Global Automatic Platform Screen Doors Market Size, Share, Growth Analysis By Product Type (Full-Height, Half-Height, Others), By Component (Door Panels, Sensors, Control Systems, Others), By Material (Glass, Metal, Others), By Application (Metro and Train Stations, Airports, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169066

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

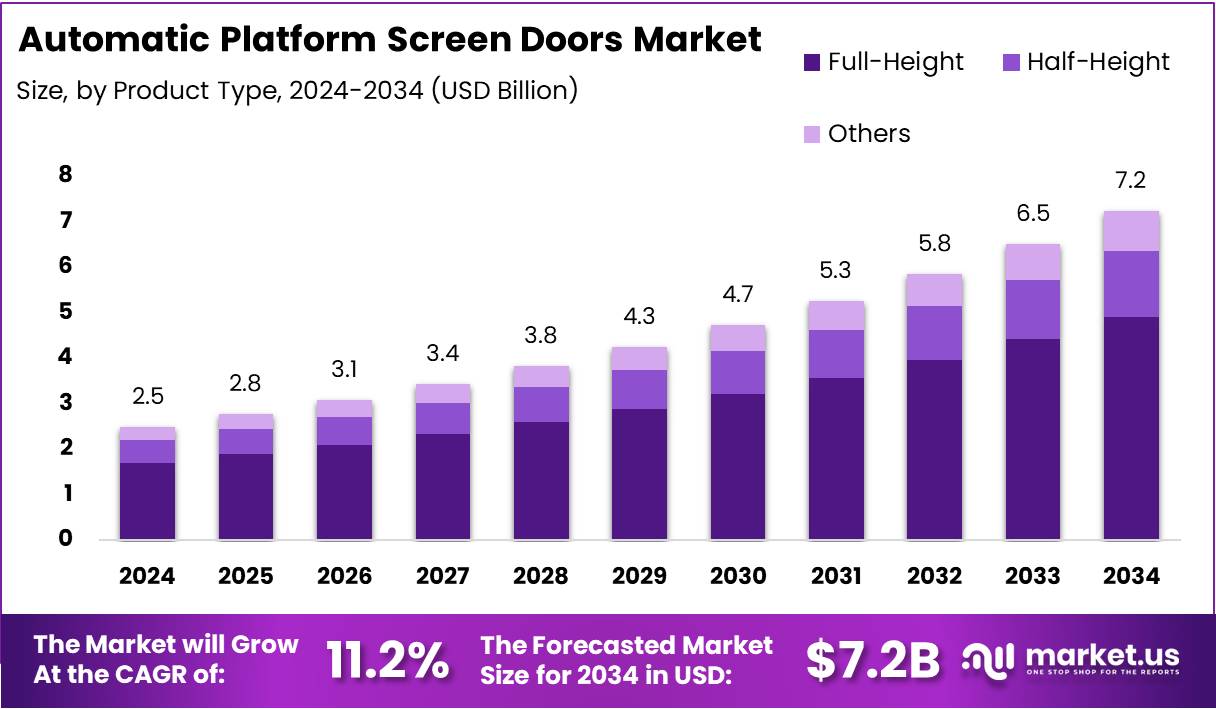

The Global Automatic Platform Screen Doors Market size is expected to be worth around USD 7.2 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

The Automatic Platform Screen Doors refers to barrier systems installed along station platforms to physically separate tracks from waiting passengers. They open and close in sync with train doors, ensuring safe boarding and alighting. This setup enhances passenger safety, prevents accidental or intentional track intrusions, and supports orderly boarding procedures.

The Automatic Platform Screen Doors Market encompasses demand, supply, and deployment of Automatic Platform Screen Doors systems across urban transit networks. Market dynamics include procurement by transit authorities, integration with existing rail infrastructure, and contract awards for installation and maintenance services. Rising urbanization and growing public transport usage drive greater adoption globally.

Urban growth and rising metro ridership push adoption. Rapid expansion of transit networks in major cities increases demand for APSD. Authorities consider APSD essential in new rail and subway projects. This growing deployment underlines a steady growth trajectory and reflects long‑term investment in public transit infrastructure.

Moreover, Automatic Platform Screen Doors deliver operational benefits beyond safety. Improved energy and climate control efficiency in underground stations reduces HVAC loads and lowers operational costs. Such benefits attract transit operators seeking environmental sustainability and energy cost reduction. Thus, market opportunity extends beyond pure safety solutions.

Furthermore, favorable regulatory environment fosters APSD uptake. Many governments mandate safety and accessibility upgrades in public transit. Policy frameworks and funding support modern rail infrastructure investments. These incentives strengthen market confidence and encourage long‑term contracts for Automatic Platform Screen Doors supply and maintenance.

In addition, concrete performance data reinforces APSD value. According to study, station cooling efficiency improved by 30 % after APSD installation. The same study found dwell time per station stop increased by 4–15 seconds, reflecting safer, more orderly boarding. Fatal subway suicides dropped by 89 % after APSD deployment, highlighting significant risk reduction.

Therefore, APSD adoption offers strong return on investment for transit operators and public authorities. Continued growth seems likely given safety, energy, and regulatory benefits. Investors and system planners should consider Automatic Platform Screen Doors integration during rail expansion or station upgrades to capitalize on compelling market demand.

Key Takeaways

- The Global Automatic Platform Screen Doors Market is projected to reach USD 7.2 Billion by 2034 from USD 2.5 Billion in 2024, growing at a CAGR of 11.2%.

- Full-Height doors dominate the By Product Type segment with a 67.9% market share in 2024.

- Door Panels lead the By Component segment with a 44.2% share in 2024.

- Glass materials dominate the By Material segment with a 59.7% share in 2024.

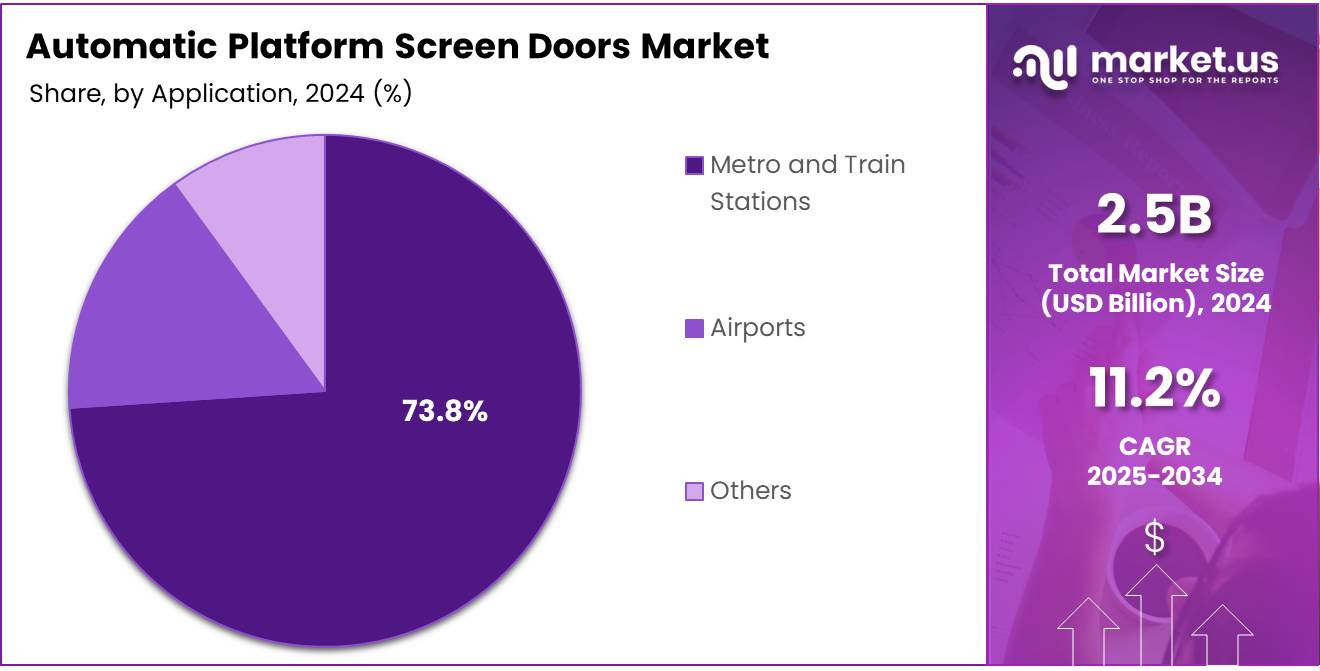

- Metro and Train Stations are the largest By Application segment with a 73.8% share in 2024.

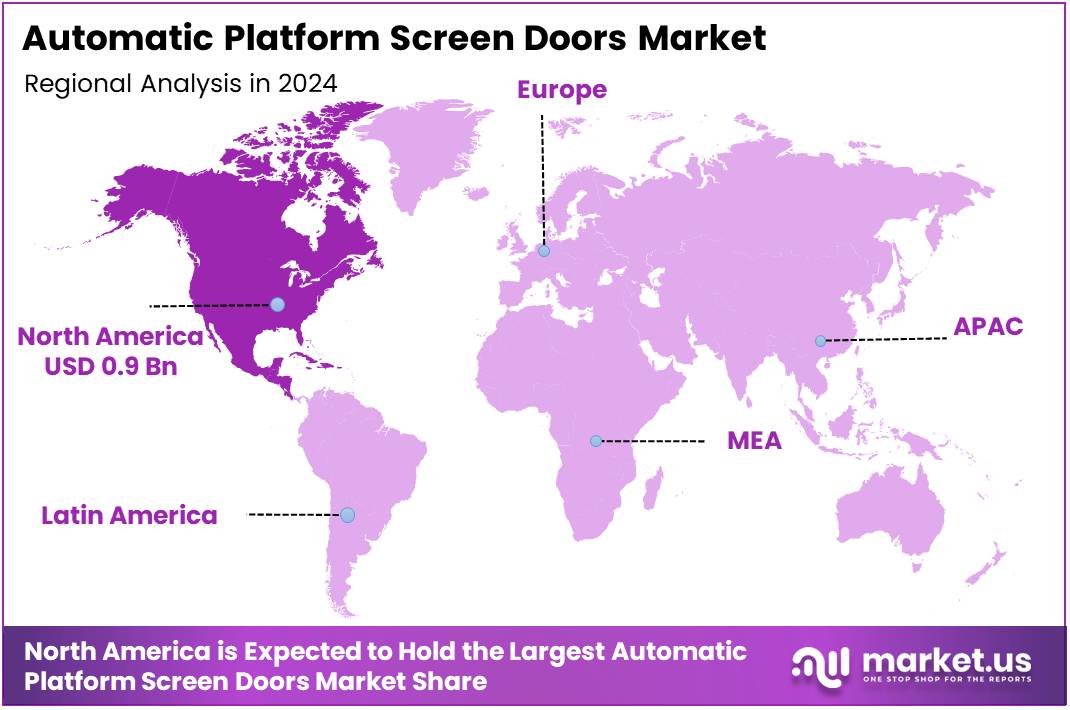

- North America holds the largest regional market share at 38.9%, valued at USD 0.9 Billion.

By Product Type Analysis

Full-Height dominates with 67.9% due to its enhanced safety features and growing adoption in urban transit.

In 2024, Full-Height held a dominant market position in the By Product Type Analysis segment of Automatic Platform Screen Doors Market, with a 67.9% share. Its complete barrier design ensures passenger safety, reduces accidental falls, and aligns with modern metro infrastructure requirements, driving widespread deployment globally.

Half-Height doors are gaining traction in stations with moderate passenger traffic. These doors provide cost-efficient solutions while ensuring partial platform protection. They are increasingly considered in smaller urban transit systems, where safety requirements are moderate but efficiency and space optimization remain important.

Other product types include customized and hybrid platform doors. These are designed for niche applications and non-standard stations. Although their adoption is lower, they provide flexibility for unique architectural or operational requirements, allowing transport authorities to maintain safety while managing installation costs effectively.

By Component Analysis

Door Panels dominates with 44.2% due to their essential role in safety and smooth operation.

In 2024, Door Panels held a dominant market position in the By Component Analysis segment, with a 44.2% share. Door panels form the primary barrier and are designed for durability, smooth operation, and aesthetic integration with station architecture, making them critical for functionality and safety.

Sensors are crucial for real-time detection of obstacles and passenger movement. They enhance operational safety and minimize accidents. Increasing integration of advanced sensor technology is improving reliability and reducing downtime, supporting smoother platform operations.

Control Systems manage the coordination of doors and train operations. Their efficiency ensures timely opening and closing, reduces delays, and enhances passenger experience. Modern systems incorporate smart algorithms and remote monitoring for better performance and predictive maintenance.

Other components include hinges, locking mechanisms, and auxiliary electronics. Though less visible, these parts are essential for overall reliability and durability. Continuous improvements in these areas are enhancing maintenance efficiency and operational life of the doors.

By Material Analysis

Glass dominates with 59.7% due to visibility, aesthetic appeal, and passenger safety.

In 2024, Glass held a dominant market position in the By Material Analysis segment, with a 59.7% share. Glass doors offer transparency, aesthetic appeal, and passenger safety. They are preferred for modern transit systems due to their visibility and ability to integrate seamlessly with architectural design.

Metal doors provide durability and strength, especially in high-traffic stations. They are resistant to impacts and weather conditions, making them suitable for outdoor or industrial transit environments. Although less visually appealing than glass, they ensure long-term operational reliability.

Other materials include composites and plastics, which are lightweight and cost-effective. They are primarily used in smaller stations or for temporary installations. Their adoption is limited but provides flexibility in low-budget or specialized projects without compromising safety.

By Application Analysis

Metro and Train Stations dominates with 73.8% due to high passenger volumes and urban expansion.

In 2024, Metro and Train Stations held a dominant market position in the By Application Analysis segment, with a 73.8% share. Extensive deployment in metro and railway networks globally is driven by passenger safety concerns and operational efficiency priorities in urban transit systems.

Airports are increasingly adopting platform doors for shuttle systems and automated terminals. They enhance passenger safety, control crowd movement, and improve energy efficiency in enclosed transit environments. However, overall market share remains lower than metro systems due to limited network size.

Other applications include bus rapid transit stations and urban transit hubs. These systems are gradually exploring platform doors to enhance safety and modernize facilities. Adoption is growing slowly but shows potential in expanding urban transport infrastructure.

Key Market Segments

By Product Type

- Full-Height

- Half-Height

- Others

By Component

- Door Panels

- Sensors

- Control Systems

- Others

By Material

- Glass

- Metal

- Others

By Application

- Metro and Train Stations

- Airports

- Others

Drivers

Rising Need for Safe and Efficient Urban Rail Systems Drives Market Growth

The global focus on zero-accident rail station infrastructure is a key driver for the Automatic Platform Screen Doors (APSD) market. Cities worldwide are prioritizing passenger safety, which encourages the installation of platform screen doors to prevent accidents and improve overall operational safety.

Governments are strongly promoting urban rail modernization programs. Investments in upgrading metro and train stations include advanced safety systems like Automatic Platform Screen Doors. These initiatives help enhance public transportation efficiency and attract more commuters, boosting market demand.

Increasing metro ridership is another significant factor. As more people use urban rail networks, managing passenger flow becomes critical. Automatic Platform Screen Doors provide an effective solution for crowd control, ensuring orderly boarding and reducing delays.

The combination of safety emphasis, government support, and growing passenger numbers creates a favorable environment for APSD adoption. Cities are investing in smart infrastructure that integrates these doors with automated train systems.

Restraints

Challenges in Integrating Automatic Platform Screen Doors Restrain Market Growth

The high retrofit integration complexity in older rail stations is a significant restraint for the automatic platform screen doors market. Many legacy stations were not originally designed to accommodate these systems, making installation costly and time-consuming. Modifying existing platforms often requires structural changes, which can disrupt daily operations and increase project expenses.

Limited standardization across rail networks also slows system compatibility, affecting market adoption. Different rail operators use varying specifications and safety protocols, making it difficult to implement uniform platform screen door systems. This lack of compatibility can lead to additional customization requirements, increasing installation timelines and costs.

These technical and operational challenges often discourage smaller metro and train operators from upgrading their stations. Integrating automatic platform screen doors into older infrastructure demands skilled labor and advanced engineering solutions, which may not be readily available in all regions.

Growth Factors

Rising Deployment of Platform Automation in Medium-Capacity Transit Lines Drives Market Growth

The increasing deployment of platform automation in medium-capacity transit lines is creating significant opportunities for the Automatic Platform Screen Doors market. Transit authorities are focusing on modernizing these lines to improve efficiency and passenger safety, which drives the adoption of Automatic Platform Screen Doors. Automated systems help reduce human errors and streamline station operations.

Energy-efficient door systems with smart power management are gaining attention in urban transit networks. Cities are adopting APSDs that consume less energy and integrate with intelligent power control, supporting sustainability goals. This trend encourages investments in modern door technologies that lower operational costs.

Expansion of metro projects in underserved urban corridors is another key growth driver. Rapid urbanization and rising commuter demand in smaller cities and developing regions are pushing governments to invest in metro infrastructure. Installing Automatic Platform Screen Doors in these new stations ensures safer and more reliable transit experiences.

Furthermore, smart and automated platform systems enhance passenger convenience. Integration with signaling and train control systems allows smoother boarding and reduces platform crowding. Such benefits make Automatic Platform Screen Doors a preferred choice for transit authorities planning new projects.

Emerging Trends

Shift Toward AI-Enabled Predictive Diagnostics Boosts Market Innovation

The Automatic Platform Screen Doors market is seeing a strong trend in adopting AI-enabled predictive diagnostics. Transit operators are increasingly using AI systems to monitor door performance, identify potential failures, and schedule maintenance proactively. This reduces downtime and ensures smoother station operations.

Another emerging trend is the integration of transparent OLED panels into Platform Screen Doors. These panels enhance passenger experience by displaying real-time information, advertisements, and alerts directly on the doors. The technology also allows for better aesthetic integration without compromising safety.

Safety systems are evolving with the adoption of edge-computing-based monitoring architectures. By processing data locally on the edge, these systems can detect anomalies in door operations instantly. This ensures faster response times and higher reliability compared to traditional centralized monitoring systems.

Operators are increasingly combining these technologies to create smart, connected door solutions. AI, OLED displays, and edge computing together enable predictive maintenance, real-time information sharing, and robust safety monitoring.

These trends are driving investment and modernization in metro and urban rail systems globally. As cities prioritize efficiency, safety, and passenger experience, the market for technologically advanced APSDs is expected to grow steadily in the coming years.

Regional Analysis

North America Dominates the Automatic Platform Screen Doors Market with a Market Share of 38.9%, Valued at USD 0.9 Billion

North America leads the Automatic Platform Screen Doors market, holding a dominant share of 38.9%, valued at USD 0.9 Billion. The market growth is driven by increasing urban rail modernization projects, focus on passenger safety, and advanced transportation infrastructure investments. Major cities are adopting APSDs to improve operational efficiency and reduce accidents.

Europe Automatic Platform Screen Doors Market Trends

Europe is witnessing steady growth in the Automatic Platform Screen Doors market, driven by expanding metro networks and government safety regulations. The region emphasizes retrofitting legacy rail stations with advanced door systems. Investments in energy-efficient and automated transit solutions are further supporting market adoption, ensuring safer and more reliable urban rail operations.

Asia Pacific Automatic Platform Screen Doors Market Trends

Asia Pacific shows significant growth potential due to rapid urbanization and expansion of metro projects in high-density cities. Governments are actively implementing Automatic Platform Screen Doors to enhance commuter safety and operational efficiency. Rising investments in smart transit solutions are accelerating the deployment of platform screen doors across major urban corridors.

Middle East and Africa Automatic Platform Screen Doors Market Trends

The Middle East and Africa are gradually adopting Automatic Platform Screen Doors, mainly in newly developed urban transit systems. Investments focus on modernizing rail infrastructure and improving passenger safety. Smart city initiatives and increasing metro expansions are expected to drive future growth in the region.

Latin America Automatic Platform Screen Doors Market Trends

Latin America is experiencing moderate growth in Automatic Platform Screen Doors adoption, supported by metro network expansions and safety-focused infrastructure projects. Government initiatives to improve urban rail efficiency and reduce accidents are gradually driving market demand across major cities in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automatic Platform Screen Doors Company Insights

In 2024, Alstom continued to strengthen its leadership in the Automatic Platform Screen Doors market by leveraging its extensive urban rail experience. The company focused on integrating advanced safety and energy-efficient solutions in metro and rail stations, which enhanced operational efficiency and reliability for its clients globally.

Siemens Mobility maintained a strong presence by expanding its smart transportation technologies. Its Automatic Platform Screen Doors solutions emphasize digital monitoring and predictive maintenance, helping transit authorities reduce operational downtime. Siemens’ focus on modular and scalable systems positions it favorably for urban infrastructure projects in emerging cities.

Mitsubishi Electric demonstrated consistent innovation in platform automation and safety systems. By integrating IoT-enabled door monitoring and control, the company enhanced station safety and operational performance. Mitsubishi Electric’s solutions also support energy-saving initiatives, aligning with the growing sustainability demands in urban transit.

Hitachi strengthened its market footprint through high-quality platform door systems with intelligent automation features. The company prioritizes reliability and compatibility with existing rail networks, which accelerates adoption in both new metro lines and retrofitting projects. Hitachi’s focus on minimizing service interruptions and maintenance complexity makes it a preferred partner for modern urban transit solutions.

Top Key Players in the Market

- Alstom

- Siemens Mobility

- Mitsubishi Electric

- Hitachi

- CRRC Corporation

- Toshiba Infrastructure Systems

- Faiveley Transport

- Schindler Group

- Hyundai Rotem

- Thales Group

- Knorr-Bremse AG

Recent Developments

- In October 2025, ST Engineering is innovating platform screen doors to enhance metro reliability. Their advanced solutions aim to improve passenger safety and operational efficiency across urban transit networks.

- In December 2024, Knorr-Bremse Rail Systems equipped the Thessaloniki Metro with cutting-edge platform screen doors. This deployment focuses on minimizing accidents and optimizing commuter flow within the station infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 7.2 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Full-Height, Half-Height, Others), By Component (Door Panels, Sensors, Control Systems, Others), By Material (Glass, Metal, Others), By Application (Metro and Train Stations, Airports, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alstom, Siemens Mobility, Mitsubishi Electric, Hitachi, CRRC Corporation, Toshiba Infrastructure Systems, Faiveley Transport, Schindler Group, Hyundai Rotem, Thales Group, Knorr-Bremse AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automatic Platform Screen Doors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automatic Platform Screen Doors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alstom

- Siemens Mobility

- Mitsubishi Electric

- Hitachi

- CRRC Corporation

- Toshiba Infrastructure Systems

- Faiveley Transport

- Schindler Group

- Hyundai Rotem

- Thales Group

- Knorr-Bremse AG