Global Batch Centrifugal For Sugar Production Market Size, Share, And Business Benefit By Type (Automatic Centrifuge, Semi-Automatic Centrifuge), By Application (Raw Sugar, Refined Sugar, Beet Sugar, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165988

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

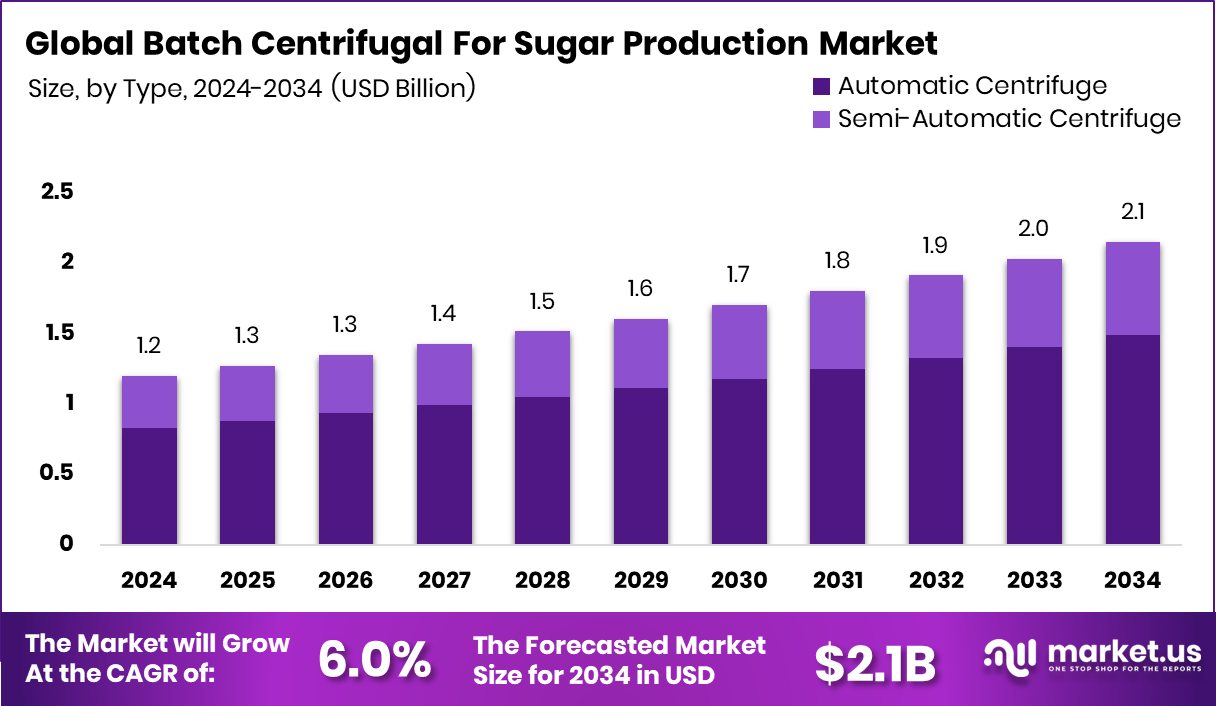

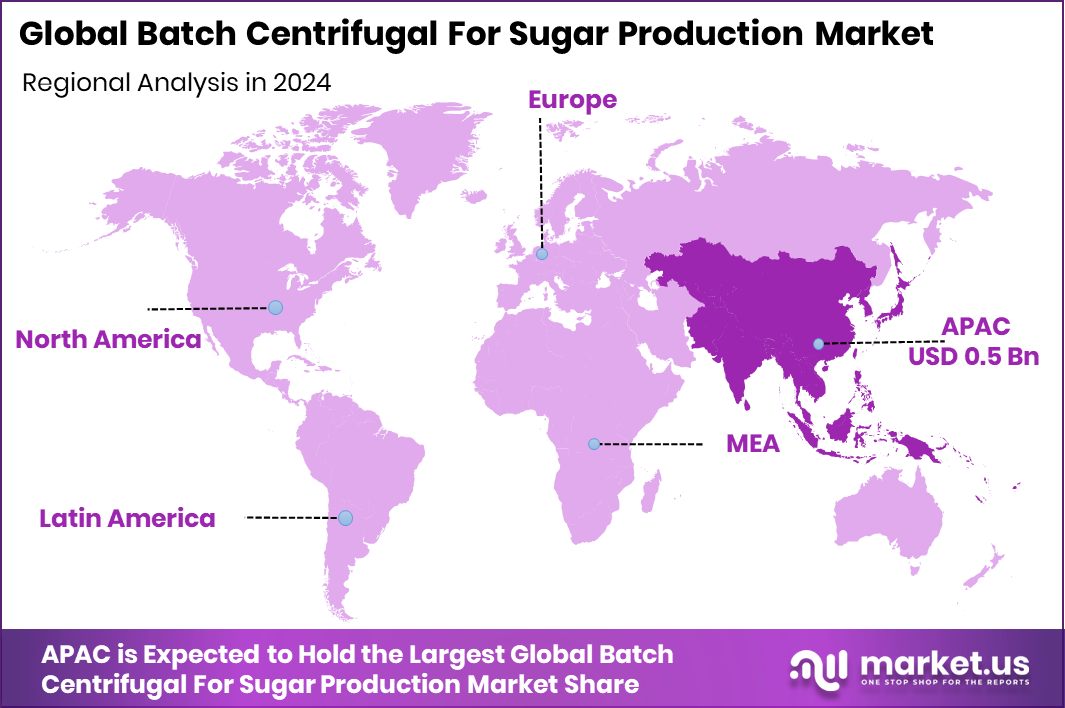

The Global Batch Centrifugal For Sugar Production Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Asia Pacific achieved a 41.7% position worth USD 0.5 Bn, reflecting stable regional growth.

Batch centrifugal for sugar production is a high-speed separation machine used in sugar mills to remove molasses from crystallized sugar. After the crystallization stage, the slurry mixture is fed into the centrifuge basket, where rapid spinning separates liquid molasses from solid sugar crystals. The process is performed in batches, allowing precise control over moisture content, purity, and crystal size. It ensures better sugar quality, reduced impurity levels, and higher efficiency compared to manual draining methods and is widely used in raw, refined, and specialty sugar plants.

The batch centrifugal for the sugar production market is influenced by the modernization of sugar mills, global demand for high-purity sugar, and better process automation. Many regions are reducing energy losses and increasing output through advanced centrifuge equipment. Higher sugar consumption across food processing, bakery, dairy, and beverage sectors encourages mills to adopt controlled and repeatable batch operations instead of outdated mechanical techniques.

Growth factors are linked to expanding agricultural productivity, where solar irrigation and soil rejuvenation efforts are projected to increase sugar output by 180,000 metric tons, creating a higher equipment need. Demand is also supported by improved farming finance access, such as the Rs 750 crore AgriSure agriculture startup fund, accelerating tech-based agribusiness upgrades.

Opportunities arise from alternative sugar and nutrition-focused innovations, including a $3 million sugar replacement startup, $5 million raised for advanced sugar processing, and rising global refining capacity, such as 1.5 million metric tons per year production in the UAE. New food-tech investments like a $25 million backing for dairy-free cheese innovation, further fuel long-term process equipment diversification.

Key Takeaways

- The Global Batch Centrifugal For Sugar Production Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In the Batch Centrifugal For Sugar Production Market, automatic centrifuges hold 68.2% share.

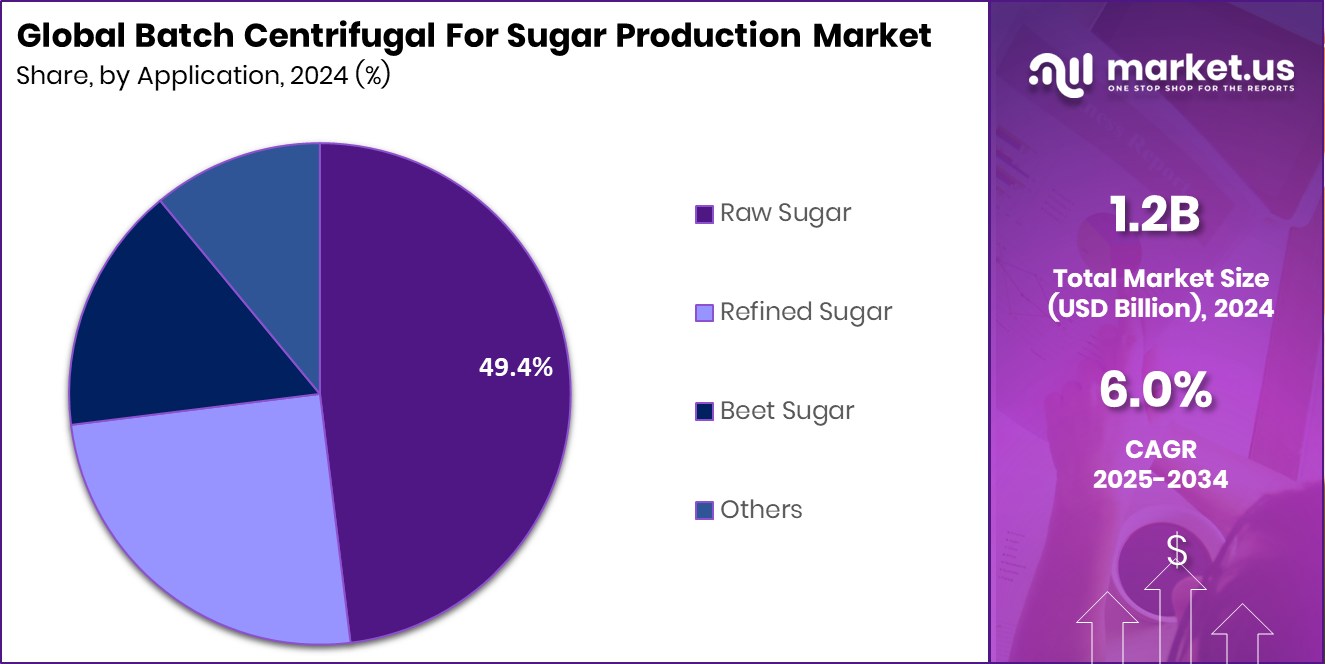

- Raw sugar applications account for 49.4% of the Batch Centrifugal for Sugar Production Market.

- Asia Pacific maintained 41.7% dominance, touching USD 0.5 Bn scale during the year period.

By Type Analysis

The Batch Centrifugal For Sugar Production Market sees the automatic centrifuge leading with 68.2%.

In 2024, Automatic Centrifuge held a dominant market position in the By Type segment of the Batch Centrifugal for Sugar Production Market, with a 68.2% share, driven by its ability to provide consistent sugar crystal quality, lower manual intervention, and improved operational safety inside sugar mills.

The preference for automatic operation aligns with modern mill upgrades, where producers seek reduced downtime, controlled batch cycles, and better molasses separation for premium-grade sugar output. Automatic systems also support uniform moisture reduction, faster discharge cycles, and enhanced hygiene standards compared to manual models.

With growing refinement needs and continuous output requirements, automatic centrifuges are preferred for stable performance, efficient batch handling, and improved sugar recovery rates, making them the leading choice across processing lines.

By Application Analysis

The Batch Centrifugal For Sugar Production Market shows raw sugar application holding 49.4%.

In 2024, Raw Sugar held a dominant market position in the By Application segment of the Batch Centrifugal For Sugar Production Market, with a 49.4% share, mainly due to its extensive use in large-scale milling units where high-volume crystallization and molasses separation are essential.

Raw sugar production relies heavily on controlled batch processing to achieve uniform crystal size and maintain purity levels suitable for further refining. The demand for raw sugar continues to rise across domestic and export-oriented mills, where consistent throughput and reduced processing loss are prioritized.

Batch centrifugal systems help maintain stable moisture, ensure better recovery from massecuite, and support continuous mill performance, making them well aligned with raw sugar production requirements.

Key Market Segments

By Type

- Automatic Centrifuge

- Semi-Automatic Centrifuge

By Application

- Raw Sugar

- Refined Sugar

- Beet Sugar

- Others

Driving Factors

Rising Demand for Efficient Sugar Processing Machines

One of the major driving factors is the industry’s ongoing shift toward faster, cleaner, and more controlled sugar extraction methods. Modern sugar mills prefer machines that reduce waste, save time, and increase sugar crystal purity without adding operational stress. Batch centrifugal systems help mills improve output while maintaining consistent quality, making them suitable for both large and mid-sized producers.

Growing attention to food quality and ingredient transparency has also influenced process upgrades inside sugar plants. The nutrition industry is evolving with new funding interests, such as Gladful raising ₹8 Crore to scale protein-rich kids’ nutrition products, indirectly supporting healthier product ecosystems where quality sugar inputs and reliable separation technology remain important across multiple food and beverage chains.

Restraining Factors

High Initial Cost Limits Technology Upgrades

A key restraining factor for the Batch Centrifugal For Sugar Production Market is the high upfront investment needed for advanced machinery, installation, and maintenance. Many mid-scale sugar mills still operate with limited capital flow, making it difficult to shift from semi-manual or older machinery to modern controlled batch centrifuge systems. The cost of skilled technicians, periodic servicing, and spare parts also adds financial pressure, especially in regions where sugar pricing and farmer payments fluctuate seasonally.

Technology adoption becomes slower when mills prioritise short-term cost savings instead of long-term efficiency gains. Amid this environment, new interest around healthier food production is expanding, seen through Troovy raising Rs 20 crore for health-focused product growth, signalling increasing attention toward nutrition-linked manufacturing value chains.

Growth Opportunity

Adoption of Automation in Mill Modernization Programs

A major growth opportunity for the Batch Centrifugal For Sugar Production Market comes from rising interest in automation-driven mill upgrades, where producers aim to reduce manual handling, improve sugar recovery, and enhance energy efficiency.

Many mills are planning the gradual replacement of outdated systems with programmable and sensor-based centrifuge machines that offer precise moisture control and cleaner separation. Governments, industry groups, and agritech-aligned investors are increasingly supporting value-chain modernization, which indirectly strengthens demand for advanced processing machinery.

The nutrition and food innovation ecosystem is also expanding, demonstrated by Troovy securing ₹20 Crore in a Pre-Series A round, showing growing confidence in cleaner and more technology-aligned production environments across food value networks where reliable sugar processing equipment becomes long-term relevant.

Latest Trends

Digital Monitoring and Smart Control Integration Trend

A key trend in the Batch Centrifugal For Sugar Production Market is the move toward digital monitoring tools and automated control systems that help operators track batch performance, moisture levels, and crystal uniformity in real time.

Mills are shifting from purely mechanical spinning units to software-enabled centrifuges that reduce errors, improve batch repeatability, and lower operational losses. Smart dashboards, predictive alerts, and energy-use tracking allow mills to optimize every cycle while reducing downtime.

The broader food and nutrition sector is also seeing tech-forward investment activity, reflected by Honey Mama’s closing $10.3 million in Series A funding, signaling a long-term shift toward cleaner, traceable, and quality-driven production ecosystems where precise sugar processing continues to hold value.

Regional Analysis

Asia Pacific reported a 41.7% share valued at USD 0.5 Bn in market performance.

Asia Pacific remained the leading regional market with a 41.7% share, valued at USD 0.5 Bn, reflecting its strong sugar manufacturing base, higher plantation coverage, and continuous mill modernization activity across multiple producing countries. The region benefits from large-scale cane processing capacity and steady demand from food and beverage industries, encouraging wider use of batch centrifugal units to improve crystal quality, purity, and batch control. The dominance is also supported by ongoing factory-level upgrades designed to reduce losses and maintain uniform product standards.

North America shows interest mainly through technology-led processing frameworks and controlled sugar quality applications, where automated batch centrifugal systems align with industrial and packaged food requirements. Europe maintains focus on sustainable and high-efficiency processing with gradual investments in batch-based refining systems aligned with quality, hygiene, and consistency preferences.

The Middle East & Africa demonstrate relevance due to expanding refining operations and growing domestic processing capacity, where modern equipment supports handling and quality control. Latin America maintains a strong sugar-producing ecosystem based on large plantations and milling footprints, where incremental adoption of batch centrifugal units supports processing efficiency, production handling, and crystal uniformity improvement efforts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The ASR Group holds strategic relevance in the Batch Centrifugal For Sugar Production Market through its strong refining, processing, and finished sugar product ecosystem. The company’s involvement in large-scale industrial operations supports the continuous requirement for high-efficiency batch centrifugal systems that ensure crystal consistency, improved separation, and better quality retention. Its focus on operational excellence and upgraded production infrastructure places it in a favourable position to influence processing standards adopted across modern sugar refining units.

ANDRITZ Group contributes value to this market through its engineering and industrial equipment capabilities, which align with demand for advanced centrifugal units designed for clean separation, energy optimisation, and reduced operational downtime. Its technological strength and ability to offer engineered solutions position it as an important stakeholder for mills transitioning from conventional mechanical units to more controlled, automated production cycles focused on scalability and precision.

BMA Braunschweigische Maschinenbauanstalt GmbH plays a key role due to its engineering background in sugar processing solutions, machinery optimisation, and equipment lifecycle support. Its relevance is tied to process-driven performance, batch efficiency, and improved crystallisation control, making it a trusted partner for sugar mills seeking uniform output and repeatable batch performance. Combined, these companies reflect the market’s shift toward long-term automation, energy efficiency, and controlled refining environments.

Top Key Players in the Market

- ASR Group

- ANDRITZ Group

- BMA Braunschweigische Maschinenbauanstalt GmbH

- Buckau-Wolf GmbH

- Fives Group

- Guangxi Su Group Co.

- JBT Corporation

- Tsukishima Holdings

- Thomas Broadbent & Sons Ltd.

- Western States

Recent Developments

- In June 2025, BMA held a detailed webinar introducing its E-series batch centrifugals for sugar production, covering features such as advanced automation, the DynFAS FS level sensor, and the updated safety concept. This event highlights BMA’s push to educate customers on its latest batch centrifugal equipment solutions for improved throughput and reliability.

- In May 2024, ANDRITZ completed the purchase of Finland‐based Procemex in May 2024. The move strengthens ANDRITZ’s automation and digitalization capabilities, which are relevant for sugar processing equipment like batch centrifuges, where smart monitoring and control systems are increasingly important. The addition supports its ability to supply more advanced, integrated systems into sugar mills.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Automatic Centrifuge, Semi-Automatic Centrifuge), By Application (Raw Sugar, Refined Sugar, Beet Sugar, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ASR Group, ANDRITZ Group, BMA Braunschweigische Maschinenbauanstalt GmbH, Buckau-Wolf GmbH, Fives Group, Guangxi Su Group Co., JBT Corporation, Tsukishima Holdings, Thomas Broadbent & Sons Ltd., Western States Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Batch Centrifugal For Sugar Production MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Batch Centrifugal For Sugar Production MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ASR Group

- ANDRITZ Group

- BMA Braunschweigische Maschinenbauanstalt GmbH

- Buckau-Wolf GmbH

- Fives Group

- Guangxi Su Group Co.

- JBT Corporation

- Tsukishima Holdings

- Thomas Broadbent & Sons Ltd.

- Western States