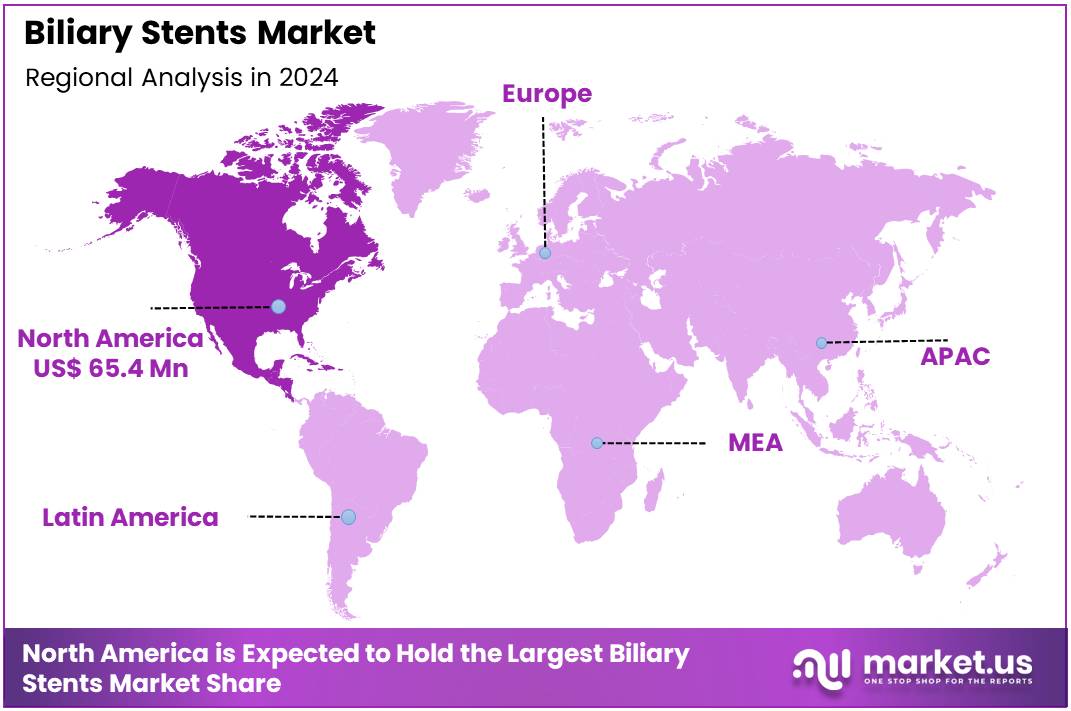

Global Biliary Stents Market size is expected to be worth around US$ 243.7 Million by 2034 from US$ 148.2 Million in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.1% share with a revenue of US$ 65.4 Million.

Increasing prevalence of biliary tract disorders, including strictures, obstructions, and malignancies, drives the growth of the biliary stents market. These stents play a crucial role in maintaining bile duct patency, alleviating symptoms such as jaundice and preventing infections. Advancements in stent materials and design, such as the development of fully covered, uncovered, and bioresorbable stents, enhance treatment efficacy and patient outcomes.

Growing adoption of minimally invasive endoscopic procedures further fuels demand by reducing patient recovery time and procedural risks. In November 2021, B. Braun entered a strategic partnership with REVA Medical to distribute the Fantom Encore bioresorbable scaffold, strengthening their position in interventional cardiology and showcasing innovation in scaffold technology that promotes vessel healing and minimizes long-term complications.

This collaboration highlights the trend towards combining advanced materials with innovative delivery systems. Opportunities arise from rising incidence of liver diseases and increasing geriatric population prone to biliary complications. The integration of drug-eluting stents offers potential for targeted therapy and reduced restenosis rates. Market players focus on expanding product portfolios to address diverse clinical needs across benign and malignant conditions. The rising emphasis on improving quality of life and reducing hospital stays encourages widespread stent adoption.

Additionally, favorable reimbursement policies and increasing healthcare expenditure support market expansion. These factors collectively position the biliary stents market for sustained growth and continuous innovation in biliary care.

Key Takeaways

- In 2024, the market for biliary stents generated a revenue of US$ 148.2 million, with a CAGR of 5.1%, and is expected to reach US$ 243.7 million by the year 2034.

- The product type segment is divided into metal, plastic, and polymer, with metal taking the lead in 2023 with a market share of 46.7%.

- Considering application, the market is divided into bilio-pancreatic leakages, pancreatic cancer, gallstones, benign biliary structures, and others. Among these, gallstones held a significant share of 36.8%.

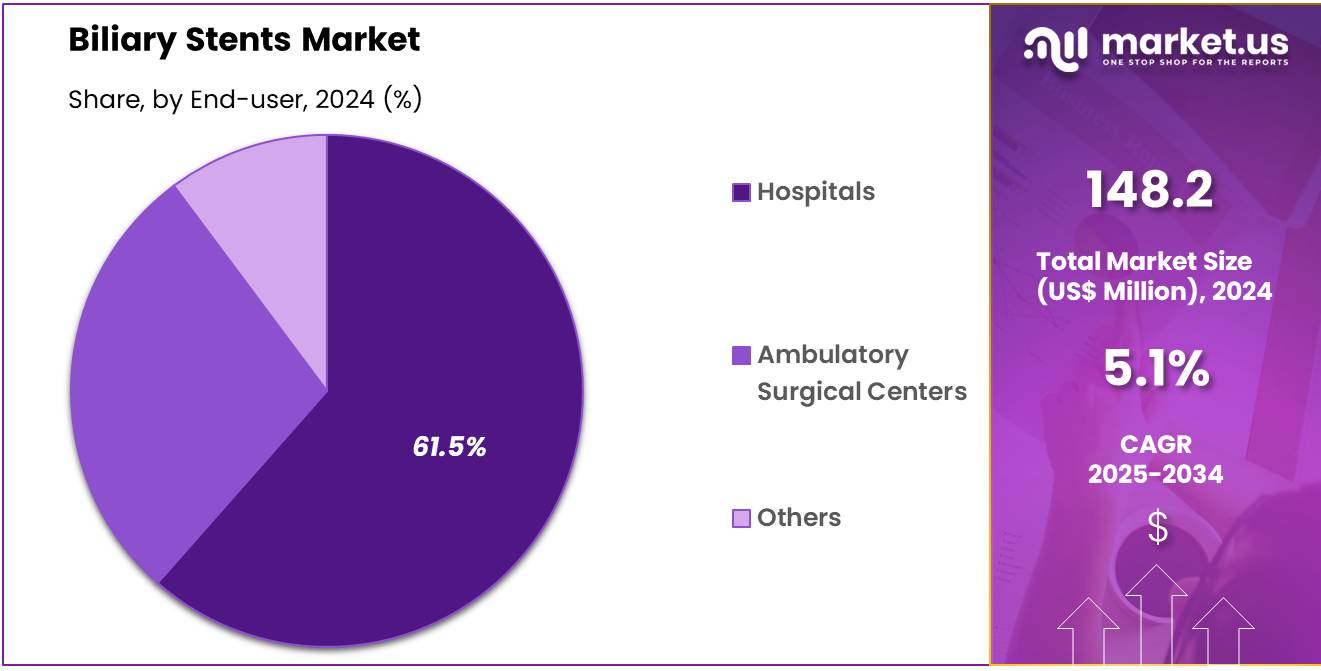

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgical centers, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 61.5% in the biliary stents market.

- North America led the market by securing a market share of 44.1% in 2023.

Product Type Analysis

The metal segment claimed a market share of 46.7% owing to its superior durability and biocompatibility compared to plastic and polymer alternatives. This growth is driven by the increasing preference for metal stents in complex and long-term biliary obstructions due to their enhanced radial strength and reduced risk of migration.

Metal stents also provide better patency rates, reducing the need for frequent replacements and thereby lowering overall healthcare costs. Technological advancements, such as drug-eluting metal stents, further fuel market expansion by minimizing restenosis. The segment benefits from rising adoption among healthcare providers and patients seeking more effective treatment solutions.

Application Analysis

The gallstones held a significant share of 36.8% due to the high prevalence of gallstone-related biliary obstructions worldwide. This growth is driven by the increasing incidence of gallstones caused by lifestyle changes and rising obesity rates. The segment benefits from advancements in minimally invasive procedures where biliary stents facilitate bile duct drainage, alleviating obstruction symptoms effectively.

Early diagnosis and improved imaging techniques have increased the identification of gallstones requiring stenting interventions. Moreover, the demand for palliative care in patients with complicated gallstone disease supports sustained segment growth. Rising awareness among clinicians about stenting benefits also propels this trend.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 61.5% owing to their advanced infrastructure and high patient inflow requiring biliary interventions. Growth in this segment is driven by hospitals’ capability to perform complex procedures involving biliary stents, supported by skilled specialists and advanced equipment.

Increasing investments in healthcare infrastructure and rising hospital admissions for biliary disorders contribute to the segment’s expansion. Hospitals also benefit from reimbursement policies favoring stenting procedures, encouraging their adoption. Additionally, the segment gains momentum due to growing collaborations between hospitals and device manufacturers for training and technology integration. The rise in minimally invasive surgeries in hospital settings further accelerates segment growth.

Key Market Segments

By Product Type

- Metal

- Plastic

- Polymer

By Application

- Bilio-pancreatic Leakages

- Pancreatic Cancer

- Gallstones

- Benign Biliary Structures

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Increasing Incidence of Biliary Diseases is Driving the Market

The rising occurrence of conditions affecting the bile ducts stands as a significant driver for the biliary stents market. These medical devices are crucial for managing obstructions that arise from various hepatobiliary diseases. Data from the National Health and Nutrition Examination Survey III indicates that over 20 million adults in the United States are affected by gallbladder disease.

This considerable patient population, dealing with a range of biliary disorders, often necessitates interventions such as the placement of biliary stents to ensure the proper flow of bile and to alleviate associated symptoms. The increasing prevalence of these medical conditions directly translates into a growing and sustained demand for biliary stents as a fundamental component of their clinical management. This upward trend in biliary diseases ensures a continuous need for effective stenting procedures.

Restraints

Risk of Complications is Restraining the Market

Despite the established therapeutic benefits of biliary stents in managing bile duct obstructions, the inherent potential for post-procedural complications can act as a notable restraint on the market’s broader expansion. Clinical issues such as the migration of the stent from its intended position or the subsequent occlusion of the stent can occur, often requiring additional medical interventions to resolve these problems.

A 2022 publication in the peer-reviewed journal Gastrointestinal Endoscopy provided a detailed analysis of the adverse events that can be associated with biliary stenting procedures. The well-documented awareness among healthcare professionals regarding these potential complications often leads to a careful and thorough evaluation of each patient’s suitability for stenting and a meticulous approach to the procedural techniques employed. This emphasis on minimizing the occurrence of complications can influence the overall rate at which biliary stenting is adopted across various clinical scenarios.

Opportunities

Technological Advancements are Creating Growth Opportunities

The continuous stream of technological innovations in the design and the materials utilized in the manufacturing of biliary stents is generating significant opportunities for growth within this market. A key advancement is the development and introduction of drug-eluting stents, which are engineered to release medication directly at the stenting site, aiming to reduce the incidence of subsequent stent occlusion and improve long-term patency.

Furthermore, the ongoing introduction of more flexible and user-friendly stent delivery systems is progressively broadening the range of biliary conditions that can be effectively and safely treated using these devices. The consistent pattern of new biliary stents receiving approval from the US Food and Drug Administration (FDA) between 2022 and 2024 clearly reflects the sustained progress and the introduction of enhanced tools into the hands of clinicians. These technological improvements are collectively contributing to making biliary stenting a more refined and increasingly effective treatment strategy applicable to a wider spectrum of biliary disorders.

Impact of Macroeconomic / Geopolitical Factors

The prevailing macroeconomic conditions exert a tangible influence on the financial capacity of healthcare systems to make investments in advanced medical devices such as biliary stents. During periods characterized by economic stability and growth, hospitals and other healthcare facilities are generally more likely to allocate resources towards acquiring newer and often more technologically advanced medical technologies, including high-quality biliary stents.

Conversely, during times of economic downturn or recession, healthcare institutions may face budgetary constraints, which could potentially affect the rate at which they adopt more expensive or cutting-edge stent technologies. Geopolitical factors also have the potential to introduce complexities into the market, particularly concerning the intricate international supply chains that are involved in the production and distribution of these essential medical devices and their constituent components.

Disruptions in global trade patterns or the emergence of international political tensions could potentially impact both the availability and the overall cost of biliary stents. However, the fundamental and critical role that these devices play in the effective treatment of significant health issues related to the biliary system often results in a relatively stable and consistent demand for them, as providing effective solutions for biliary diseases remains a high priority within healthcare systems, irrespective of broader economic or political climates.

The implementation of current tariffs by the United States government has the potential to generate a multifaceted impact on the biliary stents market. If tariffs are levied on the importation of finished biliary stents or on the raw materials and components that are necessary for their manufacturing processes, this could directly lead to an increase in the operational costs for US-based medical facilities and, ultimately, potentially result in higher prices for patients who require these medical procedures. This increase in the overall cost of biliary stenting could, in turn, influence the accessibility and the overall rate of utilization of imported devices within the US healthcare system.

Conversely, the imposition of tariffs might also serve as a motivating factor for the expansion and growth of domestic manufacturing capabilities within the United States for biliary stents and related medical devices. Such a development could potentially foster greater innovation within the local medical device industry and contribute to a reduction in the nation’s reliance on international suppliers for these critical medical tools.

While the immediate consequence of tariffs might involve increased expenses and necessary adjustments in sourcing strategies for healthcare providers, the underlying and persistent need for effective and reliable treatments for biliary obstructions is highly likely to ensure continued activity and ongoing innovation within the biliary stents market.

Latest Trends

Use of Metal Stents is a Recent Trend

A significant and increasingly prominent trend observed in the biliary stents market is the growing preference for and utilization of metal stents, particularly self-expanding metal stents (SEMS), in the management of biliary obstructions across various clinical settings. This increasing preference often arises from the generally superior long-term patency rates that have been associated with SEMS when compared to traditional plastic stents, especially in the context of managing malignant biliary strictures.

Research findings highlighted in the journal Endoscopy in 2023 lend support to the enhanced effectiveness of SEMS in addressing these types of obstructions. The perceived clinical advantages of metal stents in maintaining the patency of the bile ducts for a more extended duration are contributing to their greater adoption by healthcare professionals who are involved in the treatment of patients with biliary disorders. This shift towards the use of metal stents represents a notable evolution in the selection and application of these critical medical devices.

Regional Analysis

North America is leading the Biliary Stents Market

North America dominated the market with the highest revenue share of 44.1% owing to the rising incidence of biliary disorders requiring intervention. The American Society for Gastrointestinal Endoscopy (ASGE) actively disseminates clinical practice guidelines that underscore the importance of biliary stenting in the therapeutic management of both benign and malignant obstructions of the bile ducts.

Furthermore, the Food and Drug Administration (FDA) in the US maintains a rigorous regulatory framework for medical devices, including biliary stents, ensuring that these products meet stringent standards of safety and effectiveness before they are available for clinical use. This regulatory oversight contributes to the confidence among healthcare providers in utilizing stenting procedures. The ongoing advancements in the design and materials of biliary stents also play a role in their increased adoption for improved patient outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing overall healthcare expenditure within the region. According to the World Bank data from 2022, health expenditure as a percentage of GDP in the East Asia & Pacific region stood at 5.43%, reflecting a growing investment in healthcare services and infrastructure.

The rising adoption of minimally invasive endoscopic procedures, such as ERCP, across various countries in Asia Pacific is also a significant factor expected to drive the demand for biliary stenting to effectively manage a range of hepatobiliary conditions. Furthermore, increasing access to advanced medical technologies in this region will likely contribute to the greater utilization of these devices.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biliary stents market focus on strategies such as technological innovation, strategic partnerships, and global expansion to drive growth. They invest in developing advanced stent technologies, including drug-eluting and biodegradable options, to enhance patient outcomes and reduce complications.

Collaborations with healthcare providers and research institutions enable these companies to expand their product offerings and enter new markets. Additionally, they emphasize expanding their presence in emerging markets to capitalize on the increasing prevalence of biliary diseases and the demand for advanced medical devices. These strategies collectively aim to strengthen their market position and address the evolving needs of healthcare systems worldwide.

Boston Scientific Corporation, a leading player in this sector, specializes in developing and manufacturing medical devices for various medical specialties, including gastroenterology. The company offers a comprehensive range of biliary stents designed to treat conditions such as bile duct obstructions and cholangiocarcinoma.

Boston Scientific’s product portfolio includes both plastic and metal stents, catering to diverse clinical needs. The company has a global presence, with operations in over 100 countries, and continues to innovate in the field of biliary interventions to improve patient outcomes and expand its market share.

Top Key Players

- Olympus

- Merit Medical System

- Medtronic plc

- ENDO-FLEX GmbH

- Cook Group

- CGBIO

- Cardinal Health

- Boston Scientific

Recent Developments

- In July 2024, CGBIO obtained approval from Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) for its ARISTENT biliary stents. This regulatory clearance accelerates the product’s acceptance in the Japanese market and underpins the company’s ambitions for international growth. By enhancing its product portfolio and expanding market reach, CGBIO is positioned to capitalize on new growth avenues.

- In February 2023, Olympus finalized the acquisition of Taewoong Medical Co., Ltd., a South Korean firm known for its expertise in gastrointestinal stents. This acquisition enriches Olympus’s Gastrointestinal EndoTherapy portfolio by incorporating advanced technologies and specialized knowledge, thereby enhancing the company’s ability to deliver innovative endoscopic treatments.

Report Scope

Report Features Description Market Value (2024) US$ 148.2 Million Forecast Revenue (2034) US$ 243.7 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Metal, Plastic, and Polymer), By Application (Bilio-pancreatic Leakages, Pancreatic Cancer, Gallstones, Benign Biliary Structures, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Olympus, Merit Medical System, Medtronic plc, ENDO-FLEX GmbH, Cook Group, CGBIO , Cardinal Health, and Boston Scientific. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Olympus

- Merit Medical System

- Medtronic plc

- ENDO-FLEX GmbH

- Cook Group

- CGBIO

- Cardinal Health

- Boston Scientific