Global Aminophenol Market Size, Share, And Business Benefit By Type (M-aminophenol, P-aminophenol, O-aminophenol), By Application (Dye Intermediates, Synthesis Precursors, Fluorescent Stabilizers, Other), By End-use (Pharmaceuticals, Agrochemicals, Antioxidants, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161183

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

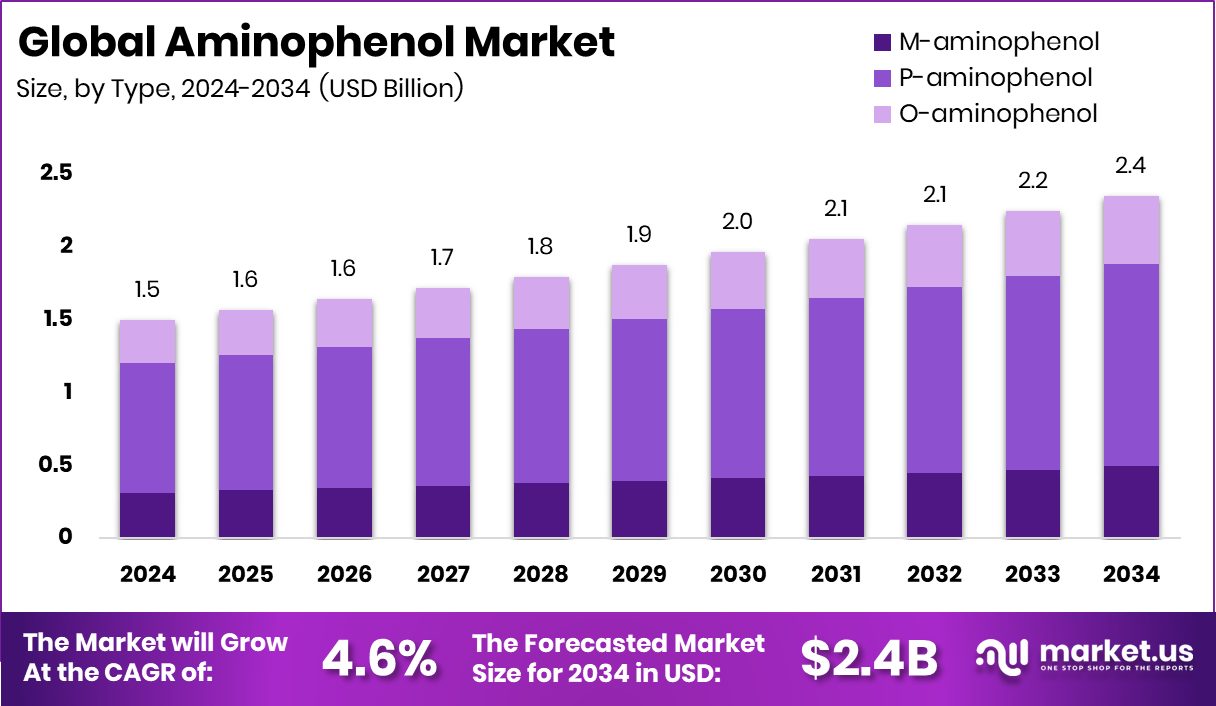

The Global Aminophenol Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. Rapid industrialization and healthcare expansion continued driving Asia Pacific’s 43.8% market dominance.

Aminophenol is a chemical compound derived from phenol in which one hydrogen is replaced by an amino group (–NH₂). Depending on the position of that amino group relative to the hydroxyl (–OH) group, there are ortho, meta-, and para-aminophenol isomers. Aminophenols serve as important intermediates in the manufacture of pharmaceuticals (notably paracetamol), dyes, agrochemicals, and specialty chemicals. Because of their dual functional groups (amino and hydroxyl), they can undergo various chemical transformations, making them versatile building blocks in industrial chemistry.

The aminophenol market refers to the global trade, production, and consumption of aminophenol compounds and their derivatives across industries such as pharmaceuticals, textiles, cosmetics, agrochemicals, and dyes. In effect, this market captures demand for aminophenols as feedstock or intermediates in downstream synthesis, as well as their pricing, supply chains, and geographic distribution. Growth in sectors like drug manufacturing, crop protection chemicals, and colorants directly influences the aminophenol market dynamics.

One key growth driver is the strong demand from the pharmaceutical sector, where para-aminophenol is used to produce paracetamol and other active compounds. As healthcare access expands and the incidence of fever, pain, and related illnesses continues, the need for such intermediates rises. In parallel, the textile and dye industries consume large volumes of aminophenol derivatives as colorants and intermediates in complex dye molecules. Technological improvements in synthesis routes (yield, cost, purity) further lower barriers to wider adoption, pushing growth even in regions with tighter margins.

Demand is bolstered by rising use in cosmetics and hair dyes, leveraging meta-aminophenol derivatives to achieve varied hues and stability. In agriculture, aminophenols serve as building blocks for certain herbicides and pesticides; thus, growth in crop protection boosts demand. Meanwhile, regulatory pressure on emissions and chemical purity encourages manufacturers to seek higher-grade aminophenols, pushing demand for refined products rather than low-grade bulk material.

A major opportunity lies in expanding into agrichemical and specialty applications—if formulations can be developed that harness aminophenols for novel, high-value crop protection agents, that will open new revenue streams. Another opportunity is in emerging markets: chemical and pharmaceutical capacity in Asia, Africa, and Latin America is growing, and local production of aminophenols rather than reliance on imports could yield cost and supply advantages.

On the funding side, Kotak arm invests Rs 375 crore in agrochemical company Cropnosys, indicating capital flow into agrochemicals; likewise, biotech start-up Pili raises US$15.8m in Series A funding, and the GEF Council approves USD 668+ million in financing for environmental/chemical projects—all of which suggest that chemical innovation, agricultural tech, and sustainability are receiving investment that might catalyze new aminophenol-based applications.

Key Takeaways

- The Global Aminophenol Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- In 2024, P-aminophenol dominated the aminophenol market, holding a 43.3% share globally.

- Dye intermediates captured a 44.9% share in the aminophenol market during 2024.

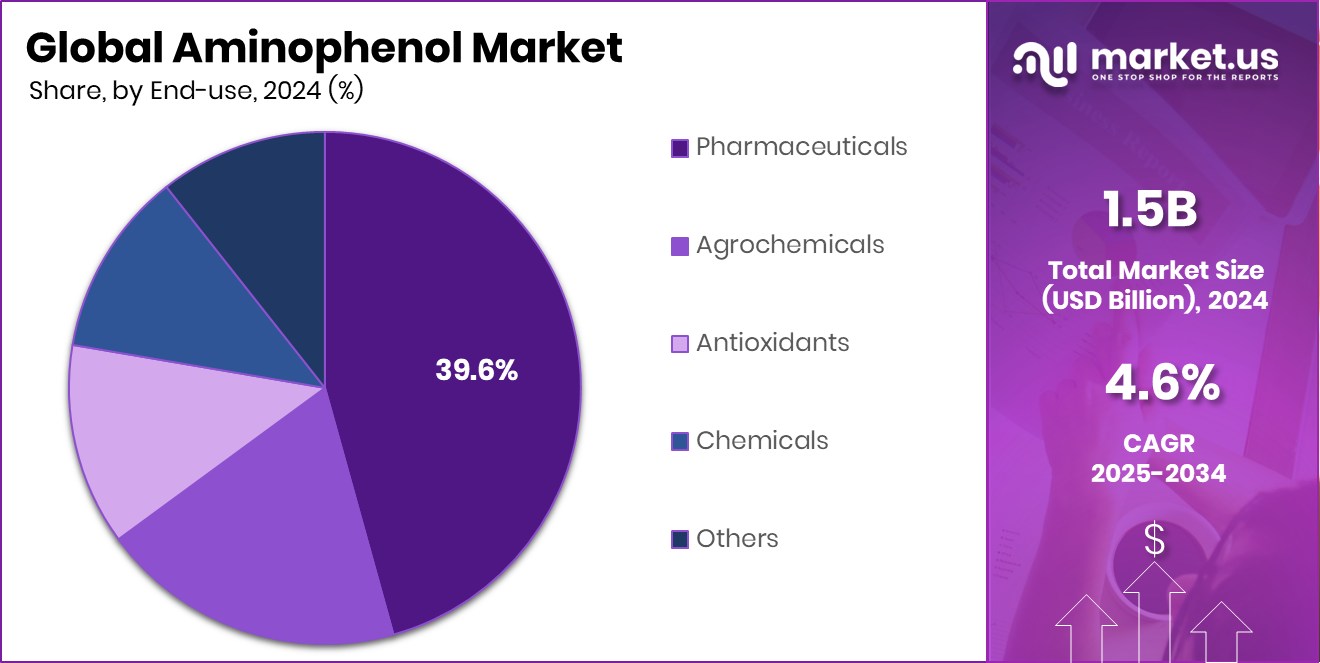

- Pharmaceuticals accounted for 39.6% of the acetaminophen market in 2024.

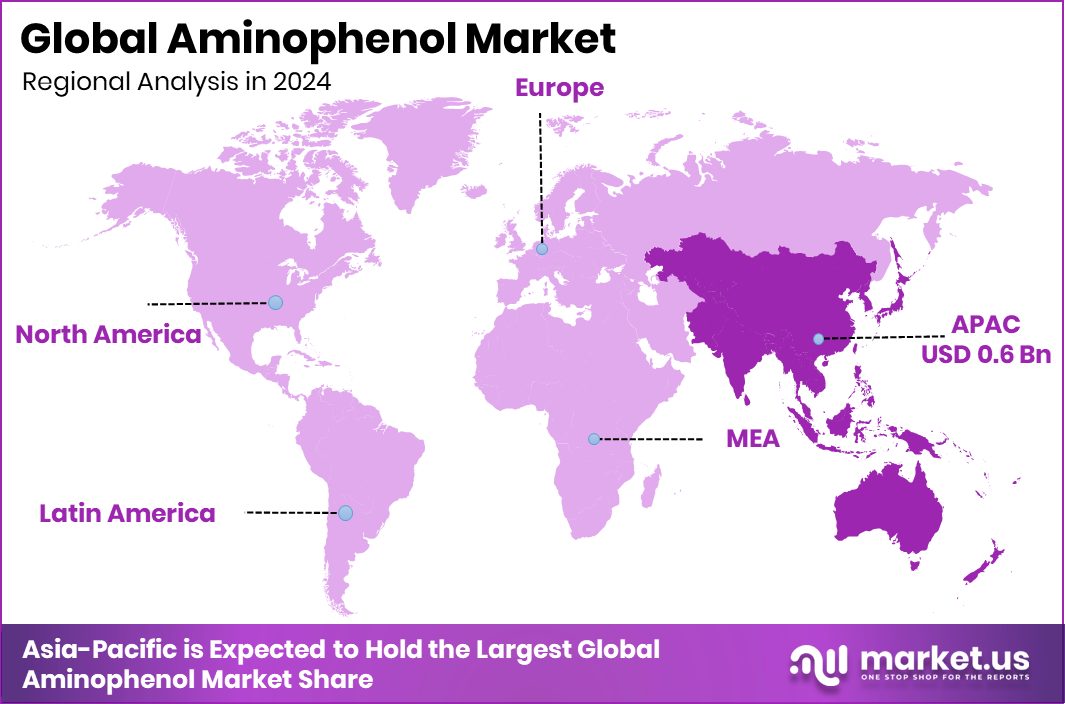

- The Asia Pacific generated USD 0.6 billion, supported by strong pharmaceutical and dye industries.

By Type Analysis

In 2024, the Aminophenol Market saw P-aminophenol hold a 43.3% share.

In 2024, P-aminophenol held a dominant market position in the By Type segment of the Aminophenol Market, capturing a 43.3% share. This dominance was driven by its extensive use as a key intermediate in pharmaceutical synthesis, particularly in the production of paracetamol, where purity and stability are crucial. Its versatile chemical structure also supports widespread application in hair dyes, colorants, and photographic developers, adding to its industrial importance.

The compound’s consistent demand from pharmaceutical and cosmetic manufacturers strengthened its market presence, while its proven safety and efficiency in large-scale production helped it maintain a stable position across major chemical markets. This steady demand base reinforced P-aminophenol’s leadership in 2024.

By Application Analysis

The Aminophenol Market recorded a 44.9% share in the dye intermediates segment.

In 2024, Dye Intermediates held a dominant market position in the By Application segment of the Aminophenol Market, capturing a 44.9% share. This strong share was primarily supported by the compound’s extensive use in manufacturing high-performance dyes and pigments for textiles, leather, and paper industries. Aminophenol-based intermediates provide excellent color stability, brightness, and fastness, making them essential in formulating synthetic and natural dyes.

The growing textile production and demand for durable, vivid coloring agents further strengthened this segment’s dominance. Additionally, the compound’s compatibility with multiple dyeing processes and its ability to enhance color quality made it a preferred choice among manufacturers, ensuring the Dye Intermediates segment maintained its leading position in 2024.

By End-use Analysis

In 2024, pharmaceuticals captured a 39.6% share in the Aminophenol Market.

In 2024, pharmaceuticals held a dominant market position in the end-use segment of the aminophenol market, capturing a 39.6% share. This leadership was primarily attributed to the extensive use of aminophenol, particularly p-aminophenol, as a key intermediate in the production of paracetamol and other pharmaceutical formulations. Its high purity, chemical stability, and compatibility with large-scale synthesis processes made it an essential raw material for drug manufacturing.

The continuous rise in global healthcare demand, along with increasing production of over-the-counter pain relief and fever management medications, supported strong consumption levels. These factors firmly established the pharmaceuticals segment as the largest end-use category within the aminophenol market in 2024.

Key Market Segments

By Type

- M-aminophenol

- P-aminophenol

- O-aminophenol

By Application

- Dye Intermediates

- Synthesis Precursors

- Fluorescent Stabilizers

- Other

By End-use

- Pharmaceuticals

- Agrochemicals

- Antioxidants

- Chemicals

- Others

Driving Factors

Rising Pharmaceutical Demand Strengthens Aminophenol Production Growth

A major driving factor for the aminophenol market is the increasing demand from the pharmaceutical sector, especially for producing paracetamol and related drugs. P-aminophenol is a vital intermediate in these medicines, and its steady use supports continuous manufacturing expansion worldwide. Growing healthcare needs, expanding drug formulations, and rising awareness about accessible pain relief solutions are all fueling higher production volumes.

Additionally, the ongoing development of advanced production lines and chemical synthesis units is improving efficiency and purity levels. Supporting this industrial expansion, Arbuda Agrochemicals filed an NSE Emerge IPO for 64 lakh shares to fund ₹120 crore debt repayment and a new ALP line, which is expected to enhance capacity and strengthen domestic chemical manufacturing capabilities.

Restraining Factors

Health and Safety Concerns Limit Aminophenol Usage

One major restraining factor for the Aminophenol Market is the health and safety risks associated with its handling and exposure. Aminophenol compounds can be toxic if inhaled, ingested, or absorbed through the skin, leading to respiratory irritation and other health issues among workers. Strict industrial safety regulations and environmental norms require controlled production, storage, and disposal processes, which increase operational costs for manufacturers.

Additionally, improper waste management or accidental spills can pose environmental hazards, making regulatory compliance even more critical. These challenges often discourage small and mid-sized producers from expanding capacity, thereby slowing market growth. Ensuring safer formulations and adopting eco-friendly production technologies remain key to overcoming these safety-related restraints.

Growth Opportunity

Expanding Cosmetic Applications Create New Market Opportunities

A key growth opportunity for the Aminophenol Market lies in its increasing use within the cosmetics and personal care industry. Aminophenol derivatives, especially meta- and para-forms, are widely used in hair dyes and coloring formulations due to their stability, color intensity, and compatibility with various shades. As consumer demand for long-lasting, safe, and high-quality hair care products grows, manufacturers are focusing on refining aminophenol-based formulations to enhance performance and reduce irritation risks.

The rising trend toward premium and natural-inspired cosmetic products also encourages innovation in mild, dermatologically tested colorants. This growing cosmetic application base provides strong potential for market expansion, particularly in emerging economies with rapidly developing beauty and personal care sectors.

Latest Trends

Shift Toward Eco-Friendly Aminophenol Production Methods

A notable trend in the Aminophenol Market is the growing shift toward sustainable and eco-friendly production processes. Manufacturers are increasingly adopting green chemistry principles to reduce waste, energy use, and harmful emissions during synthesis. Traditional chemical routes often involve hazardous reagents and generate toxic by-products, prompting a move toward cleaner catalytic and biotechnological methods. These newer approaches aim to achieve higher yields with lower environmental impact while maintaining product purity.

Additionally, regulatory authorities are encouraging environmentally responsible practices through stricter guidelines on chemical manufacturing. This trend aligns with the broader global push for sustainable industrial development, helping companies enhance their market reputation and meet the growing demand for responsibly produced chemical intermediates.

Regional Analysis

In 2024, the Asia Pacific held a 43.8% share of the Aminophenol Market.

In 2024, Asia Pacific dominated the Aminophenol Market with a 43.8% share, valued at USD 0.6 billion. The region’s dominance was driven by expanding pharmaceutical manufacturing and rising dye production across China, India, and Japan. Rapid industrialization, strong chemical infrastructure, and growing healthcare investments further reinforced its leadership position.

North America showed steady growth, supported by increasing demand for aminophenol in pharmaceutical intermediates and personal care applications. Strong regulatory standards and advanced production technologies ensured consistent product quality and regional supply reliability.

Europe remained a significant market due to its established pharmaceutical base and sustainable chemical practices. Rising investments in cleaner synthesis methods and innovation in dye formulations supported market performance.

Middle East & Africa witnessed moderate progress driven by emerging local manufacturing and import reliance. Developing pharmaceutical infrastructure and industrial diversification gradually boosted aminophenol consumption.

Latin America demonstrated stable growth, supported by expanding healthcare sectors and evolving agrochemical applications. Regional governments’ focus on industrial chemical production contributed to gradual market penetration and consumption stability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Aminophenol market was shaped by the active participation of key producers such as Wego Chemical Group, Loba Chemie, and Taixing Yangzi Pharm Chemical Co., Ltd. Each of these companies played a significant role in ensuring consistent supply and technological advancement within the industry.

Wego Chemical Group continued to strengthen its presence through a diversified chemical distribution network, emphasizing quality and reliable sourcing of aminophenol intermediates for pharmaceutical and dye applications. Its focus on logistics efficiency and global partnerships helped maintain stable supply chains and pricing competitiveness.

Loba Chemie, known for its laboratory-grade and industrial chemicals, expanded its aminophenol portfolio to support both research and large-scale pharmaceutical synthesis. The company’s commitment to purity and regulatory compliance positioned it as a dependable partner for formulation developers and manufacturers.

Taixing Yangzi Pharm Chemical Co., Ltd. remained a crucial producer in Asia, focusing on bulk aminophenol manufacturing with strict adherence to safety and environmental standards. Its investment in advanced production systems ensured consistent output quality and scalability to meet rising pharmaceutical demand.

Top Key Players in the Market

- Wego Chemical Group

- Loba Chemie

- Taixing Yangzi Pharm Chemical Co., Ltd.

- CDH Fine Chemicals

- Anhui Bayi Chemical Industry Co. Ltd.

- Parchem

- Glentham Life Sciences Ltd

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd.

Recent Developments

- In April 2025, Wego Chemical Group relocated its headquarters to a new office at 277 Northern Boulevard, Great Neck, NY 11021. This move updates their infrastructure and is meant to better support their chemical supply and distribution operations.

- In May 2024, Glentham began direct deliveries under DDP (Delivered Duty Paid) terms from its German subsidiary to EU customers, improving customs clearance and logistics.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.4 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (M-aminophenol, P-aminophenol, O-aminophenol), By Application (Dye Intermediates, Synthesis Precursors, Fluorescent Stabilizers, Other), By End-use (Pharmaceuticals, Agrochemicals, Antioxidants, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wego Chemical Group, Loba Chemie, Taixing Yangzi Pharm Chemical Co., Ltd., CDH Fine Chemicals, Anhui Bayi Chemical Industry Co. Ltd., Parchem, Glentham Life Sciences Ltd, Liaoning Shixing Pharmaceutical & Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wego Chemical Group

- Loba Chemie

- Taixing Yangzi Pharm Chemical Co., Ltd.

- CDH Fine Chemicals

- Anhui Bayi Chemical Industry Co. Ltd.

- Parchem

- Glentham Life Sciences Ltd

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd.