Global Anise Seed Extract Market Size, Share and Report Analysis By Type (Oil, Powder, Liquid, Concentrate, Whole Seed), By Application (Pharmaceuticals, Cosmetics, Food And Beverages, Flavoring, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176400

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

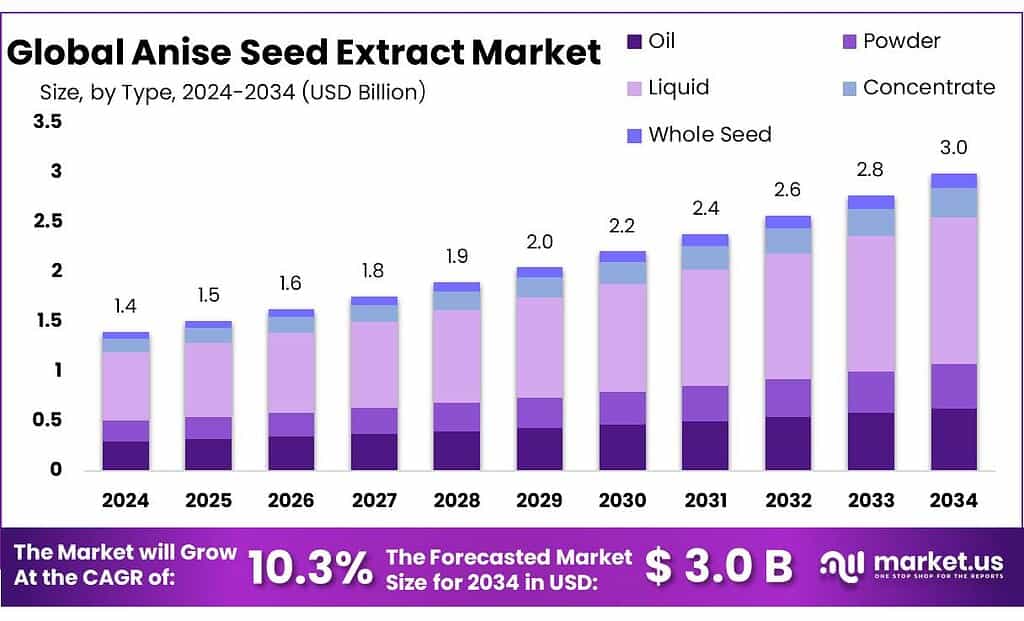

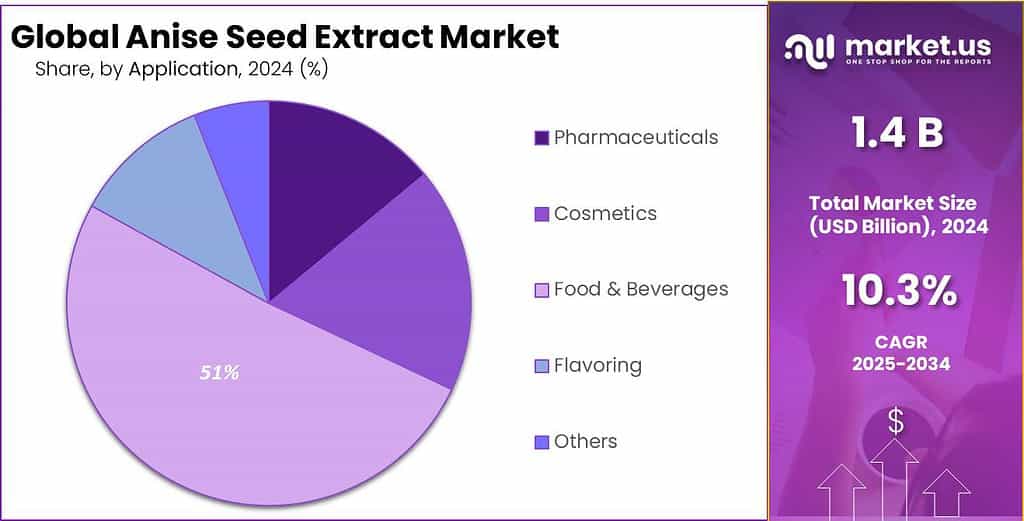

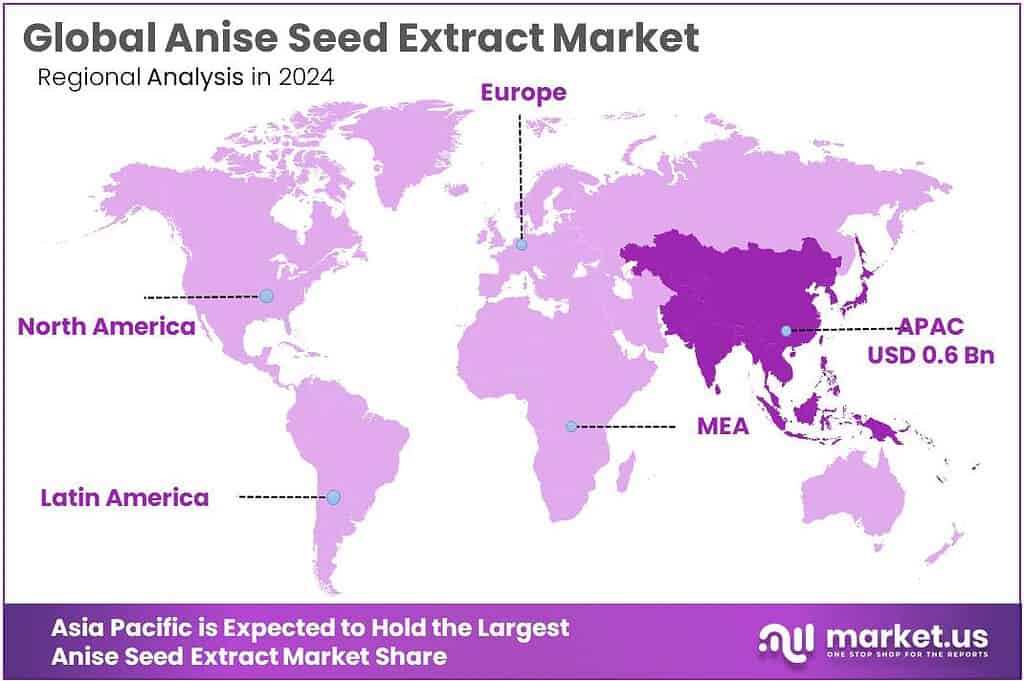

Global Anise Seed Extract Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 47.3% share, holding USD 0.6 Billion in revenue.

Anise seed extract is a concentrated flavour ingredient made from Pimpinella anisum seeds (and in some trade classifications, the closely traded “anise or badian” group) and used for its sweet, liquorice-like note in bakery, confectionery, beverages, dairy desserts, and spice blends. Industrially, it sits at the intersection of two large supply chains: the global spice trade and the regulated flavourings industry. On the regulatory side, the European Union operates a “Union list” system where only listed flavouring substances can be used in foods, under the framework of Regulation (EC) No 1334/2008 and its updates.

From an industrial scenario point of view, anise seed extract sits inside the wider “seed spices” and natural flavourings supply chain, where processors balance farm variability, food safety compliance, and export logistics. On the supply side, the crop group that includes anise/badian/fennel/coriander is produced at significant scale globally: FAO-linked data sources report 2,751,010 tonnes of production worldwide in 2022 for this combined crop category. On the trade side, India is a major hub for spices and spice products: Spices Board reports exports of 17.99 lakh tons in 2024–25, valued at Rs. 39,994.48 crore.

Driving factors are increasingly “systems-level,” not just taste trends. One push is the broader expansion and industrialization of crop-based ingredients: FAO’s latest production release notes that global production of primary crop commodities reached 9.6 billion tonnes in 2022, underscoring how scale, trade logistics, and ingredient processing capacity continue to grow across the food system—conditions that generally favor standardized spice extracts over raw, variable botanicals.

Regulation and government-backed quality systems are also shaping the market. In the EU, flavourings used in foods are governed under the framework of Regulation (EC) No 1334/2008, which sets rules for flavourings and flavouring ingredients to protect consumers and harmonize trade. Meanwhile, food safety scrutiny can directly influence ingredient choices and supplier qualification: a 2024 report noted that India’s spice trade group warned exports could drop by 40% amid international concern over ethylene oxide residues, and that monitoring steps were being strengthened.

Key Takeaways

- Anise Seed Extract Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 10.3%.

- Liquid held a dominant market position, capturing more than a 49.1% share in the Anise Seed Extract Market.

- Food & Beverages held a dominant market position, capturing more than a 51.9% share of the Anise Seed Extract Market.

- Asia Pacific led the Anise Seed Extract market, holding a dominant 47.3% share and reaching about 0.6 Bn.

By Type Analysis

Liquid dominates with 49.1% share, driven by its easy use and consistent flavour delivery.

In 2024, Liquid held a dominant market position, capturing more than a 49.1% share in the Anise Seed Extract Market. This leadership is strongly linked to how liquid extracts fit smoothly into modern food and beverage production. Manufacturers prefer liquid formats because they disperse evenly in doughs, syrups, dairy bases, confectionery mixes, and beverage concentrates. This reduces processing errors, cuts down flavour wastage, and helps achieve a consistent taste profile across large-scale batches. As industrial food plants increasingly look for faster blending and dosing solutions, the reliability of liquid formats naturally pushes them ahead of other extract types.

By Application Analysis

Food & Beverages leads the market with a strong 51.9% share driven by rising flavour demand.

In 2024, Food & Beverages held a dominant market position, capturing more than a 51.9% share of the Anise Seed Extract Market. This leadership comes from the widespread use of anise flavouring in bakery items, confectionery, herbal drinks, alcoholic spirits, dairy desserts, and ready-to-mix beverages. Food companies value anise extract because it delivers a stable, sweet licorice-like aroma that stays consistent during heating, blending, or long processing cycles. As brands move toward more natural flavouring solutions, food-grade extracts have become a preferred choice, helping manufacturers meet clean-label expectations while maintaining product taste and quality across high-volume production lines.

Key Market Segments

By Type

- Oil

- Powder

- Liquid

- Concentrate

- Whole Seed

By Application

- Pharmaceuticals

- Cosmetics

- Food & Beverages

- Flavoring

- Others

Emerging Trends

Compliance-first sourcing is the latest trend, as anise extract buyers demand cleaner, fully traceable flavour ingredients.

A clear latest trend in the anise seed extract space is that food and beverage buyers are no longer satisfied with “good flavour” alone. They are now asking for cleaner, better-documented extracts—with test reports, origin traceability, and predictable specifications that hold up in export markets. This shift became more visible in 2024, when spice supply chains came under tighter international attention. In the UK, the Food Standards Agency stated that ethylene oxide is not allowed there and that maximum residue levels apply for herbs and spices. In day-to-day business terms, that kind of message pushes ingredient buyers to demand stronger proof from suppliers, even when the ingredient is used in small doses, as flavour extracts typically are.

The pressure is also coming from trade risk. In May 2024, Reuters reported that an Indian spice trade group warned exports could drop by 40% amid contamination allegations and the scrutiny around ethylene oxide. Even though that warning was not specific to anise alone, it matters because aniseed sits in the wider “seed spice” basket that shares the same cleaning, storage, and export compliance systems.

This trend is reinforced by how big the spice pipeline has become. Spices Board India reported that India exported 17.99 lakh tons of spices and spice products in 2024–25, valued at Rs. 39,994.48 crore, up from 15.40 lakh tons valued at Rs. 36,958.80 crore (USD 4,464.17 million) in 2023–24. When volumes move at that scale, even a small rise in compliance checks can create real delays, extra testing costs, and occasional shipment uncertainty. So, by 2025, more extract suppliers are positioning themselves as “audit-ready” partners—offering consistent COAs, residue screening, and traceable lot coding designed for large food factories.

Drivers

Clean-label food reformulation is pushing steady demand for anise seed extract in factory-made foods and drinks.

One major driving factor for Anise Seed Extract is the steady shift by food and beverage manufacturers toward natural, label-friendly flavouring systems that work reliably at scale. When a bakery, beverage, or confectionery plant runs the same recipe across multiple lines, it needs the flavour to taste the same every time. For example, India’s Spices Board India reported that in 2024–25 the country exported 17.99 lakh tons of spices and spice products valued at Rs. 39,994.48 crore. A year earlier, exports were 15.40 lakh tons valued at Rs. 36,958.80 crore, showing how quickly organised demand can rise when food brands and processors keep expanding product output.

This demand becomes even clearer when looking at “seed” categories that include aniseed in export reporting. In the Spices Board’s country-wise export tables, the “Other Seeds” group (which includes aniseed along with other seeds) totalled 39,438.28 tons in 2023–24, valued at Rs. 36,177.53 lakhs. For extract makers, this scale supports investment in better cleaning, controlled extraction, and food-grade handling—exactly the kind of back-end capability that large food companies expect when they choose an ingredient for mass production.

Government policy and trusted regulatory frameworks also amplify this driver. Trade and compliance decisions shape what ingredients are preferred. A recent industry note tied to the India–EU FTA discussion highlighted that customs duties on several spice products had been up to 8%, and that improved access can support higher-value exports into a quality-driven market.

Finally, international rules for flavourings also encourage the use of controlled, well-documented flavour ingredients. The EU’s Regulation (EC) No 1334/2008 sets out the rulebook for flavourings and flavouring ingredients used in foods, reinforcing the importance of safety evaluation and fair practices.

Restraints

Strict global food-safety scrutiny is slowing the growth of anise seed extract, especially for export-oriented suppliers.

One major restraining factor for the Anise Seed Extract market is the tightening food-safety and residue-control environment across major import regions. Over the past year, global regulators have increased inspection frequency for herbs and spices, and this pressure directly affects the sourcing of anise seeds, cleaning standards, and the acceptance of extracts in international markets. The industry witnessed this sharply in 2024, when Reuters reported that an Indian spice trade group warned exports could fall by 40% due to concerns relating to ethylene oxide (EtO) contamination.

This challenge affects anise seed extract because the raw material falls within the same seed-spice cluster used in export blends. If countries tighten checks, even compliant suppliers face delays and higher testing costs. These disruptions slow down deliveries for extract manufacturers, reduce reliability for food processors, and discourage smaller producers from entering the market. The Food Standards Agency also clarified that EtO is not permitted in the UK and that strict maximum residue limits apply for imported herbs and spices.

Furthermore, global spice movements continue to be large, meaning that even small disruptions carry big consequences. India exported 17.99 lakh tons of spices and spice products in 2024–25, valued at Rs. 39,994.48 crore (USD 4.72 billion), according to Spices Board India. On the regulatory side, international flavouring rules require continuous documentation and safety evidence. Under EU Regulation (EC) No. 1334/2008, managed by the European Union, flavouring substances must meet strict assessment criteria to enter the region’s food market.

Opportunity

Value-added spice processing is a clear growth opportunity for anise seed extract, helped by export momentum and government-backed infrastructure.

Government-supported processing infrastructure strengthens this opportunity further. A Press Information Bureau release (Parliament Q&A coverage) stated that the Spices Board has established eight crop-specific Spice Parks across India. These parks are designed to support common processing and value-add facilities in core growing regions, which is exactly the kind of backbone extract processors need—clean handling areas, shared utilities, and a more organized supply ecosystem. When processing clusters like this exist, it becomes easier for smaller extract units to scale up without building every facility from scratch.

Another strong tailwind is the push to formalize and modernize micro food processing. Ministry of Food Processing Industries updates (via PIB) note that since January 2025, 56,543 loans were sanctioned under the credit-linked subsidy component of the PMFME scheme, and Rs. 240.92 crore was sanctioned as seed capital assistance to 63,108 SHG members. Separately, a Parliament document states PMFME runs from 2020–21 to 2025–26 with an outlay of Rs. 10,000 crore.

For anise seed extract makers, the opportunity is to sell “ready-for-production” flavour inputs instead of only relying on whole-seed buyers. Food plants want ingredients that are consistent, easier to dose, and safer to handle. That is where standardized extracts fit well. In practical terms, extract suppliers who can offer stable specifications, traceability, and clean documentation are better positioned to win long-term supply contracts with food and beverage manufacturers.

Regional Insights

Asia Pacific dominates with 47.3% share, valued at 0.6 Bn, backed by strong spice supply chains and large-scale food manufacturing.

In 2024, Asia Pacific led the Anise Seed Extract market, holding a dominant 47.3% share and reaching about 0.6 Bn in value. This leadership is closely tied to how the region combines two strengths: it sits near major spice-growing and processing hubs, and it has a huge base of food and beverage manufacturers that regularly use spice-derived flavours in bakery, confectionery, dairy, and beverages. When producers can source raw spice inputs locally or regionally, the extract supply chain becomes faster and more cost-stable, which supports steady contract supply to food brands.

Supply-side capacity in the wider “anise/badian/fennel/coriander” crop group also supports Asia Pacific’s advantage. FAOSTAT-linked figures show global production of this combined crop category reached 2,751,010 tonnes in 2022, which underlines the scale available for downstream extraction and value addition. On the trade side, the region benefits from high spice export throughput. Spices Board India reported India exported 17.99 lakh tons of spices and spice products in 2024–25, valued at Rs. 39,994.48 crore, up from 15.40 lakh tons in 2023–24—a strong signal that organized sourcing and processing channels are expanding.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Spice Islands began in 1941 and sits inside B&G Foods’ Spices & Flavor Solutions unit. In fiscal 2024, that segment reported net sales of $395.196 million (the segment includes Spice Islands among other brands). This scale matters because large spice brands often expand into extracts and standardized flavour formats to support consistent consumer products.

Frontier Co-op reports a large retailer membership base—its materials reference 50,000+ member-owners, while its sustainability report cites 65,000 member-owners. It also reported $235.9 million in net sales for 2023 and “more than” $10 million contributed to philanthropy over time. This footprint supports scaled purchasing and long-term supplier programs for botanical ingredients.

Advanced Bio-Technologies operates from 10 Taft Road, Totowa, NJ 07512, and lists a direct line at (973) 339-6242, which helps buyers verify procurement and technical support quickly. The company positions itself around natural flavour and fragrance ingredients, aligning with extract buyers who need documentation and repeatable specifications for manufacturing-grade inputs.

Top Key Players Outlook

- Herb Pharm

- Spice Island

- Aura Cacia essential oils

- Frontier Natural Products Co-op

- Advanced Bio-Technologies Inc.

- Flavorganics LLC.

- Kingherbs Limited

- Dongguan Meiherb Biotech Co.

- Especias Moriana

- Avi Naturals

Recent Industry Developments

In 2024, Herb Pharm looked well placed in the anise seed extract space because it already runs a “farm-to-extract” operating model that suits clean-label buyers who want consistency, not surprises. The company’s own 2024 review says it harvested an estimated 60,512 lb of fresh herbs and 41,702 lb of dried herbs, while growing and tending 70+ herb species—scale that supports steady extraction output even when demand spikes.

Spices & Flavor Solutions segment (the business unit that includes Spice Islands) generated $395,196,000 in net sales in fiscal 2024 and delivered $110,848,000 in segment adjusted EBITDA.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Oil, Powder, Liquid, Concentrate, Whole Seed), By Application (Pharmaceuticals, Cosmetics, Food And Beverages, Flavoring, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Herb Pharm, Spice Island, Aura Cacia essential oils, Frontier Natural Products Co-op, Advanced Bio-Technologies Inc., Flavorganics LLC., Kingherbs Limited, Dongguan Meiherb Biotech Co., Especias Moriana, Avi Naturals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Herb Pharm

- Spice Island

- Aura Cacia essential oils

- Frontier Natural Products Co-op

- Advanced Bio-Technologies Inc.

- Flavorganics LLC.

- Kingherbs Limited

- Dongguan Meiherb Biotech Co.

- Especias Moriana

- Avi Naturals