Global Automotive Battery Market Size, Share, And Enhanced Productivity By Type (Lithium-ion Based, Lead-acid Based, Nickel Based, Sodium-ion, Others), By Drive (ICE, Electric Vehicle (BEV, PHEV)), By Application (Starting-Lighting-Ignition (SLI), Propulsion, Start-Stop, Auxiliary/12 V Systems, Battery-as-a-Service / Swap, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167986

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

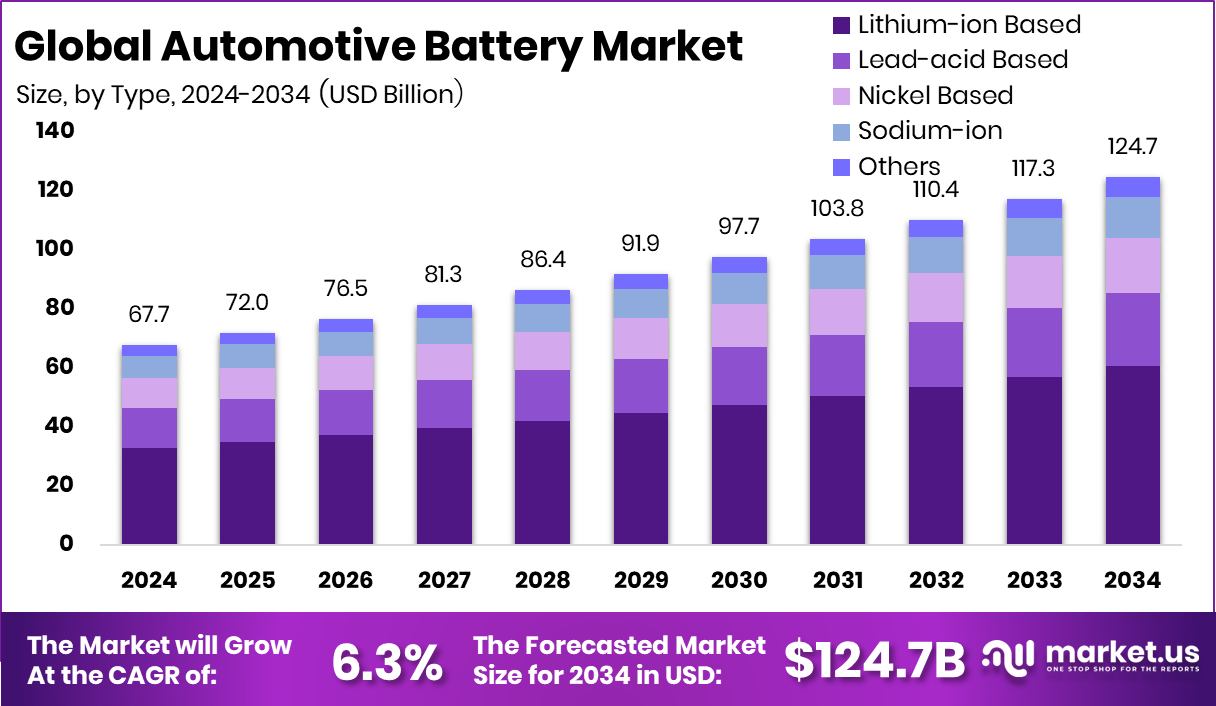

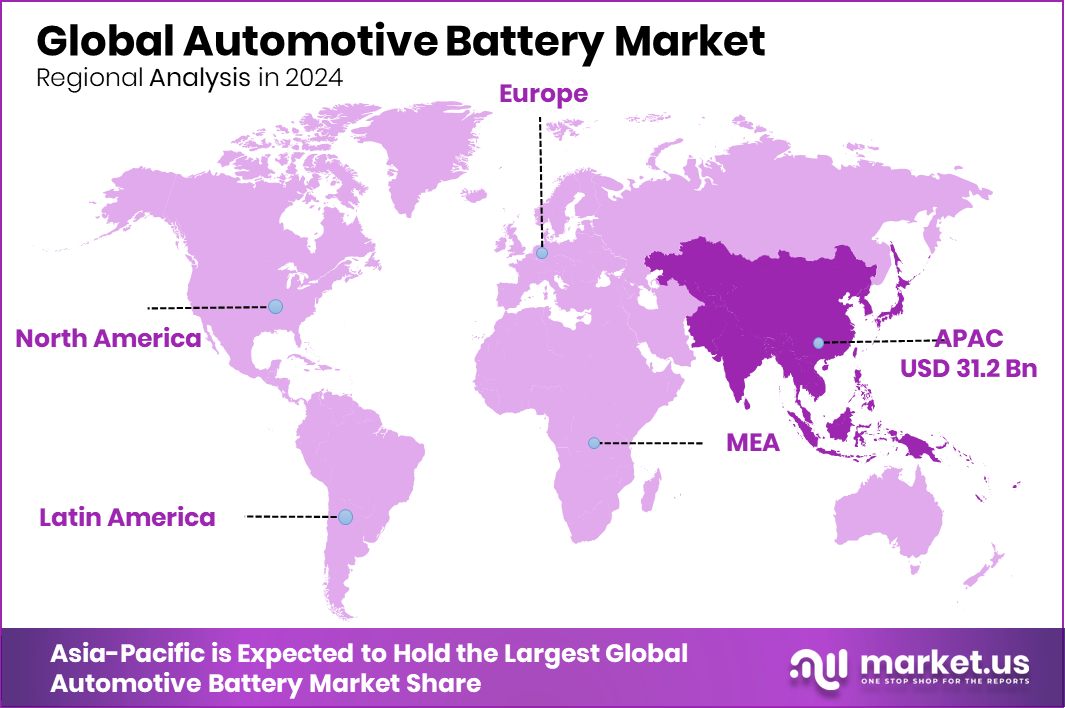

The Global Automotive Battery Market is expected to be worth around USD 124.7 billion by 2034, up from USD 67.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. Strong manufacturing presence helps Asia-Pacific capture 45.80% share, accounting for USD 31.2 Bn market size.

An automotive battery is a rechargeable energy storage unit that powers vehicle functions such as ignition, lighting, electronics, and electric drive systems. It ensures reliable performance by delivering consistent power under different driving and climate conditions.

The automotive battery market covers batteries used in passenger and commercial vehicles, including conventional, hybrid, and electric models. It includes production, recycling, and innovation around safer, longer-lasting, and more sustainable battery technologies.

Growth is driven by rising electric vehicle adoption, tighter emission rules, and strong funding into battery innovation. For example, Green Li-ion secured $20.5 M, while SGL Carbon received €42.9 M to advance lithium-ion battery materials and manufacturing technologies.

Demand is increasing as automakers focus on higher energy density, faster charging, and recycling. Battery recycling gained momentum with $542 M funding for Ascend Elements, followed by an additional $162 M to build sustainable lithium-ion material facilities in the United States.

Opportunities lie in alternative chemistries, recycling, and storage solutions. India’s Offgrid raised $15 M to reduce lithium dependence, while BatX Energies secured $5 M to scale lithium battery recycling, supporting circular and resilient supply chains.

Key Takeaways

- The Global Automotive Battery Market is expected to be worth around USD 124.7 billion by 2034, up from USD 67.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- Automotive Battery Market shows strong dominance of lead-acid based batteries, holding 48.6% share due to reliability.

- Automotive Battery Market remains largely driven by ICE vehicles, which account for 73.4% demand globally.

- Automotive Battery Market demand is led by Starting-Lighting-Ignition applications, capturing 49.9% share across vehicles.

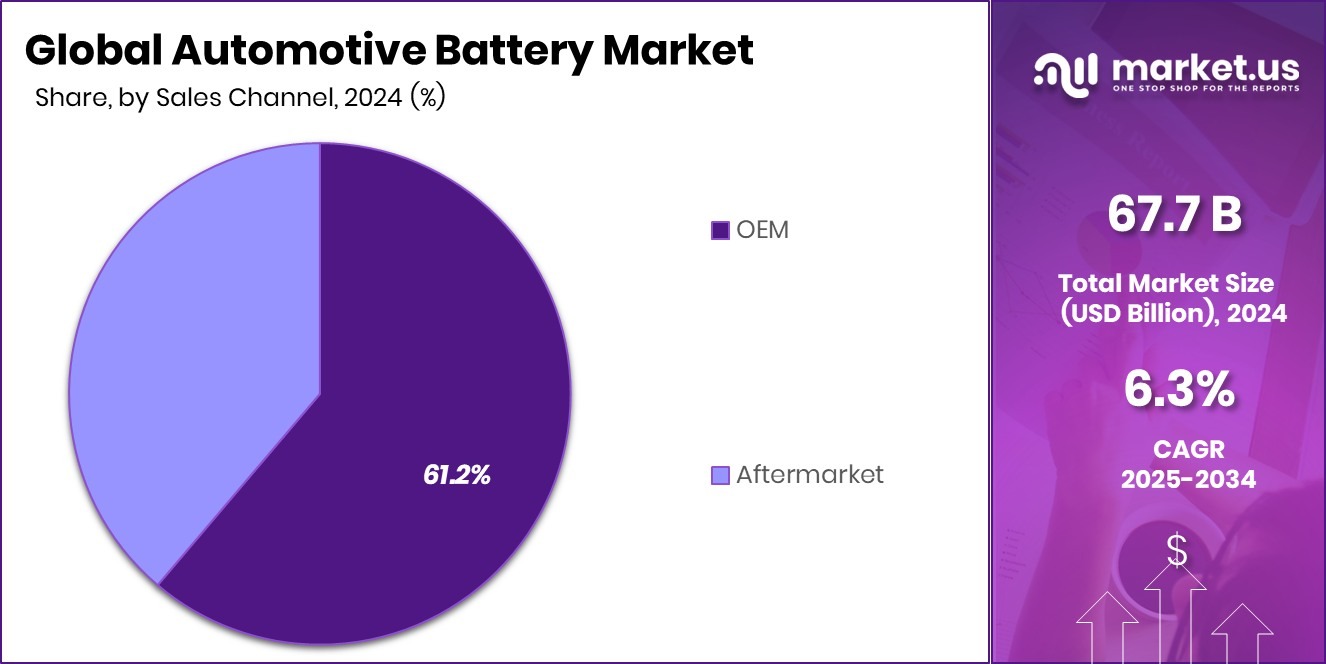

- Automotive Battery Market sales are mainly supported by OEM channels, contributing 61.2% share through vehicle production.

- The Asia-Pacific region’s Automotive Battery Market holds 45.80%, reaching USD 31.2 Bn in total value.

By Type Analysis

Automotive Battery Market by type is led by lead-acid based batteries with a 48.6% share.

In 2024, Lead-acid Based held a dominant market position in the By Type segment of the Automotive Battery Market, with a 48.6% share, reflecting its strong and sustained use across passenger and commercial vehicles. This dominance is mainly supported by proven reliability, ease of availability, and well-established manufacturing and recycling systems.

Lead-acid batteries continue to perform consistently in starting, lighting, and ignition applications, making them a practical choice for conventional vehicles operating in varied climate conditions. Their cost-effectiveness also supports large-scale adoption in price-sensitive markets, particularly where affordability and service infrastructure matter most.

Moreover, mature recycling practices help extend lifecycle value, strengthening long-term acceptance. As vehicle maintenance networks remain deeply familiar with this technology, lead-acid batteries continue to hold a stable and trusted position within the automotive battery landscape.

By Drive Analysis

Automotive Battery Market by drive is dominated by ICE vehicles, holding 73.4% share.

In 2024, ICE held a dominant market position in the By Drive segment of the Automotive Battery Market, with a 73.4% share, highlighting its continued prevalence across global vehicle fleets. This strong position reflects the large installed base of internal combustion engine vehicles that rely on dependable battery systems for starting and onboard electrical operations.

ICE vehicles remain widely used due to established fueling infrastructure, familiar vehicle technology, and widespread service networks. Batteries in this segment play a critical role in ensuring consistent vehicle performance, supporting ignition systems, lighting, and essential electronic features.

In many regions, gradual vehicle replacement cycles and long vehicle lifespans contribute to sustained demand from this drive segment. As a result, the ICE category continues to anchor battery demand within the automotive ecosystem.

By Application Analysis

Automotive Battery Market by application sees SLI batteries leading with a 49.9% share.

In 2024, Starting-Lighting-Ignition (SLI) held a dominant market position in the By Application segment of the Automotive Battery Market, with a 49.9% share, underlining its essential role in everyday vehicle operation. This dominance is supported by the universal requirement for reliable engine starting and electrical power across a wide range of vehicles.

SLI batteries are critical for delivering short, high-power bursts needed to start engines while also supporting lighting and basic electrical systems during vehicle use. Their consistent performance, ease of replacement, and compatibility with existing vehicle architectures help sustain strong acceptance.

Additionally, the routine maintenance and replacement cycle associated with SLI batteries reinforces their continued demand and leadership within the application segment.

By Sales Channel Analysis

Automotive Battery Market by sales channel is driven by OEMs, accounting for a 61.2% share.

In 2024, OEM held a dominant market position in the By Sales Channel segment of the Automotive Battery Market, with a 61.2% share, reflecting strong integration of batteries at the vehicle manufacturing stage. This leadership is driven by the direct fitting of batteries during vehicle assembly, ensuring compatibility, quality, and performance standards are met from the outset.

OEM-supplied batteries benefit from standardized specifications and long-term supply arrangements aligned with vehicle production volumes. The preference for factory-installed batteries also supports consistency in warranty coverage and vehicle reliability.

As new vehicles continue to enter the market with pre-installed battery systems, the OEM channel remains a key pillar supporting stable demand across the automotive battery value chain.

Key Market Segments

By Type

- Lithium-ion Based

- Lead-acid Based

- Nickel Based

- Sodium-ion

- Others

By Drive

- ICE

- Electric Vehicle

- BEV

- PHEV

By Application

- Starting-Lighting-Ignition (SLI)

- Propulsion

- Start-Stop

- Auxiliary/12 V Systems

- Battery-as-a-Service / Swap

- Others

By Sales Channel

- OEM

- Aftermarket

Driving Factors

Rising Electric Mobility Adoption Expands Automotive Battery Demand

The growing shift toward electric and hybrid vehicles is a major driving factor for the automotive battery market. As more consumers choose vehicles with electric powertrains, the need for reliable, efficient, and long-lasting batteries continues to rise.

Governments are also supporting cleaner transport through incentives and stricter emission rules, which encourage wider vehicle electrification. This transition increases demand not only for new batteries but also for recycling and reuse systems to manage end-of-life units responsibly.

In this context, funding activity highlights the focus on sustainability, as Maxvolt Energy raised USD 1.5 M from angel investors to strengthen lithium battery recycling capabilities. Such investments support supply stability, reduce environmental impact, and improve material recovery, reinforcing long-term growth across the automotive battery ecosystem.

Restraining Factors

High Battery Costs Limit Broader Vehicle Adoption

High battery costs remain a key restraining factor for the automotive battery market, especially in price-sensitive regions. Battery systems add a significant share to total vehicle cost, making advanced vehicles less affordable for many buyers.

The high expense comes from raw material processing, complex manufacturing steps, and safety requirements needed to ensure long service life. Cost pressure also affects maintenance and replacement decisions, delaying wider acceptance among everyday users.

To address these challenges, innovation and alternative approaches are gaining attention. For instance, Cancrie raised $1.2 Mn in a seed funding round to support new technology development aimed at improving efficiency and lowering system complexity. Such efforts highlight the ongoing need to reduce battery costs to unlock larger market adoption.

Growth Opportunity

Battery Recycling Expansion Creates Long-Term Market Opportunity

Battery recycling is emerging as a strong growth opportunity for the automotive battery market as vehicle usage continues to rise. Large numbers of batteries reaching the end of life create the need for safe recovery of valuable materials such as lithium, nickel, and cobalt. Recycling helps reduce dependence on raw material imports while lowering environmental impact.

Governments are actively supporting this shift through policy and financial support. A clear example is when American Battery Technology Company was awarded a $144 million grant contract from the U.S. Department of Energy for the construction of a second lithium-ion battery recycling facility. Such initiatives strengthen supply security, lower material costs over time, and open long-term growth avenues for sustainable automotive battery development.

Latest Trends

Sustainable Battery Recycling Gains Rapid Industry Attention

Sustainability has become one of the latest trends shaping the automotive battery market, with a strong focus on recycling and responsible material handling. As vehicles continue to rely on batteries, managing waste and reducing environmental impact is becoming a priority.

Lead-acid batteries, being widely used, require efficient recycling systems to prevent pollution and recover usable materials. This trend is supported by growing financial backing across the recycling ecosystem.

For instance, a lead acid battery recycler secured £1.5 M in packaging funding to improve collection and processing activities. Such investments highlight how the market is moving toward cleaner operations, better packaging solutions, and higher recovery rates, making battery lifecycles more sustainable and aligned with environmental goals.

Regional Analysis

Asia-Pacific leads the Automotive Battery Market with 45.80% share, valued at USD 31.2 Bn regionally.

The Asia-Pacific region dominates the Automotive Battery Market, holding a 45.80% share and reaching a market value of USD 31.2 Bn. This leadership is supported by large-scale vehicle production, strong battery manufacturing capacity, and widespread use of batteries across passenger and commercial vehicles. The region benefits from well-developed supply chains and high replacement demand, which together sustain consistent battery consumption across urban and rural transport systems.

North America represents a mature regional market with steady demand driven by vehicle ownership levels and regular battery replacement cycles. The region shows a strong focus on performance reliability, safety standards, and long-term durability, supporting stable automotive battery usage across different vehicle categories.

In Europe, automotive battery demand is reinforced by strict emission controls and a strong emphasis on vehicle efficiency. The region maintains consistent market activity through vehicle modernization and ongoing demand for dependable battery solutions.

The Middle East & Africa region shows gradual automotive battery adoption, supported by vehicle imports and expanding transport networks. Batteries remain essential for ensuring reliable vehicle operation under varying climate conditions.

Latin America continues to see stable market growth as vehicle fleets expand and maintenance-driven battery replacements support ongoing regional demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Exide Technologies continues to hold a strong position in the global automotive battery market through its long-standing expertise in battery manufacturing and recycling operations. The company’s broad portfolio supports automotive applications with a focus on reliability, durability, and lifecycle management. Its experience across conventional vehicle platforms allows Exide to stay closely aligned with replacement demand and OEM-oriented supply requirements, reinforcing its relevance in both mature and developing automotive markets.

GS Yuasa International Ltd. brings deep technical strength to the automotive battery space, supported by advanced engineering and disciplined manufacturing practices. The company is widely recognized for its focus on performance consistency and safety standards, which are critical for automotive use. GS Yuasa’s continued emphasis on improving battery efficiency and longevity supports steady adoption across passenger and commercial vehicle segments, particularly where operational reliability is a priority.

Panasonic Corporation plays an important role in the automotive battery market by leveraging its electronics heritage and strong research capabilities. The company’s approach centers on precision manufacturing, quality control, and integration of battery systems with broader vehicle technologies. Its ability to align battery development with evolving vehicle electrification needs positions Panasonic as a key contributor to technological progress within the global automotive battery ecosystem.

Top Key Players in the Market

- Exide Technologies

- GS Yuasa International Ltd.

- Panasonic Corporation

- LG Energy Solution

- A123 Systems Corp

- East Penn Manufacturing Company

- Robert Bosch GmbH

- ENERSYS.

- Samsung SDI

- Hitachi, Ltd.

Recent Developments

- In September 2024, Panasonic Energy announced it is ready to begin mass production of its new “4680” lithium-ion automotive battery cells, signaling its push toward next-generation EV battery technology.

- In April 2024, GS Yuasa launched a renewed version of its “ECO.R HV auxiliary VRLA battery” series for hybrid vehicles (notably used in many Toyota hybrids). The update improved performance for two sizes (B20 and B24), reducing the risk of sudden battery failure and improving reliability for hybrid-vehicle auxiliary systems.

- In March 2024, Exide Technologies acquired BE-Power GmbH, a German firm specializing in high-power and high-voltage lithium-ion battery solutions. This acquisition strengthens Exide’s lithium-ion technology capabilities, enabling it to combine BE-Power’s battery-management systems and module expertise with its established energy-storage business.

Report Scope

Report Features Description Market Value (2024) USD 67.7 Billion Forecast Revenue (2034) USD 124.7 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lithium-ion Based, Lead-acid Based, Nickel Based, Sodium-ion, Others), By Drive (ICE, Electric Vehicle (BEV, PHEV)), By Application (Starting-Lighting-Ignition (SLI), Propulsion, Start-Stop, Auxiliary/12 V Systems, Battery-as-a-Service / Swap, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Exide Technologies, GS Yuasa International Ltd., Panasonic Corporation, LG Energy Solution, A123 Systems Corp, East Penn Manufacturing Company, Robert Bosch GmbH, ENERSYS., Samsung SDI, Hitachi, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Exide Technologies

- GS Yuasa International Ltd.

- Panasonic Corporation

- LG Energy Solution

- A123 Systems Corp

- East Penn Manufacturing Company

- Robert Bosch GmbH

- ENERSYS.

- Samsung SDI

- Hitachi, Ltd.