Global Bee Pollen Market Size, Share, And Business Benefits By Type (Wild Flower Bee Pollen, Camellia Bee Pollen, Rape Bee Pollen, Others), By Product Form (Granules, Powder, Capsules, Liquid), By Source (Flower Pollen, Plant Pollen, Bee Products), By Application (Nutritional Supplements, Cosmetics, Food and Beverage, Pharmaceuticals, Others), By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Health Food Stores, Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159477

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

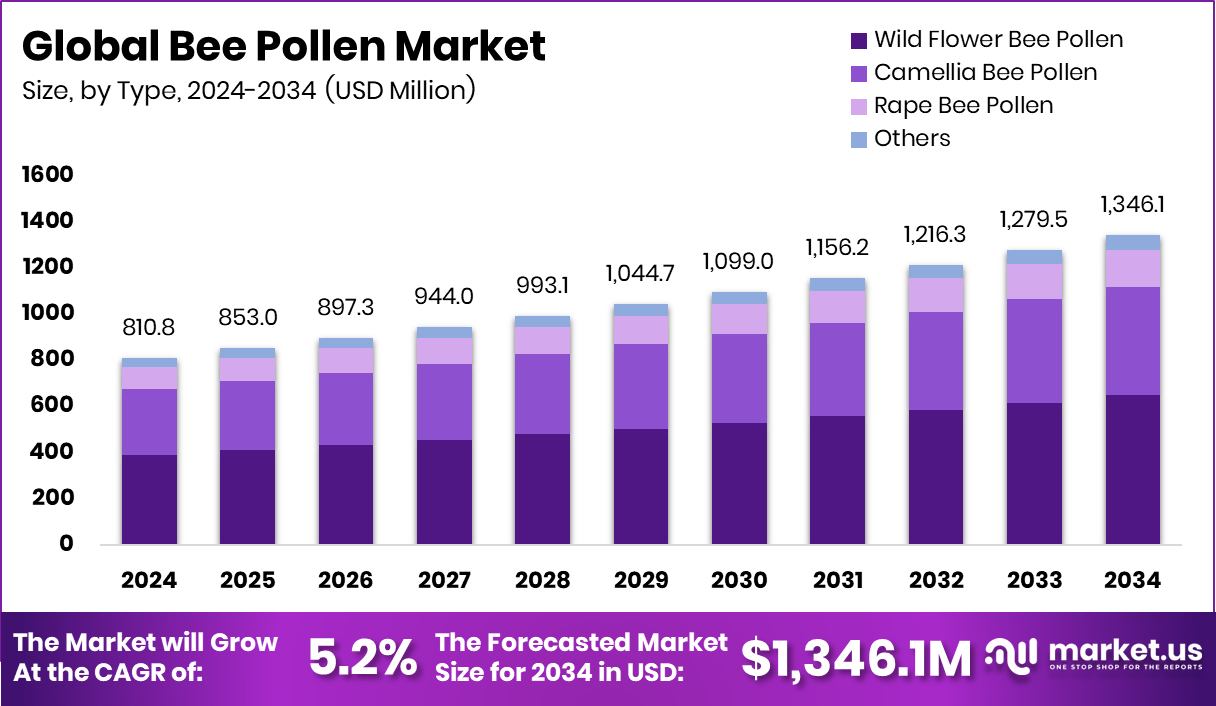

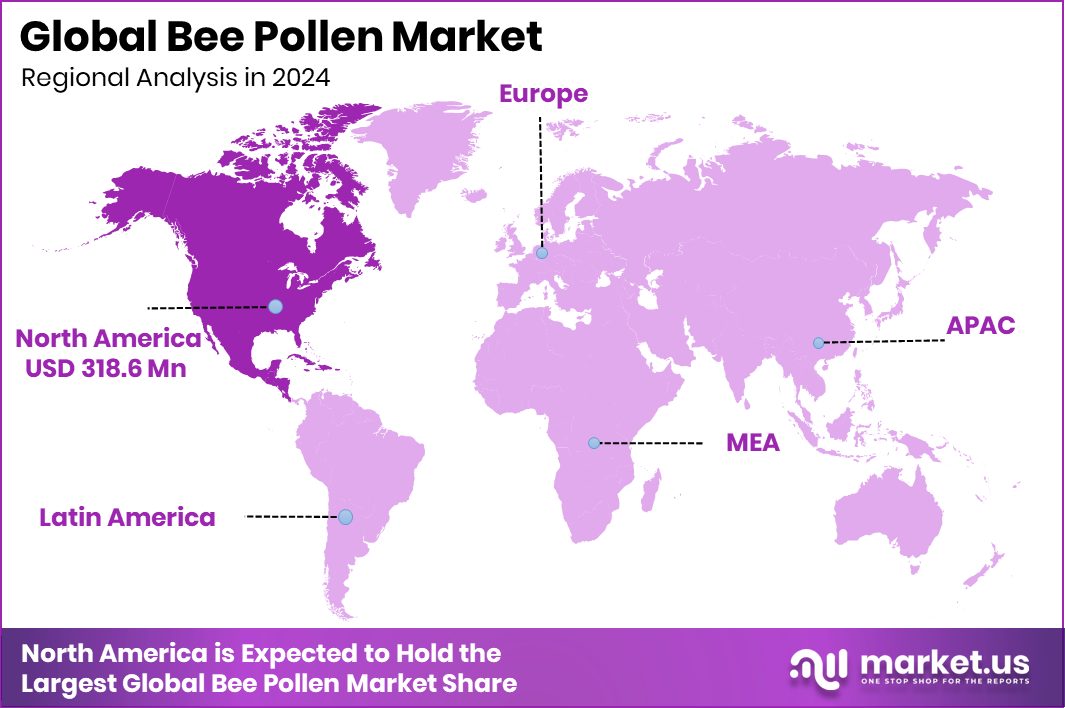

The Global Bee Pollen Market is expected to be worth around USD 1,346.1 million by 2034, up from USD 810.8 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. With a 39.30% share, North America’s bee pollen market totaled USD 318.6 Mn.

Bee pollen is a natural substance collected by honeybees from the pollen of flowers, mixed with nectar and enzymes. It contains proteins, vitamins, minerals, and antioxidants, making it highly valued as a dietary supplement. For centuries, it has been recognized for boosting energy, supporting immunity, and improving overall wellness, while also holding cultural and traditional significance across many regions.

The bee pollen market reflects the rising demand for natural health products and functional foods. Consumers seeking immunity boosters and nutrient-dense supplements are increasingly turning to bee pollen. Demand has also been supported by government and research initiatives, such as the $2 million in new funding to Montana State research labs for honeybee health, which helps safeguard the supply chain of bee-derived products.

One major growth factor is the rising awareness of sustainable and natural nutrition sources. As health-conscious populations expand, bee pollen consumption is growing steadily. Funding initiatives, including $1.7 million to strengthen Ontario’s beekeeping industry, ensure better hive management and improved productivity, supporting long-term market expansion.

Opportunities lie in technological innovations and alternatives in pollination. For example, Edete raised $3 million for bee-free pollination technology, highlighting how the ecosystem around bee products is diversifying. This not only reduces pressure on natural hives but also ensures continued demand for pollen-related products in food and wellness markets.

Key Takeaways

- The Global Bee Pollen Market is expected to be worth around USD 1,346.1 million by 2034, up from USD 810.8 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Wildflower holds the largest share, contributing 48.2% of the overall market.

- Granules remain the preferred product form in bee pollen, accounting for 41.3% market share.

- Flower pollen dominates the market by source, representing 56.7% of total bee pollen sales.

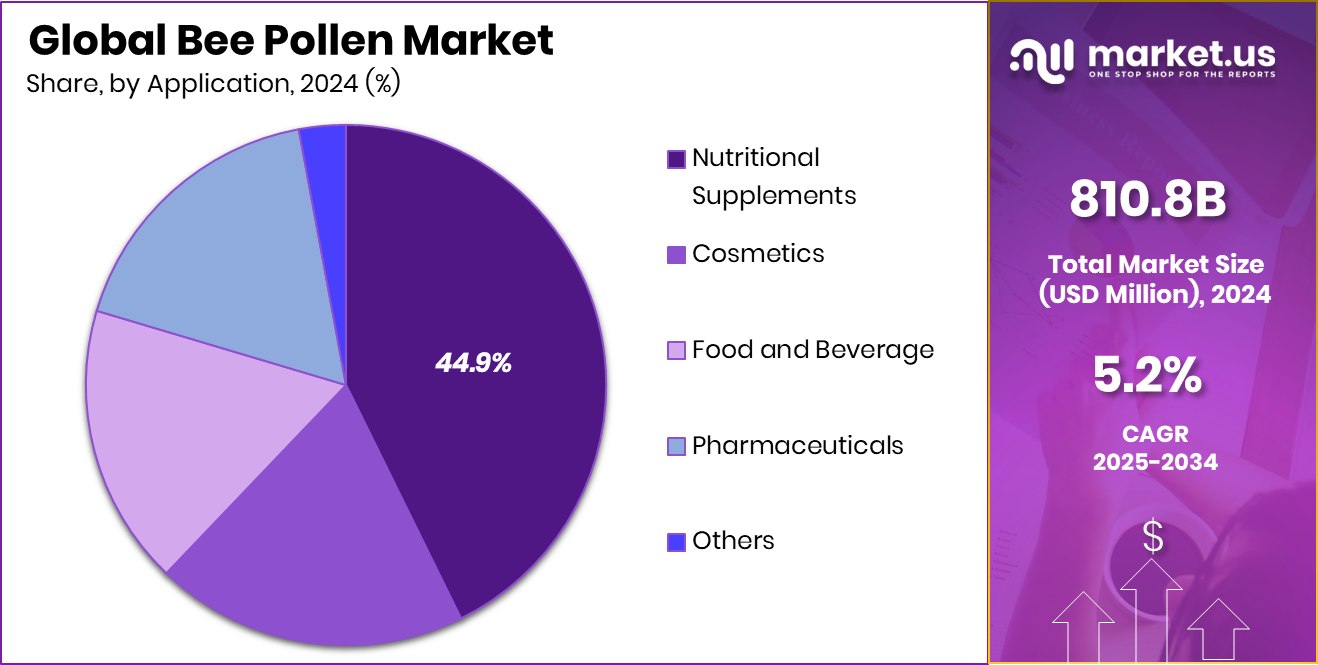

- Nutritional supplements drive demand strongly, with 44.9% applications linked to health-focused consumers.

- Supermarkets and hypermarkets lead distribution, capturing 31.8% of bee pollen retail sales worldwide.

- The bee pollen market in North America reached USD 318.6 Mn, capturing 39.30%.

By Type Analysis

Wildflower bee pollen dominates the type segment, holding 48.2% of the market share.

In 2024, Wild Flower Bee Pollen held a dominant market position in the By Type segment of the Bee Pollen Market, with a 48.2% share. This strong position is linked to its wide availability, diverse nutrient profile, and consumer preference for natural wellness products.

Wildflower varieties are often considered richer in vitamins, amino acids, and antioxidants due to their collection from multiple floral sources, enhancing their appeal among health-conscious buyers. The rising interest in organic and functional food products has further contributed to the adoption of wildflower bee pollen. Its versatility in use across dietary supplements, smoothies, and natural remedies has solidified its leading market share, making it the preferred choice in the segment.

By Product Form Analysis

Granules lead product form preference, capturing 41.3% of consumer demand globally.

In 2024, Granules held a dominant market position in the By Product Form segment of the Bee Pollen Market, with a 41.3% share. This dominance is attributed to the convenience, longer shelf life, and ease of consumption that granule form offers compared to other product formats.

Granules are widely preferred for their ability to retain the natural nutritional content of bee pollen, including proteins, enzymes, and essential vitamins, making them highly attractive for daily dietary use. Their versatility in blending with smoothies, cereals, and health supplements has further boosted their adoption among consumers. This practical form has ensured strong consumer acceptance, supporting granules in maintaining the largest share within the product form segment.

By Source Analysis

Flower pollen remains the primary source, accounting for 56.7% of total sales.

In 2024, Flower Pollen held a dominant market position in the By Source segment of the Bee Pollen Market, with a 56.7% share. This leading position is driven by its widespread availability and rich nutrient content, which makes it the most commonly consumed source of bee pollen.

Flower pollen is recognized for its natural concentration of proteins, minerals, and antioxidants, aligning well with the rising demand for health-focused and functional food products. Its acceptance among consumers stems from its traditional use and proven wellness benefits, which continue to support steady demand. The strong preference for flower-derived pollen has reinforced its status as the most influential source segment, maintaining its substantial market share.

By Application Analysis

Nutritional supplements drive applications, representing 44.9% of the bee pollen market.

In 2024, Nutritional Supplements held a dominant market position in By Application segment of the Bee Pollen Market, with a 44.9% share. This dominance reflects the growing use of bee pollen as a natural source of proteins, amino acids, and vitamins that support energy, immunity, and overall wellness.

Consumers increasingly prefer supplements enriched with bee pollen due to its reputation as a functional superfood, enhancing daily nutrition without synthetic additives. The segment’s strength is further supported by rising health awareness and the adoption of natural products in dietary routines. With its recognized benefits and versatility, nutritional supplements have maintained the largest share, solidifying their role as the leading application in the bee pollen market.

By Distribution Channel Analysis

Supermarkets and hypermarkets dominate distribution, securing 31.8% of the global share.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Bee Pollen Market, with a 31.8% share. This leadership is driven by the wide product visibility, accessibility, and consumer trust that large retail formats provide.

Shoppers prefer supermarkets and hypermarkets for their convenience of comparing multiple brands and product forms under one roof. The organized retail space ensures consistent product availability, attractive packaging displays, and promotional offers, which have played a key role in boosting sales. The strong consumer reliance on these retail outlets for health and nutritional products has helped supermarkets and hypermarkets secure the largest share, reinforcing their position as the primary distribution channel.

Key Market Segments

By Type

- Wild Flower Bee Pollen

- Camellia Bee Pollen

- Rape Bee Pollen

- Others

By Product Form

- Granules

- Powder

- Capsules

- Liquid

By Source

- Flower Pollen

- Plant Pollen

- Bee Products

By Application

- Nutritional Supplements

- Cosmetics

- Food and Beverage

- Pharmaceuticals

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Health Food Stores

- Pharmacies

- Others

Driving Factors

Government Support for Beekeeping and Pollination Growth

One of the biggest driving factors for the Bee Pollen Market is strong government support for beekeeping and pollination activities. Many countries have introduced programs to protect honeybees and promote sustainable pollination, as they are vital for food security and biodiversity. For example, the U.S. Department of Agriculture (USDA) has invested millions of dollars in pollinator health initiatives, including habitat restoration and disease management for honeybee colonies.

Similarly, the European Union funds research and provides grants to improve beekeeping practices and protect pollinator populations. These initiatives not only strengthen bee health but also secure the steady production of bee-derived products like pollen, creating long-term market growth opportunities and building consumer confidence in natural products.

Restraining Factors

Limited Government Funding for Bee Health Research

A major restraining factor for the Bee Pollen Market is the limited government funding available for advanced bee health research and protection. While some initiatives exist, the scale of support often falls short compared to the rising challenges of climate change, pesticide exposure, and habitat loss affecting bee populations. For instance, in many developing countries, financial resources for pollinator protection are minimal, leaving beekeepers with fewer tools to manage diseases or improve hive productivity.

Even in larger economies, funding often focuses on agriculture as a whole rather than dedicated bee programs. This funding gap slows innovation in hive management, weakens pollination efficiency, and directly impacts the supply of bee pollen, restraining the market’s potential growth.

Growth Opportunity

Expanding Government Programs Supporting Sustainable Beekeeping

One key growth opportunity for the Bee Pollen Market lies in the expansion of government programs that encourage sustainable beekeeping and pollinator protection. Several governments are now recognizing the importance of bees in agriculture and nutrition, and funding schemes are being created to support beekeepers with training, modern equipment, and research.

For example, the Indian government under the National Beekeeping and Honey Mission (NBHM) has allocated funds to improve scientific beekeeping, enhance honey production, and promote bee-based products. Similar programs in other regions aim to safeguard pollinator populations and boost rural incomes. These initiatives not only secure steady pollen production but also create new opportunities for bee pollen products in health and wellness markets.

Latest Trends

Rising Government Initiatives for Organic Bee Products

A key trend in the Bee Pollen Market is the rising government focus on supporting organic and chemical-free bee products. With growing consumer demand for natural and safe nutrition, governments are encouraging organic certification programs and funding eco-friendly farming practices that protect pollinators.

For instance, the European Union provides financial support under its Common Agricultural Policy (CAP) to promote sustainable beekeeping and reduce pesticide use, helping beekeepers shift toward organic methods. These efforts not only safeguard bee health but also increase the availability of premium organic pollen in the market. As a result, the trend of linking government-backed sustainability programs with consumer demand for clean products is shaping the future of the bee pollen industry.

Regional Analysis

In 2024, North America held a 39.30% share, valued at USD 318.6 Mn.

The Bee Pollen Market shows varied performance across major regions, shaped by consumer demand and product awareness. In 2024, North America dominated the global market with a 39.30% share, valued at USD 318.6 million, supported by strong adoption of natural supplements and widespread health-conscious consumer bases.

Europe follows closely, where bee pollen consumption is supported by regulatory frameworks promoting natural food products and strong demand for functional nutrition. The Asia Pacific region demonstrates rising interest, particularly driven by increasing awareness of bee products in diets and traditional wellness practices, along with growing urban populations adopting supplement-based lifestyles.

The Middle East & Africa region shows steady but slower growth, where the market is still emerging but supported by niche demand for premium wellness products. Latin America, while smaller in scale, is gradually expanding with a rising focus on natural food and health applications.

Overall, North America remains the dominant region in this market, while Europe and the Asia Pacific reflect significant expansion opportunities, reinforcing the global potential of bee pollen as a natural and nutrient-rich health product across both developed and emerging markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Apicoltura Burato continues to stand out as a traditional producer with a focus on authentic, high-quality bee products sourced from carefully managed hives. Its emphasis on purity and maintaining natural nutrient content supports its appeal to consumers seeking genuine bee pollen free from artificial processes. The company’s approach strengthens its role in supplying European markets where natural authenticity is highly valued.

YS Bee Farms has positioned itself as a trusted name in the North American market, widely recognized for its range of bee-derived health products. Its strength lies in long-standing consumer trust and a consistent supply of bee pollen that meets the expectations of health-conscious buyers. By offering products that integrate easily into daily nutrition routines, the company has reinforced its relevance in a region that leads global demand.

Beekeeper’s Naturals represents the modern face of the bee pollen industry, connecting wellness with innovation. By focusing on natural remedies and clean-label supplements, it has attracted younger consumers who value transparency and functionality in their nutrition choices. The company has also benefited from the growing trend of sustainable sourcing, appealing to those who care about both personal health and environmental responsibility.

Top Key Players in the Market

- Apicoltura Burato

- YS Bee Farms

- Beekeeper’s Naturals

- Swanson Health Products

- NOW Foods

- BeeVital

- Honey Pacifica

- Sattvic Foods

- Livemoor

- Crockett Honey Co.

Recent Developments

- In June 2025, Beekeeper’s Naturals launched Kids’ Fiber Lollipops, a new item combining propolis with prebiotic fiber for children’s gut and immune support.

- In May 2024, NOW Foods introduced a store-exclusive line of products, limiting certain new SKUs (including items like 5-HTP, CoQ10, and probiotics) to physical retail stores rather than online sales.

Report Scope

Report Features Description Market Value (2024) USD 810.8 Million Forecast Revenue (2034) USD 1,346.1 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Wild Flower Bee Pollen, Camellia Bee Pollen, Rape Bee Pollen, Others), By Product Form (Granules, Powder, Capsules, Liquid), By Source (Flower Pollen, Plant Pollen, Bee Products), By Application (Nutritional Supplements, Cosmetics, Food and Beverage, Pharmaceuticals, Others), By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Health Food Stores, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Apicoltura Burato, YS Bee Farms, Beekeeper’s Naturals, Swanson Health Products, NOW Foods, BeeVital, Honey Pacifica, Sattvic Foods, Livemoor, Crockett Honey Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apicoltura Burato

- YS Bee Farms

- Beekeeper’s Naturals

- Swanson Health Products

- NOW Foods

- BeeVital

- Honey Pacifica

- Sattvic Foods

- Livemoor

- Crockett Honey Co.