Global Automotive Chassis Market Size, Share, Growth Analysis By Chassis Type (Backbone Chassis, Ladder Chassis, Monocoque Chassis, Modular Chassis), By Material (High Strength Steel, Aluminum Alloy, Mild Steel, Carbon Fiber Composite), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Electric Vehicle Type (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug In Hybrid Electric Vehicle), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173237

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Chassis Type Analysis

- By Material Analysis

- By Vehicle Type Analysis

- By Electric Vehicle Type Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive Chassis Company Insights

- Recent Developments

- Report Scope

Report Overview

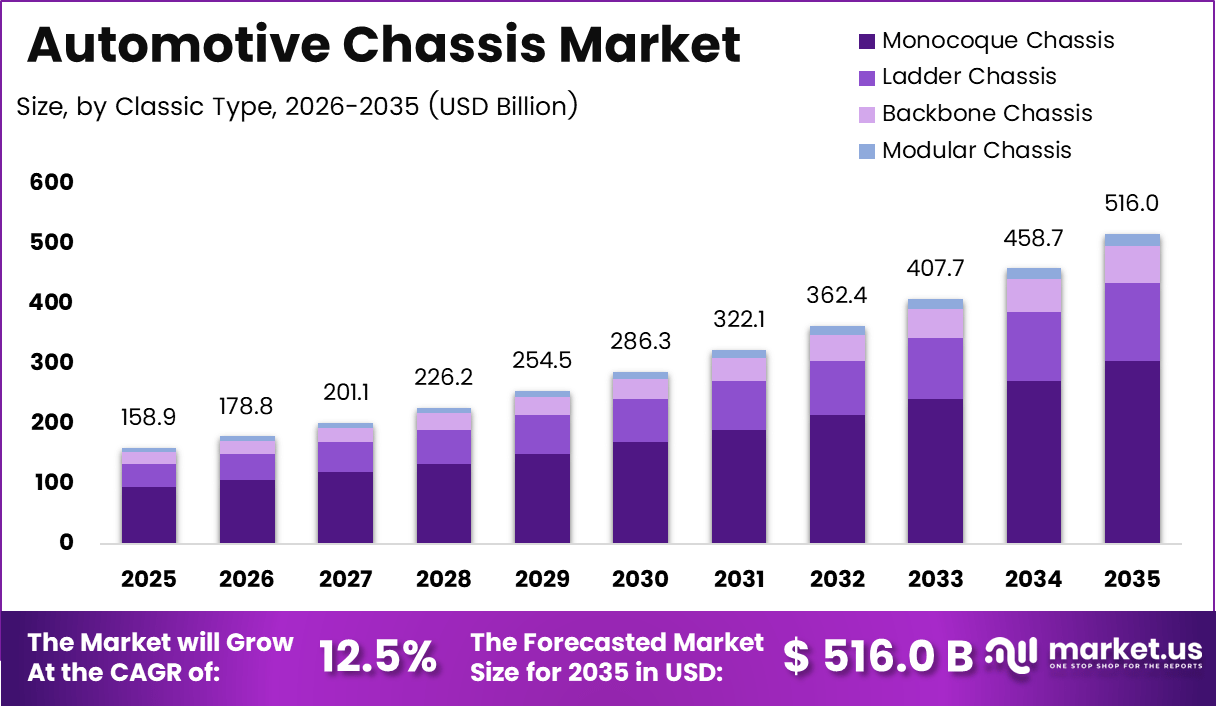

The Global Automotive Chassis Market size is expected to be worth around USD 516.0 billion by 2035, from USD 158.9 billion in 2025, growing at a CAGR of 12.5% during the forecast period from 2026 to 2035.

The automotive chassis refers to the core structural framework that supports the vehicle body, powertrain, suspension, and safety systems. From an engineering perspective, it determines load distribution, crash performance, and driving stability. As vehicle architectures evolve, the chassis increasingly integrates lightweight materials, electronics, and modular designs to meet modern mobility expectations.

The automotive chassis market represents the commercial ecosystem surrounding the design, manufacturing, and supply of chassis systems across passenger and commercial vehicles. From a market standpoint, it reflects shifting priorities toward efficiency, electrification, and safety. Consequently, OEMs increasingly view chassis platforms as strategic assets enabling faster model development and platform scalability.

Opportunities increasingly emerge from electric and hybrid vehicle platforms, where chassis redesign becomes essential to accommodate batteries and weight redistribution. Skateboard and modular architectures support flexible vehicle designs while reducing development timelines. Additionally, rising investment in smart manufacturing and digital simulation tools enables faster chassis optimization and validation cycles across global production footprints.

Government investment and regulatory oversight significantly influence chassis innovation trajectories. Safety regulations mandate enhanced crash absorption and rigidity, while emission norms indirectly push light weighting initiatives. Public funding for electric mobility infrastructure further stimulates demand for advanced chassis materials and designs, aligning structural innovation with long term sustainability and energy efficiency objectives.

Material innovation remains a defining market theme, driven by quantifiable performance gains. According to SAE International studies, polymer composites directly reduce chassis and overall vehicle weight by up to 50%, while magnesium components remain 75% lighter than steel and 33% lighter than aluminum, despite requiring specialized design approaches.

In parallel, industry research from automotive materials associations highlights that substituting steel with aluminum saves nearly 50% of steel in the body in white, enabling 20 to 30% total vehicle weight reduction. According to IEA aligned efficiency studies, a 10% weight reduction improves fuel usage by 6 to 8%, reinforcing chassis light weighting as a critical market driver.

Key Takeaways

- The Global Automotive Chassis Market is projected to reach USD 516.0 billion by 2035, growing from USD 158.9 billion in 2025 at a 12.5% CAGR.

- Monocoque Chassis emerged as the leading chassis type, accounting for a dominant share of 59.1% in 2025.

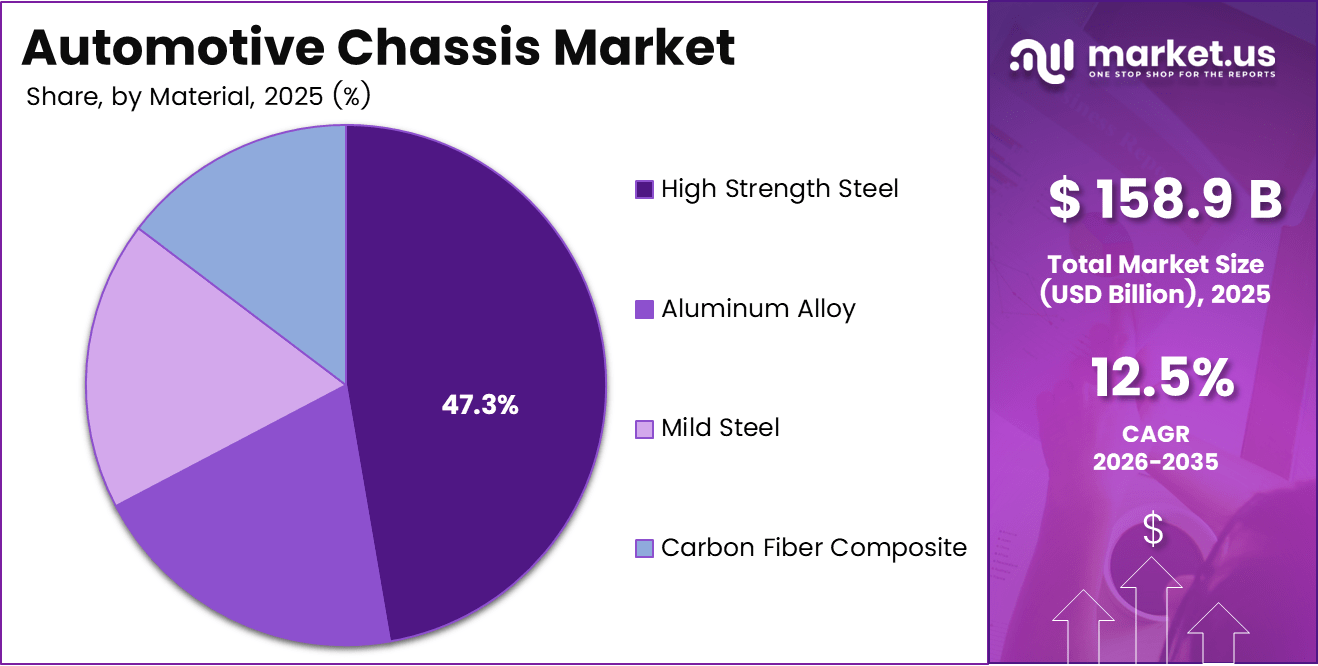

- High Strength Steel remained the most widely used material segment, holding a market share of 47.3% in 2025.

- Passenger Cars represented the largest vehicle type segment, capturing 63.2% of total chassis demand in 2025.

- Battery Electric Vehicles led the electric vehicle type category with a share of 57.4% in 2025.

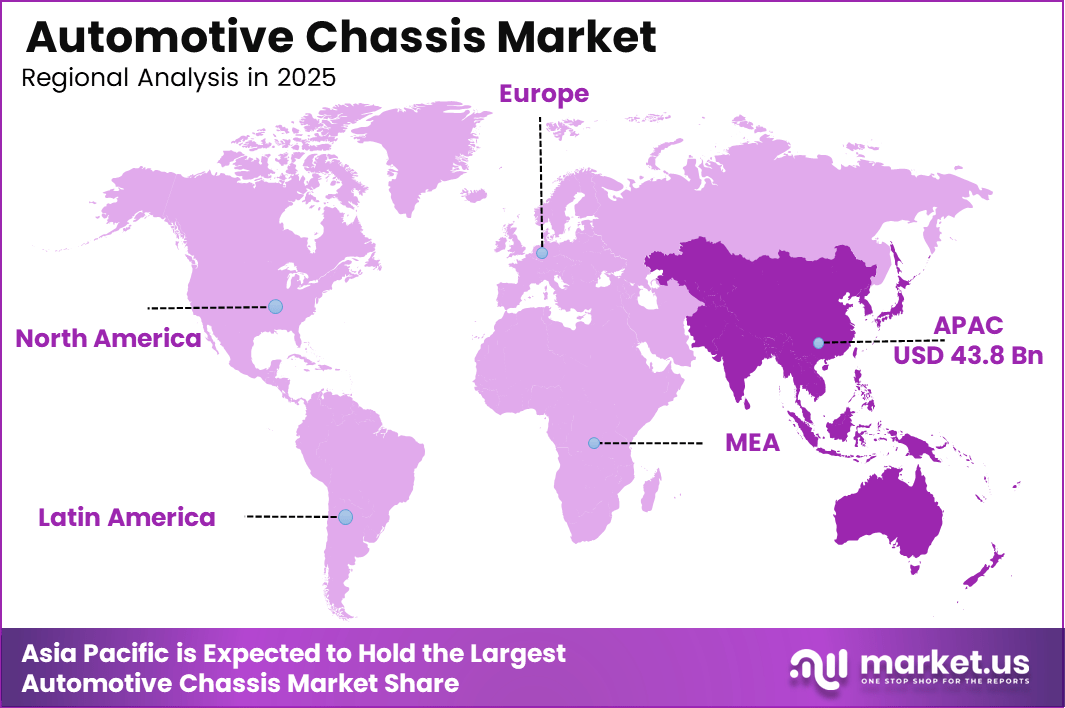

- Asia Pacific dominated the global market with a share of 43.8%, valued at USD 69.5 billion in 2025.

By Chassis Type Analysis

In 2025, Monocoque Chassis held a dominant market position in the By Chassis Type Analysis segment of Automotive Chassis Market, with a 59.1% share.

Backbone chassis continues to serve niche vehicle categories where a strong central structural tube supports drivetrain and suspension integration. Although limited in mass passenger adoption, it remains relevant in performance oriented and specialty vehicles due to its torsional rigidity and simplified structural layout.

Ladder chassis maintains importance in utility focused vehicles, particularly where durability and load carrying capability remain critical. Its body on frame construction supports easier repairs and modifications, making it suitable for commercial and off road applications despite weight disadvantages compared to newer architectures.

Monocoque chassis dominates due to its integrated body structure that enhances crash safety, weight distribution, and manufacturing efficiency. As passenger vehicle production scales globally, this architecture aligns with fuel efficiency goals, electrification requirements, and modern safety regulations, supporting its widespread adoption.

Modular chassis is gaining traction as automakers pursue platform flexibility across multiple models. This design enables shared components, faster product development, and cost optimization, particularly for electric vehicle platforms, although adoption remains gradual compared to established monocoque structures.

By Material Analysis

In 2025, High Strength Steel held a dominant market position in the By Material Analysis segment of Automotive Chassis Market, with a 47.3% share.

High strength steel remains widely used due to its balance between cost, durability, and crash performance. Automakers continue to optimize grades and forming techniques to achieve weight reduction without compromising structural integrity or manufacturing scalability.

Aluminum alloy adoption continues to expand as manufacturers seek lightweight solutions to meet emission and efficiency targets. Its corrosion resistance and recyclability support sustainability goals, although higher material and processing costs limit broader penetration across all vehicle categories.

Mild steel retains relevance in cost sensitive markets and entry level vehicles. While heavier, it offers ease of fabrication and repair, making it suitable for regions where affordability and manufacturing simplicity remain priority considerations.

Carbon fiber composite represents an advanced material choice focused on high performance and premium segments. Despite exceptional strength to weight properties, high production costs and longer cycle times constrain its large scale adoption in mainstream automotive chassis manufacturing.

By Vehicle Type Analysis

In 2025, Passenger Car held a dominant market position in the By Vehicle Type Analysis segment of Automotive Chassis Market, with a 63.2% share.

Passenger cars drive chassis demand due to high global production volumes and continuous model refresh cycles. Emphasis on comfort, safety, and efficiency accelerates the integration of lightweight materials and advanced structural designs in this segment.

Light commercial vehicles rely on chassis systems optimized for payload efficiency and durability. Growth in urban logistics and last mile delivery supports steady demand, although structural requirements differ significantly from passenger focused designs.

Heavy commercial vehicles prioritize robustness and long service life, influencing chassis material selection and architecture. While volumes remain lower, regulatory compliance and infrastructure development continue to shape chassis innovation within this segment.

By Electric Vehicle Type Analysis

In 2025, Battery Electric Vehicle held a dominant market position in the By Electric Vehicle Type Analysis segment of Automotive Chassis Market, with a 57.4% share.

Battery electric vehicles require redesigned chassis systems to accommodate battery packs and altered weight distribution. This drives demand for flat floor structures, reinforced frames, and improved crash protection around energy storage systems.

Hybrid electric vehicles continue to use adapted conventional chassis designs that balance internal combustion and electric components. This segment benefits from transitional adoption patterns in regions gradually shifting toward full electrification.

Plug in hybrid electric vehicles rely on versatile chassis platforms that support dual powertrains. Structural flexibility and weight optimization remain critical to maintaining efficiency while meeting regulatory and consumer expectations.

By Sales Channel Analysis

In 2025, OEM held a dominant market position in the By Sales Channel Analysis segment of Automotive Chassis Market, with a 87.5% share.

OEM channels dominate due to direct integration of chassis systems during vehicle manufacturing. Long term supply agreements, platform based sourcing, and quality control requirements reinforce OEM preference for direct chassis procurement.

Aftermarket demand remains limited and primarily focused on replacement, customization, and repair applications. While smaller in scale, this channel serves specific use cases such as vehicle modification, refurbishment, and regional maintenance needs.

Key Market Segments

By Chassis Type

- Backbone Chassis

- Ladder Chassis

- Monocoque Chassis

- Modular Chassis

By Material

- High Strength Steel

- Aluminum Alloy

- Mild Steel

- Carbon Fiber Composite

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Electric Vehicle Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug In Hybrid Electric Vehicle

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Integration of Lightweight Structural Platforms Drives Automotive Chassis Market Growth

The growing focus on vehicle energy efficiency continues to push automakers toward lightweight structural platforms. By reducing overall vehicle mass, chassis designs help improve fuel economy and extend driving range, especially for electric vehicles. This shift supports compliance with emission norms while maintaining performance and safety expectations.

At the same time, advanced suspension architectures are increasingly integrated into modern chassis systems. These designs improve ride comfort, handling stability, and driving precision, which directly enhances customer experience. As consumer expectations rise, manufacturers prioritize chassis solutions that balance comfort with dynamic performance.

Regulatory emphasis on vehicle safety further drives chassis innovation. Governments across regions enforce strict crashworthiness and impact absorption standards, encouraging the adoption of rigid and optimized chassis structures. This regulatory pressure accelerates investment in structural engineering and material advancements.

Additionally, the expansion of electric and hybrid vehicle production creates demand for redesigned load bearing chassis. Battery integration requires new structural layouts to support weight distribution, safety, and thermal management, making chassis development central to next generation vehicle platforms.

Restraints

High Development Costs Limit Adoption of Advanced Automotive Chassis Platforms

One major restraint in the automotive chassis market is the high cost of developing next generation modular platforms. Extensive research, prototyping, and testing are required to ensure safety, durability, and compliance, which significantly increases upfront investment for manufacturers.

Validation processes further add to development timelines and expenses. Crash testing, durability simulations, and regulatory approvals require advanced infrastructure and skilled engineering teams, making cost recovery challenging, particularly for low volume vehicle programs.

Another challenge arises from integrating electronic control systems with traditional mechanical chassis structures. Modern vehicles rely on sensors, actuators, and software driven functions that must seamlessly interact with physical components.

This integration complexity increases design risk and system dependencies. As a result, manufacturers face challenges in achieving reliability and scalability while managing cost pressures across different vehicle segments.

Growth Factors

Accelerating Demand for Skateboard Platforms Creates Growth Opportunities

The rapid adoption of skateboard chassis architectures presents a strong growth opportunity. These flat, modular platforms support electric passenger and commercial vehicles by enabling flexible body designs and efficient battery placement.

Rising investment in autonomous vehicle development further expands market potential. Autonomous systems require sensor ready and software compatible chassis designs that support cameras, radar, and control units without compromising structural integrity.

Localization of chassis manufacturing in emerging automotive hubs also offers growth potential. Regional production reduces logistics costs, improves supply chain resilience, and aligns with government initiatives promoting domestic manufacturing.

Moreover, demand for customizable chassis solutions continues to rise. Multi model platforms allow automakers to serve diverse vehicle categories while optimizing development costs and accelerating product launches.

Emerging Trends

Shift Toward Multi Material Designs Shapes Automotive Chassis Trends

A key trend in the automotive chassis market is the move toward multi material designs. Manufacturers increasingly combine aluminum, composites, and high strength steel to achieve optimal weight reduction and structural performance.

The use of digital twins and simulation driven engineering workflows is also increasing. These tools enable faster design optimization, reduce physical prototyping needs, and improve accuracy in performance prediction.

Another emerging trend is the adoption of active and semi active suspension systems integrated into chassis platforms. These systems dynamically adjust to road conditions, improving comfort, safety, and vehicle control.

Finally, growing focus on noise, vibration, and harshness optimization influences chassis design priorities. Improved NVH performance enhances ride quality and supports premium vehicle positioning across multiple segments.

Regional Analysis

Asia Pacific Dominates the Automotive Chassis Market with a Market Share of 43.8%, Valued at USD 69.5 billion

Asia Pacific leads the automotive chassis market due to its strong vehicle production base and rapid expansion of electric mobility. In 2025, the region accounted for 43.8% of global demand, valued at USD 69.5 billion, supported by large scale manufacturing capacity, cost efficient supply chains, and rising adoption of lightweight and modular chassis architectures.

North America Automotive Chassis Market Trends

North America shows steady growth driven by technological advancements in vehicle safety, electrification, and autonomous platforms. The region benefits from high penetration of advanced suspension systems and strict safety regulations, which encourage continuous chassis redesign and material innovation across passenger and commercial vehicle categories.

Europe Automotive Chassis Market Trends

Europe remains a mature yet innovation focused market, supported by stringent emission standards and sustainability targets. Automakers in the region emphasize lightweight materials, modular platforms, and efficient structural designs to meet regulatory requirements while supporting the transition toward electric and hybrid vehicles.

Middle East and Africa Automotive Chassis Market Trends

The Middle East and Africa region demonstrates moderate growth, driven by infrastructure development and increasing demand for commercial vehicles. Chassis demand in this region is influenced by durability requirements, harsh operating conditions, and gradual expansion of localized vehicle assembly operations.

Latin America Automotive Chassis Market Trends

Latin America shows gradual market expansion supported by recovering vehicle production and rising urbanization. Demand is largely driven by cost effective chassis solutions for passenger cars and light commercial vehicles, with growing focus on localization and supply chain efficiency across key automotive hubs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Chassis Company Insights

The global automotive chassis market in 2025 remains strategically important as manufacturers focus on lightweight structures, electrification readiness, and safety driven design. Leading players continue to invest in modular architectures, material innovation, and integrated systems to support evolving vehicle platforms while balancing cost efficiency, regulatory compliance, and scalable production across global markets.

Schaeffler Technologies AG maintains a strong position in the automotive chassis market through its deep engineering expertise and focus on intelligent mechanical systems. In 2025, the company emphasizes efficiency oriented chassis components that support electrified drivetrains and advanced suspension integration. Its approach aligns with rising demand for compact, lightweight, and digitally enabled vehicle platforms.

Hyundai Motor Company leverages its vertically integrated manufacturing model to advance chassis development across internal combustion and electric vehicles. The company focuses on modular and scalable chassis architectures to support multiple models while improving safety and ride quality. Its investments reflect long term strategies toward electrification and platform standardization.

Aisin Seiki plays a critical role in chassis systems by combining precision manufacturing with system level integration capabilities. In 2025, the company continues to strengthen its presence in suspension and drivetrain related chassis components. Its focus remains on reliability, cost optimization, and compatibility with hybrid and electric vehicle platforms.

Magna International Inc. remains a key contributor to global chassis innovation through its broad product portfolio and contract manufacturing capabilities. The company prioritizes lightweight materials, modular chassis solutions, and flexible production models. In 2025, its strategy supports faster vehicle development cycles and increased adoption of electric and multi platform vehicle architectures.

Top Key Players in the Market

- Schaeffler Technologies AG

- Hyundai Motor Company

- Aisin Seiki

- Magna International Inc.

- Continental AG

- ZF Friedrichshafen AG

- Benteler International AG

- CIE Automotive

- REE Automotive, Ltd.

Recent Developments

- In Aug 2025, Kongsberg Automotive exercised its call option to acquire the remaining 75% stake in Chassis Autonomy SBA AB, strengthening its control over advanced chassis and vehicle autonomy solutions while reinforcing its long term strategy in intelligent motion technologies.

- In Dec 2024, Samvardhana Motherson International Limited announced the acquisition of a 95% stake in Japan based Atsumitec Co Ltd for $57 million, expanding its footprint in gear shifters, chassis, and transmission components across two wheeler and four wheeler platforms with operations spanning nine global manufacturing facilities.

- In Sep 2025, Hon Hai’s acquisition of a 50% stake in ZF Group’s chassis modules business was recognized as a 2024 Benchmark Case by Lexpress, highlighting the strategic significance of the deal in advancing modular chassis capabilities and global automotive manufacturing collaboration.

Report Scope

Report Features Description Market Value (2025) USD 158.9 billion Forecast Revenue (2035) USD 516.0 billion CAGR (2026-2035) 12.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Chassis Type (Backbone Chassis, Ladder Chassis, Monocoque Chassis, Modular Chassis), By Material (High Strength Steel, Aluminum Alloy, Mild Steel, Carbon Fiber Composite), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Electric Vehicle Type (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug In Hybrid Electric Vehicle), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Schaeffler Technologies AG, Hyundai Motor Company, Aisin Seiki, Magna International Inc., Continental AG, ZF Friedrichshafen AG, Benteler International AG, CIE Automotive, REE Automotive, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schaeffler Technologies AG

- Hyundai Motor Company

- Aisin Seiki

- Magna International Inc.

- Continental AG

- ZF Friedrichshafen AG

- Benteler International AG

- CIE Automotive

- REE Automotive, Ltd.