Global Application Modernization Services Market Size, Share and Analysis Report By Service Type (Application Portfolio Assessment, Cloud Application Migration, Application Re-Platforming, Application Integration, UI Modernization, Post-Modernization),By Deployment (Public Cloud, Private Cloud, Hybrid Cloud),By Enterprise Size (Large Enterprise, SMEs),By Industry Vertical (BFSI, Retail & E-commerce, Manufacturing, IT & Telecommunication, Energy and Utilities, Healthcare & Life Sciences, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 167588

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

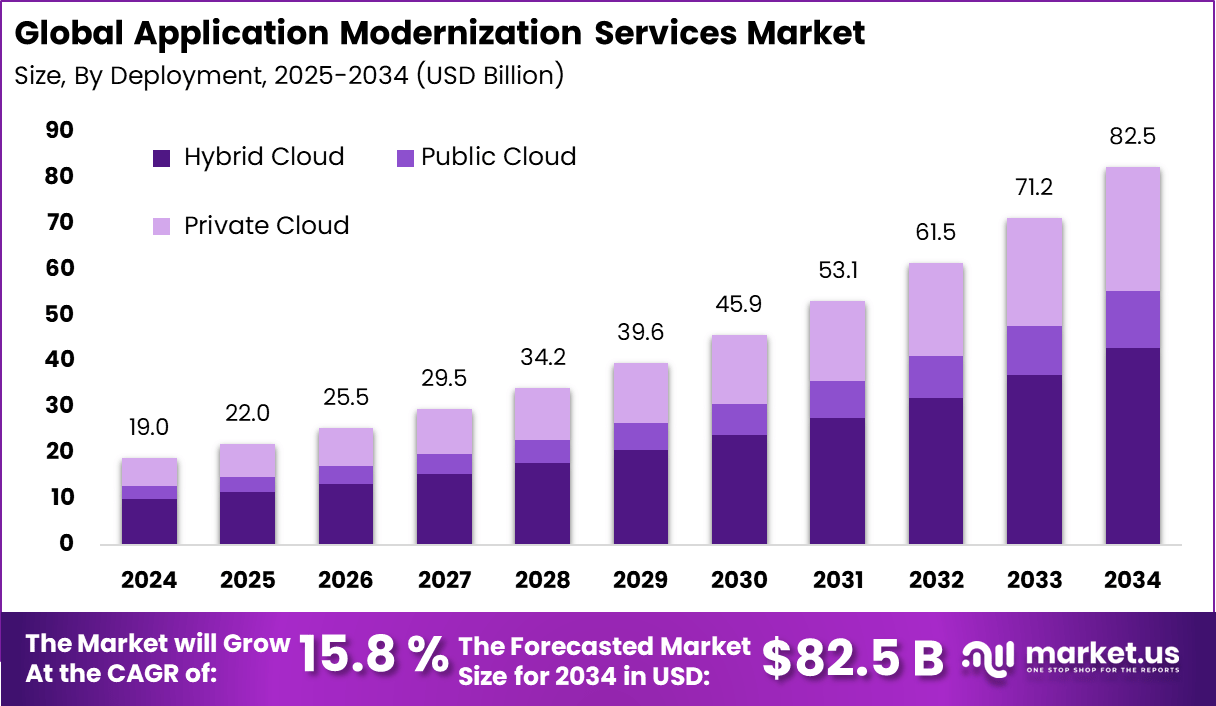

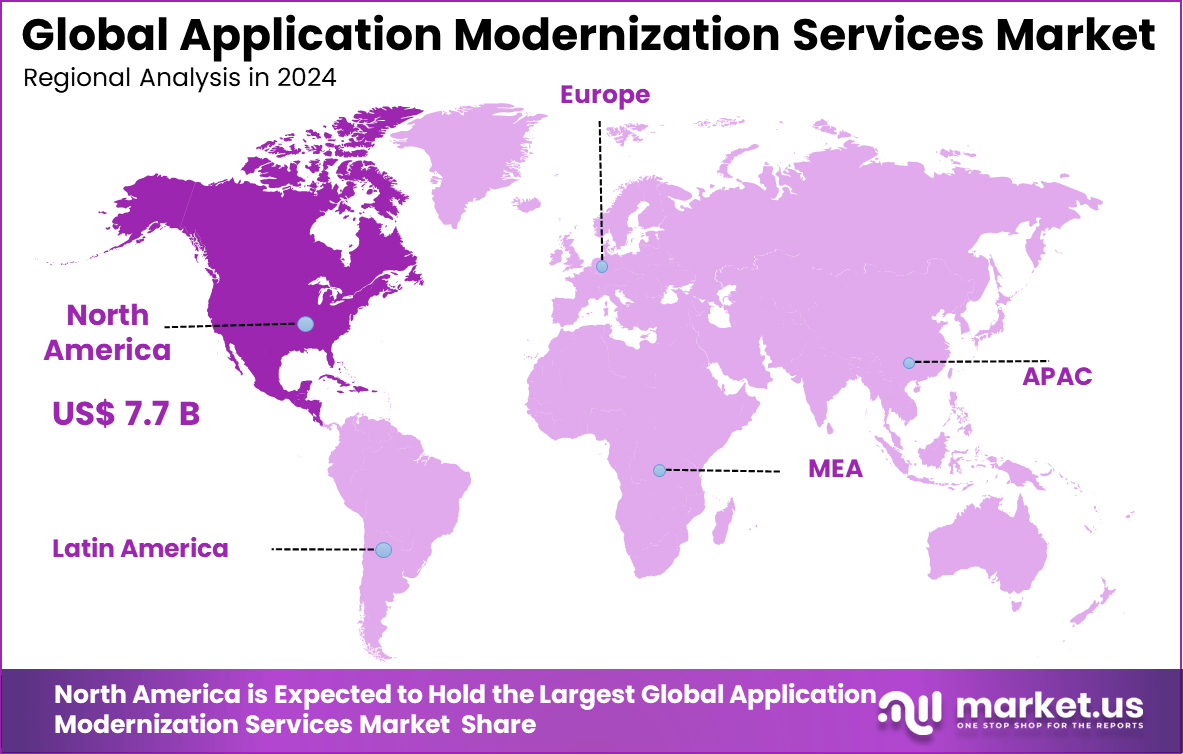

The Global Application Modernization Services Market generated USD 19.02 Billion in 2024 and is predicted to register growth to about USD 82.5 Billion by 2034, recording a CAGR of 15.80% throughout the forecast span. In 2024, North America held a dominant market position, capturing more than a 40.5% share, holding USD 7.02 Billion revenue.

The application modernization services market focuses on upgrading legacy software applications to meet modern business and technology requirements. These services help organizations improve performance, scalability, and security of existing applications. Instead of replacing systems entirely, businesses modernize applications to extend their useful life. This market plays a critical role in enterprise digital transformation.

Application modernization includes activities such as rehosting, refactoring, replatforming, and cloud migration. Organizations across industries use these services to support faster innovation and better system reliability. Legacy applications often limit operational flexibility and integration. Modernization services address these limitations while preserving core business logic.

Based on data from Radixweb, business leaders widely view modernization as essential for long term growth and competitiveness. Around 87% of respondents believe that updating systems and processes is necessary for business success, reflecting strong alignment across leadership teams.

Findings from the State of the CIO Study 2023 show that application modernization remains a top priority for CIOs. By 2025, ensuring existing systems are modern and ready for innovation is expected to stay a key focus, with nearly 91% of CIOs planning higher budgets to improve agility and operational flexibility.

Key Takeaways

- Cloud Application Migration leads the Application Modernization Services market with a strong 26.7% share.

- Hybrid Cloud dominates with a significant 52.1% share of the deployment model within application modernization.

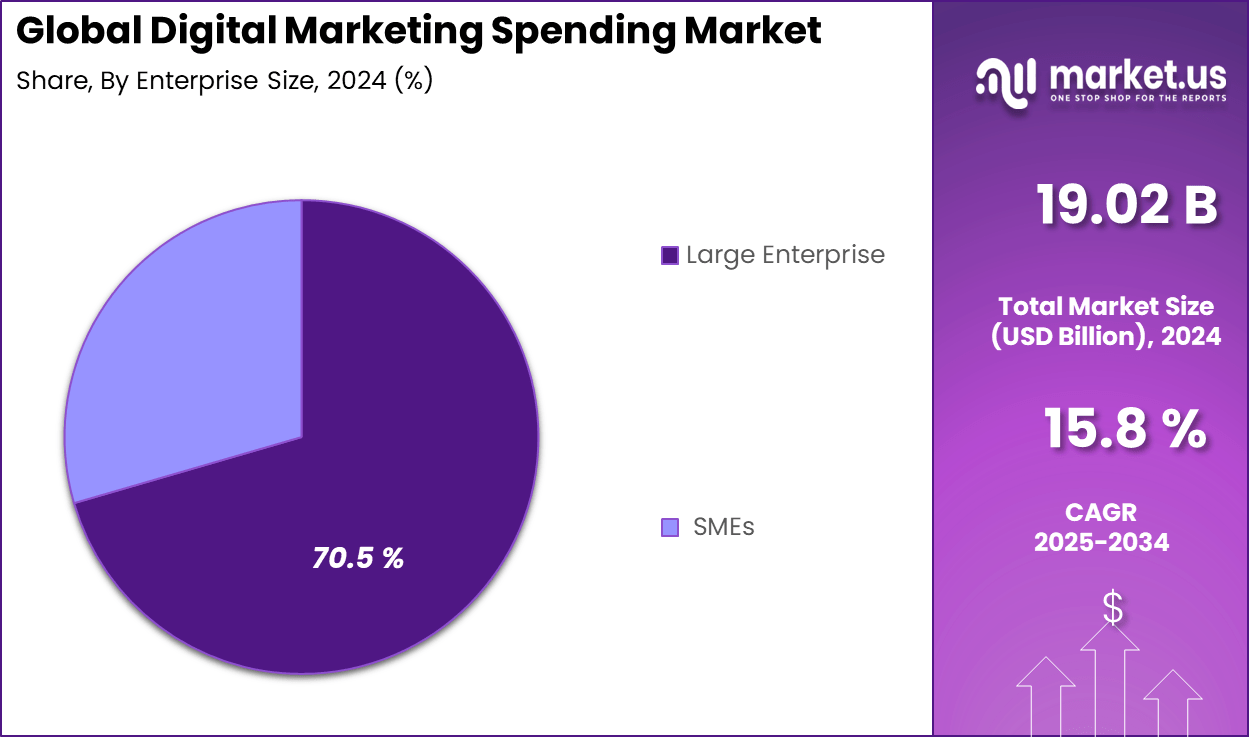

- An impressive 70.5% of the market is held by Large enterprises, which form the majority.

- BFSI (Banking, Financial Services, and Insurance) represents 25.6% of the market, making it a leading industry vertical in modernization efforts.

- North America holds the largest regional share at 40.5%, driven by advanced digital infrastructure and significant cloud adoption.

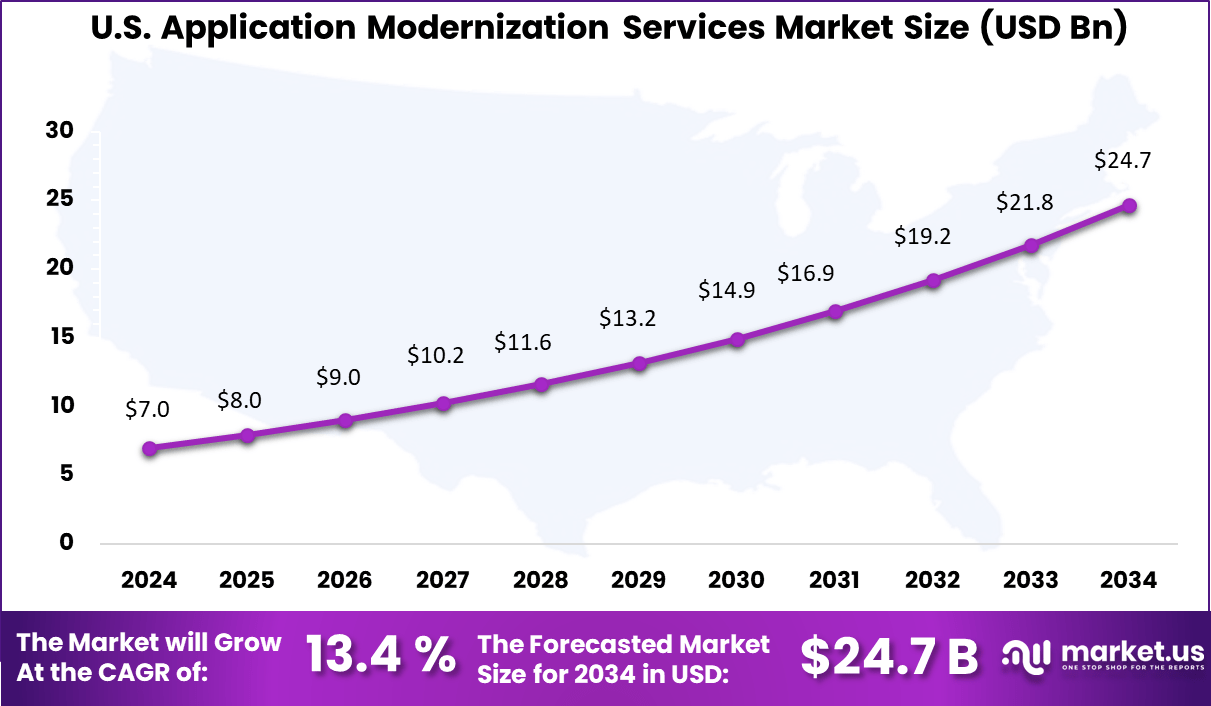

- The U.S. market itself accounts for roughly 13.4%, playing a critical role as a hub for application modernization due to strong government IT investments and a mature technology ecosystem.

U.S Market Size

The US application modernization services market represents roughly 13.4% of the global market with significant ongoing expansion. The US is characterized by strong cloud migration momentum and the demand for personalized digital experiences in business operations. Organizations face challenges such as a shortage of IT skills and high modernization costs, yet the urgency for secure, agile systems to stay competitive remains a priority.

In the US, modernization initiatives focus on enabling omnichannel customer experiences, integrating microservices, and improving data-driven decision-making. Regulatory compliance and data security are critical considerations shaping modernization strategies. Enterprises are increasingly adopting hybrid and multi-cloud solutions to optimize resources and maintain operational continuity, highlighting a mature market embracing digital transformation aggressively.

North America accounts for about 40.5% of the global application modernization services market, making it the largest regional share. This prominence is due to widespread adoption of digital transformation strategies, mature cloud infrastructures, and the presence of leading technology service providers. Enterprises here are actively replacing legacy systems with modern, cloud-first applications to support AI, cybersecurity, and distributed work models.

The North American market thrives on hybrid cloud adoption, which offers a balanced approach to legacy and cloud-based systems, and supports emerging needs like real-time analytics and AI integration. Enterprise investments focus on increasing operational agility and handling regulatory complexities effectively. Large organizations are driving demand for scalable, flexible application modernization that sustains innovation and competitive differentiation.

By Service Type

Cloud application migration accounts for 26.7%, showing its importance within application modernization initiatives. Organizations migrate legacy applications to cloud environments to improve performance and scalability. This service helps reduce dependence on outdated infrastructure. It also supports better system availability.

The growth of cloud migration services is driven by the need for flexibility and cost control. Enterprises aim to modernize applications without full redevelopment. Migration services help minimize disruption to business operations. This approach supports gradual and controlled modernization.

By Deployment

Hybrid cloud deployment holds 52.1%, reflecting preference for mixed cloud environments. Organizations use hybrid models to keep sensitive workloads on private systems while using public cloud resources for scalability. This approach balances control and flexibility. It supports diverse application needs.

Adoption of hybrid cloud is driven by data security and regulatory requirements. Enterprises benefit from workload optimization across environments. Hybrid deployment also supports integration with existing systems. These factors continue to support strong adoption.

By Enterprise Size

Large enterprises represent 70.5%, highlighting their leading role in application modernization. These organizations manage complex application portfolios across departments and regions. Modernization services help improve efficiency and system reliability. Centralized management is essential at this scale.

Adoption among large enterprises is supported by higher IT budgets and long-term digital plans. Modernized applications improve agility and reduce maintenance costs. Large organizations also face higher performance expectations. This drives continuous investment in modernization services.

By Industry Vertical

The BFSI sector holds 25.6%, making it the leading industry vertical for application modernization. Financial institutions modernize applications to support digital banking and secure transactions. Legacy systems often limit speed and flexibility. Modern services help overcome these challenges.

Growth in BFSI adoption is driven by compliance and customer experience needs. Modernized applications improve processing speed and service availability. They also support integration with new digital platforms. This makes modernization a priority for financial institutions.

Key Market Segments

By Service Type

- Application Portfolio Assessment

- Cloud Application Migration

- Application Re-Platforming

- Application Integration

- UI Modernization

- Post-Modernization

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size

- Large Enterprise

- SMEs

By Industry Vertical

- BFSI

- Retail & E-commerce

- Manufacturing

- IT & Telecommunication

- Energy and Utilities

- Healthcare & Life Sciences

- Others

Emerging Trends

In the application modernization services market, a prominent trend is the shift toward cloud native architectures. Organisations are increasingly rearchitecting legacy systems to leverage microservices, containers, and serverless frameworks. This shift supports greater scalability, resilience, and flexibility in how applications are developed and deployed, enabling faster adaptation to evolving business requirements.

Another emerging trend is the integration of automation and DevOps practices into modernization workflows. Tools that support continuous integration, continuous deployment, and infrastructure-as-code are being used to reduce manual intervention and streamline the modernization lifecycle. This integration fosters faster release cycles and more consistent quality across development and operations teams.

Growth Factors

A key growth factor in the application modernization services market is the need to align IT systems with digital transformation goals. Legacy applications often limit an organisation’s ability to innovate, integrate with modern platforms, or support digital-first customer experiences. Modernization services help organisations reimagine these applications, improving agility and enabling seamless integration with emerging technologies.

Another important growth factor is the requirement for improved performance, security, and reliability. Modernised applications are better positioned to leverage current security frameworks, optimise resource utilisation, and deliver higher performance under increased workloads. This operational improvement supports organisational objectives related to uptime, user experience, and regulatory adherence.

Driver

A principal driver of the application modernization services market is the pressure to reduce technical debt and operational bottlenecks. Legacy systems frequently incur high maintenance costs and constrain the adoption of new features. Modernisation helps organisations reduce this burden by transitioning to modular, maintainable, and interoperable systems that can evolve with business needs.

Another driver is the demand for enhanced customer experiences. Customers increasingly expect fast, seamless, and personalised digital interactions. Modernised applications, designed for current platforms and interfaces, are better suited to deliver these experiences and can integrate more easily with analytics, mobile, and omnichannel services.

Restraint

A significant restraint in this market is the complexity of modernising deeply embedded legacy systems. Older applications may contain tightly coupled dependencies, outdated programming languages, or undocumented business logic that make transformation difficult. Overcoming these challenges can increase project timelines, require specialised expertise, and elevate implementation risk.

Another restraint arises from organisational resistance to change. Stakeholders accustomed to existing systems may be hesitant to adopt new paradigms due to concerns about disruption, retraining costs, or perceived risk. Aligning organisational culture with modernization initiatives often requires strong leadership and effective change management.

Opportunity

A strong opportunity exists in expanding modernization services tailored to industry specific requirements. Sectors such as healthcare, financial services, and public institutions often operate mission critical legacy systems with unique compliance and workflow needs. Offering specialised modernization frameworks that address these contexts can unlock significant value and improve adoption.

Another opportunity lies in leveraging low code and no code platforms within modernization strategies. These platforms can accelerate redevelopment, reduce dependency on specialised programming skills, and empower business units to participate in application evolution. Incorporating these tools into modernization services enhances speed and broadens accessibility.

Challenge

One of the main challenges for the application modernization services market is ensuring data integrity and continuity throughout transformation. Migrating data from legacy repositories to modern platforms must preserve accuracy, relationships, and historical context. Data loss or inconsistency can disrupt operations and erode stakeholder confidence.

Another challenge involves balancing speed of modernization with operational stability. Rapid transformation efforts can introduce unanticipated issues if controls, testing regimes, and quality assurance practices are not deeply embedded in the approach. Establishing robust governance that supports both velocity and reliability is essential for successful outcomes.

Key Players Analysis

Oracle, IBM, and Microsoft lead the application modernization services market with platforms and tools that support legacy transformation, cloud migration, and microservices adoption. Their services help enterprises modernize core applications while maintaining security and compliance. These companies focus on scalability, hybrid cloud readiness, and integration with enterprise systems. Rising demand for cloud native applications continues to strengthen their leadership.

Accenture, Capgemini, Cognizant, Tata Consultancy Services, Infosys, HCL Technologies, and Wipro strengthen the market with large scale modernization programs covering replatforming, refactoring, and DevOps adoption. Their offerings help organizations reduce technical debt and improve agility. These providers emphasize domain expertise, automation, and delivery at scale.

DXC Technology, EPAM Systems, NTT Data, MongoDB, Rocket Software, Fujitsu, Hexaware Technologies, and other players expand the market with specialized tools and services for application reengineering and data modernization. Their solutions support faster transformation and cost control. Increasing digital transformation initiatives continue to drive steady growth in application modernization services.

Top Key Players in the Market

- Oracle

- IBM

- Microsoft

- HCL Technologies

- Accenture

- ATOS SE

- Capgemini

- Cognizant

- Tata Consultancy Services

- Aspire Systems

- NTT Data Group Corporation

- Infosys

- Dell Technologies

- Innova Solutions

- Epam Systems

- DXC Technology

- MongoDB

- Wipro

- Rocket Software

- Fujitsu

- Hexaware Technologies

- Others

Recent Developments

- October, 2025 – Wipro migrated its mission-critical Oracle payroll and recruitment databases to Oracle Cloud Infrastructure (OCI), boosting recruitment system performance by over 50% and cutting payroll processing time by 60% using Oracle Base Database Service and interconnects with Google Cloud and Azure.

- December, 2025 – Oracle Database@Google Cloud became generally available in India, enabling customers to integrate Oracle AI Database capabilities with Google Cloud’s AI and analytics tools for faster application modernization and low-latency multicloud workloads.

Report Scope

Report Features Description Market Value (2024) USD 19.02 Bn Forecast Revenue (2034) USD 82.5 Bn CAGR(2025-2034) 15.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Application Portfolio Assessment, Cloud Application Migration, Application Re-Platforming, Application Integration, UI Modernization, Post-Modernization),By Deployment (Public Cloud, Private Cloud, Hybrid Cloud),By Enterprise Size (Large Enterprise, SMEs),By Industry Vertical (BFSI, Retail & E-commerce, Manufacturing, IT & Telecommunication, Energy and Utilities, Healthcare & Life Sciences, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle, IBM, Microsoft, HCL Technologies, Accenture, ATOS SE, Capgemini, Cognizant, Tata Consultancy Services, Aspire Systems, NTT Data Group Corporation, Infosys, Dell Technologies, Innova Solutions, Epam Systems, DXC Technology, MongoDB, Wipro, Rocket Software, Fujitsu, Hexaware Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Application Modernization Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Application Modernization Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle

- IBM

- Microsoft

- HCL Technologies

- Accenture

- ATOS SE

- Capgemini

- Cognizant

- Tata Consultancy Services

- Aspire Systems

- NTT Data Group Corporation

- Infosys

- Dell Technologies

- Innova Solutions

- Epam Systems

- DXC Technology

- MongoDB

- Wipro

- Rocket Software

- Fujitsu

- Hexaware Technologies

- Others