Global Alkyl Polyglucosides Market Size, Share, And Business Benefits By Product (Fatty Alcohol, Sugar, Cornstarch, Vegetable Oil, Others), By End-use (Personal Care and Cosmetics, Home Care Products, Industrial Cleaners, Agricultural Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150606

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

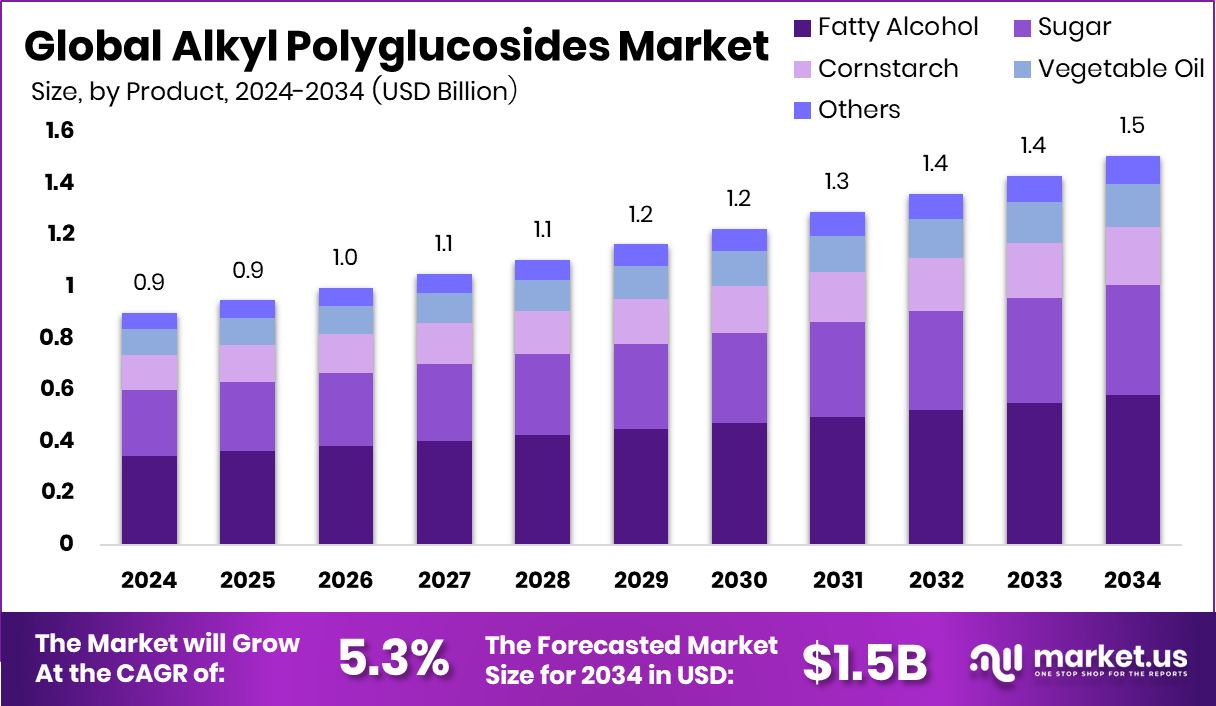

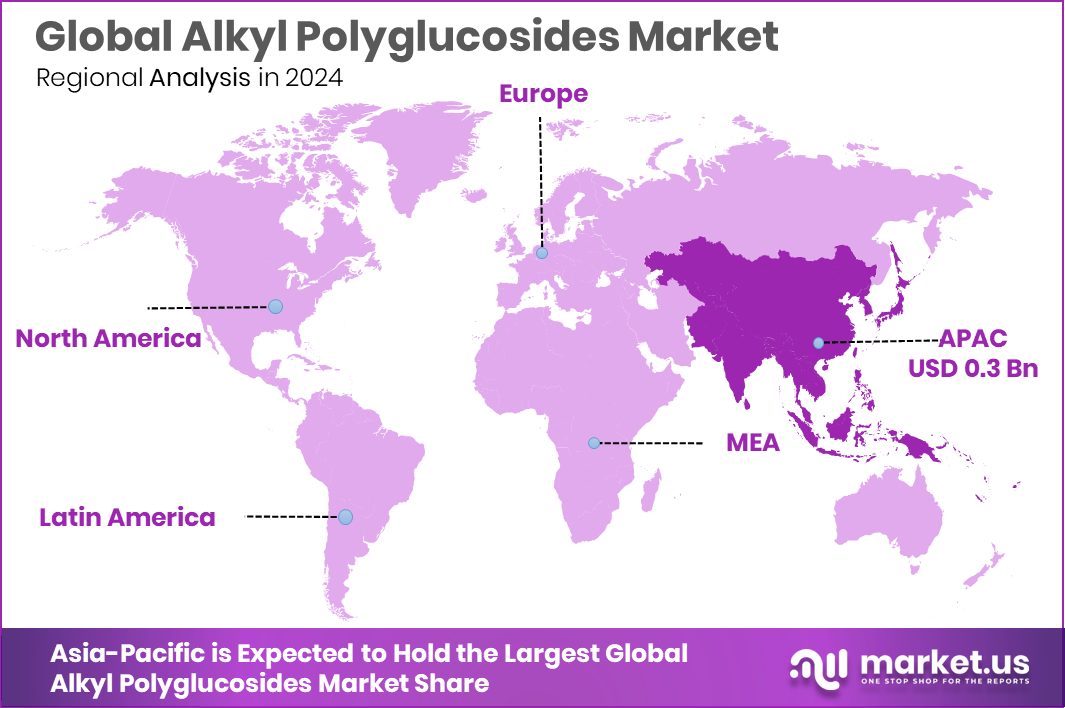

Global Alkyl Polyglucosides Market is expected to be worth around USD 1.5 billion by 2034, up from USD 0.9 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034. High demand for natural surfactants fueled Asia-Pacific’s USD 0.3 billion growth.

Alkyl Polyglucosides (APGs) are non-ionic surfactants made from renewable raw materials like sugar and fatty alcohols derived from coconut or palm kernel oil. They are biodegradable, skin-friendly, and known for their excellent foaming and cleansing properties. APGs are commonly used in personal care products, household cleaners, and industrial formulations due to their mildness, low toxicity, and compatibility with other ingredients.

The Alkyl Polyglucosides market refers to the global trade and usage of these surfactants across multiple sectors such as cosmetics, home care, agriculture, and industrial applications. With growing concerns around harsh chemicals and environmental sustainability, the demand for APGs has increased significantly. The market is being shaped by shifting consumer preferences toward biodegradable and plant-based ingredients, prompting manufacturers to reformulate products using APGs to meet clean label expectations.

Rising awareness about eco-friendly ingredients and stricter environmental norms are key growth drivers. Regulatory push from governments encouraging biodegradable ingredients in formulations has made APGs a top alternative to synthetic surfactants. Their stable performance in hard water and mildness to skin also supports market growth in personal care.

There is growing demand from the cosmetics and home care sector, where APGs are used in shampoos, face cleansers, dishwashing liquids, and laundry detergents. Consumers are actively choosing safer, sulfate-free options, especially for products that come into direct contact with skin. This rising consumer awareness is fueling continuous demand globally.

Key Takeaways

- The Global Alkyl Polyglucosides Market is expected to be worth around USD 1.5 billion by 2034, up from USD 0.9 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

- Fatty alcohol-based Alkyl Polyglucosides held 38.4% market share in 2024.

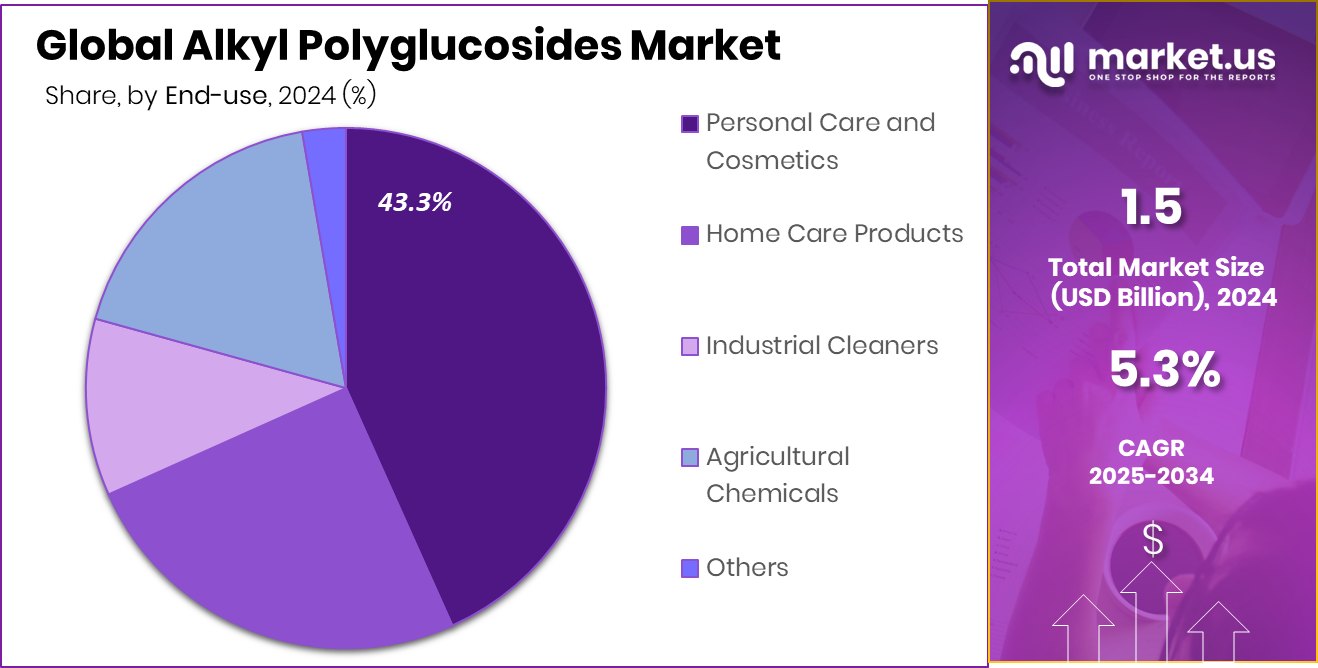

- Personal care and cosmetics accounted for 43.3% of the total APG market share.

- The Asia-Pacific market reached a value of USD 0.3 billion during the year.

By Product Analysis

Fatty alcohol-based alkyl polyglucosides hold 38.4% market share.

In 2024, Fatty Alcohol held a dominant market position in the By Product segment of the Alkyl Polyglucosides Market, with a 38.4% share. This dominance is primarily driven by the widespread availability of fatty alcohols derived from natural sources such as palm kernel oil and coconut oil, aligning well with the rising consumer shift toward plant-based and biodegradable ingredients.

Fatty alcohols serve as a key raw material in the production of Alkyl Polyglucosides, offering high compatibility, emulsifying power, and mildness in formulation. These attributes have led to their extensive use in personal care, household detergents, and industrial cleaners, all of which are witnessing increased demand for non-toxic and eco-friendly surfactants.

The segment’s growth is further supported by the sustainable sourcing of fatty alcohols, which meets both regulatory and environmental requirements. Manufacturers are increasingly favoring fatty alcohol-based APGs due to their efficient performance across a wide pH range and stability in high-foam applications.

Additionally, the higher yield and functional versatility of fatty alcohols enhance their preference over other feedstocks in surfactant production. With the global push for greener alternatives gaining momentum, fatty alcohol-based Alkyl Polyglucosides are expected to retain their leadership in the product landscape of this market.

By End-use Analysis

The personal care and cosmetics segment accounts for 43.3% market share.

In 2024, Personal Care and Cosmetics held a dominant market position in the By End-use segment of the Alkyl Polyglucosides Market, with a 43.3% share. This leadership is mainly attributed to the growing consumer demand for gentle, sulfate-free, and plant-based ingredients in daily personal care routines.

Alkyl Polyglucosides are widely preferred in shampoos, facial cleansers, body washes, and baby care products due to their non-irritating, biodegradable, and skin-friendly properties. As health-conscious consumers increasingly scrutinize ingredient labels, formulators are turning to APGs as a safe and effective alternative to synthetic surfactants.

The dominance of this segment is also reinforced by the rise of natural and organic cosmetic brands that prioritize eco-certifications and clean beauty claims. APGs derived from renewable sources like fatty alcohols and sugars align well with these values, further boosting their usage in cosmetic applications.

Moreover, the regulatory environment in several countries is favoring the use of environmentally responsible ingredients in personal care, which has accelerated the adoption of Alkyl Polyglucosides across major brands. With increasing awareness around skin sensitivities and environmental safety, the Personal Care and Cosmetics sector is expected to remain a key driver in sustaining market momentum for Alkyl Polyglucosides.

Key Market Segments

By Product

- Fatty Alcohol

- Sugar

- Cornstarch

- Vegetable Oil

- Others

By End-use

- Personal Care and Cosmetics

- Home Care Products

- Industrial Cleaners

- Agricultural Chemicals

- Others

Driving Factors

Rising Demand for Natural and Green Surfactants

People today are choosing products that are safe for their skin and better for the planet. This shift is pushing companies to move away from harsh chemical surfactants and toward ingredients like Alkyl Polyglucosides (APGs), which are made from renewable sources like sugar and coconut oil. APGs are biodegradable, gentle, and effective, making them ideal for personal care, cleaning, and baby products.

Governments are also supporting the use of eco-friendly materials by setting rules and promoting sustainability. All these things are working together to boost the demand for APGs. As more consumers choose clean and green products, the market for Alkyl Polyglucosides is growing steadily across different industries.

Restraining Factors

High Production Cost Compared to Traditional Surfactants

One of the biggest challenges for the Alkyl Polyglucosides (APGs) market is their high production cost. Making APGs involves using natural raw materials like plant-based sugars and fatty alcohols, which are often more expensive than petroleum-based ingredients used in regular surfactants. Additionally, the manufacturing process is more complex and energy-intensive, leading to higher overall costs.

This price difference can make it harder for companies to switch from cheaper synthetic surfactants to APGs, especially in cost-sensitive markets. As a result, despite their eco-friendly and skin-safe advantages, the wider use of APGs is sometimes held back by financial constraints, particularly for small-scale manufacturers and brands that operate on tight budgets.

Growth Opportunity

Expanding Use in Agricultural Spray Formulations Globally

A major growth opportunity for Alkyl Polyglucosides (APGs) is their increasing use in agriculture. Farmers and agricultural companies are looking for safer and greener alternatives to traditional chemical additives used in pesticide and fertilizer sprays. APGs work well as adjuvants—they help spray solutions spread better on plant leaves and improve absorption. Since they are biodegradable and non-toxic, they don’t harm crops, soil, or water sources.

With the global push for sustainable farming practices, especially in Europe and parts of Asia, APGs are gaining attention in agrochemical formulations. This expanding application outside of personal care and cleaning products is opening new doors for the market and helping APGs reach a wider industrial audience.

Latest Trends

Growing Adoption of Eco-Friendly Baby Care Products

More parents are today searching for gentle, safe, and natural options for their baby’s skincare and hygiene. This trend is boosting the use of Alkyl Polyglucosides (APGs) in baby shampoos, bubble baths, diaper wipes, and lotions. APGs are mild on sensitive skin, non-irritating, and biodegradable—perfect for baby care needs.

As awareness around harsh chemicals increases, baby product brands are reformulating with plant-based surfactants like APGs to meet parents’ demands for gentle cleaning. Packaging often highlights “sulfate-free” and “eco-friendly,” catching the eyes of eco-conscious shoppers.

Regional Analysis

In 2024, Asia-Pacific led the Alkyl Polyglucosides market with a 39.5% share.

In 2024, Asia-Pacific emerged as the dominant region in the global Alkyl Polyglucosides market, accounting for a 39.5% share, equivalent to USD 0.3 billion. The region’s leadership is primarily driven by strong demand across personal care, home care, and agricultural applications.

Growing awareness of environmentally friendly products in countries like China, India, and Japan has led to a notable increase in the adoption of bio-based surfactants such as Alkyl Polyglucosides. Rapid industrialization, rising disposable incomes, and a shift toward sustainable consumer products have further accelerated market expansion in this region.

North America and Europe also represent significant regions, supported by increasing consumer preference for natural ingredients and stringent regulations on chemical surfactants. In these developed markets, the shift towards sulfate-free and biodegradable formulations is evident in the household cleaning and cosmetics segments.

Meanwhile, the Middle East & Africa, and Latin America are emerging regions where awareness is steadily building. While their current market share remains lower compared to Asia-Pacific, improving retail access and consumer education are expected to gradually boost adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Airedale Chemical Company Limited maintained a focused presence by capitalizing on its agility and commitment to sustainable raw materials. The company’s nimble approach enabled prompt adaptation to evolving consumer preferences for eco-friendly ingredients. Airedale’s targeted investments in process optimization allowed for cost-efficient production of APGs, despite the general challenge of natural feedstock costs.

BASF SE, as one of the world’s largest chemical firms, leveraged its vast global footprint and extensive R&D resources to lead in scale and innovation. BASF’s commitment to sustainable chemistry reinforced market trust, as its APG formulations consistently met high-performance benchmarks in personal care and industrial cleaning. With the advantage of integrated supply chains, BASF managed to ensure stable raw-material access, an important factor in maintaining pricing competitiveness along with product consistency across global regions.

Clariant distinguished itself through its specialty chemicals expertise and customized formulation solutions. The company excelled at collaborating with personal care and homecare brands to co-develop tailor-made APG blends designed to meet specific formulation demands, such as enhanced mildness or foam stability. Clariant’s deep technical partnerships and close engagement with customers reinforced brand loyalty and opened doors to niche or innovative application areas.

Top Key Players in the Market

- Actylis

- Airedale Chemical Company Limited

- BASF SE

- Clariant

- Croda International PLC

- Dow

- Fenchem

- Kao Corporation

- LG Household & Healthcare Ltd

- SEPPIC

- Shanghai Fine Chemical Co., Ltd

Recent Developments

- In March 2024, BASF announced an investment of $70.5 million to expand its existing Cincinnati plant. This expansion is specifically aimed at increasing the production of bio-based, biodegradable surfactants, with a focus on alkyl polyglucosides (APGs). The upgrades include state-of-the-art manufacturing processes and were partly supported by local tax incentives.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Billion Forecast Revenue (2034) USD 1.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fatty Alcohol, Sugar, Cornstarch, Vegetable Oil, Others), By End-use (Personal Care and Cosmetics, Home Care Products, Industrial Cleaners, Agricultural Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Actylis, Airedale Chemical Company Limited, BASF SE, Clariant, Croda International PLC, Dow, Fenchem, Kao Corporation, LG Household & Healthcare Ltd, SEPPIC, Shanghai Fine Chemical Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alkyl Polyglucosides MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Alkyl Polyglucosides MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Actylis

- Airedale Chemical Company Limited

- BASF SE

- Clariant

- Croda International PLC

- Dow

- Fenchem

- Kao Corporation

- LG Household & Healthcare Ltd

- SEPPIC

- Shanghai Fine Chemical Co., Ltd