Global Automotive Hub Bearing Market Size, Share, Growth Analysis By Type (Ball, Roller, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers, Off-Highway), By Material (Steel, Ceramic & Hybrid, Polymer, Others), By Application (Wheel End, Engine & Turbocharger, Transmission & Driveline, Steering & Suspension, HVAC, Alternator, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177484

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

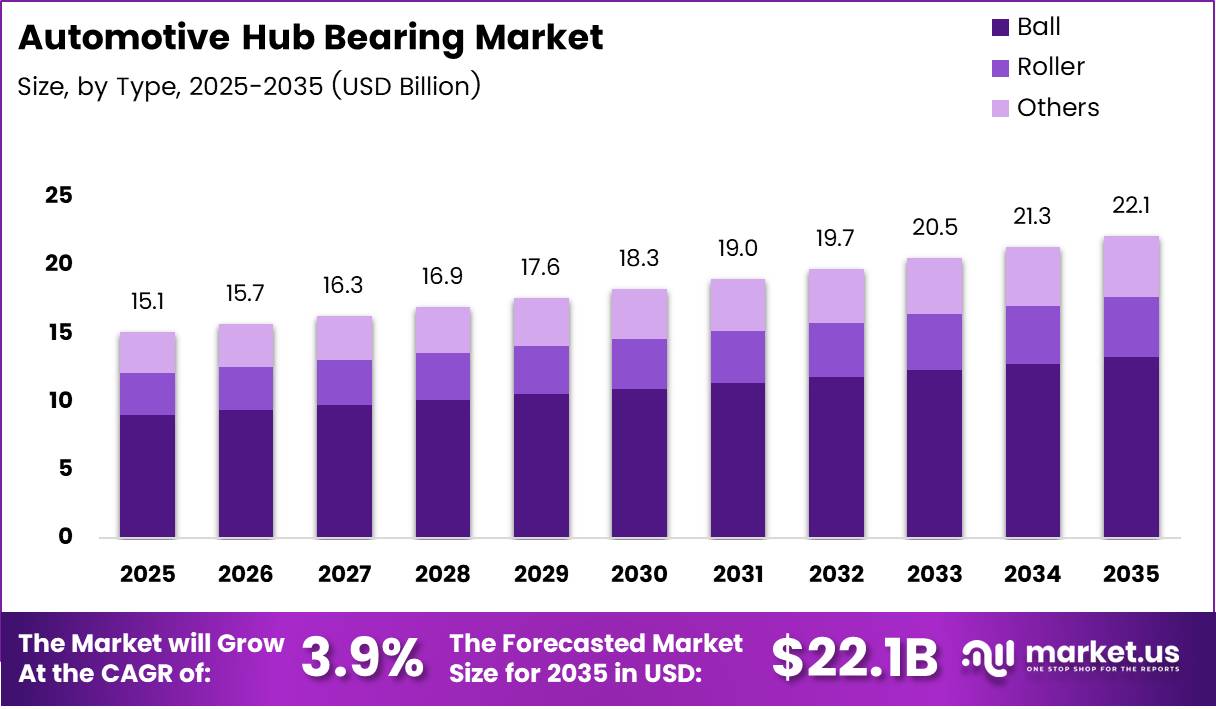

Global Automotive Hub Bearing Market size is expected to be worth around USD 22.1 Billion by 2035 from USD 15.1 Billion in 2025, growing at a CAGR of 3.9% during the forecast period 2026 to 2035.

Automotive hub bearings represent critical wheel-end components that enable smooth vehicle rotation while supporting axial and radial loads. These precision-engineered assemblies integrate rolling elements, races, and sealing systems into compact units. Hub bearings reduce friction between rotating and stationary parts, ensuring optimal vehicle performance and safety.

The automotive hub bearing industry serves diverse vehicle categories including passenger cars, commercial vehicles, two-wheelers, and off-highway equipment. Manufacturers design bearings using materials such as steel, ceramics, and polymers to meet specific application requirements. Additionally, these components play essential roles in wheel-end systems, engines, transmissions, and steering assemblies.

Market expansion reflects rising global vehicle production and increasing passenger car parc across emerging economies. Electric vehicle proliferation drives demand for high-precision integrated hub bearing systems designed for advanced powertrains. Moreover, automotive manufacturers prioritize wheel hub assemblies that improve vehicle stability, reduce noise, and enhance overall safety performance.

Government regulations targeting emission reduction accelerate adoption of low-friction, high-durability bearing solutions that support fuel efficiency goals. OEMs invest in pre-assembled hub bearing units to streamline vehicle assembly processes and improve reliability. Furthermore, the aftermarket segment grows as vehicle aging increases replacement demand for sealed-for-life hub bearings.

In October 2024, SKF launched a next-generation Hub Bearing Unit featuring ball and tapered roller hybrid design, delivering approximately 10% lower weight and 30% friction reduction versus conventional wheel bearings. This development demonstrates ongoing innovation in lightweight, efficient bearing technologies across the automotive sector.

According to NTN Global, AI-enabled hub bearing design reduced performance evaluation analysis time to less than one-tenth of conventional time, achieving approximately 90% faster analysis cycles. This technological advancement enables manufacturers to accelerate product development while optimizing bearing performance characteristics through computational intelligence.

According to NTN Global, low-friction hub bearing technology achieved up to 64% rotational friction reduction and improved electrical efficiency by approximately 0.75% versus conventional products. These performance improvements directly support automotive industry objectives for enhanced energy efficiency and extended electric vehicle driving range across passenger and commercial vehicle segments.

Key Takeaways

- Global Automotive Hub Bearing Market projected to reach USD 22.1 Billion by 2035 from USD 15.1 Billion in 2025 at 3.9% CAGR

- Ball bearings dominate Type segment with 53.8% market share driven by cost-effectiveness and widespread application compatibility

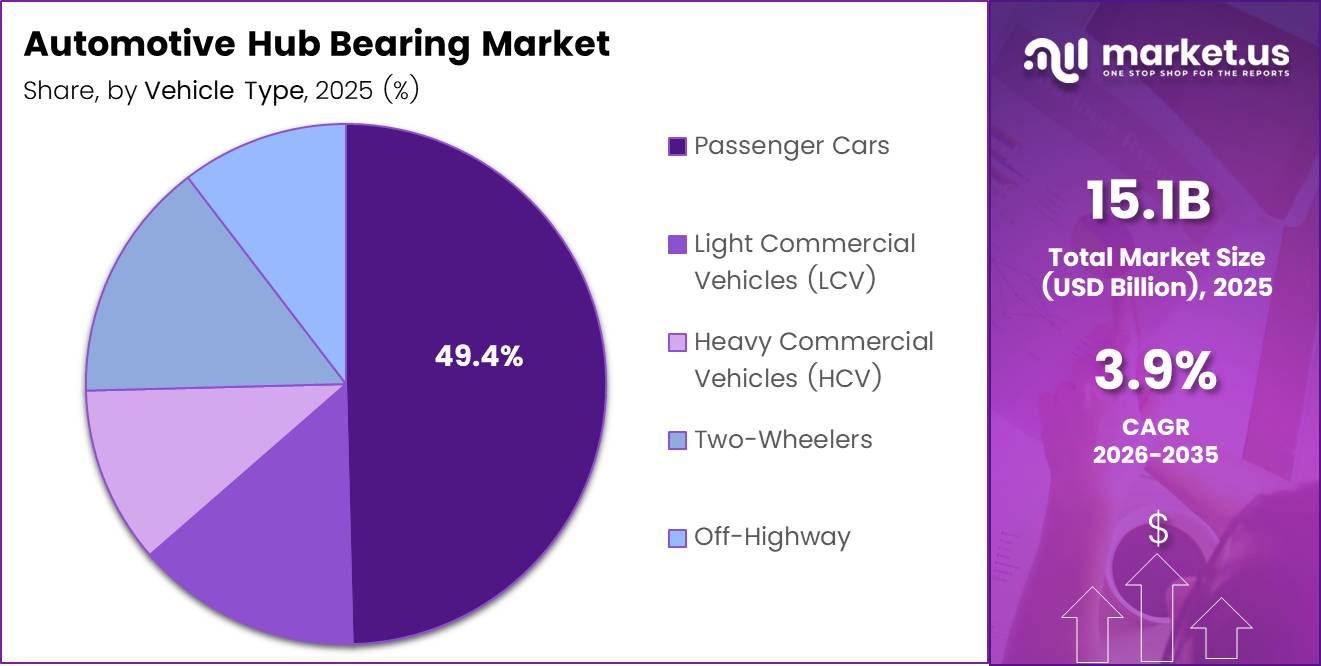

- Passenger Cars lead Vehicle Type segment accounting for 49.6% share due to high production volumes globally

- Steel material holds 67.2% market share reflecting durability requirements and established manufacturing infrastructure

- Wheel End application commands 59.1% share as primary hub bearing installation point in vehicle architecture

- OEM sales channel represents 67.9% of market driven by new vehicle production and integrated assembly processes

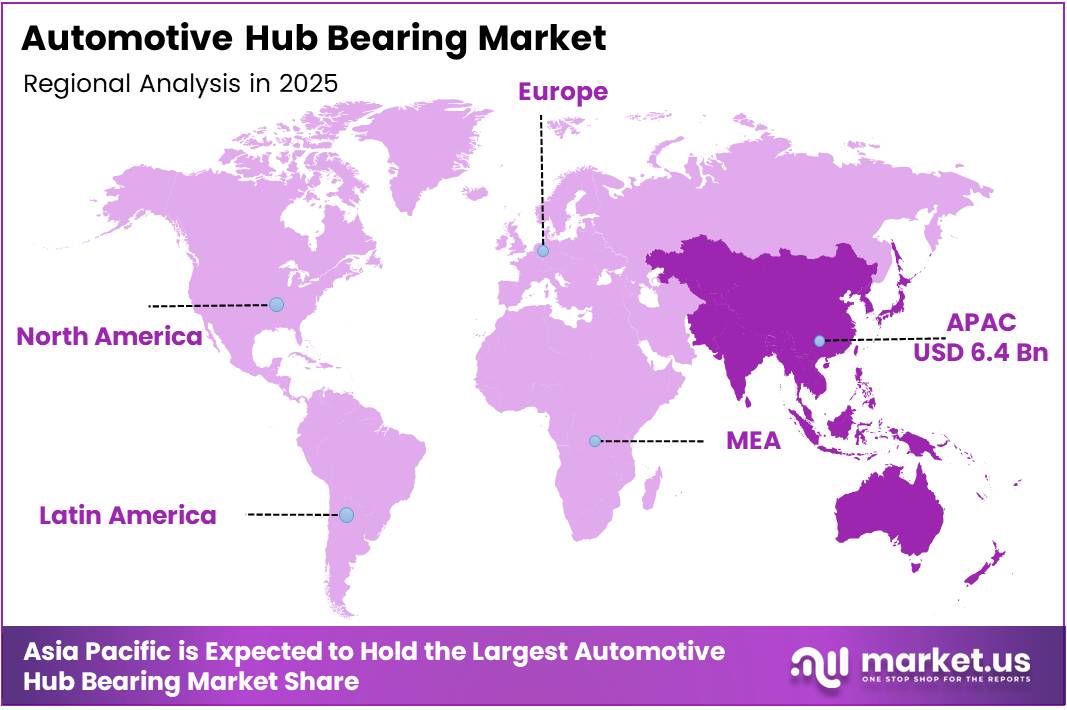

- Asia Pacific dominates regional landscape with 42.70% market share valued at USD 6.4 Billion

Type Analysis

Ball bearings dominate with 53.8% due to superior cost-efficiency and versatile application compatibility across vehicle platforms.

In 2025, Ball bearings held a dominant market position in the By Type segment of Automotive Hub Bearing Market, with a 53.8% share. Ball bearings offer manufacturers economical production costs while delivering reliable performance across passenger and commercial vehicle applications. These components feature simple geometric designs that facilitate mass manufacturing and quality control processes.

Roller bearings serve heavy-duty applications requiring enhanced load-carrying capacity and durability under extreme operating conditions. Commercial vehicles and off-highway equipment frequently utilize roller bearing designs to withstand higher radial forces. Moreover, roller bearings demonstrate superior fatigue resistance in demanding transportation and construction machinery environments where component longevity proves critical.

Others category encompasses specialized bearing designs including tapered, needle, and hybrid configurations for specific vehicle systems. These alternative bearing types address niche applications such as steering systems, differential assemblies, and high-performance vehicle platforms. Consequently, manufacturers continue developing innovative bearing geometries to meet evolving automotive engineering requirements and performance specifications.

Vehicle Type Analysis

Passenger Cars dominate with 49.6% due to high global production volumes and extensive consumer demand across markets.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Hub Bearing Market, with a 49.6% share. Passenger vehicle manufacturing represents the largest automotive production category globally, driving substantial hub bearing consumption. These vehicles require multiple hub bearing units per platform, creating consistent OEM demand patterns across sedan, SUV, and hatchback segments.

Light Commercial Vehicles (LCV) demonstrate growing hub bearing demand driven by e-commerce expansion and last-mile delivery service proliferation. LCVs operate under varied load conditions requiring durable bearing solutions that balance performance and maintenance economy. Additionally, urban logistics growth accelerates LCV fleet expansion, particularly in developing markets with infrastructure development initiatives underway.

Heavy Commercial Vehicles (HCV) require robust hub bearing systems engineered for extreme loads and extended operational lifecycles. These applications demand specialized bearing designs with enhanced sealing and contamination resistance for long-haul transportation environments. Furthermore, HCV manufacturers prioritize bearing reliability to minimize downtime costs and maintain fleet productivity across commercial operations.

Two-Wheelers represent significant hub bearing volume opportunities in Asia Pacific markets where motorcycle and scooter adoption remains prevalent. Two-wheeler hub bearings emphasize compact designs and weight optimization while maintaining adequate load capacity. Moreover, electric two-wheeler market expansion creates new bearing specification requirements for battery-powered mobility platforms.

Off-Highway vehicles encompass construction, agricultural, and mining equipment requiring specialized hub bearing solutions for harsh operating environments. These applications expose bearings to extreme temperatures, contamination, and shock loads necessitating advanced sealing technologies. Consequently, off-highway segment demands premium bearing products with extended service intervals and enhanced durability characteristics.

Material Analysis

Steel dominates with 67.2% due to proven mechanical properties and established manufacturing infrastructure worldwide.

In 2025, Steel held a dominant market position in the By Material segment of Automotive Hub Bearing Market, with a 67.2% share. Steel bearings deliver optimal strength-to-weight ratios and thermal stability required for automotive applications. Manufacturers leverage mature steel metallurgy processes and quality control systems to produce consistent, cost-effective bearing components across global production facilities.

Ceramic & Hybrid bearings gain adoption in premium and performance vehicle segments seeking reduced friction and enhanced efficiency characteristics. These advanced materials offer lower density and superior hardness compared to conventional steel bearing designs. Additionally, ceramic and hybrid bearings demonstrate improved corrosion resistance and thermal performance in extreme operating conditions, justifying higher component costs.

Polymer bearings address specific lightweight applications and corrosion-resistant requirements in select vehicle systems and components. These materials reduce overall vehicle weight while providing adequate performance for lower-load applications. Moreover, polymer bearing solutions offer noise reduction benefits and eliminate lubrication requirements in certain installation environments.

Others material category includes specialty alloys and composite materials developed for niche automotive applications requiring unique property combinations. These alternative materials target specific performance criteria such as extreme temperature resistance or electromagnetic compatibility. Consequently, manufacturers continue researching advanced material formulations to address emerging vehicle technology requirements and regulatory standards.

Application Analysis

Wheel End dominates with 59.1% as primary hub bearing installation location supporting vehicle weight and rotation.

In 2025, Wheel End held a dominant market position in the By Application segment of Automotive Hub Bearing Market, with a 59.1% share. Wheel-end applications represent the largest hub bearing consumption point, with each vehicle requiring multiple units for front and rear axle assemblies. These installations experience continuous rotation and load cycling throughout vehicle operation, driving consistent replacement demand across OEM and aftermarket channels.

Engine & Turbocharger applications utilize specialized bearing designs operating under high temperatures and rotational speeds in powertrain systems. These bearings enable efficient engine component rotation while managing thermal expansion and lubrication challenges. Additionally, turbocharger bearings require advanced materials and cooling strategies to withstand extreme operating conditions in modern forced-induction engines.

Transmission & Driveline bearings support gear mechanisms and shaft assemblies transferring power from engines to drive wheels efficiently. These applications demand bearings with precise tolerances and load distribution capabilities to minimize power losses. Moreover, transmission bearings contribute significantly to overall vehicle efficiency and drivetrain longevity across passenger and commercial vehicle platforms.

Steering & Suspension systems incorporate bearings that enable smooth directional control and absorb road surface irregularities during vehicle operation. These bearings must maintain tight tolerances while accommodating dynamic loads and frequent directional changes. Furthermore, steering and suspension bearings directly influence vehicle handling characteristics and occupant comfort levels.

HVAC, Alternator applications require compact bearing solutions for auxiliary systems supporting vehicle climate control and electrical generation functions. These bearings operate under moderate loads and speeds while contributing to overall system efficiency and reliability. Additionally, HVAC and alternator bearings must deliver quiet operation to maintain acceptable cabin noise levels.

Others category encompasses diverse bearing applications including water pumps, fuel systems, and accessory drives across vehicle platforms. These specialized applications represent smaller volume opportunities but require specific bearing characteristics for optimal system performance. Consequently, manufacturers maintain broad product portfolios to address varied automotive bearing application requirements.

Sales Channel Analysis

OEM dominates with 67.9% driven by new vehicle production and integrated manufacturing assembly processes.

In 2025, OEM held a dominant market position in the By Sales Channel segment of Automotive Hub Bearing Market, with a 67.9% share. Original equipment manufacturer channels represent primary hub bearing distribution routes, supplying components directly to vehicle assembly plants worldwide. OEM relationships ensure bearing specifications align precisely with vehicle design requirements and quality standards established by automotive manufacturers.

Aftermarket channels serve replacement demand from aging vehicle populations requiring hub bearing maintenance and repair services. Independent repair facilities, dealerships, and parts distributors constitute primary aftermarket distribution networks globally. Moreover, aftermarket growth accelerates as vehicle parc expands and older vehicles require component replacement, creating sustainable revenue opportunities for bearing manufacturers and distributors.

Drivers

Rising Global Vehicle Production and Advanced Hub Bearing Technology Adoption Drive Market Expansion

Rising global vehicle production and passenger car parc expansion increase OEM hub bearing demand across automotive manufacturing facilities worldwide. Vehicle production growth in emerging markets creates substantial component supply opportunities for bearing manufacturers. Additionally, increasing vehicle ownership rates in developing economies sustain long-term market growth trajectories as automotive infrastructure expands regionally.

Growing adoption of advanced wheel hub assemblies improves vehicle safety, stability, and noise-vibration-harshness (NVH) performance characteristics across vehicle platforms. Manufacturers integrate sealed hub bearing units that reduce maintenance requirements while enhancing reliability. Moreover, pre-assembled bearing systems streamline vehicle assembly processes, reducing production costs and improving quality control outcomes for automotive OEMs.

According to NSK, new low-friction hub unit bearings achieved approximately 40% friction reduction compared with conventional designs, helping extend EV driving range by approximately 1000 km additional annual driving distance under daily charging use case. According to NSK, lubrication and grease optimization in hub bearings enabled up to 30% friction reduction while maintaining reliability, supporting automotive industry efficiency objectives and emission reduction targets.

Restraints

Raw Material Price Volatility and Integration Complexity Challenge Market Profitability and Adoption

Volatility in raw material prices such as bearing steel and specialty alloys impacts manufacturing margins and component pricing stability. Fluctuating steel commodity markets create procurement challenges for bearing manufacturers managing cost structures. Consequently, price variations affect competitive positioning and profitability across global hub bearing supply chains, particularly for cost-sensitive aftermarket segments.

Increasing complexity of hub bearing integration raises replacement and maintenance costs in aftermarket distribution channels and service facilities. Advanced integrated bearing designs require specialized tools and technical expertise for proper installation procedures. Moreover, sealed-for-life bearing units reduce service intervals but increase component replacement costs when bearing failure occurs during vehicle operational lifecycles.

Stringent quality requirements and certification processes extend product development timelines and increase manufacturing compliance costs for bearing suppliers. Automotive safety standards mandate rigorous testing protocols and traceability systems throughout production processes. Additionally, regulatory requirements vary across regional markets, creating complexity for manufacturers operating global distribution networks and managing multiple product specifications simultaneously.

Growth Factors

Electric Vehicle Expansion and Smart Bearing Technologies Accelerate Market Innovation and Growth

Rapid expansion of electric two-wheeler and passenger EV markets creates new hub bearing design requirements for battery-powered mobility platforms. Electric vehicles demand high-precision integrated hub bearing systems that minimize friction losses and maximize energy efficiency. Additionally, EV manufacturers prioritize lightweight bearing solutions that extend driving range while maintaining safety and durability standards across vehicle platforms.

In October 2024, SKF launched Infinium circular-design bearings using Laser Metal Deposition technology, enabling repeated remanufacturing and extended lifecycle performance across automotive applications. Development of smart hub bearings with integrated sensors enables real-time vehicle health monitoring and predictive maintenance capabilities. Moreover, sensor-equipped bearings support ADAS and autonomous vehicle systems by providing critical wheel-end performance data to vehicle control systems.

According to NTN Global, earlier-generation low-friction hub bearing designs demonstrated up to 50% rotational friction reduction while maintaining sealing and contamination resistance standards. According to NTN Global, advanced hub bearing designs achieved up to 62% rotational friction reduction and improved fuel efficiency by approximately 0.53%, demonstrating continuous innovation in bearing performance optimization supporting industry sustainability goals.

Emerging Trends

Pre-Assembled Units and Lightweight Materials Transform Hub Bearing Manufacturing and Performance Standards

Shift toward pre-assembled hub bearing units reduces vehicle assembly time and improves reliability by eliminating installation errors during manufacturing processes. Integrated bearing assemblies arrive at vehicle plants ready for direct installation, streamlining production workflows. Additionally, pre-assembled units simplify quality control procedures and reduce component handling costs across automotive assembly operations.

Increasing use of lightweight materials and optimized bearing geometry enhances energy efficiency across vehicle platforms and powertrains. Manufacturers employ advanced simulation tools and computational analysis to minimize bearing mass while maintaining load capacity. Moreover, weight reduction initiatives support overall vehicle efficiency targets and regulatory compliance for fuel economy and emission standards.

According to NSK, low-friction hub bearings can improve EV range efficiency by about 0.6%, equivalent to reducing battery mass by approximately 1.4 kg, demonstrating tangible benefits for electric vehicle performance. Integration of hub bearings with ADAS and autonomous vehicle wheel-end systems enables enhanced vehicle control and safety monitoring capabilities through embedded sensor technologies.

Regional Analysis

Asia Pacific Dominates the Automotive Hub Bearing Market with a Market Share of 42.70%, Valued at USD 6.4 Billion

Asia Pacific commands the largest regional market share, holding 42.70% valued at USD 6.4 Billion, driven by concentrated automotive manufacturing capacity across China, Japan, South Korea, and India. Regional vehicle production volumes exceed other markets, creating substantial hub bearing demand across passenger and commercial vehicle segments. Moreover, expanding middle-class populations and rising vehicle ownership rates sustain long-term growth trajectories throughout Asia Pacific automotive markets.

North America Automotive Hub Bearing Market Trends

North America demonstrates strong hub bearing demand driven by established automotive manufacturing infrastructure and premium vehicle segment growth. Electric vehicle adoption accelerates across United States and Canadian markets, requiring advanced bearing technologies. Additionally, robust aftermarket networks support replacement demand from aging vehicle populations and commercial fleet maintenance operations throughout the region.

Europe Automotive Hub Bearing Market Trends

Europe maintains significant market presence through advanced automotive engineering capabilities and stringent emission regulations driving bearing innovation. European manufacturers lead development of low-friction bearing technologies supporting fuel efficiency and electrification objectives. Furthermore, premium vehicle production concentration creates demand for high-performance bearing solutions across Germany, France, and United Kingdom manufacturing facilities.

Latin America Automotive Hub Bearing Market Trends

Latin America experiences growing hub bearing demand supported by expanding automotive production in Brazil and Mexico manufacturing corridors. Regional markets benefit from foreign investment in vehicle assembly operations and component supply chain development. Additionally, increasing commercial vehicle utilization for logistics and transportation services drives bearing consumption across light and heavy vehicle segments.

Middle East & Africa Automotive Hub Bearing Market Trends

Middle East and Africa demonstrate emerging market potential through infrastructure development initiatives and increasing vehicle import volumes. Regional aftermarket channels expand to support growing vehicle populations requiring maintenance and replacement components. Moreover, commercial vehicle deployment for construction and mining operations creates specialized bearing demand across off-highway application segments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

SKF maintains a leading position in the automotive hub bearing market through continuous innovation in friction reduction technologies and circular economy initiatives. The company develops next-generation bearing solutions that deliver substantial weight reductions and performance improvements across vehicle platforms. Moreover, SKF’s global manufacturing footprint and technical expertise enable comprehensive support for automotive OEM customers worldwide across diverse application requirements.

Schaeffler & Company LLC demonstrates strong market presence through advanced engineering capabilities and integrated automotive systems solutions. The company supplies hub bearing assemblies for passenger cars, commercial vehicles, and specialty applications requiring precision components. Additionally, Schaeffler invests in electrification technologies and sensor-integrated bearings supporting autonomous vehicle development and advanced driver assistance systems across the automotive industry.

Nachi-Fujikoshi Corp leverages Japanese manufacturing excellence and quality control standards to deliver reliable hub bearing products globally. The company maintains comprehensive product portfolios serving diverse vehicle segments and application requirements across OEM and aftermarket channels. Furthermore, Nachi-Fujikoshi develops specialized bearing solutions for industrial and automotive applications, utilizing advanced materials and surface treatment technologies.

NSK Ltd leads innovation in low-friction hub bearing technologies achieving significant performance improvements for electric and conventional vehicles. The company’s research and development initiatives focus on friction reduction, energy efficiency, and extended service life characteristics. Moreover, NSK’s advanced bearing designs contribute measurably to vehicle range extension and CO₂ emission reduction objectives across global automotive markets.

Key players

- SKF

- Schaeffler & Company LLC

- Nachi-Fujikoshi Corp

- NSK Ltd

- JTEKT Corporation

- The Timken Company

- GKN Ltd

- The ILJIN GROUP

- NTN Corporation

- GMB Corporation

- FKG Bearing Co Ltd

Recent Developments

- October 2024 – SKF introduced an ultra-low friction GEN-3 wheel bearing designed mainly for passenger vehicles, achieving approximately 30% friction reduction using optimized geometry, seals, and low-friction grease formulations to enhance fuel efficiency and reduce emissions across vehicle platforms.

- September 2024 – NSK launched a new low-friction hub unit bearing achieving approximately 40% friction reduction through advanced seal design and surface processing technologies, supporting electric vehicle range extension and conventional vehicle fuel economy improvement objectives across automotive applications.

Report Scope

Report Features Description Market Value (2025) USD 15.1 Billion Forecast Revenue (2035) USD 22.1 Billion CAGR (2026-2035) 3.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ball, Roller, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers, Off-Highway), By Material (Steel, Ceramic & Hybrid, Polymer, Others), By Application (Wheel End, Engine & Turbocharger, Transmission & Driveline, Steering & Suspension, HVAC, Alternator, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape SKF, Schaeffler & Company LLC, Nachi-Fujikoshi Corp, NSK Ltd, JTEKT Corporation, The Timken Company, GKN Ltd, The ILJIN GROUP, NTN Corporation, GMB Corporation, FKG Bearing Co Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Hub Bearing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Hub Bearing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- SKF

- Schaeffler & Company LLC

- Nachi-Fujikoshi Corp

- NSK Ltd

- JTEKT Corporation

- The Timken Company

- GKN Ltd

- The ILJIN GROUP

- NTN Corporation

- GMB Corporation

- FKG Bearing Co Ltd