Global Allergy Immunotherapy Market By Treatment Type (Subcutaneous Immunotherapy (SCIT) and Sublingual Immunotherapy (SLIT)), By Type (Tablets and Drops), By Allergy Type (Allergic Rhinitis, Allergic Asthma, and Others), By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151373

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

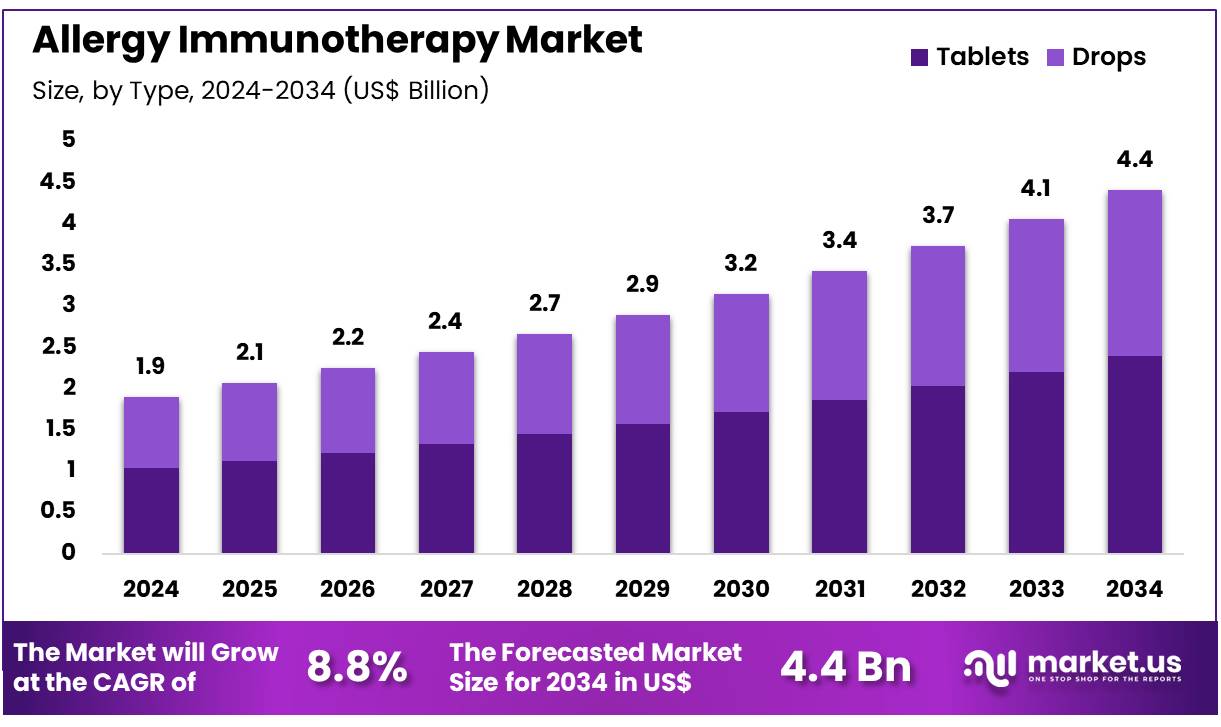

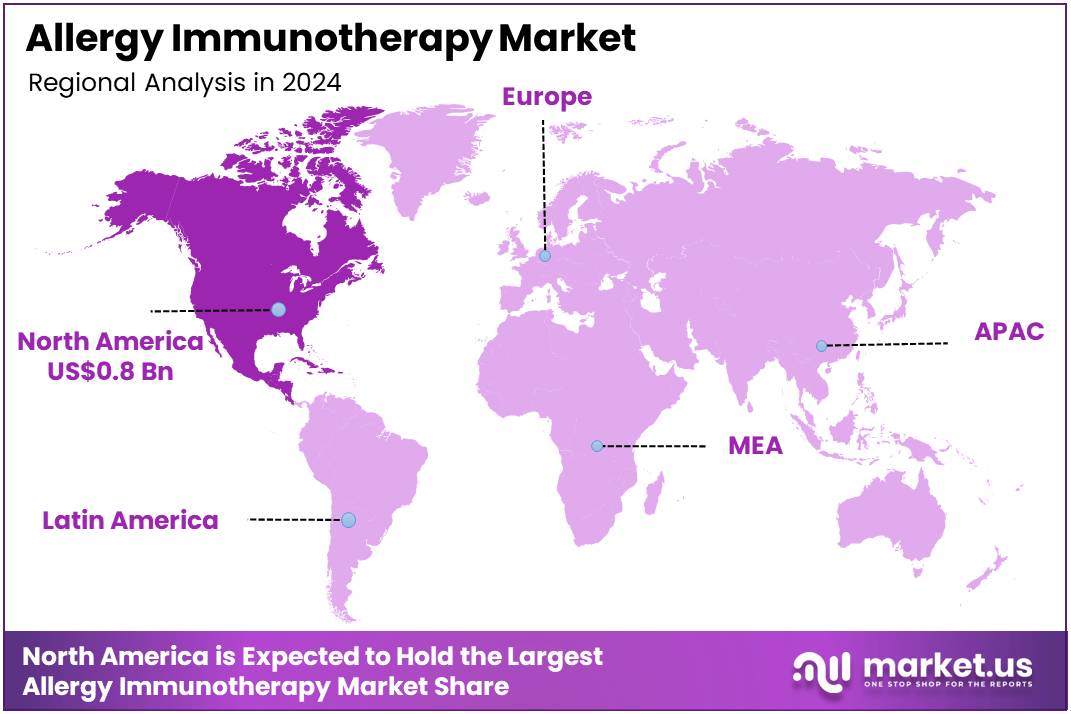

Global Allergy Immunotherapy Market size is expected to be worth around US$ 4.4 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.5% share with a revenue of US$ 0.8 Billion.

Increasing cases of allergic diseases, combined with greater awareness and demand for personalized treatments, are propelling the growth of the allergy immunotherapy market. Immunotherapy plays a key role in treating conditions like allergic rhinitis, asthma, and food allergies by gradually desensitizing the immune system to specific allergens.

The rise in the prevalence of allergic conditions, particularly among children and adults, has heightened the demand for effective long-term solutions, shifting preferences from traditional symptomatic treatments to more targeted immunotherapy options. This market has expanded due to innovations such as sublingual and subcutaneous immunotherapies, which offer improved ease of administration and enhanced patient compliance.

Additionally, the growing interest in biologic drugs for severe allergic conditions presents significant opportunities for market players. Allergy immunotherapy is also gaining traction in the treatment of insect venom allergies and allergic asthma, further broadening its therapeutic applications.

In March 2021, the National Health Commission of China launched a nationwide campaign to raise awareness of allergic diseases, promote early diagnosis, and improve access to treatment. This initiative aimed to strengthen healthcare infrastructure, support early intervention, and reduce the burden of allergies, aligning with the growing focus on improving allergy management and expanding immunotherapy access.

Key Takeaways

- In 2024, the market for allergy immunotherapy generated a revenue of US$ 1.9 Billion, with a CAGR of 8.8%, and is expected to reach US$ 4.4 Billion by the year 2034.

- The treatment type segment is divided into subcutaneous immunotherapy and sublingual immunotherapy, with subcutaneous immunotherapy taking the lead in 2023 with a market share of 66.4%.

- Considering type, the market is divided into tablets and drops. Among these, tablets held a significant share of 54.4%.

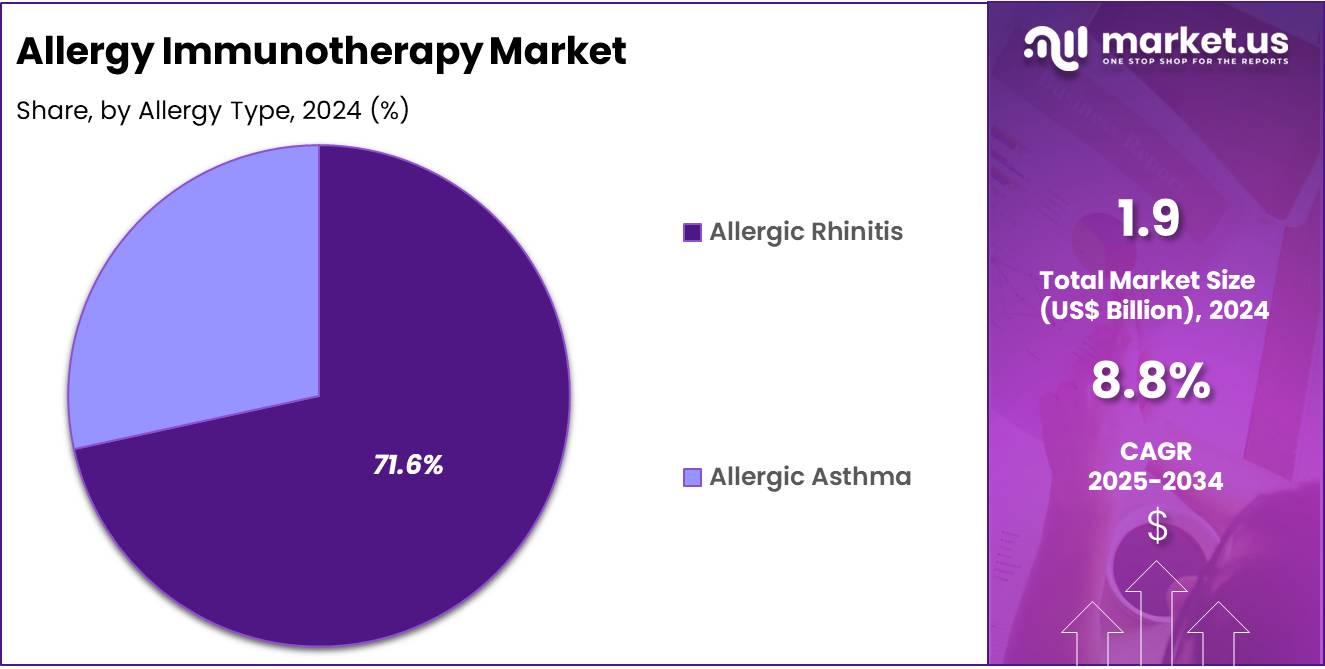

- Furthermore, concerning the allergy type segment, the market is segregated into allergic rhinitis, allergic asthma, and others. The allergic rhinitis sector stands out as the dominant player, holding the largest revenue share of 71.6% in the allergy immunotherapy market.

- The distribution channel segment is segregated into hospital pharmacy, online pharmacy, and retail pharmacy, with the hospital pharmacy segment leading the market, holding a revenue share of 39.4%.

- North America led the market by securing a market share of 39.5%.

Treatment Type Analysis

SCIT continues to be the dominant treatment modality in the allergy immunotherapy market, holding a substantial market share of 66.4%. Its long-established efficacy in treating various allergic conditions, including allergic rhinitis and allergic asthma, has solidified its position as the gold standard for allergen desensitization.

The treatment involves the gradual administration of increasing doses of allergens, leading to long-term symptom relief and potential disease modification. The widespread adoption of SCIT is further supported by its comprehensive allergen coverage, targeting multiple allergens such as pollen, dust mites, and pet dander. Additionally, the familiarity of healthcare providers with SCIT protocols and its proven track record contribute to its sustained dominance in the market.

Type Analysis

The tablets segment has gained significant traction in the allergy treatment landscape, accounting for 54.4% of the market share. The convenience of at-home administration and the non-invasive nature of tablets have made them a preferred choice for many patients. These tablets are designed to dissolve under the tongue, allowing for easy self-administration and reducing the need for frequent clinical visits.

The growing preference for patient-centric treatment options and the increasing awareness of the benefits of SLIT tablets have driven their adoption. Moreover, the availability of SLIT tablets for various allergens, including grass pollen and house dust mites, has expanded treatment options for patients, further fueling the segment’s growth.

Allergy Type Analysis

Allergic rhinitis remains the leading allergy type treated with immunotherapy, comprising 71.6% of the market share. The high prevalence of allergic rhinitis, characterized by symptoms such as sneezing, nasal congestion, and itchy eyes, has driven the demand for effective treatment options. Factors such as urbanization, environmental pollution, and climate change have contributed to the increasing incidence of allergic rhinitis, particularly in urban areas.

As awareness of the condition grows and patients seek long-term relief, the adoption of allergy immunotherapy for allergic rhinitis is expected to continue its upward trajectory. The availability of both SCIT and SLIT options for allergic rhinitis further enhances treatment accessibility and patient compliance.

Distribution Channel Analysis

Hospital pharmacies play a pivotal role in the distribution of allergy immunotherapy treatments, holding a 39.4% share of the market. Hospitals are equipped with the necessary infrastructure and trained personnel to administer SCIT, making them a primary setting for this treatment modality. The presence of allergists and immunologists within hospital settings ensures that patients receive personalized care and monitoring during treatment.

Additionally, hospitals often have established relationships with pharmaceutical suppliers, ensuring a consistent supply of the latest allergy immunotherapy products. As the demand for specialized allergy treatments grows, hospital pharmacies are expected to maintain their significant role in the distribution of allergy immunotherapy medications.

Key Market Segments

By Treatment Type

- Subcutaneous Immunotherapy (SCIT)

- Sublingual Immunotherapy (SLIT)

By Type

- Tablets

- Drops

By Allergy Type

- Allergic Rhinitis

- Allergic Asthma

- Others

By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Drivers

Rising Global Prevalence of Allergic Diseases is Driving the Market

The increasing global prevalence of various allergic diseases, including allergic rhinitis, asthma, and food allergies, is a primary driver for the allergy immunotherapy market. As environmental factors, lifestyle changes, and genetic predispositions contribute to a growing number of individuals suffering from allergies, there is a heightened demand for long-term, disease-modifying treatments like immunotherapy.

The World Health Organization (WHO) notes that allergic diseases affect 30-40% of the global population, with numbers continuing to rise. Specifically, allergic rhinitis affects between 10% and 30% of adults and up to 40% of children globally, as cited in various medical publications. This widespread and increasing burden of allergic conditions creates a consistent and expanding patient pool seeking effective and durable solutions beyond symptomatic relief, directly fueling the growth of the allergy immunotherapy sector.

Restraints

Long Treatment Duration and Adherence Challenges are Restraining the Market

The allergy immunotherapy market faces significant restraint due to the long treatment duration and associated challenges with patient adherence. Both subcutaneous immunotherapy (SCIT) and sublingual immunotherapy (SLIT) typically require several years of consistent administration, which can be burdensome for patients. This extended commitment often leads to drop-out rates, reducing the overall efficacy of the treatment in a real-world setting.

Studies on adherence to allergen immunotherapy (AIT) have shown wide variability, with reported rates ranging from approximately 25% to over 90%, depending on the study design and patient population, as highlighted in a 2024 review published in Frontiers in Pharmacology. The necessity for frequent clinic visits for SCIT or daily self-administration for SLIT, combined with the slow onset of noticeable benefits, can contribute to patient fatigue and discontinuation, thereby limiting the full market potential.

Opportunities

Development of Novel Allergen Formulations and Delivery Systems Creates Growth Opportunities

The ongoing development of novel allergen formulations and innovative delivery systems presents significant growth opportunities in the allergy immunotherapy market. Research and development efforts are focused on creating more potent, safer, and more convenient immunotherapy products that can improve patient compliance and expand the range of treatable allergies. This includes developing recombinant allergens, peptide-based immunotherapies, and advanced administration methods such as epicutaneous patches or intranasal sprays.

For example, in February 2025, the US Food and Drug Administration (FDA) approved Odactra (house dust mite sublingual allergen extract) for an expanded age range to include children aged 5 through 11 years, demonstrating continued regulatory support for novel formulations and broader patient populations. These advancements aim to reduce side effects, shorten treatment duration, and enhance ease of use, making immunotherapy a more attractive option for a wider array of allergic patients.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the allergy immunotherapy market, primarily through their impact on healthcare spending, disposable income for out-of-pocket medical expenses, and the prioritization of long-term treatments. During periods of economic stability and growth, there is generally increased government and private sector investment in healthcare infrastructure and innovative therapies, facilitating broader access to potentially costly, long-term treatments like allergy immunotherapy.

Conversely, an economic downturn or high inflation can lead to tighter household budgets, making the multi-year financial commitment of immunotherapy more challenging for patients, especially where insurance coverage is partial. A 2022 systematic review highlighted that economic crises can lead to increased co-payments and reduced pharmaceutical spending in some countries, directly impacting patient access to medications. Geopolitical factors, such as trade agreements and the stability of global supply chains for specialized allergen extracts and adjuvants, also play a crucial role.

Disruptions caused by international conflicts or trade disputes can lead to increased costs or shortages of essential components, affecting manufacturing and the availability of treatments. However, the rising global burden of allergies and the proven long-term benefits of immunotherapy ensure a persistent underlying demand, providing a degree of resilience to the market even amidst economic and political fluctuations.

Current US tariff policies can directly impact the allergy immunotherapy market by altering the cost of imported raw materials, allergen extracts, and manufacturing equipment. While finished pharmaceutical products often have specific tariff considerations, any tariffs on key chemical components or specialized diagnostic equipment used in producing or monitoring immunotherapy could raise overall production costs for manufacturers.

A report commissioned by the Pharmaceutical Research and Manufacturers of America (PhRMA) in April 2025 indicated that a proposed 25% US tariff on pharmaceutical imports could increase US drug costs by nearly US$51 billion annually, boosting prices by as much as 12.9% if fully passed on to consumers. This potential increase in costs could translate to higher prices for allergy immunotherapy, impacting patient affordability and potentially slowing market adoption.

Conversely, such tariff policies can act as an incentive for pharmaceutical companies to invest more heavily in domestic manufacturing capabilities for allergen extracts and related products within the US. This shift towards onshoring production could lead to a more secure and robust domestic supply chain for allergy treatments in the long term, reducing reliance on potentially volatile international sources and enhancing national health security, despite the initial financial adjustments.

Latest Trends

Increased Adoption of Oral Immunotherapy for Food Allergies is a Recent Trend

A prominent recent trend in the allergy immunotherapy market is the increased adoption and research focus on oral immunotherapy (OIT) for food allergies, particularly peanut allergy. As food allergies present a significant and life-threatening burden, OIT offers a promising approach to desensitize patients by gradually introducing controlled amounts of the allergen. This trend reflects a shift towards more proactive and curative treatments for severe allergies.

The Anaphylaxis Campaign, in a January 2025 review of allergy research, highlighted that a clinical trial for Omalizumab (Xolair), originally approved for asthma, demonstrated its ability to reduce allergic reactions to multiple foods, increasing the threshold for allergic responses in participants with severe food allergies. This growing interest and clinical success in OIT for food allergies represent a major area of expansion and innovation within the broader allergy immunotherapy landscape.

Regional Analysis

North America is leading the Allergy Immunotherapy Market

North America dominated the market with the highest revenue share of 39.5% owing to the high prevalence of allergic diseases across the population and critical regulatory advancements. According to the Centers for Disease Control and Prevention (CDC), as of 2021, nearly 1 in 3 US adults and more than 1 in 4 US children reported having a seasonal allergy, eczema, or food allergy.

This widespread burden of allergies underscores a consistent and substantial demand for treatments that provide long-term relief. A notable government-driven development contributing to market expansion was the Food and Drug Administration’s (FDA) expanded approval for specific allergy therapies to include broader patient demographics in 2024.

These regulatory milestones facilitate earlier intervention and improve access to specific immunotherapies, thus enabling more individuals to pursue a disease-modifying treatment approach. These factors, rooted in public health data and crucial regulatory decisions by government bodies, collectively reflect and propel the continued upward trajectory of the market in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising burden of allergic diseases and increasing healthcare expenditure. The “Health at a Glance: Asia/Pacific 2024” report, a joint publication by the OECD and the World Health Organization (WHO), highlights an increasing trend in overall healthcare spending across the region, indicating a greater capacity for investment in advanced medical treatments. Such increased investment provides a fertile ground for the adoption of sophisticated allergy therapies.

Furthermore, the rising awareness of allergic conditions among both patients and healthcare professionals, spurred by various public health campaigns and medical education initiatives, is likely to enhance diagnosis and treatment rates. Efforts by national health ministries and public health bodies to address non-communicable diseases, including allergies, will further support the market. These collective developments, rooted in public health trends and reports from recognized intergovernmental organizations, are expected to drive the expansion of access to allergy immunotherapies throughout Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the allergy immunotherapy market focus on a variety of strategies to drive growth, including expanding their product offerings through the development of new allergy treatments and delivery methods. They prioritize increasing access to therapies by strengthening their distribution networks and establishing partnerships with healthcare providers.

These companies also heavily invest in research and development to enhance the efficacy and safety of their products, making them more attractive to patients and clinicians. Additionally, they leverage digital technologies, including telemedicine and patient engagement platforms, to improve treatment compliance and monitoring. Acquisitions and collaborations are also key components of their growth strategies, allowing them to broaden their portfolios and enter new markets.

Stallergenes Greer is a significant player in the allergy immunotherapy market. The company specializes in developing and manufacturing allergy treatments, including sublingual and subcutaneous immunotherapies. With over 70 years of expertise, Stallergenes Greer has established a strong presence globally, offering products that aim to provide long-term relief for allergy sufferers.

The company focuses on continuous innovation through its robust R&D pipeline and strategic partnerships with healthcare providers to improve patient outcomes. Stallergenes Greer is committed to providing effective and personalized solutions for individuals with allergic conditions, particularly in the field of respiratory allergies.

Top Key Players

- Viatris

- Siemens

- LETIPharma

- DVB Technologies SA

- DMK Pharmaceuticals

- Circassia

- ASIT Biotech

- Allergy Therapeutics

Recent Developments

- In October 2024, Viatris secured global rights to sotagliflozin from Lexicon Pharmaceuticals, excluding the US and Europe. The drug, approved in May 2023, targets cardiovascular risks in heart failure and type 2 diabetes patients. The agreement includes a US$ 25 million upfront payment, potential milestone payments, and Viatris taking charge of regulatory and commercialization efforts, while Lexicon will supply clinical and commercial quantities. This partnership strengthens Viatris’ cardiovascular portfolio and aims to enhance global patient access to innovative therapies.

- In September 2024, Merck and Siemens expanded their partnership with a Memorandum of Understanding to advance smart manufacturing. The collaboration focuses on integrating technologies to improve production processes, reduce time-to-market, and prioritize sustainability. Merck will leverage Siemens’ Xcelerator platform to streamline operations and develop a modular GMP production line that meets high safety standards, fostering growth across Merck’s healthcare, life science, and electronics sectors.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 4.4 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Subcutaneous Immunotherapy (SCIT) and Sublingual Immunotherapy (SLIT)), By Type (Tablets and Drops), By Allergy Type (Allergic Rhinitis, Allergic Asthma, and Others), By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Viatris, Siemens, LETIPharma, DVB Technologies SA, DMK Pharmaceuticals, Circassia, ASIT Biotech, Allergy Therapeutics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Allergy Immunotherapy MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Allergy Immunotherapy MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Viatris

- Siemens

- LETIPharma

- DVB Technologies SA

- DMK Pharmaceuticals

- Circassia

- ASIT Biotech

- Allergy Therapeutics