Global Asphalt Shingles Market Size, Share, And Business Benefits By Product Type (Architectural Asphalt Shingles, Three-Tab Asphalt Shingles, Strip Shingles, Luxury Shingles, Others), By Compositionn (Fiberglass, Organic, Others), By Installation (New Construction, Retrofit), By End Use (Residential (Single-family Homes, Multi-family Housing, Townhouses), Commercial (Office buildings, Retail spaces, Institutional structures, Others), Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148538

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

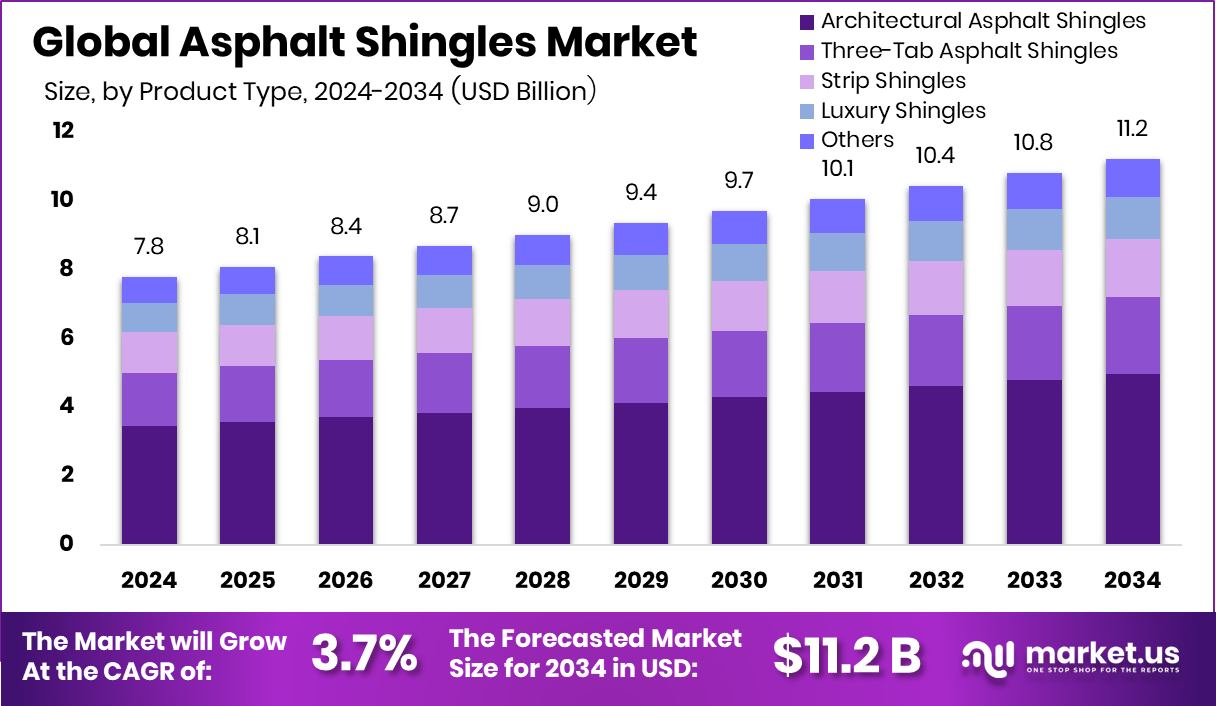

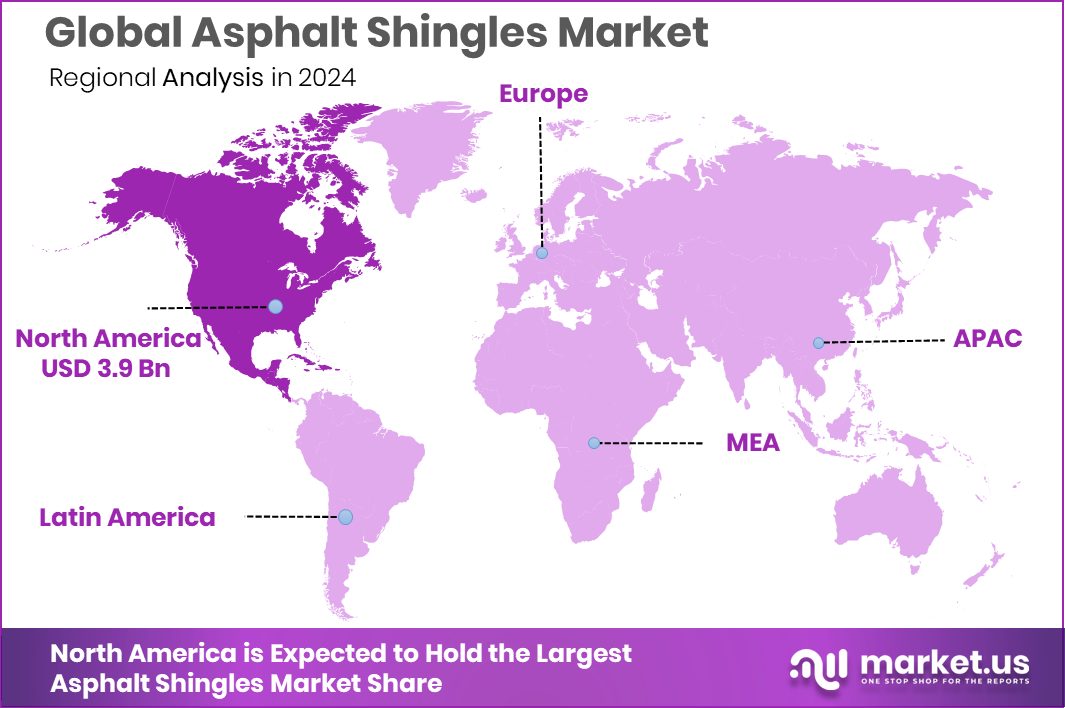

Global Asphalt Shingles Market is expected to be worth around USD 11.2 billion by 2034, up from USD 7.8 billion in 2024, and grow at a CAGR of 3.7% from 2025 to 2034. With a 49.8% share, North America’s Asphalt Shingles Market reached USD 3.9 billion.

Asphalt shingles are a type of roofing material composed of a fiberglass or organic mat base, coated with asphalt and mineral granules. They are widely used in residential and commercial buildings due to their affordability, durability, and variety of styles and colors. These shingles are designed to protect roofs from harsh weather conditions, including rain, wind, and UV radiation, while also enhancing the aesthetic appeal of structures.

The asphalt shingles market refers to the global industry focused on the production, distribution, and sale of asphalt-based roofing materials. This market is driven by factors such as increasing construction activities, growing demand for cost-effective roofing solutions, and rising awareness of weather-resistant and energy-efficient roofing systems.

The asphalt shingles market is experiencing growth driven by expanding urbanization and increasing residential construction projects. The rise in housing renovations and the need for affordable roofing materials have boosted the demand for asphalt shingles. Additionally, technological advancements in shingle design, such as enhanced weather resistance and energy efficiency, further propel market expansion.

Demand for asphalt shingles is fueled by their affordability and versatility. Homeowners and contractors prefer these shingles for their cost-effectiveness, easy installation, and availability in various colors and styles. Furthermore, the increasing focus on sustainable and energy-efficient roofing solutions has led to higher demand for reflective and solar-integrated shingles.

Key Takeaways

- Global Asphalt Shingles Market is expected to be worth around USD 11.2 billion by 2034, up from USD 7.8 billion in 2024, and grow at a CAGR of 3.7% from 2025 to 2034.

- Architectural asphalt shingles dominate the market with a 44.2% share, driven by aesthetic appeal.

- Fiberglass shingles, accounting for 78.5%, are preferred for their lightweight structure and enhanced durability.

- Retrofit installations hold a substantial 67.4% market share, benefiting from rising renovation activities globally.

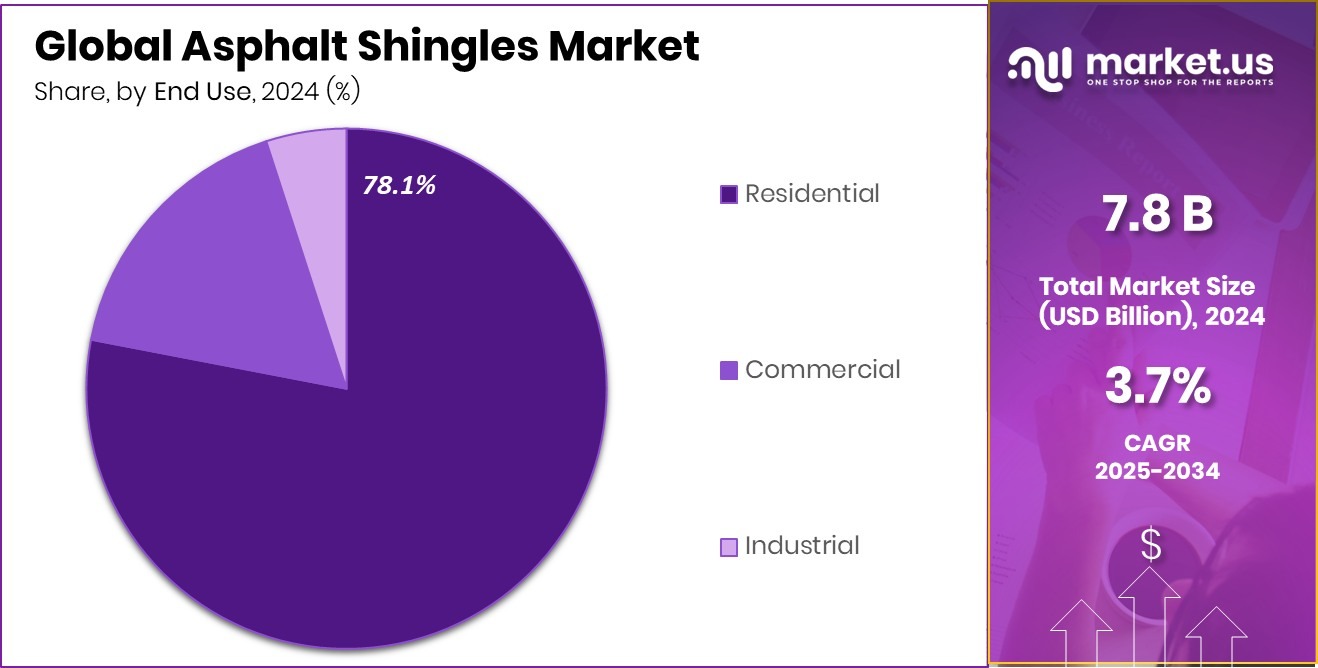

- The residential sector leads the asphalt shingles market with a commanding 78.1% share, fueling demand.

- North America’s Asphalt Shingles Market, valued at USD 3.9 billion, captures a 49.8% share.

By Product Type Analysis

Architectural asphalt shingles captured a dominant 44.2% market share globally.

In 2024, Architectural Asphalt Shingles held a dominant market position in the By Product Type segment of the Asphalt Shingles Market, with a 44.2% share. This segment’s substantial share is attributed to its enhanced aesthetic appeal, durability, and advanced weather-resistant properties, making it a preferred choice for residential and commercial roofing.

The increasing preference for visually appealing and cost-effective roofing solutions has driven the demand for architectural asphalt shingles, leading to their widespread adoption across various construction projects.

Additionally, advancements in manufacturing technology have enabled the production of shingles with enhanced impact resistance and longer lifespans, further propelling the segment’s dominance.

The architectural asphalt shingles segment continues to capture market share, driven by ongoing construction activities and the growing inclination towards aesthetically pleasing yet functional roofing solutions.

By Composition Analysis

Fiberglass-based asphalt shingles accounted for 78.5% due to superior durability features.

In 2024, Fiberglass held a dominant market position in the By Composition segment of the Asphalt Shingles Market, with a 78.5% share. This significant share can be attributed to its superior durability, lightweight structure, and cost-effectiveness, making it a preferred choice for roofing applications.

Fiberglass shingles offer enhanced resistance to moisture, fire, and extreme weather conditions, contributing to their widespread acceptance across residential and commercial sectors. The growing trend of energy-efficient roofing solutions has further bolstered the demand for fiberglass shingles, as they provide improved thermal insulation and contribute to lower energy consumption.

Additionally, the easy installation process and availability in various textures and colors have positioned fiberglass as a versatile option, catering to diverse architectural preferences. The dominance of fiberglass in the composition segment is expected to persist, driven by its proven performance, cost efficiency, and alignment with sustainable construction practices.

By Installation Analysis

Retrofit installations held 67.4%, driven by rising home renovation projects worldwide.

In 2024, Retrofit held a dominant market position in the By Installation segment of the Asphalt Shingles Market, with a 67.4% share. This substantial share underscores the growing demand for cost-effective and time-efficient roofing solutions, particularly in residential renovations and repair projects.

The retrofit segment’s dominance is driven by its ability to provide an economical alternative to complete roof replacements, allowing homeowners to upgrade their roofs without extensive structural modifications. Additionally, the rising frequency of weather-related damages has led to an increase in retrofitting activities, further propelling segment growth.

The availability of advanced asphalt shingles designed for quick installation and minimal disruption has bolstered the appeal of retrofit applications, enhancing their market penetration. Furthermore, the retrofit segment benefits from supportive government initiatives aimed at promoting sustainable and energy-efficient roofing solutions, aligning with growing consumer preferences for eco-friendly materials.

By End Use Analysis

The residential segment dominated with a 78.1% share, reflecting strong housing sector demand.

In 2024, Residential held a dominant market position in the By End Use segment of the Asphalt Shingles Market, with a 78.1% share. This substantial share reflects the increasing adoption of asphalt shingles in residential roofing due to their affordability, aesthetic appeal, and weather-resistant properties.

The growing emphasis on home renovation and remodeling projects has further fueled the demand for asphalt shingles, particularly in urban and suburban areas where residential construction activities are prominent. Additionally, the availability of various shingle designs, colors, and textures has allowed homeowners to enhance curb appeal while maintaining structural integrity.

The residential segment’s dominance is further reinforced by the rising trend of single-family housing units, where asphalt shingles serve as a cost-effective and durable roofing solution. Moreover, the increasing frequency of extreme weather conditions has prompted homeowners to invest in resilient roofing materials, contributing to the sustained demand for asphalt shingles in residential applications.

Key Market Segments

By Product Type

- Architectural Asphalt Shingles

- Three-Tab Asphalt Shingles

- Strip Shingles

- Luxury Shingles

- Others

By Composition

- Fiberglass

- Organic

- Others

By Installation

- New Construction

- Retrofit

By End Use

- Residential

- Single-family Homes

- Multi-family Housing

- Townhouses

- Commercial

- Office buildings

- Retail spaces

- Institutional structures

- Others

- Industrial

Driving Factors

Rising Home Renovations Boost Asphalt Shingles Demand

The growing trend of home renovations and remodeling activities is a significant driving factor in the Asphalt Shingles Market. Homeowners increasingly seek cost-effective roofing solutions that offer durability and aesthetic appeal, making asphalt shingles a preferred choice.

The rising frequency of extreme weather events has further accelerated the demand for roofing upgrades, prompting property owners to invest in weather-resistant and impact-resistant shingles.

Additionally, the availability of various designs and colors in asphalt shingles provides homeowners with versatile options to enhance curb appeal while maintaining budget-friendly costs. As urbanization continues to rise and more households prioritize home improvement, the demand for asphalt shingles is expected to maintain an upward trajectory.

Restraining Factors

Environmental Concerns Limit Asphalt Shingles Adoption

Environmental concerns associated with the production and disposal of asphalt shingles act as a significant restraining factor in the market. Asphalt shingles are petroleum-based, contributing to greenhouse gas emissions during manufacturing and increasing landfill waste upon disposal.

The limited recyclability of asphalt shingles further exacerbates environmental impact, prompting regulatory bodies to implement stringent waste management policies. Additionally, the rising awareness of sustainable roofing alternatives, such as metal and solar shingles, has led some consumers to opt for eco-friendly options over traditional asphalt shingles.

As environmental regulations tighten and sustainable construction gains momentum, the asphalt shingles market faces potential challenges in maintaining its market share, especially in regions prioritizing green building practices.

Growth Opportunity

Advanced Roofing Technologies Drive Market Expansion

The integration of advanced roofing technologies presents a substantial growth opportunity in the Asphalt Shingles Market. Manufacturers are increasingly incorporating features like enhanced impact resistance, solar reflectivity, and algae-resistant coatings to meet evolving consumer demands.

These advanced shingles not only extend the lifespan of roofs but also offer energy-saving benefits, making them more appealing to environmentally conscious homeowners. Additionally, the rise of smart roofing systems that monitor temperature and moisture levels has opened new avenues for product differentiation in the market.

As technology-driven roofing solutions gain traction, companies investing in innovative asphalt shingle products are well-positioned to capitalize on this emerging growth opportunity, particularly in regions prone to severe weather conditions.

Latest Trends

Eco-Friendly Shingles Gain Popularity in the Market

In 2024, a notable trend in the asphalt shingles market is the increasing demand for eco-friendly roofing solutions. Homeowners are showing a growing preference for shingles made with recycled materials, such as rubber and post-consumer asphalt, which helps reduce environmental impact.

These sustainable shingles not only contribute to environmental conservation but also offer enhanced energy efficiency by reflecting solar heat, thereby lowering indoor temperatures and reducing cooling costs. Manufacturers are responding to this demand by developing shingles that are both durable and environmentally responsible.

This shift towards green building practices is influencing purchasing decisions, with many consumers willing to invest in sustainable roofing options that align with their environmental values. As awareness of environmental issues continues to rise, the popularity of eco-friendly asphalt shingles is expected to grow, shaping the future of the roofing industry.

Regional Analysis

In North America, Asphalt Shingles dominate the market with a 49.8% share, generating USD 3.9 billion.

In 2024, Asia-Pacific emerged as the leading region in the Asphalt Shingles Market, capturing a dominant 53.8% share. The region’s extensive construction activities, coupled with increasing urbanization and infrastructure development, have driven the demand for cost-effective and durable roofing solutions like asphalt shingles.

North America follows with a significant 49.8% market share, generating USD 3.9 billion, primarily driven by the rising focus on home renovations and re-roofing projects. The U.S. and Canada continue to be key contributors, with a growing preference for aesthetically appealing and weather-resistant shingles. Europe also showcases considerable demand due to the expanding residential sector and renovation activities, particularly in countries like Germany and the UK.

Meanwhile, Latin America and the Middle East & Africa exhibit moderate growth, driven by infrastructural development and increasing awareness of roofing solutions. As the construction sector continues to thrive globally, Asia-Pacific’s leadership in the Asphalt Shingles Market is expected to persist, fueled by large-scale residential and commercial projects.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Atlas Roofing Corporation maintained a strong position in the global Asphalt Shingles Market by focusing on high-performance roofing products tailored for residential and commercial applications. The company leveraged its extensive distribution network to cater to increasing demand for durable and weather-resistant asphalt shingles, capitalizing on rising construction and renovation activities across North America.

Meanwhile, Building Products of Canada Corp. emphasized its comprehensive range of asphalt shingles designed to withstand extreme weather conditions, reinforcing its brand presence in the Canadian market. The company’s strategic focus on product innovation and sustainable roofing solutions has positioned it as a key player, particularly in the premium segment.

Duro-Last Roofing continued to expand its asphalt shingles portfolio, targeting industrial and commercial sectors with energy-efficient and impact-resistant products. The company’s emphasis on customized roofing systems has allowed it to penetrate niche markets, driving sales growth amid growing awareness of sustainable construction practices.

Top Key Players in the Market

- Atlas Roofing Corporation

- Building Products of Canada Corp

- Duro-Last Roofing

- GAF Materials Corporation

- Henry Company LLC

- IKO Industries Ltd

- Johns Manville

- Malarkey Roofing Products

- Owens Corning

- Pabco Roofing Products

- Saint-Gobain

- Siplast Inc.

- Soprema

- Tamko Building Products

Recent Developments

- In January 2025, Duro-Last introduced the Duro-TECH™ TPO product line, expanding its offerings in thermoplastic roofing systems. This launch was announced during the company’s National Sales Seminar and is part of Duro-Last’s commitment to innovation in roofing solutions.

- In September 2024, GAF launched the Timberline HDZ® Reflector Series Shingles, designed to meet California’s Cool Roof Requirements. These shingles feature EcoDark® granules, offering dark color options while maintaining high solar reflectance. They also come with a 25-year StainGuard Plus™ Algae Protection Limited Warranty and are eligible for the WindProven™ Limited Wind Warranty.

Report Scope

Report Features Description Market Value (2024) USD 7.8 Billion Forecast Revenue (2034) USD 11.2 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Architectural Asphalt Shingles, Three-Tab Asphalt Shingles, Strip Shingles, Luxury Shingles, Others), By Compositionn (Fiberglass, Organic, Others), By Installation (New Construction, Retrofit), By End Use (Residential (Single-family Homes, Multi-family Housing, Townhouses), Commercial (Office buildings, Retail spaces, Institutional structures, Others), Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlas Roofing Corporation, Building Products of Canada Corp, Duro-Last Roofing, GAF Materials Corporation, Henry Company LLC, IKO Industries Ltd, Johns Manville, Malarkey Roofing Products, Owens Corning, Pabco Roofing Products, Saint-Gobain, Siplast Inc., Soprema, Tamko Building Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Roofing Corporation

- Building Products of Canada Corp

- Duro-Last Roofing

- GAF Materials Corporation

- Henry Company LLC

- IKO Industries Ltd

- Johns Manville

- Malarkey Roofing Products

- Owens Corning

- Pabco Roofing Products

- Saint-Gobain

- Siplast Inc.

- Soprema

- Tamko Building Products