Global Automotive Interior Materials Market Size, Share, Growth Analysis By Product (Plastic, Leather, Composite, Metals, Fabric), By Vehicle Type (Passenger, LCV, HCV), By Application (Seats, Dashboard, Airbags & Seat belts, Door Panel & Trims, Carpet and Headliners, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173291

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

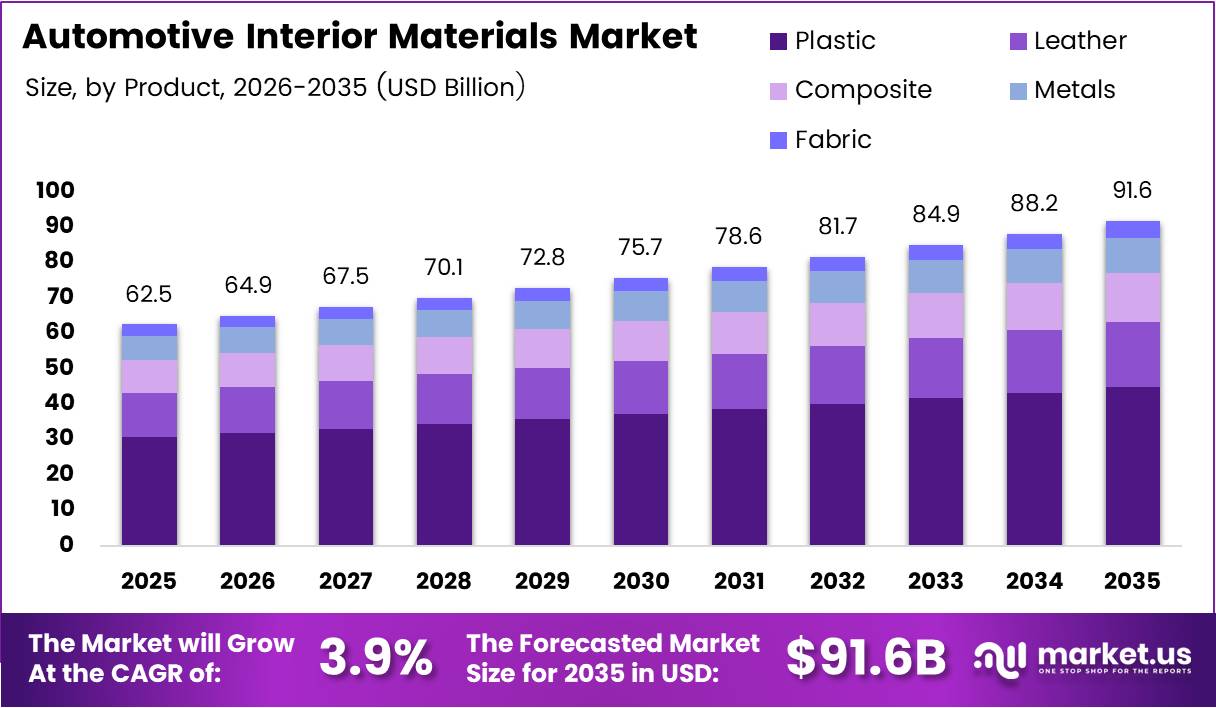

The Global Automotive Interior Materials Market size is expected to be worth around USD 91.6 Billion by 2035 from USD 62.5 Billion in 2025, growing at a CAGR of 3.90% during the forecast period 2026 to 2035.

The automotive interior materials market represents a critical segment within the global automotive manufacturing ecosystem. This market encompasses various materials including plastics, leather, composites, metals, and fabrics used across vehicle interiors. These materials serve functional and aesthetic purposes in seats, dashboards, door panels, and other cabin components.

Currently, the market demonstrates robust expansion driven by evolving consumer preferences and regulatory pressures. Manufacturers increasingly prioritize lightweight materials that enhance fuel efficiency while maintaining safety standards. The shift toward electric vehicles further accelerates demand for specialized thermal and acoustic materials that address unique EV cabin requirements.

Consumer expectations continue reshaping material selection criteria significantly. Modern buyers seek premium finishes, enhanced comfort, and sustainable options in vehicle interiors. This trend particularly influences material innovation cycles and supplier partnerships across the automotive value chain.

Regulatory frameworks play a pivotal role in market evolution. Stringent safety and flammability standards mandate advanced material adoption across vehicle categories. These regulations drive continuous investment in research and development activities among material suppliers and automotive OEMs.

The market benefits from rising vehicle production volumes globally. Emerging economies contribute substantially to this growth trajectory, expanding manufacturing capacities and consumer bases. Asia Pacific leads this expansion, representing significant market opportunities for interior material suppliers.

Sustainability initiatives increasingly influence material procurement strategies. Automotive manufacturers progressively adopt bio-based and recycled materials to meet environmental mandates. According to the European Commission, plastics and polymer-based materials account for 14-18% of total vehicle mass in standard European road vehicles.

Consumer research reveals changing priorities in vehicle purchasing decisions. According to Asahi Kasei’s global survey, 56% of U.S. car buyers emphasize interior cleanliness highly, valuing it more than connectivity and personalization features. This insight underscores the growing importance of hygiene-focused material solutions in automotive interiors.

Key Takeaways

- Global Automotive Interior Materials Market valued at USD 62.5 Billion in 2025, projected to reach USD 91.6 Billion by 2035 at 3.90% CAGR

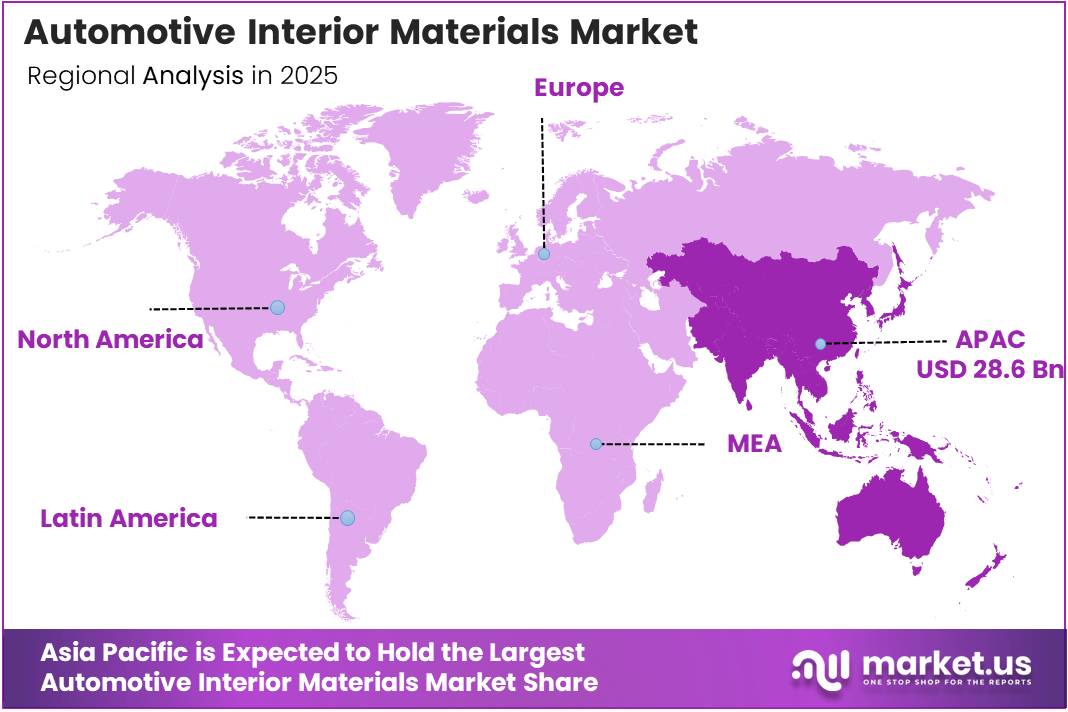

- Asia Pacific dominates with 45.80% market share, valued at USD 28.6 Billion

- Plastic segment leads product category with 39.2% market share

- Passenger vehicles account for 78.7% of vehicle type segment

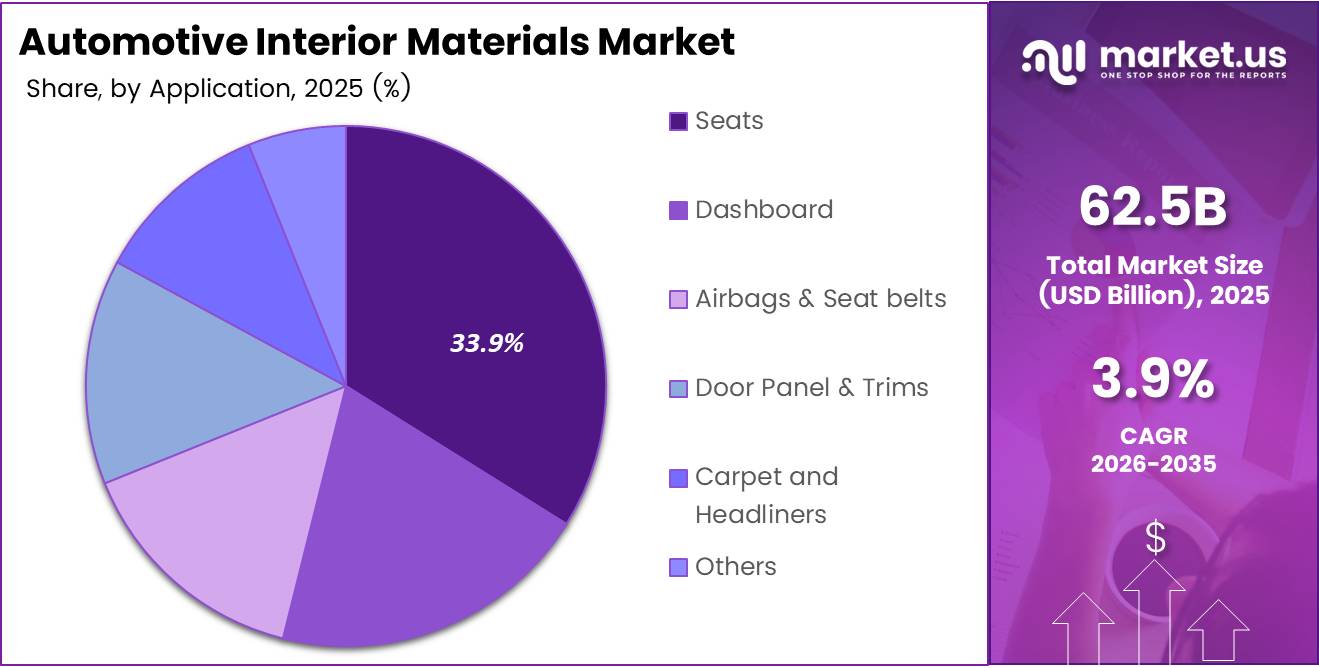

- Seats application holds largest share at 33.9% of total market

Product Analysis

Plastic dominates with 39.2% due to its cost-effectiveness, lightweight properties, and design flexibility.

In 2025, Plastic held a dominant market position in the By Product Analysis segment of Automotive Interior Materials Market, with a 39.2% share. Plastics offer exceptional versatility across multiple interior applications including dashboards, door panels, and trim components. Their moldability enables complex geometric designs while maintaining structural integrity. Additionally, plastics contribute significantly to vehicle weight reduction initiatives, directly impacting fuel efficiency targets.

Leather represents the premium segment within automotive interior materials, commanding strong demand in luxury and high-end vehicle categories. This material provides superior tactile experience and aesthetic appeal, particularly in seating and steering wheel applications. Manufacturers increasingly explore vegan leather alternatives responding to sustainability concerns and animal welfare considerations.

Composite materials gain traction through their enhanced performance characteristics combining multiple material properties. These engineered solutions deliver improved strength-to-weight ratios compared to traditional materials. Composites find applications in structural interior components requiring durability alongside weight optimization.

Metals serve specific functional requirements in automotive interiors, particularly for structural support and decorative accents. While representing smaller volumes, metals remain essential for safety-critical components and premium finishes. Aluminum and specialized alloys increasingly replace heavier metals supporting lightweighting objectives.

Fabric materials address comfort and aesthetic requirements across seating and soft trim applications. Advanced textile technologies enable improved stain resistance, durability, and thermal management properties. Sustainable fabric options incorporating recycled fibers experience growing adoption aligned with environmental commitments.

Vehicle Type Analysis

Passenger vehicles dominate with 78.7% driven by high production volumes and diverse model offerings globally.

In 2025, Passenger vehicles held a dominant market position in the By Vehicle Type Analysis segment of Automotive Interior Materials Market, with a 78.7% share. This segment encompasses sedans, hatchbacks, SUVs, and crossovers serving personal transportation needs. The passenger vehicle category drives substantial material consumption through sheer production scale and increasing content per vehicle. Premium features proliferate across mass-market segments, elevating material quality requirements and specifications.

Light Commercial Vehicles (LCV) represent an important growth segment within automotive interior materials market. These vehicles balance functionality with driver comfort requirements for extended operational periods. Material selections prioritize durability and ease of maintenance while incorporating comfort features. The expanding e-commerce and last-mile delivery sectors boost LCV demand significantly.

Heavy Commercial Vehicles (HCV) focus on durability and functional performance over aesthetic considerations in interior material selection. These applications demand materials withstanding intensive use and harsh operating conditions. However, driver comfort receives increased attention as regulations address operator welfare and retention challenges in commercial transportation.

Application Analysis

Seats dominate with 33.9% as they require substantial material quantities and directly impact passenger comfort.

In 2025, Seats held a dominant market position in the By Application Analysis segment of Automotive Interior Materials Market, with a 33.9% share. Seating systems consume diverse materials including foams, fabrics, leathers, and structural components. This application directly influences perceived vehicle quality and occupant satisfaction levels. Advanced seating technologies integrate heating, cooling, and massage functions requiring specialized material properties.

Dashboard applications showcase material innovation combining aesthetic appeal with functional requirements. These components integrate numerous systems including instrumentation, infotainment, and climate control interfaces. Material selections must address thermal stability, UV resistance, and low volatile organic compound emissions. Soft-touch surfaces increasingly replace hard plastics enhancing premium perception.

Airbags and seat belts represent safety-critical applications requiring materials meeting stringent regulatory standards. These systems demand materials maintaining performance integrity across temperature extremes and extended service life. Continuous innovation focuses on lighter materials without compromising protective capabilities.

Door panels and trims combine structural and aesthetic functions utilizing multiple material types. These components contribute significantly to interior ambiance through surface finishes and integrated features. Weight reduction initiatives drive adoption of lightweight composites and advanced polymers in door panel construction.

Carpet and headliners address acoustic management and aesthetic requirements within vehicle cabins. These applications utilize materials providing sound absorption, thermal insulation, and visual appeal. Sustainable alternatives incorporating recycled content gain market acceptance without sacrificing performance characteristics.

Others category encompasses various interior components including consoles, pillars, and small trim pieces. These applications collectively represent significant material volumes despite individual component sizes. Innovation in these areas focuses on integration, modularity, and cost optimization.

Key Market Segments

By Product

- Plastic

- Leather

- Composite

- Metals

- Fabric

By Vehicle Type

- Passenger

- LCV

- HCV

By Application

- Seats

- Dashboard

- Airbags & Seat belts

- Door Panel & Trims

- Carpet and Headliners

- Others

Drivers

Stringent Vehicle Safety and Flammability Regulations Driving Advanced Interior Material Adoption

Regulatory frameworks worldwide mandate strict compliance with safety and flammability standards for automotive interior materials. These requirements compel manufacturers to invest in advanced materials meeting enhanced performance criteria. Testing protocols continuously evolve, addressing emerging safety concerns and technological capabilities.

Consumer demand for premium and comfortable cabin environments significantly influences material selection strategies. Modern buyers expect superior tactile experiences, aesthetic quality, and personalized interior atmospheres. This trend drives innovation in surface finishes, texture variations, and customization options across vehicle segments.

Global vehicle production growth directly correlates with automotive interior materials consumption patterns. Expanding manufacturing footprints in emerging markets create substantial demand for diverse material types. Both passenger and commercial vehicle segments contribute to this production volume expansion.

OEM light weighting initiatives prioritize materials delivering weight reduction without compromising safety or functionality. Fuel efficiency regulations and emission reduction targets make lightweight materials essential. This focus accelerates adoption of advanced polymers, composites, and aluminum alternatives replacing traditional heavier materials.

Restraints

High Cost of Advanced and Sustainable Interior Materials Limiting Mass Adoption

Advanced interior materials command premium pricing compared to conventional alternatives, creating adoption barriers. Bio-based and sustainable options typically involve higher production costs impacting vehicle affordability. Cost-sensitive markets particularly resist premium material specifications despite performance benefits.

Raw material price volatility significantly affects interior component manufacturing economics. Petroleum-based materials experience price fluctuations tied to global energy markets. These variations compress manufacturer margins and complicate long-term pricing strategies.

Supply chain complexities further compound cost challenges in automotive interior materials procurement. Material suppliers face pressure balancing quality requirements with competitive pricing. This dynamic particularly affects smaller manufacturers lacking economies of scale.

Growth Factors

Rapid Penetration of Electric Vehicles Requiring Specialized Thermal and Acoustic Interior Materials

Electric vehicle adoption creates unique material requirements addressing battery thermal management and reduced cabin noise. EV interiors demand enhanced acoustic insulation compensating for absent engine noise masking. Specialized materials address these performance criteria while maintaining weight efficiency.

Sustainability mandates accelerate bio-based and recycled material integration across automotive interior applications. Manufacturers establish circular economy initiatives incorporating post-consumer and post-industrial recycled content. These materials must match virgin material performance while delivering environmental benefits.

Customization and modular interior design trends open new material application opportunities. Consumers increasingly expect personalized cabin environments reflecting individual preferences. This trend supports premium material adoption and diversified product offerings.

Emerging economy automotive production expansion generates substantial material demand growth. Countries including India, Southeast Asian nations, and Latin American markets increase manufacturing capacities. These regions offer significant volume growth potential for interior material suppliers.

Emerging Trends

Accelerated Shift Toward Vegan Leather and Synthetic Upholstery Alternatives

Vegan leather alternatives gain momentum driven by sustainability concerns and animal welfare considerations. These synthetic materials increasingly match traditional leather characteristics in appearance and performance. Major automotive brands commit to leather-free interior options across model ranges.

Smart and functional materials incorporating noise, vibration, and heat control properties reshape interior design possibilities. Advanced polymers integrate multiple performance characteristics reducing component complexity. These materials enable thinner, lighter interior constructions without sacrificing comfort.

Soft-touch surfaces proliferate across mass-market vehicle segments previously featuring hard plastic interiors. This democratization of premium materials enhances perceived quality across price points. Manufacturers leverage advanced coating technologies making soft-touch finishes cost-effective.

OEM and material supplier collaborations intensify focusing on innovative interior solutions. These partnerships accelerate material development cycles and align specifications with design objectives. Joint development programs address specific performance targets and sustainability commitments.

Regional Analysis

Asia Pacific Dominates the Automotive Interior Materials Market with a Market Share of 45.80%, Valued at USD 28.6 Billion

Asia Pacific commands the largest market position driven by massive vehicle production volumes in China, India, Japan, and South Korea. The region houses major automotive manufacturing hubs serving domestic and export markets. Regional material suppliers benefit from proximity to OEM production facilities and cost-competitive manufacturing. The 45.80% market share reflects continuing production expansion and rising domestic consumption. Market value stands at USD 28.6 Billion, underscoring the region’s economic significance in global automotive interior materials sector.

North America Automotive Interior Materials Market Trends

North America maintains strong market presence characterized by premium vehicle segment strength and advanced material adoption. The region emphasizes safety, comfort, and sustainability in interior material specifications. Established automotive heritage and stringent regulatory frameworks drive continuous material innovation. Light vehicle production stability supports consistent material demand despite modest volume growth.

Europe Automotive Interior Materials Market Trends

Europe leads sustainability initiatives in automotive interior materials through circular economy mandates and recycled content requirements. The region hosts premium automotive brands setting global material quality benchmarks. Strict emissions regulations accelerate lightweight material adoption across vehicle categories. European material suppliers pioneer bio-based alternatives and innovative manufacturing processes.

Middle East and Africa Automotive Interior Materials Market Trends

Middle East and Africa represent emerging opportunities with growing automotive assembly operations and consumer markets. The region increasingly attracts international automotive investments establishing local manufacturing presence. Material demand correlates with expanding vehicle production and import activities. Climate considerations influence material specifications addressing extreme temperature performance requirements.

Latin America Automotive Interior Materials Market Trends

Latin America demonstrates steady growth potential driven by Brazil, Mexico, and Argentina’s automotive sectors. The region serves as manufacturing base for domestic consumption and North American exports. Material demand reflects balanced mix of compact, mid-size, and light commercial vehicles. Economic fluctuations periodically impact market growth trajectories and material specification decisions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Interior Materials Company Insights

Lear Corp. maintains prominent positioning within global automotive interior materials and seating systems markets. The company delivers integrated solutions combining seating, electrical distribution, and electronic systems for automotive interiors. Lear’s extensive global footprint and established OEM relationships support consistent market presence. Their focus on innovation addresses evolving vehicle electrification requirements and consumer comfort expectations across vehicle segments.

DRÄXLMAIER Group specializes in premium automotive interior components and electrical systems serving luxury vehicle manufacturers. The company emphasizes craftsmanship and advanced manufacturing technologies in interior material applications. DRÄXLMAIER maintains strong partnerships with European premium automotive brands while expanding global capabilities. Their expertise spans complete interior systems integration including ambient lighting, trim, and wiring harnesses.

Asahi Kasei Corporation brings chemical and materials science expertise to automotive interior applications through advanced polymer and synthetic materials. The company develops innovative solutions addressing hygiene, sustainability, and performance requirements in vehicle cabins. Asahi Kasei’s research capabilities enable material innovations meeting stringent automotive specifications. Their product portfolio includes synthetic leathers, acoustic materials, and specialty fabrics for diverse interior applications.

DK SCHWEIZER focuses on textile and surface materials for automotive interiors providing decorative and functional solutions. The company specializes in innovative fabric technologies, airbag fabrics, and technical textiles. DK SCHWEIZER serves global automotive manufacturers with customized material solutions. Their development activities concentrate on sustainable materials and enhanced performance characteristics for next-generation vehicle interiors.

Key Companies

- Lear Corp.

- DRÄXLMAIER Group

- Asahi Kasei Corporation

- DK SCHWEIZER

- Antolin

- TOYOTA BOSHOKU CORPORATION

- SEIREN CO. LTD.

- FORVIA HELLA

- Yanfeng

- TOYODA GOSEI CO., LTD.

Recent Developments

- December 2025: Inteva Products Strengthens Interiors Position with Acquisition of Portions of International Automotive Components (IAC) Group in Europe. This strategic acquisition expands Inteva’s European manufacturing footprint and interior systems capabilities, enhancing their competitive positioning in the region’s automotive supply chain.

- August 2025: Tata AutoComp expands European presence with acquisition of IAC’s operations in Slovakia. The acquisition enables Tata AutoComp to strengthen its European operations while accessing established manufacturing facilities and customer relationships in Central European automotive markets.

- July 2025: TMG, Haartz JV to build $51M auto interiors plant. This joint venture investment represents significant capacity expansion for automotive interior materials production, addressing growing demand from regional automotive manufacturers and supporting advanced material technologies.

- June 2025: Mutares has completed the acquisition of NBHX Trim Europe from Ningbo Lawrence Automotive Interiors Co., Ltd. This transaction consolidates European interior trim operations under Mutares’ portfolio, creating opportunities for operational synergies and market expansion initiatives.

Report Scope

Report Features Description Market Value (2025) USD 62.5 Billion Forecast Revenue (2035) USD 91.6 Billion CAGR (2026-2035) 3.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Plastic, Leather, Composite, Metals, Fabric), By Vehicle Type (Passenger, LCV, HCV), By Application (Seats, Dashboard, Airbags & Seat belts, Door Panel & Trims, Carpet and Headliners, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lear Corp., DRÄXLMAIER Group, Asahi Kasei Corporation, DK SCHWEIZER, Antolin, TOYOTA BOSHOKU CORPORATION, SEIREN CO. LTD., FORVIA HELLA, Yanfeng, TOYODA GOSEI CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Interior Materials MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Interior Materials MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Lear Corp.

- DRÄXLMAIER Group

- Asahi Kasei Corporation

- DK SCHWEIZER

- Antolin

- TOYOTA BOSHOKU CORPORATION

- SEIREN CO. LTD.

- FORVIA HELLA

- Yanfeng

- TOYODA GOSEI CO., LTD.