Global Automotive Test Equipment Market Size, Share, Growth Analysis By Product (Chassis Dynamometer, Engine Dynamometer, Wheel Alignment Tester, Vehicle Emission Test System, Others), By Advanced Technology Type (EV and Battery Testing, ADAS Testing, ECU Testing, Data Logger System), By Vehicle (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle), By Application (PC/Laptop-Based Scan Tool, Handheld Scan Tool, Mobile Device-Based Scan Tool), By End User (OEM R&D Centers, Tier 1 Suppliers, Independent Test Labs, Vehicle Inspection Centers, Aftermarket Service Shops), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176430

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

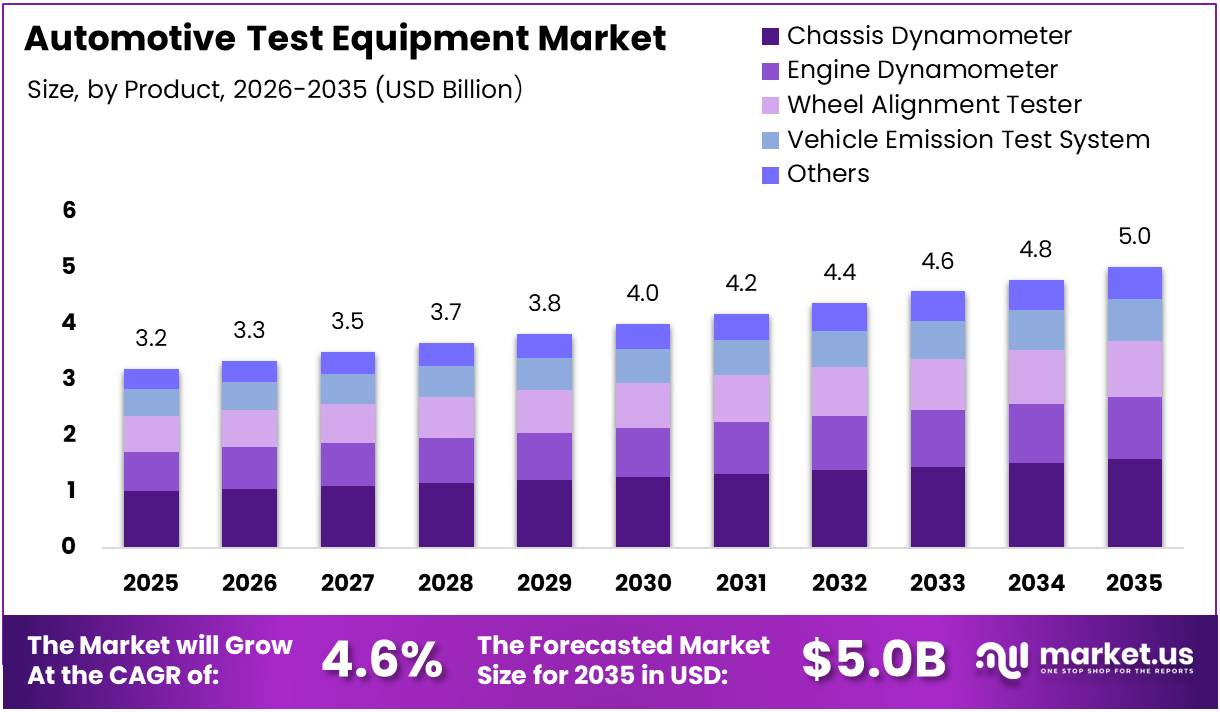

The Global Automotive Test Equipment Market size is expected to be worth around USD 5.0 Billion by 2035 from USD 3.2 Billion in 2025, growing at a CAGR of 4.6% during the forecast period 2026 to 2035.

The Automotive Test Equipment Market encompasses sophisticated diagnostic and measurement instruments used to evaluate vehicle performance, safety, and compliance standards. These systems test various automotive components including engines, chassis, emissions, batteries, and electronic control units throughout vehicle development and production lifecycles.

Modern vehicles integrate numerous complex electronic systems requiring comprehensive validation. Consequently, automotive manufacturers and testing facilities rely heavily on advanced equipment to ensure quality assurance, regulatory compliance, and optimal performance across diverse vehicle platforms and emerging technologies.

The market experiences robust growth driven by evolving automotive technologies and stringent safety regulations. Moreover, the transition toward electric vehicles and autonomous driving systems creates substantial demand for specialized testing capabilities that can validate innovative powertrain architectures and advanced driver-assistance features.

Government agencies worldwide enforce increasingly strict emission standards and safety protocols. Therefore, original equipment manufacturers and tier suppliers must invest in cutting-edge test equipment to meet certification requirements and maintain competitive advantages in global markets while ensuring consumer safety and environmental protection.

According to ResearchGate, advanced multi-sensor fusion testing combining voltage, temperature, and pressure data reduces State of Charge estimation errors by up to 40% compared to single-sensor testing approaches. Additionally, according to arXiv, multi-view camera inspection systems achieve approximately 93% verification accuracy with 86% defect-detection recall, processing about 3.3 vehicles per minute.

According to AutocarPro, software-defined test systems for automotive reduce configuration and test timelines by up to approximately 60%, accelerating diagnostic workflows and coverage across complex subsystems. This demonstrates how technological advancement enhances testing efficiency and accuracy throughout automotive development cycles.

The industry witnesses significant opportunities in electric vehicle testing infrastructure and autonomous vehicle validation. Furthermore, cloud-connected diagnostic platforms and AI-enabled testing solutions represent transformative trends reshaping traditional automotive quality assurance processes and enabling remote monitoring capabilities across global manufacturing networks.

Key Takeaways

- Global Automotive Test Equipment Market projected to reach USD 5.0 Billion by 2035 from USD 3.2 Billion in 2025

- Market growing at CAGR of 4.6% during forecast period 2026-2035

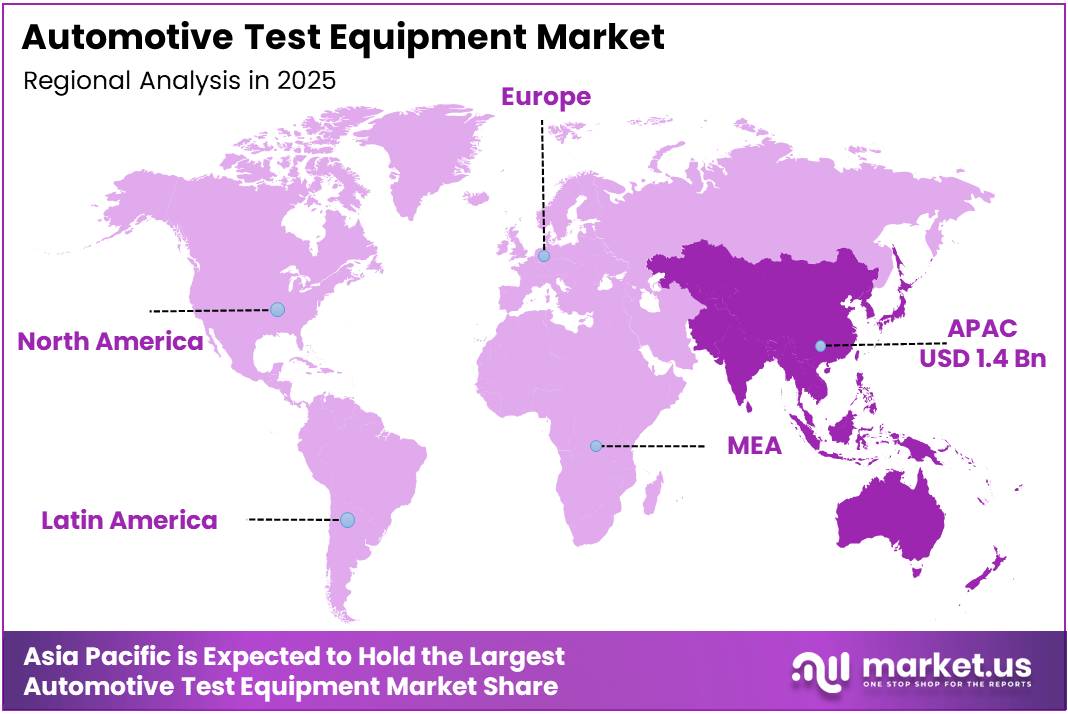

- Asia Pacific dominates with 43.80% market share, valued at USD 1.4 Billion

- Chassis Dynamometer segment leads By Product category with 31.6% share

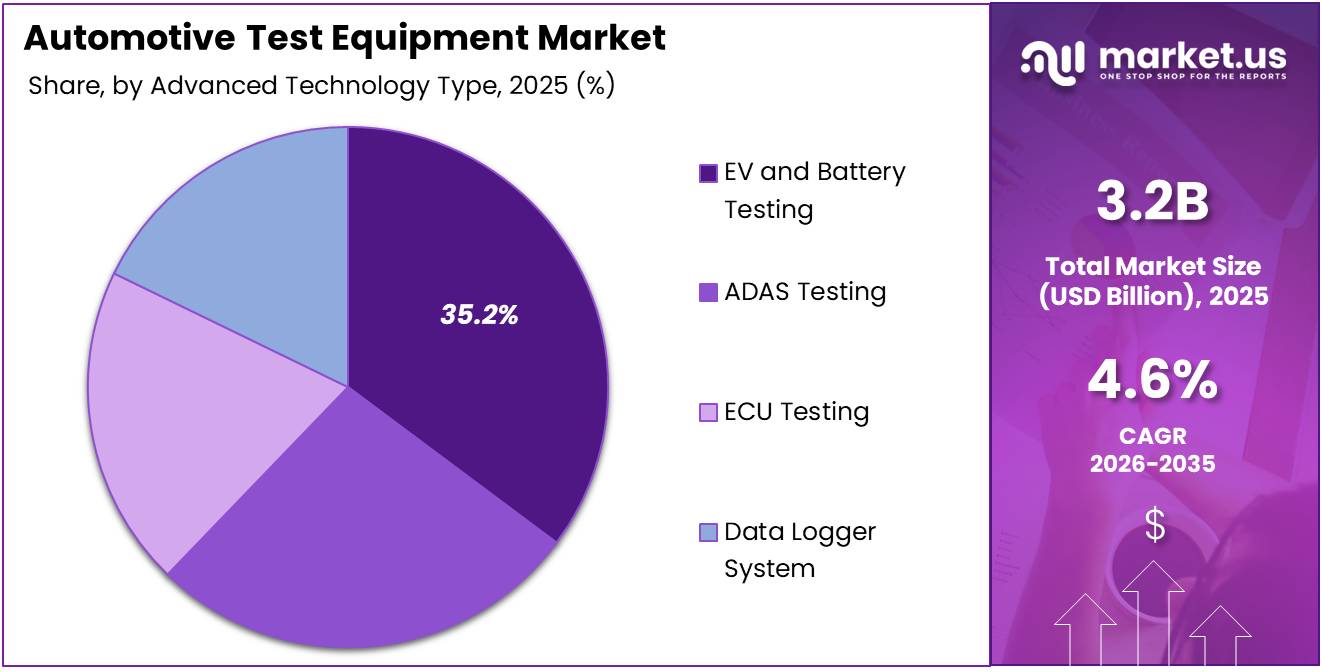

- EV and Battery Testing dominates Advanced Technology Type segment at 35.2%

- Passenger Vehicle segment holds 67.1% share in By Vehicle category

- PC/Laptop-Based Scan Tool leads Application segment with 41.8% market share

- OEM R&D Centers dominate End User segment holding 34.4% share

Product Analysis

Chassis Dynamometer dominates with 31.6% due to comprehensive vehicle performance testing capabilities.

In 2025, Chassis Dynamometer held a dominant market position in the By Product segment of Automotive Test Equipment Market, with a 31.6% share. This equipment simulates real-world driving conditions while measuring power output, fuel efficiency, and emission levels. Consequently, automotive manufacturers utilize chassis dynamometers extensively for certification testing and research development applications.

Engine Dynamometer systems provide critical measurements for powertrain development and validation processes. These instruments test engine performance under controlled laboratory conditions, enabling engineers to optimize combustion efficiency and durability. Moreover, engine dynamometers support hybrid and electric powertrain testing requirements across diverse vehicle platforms.

Wheel Alignment Tester equipment ensures precise suspension geometry and tire positioning accuracy. These systems improve vehicle handling characteristics, reduce tire wear, and enhance fuel economy through proper alignment calibration. Therefore, automotive service centers and manufacturing facilities depend on advanced wheel alignment technology for quality assurance.

Vehicle Emission Test System measures pollutant output compliance with environmental regulations worldwide. These sophisticated instruments analyze exhaust gases to verify adherence to emission standards across different driving cycles. Additionally, emission testing equipment supports electric vehicle validation by monitoring battery efficiency and overall environmental impact.

Others category encompasses specialized testing equipment including torque measurement systems, fuel consumption analyzers, and noise-vibration-harshness testing instruments. These diverse tools address specific validation requirements across automotive development and production processes. Furthermore, this segment includes emerging testing technologies supporting connected vehicle features and advanced diagnostic capabilities.

Advanced Technology Type Analysis

EV and Battery Testing dominates with 35.2% due to accelerating electric vehicle adoption globally.

In 2025, EV and Battery Testing held a dominant market position in the By Advanced Technology Type segment of Automotive Test Equipment Market, with a 35.2% share. This segment encompasses battery performance validation, thermal management testing, and charging system verification. Consequently, automotive manufacturers prioritize battery testing infrastructure to ensure safety and reliability standards.

ADAS Testing equipment validates advanced driver-assistance system functionality including collision avoidance and lane-keeping capabilities. These sophisticated platforms test sensor accuracy, software algorithms, and system integration across various driving scenarios. Moreover, ADAS testing supports autonomous vehicle development by ensuring reliable performance under diverse environmental conditions.

ECU Testing systems verify electronic control unit functionality and software integrity throughout vehicle development cycles. These instruments test communication protocols, signal processing, and fault diagnostics across multiple automotive subsystems. Additionally, ECU testing equipment enables over-the-air update validation and cybersecurity assessment for connected vehicle platforms.

Data Logger System captures real-time vehicle performance data during testing and development processes. These instruments record multiple parameters simultaneously, enabling comprehensive analysis of vehicle behavior and system interactions. Therefore, data loggers provide essential insights for optimizing vehicle performance and identifying potential reliability issues.

Vehicle Analysis

Passenger Vehicle dominates with 67.1% due to high production volumes and consumer market demand.

In 2025, Passenger Vehicle held a dominant market position in the By Vehicle segment of Automotive Test Equipment Market, with a 67.1% share. This category encompasses sedans, SUVs, and hatchbacks requiring extensive testing for safety, emissions, and performance standards. Consequently, automotive manufacturers invest significantly in passenger vehicle testing infrastructure to meet consumer expectations and regulatory requirements.

Light Commercial Vehicle segment requires specialized testing equipment for cargo capacity and durability validation. These vehicles undergo rigorous assessments for payload handling, fuel efficiency, and operational reliability under commercial usage conditions. Moreover, light commercial vehicles incorporate advanced telematics and fleet management systems requiring comprehensive electronic validation.

Heavy Commercial Vehicle testing focuses on powertrain durability, braking performance, and safety system verification. These large vehicles demand robust testing infrastructure capable of handling substantial weight and power requirements. Additionally, heavy commercial vehicles increasingly adopt electrification technologies, creating new testing demands for battery systems and electric drivetrains.

Application Analysis

PC/Laptop-Based Scan Tool dominates with 41.8% due to advanced diagnostic capabilities and versatility.

In 2025, PC/Laptop-Based Scan Tool held a dominant market position in the By Application segment of Automotive Test Equipment Market, with a 41.8% share. These sophisticated systems offer comprehensive diagnostic functionality with extensive vehicle coverage and real-time data analysis capabilities. Consequently, professional service centers and research facilities prefer PC-based tools for complex troubleshooting and calibration tasks.

Handheld Scan Tool provides portable diagnostic solutions for quick fault identification and basic system checks. These compact devices offer essential functionality for routine maintenance and on-site vehicle diagnostics. Moreover, handheld tools deliver cost-effective solutions for independent repair shops and mobile service operations requiring flexible diagnostic capabilities.

Mobile Device-Based Scan Tool leverages smartphone and tablet platforms for convenient automotive diagnostics. These applications provide wireless connectivity and user-friendly interfaces for basic vehicle health monitoring. Additionally, mobile-based tools integrate cloud connectivity, enabling remote diagnostics and over-the-air software updates for enhanced service efficiency.

End User Analysis

OEM R&D Centers dominate with 34.4% due to extensive vehicle development and validation requirements.

In 2025, OEM R&D Centers held a dominant market position in the By End User segment of Automotive Test Equipment Market, with a 34.4% share. These facilities conduct comprehensive testing throughout vehicle development cycles, from prototype validation to production certification. Consequently, OEM research centers invest heavily in advanced testing infrastructure to accelerate innovation and ensure product quality.

Tier 1 Suppliers require sophisticated test equipment to validate component performance before delivering to automotive manufacturers. These suppliers conduct extensive quality assurance testing to meet stringent OEM specifications and industry standards. Moreover, tier suppliers support co-development activities requiring advanced testing capabilities for integrated system validation.

Independent Test Labs provide third-party certification and compliance testing services for automotive manufacturers worldwide. These facilities offer specialized expertise and accredited testing capabilities for regulatory approval and market access. Additionally, independent labs support homologation requirements across different global markets and certification standards.

Vehicle Inspection Centers utilize diagnostic equipment for periodic safety and emission compliance verification. These facilities ensure vehicles meet mandatory roadworthiness standards throughout their operational lifecycle. Therefore, inspection centers require reliable and standardized testing equipment for consistent evaluation across diverse vehicle types.

Aftermarket Service Shops depend on diagnostic tools for routine maintenance, repair diagnostics, and component replacement verification. These facilities serve end consumers requiring cost-effective solutions for vehicle servicing and troubleshooting. Furthermore, aftermarket shops increasingly adopt advanced scanning tools to service modern vehicles with complex electronic systems.

Key Market Segments

By Product

- Chassis Dynamometer

- Engine Dynamometer

- Wheel Alignment Tester

- Vehicle Emission Test System

- Others

By Advanced Technology Type

- EV and Battery Testing

- ADAS Testing

- ECU Testing

- Data Logger System

By Vehicle

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Application

- PC/Laptop-Based Scan Tool

- Handheld Scan Tool

- Mobile Device-Based Scan Tool

By End User

- OEM R&D Centers

- Tier 1 Suppliers

- Independent Test Labs

- Vehicle Inspection Centers

- Aftermarket Service Shops

Drivers

Rising Complexity of Electronic Control Units (ECUs) Across Modern Vehicles

Modern vehicles incorporate numerous electronic control units managing engine performance, safety systems, and infotainment functionality. Consequently, automotive manufacturers require sophisticated testing equipment capable of validating ECU communication protocols and software integrity across interconnected systems. This complexity drives demand for advanced diagnostic tools.

The proliferation of connected vehicle technologies introduces additional testing requirements for cybersecurity and over-the-air update validation. Moreover, ECUs manage critical safety functions including braking, steering, and collision avoidance systems requiring rigorous testing protocols. Therefore, comprehensive ECU testing infrastructure becomes essential for ensuring vehicle reliability and consumer safety.

Automotive suppliers invest significantly in test equipment to verify ECU performance under diverse operating conditions and environmental scenarios. Additionally, the transition toward software-defined vehicles amplifies testing complexity as manufacturers integrate cloud connectivity and autonomous driving capabilities. This technological evolution continuously expands testing equipment market opportunities.

Restraints

Long Implementation and Calibration Cycles for Advanced Testing Systems

Advanced automotive test equipment requires extensive installation, integration, and calibration procedures before achieving operational readiness. Consequently, manufacturers face significant time investments and potential production delays when implementing new testing infrastructure. This lengthy setup process creates barriers for rapid technology adoption and market expansion.

Specialized technical expertise is necessary to configure and maintain sophisticated testing platforms across diverse vehicle architectures. Moreover, calibration requirements vary significantly between different vehicle types, powertrain configurations, and testing applications. Therefore, automotive facilities must allocate substantial resources for training personnel and establishing standardized testing procedures.

Short product lifecycles due to rapid automotive technology evolution compound implementation challenges as testing equipment becomes outdated quickly. Additionally, continuous software updates and hardware modifications require ongoing calibration adjustments and validation processes. This dynamic environment increases total cost of ownership and complicates long-term investment planning.

Growth Factors

Expansion of Testing Demand for Electric and Hybrid Powertrain Systems

Electric vehicle adoption accelerates globally, creating substantial demand for specialized battery testing and thermal management validation equipment. Consequently, automotive manufacturers invest heavily in infrastructure capable of evaluating battery performance, charging efficiency, and safety characteristics. This transition represents significant growth opportunities for testing equipment providers.

Hybrid powertrain systems require comprehensive testing of both electric and combustion components along with their integrated operation. Moreover, battery degradation analysis and lifecycle testing become critical for ensuring warranty compliance and customer satisfaction. Therefore, specialized testing capabilities for electric drivetrains expand rapidly across manufacturing and research facilities.

Growing need for software, firmware, and over-the-air validation tools drives investment in advanced testing platforms. Additionally, increasing investments in autonomous vehicle testing infrastructure support market expansion as manufacturers develop self-driving capabilities. These emerging technologies create continuous demand for innovative testing solutions and validation methodologies.

Emerging Trends

Shift Toward Automated and AI-Enabled Automotive Testing Solutions

Artificial intelligence integration enhances testing efficiency by automating defect detection and pattern recognition across complex vehicle systems. Consequently, manufacturers adopt AI-enabled platforms to reduce testing time while improving diagnostic accuracy and consistency. This technological advancement transforms traditional manual testing processes into intelligent automated workflows.

Hardware-in-the-Loop and simulation-based testing methodologies enable virtual validation before physical prototype development. Moreover, these approaches reduce development costs and accelerate time-to-market by identifying design issues earlier in development cycles. Therefore, simulation technologies become increasingly prevalent across automotive research and development facilities.

Cloud-connected and remote diagnostic test platforms enable distributed testing capabilities across global manufacturing networks. Additionally, these systems facilitate real-time data sharing, collaborative analysis, and centralized monitoring of testing operations worldwide. This connectivity trend supports flexible testing architectures and improves resource utilization across automotive organizations.

Regional Analysis

Asia Pacific Dominates the Automotive Test Equipment Market with a Market Share of 43.80%, Valued at USD 1.4 Billion

Asia Pacific leads the global market driven by extensive automotive manufacturing presence across China, Japan, South Korea, and India. The region holds 43.80% market share valued at USD 1.4 Billion, supported by robust vehicle production volumes and increasing electrification adoption. Moreover, government initiatives promoting electric mobility and stringent emission regulations accelerate testing equipment investments throughout the region.

North America Automotive Test Equipment Market Trends

North America demonstrates strong market growth supported by advanced automotive research facilities and early adoption of autonomous vehicle technologies. The region prioritizes safety testing and ADAS validation, driving demand for sophisticated diagnostic equipment. Additionally, established automotive manufacturers maintain extensive testing infrastructure across the United States and Canada for quality assurance and regulatory compliance.

Europe Automotive Test Equipment Market Trends

Europe exhibits significant market activity driven by stringent environmental regulations and automotive innovation leadership. The region emphasizes emission testing and electrification validation across Germany, France, and the United Kingdom. Furthermore, European automotive suppliers invest heavily in advanced testing capabilities to maintain competitive advantages in global markets and support sustainability objectives.

Latin America Automotive Test Equipment Market Trends

Latin America shows moderate growth potential supported by expanding automotive manufacturing operations in Brazil and Mexico. The region focuses on cost-effective testing solutions for production quality assurance and regulatory compliance. Moreover, increasing vehicle ownership and aftermarket service demand create opportunities for diagnostic equipment adoption across the region.

Middle East & Africa Automotive Test Equipment Market Trends

Middle East and Africa represent emerging markets with growing automotive testing requirements driven by vehicle inspection regulations and service infrastructure development. The region prioritizes emission testing and safety compliance validation across GCC countries and South Africa. Additionally, automotive import regulations stimulate demand for certification testing capabilities throughout the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Robert Bosch GmbH maintains global leadership in automotive testing solutions through comprehensive product portfolios spanning diagnostic tools and test systems. The company leverages extensive automotive expertise to develop innovative testing equipment supporting traditional powertrains and emerging electric vehicle technologies. Moreover, Bosch integrates advanced software capabilities enabling cloud connectivity and remote diagnostic functionalities across its testing platforms.

Siemens delivers sophisticated test automation and simulation solutions for automotive manufacturers worldwide. The company provides integrated testing infrastructure combining hardware-in-the-loop systems with advanced software platforms for comprehensive vehicle validation. Additionally, Siemens expands its capabilities through strategic acquisitions, enhancing PCB test engineering solutions and strengthening its position in automotive electronics testing markets.

Delphi Technologies specializes in powertrain testing equipment and diagnostic solutions for modern vehicle systems. The company focuses on electrification testing capabilities supporting hybrid and electric vehicle development requirements. Furthermore, Delphi Technologies develops advanced sensors and measurement instruments enabling precise validation of complex automotive subsystems throughout development and production processes.

Continental AG offers comprehensive automotive testing solutions leveraging its extensive experience in vehicle systems and components manufacturing. The company develops specialized equipment for ADAS validation, battery testing, and electronic control unit diagnostics. Moreover, Continental integrates testing capabilities with its component development activities, providing holistic solutions for automotive manufacturers seeking integrated validation approaches.

Key Players

- Robert Bosch GmbH

- Siemens

- Delphi Technologies

- Continental AG

- Honeywell International Inc

- ABB

- Softing AG

- HORIBA

- SGS Société Générale de Surveillance SA

- Anthony Best Dynamics Limited

Recent Developments

- January 2026 – Siemens acquires ASTER Technologies to deliver industry-leading PCB test engineering solutions, expanding its automotive electronics testing capabilities and strengthening its position in advanced semiconductor validation markets for next-generation vehicle systems.

- December 2025 – ALEE and the ThyssenKrupp Automotive Systems Test Center joined forces to provide vehicle manufacturers and suppliers with expanded testing and homologation services focused on durability testing for components and systems across European markets.

- September 2025 – DEKRA grows automotive wireless testing capabilities with acquisition of Wireless Approval Consultants, enhancing its ability to validate connected vehicle technologies and V2X communication systems for automotive manufacturers worldwide.

- February 2025 – Teradyne, a US-based automated test equipment supplier, entered into strategic partnership with German semiconductor manufacturer Infineon Technologies to advance power semiconductor testing for electric vehicle applications and charging infrastructure.

Report Scope

Report Features Description Market Value (2025) USD 3.2 Billion Forecast Revenue (2035) USD 5.0 Billion CAGR (2026-2035) 4.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Chassis Dynamometer, Engine Dynamometer, Wheel Alignment Tester, Vehicle Emission Test System, Others), By Advanced Technology Type (EV and Battery Testing, ADAS Testing, ECU Testing, Data Logger System), By Vehicle (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle), By Application (PC/Laptop-Based Scan Tool, Handheld Scan Tool, Mobile Device-Based Scan Tool), By End User (OEM R&D Centers, Tier 1 Suppliers, Independent Test Labs, Vehicle Inspection Centers, Aftermarket Service Shops) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Siemens, Delphi Technologies, Continental AG, Honeywell International Inc, ABB, Softing AG, HORIBA, SGS Société Générale de Surveillance SA, Anthony Best Dynamics Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Test Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Test Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Siemens

- Delphi Technologies

- Continental AG

- Honeywell International Inc

- ABB

- Softing AG

- HORIBA

- SGS Société Générale de Surveillance SA

- Anthony Best Dynamics Limited