Global Apple Fruit Concentrate Market Size, Share, And Enhanced Productivity By Nature (Organic, Conventional), By Type (Puree Concentrate, Clear Concentrate, Juice Concentrate, Powdered Concentrate, Frozen Concentrate, Others), By End Use (Bakery and Confectionery, Beverages, Sauces, Dressings and Condiments, Dairy and Yogurt, Infant and Baby Foods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175913

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

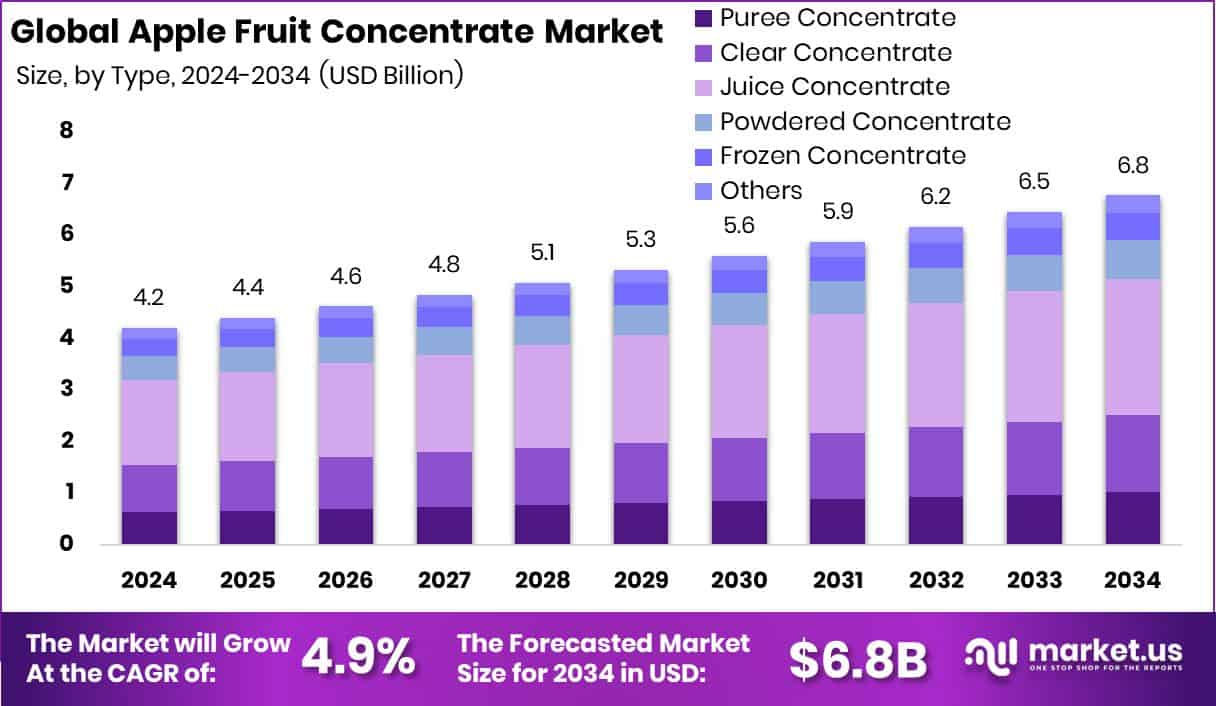

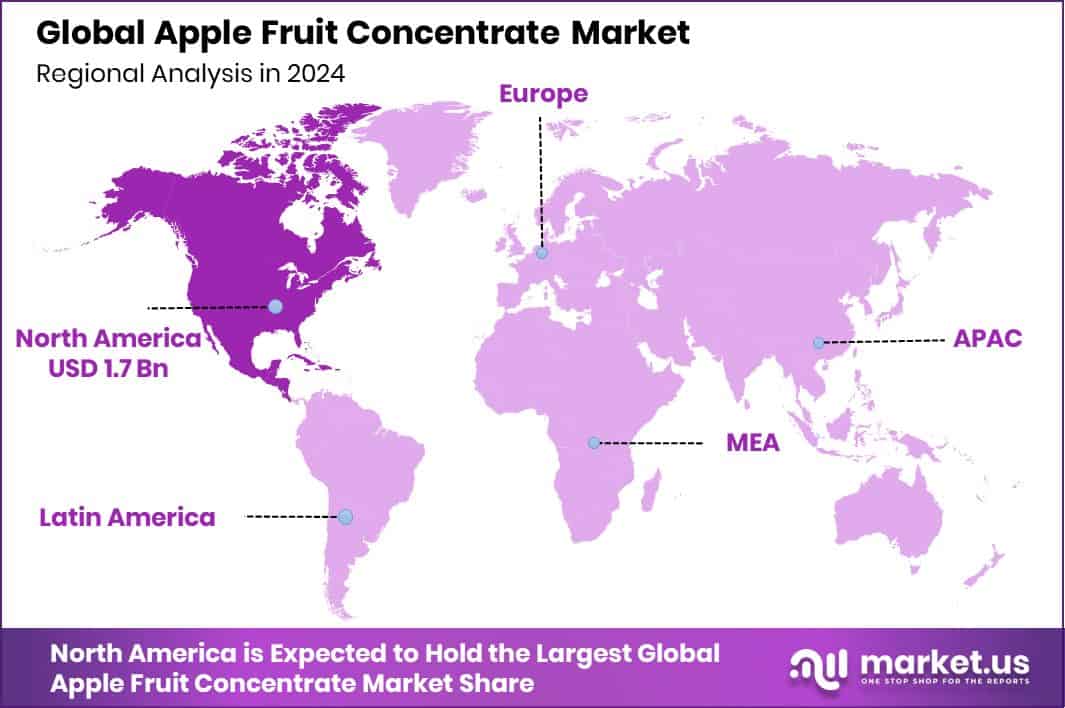

The Global Apple Fruit Concentrate Market is expected to be worth around USD 6.8 billion by 2034, up from USD 4.2 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. The North America market maintained stability, holding 42.5% and generating USD 1.7 Bn.

The Apple Fruit Concentrate Market is structured across clear taxonomy layers, including Organic and Conventional under nature, several concentrate formats such as Puree, Clear, Juice, Powdered, Frozen, and multiple end-use categories ranging from Beverages and Bakery to Infant Foods and Dairy. This segmentation reflects how apple concentrate supports a wide variety of food and beverage formulations across global processing industries.

Apple fruit concentrate is a processed, condensed form of apple juice or puree where water is removed to create a thick, stable ingredient. It is used for flavoring, sweetening, color enhancement, and nutritional enrichment across drinks, bakery fillings, sauces, and packaged foods. The Apple Fruit Concentrate Market represents the commercial ecosystem of producers, processors, buyers, and applications that depend on this versatile ingredient for large-scale food manufacturing.

Growth in this market is supported by increasing consumer interest in fruit-based, naturally sweetened products. Demand is also rising because concentrate provides a stable, cost-efficient ingredient for manufacturers. Recent investments, such as a $32 million expansion funded for a West Michigan fruit processor, show how processing capacity is scaling to meet market needs. This expansion trend strengthens supply reliability across the industry.

Demand is further boosted by the shift toward functional and low-sugar beverages. New-age drink brands have increased usage of apple concentrates as a natural sweetening base. The wider functional beverage movement gained momentum when functional soda Poppi raised $25 million, signaling ongoing consumer appetite for fruit-forward, health-oriented drinks.

Opportunity in this market continues to expand as companies invest in new production systems to increase output efficiency. For new entrants, production planning must consider early-stage capital, including $1,000,000 in CAPEX for core machinery, such as a $300,000 concentration evaporator and a $250,000 extraction system, highlighting the importance of scaling technology to meet growing demand.

Key Takeaways

- The Global Apple Fruit Concentrate Market is expected to be worth around USD 6.8 billion by 2034, up from USD 4.2 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- The Apple Fruit Concentrate Market sees strong leadership as Conventional products secure 86.7% global preference.

- In the Apple Fruit Concentrate Market, Juice Concentrate maintains dominance with a significant 39.1% overall market share.

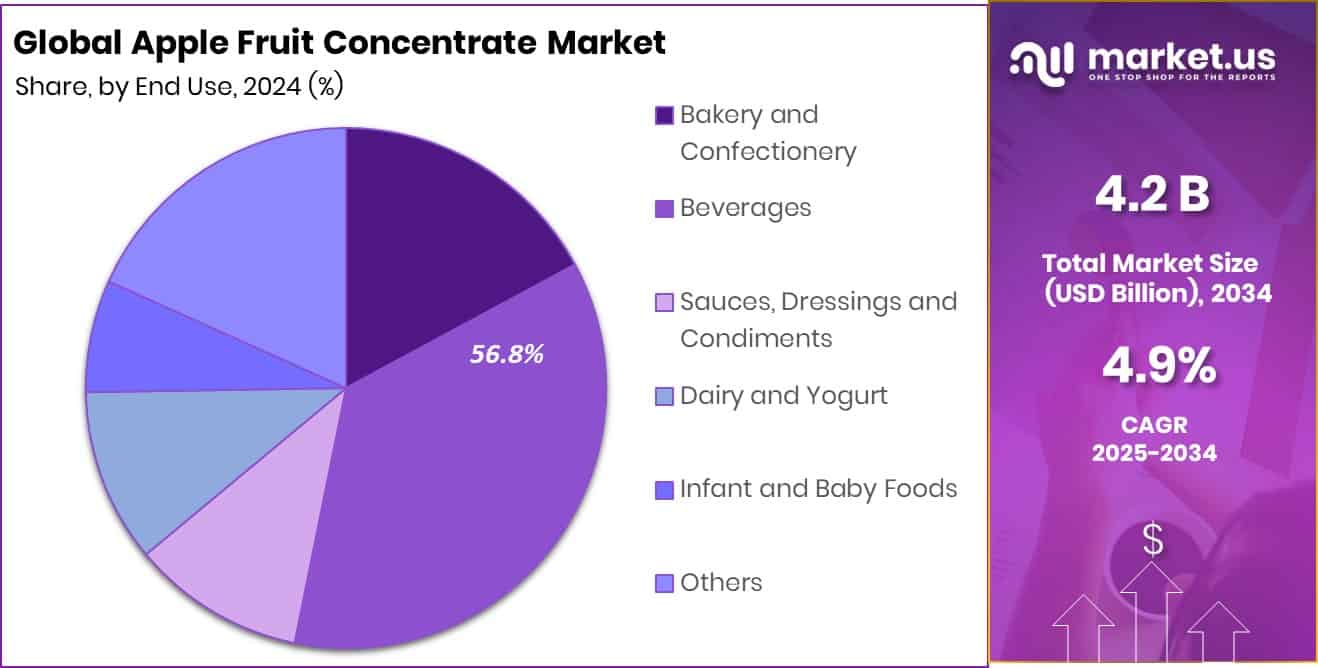

- The Apple Fruit Concentrate Market grows steadily as Beverages account for 56.8% of total end-use demand.

- In North America, strong beverage manufacturing boosted its 42.5% share worth USD 1.7 Bn.

By Nature Analysis

In the Apple Fruit Concentrate Market, Conventional holds 86.7%, showcasing strong consumer preference.

In 2024, the Apple Fruit Concentrate Market continued to be dominated by the Conventional segment, securing an impressive 86.7% share as manufacturers and beverage processors relied heavily on cost-efficient raw materials. Conventional apple concentrate remained the preferred option due to its consistent supply chain, large-scale orchard production, and affordability for juice brands, bakery companies, and foodservice distributors.

Many mid-sized processors opted for conventional sourcing because it supports stable pricing and bulk procurement, which is essential for high-volume applications. Despite rising interest in organic formulations, conventional concentrate maintained its lead as mainstream consumers prioritize reasonable pricing over premium claims. As large beverage companies expand product lines globally, conventional apple concentrate continues to serve as a dependable component in mass-market formulations.

By Type Analysis

The Apple Fruit Concentrate Market sees Juice Concentrate leading with 39.1% dominance globally.

In 2024, Juice Concentrate held a strong position in the Apple Fruit Concentrate Market with a notable 39.1% share, driven by its extensive use across juices, nectars, smoothies, and ready-to-drink blends. Food and beverage brands increasingly relied on apple juice concentrate as a natural sweetener and flavor enhancer, especially in clean-label products. Its long shelf life, stable quality, and ease of transportation made it a flexible ingredient for both domestic and export-focused manufacturers.

Growing consumer preference for fruit-based beverages encouraged producers to expand their concentrate capacity, supporting steady demand. Additionally, private-label beverage lines in supermarkets boosted uptake, as apple juice concentrate remains one of the most economical and versatile fruit bases available for mass production.

By End Use Analysis

Beverages remain the largest end-use in the Apple Fruit Concentrate Market at 56.8%.

In 2024, the Beverages segment accounted for a leading 56.8% share of the Apple Fruit Concentrate Market, supported by strong demand from juice drinks, flavored waters, craft beverages, and functional drink formulations. Apple concentrate continued to serve as a foundational ingredient because of its neutral sweetness, clarity, and compatibility with multiple flavor profiles.

Brands invested in product innovation, incorporating apple concentrate into low-sugar beverages and fortified drinks to align with evolving wellness trends. Its broad usability enabled beverage makers to diversify offerings without significantly increasing production costs. As both traditional juice consumption and modern beverage categories expanded, apple fruit concentrate remained a central input, reinforcing its importance across mainstream and premium beverage portfolios alike.

Key Market Segments

By Nature

- Organic

- Conventional

By Type

- Puree Concentrate

- Clear Concentrate

- Juice Concentrate

- Powdered Concentrate

- Frozen Concentrate

- Others

By End Use

- Bakery and Confectionery

- Beverages

- Sauces, Dressings and Condiments

- Dairy and Yogurt

- Infant and Baby Foods

- Others

Driving Factors

Rising demand for natural fruit ingredients

In the Apple Fruit Concentrate Market, demand continues to grow as manufacturers shift toward natural, fruit-based inputs for beverages, bakery items, sauces, and infant foods. Consumers increasingly prefer clean, recognizable ingredients, and apple concentrate fits this requirement well with its naturally sweet profile and versatility. This broader movement toward plant-based and natural formulations is also reflected in industry funding trends, such as the $44M investment secured by Ripple, which highlights strong investor confidence in fruit-derived and plant-based ingredient systems.

Although Ripple operates in dairy alternatives, the scale of this funding signals a wider industry push toward natural ingredient innovation. Such momentum supports ongoing adoption of apple fruit concentrate across global processing sectors.

Restraining Factors

High processing costs limit scalability

A key restraint for the Apple Fruit Concentrate Market comes from high processing and production costs, which can limit scalability for new entrants and mid-sized processors. Concentration equipment, energy usage, food-grade facility requirements, and quality testing all increase operational expenses. Smaller processors often struggle to manage these upfront investments, especially when aiming for premium grades like clear or organic concentrate.

Industry activity shows similar financial pressures in related food-tech categories, such as Better Dairy securing US$2.1M in seed funding, underscoring how companies must raise capital simply to overcome technical and production cost barriers. In the apple concentrate segment, these financial hurdles can slow expansion, delay upgrades, and restrict output capacity unless sufficient funding is available.

Growth Opportunity

Increasing adoption in functional beverages

Functional beverage brands increasingly rely on apple fruit concentrate as a natural base for flavor, sweetness, and nutritional positioning. As wellness drinks, gut-health tonics, and reduced-sugar beverages expand, apple concentrate offers a reliable and affordable ingredient that blends well with botanicals, probiotics, and vitamins.

The opportunity is supported by broader funding momentum in next-generation drink and dairy-alternative companies, such as Imagindairy raising $15M in a seed extension, showing strong investor interest in functional and innovative beverage ingredients. This growing financial support in adjacent product categories reflects a favorable environment for concentrate-based formulations. As beverage startups experiment with fruit-forward recipes, apple concentrate stands to gain new applications, wider usage, and stronger demand.

Latest Trends

Growth of organic apple concentrate usage

One of the latest trends shaping the Apple Fruit Concentrate Market is the rapid rise of organic formulations. As consumers look for cleaner labels and reduced chemical exposure, organic apple concentrate gains preference in baby foods, premium beverages, and health-focused packaged foods. This trend mirrors broader investment waves in better-for-you food sectors, such as Chobani raising $650M in growth capital, driven by its strong retail performance of $1.4B.

Additionally, alternative dairy innovators like Remilk securing $120M highlight sustained investor interest in natural and clean food systems. These financings reinforce the broader industry movement toward clean-label ingredients, supporting the upward shift toward organic apple concentrate across global markets.

Regional Analysis

North America led the Apple Fruit Concentrate Market with 42.5%, reaching USD 1.7 Bn.

In the Apple Fruit Concentrate Market, North America emerged as the dominating region, securing a substantial 42.5% share valued at USD 1.7 Bn, supported by strong consumption of fruit-based beverages and the presence of established juice processors across the U.S. and Canada. The region’s mature food industry and consistent demand for natural sweeteners further reinforced its leadership position.

In Europe, consumption remained steady as Germany, France, and the U.K. continued to integrate apple concentrate into bakery fillings, premium juices, and flavored beverages, sustaining the region’s long-standing preference for processed fruit products. Asia Pacific showed expanding utilization, driven by rising urban demand in China and India for packaged drinks and fruit mixes, as well as the growing use of apple concentrate in affordable beverage formulations.

The Middle East & Africa region saw moderate growth, supported by increasing imports of concentrate for juice manufacturing in Gulf countries. Latin America maintained stable uptake, particularly in Brazil and Mexico, where apple-based beverages and value-driven formulations strengthened demand for concentrate across local processing industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AGRANA Beteiligungs-AG continued to strengthen its position in the global Apple Fruit Concentrate Market by leveraging its large-scale fruit processing capabilities and long-standing relationships with beverage and food manufacturers. The company’s focus on consistent quality, diversified sourcing, and efficient production supported its competitive edge. AGRANA’s integrated operations across fruit ingredients allowed it to serve multiple downstream sectors, ensuring stable demand for its apple concentrate portfolio. Its broad global footprint helped the company maintain steady supply reliability, which remained a critical factor for major juice and food producers.

ADM played a key role in shaping market performance through its extensive ingredient network and strong processing infrastructure. The company’s emphasis on natural ingredients and fruit-based solutions enabled it to meet rising demand from beverage, bakery, and dairy categories. ADM’s operational scale, combined with its ability to deliver customized concentrate solutions, enhanced its relevance across major consumer markets. Its continuous improvements in supply chain efficiencies helped maintain consistent product availability for manufacturers.

Kerry Plc contributed to market advancement by integrating apple concentrate into its wider range of taste and nutrition solutions. The company’s expertise in flavor systems, beverage applications, and product innovation allowed it to support customers seeking differentiated formulations. Kerry’s technical capabilities and global service network helped brands enhance product profiles using apple fruit concentrate as a foundational ingredient.

Top Key Players in the Market

- AGRANA Beteiligungs-AG

- ADM

- Kerry Plc

- Ingredion

- Tree Top Inc.

- Britvic PLC

- Louis Dreyfus Company

- ABC Fruits

- Lemonconcentrate S.L.U

- Kiril Mischeff

- E.E. & Brian Smith

Recent Developments

- In September 2025, LDC completed the acquisition of grains and oilseeds activities in Hungary and parts of Poland. This strengthened the company’s processing and storage footprint in Central Europe, helping it better serve customers in these key regions.

- In July 2024, Britvic agreed to be acquired by the Carlsberg Group under a recommended cash offer. This deal, agreed with Britvic’s board, set out terms for Carlsberg to buy the entire company, valuing Britvic at about £3.3 billion and bringing its portfolio of soft drink brands under the Carlsberg umbrella.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Type (Puree Concentrate, Clear Concentrate, Juice Concentrate, Powdered Concentrate, Frozen Concentrate, Others), By End Use (Bakery and Confectionery, Beverages, Sauces, Dressings and Condiments, Dairy and Yogurt, Infant and Baby Foods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGRANA Beteiligungs-AG, ADM, Kerry Plc, Ingredion, Tree Top Inc., Britvic PLC, Louis Dreyfus Company, ABC Fruits, Lemonconcentrate S.L.U, Kiril Mischeff, E.E. & Brian Smith Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Apple Fruit Concentrate MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Apple Fruit Concentrate MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AGRANA Beteiligungs-AG

- ADM

- Kerry Plc

- Ingredion

- Tree Top Inc.

- Britvic PLC

- Louis Dreyfus Company

- ABC Fruits

- Lemonconcentrate S.L.U

- Kiril Mischeff

- E.E. & Brian Smith