Global Automotive eCall Market Size, Share, Growth Analysis By Trigger Type (Automatically Initiated eCall (AleC), Manually Initiated eCall (MieC)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type (IC Engine, Electric) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173423

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

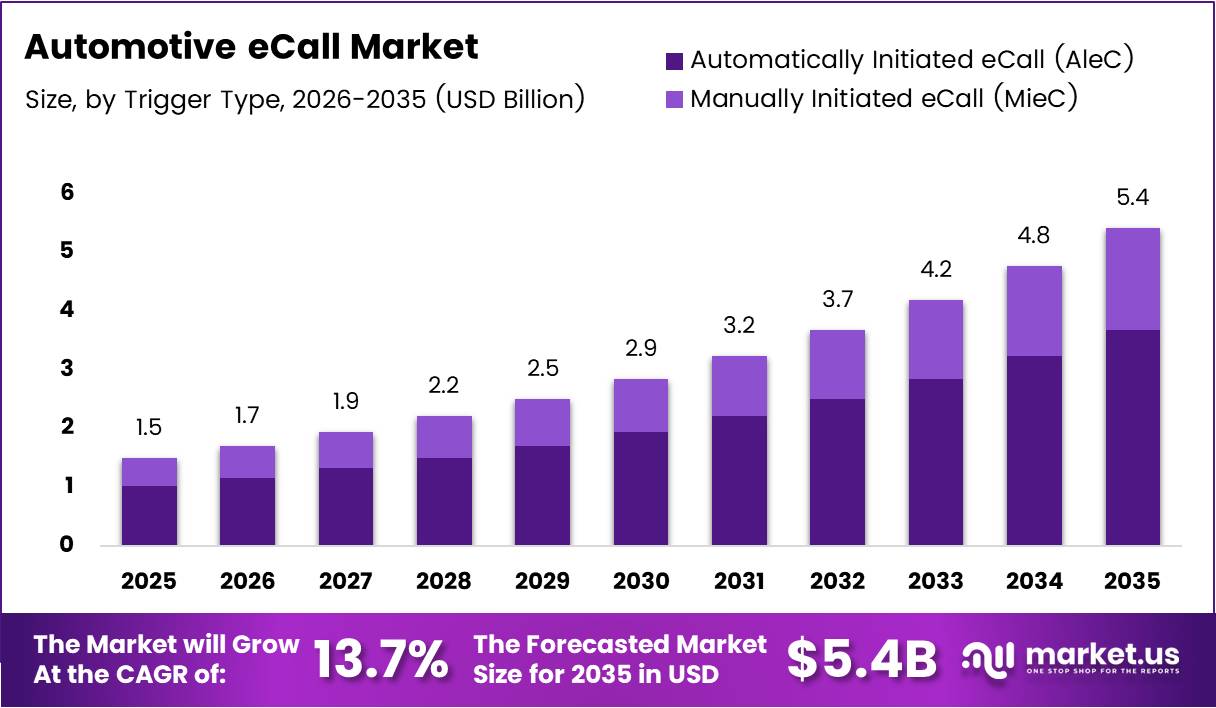

The global Automotive eCall Market is projected to reach approximately USD 5.4 Billion by 2035, up from USD 1.5 Billion in 2025, expanding at a CAGR of 13.7% during the forecast period from 2026 to 2035. This substantial growth reflects increasing regulatory mandates and technological advancement in vehicle safety systems.

Automotive eCall represents an automated emergency call system embedded within vehicles that automatically contacts emergency services during serious accidents. The technology transmits critical data including precise location coordinates, vehicle identification, and crash severity information to emergency response centers. This enables faster emergency response times and potentially saves lives.

The market experiences significant momentum driven by stringent regulatory frameworks across developed regions. European Union’s mandatory eCall regulation for all new M1 and N1 vehicles has fundamentally transformed the automotive safety landscape. This legislative push accelerates adoption rates and establishes industry-wide compliance standards.

Rising road accident fatalities globally intensify the need for advanced emergency response systems. Governments prioritize investment in connected vehicle infrastructure and telematics architectures to reduce response times. These initiatives create substantial opportunities for eCall system deployment across diverse vehicle segments.

Connected vehicle penetration continues expanding rapidly, supporting seamless integration of eCall technology with existing telematics platforms. Insurance providers increasingly adopt eCall-enabled crash notification services for real-time incident management. The convergence of automotive connectivity and emergency response modernization positions eCall as essential safety infrastructure.

Technological advancements enhance system capabilities significantly. Integration of AI-based crash severity detection algorithms improves emergency assessment accuracy. Migration from 4G LTE to 5G-NR connectivity reduces latency for critical communications. According to Intelematics, the company currently delivers eCall services to more than 900,000 connected vehicles across major brands including Toyota, Lexus, Hyundai, Mitsubishi and Genesis.

Market expansion extends beyond passenger vehicles into commercial vehicle and two-wheeler segments. Smart city emergency infrastructure programs foster interoperability between eCall systems and municipal response networks. OEM manufacturers explore subscription-based safety service models, creating new revenue streams while enhancing vehicle value propositions through comprehensive emergency protection.

Key Takeaways

- Global Automotive eCall Market projected to grow from USD 1.5 Billion in 2025 to USD 5.4 Billion by 2035 at a CAGR of 13.7%

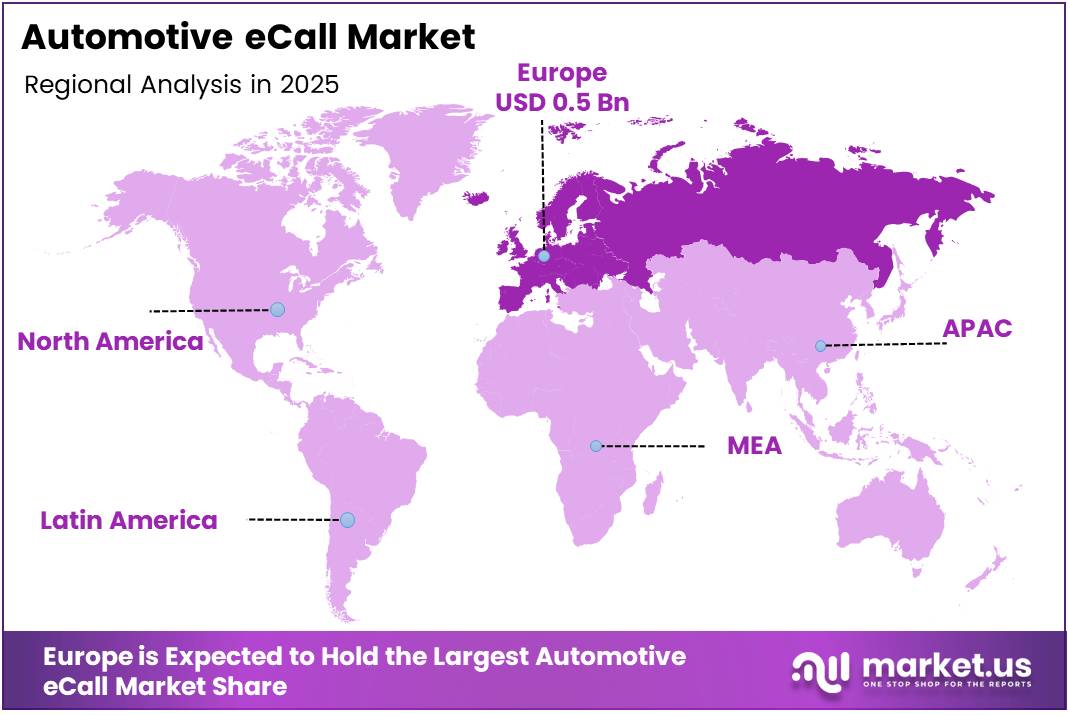

- Europe dominates the market with 39.2% share, valued at USD 0.5 Billion

- Automatically Initiated eCall (AleC) holds 73.8% market share in trigger type segment

- Passenger Cars account for 82.2% of vehicle type segment

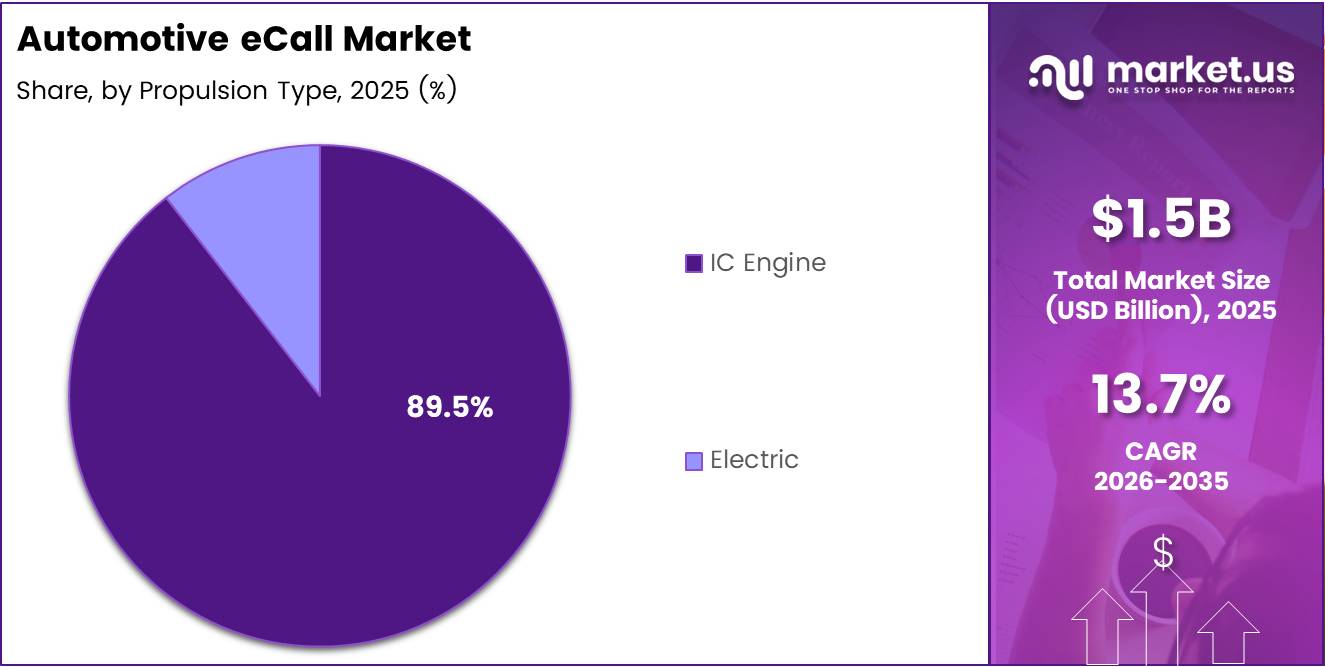

- IC Engine propulsion type represents 89.5% of the market

Trigger Type Analysis

Automatically Initiated eCall (AleC) dominates with 73.8% due to its life-saving automatic crash detection capabilities.

In 2025, Automatically Initiated eCall (AleC) held a dominant market position in the Trigger Type Analysis segment of Automotive eCall Market, with a 73.8% share. AleC systems activate autonomously when vehicle sensors detect severe collision forces or airbag deployment. This automatic functionality eliminates reliance on conscious driver action during critical moments when occupants may be incapacitated.

The technology integrates sophisticated crash detection algorithms that analyze impact severity and vehicle dynamics instantaneously. Regulatory mandates across Europe specifically require automatic eCall functionality, driving widespread OEM adoption. Insurance providers favor AleC systems for accurate crash timestamping and location verification, supporting faster claims processing and emergency dispatch coordination.

Manually Initiated eCall (MieC) serves as a complementary emergency communication channel activated by vehicle occupants through dedicated in-cabin buttons. This trigger type proves valuable for witnessing accidents, medical emergencies, or security incidents not involving vehicle collisions. MieC systems provide flexibility for occupants to request emergency assistance across diverse scenarios beyond crash events.

The manual activation feature addresses situations where automatic systems may not trigger, such as minor collisions or non-crash emergencies. Integration with vehicle telematics platforms enables MieC to transmit identical location and vehicle identification data as AleC systems, ensuring consistent emergency response protocols.

Vehicle Type Analysis

Passenger Cars dominate with 82.2% driven by regulatory compliance requirements and high production volumes.

In 2025, Passenger Cars held a dominant market position in the Vehicle Type Analysis segment of Automotive eCall Market, with an 82.2% share. European Union regulations mandate eCall installation in all new passenger vehicles, creating universal compliance requirements for manufacturers. The passenger car segment benefits from established telematics infrastructure and higher consumer safety expectations.

Mass production volumes enable economies of scale for eCall hardware integration, reducing per-unit implementation costs. Premium and mid-range passenger vehicles increasingly feature advanced connected services where eCall serves as foundational safety infrastructure. Consumer awareness regarding emergency response capabilities influences purchasing decisions, encouraging manufacturers to prominently feature eCall functionality in vehicle specifications and marketing materials.

Commercial Vehicles represent an expanding adoption segment as fleet operators recognize operational safety and liability reduction benefits. Truck and van manufacturers integrate eCall systems to enhance driver protection and comply with emerging regulatory extensions beyond passenger vehicles. Commercial fleet telematics platforms incorporate eCall functionality alongside existing GPS tracking and vehicle diagnostics systems.

Insurance providers offer premium discounts for commercial fleets equipped with automatic emergency notification capabilities, improving risk profiles. The commercial segment experiences gradual regulatory expansion as authorities extend eCall mandates to light commercial vehicle categories, accelerating retrofit and new vehicle installation rates.

Propulsion Type Analysis

IC Engine vehicles dominate with 89.5% due to existing vehicle population and regulatory implementation timelines.

In 2025, IC Engine held a dominant market position in the Propulsion Type Analysis segment of Automotive eCall Market, with an 89.5% share. Internal combustion engine vehicles constitute the overwhelming majority of existing vehicle production and on-road fleet populations globally. Initial eCall regulatory mandates focused primarily on conventional powertrain vehicles, establishing integration protocols and technical standards around traditional automotive electrical architectures.

IC engine vehicles benefit from mature telematics control unit designs optimized for 12V electrical systems and conventional vehicle network topologies. Manufacturers leverage established supply chains and proven hardware platforms for rapid eCall deployment across gasoline and diesel vehicle lineups. The installed base of IC engine vehicles with eCall capability continues growing as regulatory compliance deadlines take effect across major automotive markets.

Electric vehicles represent a rapidly growing eCall adoption segment as EV production accelerates and regulatory requirements apply equally across all propulsion types. Electric vehicle architectures offer inherent advantages for eCall integration including advanced electrical systems, higher voltage availability, and native connectivity infrastructure. EV manufacturers position comprehensive safety features including eCall as key differentiators in premium market segments.

Battery electric vehicles incorporate eCall functionality alongside extensive telematics capabilities for battery monitoring, charging management, and over-the-air updates. The electric propulsion segment benefits from newer vehicle designs that integrate eCall from initial development stages rather than retrofit approaches, enabling optimized system performance and reduced implementation complexity.

Key Market Segments

By Trigger Type

- Automatically Initiated eCall (AleC)

- Manually Initiated eCall (MieC)

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion Type

- IC Engine

- Electric

Drivers

Mandatory EU eCall Regulation Enforcement Drives Rapid Market Expansion

European Union’s mandatory eCall regulation for all new M1 and N1 vehicle categories fundamentally transforms market dynamics by creating universal compliance requirements. This legislation eliminates optional adoption, compelling every automotive manufacturer selling vehicles in European markets to integrate eCall systems as standard equipment. The regulatory framework establishes technical specifications ensuring interoperability across emergency response networks and vehicle platforms.

Rising road accident fatalities worldwide intensify governmental focus on emergency response modernization initiatives. Statistics demonstrate that reduced emergency response times significantly improve accident survival rates and minimize injury severity. This evidence-based approach drives regulatory bodies to mandate eCall technology as proven life-saving infrastructure. Authorities recognize connected emergency systems as cost-effective public safety investments.

Connected vehicle telematics architectures proliferate rapidly across automotive industry, creating favorable conditions for seamless eCall integration. Modern vehicles increasingly feature embedded connectivity hardware, cellular modems, and GPS receivers that serve dual purposes for both consumer services and emergency communications. This convergence reduces incremental costs for eCall implementation while leveraging existing platform investments.

Insurance telematics integration accelerates adoption through real-time crash notification services that benefit both providers and policyholders. Insurers leverage eCall data for accurate incident verification, fraud reduction, and expedited claims processing. Policyholders receive premium discounts and enhanced emergency assistance, creating compelling value propositions that encourage voluntary adoption beyond regulatory minimums.

Restraints

High Telematics Hardware Costs Challenge Market Affordability

High embedded Telematics Control Unit hardware and installation costs create significant barriers, particularly for entry-level vehicle segments and price-sensitive markets. The TCU represents sophisticated electronics incorporating cellular modems, GPS receivers, crash sensors, and processing capabilities that add measurable per-vehicle expenses. Manufacturers face pressure balancing regulatory compliance requirements against competitive pricing strategies in cost-conscious market segments.

Installation complexity extends beyond hardware costs to encompass vehicle integration engineering, software development, and testing validation procedures. Each vehicle platform requires customized eCall implementation addressing specific electrical architectures, sensor configurations, and interior packaging constraints. These engineering investments multiply across diverse model lineups, creating substantial development expenditures that manufacturers must amortize across production volumes.

Cybersecurity and data privacy compliance complexities introduce additional technical and legal challenges for eCall system deployment. Connected emergency systems transmit sensitive location data and crash information requiring robust encryption and secure communication protocols. Manufacturers must demonstrate compliance with stringent data protection regulations including GDPR while maintaining system reliability during critical emergency situations.

Data privacy concerns vary significantly across global markets, complicating international standardization efforts and increasing compliance complexity. Different regulatory frameworks governing personal data collection, storage, and transmission require region-specific system configurations. These variations increase development costs and limit economies of scale for global eCall platform deployment across diverse markets.

Growth Factors

AI-Based Crash Detection Integration Unlocks Advanced Safety Capabilities

Integration of AI-based crash severity detection algorithms represents transformative growth opportunity, enabling more accurate emergency assessment and appropriate response resource allocation. Machine learning models analyze multiple sensor inputs simultaneously, distinguishing between minor incidents and life-threatening collisions requiring immediate emergency dispatch. This intelligence reduces false positive activations while ensuring critical situations receive priority response.

Expansion of eCall systems into two-wheeler and commercial vehicle segments opens substantial untapped market potential beyond passenger car applications. Motorcycles and scooters face disproportionately high accident fatality rates, creating compelling safety justification for emergency notification systems. Commercial vehicle adoption addresses fleet safety requirements while providing operational benefits through integrated telematics platforms serving multiple business functions.

Smart city emergency infrastructure interoperability programs create synergies between vehicle eCall systems and municipal response networks. Connected infrastructure enables dynamic emergency vehicle routing, traffic signal prioritization, and hospital capacity coordination based on real-time incident data. These integrated approaches improve overall emergency response effectiveness while demonstrating clear public safety returns on smart city technology investments.

OEM subscription-based safety service monetization models transform eCall from compliance cost into revenue-generating connected service offerings. Manufacturers bundle emergency assistance with roadside support, stolen vehicle recovery, and concierge services under recurring subscription packages. This business model approach reframes eCall as value-added service enhancing customer relationships and creating ongoing revenue streams beyond initial vehicle sales.

Emerging Trends

5G Connectivity Migration Enhances Emergency Communication Performance

GNSS multi-constellation positioning integration in eCall modules significantly improves location accuracy and reliability across diverse operating environments. Modern systems combine GPS, GLONASS, Galileo, and BeiDou signals for robust positioning even in challenging urban canyon or rural coverage scenarios. This enhanced positioning capability ensures emergency responders receive precise accident location coordinates, reducing search time and accelerating assistance arrival.

4G LTE to 5G-NR migration delivers substantially lower latency for emergency connectivity, enabling faster call establishment and data transmission during critical situations. Fifth-generation cellular technology provides dedicated network slicing capabilities that can prioritize emergency communications over commercial data traffic. This guaranteed quality of service proves essential for mission-critical safety applications requiring reliable connectivity regardless of network congestion conditions.

Embedded SIM adoption in factory-installed eCall units streamlines manufacturing processes while enabling flexible carrier selection and international roaming capabilities. eSIM technology eliminates physical SIM card logistics, reducing production complexity and enabling remote carrier provisioning. This approach supports global vehicle distribution without region-specific hardware variations, simplifying supply chain management and reducing inventory complexity for multinational manufacturers.

Over-the-air safety software update enablement ensures eCall systems maintain current functionality throughout vehicle lifecycle without requiring physical service visits. OTA capabilities allow manufacturers to deploy security patches, feature enhancements, and regulatory compliance updates remotely. This maintenance approach reduces ownership costs while ensuring installed systems remain compatible with evolving emergency service infrastructure and communication protocols.

Regional Analysis

Europe Dominates the Automotive eCall Market with a Market Share of 39.2%, Valued at USD 0.5 Billion

Europe commands the global Automotive eCall Market with a dominant 39.2% share, valued at USD 0.5 Billion, driven by pioneering regulatory mandates and mature implementation infrastructure. The European Union’s mandatory eCall regulation established comprehensive legal framework requiring automatic emergency call systems in all new type-approved vehicles since 2018.

This regulatory leadership positioned European markets as primary adoption drivers, creating extensive deployment experience and technical standardization. European automotive manufacturers developed sophisticated eCall integration expertise, establishing regional supply chains and service networks supporting widespread system deployment across passenger and commercial vehicle segments.

North America Automotive eCall Market Trends

North America demonstrates growing eCall adoption through voluntary manufacturer implementation and emerging state-level regulatory initiatives. Major automotive brands offer eCall-equivalent systems as premium safety features or subscription services, emphasizing consumer value propositions over regulatory compliance.

The region benefits from established telematics infrastructure and high connected vehicle penetration rates, facilitating seamless emergency notification integration. Insurance industry engagement drives adoption through usage-based programs offering premium discounts for equipped vehicles.

Asia Pacific Automotive eCall Market Trends

Asia Pacific represents the fastest-growing regional market as governments recognize road safety imperatives and connected vehicle opportunities. Countries including Japan, South Korea, and Australia advance regulatory frameworks encouraging or mandating eCall-type emergency systems.

According to Fleet Auto News, ANCAP announced adoption of eCall requirements, signaling strengthening safety standards across the region. Rapid automotive production growth and increasing safety consciousness among consumers accelerate voluntary adoption alongside regulatory development, positioning Asia Pacific as critical long-term growth market.

Middle East and Africa Automotive eCall Market Trends

Middle East and Africa emerge as developing markets with gradual eCall adoption driven by luxury vehicle imports and premium segment growth. Gulf Cooperation Council nations demonstrate particular interest in advanced safety technologies as part of smart city initiatives and road safety improvement programs.

Infrastructure development remains ongoing, with governments investing in emergency response network modernization. The region shows promise for future growth as regulatory frameworks mature and local manufacturing capabilities expand.

Latin America Automotive eCall Market Trends

Latin America experiences early-stage eCall market development with adoption concentrated in premium vehicle segments and imported models from markets with existing mandates. Brazil and Mexico lead regional interest as largest automotive markets, though comprehensive regulatory frameworks remain under development.

Economic factors influence adoption rates, with cost considerations significant for mass-market vehicle segments. However, growing awareness of road safety benefits and increasing connectivity infrastructure investment suggest accelerating future adoption trajectories.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive eCall Company Insights

Continental AG maintains leading market position through comprehensive automotive safety system portfolio and extensive OEM relationships across global markets. The company leverages decades of experience in vehicle electronics and telematics to deliver integrated eCall solutions that seamlessly interface with existing safety architectures.

Robert Bosch GmbH positions itself as innovation leader combining eCall technology with broader connected vehicle and autonomous driving development initiatives. Bosch integrates emergency call functionality within comprehensive telematics control units serving multiple vehicle systems including navigation, diagnostics, and over-the-air updates. The company’s extensive automotive sensor portfolio enables sophisticated crash severity assessment capabilities that enhance emergency response accuracy.

Telit specializes in cellular communication modules and IoT connectivity solutions that form critical infrastructure components for automotive eCall implementations. The company provides compact, automotive-qualified cellular modems supporting multiple frequency bands and network standards required for global vehicle deployment.

Thales Group brings aerospace and defense-grade security expertise to automotive eCall systems, addressing growing cybersecurity and data privacy concerns. The company develops secure communication protocols and encryption technologies protecting sensitive emergency data transmission from potential cyber threats. Thales integrates secure element technology and hardware security modules within eCall architectures, ensuring robust protection against unauthorized access or system compromise.

Key Players

- Continental AG

- Robert Bosch GmbH

- Telit

- Thales Group

- STMicroelectronics

- u-blox

- Texas Instruments Incorporated

- Valeo

- Visteon Corporation

Recent Developments

- October 2025: Qualcomm announced acquisition of Arduino alongside innovations in ultrasonic range finder and memory module technologies during Embedded Week, demonstrating continued investment in automotive connectivity components essential for advanced eCall system implementations.

- August 2025: Infineon successfully completed acquisition of Marvell’s Automotive Ethernet business, strengthening capabilities in high-speed vehicle networking infrastructure that supports next-generation eCall systems requiring enhanced data transmission and lower latency emergency communications.

Report Scope

Report Features Description Market Value (2025) USD 1.5 Billion Forecast Revenue (2035) USD 5.4 Billion CAGR (2026-2035) 13.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Trigger Type (Automatically Initiated eCall (AleC), Manually Initiated eCall (MieC)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type (IC Engine, Electric) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Continental AG, Robert Bosch GmbH, Telit, Thales Group, STMicroelectronics, u-blox, Texas Instruments Incorporated, Valeo, Visteon Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Continental AG

- Robert Bosch GmbH

- Telit

- Thales Group

- STMicroelectronics

- u-blox

- Texas Instruments Incorporated

- Valeo

- Visteon Corporation