Global Baghouse Filters Market Size, Share and Report Analysis By Type (Shaker Baghouse Filters, Reverse Air Baghouse Filters, Pulse Jet Baghouse Filters), By Material (Non-woven, Woven, Others), By Application (Woodworking, Pharmaceuticals, Cement, Power Generation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175616

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

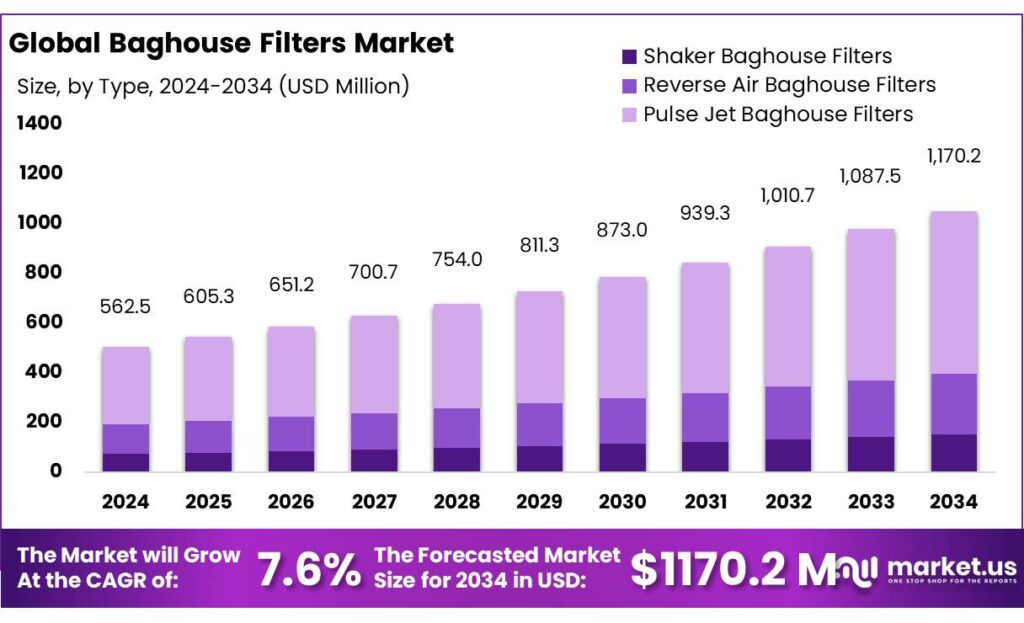

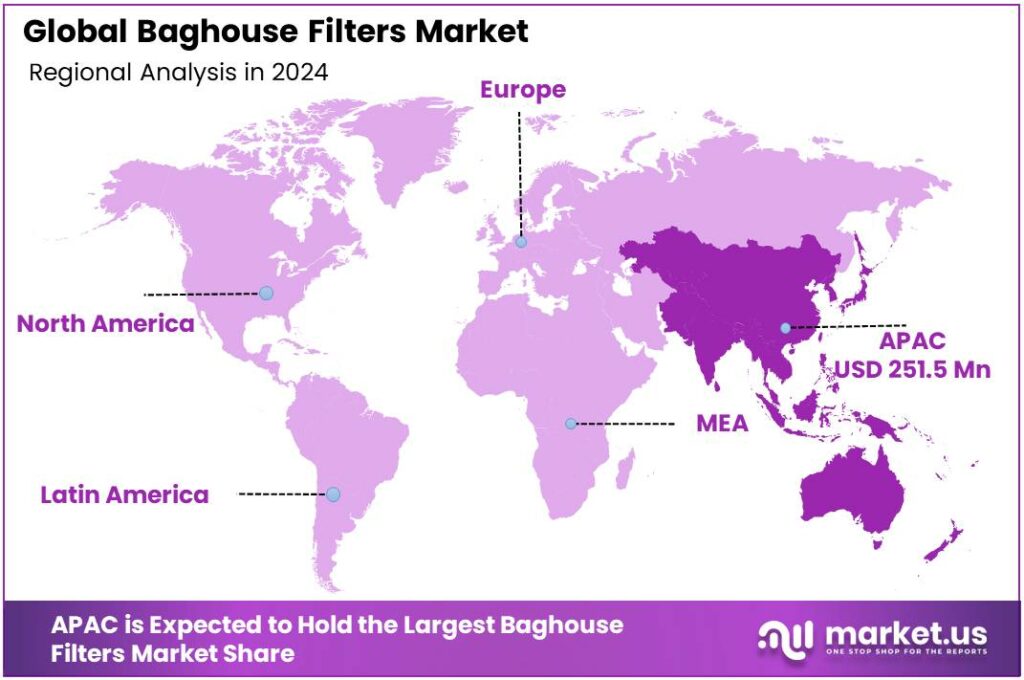

Global Baghouse Filters Market size is expected to be worth around USD 1170.2 Million by 2034, from USD 562.5 Million in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.7% share, holding USD 251.4 Million in revenue.

Baghouse filters (fabric filters) are a core piece of industrial air-pollution control, designed to capture fine particulate matter from high-volume exhaust streams using woven or felted filter media. In food and agri-processing plants, they are commonly installed on flour and grain handling lines, sugar conveying, spray-drying and powder mixing, ingredient transfer points, packaging, and bulk storage vents. The business case is straightforward: food dust is often ultra-fine, it can create housekeeping burdens, and—most importantly—it can become a combustible dust hazard if allowed to accumulate.

The current industrial scenario is being shaped by both scale and scrutiny in the food supply chain. Global cereal production is expected to reach a record 2,990 million tonnes in 2025, which signals sustained throughput across grain receiving, milling, and downstream ingredient processing—exactly the environments where dust capture equipment runs continuously. In parallel, global compound feed production is estimated at just over one billion tonnes annually, with global commercial feed manufacturing turnover estimated at over US$400 billion—a large installed base for dust collection retrofits and new builds in prepared feeds, premixes, and additives.

Key driving factors are safety enforcement, emissions compliance, and operational reliability. Combustible dust prevention is a particularly strong driver in food operations: the U.S. Chemical Safety Board (CSB) identified 281 combustible dust incidents (1980–2005) that resulted in 119 deaths and 718 injuries, underscoring why plants prioritize dust capture and containment around transfer and processing equipment.

OSHA’s updated combustible dust emphasis further reinforces the point: in incident reporting used to revise OSHA’s program, wood and food products averaged 70% of the materials involved in combustible dust fires and explosions (2018). Operational guidance is also becoming more explicit; OSHA notes that NFPA 61 sets an accumulation limit of 1/8 inch of dust over 5% of a footprint area—pushing plants toward engineered capture at the source, not just cleanup.

Safety is the second hard driver. Grain, flour, and sugar dust are combustible, and incidents can escalate quickly without strong capture at the source plus housekeeping discipline. OSHA’s grain-handling standard sets a clear housekeeping trigger: fugitive grain dust accumulations above ⅛ inch (0.32 cm) at priority areas must be removed. At a broader level, OSHA highlights CSB findings of 281 combustible-dust incidents between 1980–2005, causing 119 deaths and 718 injuries—numbers that continue to shape corporate risk reviews and insurer expectations for dust-collection performance.

Key Takeaways

- Baghouse Filters Market size is expected to be worth around USD 1170.2 Million by 2034, from USD 562.5 Million in 2024, growing at a CAGR of 7.6%.

- Pulse Jet Baghouse Filters held a dominant market position, capturing more than a 56.2% share.

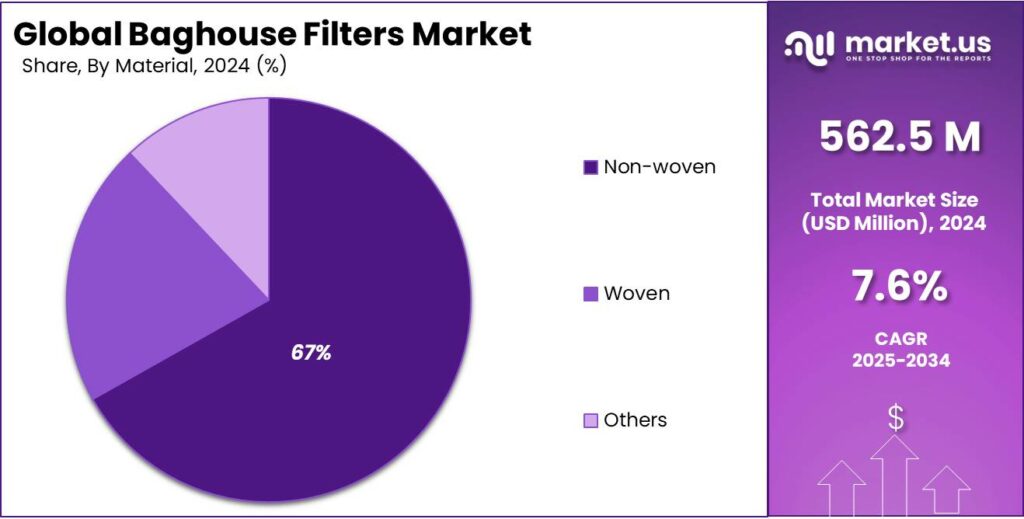

- Non-woven held a dominant market position, capturing more than a 66.5% share.

- Cement held a dominant market position, capturing more than a 38.9% share.

- Asia Pacific held the dominating position, accounting for 44.7% of the Baghouse Filters Market and valued at 251.4 Mn.

By Type Analysis

Pulse Jet Baghouse Filters lead the market with a strong 56.2% share, driven by their efficiency and suitability for modern industrial operations.

In 2024, Pulse Jet Baghouse Filters held a dominant market position, capturing more than a 56.2% share, reflecting their widespread acceptance across industries that need continuous dust extraction without interruption. These systems work with short, high-pressure bursts of air to clean the filter bags, which allows factories to keep running while maintaining strong airflow. Their ability to handle high dust loads, maintain low emissions, and reduce maintenance downtime has made them the preferred choice in sectors ranging from food processing and cement to chemicals and metals.

By Material Analysis

Non-woven material leads the market with a strong 66.5% share, supported by its durability and consistent filtration performance.

In 2024, Non-woven held a dominant market position, capturing more than a 66.5% share, as industries increasingly relied on these fabrics for high-performance baghouse filtration. Non-woven materials, typically made from polyester, polypropylene, or advanced synthetic blends, offer strong dust-holding capacity, better airflow, and longer service life compared to traditional woven fabrics. These qualities make them the preferred choice in demanding environments such as cement, metals, food ingredients, grain processing, and chemical plants where fine particulate matter is continuously generated.

By Application Analysis

Cement industry leads the segment with a strong 38.9% share, driven by its high dust-intensive operations and strict emission norms.

In 2024, Cement held a dominant market position, capturing more than a 38.9% share, reflecting the sector’s heavy dependence on baghouse filtration for controlling clinker dust, kiln emissions, and material-handling particulates. Cement production involves high-temperature processes, grinding, and bulk movement of raw materials, all of which generate large volumes of fine dust. Because of this, cement plants rely on robust baghouse systems to maintain safe working conditions, reduce particulate discharge, and comply with tightening air-quality regulations.

Key Market Segments

By Type

- Shaker Baghouse Filters

- Reverse Air Baghouse Filters

- Pulse Jet Baghouse Filters

By Material

- Non-woven

- Woven

- Others

By Application

- Woodworking

- Pharmaceuticals

- Cement

- Power Generation

- Others

Emerging Trends

Connected “smart” baghouses are becoming the new normal as plants chase uptime and compliance

One clear latest trend in baghouse filters is the shift from “fit-and-forget” dust collection to connected, continuously monitored systems. Instead of waiting for a baghouse to show obvious problems—like visible dust, poor pickup at hoods, or a sudden spike in fan load—more plants are using sensors and cloud dashboards to watch performance in real time. In practical terms, this means tracking differential pressure, airflow, pulse-cleaning cycles, and hopper conditions so maintenance teams can fix issues early, not after production suffers. Industry suppliers describe IoT setups that monitor core signals such as differential pressure, airflow, valve cycles, emissions, and motor load, then push alerts and reports to plant teams.

The reason this matters is simple: many dust-heavy food operations run long hours, and stoppages cost money fast. Global grain movement remains huge, which keeps elevators, mills, and ingredient plants busy and dusty. FAO’s latest brief revised 2025 world cereal production upward to 3,003 million tonnes, and forecasts 2025/26 world cereal trade at 500.6 million tonnes. When that much grain is being produced and shipped, a lot of it passes through handling steps—receiving pits, conveyors, silos, grinding, blending—where fine dust is created. Plant managers are under pressure to keep lines running smoothly, so the idea of spotting a cleaning-system fault before it forces a shutdown is becoming very attractive.

Connected monitoring is also gaining attention because it supports safety and housekeeping discipline in grain and food facilities. OSHA’s grain-handling standard sets an action point that many operators know by heart: employers must remove fugitive grain dust accumulations whenever they exceed ⅛ inch (0.32 cm) in priority areas (or demonstrate equivalent protection). In real-world conditions, remote monitoring does not replace housekeeping, but it helps reduce the root cause—excess dust escaping capture—by flagging issues like high pressure drop, pulse valve problems, or blocked compressed-air lines before dust starts building up.

This trend is also tied to a broader shift toward stricter particulate expectations. In the U.S., EPA set the primary annual PM2.5 standard at 9.0 µg/m³, down from 12.0 µg/m³, and the agency’s overview explains the revision is intended to provide increased public health protection. Regardless of sector, tighter PM expectations encourage plants to prove their control equipment is working day after day—not just at inspection time—which makes digital records and alerts more valuable.

Drivers

Stricter dust-control expectations in food and grain handling are pushing baghouse filter adoption

A major driving factor for baghouse filters is the growing need to control fine dust in food and grain operations—both for safety inside plants and for cleaner air outside the gate. Food processing creates dust at almost every step: receiving grain, milling flour, blending ingredients, drying, conveying, and bulk loading. When volumes are high, dust becomes a daily operational risk, not an occasional nuisance.

FAO’s latest updates show how large the upstream “throughput” is: world cereal trade for 2025/26 is forecast at 500.6 million tonnes, and global cereal production is projected around 3,003 million tonnes for 2025. Those numbers matter because bigger harvests and trade flows translate into more grain moving through elevators, mills, and ingredient supply chains—where dust collection is essential to keep lines running smoothly.

Inside food and grain sites, the safety angle is just as powerful. Fine organic dust can be combustible, and regulators focus heavily on housekeeping and dust-capture controls. OSHA’s guidance tied to the grain-handling standard sets a clear trigger for “priority” areas: fugitive grain dust accumulations, whenever they exceed 1/8 inch (0.32 cm), must be removed immediately by the employer. In real plants, that threshold pushes operators toward reliable source-capture systems—like baghouses—because manual cleaning alone struggles to keep up during peak production. Baghouses help reduce the amount of dust that settles on floors, beams, and equipment, making compliance more practical and helping plants maintain safer conditions for workers.

At the same time, public air-quality goals are tightening, which raises expectations for particulate control across industrial clusters that include food processing. In the U.S., EPA revised the primary annual PM2.5 standard from 12.0 µg/m³ to 9.0 µg/m³, reflecting updated health science and a push for stronger protection. This is not a “food-only” rule, but it increases the pressure on industrial sites in impacted regions to reduce fine particulate emissions and manage dusty operations more carefully.

In India, the National Clean Air Programme (NCAP) aims for reductions “up to 40%” in PM10 levels (or meeting standards) by 2025–26, covering 131 cities. When national and city action plans become more serious, industries that handle powders and grains often find it easier to justify upgrades to proven filtration systems rather than relying on incremental fixes.

Restraints

High upfront costs and operational complexity slow down wider adoption of baghouse filters

One significant restraining factor for the adoption of baghouse filters, especially in food and allied industries, is the high initial investment and ongoing operational complexity associated with these systems. While a baghouse can dramatically improve air quality and safety, the financial and technical barriers to implementation can be daunting for many facilities, particularly small and medium-sized enterprises in food processing and grain handling.

Compounding the investment issue is the complexity of operating and maintaining a baghouse effectively. These systems require trained personnel to monitor differential pressure, change filter bags on schedule, and ensure that pulse-jet cleaning cycles and compressed air systems are functioning correctly. Without proper operation, bags can clog, reducing airflow and increasing energy use—a counterproductive outcome that can raise costs rather than lower them. This level of operational sophistication demands training and often the hiring of specialized technicians, which adds to the total cost of ownership.

The financial strain of adopting advanced dust collection becomes particularly visible when looking at the scale of food and grain throughput globally. According to the Food and Agriculture Organization (FAO), world cereal production is forecast to reach 3,003 million tonnes in 2025, with cereal trade estimated at 500.6 million tonnes in 2025/26.

While these figures highlight the massive scale of global grain movement—and thus the potential need for robust dust control—they also reflect the reality that many facilities across regions are operating under tight budget constraints. Smaller processors in developing economies may struggle more than larger industrial players to justify the capital expense required for full baghouse integration when balancing operational priorities and cash flow.

Opportunity

Upgrading dust control in high-throughput food and grain plants is a clear growth opportunity for baghouse filters

A major growth opportunity for baghouse filters is the steady modernization of dust control systems across food and grain handling—especially where plants are expanding throughput, adding new lines, or upgrading older collectors. This is not a niche need. Global grain movement is large and still rising, which keeps elevators, mills, and ingredient processors operating at high utilization. FAO forecasts world cereal production at 3,003 million tonnes in 2025, and world cereal trade at 500.6 million tonnes in 2025/26. Those volumes mean more receiving, conveying, milling, blending, and bulk loading—exactly the points where fine dust is generated and must be captured at source to avoid product loss, downtime, and worker exposure.

Safety expectations create a second, very practical reason for investment. Grain and many food powders are combustible, so plants are pushed to keep dust levels low and stable, not just “acceptable on inspection day.” OSHA’s grain-handling requirements and interpretations are blunt about housekeeping triggers: fugitive grain dust accumulations, whenever they exceed ⅛ inch (0.32 cm) in priority areas, must be removed immediately. When a facility is running hard, relying on manual cleanup alone becomes expensive and unreliable, which is why better dust capture (often via baghouse filtration) becomes a real operational upgrade rather than a compliance checkbox.

Government clean-air programs also strengthen the business case for dust-collection upgrades in industrial clusters that include food processing. In India, the National Clean Air Programme (NCAP) aims to achieve reductions “up to 40%” in PM10 concentrations by 2025–26 across 131 cities. That target increases local scrutiny on particulate sources and keeps air-quality improvement on the agenda for industrial permitting and enforcement. In addition, a performance-linked grant of ₹13,036.52 crore has been provided to 130 cities as critical gap funding to implement air-quality improvement measures—an indicator that the program has real money behind it, not just policy language.

Regional Insights

Asia Pacific dominates with 44.7% share, valued at 251.4 Mn, backed by heavy industry and tightening dust-control focus

Asia Pacific is the core demand hub for baghouse filters because it combines large-scale, dust-intensive production with rising expectations on particulate control in industrial clusters. In regional terms, Asia Pacific held the dominating position, accounting for 44.7% of the Baghouse Filters Market and valued at 251.4 Mn, reflecting consistent installation activity in cement, metals, minerals, and bulk-material handling where fine dust is generated every hour of operation. Cement is a strong anchor for this region’s filtration needs: the International Energy Agency notes India strengthened its position as the second-largest cement producer in 2022, with its share of global production rising to 9%.

This matters operationally because cement lines rely on baghouses across kiln systems, clinker coolers, raw mills, and finish mills, creating ongoing demand for both new collectors and replacement filter media. Asia Pacific also benefits from a broad base of food and agri-processing—grain handling, milling, feed production, and ingredient blending—where dust capture supports hygiene, worker safety, and uptime. FAO’s scale indicators underline the intensity of upstream grain movement that feeds these facilities, with world cereal trade forecast at 500.6 million tonnes in 2025/26.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGET strengthens its position in the baghouse filters market by supplying dust-collection systems built for industrial durability. The company supports more than 80+ product configurations and serves facilities operating 24/7 dust-intensive lines. Its solutions typically manage airflows ranging from 500 CFM to 100,000 CFM, helping manufacturers meet strict emission control and plant-safety requirements across multiple sectors.

Airex Industries delivers high-efficiency baghouse systems used across North America, backed by 40+ years of expertise. The company’s installations typically operate at filtration efficiencies above 99.9% and handle airflows from 2,000 to 250,000 CFM. Airex also integrates energy-saving controls that can reduce plant ventilation energy consumption by up to 30% for large industrial operations.

Amerair specializes in large-scale filtration and emission-control systems, serving industries that manage dust loads above 100,000 tons/year. Their baghouse designs often achieve particulate emissions as low as 5 mg/Nm³, meeting strict regulatory environments. With over 25+ years of operations, Amerair supports both retrofits and turnkey systems across cement, metal, and bulk-material plants.

Top Key Players Outlook

- AGET Manufacturing Co.

- Aircon Corp.

- Airex Industries Inc.

- Amerair Industries LLC

- Baghouse America Inc.

- Camfil AB

- CECO Environmental Corp.

- CPE Filters Inc.

- Daikin Industries Ltd.

- Dynavac India Pvt. Ltd.

Recent Industry Developments

Baghouse America Inc product range includes pulse-jet baghouses, cartridge dust collectors, bin vents, and replacement filter bags, with systems engineered for airflows from 1,000 CFM up to 1,000,000 CFM to fit a wide variety of industries from food processing to heavy manufacturing.

AGET Manufacturing Company, established in 1938 in Adrian, Michigan, builds and supplies industrial dust collection systems including baghouse filters as part of its DUSTKOP product line, which are designed to remove very fine particulates down to 0.3 microns with filtration efficiencies often exceeding 99%–99.9%.

Report Scope

Report Features Description Market Value (2024) USD 562.5 Mn Forecast Revenue (2034) USD 1170.2 Mn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Shaker Baghouse Filters, Reverse Air Baghouse Filters, Pulse Jet Baghouse Filters), By Material (Non-woven, Woven, Others), By Application (Woodworking, Pharmaceuticals, Cement, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGET Manufacturing Co., Aircon Corp., Airex Industries Inc., Amerair Industries LLC, Baghouse America Inc., Camfil AB, CECO Environmental Corp., CPE Filters Inc., Daikin Industries Ltd., Dynavac India Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGET Manufacturing Co.

- Aircon Corp.

- Airex Industries Inc.

- Amerair Industries LLC

- Baghouse America Inc.

- Camfil AB

- CECO Environmental Corp.

- CPE Filters Inc.

- Daikin Industries Ltd.

- Dynavac India Pvt. Ltd.