Global Automatic Number Plate Recognition System Market Market Size, Share, Growth Analysis By Type (Fixed ANPR Systems, Portable ANPR Systems), By Component (Hardware, Software, Service), By Application (Security & Surveillance, Toll Management, Parking Management, Traffic Management, Others), By End Use (Government, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167612

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

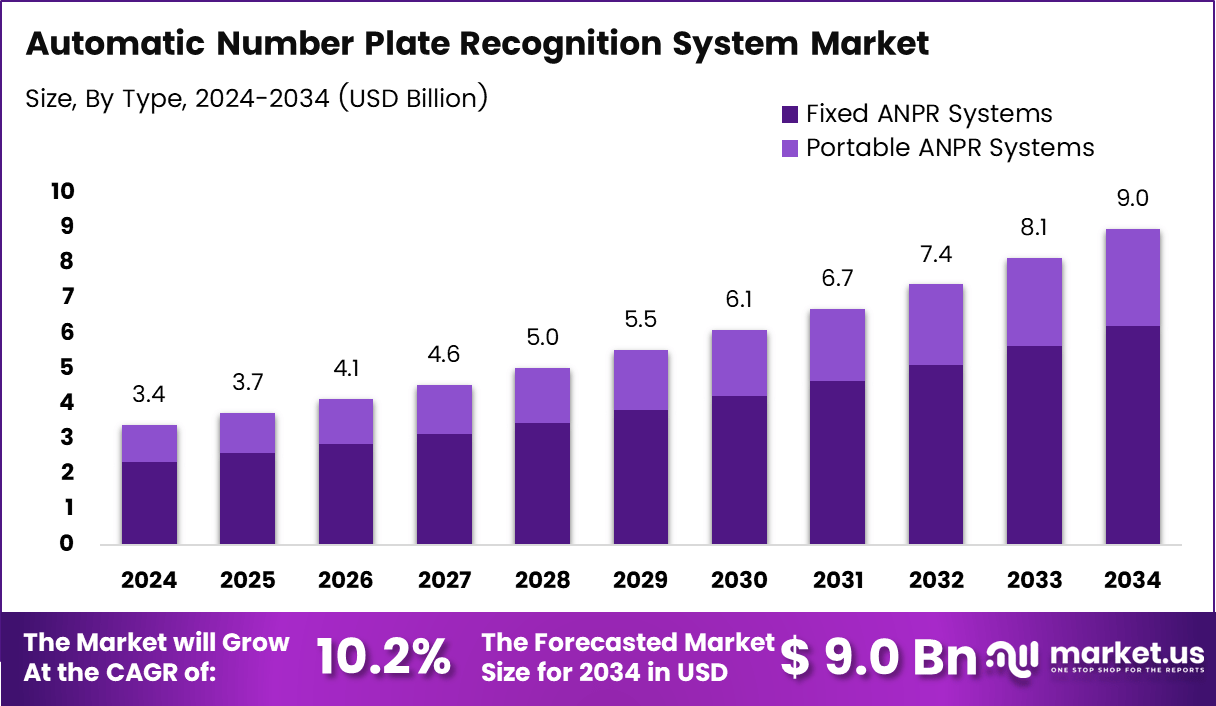

The Global Automatic Number Plate Recognition System Market size is expected to be worth around USD 9.0 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034.

The Automatic Number Plate Recognition System Market represents a rapidly advancing segment of intelligent transportation solutions supporting vehicle monitoring, traffic automation, and real-time enforcement. The market continues expanding as governments modernise mobility infrastructure and integrate smart sensors to strengthen urban traffic management, digital tolling, and public-safety and security applications.

Moving forward, growth is shaped by increasing adoption of AI-enabled imaging, improved edge processing, and scalable cloud architectures that support high-volume data environments. Enterprises leverage ANPR to automate access control, streamline logistics movements, and enhance operational visibility across busy transport networks. These benefits encourage strong adoption across public and private sectors.

Moreover, regulatory alignment accelerates structured deployments as governments mandate standardized enforcement, pollution monitoring, and vehicle-tracking frameworks. Public investment in road digitisation, highway automation, and city surveillance creates additional opportunities for ANPR solution providers. These initiatives strengthen market confidence and establish long-term demand for advanced detection and analytics capabilities.

In addition, rising security requirements enable ANPR integration with broader smart-city platforms, supporting automated violation detection and data-driven decision-making. Organisations value the improved accuracy, operational consistency, and real-time responsiveness offered by advanced ANPR technologies, reinforcing the need for continuous innovation and flexible system design.

According to Research, accuracy rates typically range between 90% and 98%, shaped by camera performance, algorithms, and environmental conditions. Furthermore, access to the UK National ANPR Service costs around $ 45,908.8 per annum, indicating the scale of operational investment required for nationwide monitoring compliance.

According to a Survey, AR/VR-aligned digital imaging technologies are expected to grow by 25% in the coming years, indirectly benefiting ANPR software innovation through improved computer-vision research. These statistical indicators, combined with rising government investment and infrastructure upgrades, highlight significant long-term opportunities for the Automatic Number Plate Recognition System Market.

Key Takeaways

- The Global Automatic Number Plate Recognition System Market is valued at USD 3.4 billion in 2024 and projected to reach USD 9.0 billion by 2034.

- The market grows at a steady pace with a recorded 10.2% CAGR between 2025 and 2034.

- Fixed ANPR Systems dominate the type segment with a strong market share of 69.2% in 2024.

- Hardware leads the component segment, accounting for a 55.3% share in 2024.

- Security & Surveillance stands as the largest application segment with 31.9% contribution in 2024.

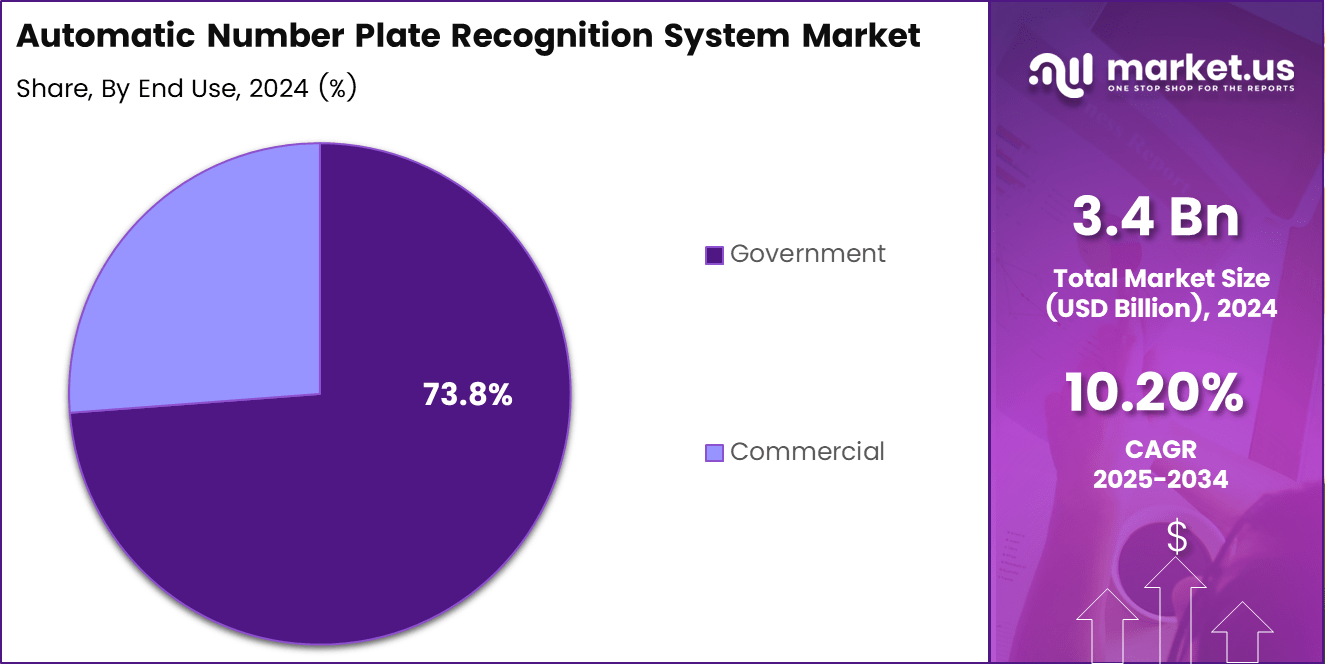

- Government end users dominate the market, capturing 73.8% share in 2024.

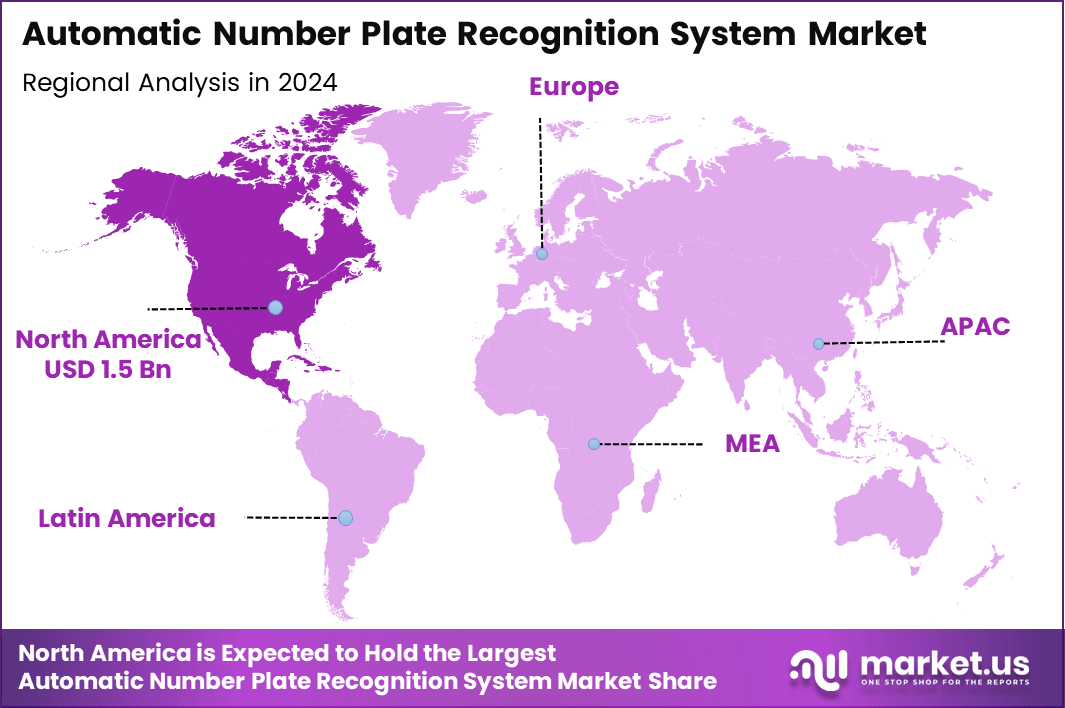

- North America remains the leading region with a significant 45.8% share, valued at USD 1.5 billion in 2024.

By Type Analysis

Fixed ANPR Systems dominate with 69.2% due to stable deployment, higher accuracy, and long-term enforcement utility.

In 2024, Fixed ANPR Systems held a dominant market position in the By Type Analysis segment of the Automatic Number Plate Recognition System Market, with a 69.2% share. These systems gained strong adoption because governments prioritised permanent roadside, tolling, and city-surveillance installations that deliver continuous imaging, stable connectivity, and consistent operational visibility.

Portable ANPR Systems continued expanding as organisations sought flexible, mobile enforcement tools for temporary checkpoints, crowd-management zones, and rapid deployment scenarios. These units supported field operations where fixed infrastructure was impractical, helping agencies cover blind spots, respond to events quickly, and improve short-term monitoring capabilities across diverse road environments.

By Component Analysis

Hardware dominates with 55.3% driven by large-scale camera deployment and infrastructure investment.

In 2024, Hardware held a dominant market position in the By Component Analysis segment of the Automatic Number Plate Recognition System Market, with a 55.3% share. The demand grew as agencies installed high-resolution cameras, infrared sensors, and edge-processing units to support accurate plate capture across highways, intersections, and secured facilities.

Software adoption increased steadily as users transitioned toward AI-based recognition engines, improved OCR accuracy, and scalable cloud analytics. Software upgrades enhanced real-time monitoring, automated violation detection, and integration with digital mobility systems, enabling organisations to modernise operations without major hardware replacement cycles.

Service offerings expanded further due to rising needs for maintenance, system calibration, data management, and technical support agreements. Service providers played a key role in optimising uptime, enhancing lifecycle performance, and ensuring compliance with evolving data-security and surveillance regulations across large ANPR deployments.

By Application Analysis

Security & Surveillance dominates with 31.9% due to rising enforcement and smart-city monitoring demands.

In 2024, Security & Surveillance held a dominant market position in the By Application Analysis segment of the Automatic Number Plate Recognition System Market, with a 31.9% share. Adoption strengthened as cities expanded safety programs, automated vehicle identification, and enhanced real-time threat detection across sensitive zones and public infrastructure.

Toll Management applications grew as governments modernised toll plazas, deployed cashless systems, and reduced congestion through automated vehicle recognition. ANPR supported smoother transactions, reduced leakages, and improved throughput across expressways and long-distance transport corridors.

Parking Management adoption expanded as commercial complexes, airports, and malls deployed automated entry-exit monitoring to reduce manual checks and improve operational efficiency. The shift toward ticketless parking and digital access reinforced demand for reliable ANPR-based automation.

Traffic Management applications benefited from rising urban-mobility initiatives, enabling authorities to monitor flow patterns, enforce lane discipline, and generate data-driven insights. These systems contributed to smoother mobility, reduced bottlenecks, and enhanced road-safety outcomes.

Other applications included fleet tracking, border control, and institutional security. These use cases continued to diversify as organisations sought scalable ANPR solutions to streamline vehicle movement, improve compliance, and strengthen perimeter monitoring requirements.

By End Use Analysis

Government dominates with 73.8% due to national security, enforcement, and infrastructure-modernisation priorities.

In 2024, the Government held a dominant market position in the By End Use Analysis segment of the Automatic Number Plate Recognition System Market, with a 73.8% share. Public agencies deployed ANPR extensively for enforcement, traffic automation, urban surveillance, tolling oversight, and strategic mobility programs supporting smart-city development.

Commercial adoption increased as private facilities, logistics operators, industrial parks, and residential complexes implemented ANPR for automated access control, parking validation, and real-time movement tracking. Rising focus on operational efficiency and contactless mobility strengthened demand across enterprise environments.

Key Market Segments

By Type

- Android

- Linux

- QNX

- Windows

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Application

- Infotainment System

- ADAS & Safety System

- Connected Services

- Body Control & Comfort System

- Engine Management & Powertrain Control

- Communication & Telematics

- Others

Drivers

Expansion of AI-Based Video Analytics Enhances Market Growth

The Automatic Number Plate Recognition System Market is experiencing strong momentum as AI-driven video analytics significantly improve plate-reading accuracy. This technology helps systems identify characters faster and handle complex conditions such as nighttime glare, vehicle speed, and crowded intersections. Increased precision encourages governments and enterprises to scale deployments.

Smart urban mobility programs further accelerate adoption as cities introduce automated traffic tools to manage congestion and reduce manual monitoring. ANPR systems support digital traffic flows, enable real-time alerts, and streamline vehicle verification processes. These functions make ANPR essential in next-generation smart-city infrastructure.

Moreover, seamless integration with tolling, parking, and vehicle access-control ecosystems expands usage across highways, commercial facilities, and private campuses. ANPR helps eliminate human error, speeds up entry processes, and supports cashless operations. These benefits strengthen the market’s long-term value proposition for public and private entities.

Growing enforcement requirements also drive demand as authorities focus on speed compliance, red-light violation detection, and stolen-vehicle tracking. Automated systems create reliable data trails, enhance road safety, and support transparent monitoring practices. This shift increases the importance of ANPR in modern law enforcement and mobility governance.

Restraints

High Upfront Investment Limits Faster Market Adoption

The Automatic Number Plate Recognition System Market faces restraints primarily linked to high initial investment for cameras, servers, and imaging units. Many projects require multiple camera installations across highways and intersections, increasing the total setup cost. This makes smaller agencies hesitant to implement large-scale systems.

Another key restraint comes from inconsistent plate formats across regions. Variations in fonts, sizes, backgrounds, and materials make accurate detection challenging. These inconsistencies reduce system performance and slow down operational processes in areas where plate standards are not strictly enforced.

Low-quality plates, especially those damaged, faded, or illegally modified, further reduce accuracy levels. Poor visibility during rain, fog, or nighttime conditions amplifies this issue. Operators often need additional lighting or infrared solutions, adding complexity and cost burden to deployments.

Accuracy-related concerns make some commercial operators cautious, as failed detection impacts workflows in parking management, toll plazas, and access-control operations. These limitations highlight the need for improved regulation, better imaging infrastructure, and standardised plate design to unlock wider ANPR adoption.

Growth Factors

Cloud-Native ANPR Solutions Create New Market Opportunities

The Automatic Number Plate Recognition System Market is gaining new opportunities through the adoption of cloud-native platforms. These systems allow decentralised deployments across multiple locations while providing centralised data management. As organisations scale operations, cloud-based ANPR reduces hardware dependency and lowers long-term maintenance costs.

Cross-border vehicle monitoring offers additional growth potential as governments strengthen border security for freight, customs, and immigration. ANPR enables quick vehicle identification, real-time data exchange, and seamless coordination between regional authorities. This improves trade movement while enhancing national security monitoring.

Retail parking operators increasingly rely on ANPR to automate entry validation, speed up exit processes, and reduce queuing. Airports and gated facilities also adopt ANPR to ensure controlled access, improve traffic flow, and maintain safety compliance. These deployments create strong commercial opportunities for vendors.

As data analytics evolve, ANPR systems support advanced insights for vehicle behaviour, repeat visits, and operational trends. These analytics help businesses optimise parking strategies and improve security planning. This shift positions ANPR as both a monitoring and decision-support tool for modern mobility ecosystems.

Emerging Trends

Shift Toward Edge-Processing Cameras Reshapes Market Trends

The Automatic Number Plate Recognition System Market is witnessing major technological shifts as edge-processing cameras reduce the dependency on centralised servers. These devices process data on-site, lowering bandwidth usage and improving detection speed. This trend supports faster response times and more efficient field operations.

Hybrid ANPR models combining OCR, AI vision, and deep learning are increasingly preferred. These systems deliver stronger recognition performance across varied lighting and traffic situations. By merging multiple analytical layers, they improve reliability and address previous accuracy gaps in traditional ANPR solutions.

Integration with EV charging hubs, smart highways, and autonomous mobility programs is also emerging. ANPR enables automated billing, vehicle authentication, and lane prioritisation in next-generation mobility infrastructure. These integrations strengthen the role of ANPR in future transport ecosystems.

Privacy-preserved ANPR frameworks are gaining traction as organisations adopt encrypted plate tokens and anonymisation techniques. This ensures compliance with data-protection regulations while maintaining operational efficiency. Such advancements reinforce user trust and encourage broader acceptance of automated vehicle-recognition technologies.

Regional Analysis

North America Dominates the Automatic Number Plate Recognition System Market with a Market Share of 45.8%, Valued at USD 1.5 Billion

North America holds the leading position in the Automatic Number Plate Recognition (ANPR) System Market, supported by strong adoption across traffic enforcement, smart mobility, and connected infrastructure programs. The region benefits from the wide-scale deployment of automated tolling, parking analytics, and roadway monitoring systems, driving its dominant 45.8% share and valuation of USD 1.5 billion. Federal and state-level smart transportation investments continue to expand demand for high-precision ANPR platforms across the US and Canada.

Europe Automatic Number Plate Recognition System Market Trends

Europe represents a mature ANPR ecosystem driven by stringent road-safety directives and cross-border vehicle monitoring regulations. The region shows steady adoption across urban congestion charging, low-emission zones, and law-enforcement operations. Advancements in intelligent transport systems and city-level automation programs further position Europe as one of the most structured ANPR users globally.

Asia Pacific Automatic Number Plate Recognition System Market Trends

Asia Pacific is experiencing rapid ANPR expansion as governments modernise transportation infrastructure and strengthen traffic management in high-density metros. Growing investments in smart city programs across China, India, Japan, and South Korea accelerate system adoption. Rising vehicle ownership and urban congestion challenges are encouraging municipalities to deploy ANPR for enforcement, tolling, and intelligent mobility optimisation.

Middle East & Africa Automatic Number Plate Recognition System Market Trends

Middle East & Africa are witnessing increasing ANPR uptake driven by smart city initiatives, advanced highway surveillance systems, and national-level vehicle security programs. Gulf countries, in particular, invest heavily in intelligent transport upgrades, integrating ANPR into border control, high-speed corridors, and urban monitoring. Growth remains supported by urban expansion and infrastructure modernisation.

Latin America Automatic Number Plate Recognition System Market Trends

Latin America shows growing ANPR demand as cities expand digital traffic enforcement, automated toll collection, and public-safety systems. Countries such as Brazil, Mexico, and Chile increasingly integrate ANPR into crime-prevention networks and urban mobility platforms. Although adoption is emerging, infrastructure upgrades and government-backed digitisation projects create strong long-term potential.

United States Automatic Number Plate Recognition System Market Trends

The United States contributes significantly to North America’s leadership, driven by the rapid digitalisation of transportation networks, automated violation monitoring, and highway tolling modernisation. State DOTs and city authorities actively deploy ANPR to strengthen roadway intelligence, optimise traffic flows, and support public-safety operations. Growing smart mobility investments reinforce the country’s strong ANPR penetration across commercial and government environments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automatic Number Plate Recognition System Market Company Insights

The global Automatic Number Plate Recognition (ANPR) System Market in 2024 reflects steady adoption across smart mobility programs, automated traffic enforcement, and integrated security ecosystems. Major technology providers continue strengthening their portfolios with higher-accuracy optics, AI-driven video analytics, and scalable platforms supporting urban digitalisation initiatives.

Adaptive Recognition Inc. remains a key innovator in optical character recognition and camera-based identification systems, with its solutions expected to gain traction due to increasing demand for high-speed and low-light plate-reading performance. The company’s modular ANPR architecture supports diverse applications spanning tolling, border control, and critical-infrastructure security.

Axis Communications AB continues expanding its network-video expertise into license-plate analytics through advanced edge-processing capabilities. Its camera platforms are anticipated to remain preferred in urban traffic automation due to strong integration flexibility, cybersecurity layers, and reliable outdoor deployment performance.

Genetec Inc. strengthens its position through unified security platforms that combine video management, access control, and plate-recognition modules. Its ecosystem-driven approach is projected to remain attractive for cities and enterprises seeking centralised analytics, fleet oversight, and compliance automation.

Kapsch TrafficCom AG leverages deep expertise in intelligent transportation systems, enabling end-to-end ANPR-enabled tolling, congestion management, and enforcement programs. Its traffic-centric portfolio is expected to maintain relevance as governments scale digital tolling and smart-corridor operations worldwide.

Although other players such as Tattile s.r.l., Siemens AG, Vaxtor Ltd, and NDI Recognition System remain influential, the above four continue shaping global ANPR advancement through innovation, system reliability, and deployment scalability across next-generation mobility networks.

Top Key Players in the Market

- BlackBerry Limited

- Microsoft Corporation

- Alphabet Inc.

- Apple Inc.

- Baidu, Inc.

- Wind River Systems, Inc.

- Hitex GmbH

- Bayerische Motoren Werke AG

- NVIDIA Corporation

- Green Hills Software

Recent Developments

- In August 2024, Jenoptik deployed its VECTOR SR system for automated speed enforcement, integrating a high-resolution imaging module with advanced ANPR and radar-based detection. The system enhanced accuracy in identifying violations and supported safer traffic corridors through continuous monitoring and automated evidence collection.

- In April 2025, the Indian government confirmed that a satellite-based tolling framework is under evaluation, while a hybrid ANPR-FASTag model will be tested at selected toll plazas. This pilot approach helped authorities assess real-world feasibility, ensuring smoother transition planning instead of replacing FASTag nationwide.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fixed ANPR Systems, Portable ANPR Systems), By Component (Hardware, Software, Service), By Application (Security & Surveillance, Toll Management, Parking Management, Traffic Management, Others), By End Use (Government, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Adaptive Recognition Inc., Axis Communications AB, Genetec Inc., Kapsch TrafficCom AG, Leonardo US Cyber and Security Solutions, LLC, Tattile s.r.l., Siemens AG, Vaxtor Ltd, NDI Recognition System Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Automatic Number Plate Recognition System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automatic Number Plate Recognition System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BlackBerry Limited

- Microsoft Corporation

- Alphabet Inc.

- Apple Inc.

- Baidu, Inc.

- Wind River Systems, Inc.

- Hitex GmbH

- Bayerische Motoren Werke AG

- NVIDIA Corporation

- Green Hills Software