Global Anti-Graffiti Coatings Market Size, Share, And Enhanced Productivity By Type (Sacrificial, Semi-Sacrificial, Non-Sacrificial), By Substrate (Wood, Concrete, Brick, Metal, Glass, Ceramics, Others), By Product Type (Permanent, Semi-permanent, Temporary), By Technology (Solvent-Based, Water-Based, Powder Coatings, Nano Coatings), By End-Use (Transportation, Building and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177022

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

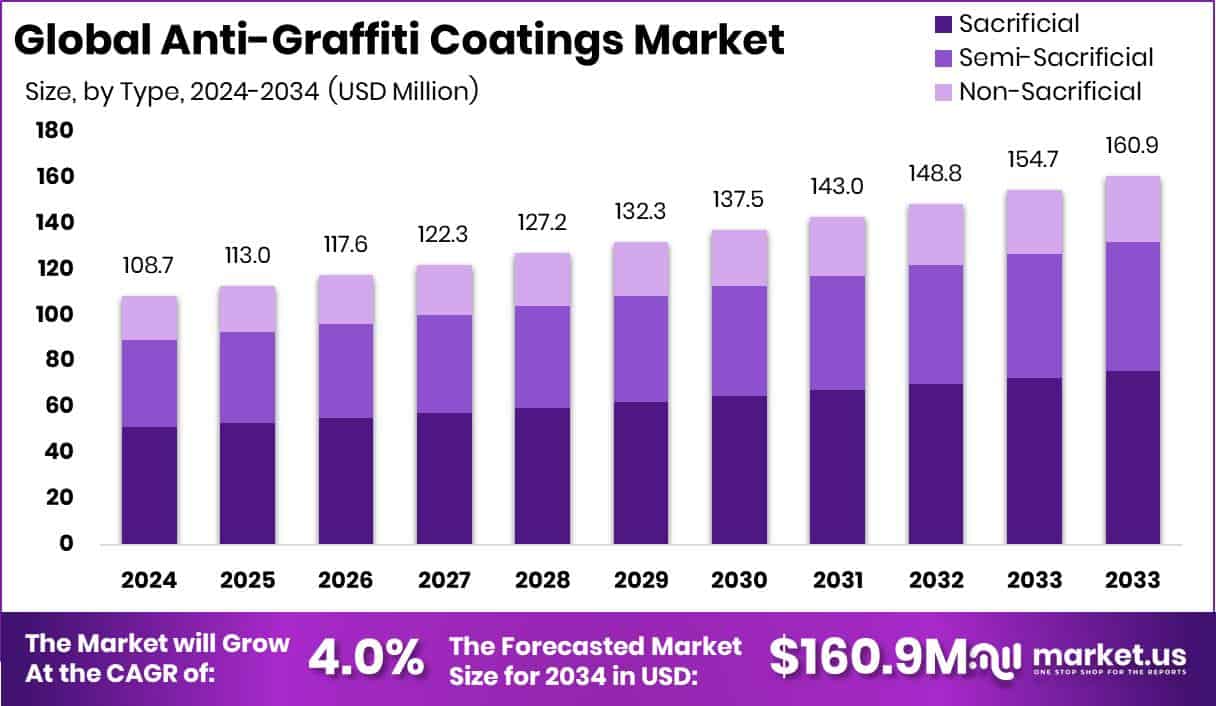

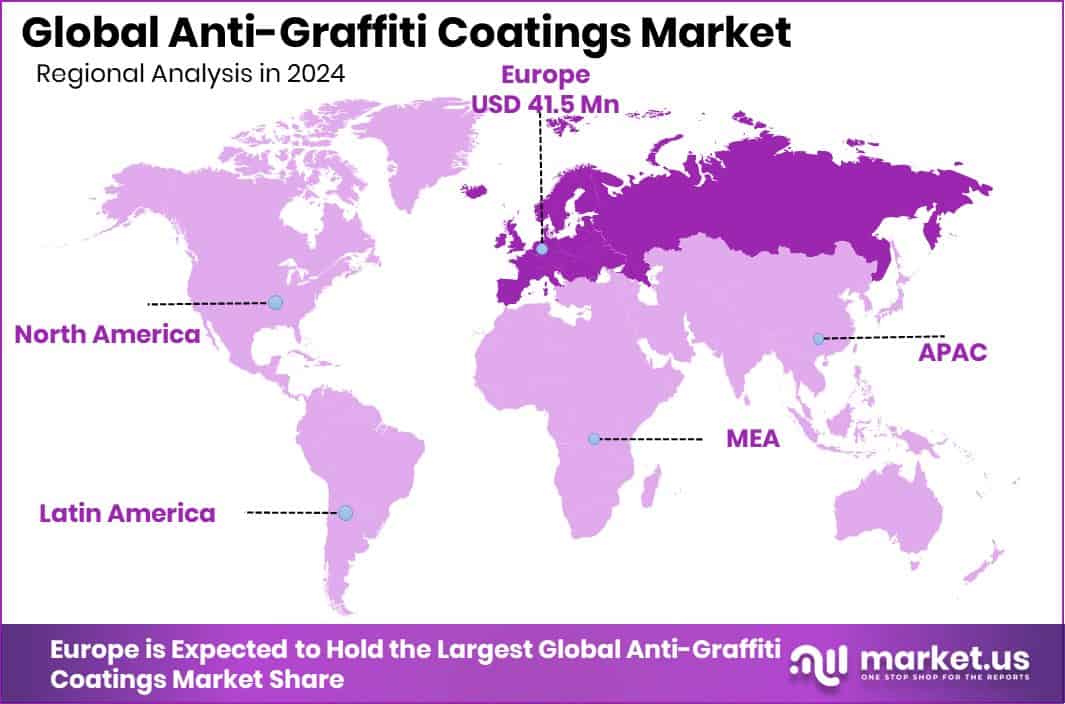

The Global Anti-Graffiti Coatings Market is expected to be worth around USD 160.9 million by 2034, up from USD 108.7 million in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034. Europe recorded a 38.2% share in the Anti-Graffiti Coatings Market worth USD 41.5 Mn.

The Global Anti-Graffiti Coatings Market includes a structured taxonomy covering Type, Substrate, Product Type, Technology, and End-Use. These coatings are designed to create a protective layer that prevents spray paint, markers, and stains from bonding to surfaces. Anti-graffiti coatings help preserve buildings, public infrastructure, and transport assets by making graffiti removal faster, safer, and less costly. The Anti-Graffiti Coatings Market refers to the growing demand for such protective solutions across construction, transportation, and urban development projects as cities aim to maintain clean and visually appealing environments.

Growth in this market is supported by rising restoration and maintenance activities worldwide. For example, the restoration of a canal walkway backed by a £16 million funding boost highlights the increasing priority placed on protecting public assets. Such projects naturally encourage the adoption of anti-graffiti coatings to safeguard upgraded structures.

Demand is also rising because large infrastructure bodies are investing in cleanliness initiatives. Network Rail’s £2 million spring clean to remove graffiti from Britain’s railway demonstrates how public authorities are actively seeking long-lasting protective solutions to reduce recurring cleaning costs.

Opportunities in the market are strengthened by advancements in coating technologies. Innovations such as Anaphite securing £1.4 million for LFP dry-coating development and raising $1.8 million to expand coating applications indicate broader momentum in surface protection research. Meanwhile, Augmentus raising $11 million to scale no-code robotic programming reflects the future potential for automated coating applications, offering improved efficiency and consistency across large infrastructure surfaces.

Key Takeaways

- The Global Anti-Graffiti Coatings Market is expected to be worth around USD 160.9 million by 2034, up from USD 108.7 million in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- The Anti-Graffiti Coatings Market grows as sacrificial coatings hold 47.1%, driven by easy maintenance.

- Strong adoption in infrastructure boosts the Anti-Graffiti Coatings Market, with concrete substrates capturing 32.7%.

- The Anti-Graffiti Coatings Market expands steadily because permanent coating solutions dominate with 45.8% global share.

- Rising eco-friendly preferences accelerate the Anti-Graffiti Coatings Market as water-based technology leads with 39.3%.

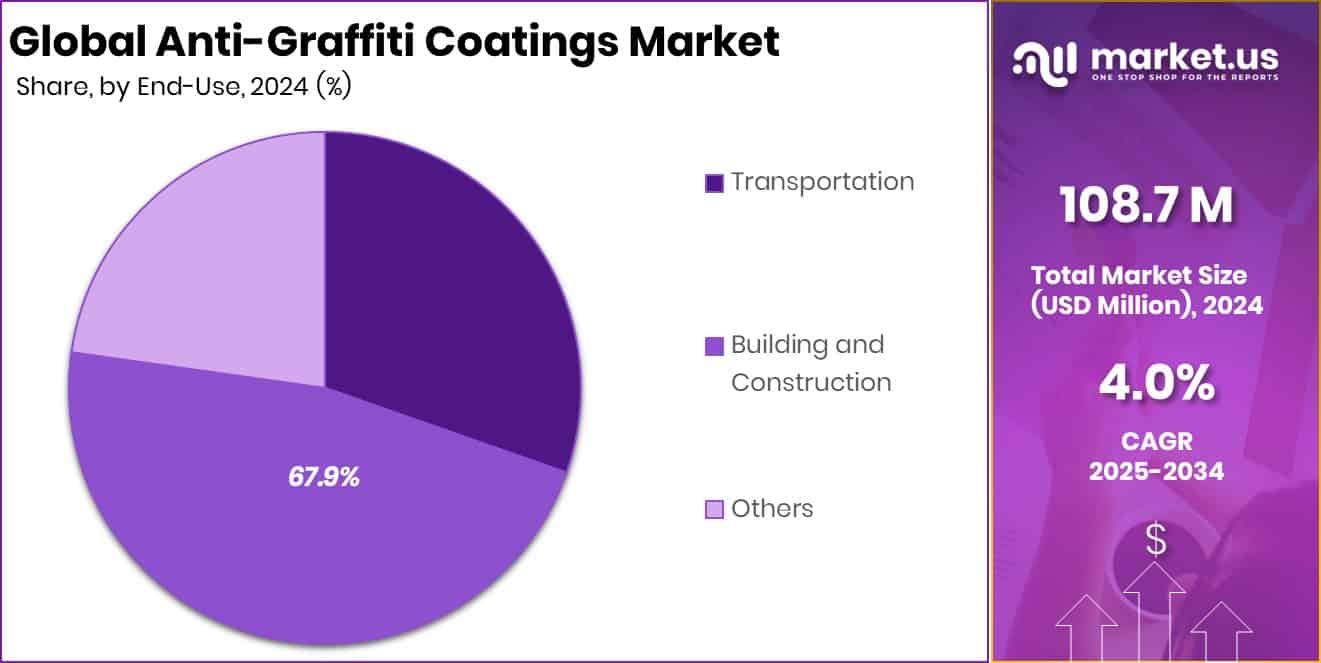

- Urban development strongly drives the Anti-Graffiti Coatings Market, with building and construction covering 67.9% share.

- The Anti-Graffiti Coatings Market in Europe reached USD 41.5 Mn with 38.2% dominance.

By Type Analysis

The anti-graffiti coatings market was dominated by the sacrificial type with a 47.1% share.

In 2024, the Anti-Graffiti Coatings Market saw the Sacrificial segment dominate the By Type category with a significant 47.1% share. This leadership reflects the growing preference for cost-effective and easily removable coatings that help public authorities and commercial property owners manage recurring graffiti issues.

Sacrificial coatings are widely adopted because they provide a temporary yet efficient protective layer that can be washed off along with graffiti without damaging the underlying surface. Their lower cost, simple application, and compatibility with various wall materials make them highly suitable for urban infrastructure. Increasing municipal investments in city beautification, coupled with the need for quick graffiti removal systems, continues to elevate demand for sacrificial coating solutions across both developed and emerging regions.

By Substrate Analysis

The anti-graffiti coatings market dominated concrete substrates, capturing a strong 32.7% share.

In 2024, the Anti-Graffiti Coatings Market recorded the Concrete segment as the dominant category under By Substrate, securing a strong 32.7% share. Concrete is extensively used in public infrastructure such as bridges, tunnels, metro stations, and commercial building exteriors, making it highly vulnerable to vandalism. This widespread use creates a sustained need for protective coatings that preserve aesthetics and reduce maintenance expenses.

Anti-graffiti coatings help enhance durability, prevent deep penetration of paint into porous concrete surfaces, and allow for quicker cleaning cycles. With urbanization intensifying worldwide, municipalities and private developers increasingly apply these coatings to extend surface lifespan. The growing emphasis on long-term asset protection and reduced cleaning costs continues to drive the dominance of anti-graffiti solutions for concrete structures.

By Product Type Analysis

The anti-graffiti coatings market was dominated by the permanent product type at 45.8% share.

In 2024, the Anti-Graffiti Coatings Market saw the Permanent segment dominate the By Product Type classification with a notable 45.8% share. Permanent coatings remain in place after graffiti removal, offering strong chemical resistance and long-lasting protection. They require less frequent reapplication compared to sacrificial solutions, making them a preferred choice for high-traffic or high-risk vandalism zones.

Government agencies, transportation departments, and commercial facility managers increasingly choose permanent coatings to minimize long-term maintenance budgets. Their ability to withstand repeated cleaning cycles, environmental exposure, and harsh weather conditions enhances their value. As infrastructure development expands and public surfaces require extended protection, permanent coatings continue gaining strong traction across global markets, reinforcing their substantial market share and long-term application benefits.

By Technology Analysis

The anti-graffiti coatings market is dominated by water-based technology, holding a 39.3% share globally.

In 2024, the Anti-Graffiti Coatings Market observed the Water-Based segment leading the By Technology landscape with a dominant 39.3% share. Water-based formulations are favored due to their low VOC emissions, environmental safety, fast drying properties, and compliance with global regulatory standards. With stricter environmental norms emerging across North America, Europe, and Asia, manufacturers are increasingly transitioning toward sustainable coating technologies.

Water-based coatings also provide excellent adhesion, weather resistance, and ease of application, making them suitable for building exteriors, public utilities, and transportation assets. Their reduced toxicity ensures safer application in densely populated urban environments. As green construction practices expand and industries prioritize eco-friendly alternatives, water-based anti-graffiti coatings continue to secure strong market preference and widespread adoption.

By End-Use Analysis

The anti-graffiti coatings market was dominated by building construction end-use with a 67.9% share.

In 2024, the Anti-Graffiti Coatings Market identified the Building and Construction segment as the dominant end-use category, capturing an impressive 67.9% share. This segment benefits from rapid urban development, increased infrastructure renovation, and higher investment in public facilities. Commercial buildings, residential complexes, transit stations, and public structures rely heavily on anti-graffiti coatings to maintain visual appeal and reduce ongoing cleaning expenses.

The rise in vandalism incidents across metropolitan areas has pushed property owners and city authorities to adopt long-lasting protective solutions. Building exteriors made from concrete, metal, and wood increasingly require these coatings to prevent damage and maintain asset longevity. With growing emphasis on aesthetic maintenance and cost-effective cleaning, this segment maintains clear dominance in global demand.

Key Market Segments

By Type

- Sacrificial

- Semi-Sacrificial

- Non-Sacrificial

By Substrate

- Wood

- Concrete

- Brick

- Metal

- Glass

- Ceramics

- Others

By Product Type

- Permanent

- Semi-permanent

- Temporary

By Technology

- Solvent-Based

- Water-Based

- Powder Coatings

- Nano Coatings

By End-Use

- Transportation

- Building and Construction

- Others

Driving Factors

Growing infrastructure maintenance boosts coating demand

Growing infrastructure maintenance continues to boost demand for anti-graffiti coatings as cities and public authorities focus on protecting assets that face repeated vandalism. Maintenance projects across railways, bridges, and public walkways require long-lasting coatings that reduce cleaning frequency and help preserve structural appearance. This need aligns with ongoing innovation in protective materials, supported by developments in adjacent coating technologies.

A notable example is a UK battery innovator raising £1.4m to tackle LFP manufacturing challenges, reflecting broader momentum in advanced surface engineering and protective formulations. As infrastructure upgrades expand globally, anti-graffiti coatings become essential for reducing lifetime maintenance costs, improving durability, and ensuring faster cleaning cycles for public and commercial structures.

Restraining Factors

High coating application costs limit usage

Despite rising demand, high application and reapplication costs continue to limit the broader use of anti-graffiti coatings, especially across small municipalities and cost-sensitive infrastructure projects. These coatings require specialized labor, precise surface preparation, and periodic maintenance, increasing total ownership expenses for asset managers.

Financial constraints grow more evident when examining unrelated cases, such as a company settling a $2M COVID relief fund fraud investigation, which highlights how organizations are re-evaluating expenditures, reducing discretionary budgets, and placing stricter oversight on operational costs. Such pressures often delay protective coating investments. As budgets tighten, decision-makers may postpone applying anti-graffiti solutions, creating a restraint in market expansion despite increasing urban vandalism concerns.

Growth Opportunity

Increasing restoration projects create a strong demand

Growing restoration and redevelopment projects are creating strong opportunities for anti-graffiti coatings, as aging structures require renewed surface protection. Public pathways, heritage buildings, and transportation hubs are undergoing upgrades that naturally demand coatings capable of preventing long-term damage from graffiti and stains. This momentum is reinforced by examples of business expansion within material and construction-linked industries.

For instance, Origin Frames Ltd securing £2.5m in funding to support growth signals broader investment in building-related innovation. As restoration projects grow in number and scale, demand rises for coatings that protect renovated surfaces, reduce cleaning labor, and extend the life of architectural materials. This trend positions anti-graffiti coatings as essential components in modern redevelopment plans.

Latest Trends

Adoption of sustainable water-based coating systems

The market is witnessing a strong shift toward sustainable, water-based anti-graffiti coatings that reduce environmental impact while maintaining durability and cleaning efficiency. These products appeal to construction firms and public agencies seeking eco-friendly solutions as part of broader green-building initiatives. Industry investment also supports this trend.

For example, Cole’s Coatings investing $70K to expand operations in Hillsboro underscores continued growth in coating-focused businesses. Meanwhile, material innovation advances further as Nature Coatings secures $2.45M to scale pigment technology that enhances eco-friendly formulations. These developments reflect a move toward safer, low-VOC coatings that meet regulatory expectations, creating a trend toward cleaner, more sustainable surface protection solutions.

Regional Analysis

Europe leads the Anti-Graffiti Coatings Market with a strong 38.2% share, valued USD 41.5 Mn.

Europe dominates the Anti-Graffiti Coatings Market in 2024, holding a leading 38.2% share valued at USD 41.5 Mn, driven by extensive urban infrastructure and strong emphasis on aesthetic preservation across public spaces. North America follows with steady adoption across commercial buildings, transport networks, and public utilities as cities continue implementing protective surface solutions to reduce long-term maintenance.

The Asia Pacific region sees expanding demand, supported by rapid construction growth and increased municipal focus on surface protection across dense metropolitan areas. Meanwhile, the Middle East & Africa experiences gradual uptake of anti-graffiti solutions, particularly in emerging urban centers seeking to protect newly developed structures.

Latin America shows consistent usage across transportation corridors and public infrastructure, with growing interest from municipal authorities aiming to reduce graffiti-related cleaning costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Sherwin-Williams Company continues to strengthen its presence by offering durable protective coating solutions widely used across commercial buildings and public infrastructure. Its long-standing expertise in surface technologies enables the company to deliver coatings that support easier graffiti removal while maintaining structural aesthetics, making it a trusted choice among end users seeking long-term protection.

3M remains influential through its focus on advanced surface protection films and coating technologies designed to resist vandalism. The company leverages its materials science capabilities to enhance product performance, particularly in urban environments where graffiti incidents are frequent. Its solutions are valued for their reliability, ease of application, and ability to preserve the appearance of various substrates, contributing to reduced maintenance cycles for property owners.

BASF SE adds strong technical depth to the market with its portfolio of high-performance coating formulations. The company’s emphasis on research-driven product development supports enhanced adhesion, weather resistance, and sustainability attributes in anti-graffiti applications. BASF’s involvement helps meet diverse regional needs, reinforcing global demand for durable protective coatings.

Top Key Players in the Market

- The Sherwin-Williams Company

- 3M

- BASF SE

- AkzoNobel N.V.

- Axalta Coating Systems, LLC

- Edge Film Technologies

- ChemMasters, Inc.

- SIKA CORPORATION

- A&A Thermal Spray Coatings

- FSC Coatings Inc.

Recent Developments

- In 2025, 3M significantly increased its pace of new product launches, with reports noting that the company brought forward hundreds of new products during the year. While not all specifically anti-graffiti, this acceleration shows 3M’s ongoing focus on expanding its protective coatings and materials portfolio.

- In February 2025, BASF SE signed an agreement to sell its Brazilian decorative paints business to The Sherwin-Williams Company for USD 1.15 billion. This divestiture includes production sites, brand names, and around 1,000 employees, helping BASF streamline its coatings portfolio.

Report Scope

Report Features Description Market Value (2024) USD 108.7 Million Forecast Revenue (2034) USD 160.9 Million CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sacrificial, Semi-Sacrificial, Non-Sacrificial), By Substrate (Wood, Concrete, Brick, Metal, Glass, Ceramics, Others), By Product Type (Permanent, Semi-permanent, Temporary), By Technology (Solvent-Based, Water-Based, Powder Coatings, Nano Coatings), By End-Use (Transportation, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Sherwin-Williams Company, 3M, BASF SE, AkzoNobel N.V., Axalta Coating Systems, LLC, Edge Film Technologies, ChemMasters, Inc., SIKA CORPORATION, A&A Thermal Spray Coatings, FSC Coatings Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti-Graffiti Coatings MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Anti-Graffiti Coatings MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- The Sherwin-Williams Company

- 3M

- BASF SE

- AkzoNobel N.V.

- Axalta Coating Systems, LLC

- Edge Film Technologies

- ChemMasters, Inc.

- SIKA CORPORATION

- A&A Thermal Spray Coatings

- FSC Coatings Inc.