Global Benzyl Chloride Market Size, Share, And Business Benefit By Product (Benzyl Alcohol, Benzyl Cyanide, Benzyl Quaternary Ammonium Compounds, Benzyl Phthalate, Benzyl Ester, Others), By Application (Pharmaceutical, Agriculture, Paints and Coatings, Food and Beverage, Plastic and Polymer, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163309

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

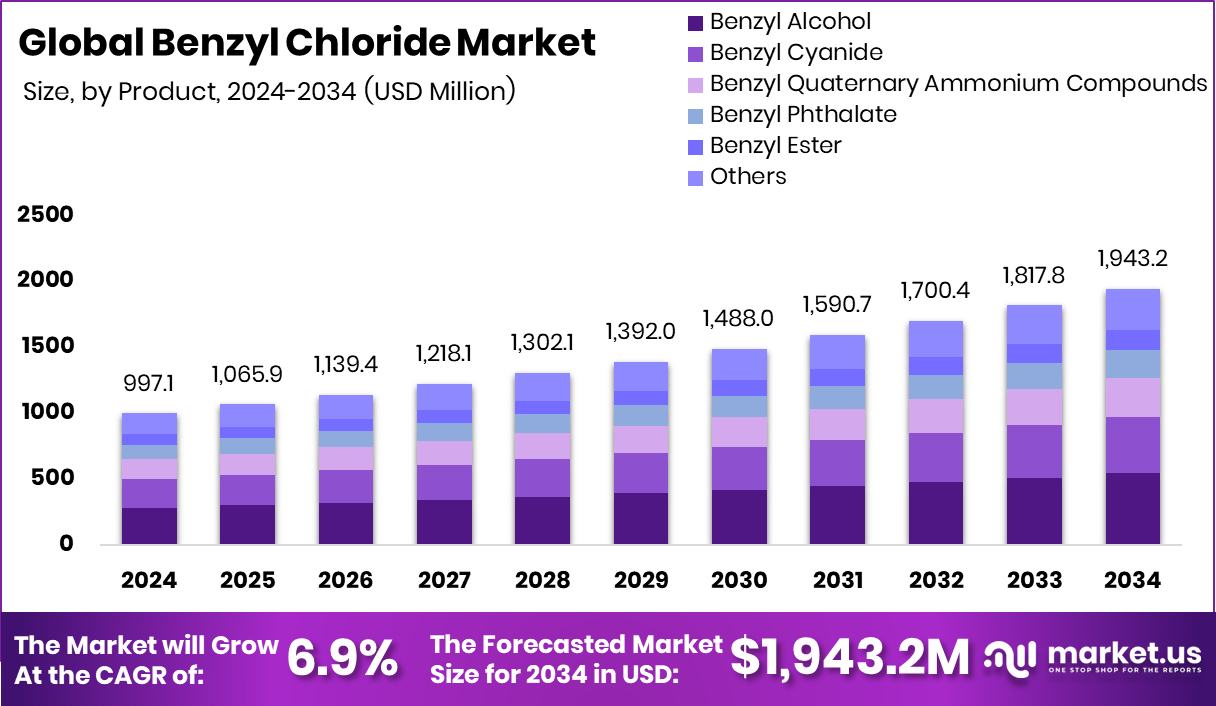

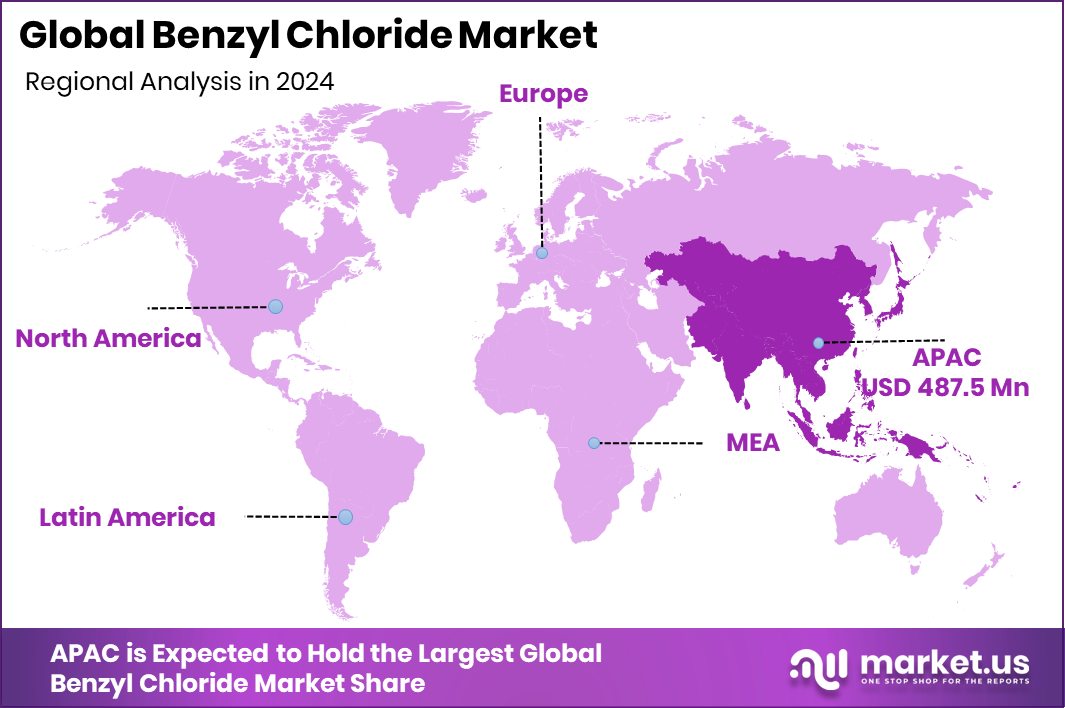

The Global Benzyl Chloride Market is expected to be worth around USD 1,943.2 million by 2034, up from USD 997.1 million in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia-Pacific’s 48.90% leadership reflects strong growth in pharmaceuticals, coatings, and specialty chemical production.

Benzyl chloride (C₇H₇Cl) is a colorless to slightly yellow liquid with a sharp odor, widely used as a chemical intermediate. It serves as a key raw material in producing benzyl alcohol, benzyl esters, quaternary ammonium compounds, dyes, and pharmaceutical ingredients. Due to its high reactivity, it is essential in alkylation and synthesis reactions across various industrial chemical processes. Its controlled use is crucial, as the compound is toxic and must be handled under strict safety standards.

The benzyl chloride market covers global production, consumption, and trade of this compound and its derivatives. It caters to applications in pharmaceuticals, surfactants, dyes, coatings, and plastics. Market growth is shaped by demand for specialty chemicals, regulatory control, and shifts toward sustainable manufacturing. Industrial expansion in the Asia-Pacific and increased investments in chemical infrastructure are also influencing market supply dynamics and innovation within derivative segments.

The benzyl chloride market is growing due to expanding demand from specialty chemicals and surfactant manufacturing. Its role in producing disinfectants, dyes, and plasticizers supports industrial demand. Rising hygiene awareness and higher consumption of personal care products further drive growth. Investment inflows such as Magpet Polymers securing ₹205 crore funding for India’s largest bottle-to-bottle recycling facility and British International Investment’s ₹205 crore commitment highlight how sustainability-focused funding indirectly boosts chemical intermediates demand, strengthening overall market growth.

The demand for benzyl chloride continues to rise in the pharmaceuticals, personal care, and coatings industries. It serves as a crucial intermediate for perfumes, antiseptics, and active drug ingredients. Expanding funding for sustainable polymer research—such as UCLA and UCSB receiving $23.7 million for biologically based polymers and EF Polymer securing USD 6.6 million in Series B funding—indicates growing chemical innovation, which stimulates demand for related intermediates like benzyl chloride used in polymer and surfactant synthesis.

Future opportunities lie in developing sustainable derivatives of benzyl chloride for eco-friendly applications. As industries invest in polymer innovation and recycling, the compound’s role in high-performance coatings and biodegradable surfactants gains value. Government funding—such as Ohio’s Polymer Cluster, awarded $51 million, and Akron’s $51 million allocation for sustainable polymer tech hubs—creates a strong ecosystem for chemical R&D. Expanding production in Asia-Pacific and cleaner processing technologies can further strengthen the global benzyl chloride market.

Key Takeaways

- The Global Benzyl Chloride Market is expected to be worth around USD 1,943.2 million by 2034, up from USD 997.1 million in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In the Benzyl Chloride Market, the Benzyl Alcohol segment captured 34.8% share, driven by growing pharmaceutical formulations.

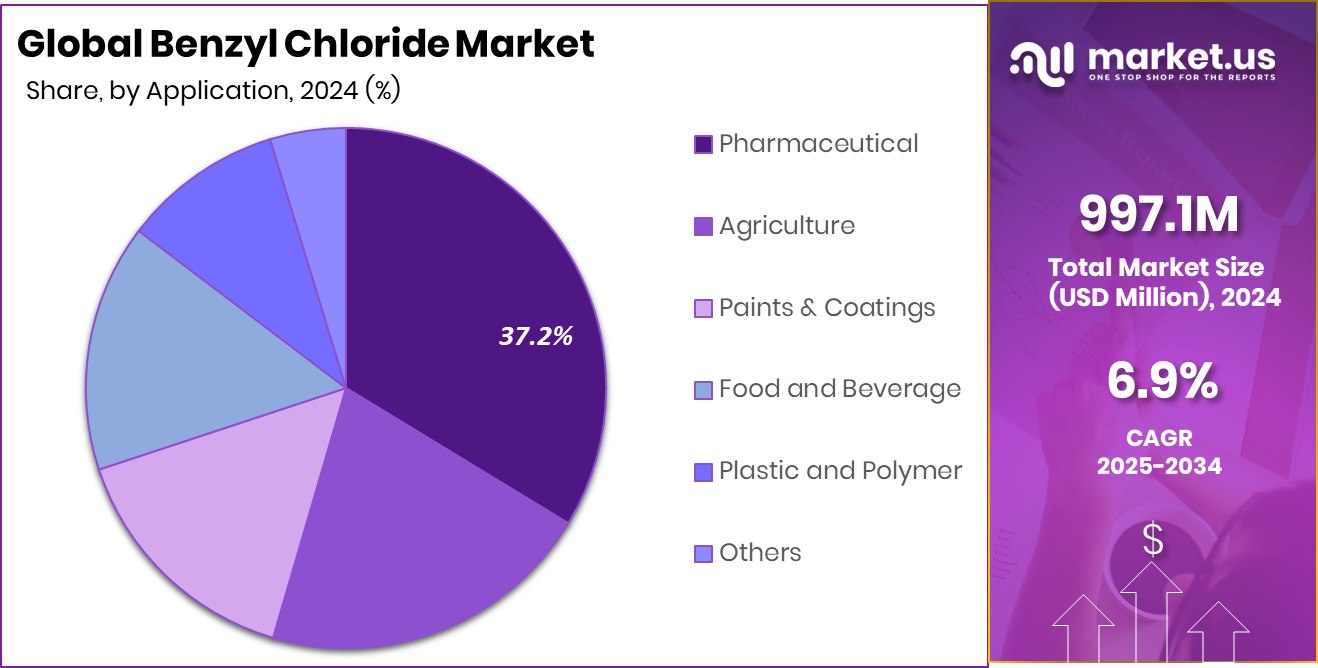

- In the Benzyl Chloride Market, the pharmaceutical segment held a 37.2% share, supported by rising drug synthesis activities.

- The Asia-Pacific market value reached USD 487.5 million, driven by industrial chemical expansion.

By Product Analysis

In the Benzyl Chloride Market, benzyl alcohol dominated with a 34.8% share.

In 2024, Benzyl Alcohol held a dominant market position in the By Product segment of the Benzyl Chloride Market, accounting for a 34.8% share. This dominance was primarily due to its wide use as a key intermediate in pharmaceuticals, personal care products, and industrial applications.

Benzyl alcohol, derived from benzyl chloride, is valued for its excellent solvent and preservative properties, making it essential in formulations of creams, lotions, and coatings. The segment’s growth was also driven by its increasing use in resins and plasticizers, which improved durability and performance. Rising consumption across cosmetics and manufacturing industries further reinforced benzyl alcohol’s leading position within the global benzyl chloride market.

By Application Analysis

The Benzyl Chloride Market recorded pharmaceuticals leading with a 37.2% share.

In 2024, Pharmaceutical held a dominant market position in the By Application segment of the Benzyl Chloride Market, accounting for a 37.2% share. This dominance was driven by the compound’s essential role as an intermediate in producing active pharmaceutical ingredients and therapeutic compounds. Benzyl chloride is widely used to manufacture benzyl alcohol and benzyl cyanide, both crucial in synthesizing antibiotics, local anesthetics, and other medicinal formulations.

The rising global demand for pharmaceuticals, coupled with continuous advancements in drug synthesis, strengthened its market position. Additionally, expanding healthcare infrastructure and increased investment in specialty drug manufacturing further supported the growth of the pharmaceutical segment within the benzyl chloride market.

Key Market Segments

By Product

- Benzyl Alcohol

- Benzyl Cyanide

- Benzyl Quaternary Ammonium Compounds

- Benzyl Phthalate

- Benzyl Ester

- Others

By Application

- Pharmaceutical

- Agriculture

- Paints and Coatings

- Food and Beverage

- Plastic and Polymer

- Others

Driving Factors

Rising Hygiene & Specialty Chemical Use

In recent years, the demand for advanced cleaning agents, disinfectants, and surfactants has surged, driving the market for benzyl chloride (as an intermediate) significantly. As industries and end-users emphasise higher performance, safer chemicals, and differentiating features, the role of benzyl chloride-derived compounds grows stronger.

Meanwhile, the chemical industry is attracting fresh investment toward greener and more innovative manufacturing models—Ecoat secures €21 million to reinvent the future of paint—sustainably. This funding underlines how value chains around specialty chemicals are gaining momentum and, in turn, boosting demand for intermediates such as benzyl chloride. As regulations around hygiene, safety, and environmental footprint tighten globally, the need for functional, high-performance intermediates stimulates market expansion.

Restraining Factors

Stringent Environmental and Safety Regulations

One of the key restraints for the benzyl chloride market is the strict environmental and safety regulations associated with its production, storage, and handling. Benzyl chloride is a highly reactive and toxic compound that poses health and environmental risks if mishandled. Governments across major regions enforce strict limits on emissions, exposure levels, and waste disposal procedures, which increases compliance costs for manufacturers. These regulatory requirements often slow down production expansion and limit smaller producers from entering the market.

Additionally, the need for advanced safety infrastructure and worker protection systems further raises operational expenses. As industries transition toward sustainable practices, manufacturers face the challenge of balancing regulatory compliance with maintaining profitability and production efficiency.

Growth Opportunity

Expanding Use in High-Value Chemical Manufacturing

A major growth opportunity for the benzyl chloride market lies in its expanding use across high-value specialty chemical manufacturing. The compound serves as a vital intermediate in producing advanced coatings, plasticizers, and pharmaceutical ingredients. With industries focusing on performance-based formulations and sustainability, benzyl chloride derivatives are gaining renewed importance in creating modern, durable materials.

The recent JSW securing a ₹9,300-crore financing package for the Akzo Nobel acquisition highlights growing investments in the coatings and specialty chemical sector. Such large-scale funding reflects investor confidence in chemical innovation, indirectly benefiting intermediates like benzyl chloride. As companies modernize operations and integrate new chemical technologies, demand for benzyl chloride in precision synthesis and specialized formulations is expected to strengthen further worldwide.

Latest Trends

Rising Investments in Specialty Chemical Integration

A key trend shaping the benzyl chloride market is the rising investment in integrated specialty chemical production. Manufacturers are increasingly focusing on backward and forward integration to secure raw material supply and enhance value-added product lines such as coatings, surfactants, and pharmaceuticals. This trend is reinforced by large-scale institutional investments—Asian Paints, Dixon Tech & 3 other stocks in which mutual funds acquired shares worth up to ₹10,093 crore.

Such strong financial participation highlights investor confidence in the broader chemicals and materials ecosystem. As capital flows into coatings and specialty intermediates, it indirectly boosts demand for essential raw materials like benzyl chloride. This integration strategy ensures improved efficiency, product diversification, and stable long-term growth for chemical producers.

Regional Analysis

In 2024, the Asia-Pacific dominated the Benzyl Chloride Market with 48.90% regional share.

In 2024, Asia-Pacific dominated the Benzyl Chloride Market, accounting for a 48.90% share valued at USD 487.5 million. The region’s dominance is driven by rapid industrialization, strong chemical manufacturing infrastructure, and expanding pharmaceutical and coatings industries in countries like China, India, and Japan. Increasing production of specialty chemicals and intermediates, supported by local demand for surfactants, dyes, and resins, further strengthens Asia-Pacific’s leadership position.

North America follows with steady growth supported by advancements in pharmaceutical formulations and the presence of robust regulatory frameworks ensuring quality and safety in chemical production. Europe continues to maintain a significant share, propelled by rising investments in sustainable and bio-based chemicals, particularly in Germany and France.

Meanwhile, the Middle East & Africa and Latin America show emerging growth opportunities, driven by developing industrial sectors and expanding demand for industrial coatings and cleaning agents. Overall, Asia-Pacific remains the leading regional contributor to market revenue, supported by growing downstream industries, strong domestic consumption, and continuous infrastructure expansion across the chemical and pharmaceutical sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Benzyl Chloride Market saw strong participation from key companies such as Kemin Industries, Inc., Lanxess AG, and Valtris Specialty Chemicals, each contributing to market advancement through innovation and diversification.

Kemin Industries, Inc. leveraged its expertise in specialty ingredients and chemical intermediates to strengthen its production processes, ensuring consistent quality and performance across pharmaceutical and personal care applications. The company’s focus on sustainable chemistry and precise formulation enhanced its competitive position in value-added derivatives.

Lanxess AG, with its extensive chemical portfolio and manufacturing capabilities, played a leading role in advancing benzyl chloride utilization across coatings, resins, and polymer intermediates. Its focus on operational efficiency and regulatory compliance allowed it to maintain strong market reliability.

Valtris Specialty Chemicals concentrated on high-performance intermediates and additives derived from benzyl chloride, supporting industries like plastics, coatings, and lubricants. Its technological expertise and production flexibility enabled the company to meet diverse customer needs across regions. Collectively, these companies reinforced market stability by integrating product innovation, environmental safety, and customer-centric development strategies, contributing significantly to the benzyl chloride market’s global growth and supply chain resilience in 2024.

Top Key Players in the Market

- Kemin Industries, Inc.

- Lanxess AG

- Valtris Specialty Chemicals

- Shanghai Xinglu Chemical Technology Co., Ltd.

- Nippon Light Metal Holdings Co., Ltd.

- Hubei Phoenix Chemical Company Limited

- Benzo Chem Industries Pvt. Ltd.

- KLJ Group

- LBB Specialties

Recent Developments

- In September 2025, Lanxess announced an expansion in the U.S., adding rubber-processing promoter production at its Bushy Park facility in South Carolina to better serve local demand.

- In June 2024, Kemin acquired Archangel Inc., a specialist in antimicrobial technologies for the U.S. biofuel industry. This move broadened Kemin’s product offerings in antimicrobial and bio-based segments, enhancing its portfolio of NOVA™ EZL and NOVA™ EZP solutions. The acquisition helps Kemin strengthen its presence in sustainable and high-performance chemical ingredients.

Report Scope

Report Features Description Market Value (2024) USD 997.1 Million Forecast Revenue (2034) USD 1,943.2 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Benzyl Alcohol, Benzyl Cyanide, Benzyl Quaternary Ammonium Compounds, Benzyl Phthalate, Benzyl Ester, Others), By Application (Pharmaceutical, Agriculture, Paints and Coatings, Food and Beverage, Plastic and Polymer, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kemin Industries, Inc., Lanxess AG, Valtris Specialty Chemicals, Shanghai Xinglu Chemical Technology Co., Ltd., Nippon Light Metal Holdings Co., Ltd., Hubei Phoenix Chemical Company Limited, Benzo Chem Industries Pvt. Ltd., KLJ Group, LBB Specialties Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kemin Industries, Inc.

- Lanxess AG

- Valtris Specialty Chemicals

- Shanghai Xinglu Chemical Technology Co., Ltd.

- Nippon Light Metal Holdings Co., Ltd.

- Hubei Phoenix Chemical Company Limited

- Benzo Chem Industries Pvt. Ltd.

- KLJ Group

- LBB Specialties