Global Bamboo Fiber Market Size, Share, Growth Analysis By Fiber Type (Bamboo Rayon Fiber, Bamboo Lyocell Fiber, Carbonized Bamboo Fiber), By Product Type (Yarn, Fabric, Nonwoven Fabric), By Application (Textiles, Apparel, Home Furnishings, Medical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157838

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

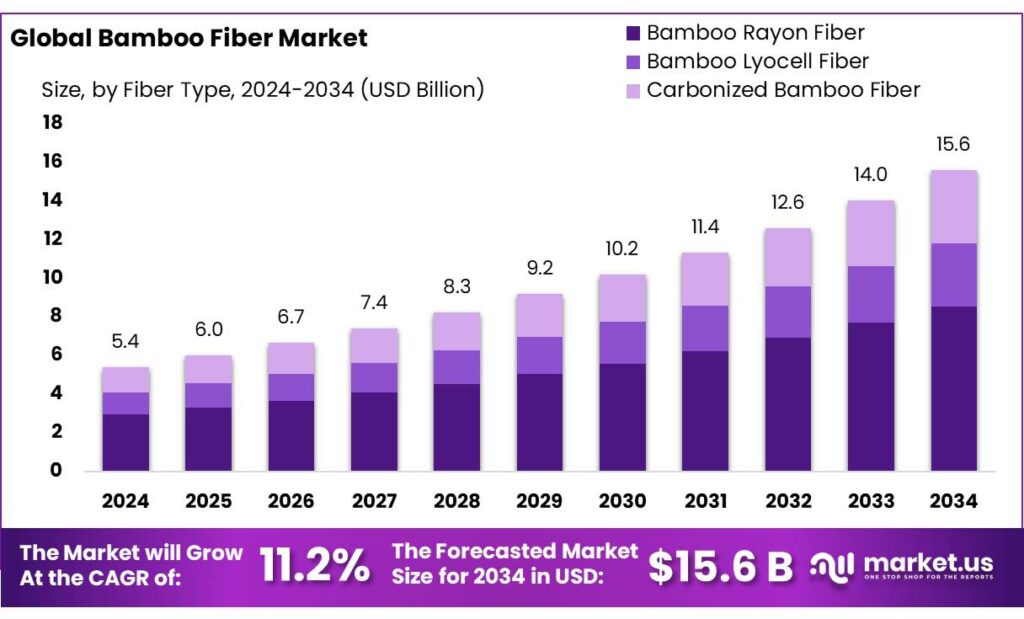

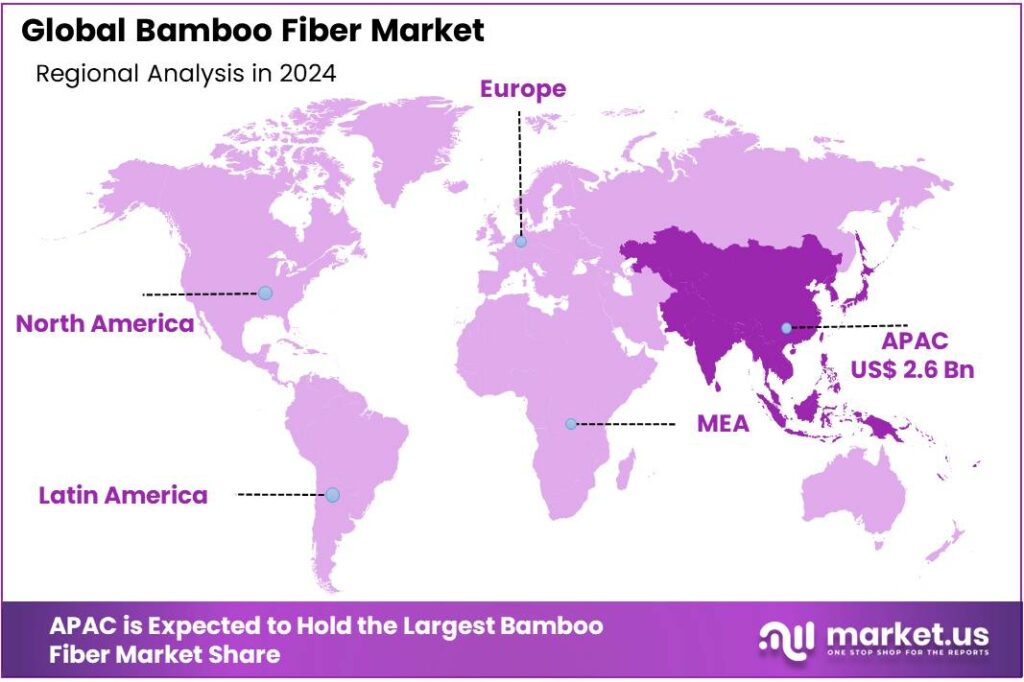

The Global Bamboo Fiber Market size is expected to be worth around USD 15.6 Billion by 2034, from USD 5.4 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 48.2% share, holding USD 2.6 Billion in revenue.

Bamboo fiber, derived from the pulp of bamboo plants, has emerged as a sustainable alternative to synthetic textiles. Its natural properties—such as breathability, softness, and biodegradability—make it increasingly popular in the textile industry. In India, with its vast bamboo resources, the potential for bamboo fiber production is significant, aligning with global trends towards eco-friendly materials.

India stands as the second-largest producer of bamboo globally, with an estimated 14.6 million tonnes produced annually. Despite this abundance, the bamboo processing sector remains underdeveloped. According to the Ministry of Agriculture, less than 30% of bamboo-processing units in the country are mechanized. This indicates a substantial opportunity for modernization and scaling up the industry.

The National Bamboo Mission (NBM), restructured in 2018, plays a pivotal role in enhancing bamboo cultivation, processing, and marketing across 24 states and union territories. As of December 31, 2024, the mission has established 408 bamboo nurseries, including 14 accredited ones, and has covered 60,000 hectares of non-forest areas under bamboo plantation. Additionally, 104 bamboo treatment and preservation units have been set up to support the industry.

- For instance, a bamboo cultivation project in Ajara, Maharashtra, aims to boost farmer income by enhancing traditional bamboo productivity using scientific methods. Over 300 farmers participated in a workshop organized by the Institute for Social and Economic Change (ISEC), Bengaluru, in collaboration with the Indian Council of Social Science Research (ICSSR).

The demand for bamboo-based products is also reflected in India’s export data. Between November 2023 and October 2024, India exported 502 shipments of bamboo products to 40 countries, with the United States being the largest importer, accounting for 53% of the total exports. This indicates a growing international recognition of India’s bamboo products, including textiles, furniture, and handicrafts.

Key Takeaways

- Bamboo Fiber Market size is expected to be worth around USD 15.6 Billion by 2034, from USD 5.4 Billion in 2024, growing at a CAGR of 11.2%.

- Bamboo Rayon Fiber held a dominant market position, capturing more than a 54.8% share of the global bamboo fiber market.

- Bamboo Fiber Yarn held a dominant position in the global bamboo fiber market, capturing more than a 47.2% share.

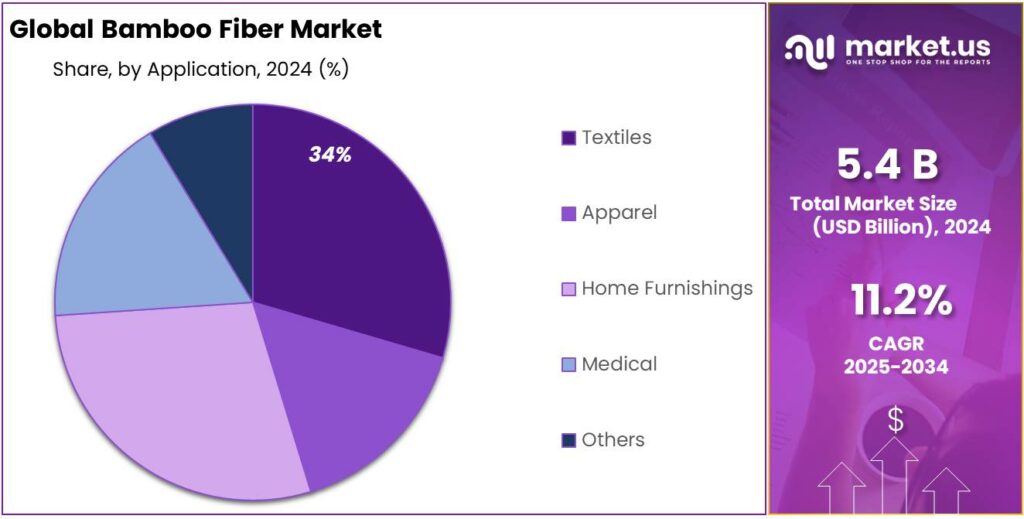

- Textiles held a dominant market position, capturing more than a 34.6% share of the global bamboo fiber market.

- Asia-Pacific (APAC) region held a commanding 48.2% share of the global bamboo fiber market, translating to an estimated market value of approximately USD 2.6 billion.

By Fiber Type Analysis

Bamboo Rayon Fiber Dominates with 54.8% Share in 2024

In 2024, Bamboo Rayon Fiber held a dominant market position, capturing more than a 54.8% share of the global bamboo fiber market. This segment’s prominence is attributed to its widespread use in textile manufacturing, particularly in apparel and home furnishings. The production of bamboo rayon involves a chemical process that transforms bamboo pulp into a viscous solution, which is then spun into fibers. This method, while effective, has raised environmental concerns due to the use of chemicals such as carbon disulfide. Despite these concerns, the demand for bamboo rayon remains robust due to its desirable properties, including softness, breathability, and antibacterial qualities.

By Product Type Analysis

Bamboo Fiber Yarn Leads with 47.2% Market Share in 2024

In 2024, Bamboo Fiber Yarn held a dominant position in the global bamboo fiber market, capturing more than a 47.2% share. This segment’s growth is primarily driven by the increasing demand for sustainable and eco-friendly textiles, as well as the versatility of bamboo fiber yarn in various applications.

In India, the bamboo fiber industry is gaining momentum, with several initiatives aimed at promoting its cultivation and processing. The National Bamboo Mission, for instance, focuses on increasing bamboo production and enhancing its utilization in various sectors, including textiles. This initiative aligns with the global trend towards sustainable materials and supports the growth of bamboo fiber applications in India.

By Application Analysis

Textiles Lead the Bamboo Fiber Market with 34.6% Share in 2024

In 2024, Textiles held a dominant market position, capturing more than a 34.6% share of the global bamboo fiber market. This dominance is driven by the growing demand for sustainable, eco-friendly fabrics in the textile industry. Bamboo fiber, with its softness, breathability, and biodegradability, is increasingly being used in clothing, home textiles, and industrial fabrics.

The rise of conscious consumerism, focusing on environmentally responsible products, has further contributed to the market share of bamboo fiber in textiles. This growth is expected to continue, with the textile application of bamboo fiber projected to expand at a steady rate in the coming years, driven by both consumer demand and advancements in manufacturing processes. The market for bamboo-based textiles is anticipated to grow as brands and manufacturers continue to prioritize sustainability and innovation in their product lines.

Key Market Segments

By Fiber Type

- Bamboo Rayon Fiber

- Bamboo Lyocell Fiber

- Carbonized Bamboo Fiber

By Product Type

- Yarn

- Fabric

- Nonwoven Fabric

By Application

- Textiles

- Apparel

- Home Furnishings

- Medical

- Others

Emerging Trends

Bamboo Fiber in Food Processing: A Sustainable Ingredient for Health-Conscious Consumers

Bamboo fiber is gaining recognition in the food industry as a sustainable and health-conscious ingredient. In 2024, the food sector accounted for approximately 42% of the global demand for bamboo fiber ingredients. This growing interest is driven by consumers’ increasing preference for natural, high-fiber, and gluten-free products. Manufacturers are incorporating bamboo fiber into various food items, including bakery products, dairy alternatives, snacks, and beverages, to enhance fiber content and appeal to health-conscious consumers.

Government initiatives worldwide are supporting the adoption of sustainable ingredients like bamboo fiber. For instance, Brazil has implemented laws promoting bamboo cultivation, recognizing its environmental and economic benefits. Such policies encourage the use of bamboo in various industries, including food processing, by providing incentives for sustainable practices.

The versatility of bamboo fiber extends beyond its nutritional benefits. It also offers functional advantages in food processing. Bamboo fiber’s natural properties make it an effective ingredient in creating biodegradable packaging solutions, aligning with the global shift towards reducing plastic waste. This dual role as both a food ingredient and a sustainable packaging material underscores bamboo fiber’s potential in promoting a circular economy.

Drivers

Government Support and Policy Initiatives

The Indian government has recognized the potential of bamboo as a sustainable resource and has implemented several initiatives to promote its cultivation and utilization. The National Bamboo Mission (NBM) was launched to increase the area under bamboo cultivation and improve post-harvest management.

In 2022, the government amended the Forest Rights Act, classifying bamboo as a grass species, which simplified the process for farmers to cultivate and trade bamboo without requiring forest clearance. This policy change has encouraged farmers to adopt bamboo cultivation, leading to an increase in bamboo production across the country.

Additionally, the government has provided financial assistance and subsidies to promote bamboo-based industries. For instance, the Ministry of Agriculture and Farmers Welfare offers financial support for setting up bamboo processing units and value-added product manufacturing. These initiatives aim to enhance the economic viability of bamboo cultivation and processing, thereby fostering the growth of the bamboo fiber industry.

India’s bamboo products have found a growing market abroad. Between March 2023 and February 2024, India exported 26,299 shipments of bamboo products to various countries, with the United States, Seychelles, and Bhutan being the largest importers. The United States alone accounted for 53% of these exports, highlighting the strong demand for bamboo products in international markets. This trend underscores the global recognition of India’s bamboo products and the potential for further expansion in export markets.

Restraints

High Silica Content in Bamboo Fiber

Bamboo fiber is increasingly recognized for its eco-friendly properties and versatility in various applications, including textiles, paper, and composites. However, one significant challenge hindering its widespread industrial adoption is the high silica content inherent in bamboo. This natural characteristic poses several technical and economic barriers, particularly in sectors like pulp and paper manufacturing.

In India, the pulp and paper industry predominantly relies on wood, agro-residues, and recycled fibers, with bamboo accounting for a minimal share. The primary reason for this limited utilization is the high silica content in bamboo, which ranges from 2.5% to 5%.

Silica, while beneficial in some contexts, complicates the pulping process by causing scaling and fouling in equipment, leading to increased maintenance costs and reduced operational efficiency. This issue is particularly pronounced in regions like Northeast India, where high-quality bamboo species are abundant, yet the lack of specialized processing infrastructure deters investment in bamboo-based pulp production.

To address these challenges, the Indian government, through initiatives like the National Bamboo Mission (NBM), has been promoting the development of bamboo-based industries. The NBM aims to enhance the cultivation, processing, and marketing of bamboo, thereby increasing its utilization in various sectors. However, the high silica content remains a technical hurdle that requires innovative solutions.

Opportunity

Export Growth and Market Expansion

One of the most promising growth opportunities for bamboo fiber lies in its export potential, particularly as global demand for sustainable and eco-friendly products continues to rise. India, with its abundant bamboo resources and supportive government policies, is well-positioned to capitalize on this trend.

- October 2024, India exported 502 shipments of bamboo products to 205 buyers across 40 countries, marking a 21% growth compared to the previous year. Notably, the United States emerged as the largest importer, accounting for 53% of these exports.

The Indian government’s initiatives, such as the National Bamboo Mission (NBM), have played a crucial role in promoting bamboo cultivation and processing. The NBM aims to enhance bamboo production, improve post-harvest management, and promote value-added products. These efforts have led to increased bamboo availability and improved processing technologies, making Indian bamboo products more competitive in international markets.

Regional Insights

Asia-Pacific Dominates Bamboo Fiber Market with 48.2% Share in 2024

In 2024, the Asia-Pacific (APAC) region held a commanding 48.2% share of the global bamboo fiber market, translating to an estimated market value of approximately USD 2.6 billion. This dominance is primarily attributed to the region’s extensive bamboo cultivation, advanced manufacturing capabilities, and a strong consumer preference for sustainable products.

China and India are pivotal players in this landscape, with China leading in both bamboo production and processing. The country’s vast bamboo resources and well-established infrastructure have positioned it as a global hub for bamboo fiber manufacturing. India, on the other hand, is witnessing significant growth in bamboo cultivation, supported by government initiatives aimed at promoting bamboo as a sustainable resource. The National Bamboo Mission in India, for instance, focuses on increasing bamboo production and enhancing its utilization in various sectors, including textiles.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aditya Birla Group, through its subsidiary Grasim Industries, is a prominent player in the bamboo fiber market. The company manufactures Birla Viscose EcoSoft, a sustainable bamboo viscose fiber, under its Birla Cellulose brand. This fiber is produced using bamboo pulp and is known for its softness and biodegradability. Grasim Industries operates several viscose mills globally, contributing to its significant presence in the man-made cellulosic fiber industry.

Red Sun Group, based in China, is involved in the production of various textile products, including those made from bamboo fibers. The company emphasizes the use of high-quality materials and innovative technology in its manufacturing processes. Red Sun Group’s products are recognized for their softness and breathability, catering to the growing demand for sustainable textiles.

Sateri Group, a subsidiary of Royal Golden Eagle, is a leading producer of viscose staple fiber (VSF), including those derived from bamboo. The company operates several mills in China, with a total design capacity of 250,000 tons. Sateri’s EcoCosy® brand represents its commitment to sustainability, offering fibers made from renewable wood cellulose. The company is also investing in research and development to explore alternative cellulose feedstocks and closed-loop manufacturing solutions.

Top Key Players Outlook

- Aditya Birla

- Red Sun Group

- Sateri Group

- Shanghai Aotian Bio Technology

- Lenzing Group

- Kelheim Fibres

Recent Industry Developments

In 2024 Red Sun Group, reported an annual sales revenue of 3 billion RMB, reflecting its strong position in the textile market.

In 2024, Sateri’s total fiber production capacity, encompassing both viscose and lyocell fibers, stands at 2.1 million tonnes annually. The company operates 14 factories across China, with a significant presence in regions such as Jiangsu, Shandong, and Fujian provinces.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Bn Forecast Revenue (2034) USD 15.6 Bn CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fiber Type (Bamboo Rayon Fiber, Bamboo Lyocell Fiber, Carbonized Bamboo Fiber), By Product Type (Yarn, Fabric, Nonwoven Fabric), By Application (Textiles, Apparel, Home Furnishings, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aditya Birla, Red Sun Group, Sateri Group, Shanghai Aotian Bio Technology, Lenzing Group, Kelheim Fibres Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aditya Birla

- Red Sun Group

- Sateri Group

- Shanghai Aotian Bio Technology

- Lenzing Group

- Kelheim Fibres